f8b71ed4303e110fb1f527bd3f03f273.ppt

- Количество слайдов: 56

Financial Accounting: A Business Process Approach Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 -1

Preparing and Analyzing the Statement of Cash Flows Chapter 9 Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 2

Learning Objectives When you are finished studying Chapter 9, you will be able to: 1. Explain the importance of the statement of cash flows and the three classifications of cash included on it. 2. Explain the difference between the direct method and the indirect method of preparing the statement of cash flows. 3. Convert accrual amounts to cash amounts. 4. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 3

Learning Objectives 5. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. 6. Prepare the cash flows from investing activities section and the cash flows from financing activities section of the statement of cash flows. 7. Perform general analysis of the statement of cash flows and calculate free cash flow. 8. Use the statement of cash flows and the related controls to evaluate the risk of investing in a firm. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 4

Ethics Matters In the settlement of Journal (WSJ) article In May 2008, a Wall Streetthese charges, GE did emphasized the importanceallegations. in evaluating not admit or deny the of cash flows Did the gap stocks. Because earnings can to pay net income, fine between GE’s cash flows and a $50 million as In August 2009, GE agreed be affected by accounting choices, cash flowsand Exchange Commission (SEC) to In the Securities may be a better gauge than net to the WSJ Sloan, General Electric Co. was observed by article, provide some hint about income of a firm’s financial health. settle civil fraud and other charges that GE’s 2002 cited as an example of a company were the accounting problems at GE that with ayet and 2003 gap between net income and growing financial statements misled investors. to be uncovered? Never underestimate cash be the Headline earnings numbers—typically net income—can According to the SEC’s Division of Enforcement, “GE flow the to be gained by the as changing a massaged by perfectly rules beyondsuch breaking point. insights accounting legal tricks, company had been bent which “suggested following the cash. depreciation schedule or its numbers. ” is recognized. stretching to meet the statement of cash Start by understanding way revenue a company’s Overly aggressive accounting can distort Cash flows—how much actual money ainvestors. ” true financial condition and mislead flows, the topic of this chapter. company spits out —are by no means immune from shenanigans, but many analysts consider them a cleaner way to assess a company’s health. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 5

Learning Objective 1 Statement of Cash Flows The Statement of Cash Flows: Øprovides crucial information to decision makers to help predict future cash flows of the business. Øshows how the business acquired its cash during the current year. Øshows how the business spent its cash during the current year. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 6

The Statement Of Cash Flows The Statement of Cash Flows is divided into three categories: 1. Operating Cash related to the day-to-day activities 2. Investing Cash related to buying and selling firm assets to be used longer than one year 3. Financing Cash receipts and disbursements related to loans (principal), cash contributions from and distributions to owners Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 7

Categories of Cash Flows: Operating Activities: Cash inflows and outflows that are directly related to income from normal operations. FASB defines operating activities as those that are not investing or financing activities. Activities related to operating cash flows: c. (inflow) cash collections from customers b. (outflow) cash paid to vendors c. (related balance sheet accounts) current assets and current liabilities Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 8

Categories of Cash Flows: Investing Activities: Cash inflows and outflows that are related to the purchase and sale of productive assets. Activities related to investing cash flows: a. (inflow) cash proceeds from sale of long-term assets (building, land, etc. ) b. (outflow) cash paid to purchase long- term assets c. (related balance sheet accounts) long-term assets Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 9

Categories of Cash Flows: Financing Activities: Cash inflows and outflows that are related to how cash was obtained to finance the business. Activities related to financing cash flows: a. (inflow) cash proceeds from a new stock issue or sale of bonds or other borrowing b. (outflow) cash dividends paid to shareholders’ principal payments, retire bonds or loans c. (related balance sheet accounts) liabilities and shareholders’ equity Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 10

Cash Flows from Noncash Activities Investing and financing activities that do not involve cash, e. g. , ØRetirement of bonds by issuing stock. ØSettlement of debt by transferring assets. Noncash activities must be disclosed separately in the financial statements. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 11

Cash Budget Preparing a cash budget is a crucial activity for all companies. The sources and uses of cash must be estimated in detail— both the amounts of cash and when it is needed. Each month, projected cash inflows and outflows must be budgeted by source and use. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 12

Cash Budget With this level of detail, a company can plan ahead for any cash shortage by: (1) securing a line of credit from a local bank, (2) borrowing the money, or (3) altering the timing of its receipts (tightening up credit policies) or disbursements (postponing purchases). Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 13

Learning Objective 2 Two Alternative Approaches Indirect Method ØShows net cash inflow (outflow) from operations as an adjustment of net income. ØUsed by 97% of companies. Direct Method ØReports the components of cash from operations as gross receipts and payments. ØRecommended used. by the FASB, but rarely Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 14

Direct and Indirect Method Two ways to compute net cash flow from Operating Activities: Direct method Ø Shows every cash inflow and outflow Ø Converts every number on the income statement to its cash amount. Indirect method Ø Starts with net income and makes adjustments for items that are not cash Both methods result in the same net cash from operating activities. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 15

Preparing the Statement of Cash Flows The face of the statement includes: Net Cash Flows from Operating Activities +Net Cash Flows from Investing Activities +Net Cash Flows from Financing Activities Net Cash Flows for the period + Beginning Cash Balance End of period Cash Balance Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 16

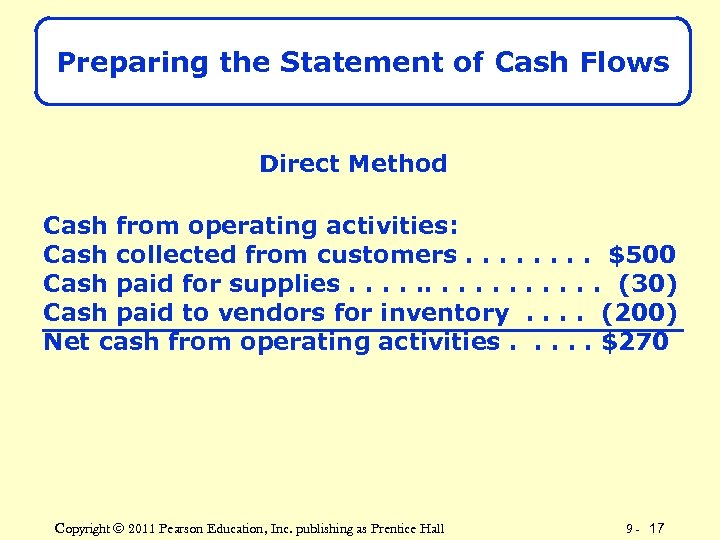

Preparing the Statement of Cash Flows Direct Method Cash from operating activities: Cash collected from customers. . . . $500 Cash paid for supplies. . . . (30) Cash paid to vendors for inventory. . (200) Net cash from operating activities. . . $270 Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 17

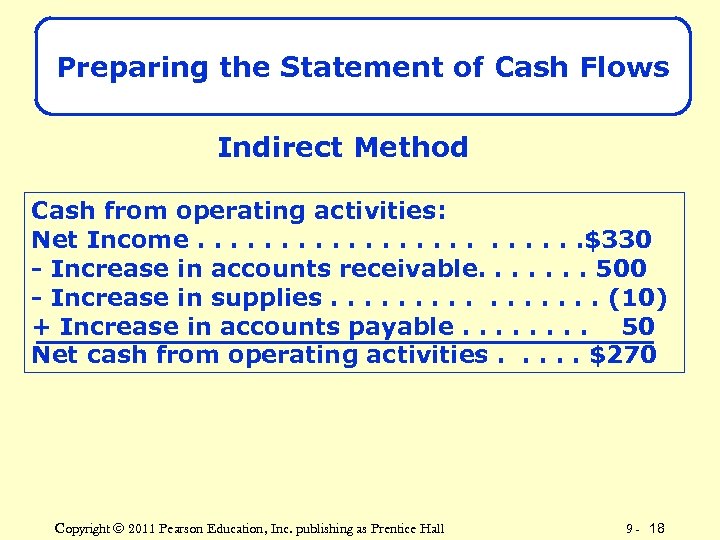

Preparing the Statement of Cash Flows Indirect Method Cash from operating activities: Net Income. . . $330 - Increase in accounts receivable. . . . 500 - Increase in supplies. . . . (10) + Increase in accounts payable. . . . 50 Net cash from operating activities. . . $270 Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 18

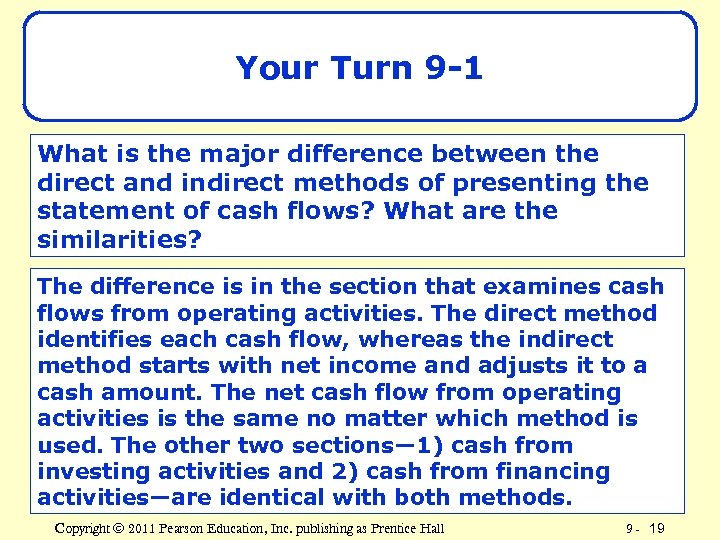

Your Turn 9 -1 What is the major difference between the direct and indirect methods of presenting the statement of cash flows? What are the similarities? The difference is in the section that examines cash flows from operating activities. The direct method identifies each cash flow, whereas the indirect method starts with net income and adjusts it to a cash amount. The net cash flow from operating activities is the same no matter which method is used. The other two sections— 1) cash from investing activities and 2) cash from financing activities—are identical with both methods. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 19

Learning Objective 3 Converting Accrual Data to Cash Data Accounting records are kept on the accrual basis (GAAP). Cash data must be developed before the Statement of Cash Flows can be prepared (especially for operating activities). The examples that follow demonstrate the direct method for converting accrual data to cash data. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 20

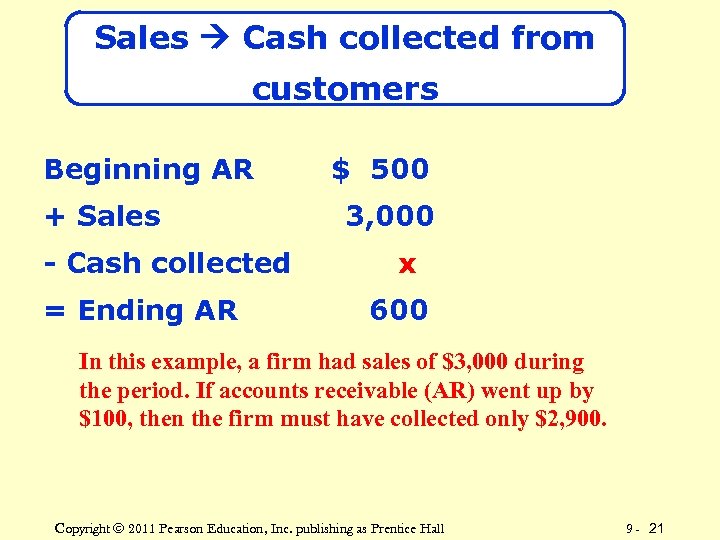

Sales Cash collected from customers Beginning AR + Sales - Cash collected = Ending AR $ 500 3, 000 x 600 In this example, a firm had sales of $3, 000 during the period. If accounts receivable (AR) went up by $100, then the firm must have collected only $2, 900. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 21

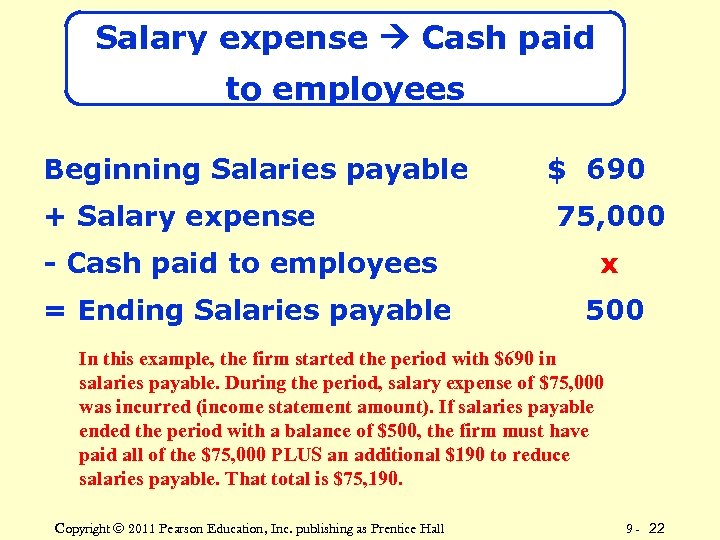

Salary expense Cash paid to employees Beginning Salaries payable + Salary expense $ 690 75, 000 - Cash paid to employees x = Ending Salaries payable 500 In this example, the firm started the period with $690 in salaries payable. During the period, salary expense of $75, 000 was incurred (income statement amount). If salaries payable ended the period with a balance of $500, the firm must have paid all of the $75, 000 PLUS an additional $190 to reduce salaries payable. That total is $75, 190. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 22

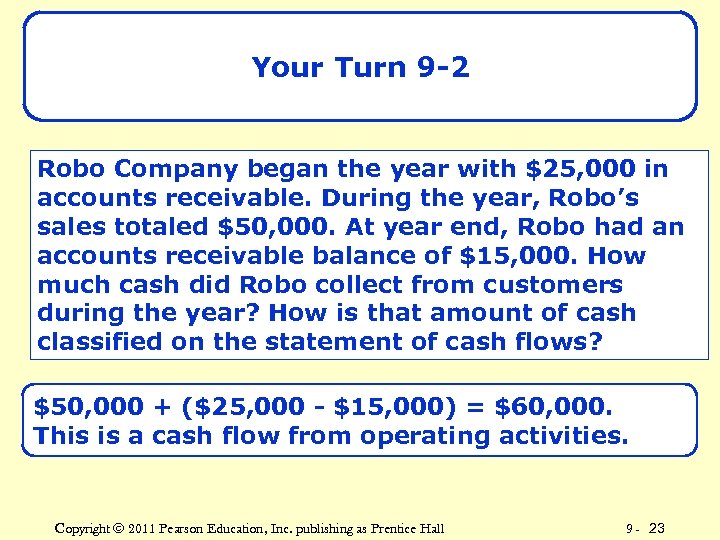

Your Turn 9 -2 Robo Company began the year with $25, 000 in accounts receivable. During the year, Robo’s sales totaled $50, 000. At year end, Robo had an accounts receivable balance of $15, 000. How much cash did Robo collect from customers during the year? How is that amount of cash classified on the statement of cash flows? $50, 000 + ($25, 000 - $15, 000) = $60, 000. This is a cash flow from operating activities. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 23

Learning Objective 4 Direct Method of Preparing the Statement of Cash Flows Each amount on the income statement must be converted to its cash equivalent. At the same time, you must account for the change in every current asset and current liability. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 24

Direct Method To use the direct method of preparing a statement of cash flows, we’ll examine each item on the income statement and make it “cash. ” The indirect method is applied just to the operating section of the statement of cash flows. We’ll need the income statement and beginning and ending balance sheets for the period. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 25

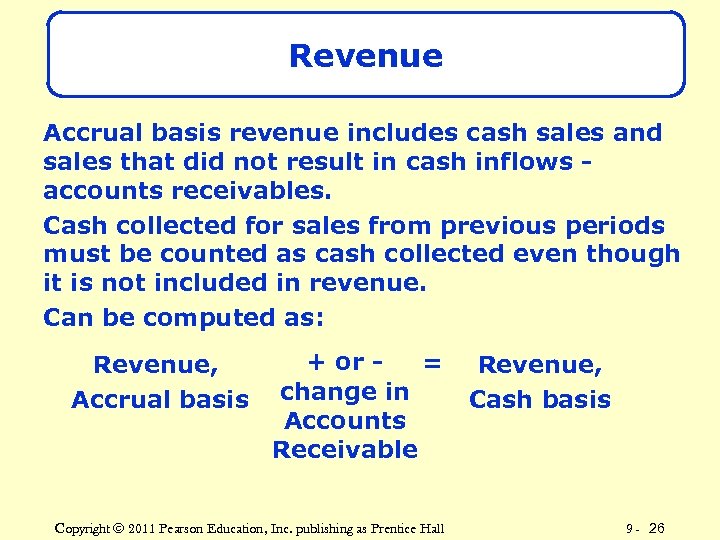

Revenue Accrual basis revenue includes cash sales and sales that did not result in cash inflows accounts receivables. Cash collected for sales from previous periods must be counted as cash collected even though it is not included in revenue. Can be computed as: Revenue, Accrual basis + or = change in Accounts Receivable Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall Revenue, Cash basis 9 - 26

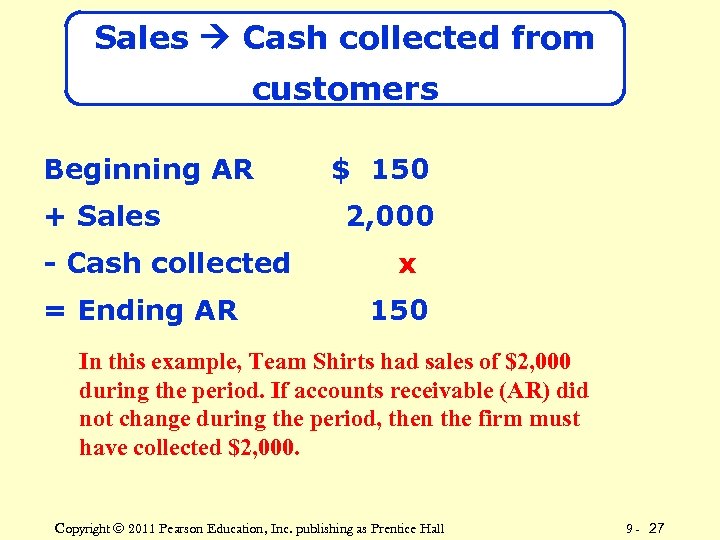

Sales Cash collected from customers Beginning AR + Sales - Cash collected = Ending AR $ 150 2, 000 x 150 In this example, Team Shirts had sales of $2, 000 during the period. If accounts receivable (AR) did not change during the period, then the firm must have collected $2, 000. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 27

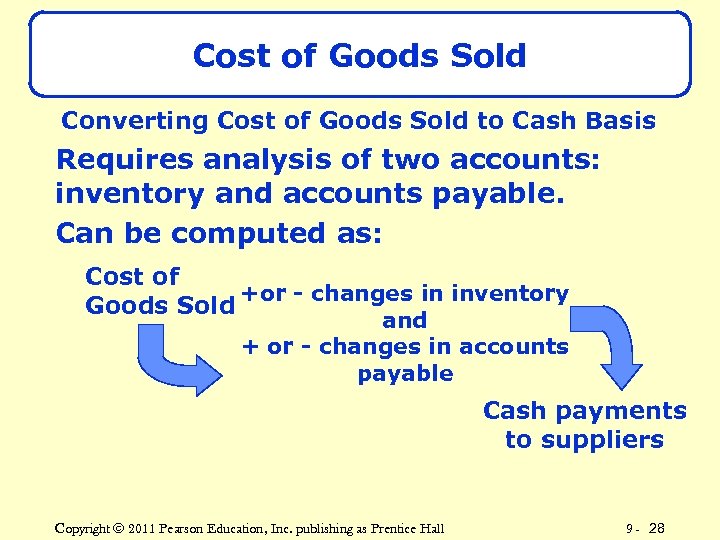

Cost of Goods Sold Converting Cost of Goods Sold to Cash Basis Requires analysis of two accounts: inventory and accounts payable. Can be computed as: Cost of +or - changes in inventory Goods Sold and + or - changes in accounts payable Cash payments to suppliers Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 28

Cost of Goods Sold Why is COST OF GOODS SOLD (from the income statement) not equal to cash? We might have sold some goods that we already had in the inventory or we may have had to buy all of the goods we sold PLUS some more that we put into building up the inventory. So, we must look at the change in inventory to see if cost of goods sold is more or less than the inventory we bought during the period. Inventory went up from $100 to $300. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 29

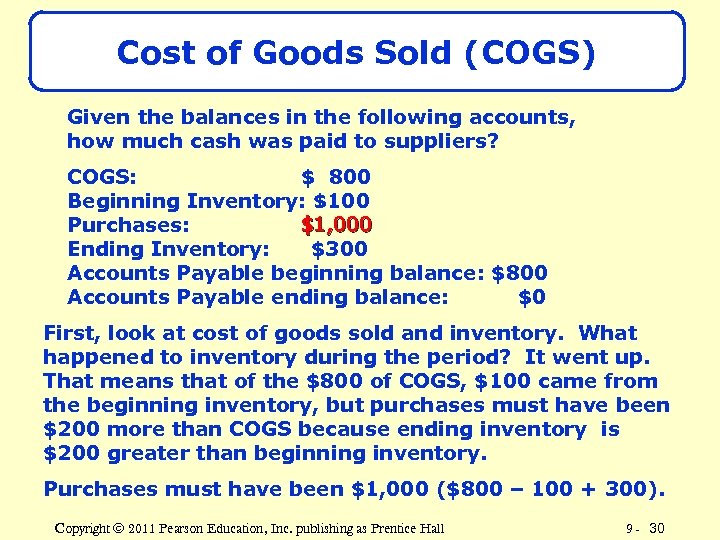

Cost of Goods Sold (COGS) Given the balances in the following accounts, how much cash was paid to suppliers? COGS: $ 800 Beginning Inventory: $100 $1, 000 Purchases: X Ending Inventory: $300 Accounts Payable beginning balance: $800 Accounts Payable ending balance: $0 First, look at cost of goods sold and inventory. What happened to inventory during the period? It went up. That means that of the $800 of COGS, $100 came from the beginning inventory, but purchases must have been $200 more than COGS because ending inventory is $200 greater than beginning inventory. Purchases must have been $1, 000 ($800 – 100 + 300). Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 30

Cost of Goods Sold Did we actually have to pay for all $1, 000 worth of those goods? (Or did we pay for those plus some we purchased the period before? ) To figure that out, we have to look at Accounts Payable (A/P). Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 31

Cost of Goods Sold Since A/P went down, that means we must have paid the $1, 000 for this month’s purchases and the $800 owed for February, the decrease in A/P. So, rather than just paying $1, 000 for the purchases, we paid a total of $1, 800 to vendors. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 32

Depreciation Expense The cash we spend to buy equipment is considered an investing cash flow, and the related depreciation expense is a non-cash expense, so we can simply ignore it when we prepare the statement of cash flows using the direct method. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 33

Other Expenses Insurance expense is $50. But the balance sheet shows that Prepaid insurance decreased by $50 during the month. That means that Team Shirts did not pay any cash for insurance during the month. Interest expense is $30. Interest payable went from -0 to $30 during the month. This means that Team Shirts did not pay any cash for interest during the month. Finally, Other payables (balance sheet) went from $50 to -0 - during the month. This means that there was a cash payment made to satisfy this liability, even though the expense was recorded in a prior period. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 34

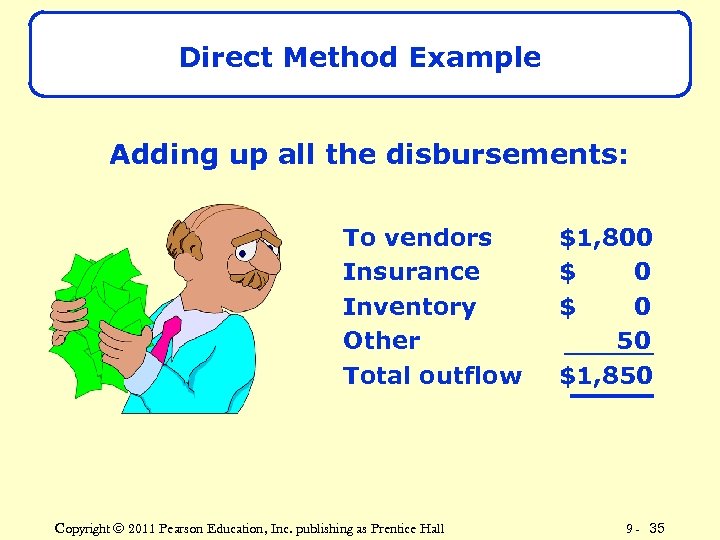

Direct Method Example Adding up all the disbursements: To vendors Insurance Inventory Other Total outflow Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall $1, 800 $ 0 50 $1, 850 9 - 35

Direct Method In summary, what kinds of All accounts need to be examined to income statement accounts and all current asset and current liability accounts. see if there is a difference between our accrual accounting records and actual cash? versus General Ledger Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 36

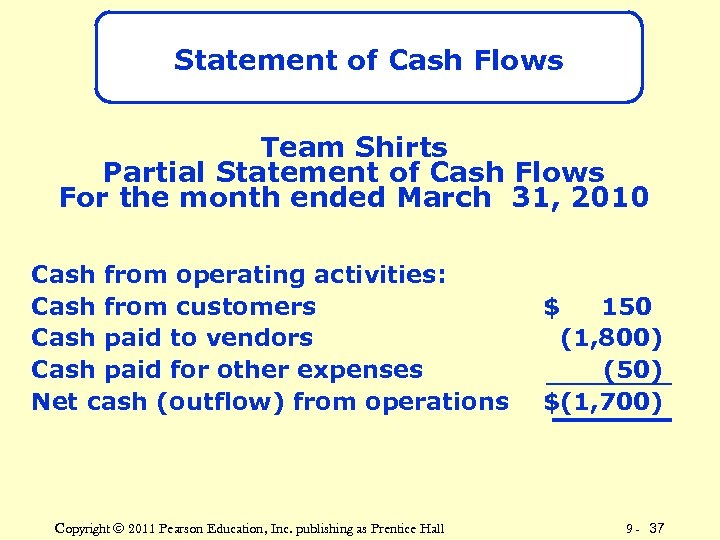

Statement of Cash Flows Team Shirts Partial Statement of Cash Flows For the month ended March 31, 2010 Cash from operating activities: Cash from customers Cash paid to vendors Cash paid for other expenses Net cash (outflow) from operations Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall $ 150 (1, 800) (50) $(1, 700) 9 - 37

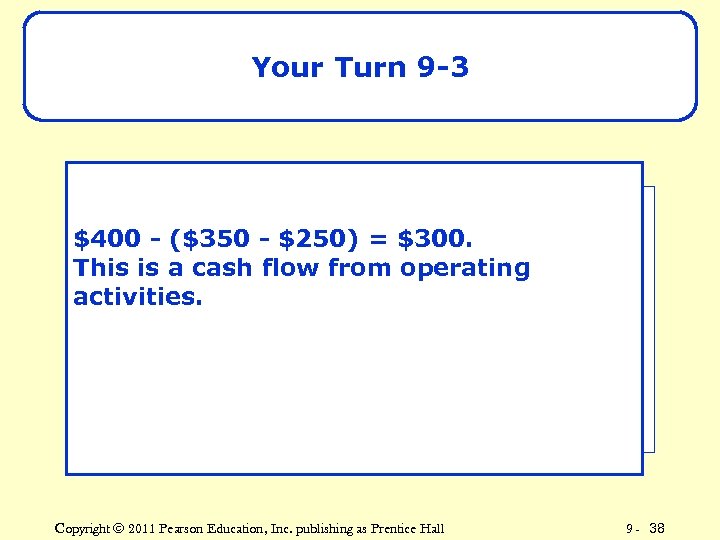

Your Turn 9 -3 Flex Company began the year 2010 with $350 of prepaid insurance. For 2010, the $400 - ($350 - $250) = $300. company’s income from operating This is a cash flow statement showed insurance expense of $400. If Flex activities. Company ended the year with $250 of prepaid insurance, how much cash was paid for insurance during 2010? On the statement of cash flows, how would that cash be classified? Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 38

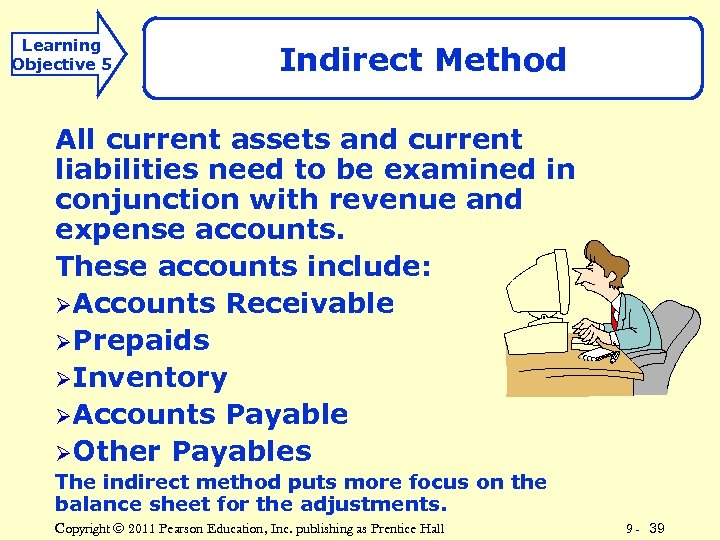

Learning Objective 5 Indirect Method All current assets and current liabilities need to be examined in conjunction with revenue and expense accounts. These accounts include: ØAccounts Receivable ØPrepaids ØInventory ØAccounts Payable ØOther Payables The indirect method puts more focus on the balance sheet for the adjustments. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 39

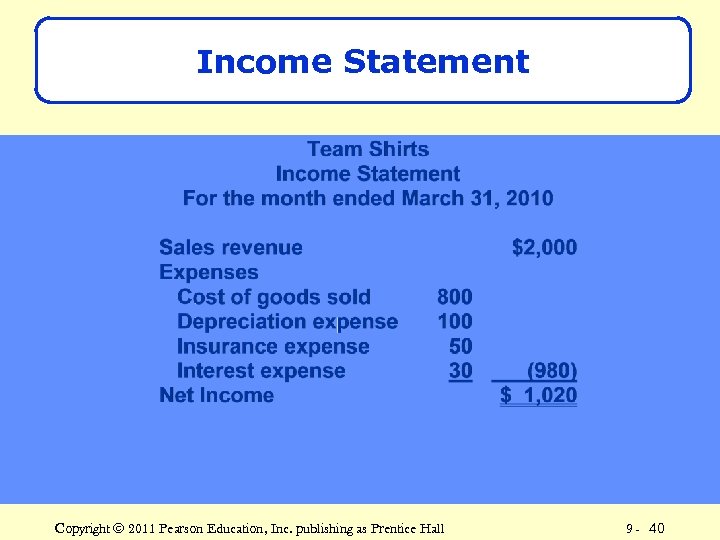

Income Statement Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 40

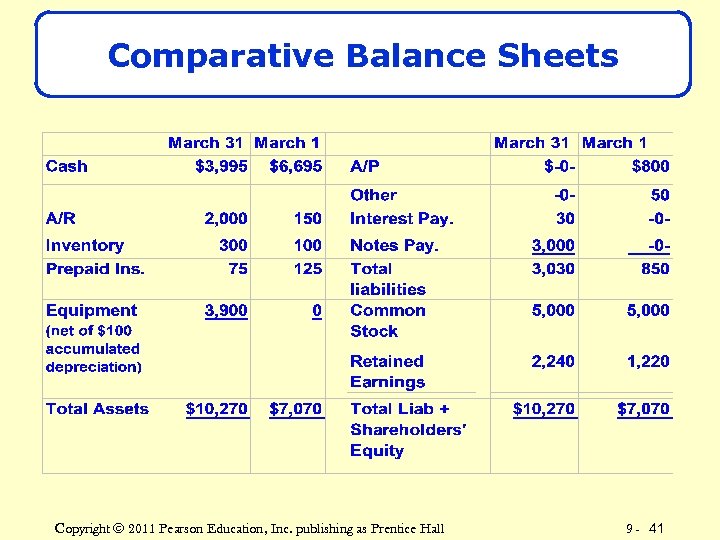

Comparative Balance Sheets Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 41

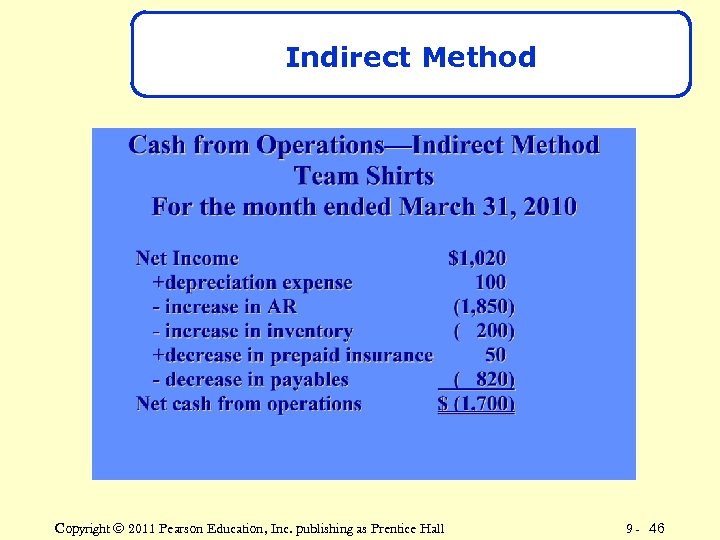

Indirect Method Net cash flows from operating activities are determined by the indirect method: Start with net income, then. . . Add and subtract items that reconcile net income to operating cash flows. Requires an analysis of changes in all current asset and current liability accounts, except cash. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 42

Indirect Method Noncash additions to net income: ØDepreciation, depletion, and amortization. ØAll losses. Noncash deductions from net income: ØAll gains. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 43

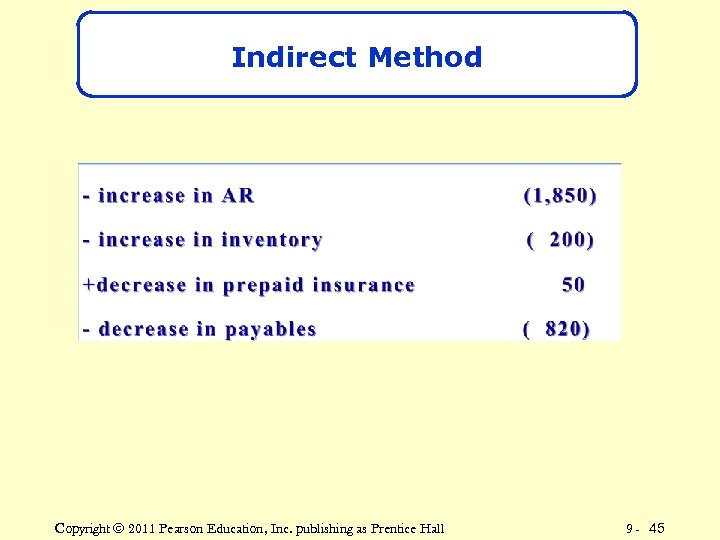

Indirect Method Then, adjust for the change in every current asset and every current liability: Current asset increases subtract Current asset decreases add Current liability increases add Current liability decreases subtract Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 44

Indirect Method Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 45

Indirect Method Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 46

Summary of Direct and Indirect Methods The direct method provides more detail about cash from operating activities. ØShows individual operating cash flows. ØShows reconciliation of operating cash flows to net income in a supplemental schedule. The investing and financing sections for the two methods are identical. Net cash flow is the same for both methods. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 47

Your Turn 9 -4 Suppose a net income and add back depreciation Begin with company had net income of $50, 000 for the year. Depreciation expense, the only noncash expense: $50, 000 + $7, 000 = $57, 000. Then, item on the $2, 000 increase in accounts receivable. subtractthe income statement, was $7, 000. The only current account were included in the year was Sales onasset that changed during net income but accounts deducted if the cash has not been should bereceivable, which began the year at $6, 500 and ended the year the $500 The only current collected. Next, add at $8, 500. increase in salaries liability Some of the was salaries payable, which payable. that changed salaries expense, which was began the year at $2, 500 and ended the year at deducted on the income statement, was not paid at $3, 000. Assume this is the balance sheet date. all the relevant information. Calculate net cash from operating = $55, 500 net $50, 000 + $7, 000 - $2, 000 + $500 activities using the indirect method. cash from operating activities. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 48

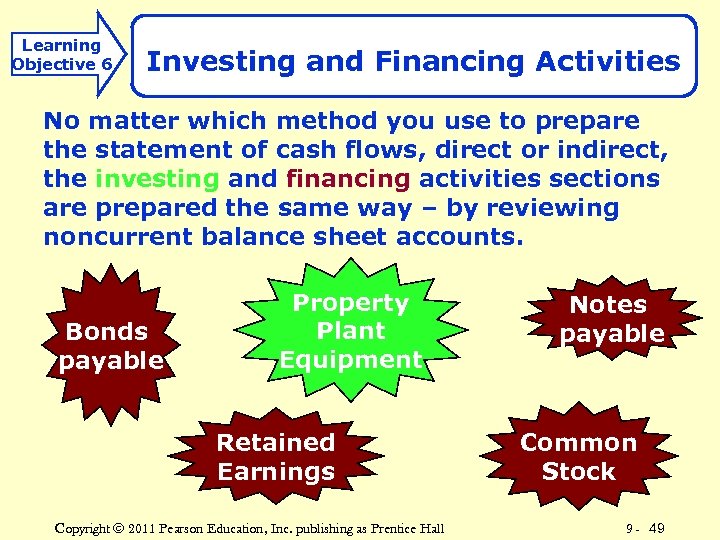

Learning Objective 6 Investing and Financing Activities No matter which method you use to prepare the statement of cash flows, direct or indirect, the investing and financing activities sections are prepared the same way – by reviewing noncurrent balance sheet accounts. Bonds payable Property Plant Equipment Retained Earnings Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall Notes payable Common Stock 9 - 49

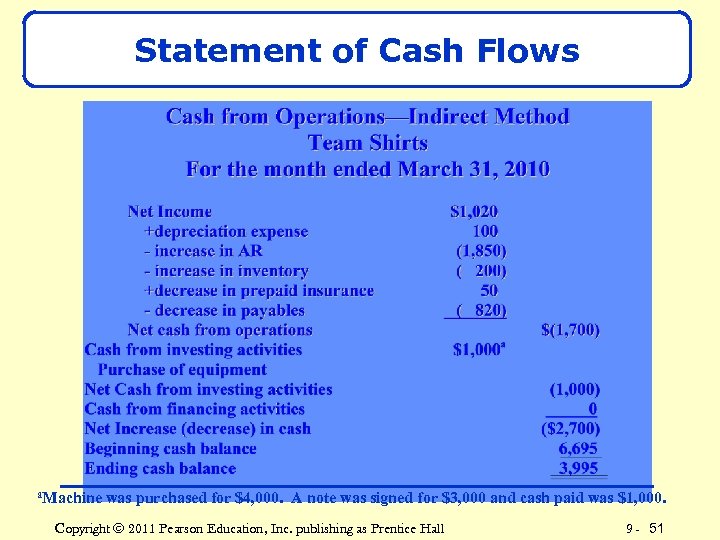

Investing Activities Team Shirts’ March 31 balance sheet shows equipment with a cost of $4, 000, and accumulated depreciation of $100 with a carrying value of $3, 900. The equipment was not on the March 1 balance sheet. The company must have bought it during March. The equipment purchase is an investing activity. We must now determine how the company paid for the asset. Team Shirts paid $1, 000 cash and signed a note payable for the $3, 000 difference. The note is disclosed on the Statement of Cash Flows as non-cash activity because it is implicit in the transaction. There were no other notes, principal payments, or capital transactions such as dividends paid or stock issues during March. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 50

Statement of Cash Flows a. Machine was purchased for $4, 000. A note was signed for $3, 000 and cash paid was $1, 000. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 51

How Important is the Statement of Cash Flows? It is crucial to the presentation of a complete picture of the financial status of a business. Many businesses with great ideas and potential have failed due to their failure to manage their cash flows. Remember, the statement is REQUIRED by GAAP. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 52

Learning Objective 7 Ratio Analysis Free cash flow is cash flows from operating activities minus dividends and capital expenditures. Auto. Zone had $921. 1 million in cash flows from operating activities, 0 dividends paid, and $243. 6 million in capital expenditures as of 08/30/2008. $921. 1 M – 243. 6 M = $677. 5 Million Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 53

Your Turn 9 -5 DRP Company reported net cash from operating activities of $45, 600. Suppose the firm purchased = Net cash fromof new long. Free cash flow $25, 000 worth operations term assets for cash and did not pay any = Purchase of long-term assets - Dividends during the$0 = $20, 600. $45, 600 - $25, 000 - year. The firm’s average current liabilities for the year were $40, 000. What was the firm’s free cash flow during the year? Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 54

Learning Objective 8 Business Risk, Control, and Ethics Investors’ risks associated with the Statement of Cash Flows: The statement of cash flows is considered to be one statement that cannot be manipulated. Beware! Although managers can rarely falsify cash inflows and outflows, they can manipulate the classification of the cash flows to prepare misleading financial statements. Because analysts are looking for positive cash flow from operating activities, investors want to see low numbers for costs of doing business, and investing cash outflows are interpreted as a positive signal of future growth. The statement of cash flows and related controls should be used to evaluate the risk of investing in a firm. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 55

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Printed in the United States of America. Copyright © 2011 Pearson Education, Inc. publishing as Prentice Hall 9 - 56

f8b71ed4303e110fb1f527bd3f03f273.ppt