37091fb6f83e3b12b8f6c9aa5654c020.ppt

- Количество слайдов: 42

FINANCIAL ACCOUNTING A USER PERSPECTIVE Hoskin • Fizzell • Davidson Second Canadian Edition

FINANCIAL ACCOUNTING A USER PERSPECTIVE Hoskin • Fizzell • Davidson Second Canadian Edition

Shareholders’ Equity Chapter Eleven

Shareholders’ Equity Chapter Eleven

Forms of Organization • Sole Proprietorship • Partnership • Corporation

Forms of Organization • Sole Proprietorship • Partnership • Corporation

Sole Proprietorship • • Single-owner business Unlimited liability No reporting to shareholders Owner’s capital and withdrawals accounts • Profits are not taxed separately

Sole Proprietorship • • Single-owner business Unlimited liability No reporting to shareholders Owner’s capital and withdrawals accounts • Profits are not taxed separately

Partnership • • • Two or more owners Partnership agreement Unlimited liability Profits are not taxed separately Partner’s capital and withdrawals accounts

Partnership • • • Two or more owners Partnership agreement Unlimited liability Profits are not taxed separately Partner’s capital and withdrawals accounts

Corporation • Legally separate from the shareholders • Limited liability • Subject to taxation • Requires more paperwork and regulation

Corporation • Legally separate from the shareholders • Limited liability • Subject to taxation • Requires more paperwork and regulation

Corporations • Companies may be incorporated under federal or provincial law • Need articles of incorporation documentation – Includes information on type of business, organization, management, and kinds of shares

Corporations • Companies may be incorporated under federal or provincial law • Need articles of incorporation documentation – Includes information on type of business, organization, management, and kinds of shares

Shares • Authorized shares – The maximum number of shares that a company can issue, as specified in the articles – Many companies establish an unlimited number

Shares • Authorized shares – The maximum number of shares that a company can issue, as specified in the articles – Many companies establish an unlimited number

Shares • Par value – A specified dollar amount attached to each share – Used in the past, no longer permitted • No par value shares – Used today

Shares • Par value – A specified dollar amount attached to each share – Used in the past, no longer permitted • No par value shares – Used today

Shares • Legal capital – Total amount received for shares when initially sold – Must be kept intact – Cannot be paid out as dividends

Shares • Legal capital – Total amount received for shares when initially sold – Must be kept intact – Cannot be paid out as dividends

Shares • Different classes of shares – Common shares – Preferred shares • Differ in the rights that accrue to their holders

Shares • Different classes of shares – Common shares – Preferred shares • Differ in the rights that accrue to their holders

Common Shares • Represents the basic voting ownership rights of the company • Generally issued through underwriters – Details and features are outlined in a prospectus

Common Shares • Represents the basic voting ownership rights of the company • Generally issued through underwriters – Details and features are outlined in a prospectus

Common Shares • Basic set of rights that allow the owner to share proportionately in: – Profits and losses – Selection of the management – Assets upon liquidation – Subsequent issues of shares (preemptive right)

Common Shares • Basic set of rights that allow the owner to share proportionately in: – Profits and losses – Selection of the management – Assets upon liquidation – Subsequent issues of shares (preemptive right)

Common Shares • Measure of performance for shareholders – Earnings per share Net income Average common shares outstanding

Common Shares • Measure of performance for shareholders – Earnings per share Net income Average common shares outstanding

Common Shares • Different classes of shares are entitled to different portions of the earnings • Preferred shares are restricted in the amounts of dividends • Common shares dividends not restricted

Common Shares • Different classes of shares are entitled to different portions of the earnings • Preferred shares are restricted in the amounts of dividends • Common shares dividends not restricted

Common Shares • If a corporation declares a dividend, shareholders share proportionately • Common share carry the right to vote • Standard rule is one share, one vote

Common Shares • If a corporation declares a dividend, shareholders share proportionately • Common share carry the right to vote • Standard rule is one share, one vote

Preferred Shares • Usually nonvoting • Have preference over common shares with regard to dividends • Preferred shareholders are not guaranteed a dividend

Preferred Shares • Usually nonvoting • Have preference over common shares with regard to dividends • Preferred shareholders are not guaranteed a dividend

Preferred Shares • If a dividend is declared, preferred shareholders will receive dividends before common • Preferred dividend – Amount is usually stated as a dollar amount per share

Preferred Shares • If a dividend is declared, preferred shareholders will receive dividends before common • Preferred dividend – Amount is usually stated as a dollar amount per share

Preferred Shares • Cumulative preferred shares – If a dividend is not declared in one year, the dividends carry over to the next year – Dividends in arrears • Dividends from prior years that have not been declared

Preferred Shares • Cumulative preferred shares – If a dividend is not declared in one year, the dividends carry over to the next year – Dividends in arrears • Dividends from prior years that have not been declared

Preferred Shares • Convertible preferred shares – At the option of the shareholder – Can be converted into common shares based on a preset ratio

Preferred Shares • Convertible preferred shares – At the option of the shareholder – Can be converted into common shares based on a preset ratio

Preferred Shares • Redeemable preferred shares – Can be bought back by the company (retired) – Price and time is specified • Retractable preferred shares – Can be sold back to the company (retired) at the option of the shareholder

Preferred Shares • Redeemable preferred shares – Can be bought back by the company (retired) – Price and time is specified • Retractable preferred shares – Can be sold back to the company (retired) at the option of the shareholder

Preferred Shares • Participating preferred shares – Shareholders can share dividends in excess of those specified

Preferred Shares • Participating preferred shares – Shareholders can share dividends in excess of those specified

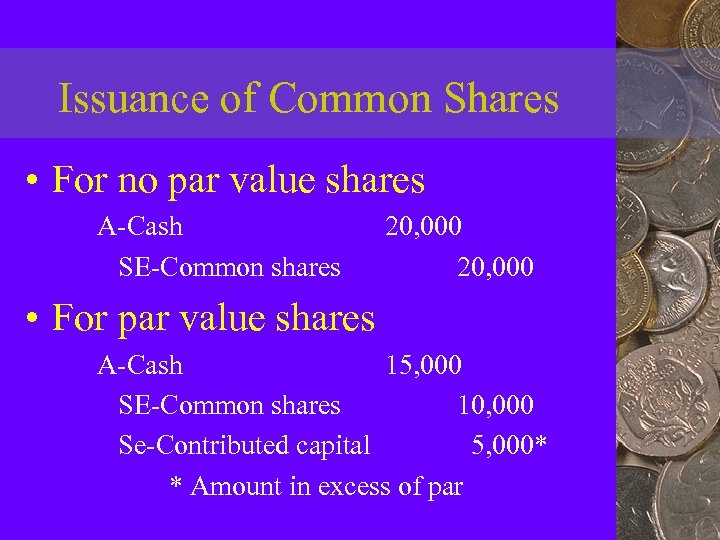

Issuance of Common Shares • For no par value shares A-Cash SE-Common shares 20, 000 • For par value shares A-Cash 15, 000 SE-Common shares 10, 000 Se-Contributed capital 5, 000* * Amount in excess of par

Issuance of Common Shares • For no par value shares A-Cash SE-Common shares 20, 000 • For par value shares A-Cash 15, 000 SE-Common shares 10, 000 Se-Contributed capital 5, 000* * Amount in excess of par

Treasury Shares • Shares that have been repurchased by the issuing company • Usually cancelled immediately upon purchase

Treasury Shares • Shares that have been repurchased by the issuing company • Usually cancelled immediately upon purchase

Shares • Authorized shares – Number approved for issue in the articles of incorporation • Issued shares – Number that have been sold (issued) by the company

Shares • Authorized shares – Number approved for issue in the articles of incorporation • Issued shares – Number that have been sold (issued) by the company

Shares • Outstanding shares – Number that remain in the possession of shareholders outside the company

Shares • Outstanding shares – Number that remain in the possession of shareholders outside the company

Repurchase of Shares • If the cost of repurchase differs from the original amount received SE-Common shares A-Cash SE-Contributed surplus 10, 000 9, 000 1, 000 OR: SE-Common shares SE-Retained earnings A-Cash 10, 000 2, 000 12, 000

Repurchase of Shares • If the cost of repurchase differs from the original amount received SE-Common shares A-Cash SE-Contributed surplus 10, 000 9, 000 1, 000 OR: SE-Common shares SE-Retained earnings A-Cash 10, 000 2, 000 12, 000

Cash Dividends • Payments to shareholders from total net income retained in a company in the Retained Earnings account • Payment in return for the company’s use of the shareholders’ money

Cash Dividends • Payments to shareholders from total net income retained in a company in the Retained Earnings account • Payment in return for the company’s use of the shareholders’ money

Cash Dividends • Paid only if Board of Directors has voted to declare a dividend • Declaration makes a legal liability • Not paid on treasury shares • Paid only on outstanding shares

Cash Dividends • Paid only if Board of Directors has voted to declare a dividend • Declaration makes a legal liability • Not paid on treasury shares • Paid only on outstanding shares

Dividend Dates • Date of declaration – Date of the Board of Directors vote SE-Dividends declared L-Dividends payable xx xx

Dividend Dates • Date of declaration – Date of the Board of Directors vote SE-Dividends declared L-Dividends payable xx xx

Dividend Dates • Date of record – Date on which a shareholder must own the shares in order to receive the dividend – No journal entry is made

Dividend Dates • Date of record – Date on which a shareholder must own the shares in order to receive the dividend – No journal entry is made

Dividend Dates • Date of payment – Date on which the payment is made L-Dividends payable A-Cash xx xx

Dividend Dates • Date of payment – Date on which the payment is made L-Dividends payable A-Cash xx xx

Property Dividends • Dividend declared that will be settled with some resource other than cash • Also known as dividends in kind • Valued at fair market value

Property Dividends • Dividend declared that will be settled with some resource other than cash • Also known as dividends in kind • Valued at fair market value

Stock Dividends • Additional shares of the company are issued instead of cash or property • Issuance does not alter the overall value of the company

Stock Dividends • Additional shares of the company are issued instead of cash or property • Issuance does not alter the overall value of the company

Stock Dividends • Example – Company has 100 shares outstanding, owned equally by 10 people – A 10% stock dividend is issued – Each shareholder receives 1 new share, resulting in 110 shares outstanding

Stock Dividends • Example – Company has 100 shares outstanding, owned equally by 10 people – A 10% stock dividend is issued – Each shareholder receives 1 new share, resulting in 110 shares outstanding

Stock Dividends • Why issue stock dividends? – Shareholder may be better off • Market adjusts the value of the shares – Company is able to capitalize its retained earnings

Stock Dividends • Why issue stock dividends? – Shareholder may be better off • Market adjusts the value of the shares – Company is able to capitalize its retained earnings

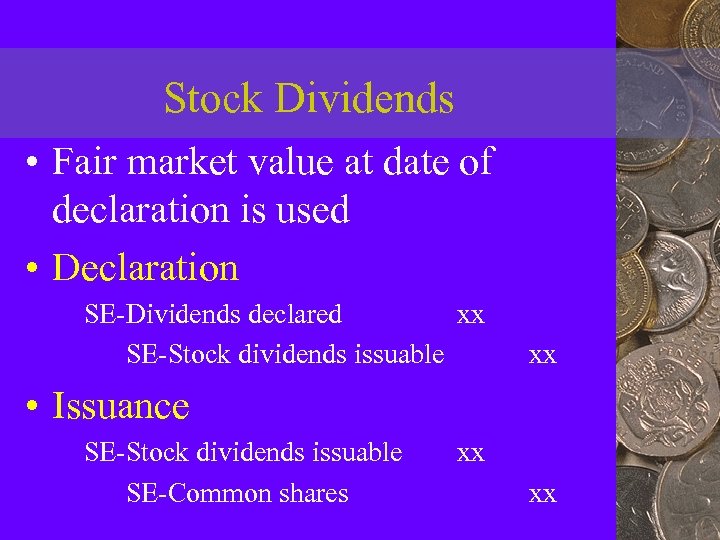

Stock Dividends • Fair market value at date of declaration is used • Declaration SE-Dividends declared xx SE-Stock dividends issuable xx • Issuance SE-Stock dividends issuable SE-Common shares xx xx

Stock Dividends • Fair market value at date of declaration is used • Declaration SE-Dividends declared xx SE-Stock dividends issuable xx • Issuance SE-Stock dividends issuable SE-Common shares xx xx

Stock Splits • Usually stated as a ratio – Example: A two-for-one stock split • Each share currently held is exchanged for two new shares • Number of shares outstanding is doubled • No change in dollar amounts of any shareholders’ equity account

Stock Splits • Usually stated as a ratio – Example: A two-for-one stock split • Each share currently held is exchanged for two new shares • Number of shares outstanding is doubled • No change in dollar amounts of any shareholders’ equity account

Stock Options • An agreement between two parties to either buy or sell a share at a fixed price at some future date – Exercise price: the fixed price – Call option: agreement to buy – Put option: agreement to sell

Stock Options • An agreement between two parties to either buy or sell a share at a fixed price at some future date – Exercise price: the fixed price – Call option: agreement to buy – Put option: agreement to sell

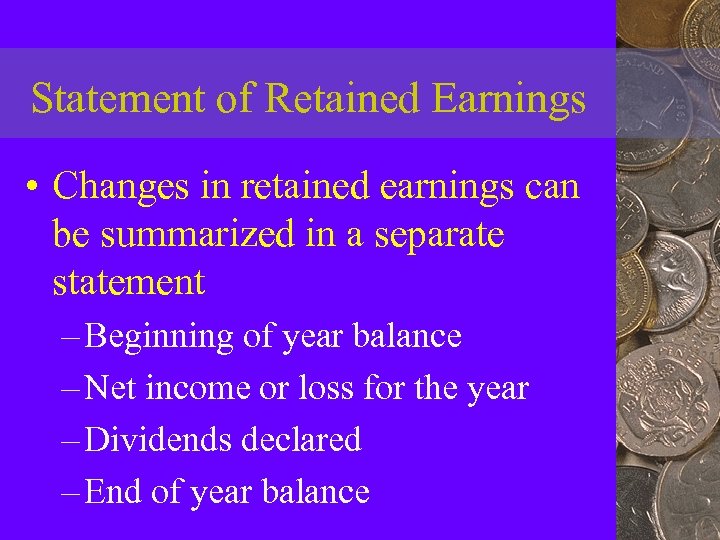

Statement of Retained Earnings • Changes in retained earnings can be summarized in a separate statement – Beginning of year balance – Net income or loss for the year – Dividends declared – End of year balance

Statement of Retained Earnings • Changes in retained earnings can be summarized in a separate statement – Beginning of year balance – Net income or loss for the year – Dividends declared – End of year balance

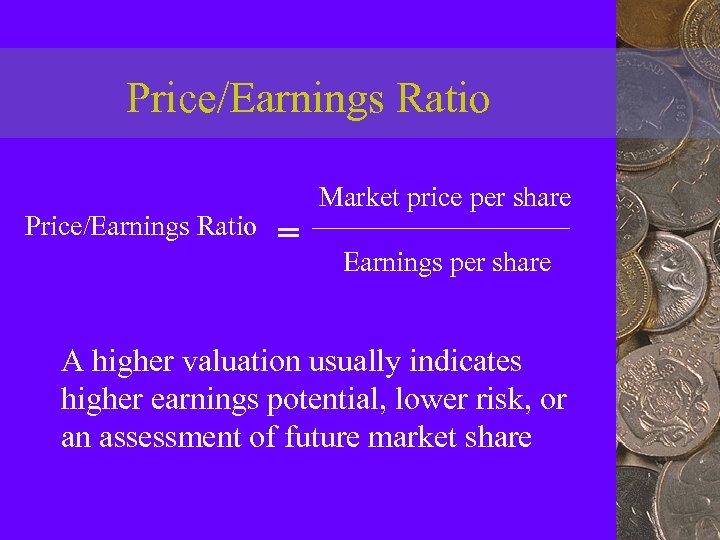

Price/Earnings Ratio = Market price per share Earnings per share A higher valuation usually indicates higher earnings potential, lower risk, or an assessment of future market share

Price/Earnings Ratio = Market price per share Earnings per share A higher valuation usually indicates higher earnings potential, lower risk, or an assessment of future market share

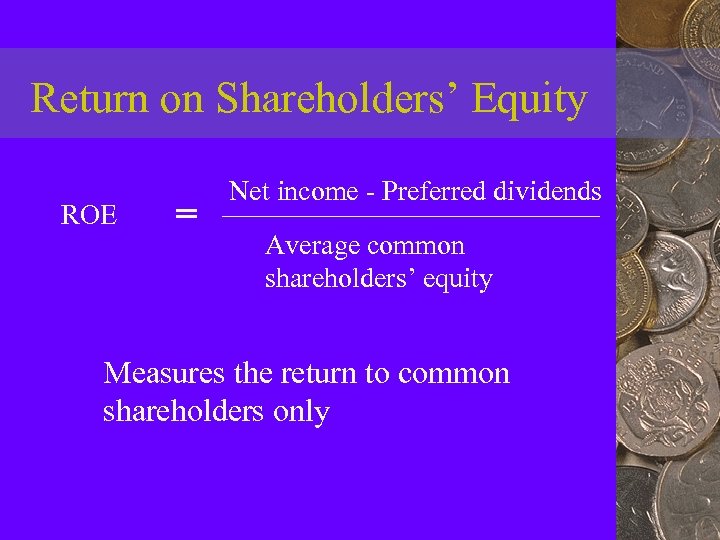

Return on Shareholders’ Equity ROE = Net income - Preferred dividends Average common shareholders’ equity Measures the return to common shareholders only

Return on Shareholders’ Equity ROE = Net income - Preferred dividends Average common shareholders’ equity Measures the return to common shareholders only