57b753e0050770fac03c488f580833ef.ppt

- Количество слайдов: 44

Financial Accounting, 5 e Weygandt, Kieso, & Kimmel Prepared by Kurt M. Hull, MBA CPA California State University, Los Angeles John Wiley & Sons, Inc.

Financial Accounting, 5 e Weygandt, Kieso, & Kimmel Prepared by Kurt M. Hull, MBA CPA California State University, Los Angeles John Wiley & Sons, Inc.

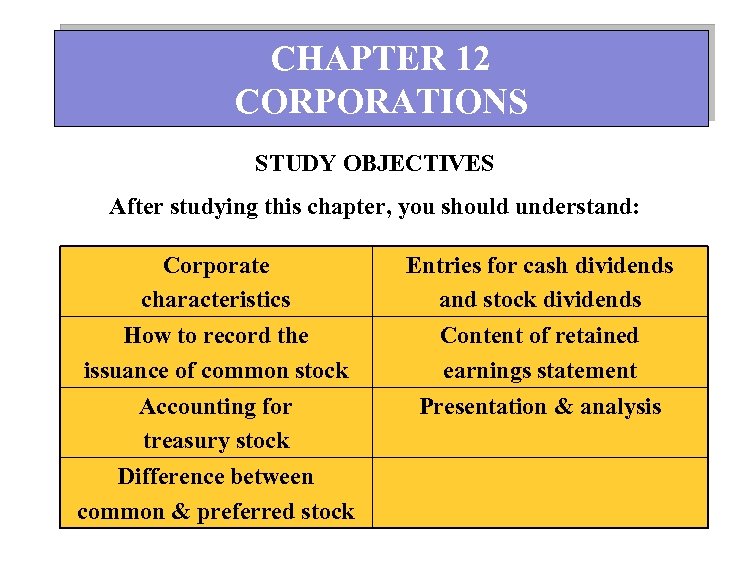

CHAPTER 12 CORPORATIONS STUDY OBJECTIVES After studying this chapter, you should understand: Corporate characteristics How to record the issuance of common stock Entries for cash dividends and stock dividends Content of retained earnings statement Accounting for treasury stock Difference between common & preferred stock Presentation & analysis

CHAPTER 12 CORPORATIONS STUDY OBJECTIVES After studying this chapter, you should understand: Corporate characteristics How to record the issuance of common stock Entries for cash dividends and stock dividends Content of retained earnings statement Accounting for treasury stock Difference between common & preferred stock Presentation & analysis

STUDY OBJECTIVE 1 CORPORATE CHARACTERISTICS Separate legal existence Limited liability Transferable ownership Advantages Ability to acquire capital Continuous life Management vs. ownership Disadvantages Government regulation Double taxation Corporations may be publicly or privately owned

STUDY OBJECTIVE 1 CORPORATE CHARACTERISTICS Separate legal existence Limited liability Transferable ownership Advantages Ability to acquire capital Continuous life Management vs. ownership Disadvantages Government regulation Double taxation Corporations may be publicly or privately owned

FORMING A CORPORATION Steps to form a corporation A. Application B. Charter C. By-laws Organizational costs are expensed as incurred.

FORMING A CORPORATION Steps to form a corporation A. Application B. Charter C. By-laws Organizational costs are expensed as incurred.

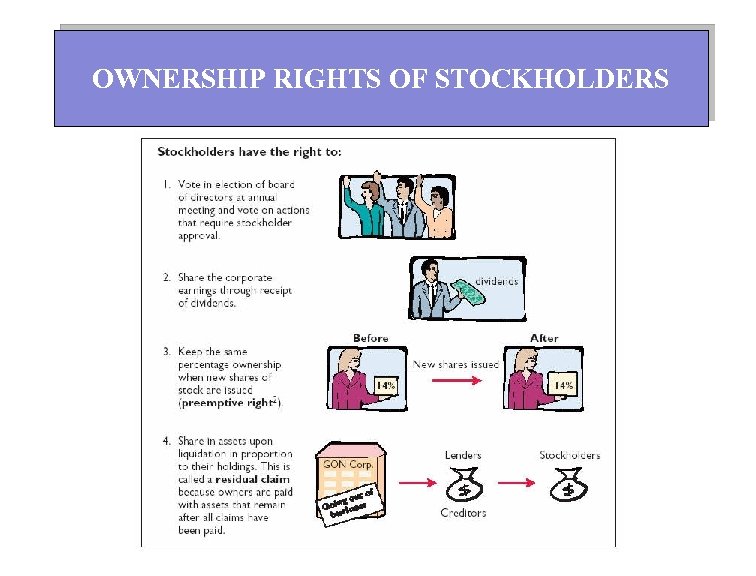

OWNERSHIP RIGHTS OF STOCKHOLDERS

OWNERSHIP RIGHTS OF STOCKHOLDERS

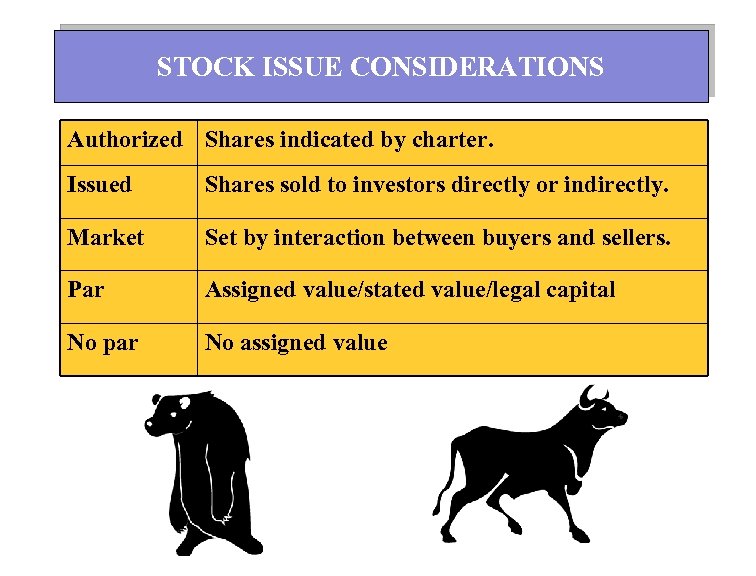

STOCK ISSUE CONSIDERATIONS Authorized Shares indicated by charter. Issued Shares sold to investors directly or indirectly. Market Set by interaction between buyers and sellers. Par Assigned value/stated value/legal capital No par No assigned value

STOCK ISSUE CONSIDERATIONS Authorized Shares indicated by charter. Issued Shares sold to investors directly or indirectly. Market Set by interaction between buyers and sellers. Par Assigned value/stated value/legal capital No par No assigned value

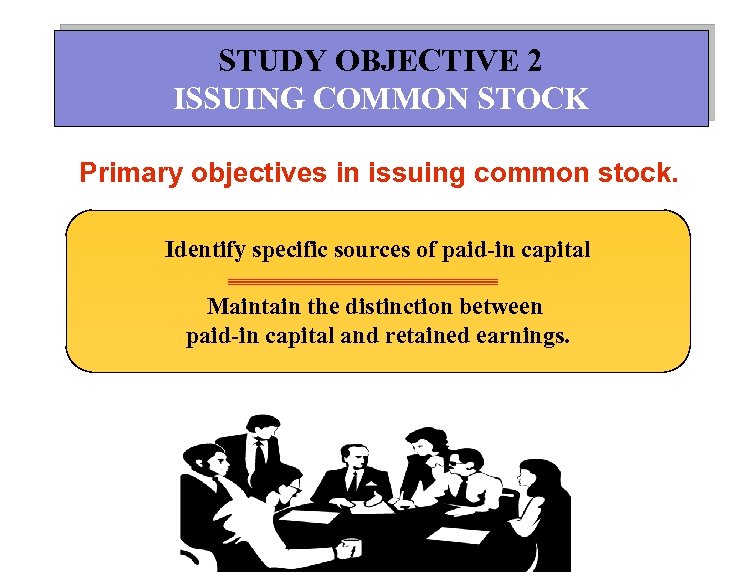

STUDY OBJECTIVE 2 ISSUING COMMON STOCK Primary objectives in issuing common stock. Identify specific sources of paid-in capital Maintain the distinction between paid-in capital and retained earnings.

STUDY OBJECTIVE 2 ISSUING COMMON STOCK Primary objectives in issuing common stock. Identify specific sources of paid-in capital Maintain the distinction between paid-in capital and retained earnings.

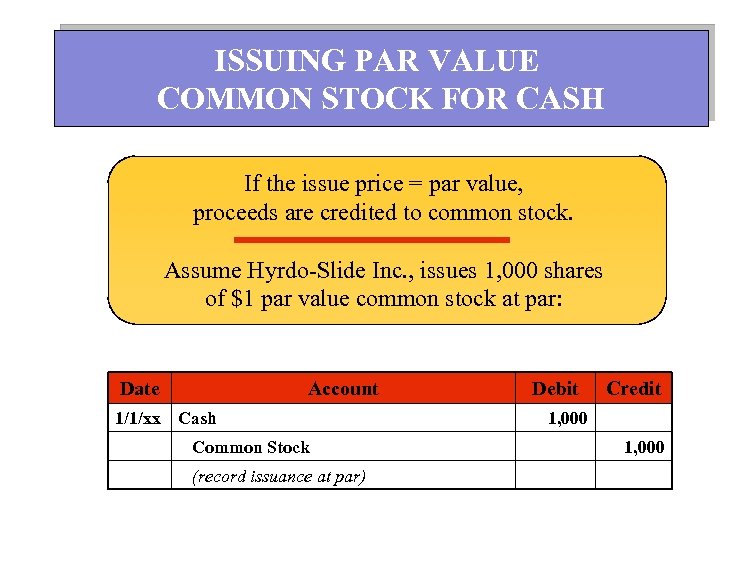

ISSUING PAR VALUE COMMON STOCK FOR CASH If the issue price = par value, proceeds are credited to common stock. Assume Hyrdo-Slide Inc. , issues 1, 000 shares of $1 par value common stock at par: Date Account 1/1/xx Cash Common Stock (record issuance at par) Debit Credit 1, 000

ISSUING PAR VALUE COMMON STOCK FOR CASH If the issue price = par value, proceeds are credited to common stock. Assume Hyrdo-Slide Inc. , issues 1, 000 shares of $1 par value common stock at par: Date Account 1/1/xx Cash Common Stock (record issuance at par) Debit Credit 1, 000

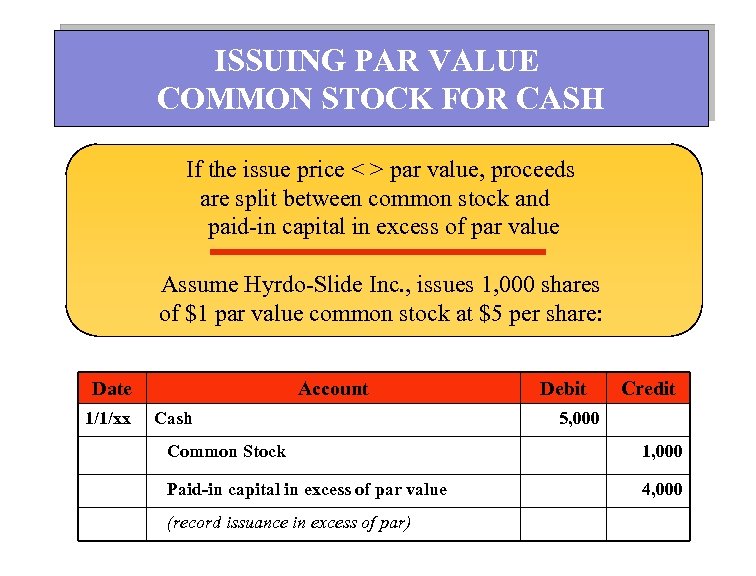

ISSUING PAR VALUE COMMON STOCK FOR CASH If the issue price < > par value, proceeds are split between common stock and paid-in capital in excess of par value Assume Hyrdo-Slide Inc. , issues 1, 000 shares of $1 par value common stock at $5 per share: Date 1/1/xx Account Cash Debit Credit 5, 000 Common Stock 1, 000 Paid-in capital in excess of par value 4, 000 (record issuance in excess of par)

ISSUING PAR VALUE COMMON STOCK FOR CASH If the issue price < > par value, proceeds are split between common stock and paid-in capital in excess of par value Assume Hyrdo-Slide Inc. , issues 1, 000 shares of $1 par value common stock at $5 per share: Date 1/1/xx Account Cash Debit Credit 5, 000 Common Stock 1, 000 Paid-in capital in excess of par value 4, 000 (record issuance in excess of par)

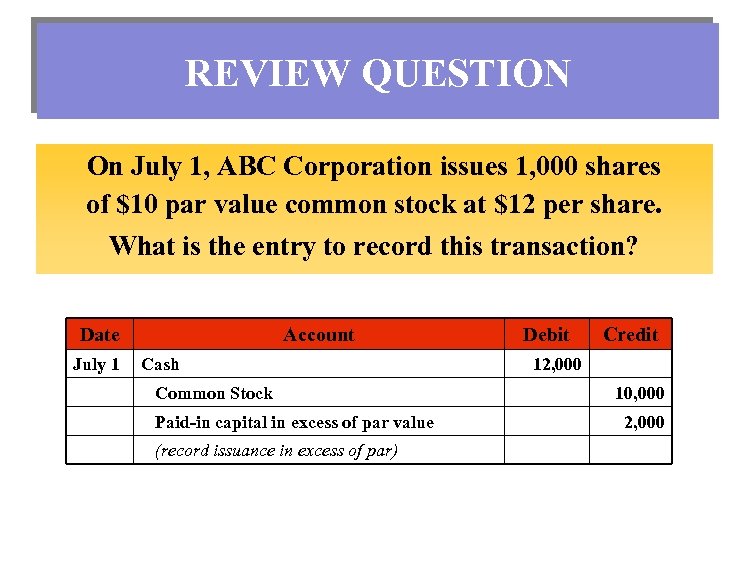

REVIEW QUESTION On July 1, ABC Corporation issues 1, 000 shares of $10 par value common stock at $12 per share. What is the entry to record this transaction? Date July 1 Account Cash Common Stock Paid-in capital in excess of par value (record issuance in excess of par) Debit Credit 12, 000 10, 000 2, 000

REVIEW QUESTION On July 1, ABC Corporation issues 1, 000 shares of $10 par value common stock at $12 per share. What is the entry to record this transaction? Date July 1 Account Cash Common Stock Paid-in capital in excess of par value (record issuance in excess of par) Debit Credit 12, 000 10, 000 2, 000

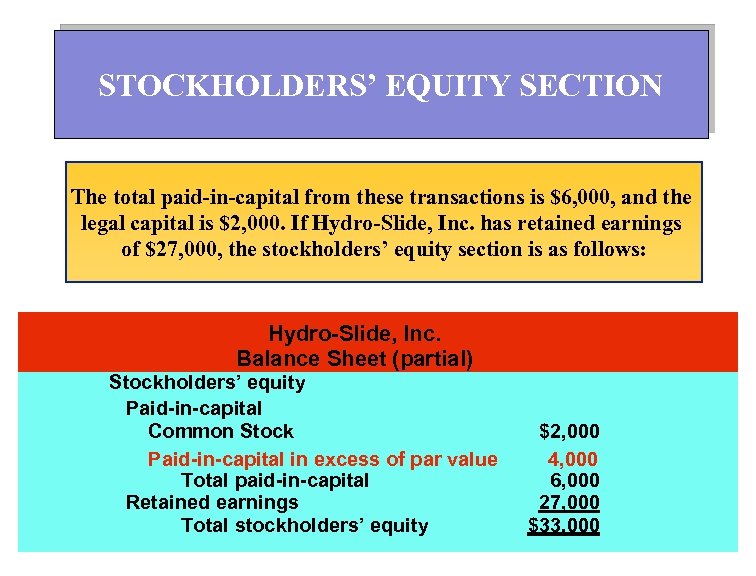

STOCKHOLDERS’ EQUITY SECTION The total paid-in-capital from these transactions is $6, 000, and the legal capital is $2, 000. If Hydro-Slide, Inc. has retained earnings of $27, 000, the stockholders’ equity section is as follows: Hydro-Slide, Inc. Balance Sheet (partial) Stockholders’ equity Paid-in-capital Common Stock Paid-in-capital in excess of par value Total paid-in-capital Retained earnings Total stockholders’ equity $2, 000 4, 000 6, 000 27, 000 $33, 000

STOCKHOLDERS’ EQUITY SECTION The total paid-in-capital from these transactions is $6, 000, and the legal capital is $2, 000. If Hydro-Slide, Inc. has retained earnings of $27, 000, the stockholders’ equity section is as follows: Hydro-Slide, Inc. Balance Sheet (partial) Stockholders’ equity Paid-in-capital Common Stock Paid-in-capital in excess of par value Total paid-in-capital Retained earnings Total stockholders’ equity $2, 000 4, 000 6, 000 27, 000 $33, 000

ISSUING NO-PAR COMMON STOCK FOR CASH If issue price > stated value, the stated value is credited to common stock, and the excess goes to paid-in excess of stated value. If Hydro-Slide Inc. issues 5, 000 shares of $5 stated value no-par stock for $8 per share: Date 1/1/xx Account Cash Debit Credit 40, 000 Common Stock (5000 x $5) 25, 000 Paid-in capital in excess of stated value 15, 000 (record issuance of stated value, no par shares)

ISSUING NO-PAR COMMON STOCK FOR CASH If issue price > stated value, the stated value is credited to common stock, and the excess goes to paid-in excess of stated value. If Hydro-Slide Inc. issues 5, 000 shares of $5 stated value no-par stock for $8 per share: Date 1/1/xx Account Cash Debit Credit 40, 000 Common Stock (5000 x $5) 25, 000 Paid-in capital in excess of stated value 15, 000 (record issuance of stated value, no par shares)

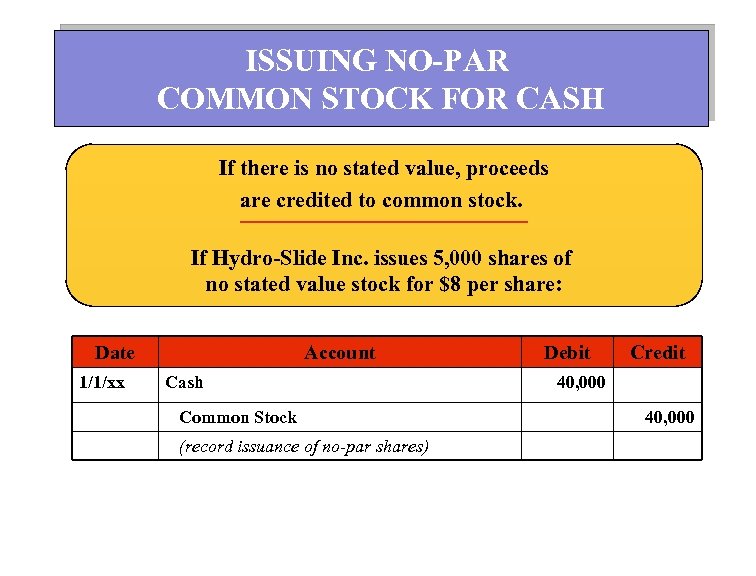

ISSUING NO-PAR COMMON STOCK FOR CASH If there is no stated value, proceeds are credited to common stock. If Hydro-Slide Inc. issues 5, 000 shares of no stated value stock for $8 per share: Date 1/1/xx Account Cash Common Stock (record issuance of no-par shares) Debit Credit 40, 000

ISSUING NO-PAR COMMON STOCK FOR CASH If there is no stated value, proceeds are credited to common stock. If Hydro-Slide Inc. issues 5, 000 shares of no stated value stock for $8 per share: Date 1/1/xx Account Cash Common Stock (record issuance of no-par shares) Debit Credit 40, 000

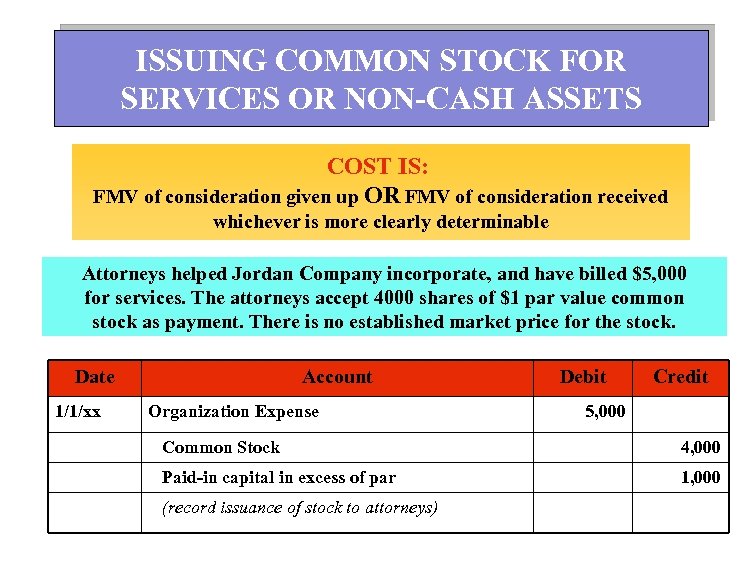

ISSUING COMMON STOCK FOR SERVICES OR NON-CASH ASSETS COST IS: FMV of consideration given up OR FMV of consideration received whichever is more clearly determinable Attorneys helped Jordan Company incorporate, and have billed $5, 000 for services. The attorneys accept 4000 shares of $1 par value common stock as payment. There is no established market price for the stock. Date 1/1/xx Account Organization Expense Debit Credit 5, 000 Common Stock 4, 000 Paid-in capital in excess of par 1, 000 (record issuance of stock to attorneys)

ISSUING COMMON STOCK FOR SERVICES OR NON-CASH ASSETS COST IS: FMV of consideration given up OR FMV of consideration received whichever is more clearly determinable Attorneys helped Jordan Company incorporate, and have billed $5, 000 for services. The attorneys accept 4000 shares of $1 par value common stock as payment. There is no established market price for the stock. Date 1/1/xx Account Organization Expense Debit Credit 5, 000 Common Stock 4, 000 Paid-in capital in excess of par 1, 000 (record issuance of stock to attorneys)

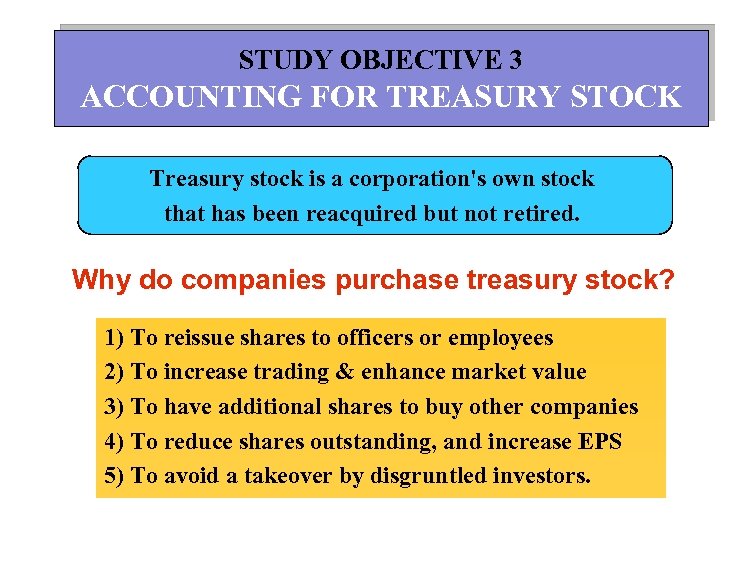

STUDY OBJECTIVE 3 ACCOUNTING FOR TREASURY STOCK Treasury stock is a corporation's own stock that has been reacquired but not retired. Why do companies purchase treasury stock? 1) To reissue shares to officers or employees 2) To increase trading & enhance market value 3) To have additional shares to buy other companies 4) To reduce shares outstanding, and increase EPS 5) To avoid a takeover by disgruntled investors.

STUDY OBJECTIVE 3 ACCOUNTING FOR TREASURY STOCK Treasury stock is a corporation's own stock that has been reacquired but not retired. Why do companies purchase treasury stock? 1) To reissue shares to officers or employees 2) To increase trading & enhance market value 3) To have additional shares to buy other companies 4) To reduce shares outstanding, and increase EPS 5) To avoid a takeover by disgruntled investors.

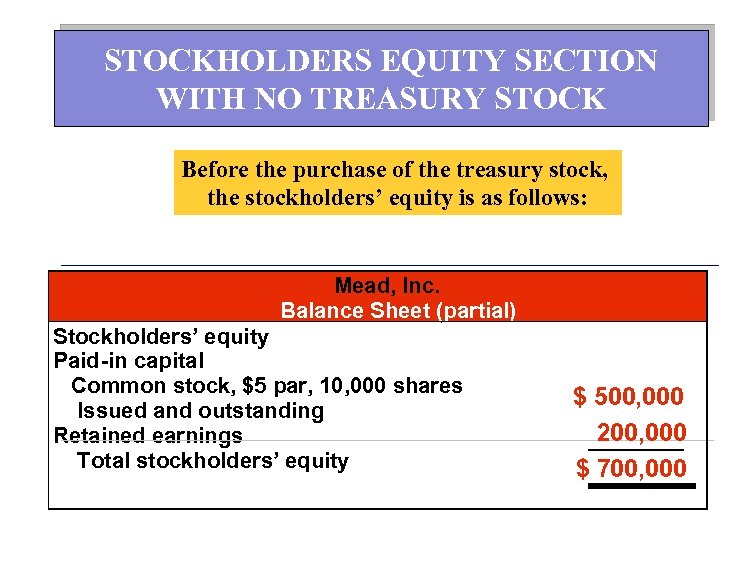

STOCKHOLDERS EQUITY SECTION WITH NO TREASURY STOCK Before the purchase of the treasury stock, the stockholders’ equity is as follows: Mead, Inc. Balance Sheet (partial) Stockholders’ equity Paid -in capital Common stock, $5 par, 10, 000 shares Issued and outstanding Retained earnings Total stockholders’ equity $ 500, 000 200, 000 $ 700, 000

STOCKHOLDERS EQUITY SECTION WITH NO TREASURY STOCK Before the purchase of the treasury stock, the stockholders’ equity is as follows: Mead, Inc. Balance Sheet (partial) Stockholders’ equity Paid -in capital Common stock, $5 par, 10, 000 shares Issued and outstanding Retained earnings Total stockholders’ equity $ 500, 000 200, 000 $ 700, 000

PURCHASE OF TREASURY STOCK If Mead, Inc. has 100, 000 shares of $5 par value common stock outstanding (all issued at par value) and it decides to acquire 4, 000 shares of its stock at $8 per share, the entry is: Date Feb 1 Account Treasury stock Debit Credit 32, 000 Cash 32, 000 (record purchase of treasury stock) Cost method

PURCHASE OF TREASURY STOCK If Mead, Inc. has 100, 000 shares of $5 par value common stock outstanding (all issued at par value) and it decides to acquire 4, 000 shares of its stock at $8 per share, the entry is: Date Feb 1 Account Treasury stock Debit Credit 32, 000 Cash 32, 000 (record purchase of treasury stock) Cost method

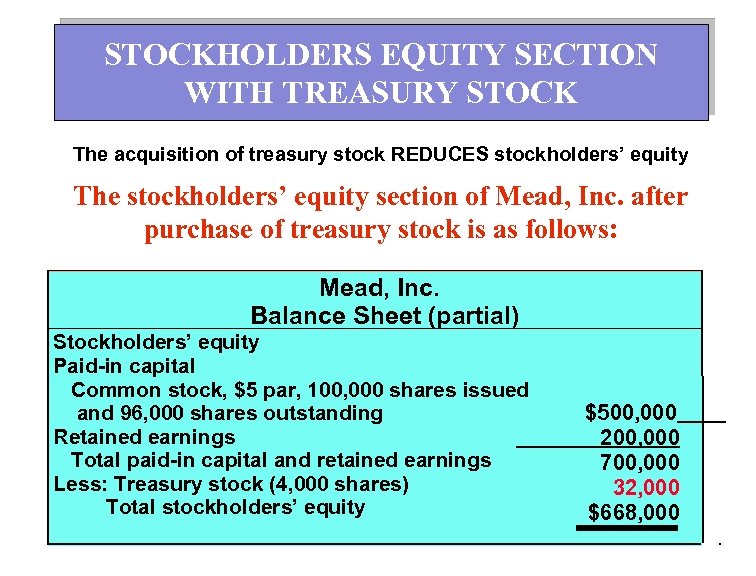

STOCKHOLDERS EQUITY SECTION WITH TREASURY STOCK The acquisition of treasury stock REDUCES stockholders’ equity The stockholders’ equity section of Mead, Inc. after purchase of treasury stock is as follows: Mead, Inc. Balance Sheet (partial) Stockholders’ equity Paid-in capital Common stock, $5 par, 100, 000 shares issued and 96, 000 shares outstanding Retained earnings Total paid-in capital and retained earnings Less: Treasury stock (4, 000 shares) Total stockholders’ equity $500, 000 200, 000 700, 000 32, 000 $668, 000

STOCKHOLDERS EQUITY SECTION WITH TREASURY STOCK The acquisition of treasury stock REDUCES stockholders’ equity The stockholders’ equity section of Mead, Inc. after purchase of treasury stock is as follows: Mead, Inc. Balance Sheet (partial) Stockholders’ equity Paid-in capital Common stock, $5 par, 100, 000 shares issued and 96, 000 shares outstanding Retained earnings Total paid-in capital and retained earnings Less: Treasury stock (4, 000 shares) Total stockholders’ equity $500, 000 200, 000 700, 000 32, 000 $668, 000

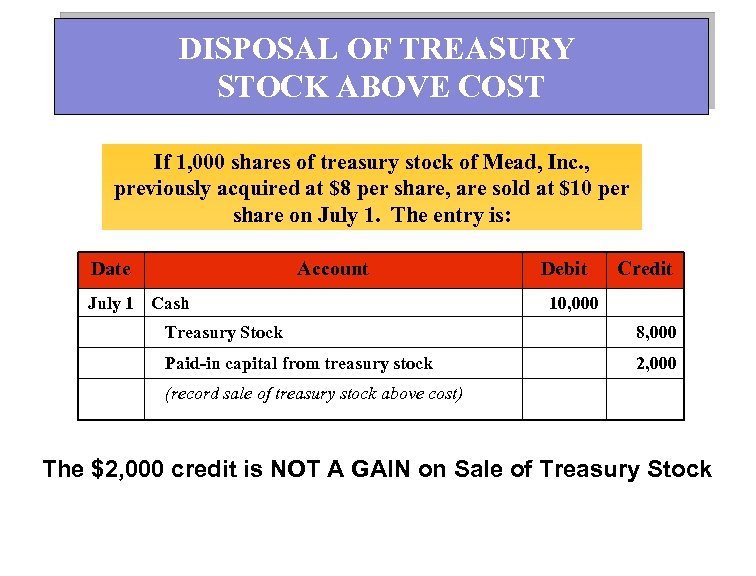

DISPOSAL OF TREASURY STOCK ABOVE COST If 1, 000 shares of treasury stock of Mead, Inc. , previously acquired at $8 per share, are sold at $10 per share on July 1. The entry is: Date Account July 1 Cash Debit Credit 10, 000 Treasury Stock 8, 000 Paid-in capital from treasury stock 2, 000 (record sale of treasury stock above cost) The $2, 000 credit is NOT A GAIN on Sale of Treasury Stock

DISPOSAL OF TREASURY STOCK ABOVE COST If 1, 000 shares of treasury stock of Mead, Inc. , previously acquired at $8 per share, are sold at $10 per share on July 1. The entry is: Date Account July 1 Cash Debit Credit 10, 000 Treasury Stock 8, 000 Paid-in capital from treasury stock 2, 000 (record sale of treasury stock above cost) The $2, 000 credit is NOT A GAIN on Sale of Treasury Stock

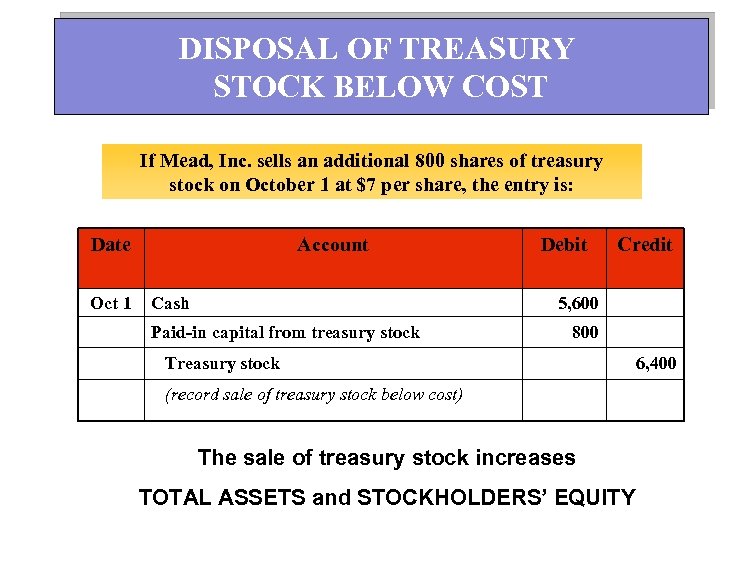

DISPOSAL OF TREASURY STOCK BELOW COST If Mead, Inc. sells an additional 800 shares of treasury stock on October 1 at $7 per share, the entry is: Date Oct 1 Account Cash Debit Credit 5, 600 Paid-in capital from treasury stock 800 Treasury stock (record sale of treasury stock below cost) The sale of treasury stock increases TOTAL ASSETS and STOCKHOLDERS’ EQUITY 6, 400

DISPOSAL OF TREASURY STOCK BELOW COST If Mead, Inc. sells an additional 800 shares of treasury stock on October 1 at $7 per share, the entry is: Date Oct 1 Account Cash Debit Credit 5, 600 Paid-in capital from treasury stock 800 Treasury stock (record sale of treasury stock below cost) The sale of treasury stock increases TOTAL ASSETS and STOCKHOLDERS’ EQUITY 6, 400

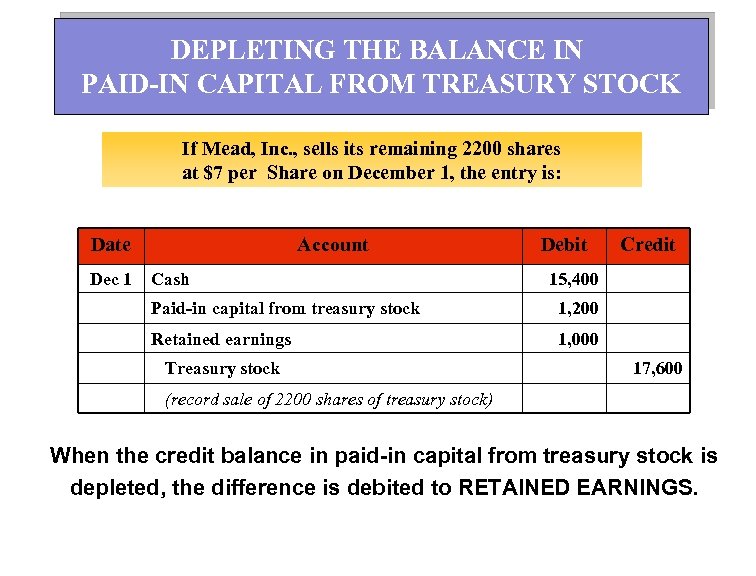

DEPLETING THE BALANCE IN PAID-IN CAPITAL FROM TREASURY STOCK If Mead, Inc. , sells its remaining 2200 shares at $7 per Share on December 1, the entry is: Date Dec 1 Account Cash Debit Credit 15, 400 Paid-in capital from treasury stock 1, 200 Retained earnings 1, 000 Treasury stock 17, 600 (record sale of 2200 shares of treasury stock) When the credit balance in paid-in capital from treasury stock is depleted, the difference is debited to RETAINED EARNINGS.

DEPLETING THE BALANCE IN PAID-IN CAPITAL FROM TREASURY STOCK If Mead, Inc. , sells its remaining 2200 shares at $7 per Share on December 1, the entry is: Date Dec 1 Account Cash Debit Credit 15, 400 Paid-in capital from treasury stock 1, 200 Retained earnings 1, 000 Treasury stock 17, 600 (record sale of 2200 shares of treasury stock) When the credit balance in paid-in capital from treasury stock is depleted, the difference is debited to RETAINED EARNINGS.

STUDY OBJECTIVE 4 PREFERRED STOCK Preferred stock has priority over common stock in terms of Distribution of earnings Assets in liquidation No voting rights. Identified separately from other stock and paid in capitals.

STUDY OBJECTIVE 4 PREFERRED STOCK Preferred stock has priority over common stock in terms of Distribution of earnings Assets in liquidation No voting rights. Identified separately from other stock and paid in capitals.

DIVIDEND PRFERENCES CUMULATIVE DIVIDEND Preferred stockholders must be paid both current and prior year dividends before common stockholders receive any dividends. DIVIDENDS IN ARREARS Preferred dividends not declared in a given period. Not considered a liability, but disclosed in the notes to the financial statements.

DIVIDEND PRFERENCES CUMULATIVE DIVIDEND Preferred stockholders must be paid both current and prior year dividends before common stockholders receive any dividends. DIVIDENDS IN ARREARS Preferred dividends not declared in a given period. Not considered a liability, but disclosed in the notes to the financial statements.

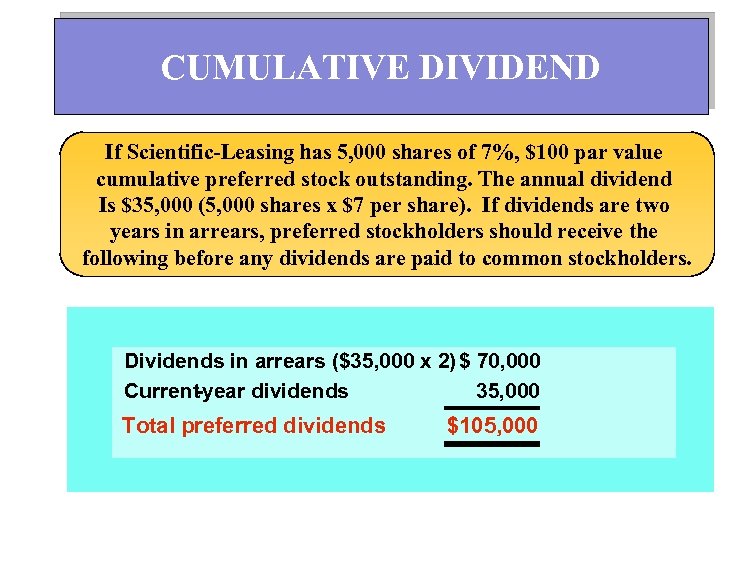

CUMULATIVE DIVIDEND If Scientific-Leasing has 5, 000 shares of 7%, $100 par value cumulative preferred stock outstanding. The annual dividend Is $35, 000 (5, 000 shares x $7 per share). If dividends are two years in arrears, preferred stockholders should receive the following before any dividends are paid to common stockholders. Dividends in arrears ($35, 000 x 2) $ 70, 000 Current -year dividends 35, 000 Total preferred dividends $105, 000

CUMULATIVE DIVIDEND If Scientific-Leasing has 5, 000 shares of 7%, $100 par value cumulative preferred stock outstanding. The annual dividend Is $35, 000 (5, 000 shares x $7 per share). If dividends are two years in arrears, preferred stockholders should receive the following before any dividends are paid to common stockholders. Dividends in arrears ($35, 000 x 2) $ 70, 000 Current -year dividends 35, 000 Total preferred dividends $105, 000

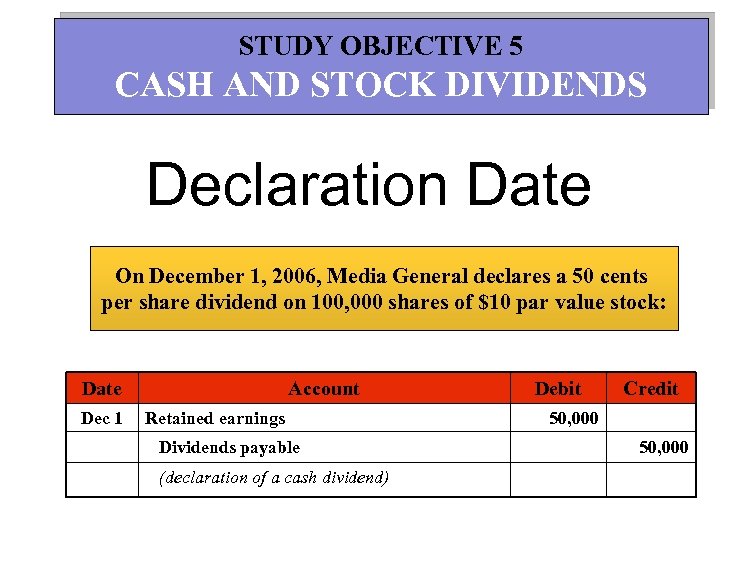

STUDY OBJECTIVE 5 CASH AND STOCK DIVIDENDS Declaration Date On December 1, 2006, Media General declares a 50 cents per share dividend on 100, 000 shares of $10 par value stock: Date Dec 1 Account Retained earnings Dividends payable (declaration of a cash dividend) Debit Credit 50, 000

STUDY OBJECTIVE 5 CASH AND STOCK DIVIDENDS Declaration Date On December 1, 2006, Media General declares a 50 cents per share dividend on 100, 000 shares of $10 par value stock: Date Dec 1 Account Retained earnings Dividends payable (declaration of a cash dividend) Debit Credit 50, 000

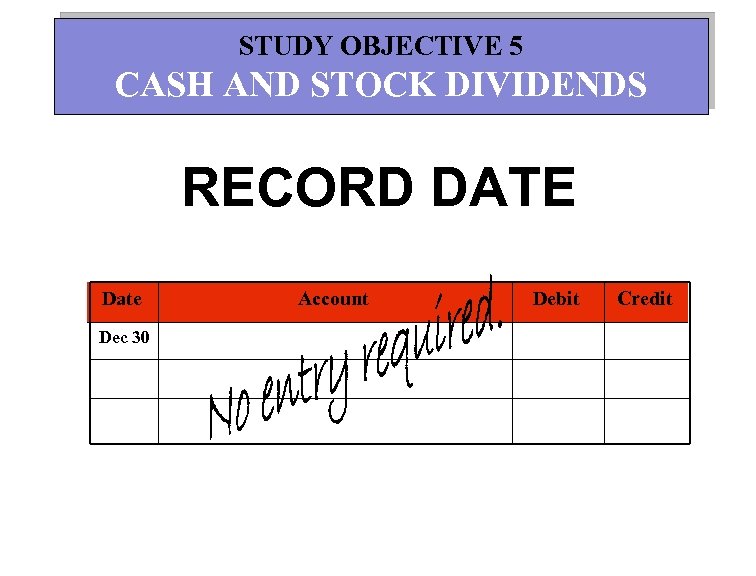

STUDY OBJECTIVE 5 CASH AND STOCK DIVIDENDS RECORD DATE Date Dec 30 Account Debit Credit

STUDY OBJECTIVE 5 CASH AND STOCK DIVIDENDS RECORD DATE Date Dec 30 Account Debit Credit

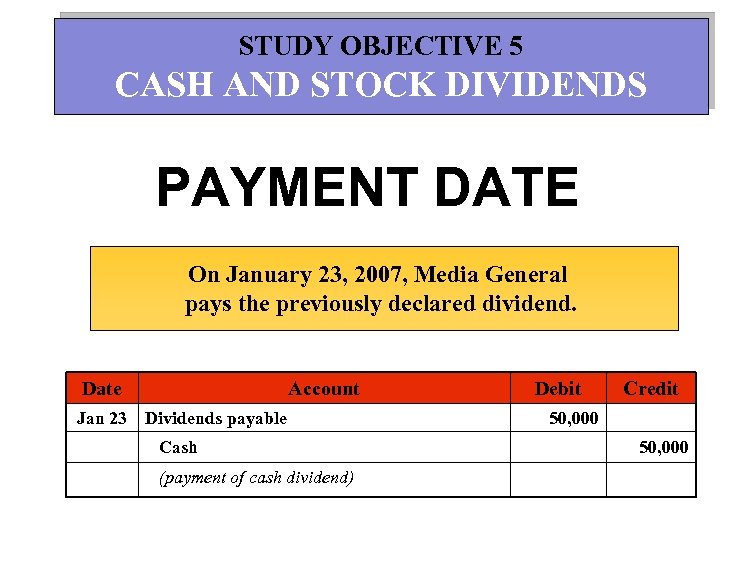

STUDY OBJECTIVE 5 CASH AND STOCK DIVIDENDS PAYMENT DATE On January 23, 2007, Media General pays the previously declared dividend. Date Account Jan 23 Dividends payable Cash (payment of cash dividend) Debit Credit 50, 000

STUDY OBJECTIVE 5 CASH AND STOCK DIVIDENDS PAYMENT DATE On January 23, 2007, Media General pays the previously declared dividend. Date Account Jan 23 Dividends payable Cash (payment of cash dividend) Debit Credit 50, 000

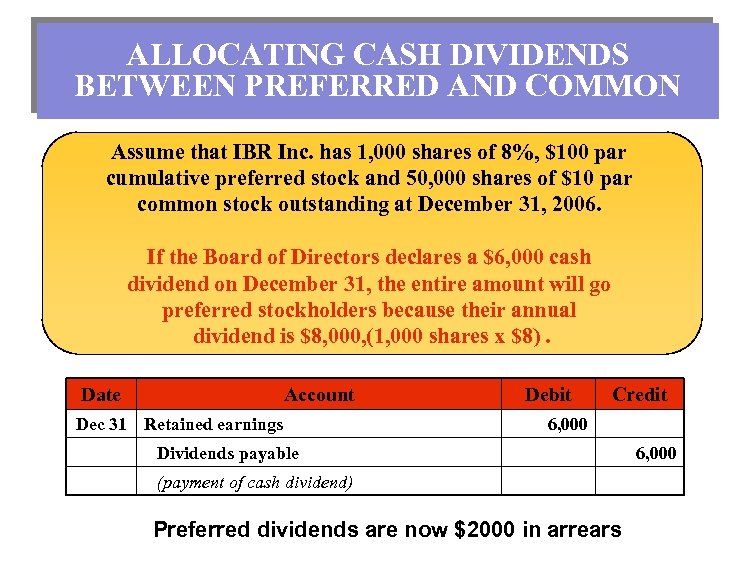

ALLOCATING CASH DIVIDENDS BETWEEN PREFERRED AND COMMON Assume that IBR Inc. has 1, 000 shares of 8%, $100 par cumulative preferred stock and 50, 000 shares of $10 par common stock outstanding at December 31, 2006. If the Board of Directors declares a $6, 000 cash dividend on December 31, the entire amount will go preferred stockholders because their annual dividend is $8, 000, (1, 000 shares x $8). Date Account Dec 31 Retained earnings Debit Credit 6, 000 Dividends payable (payment of cash dividend) Preferred dividends are now $2000 in arrears 6, 000

ALLOCATING CASH DIVIDENDS BETWEEN PREFERRED AND COMMON Assume that IBR Inc. has 1, 000 shares of 8%, $100 par cumulative preferred stock and 50, 000 shares of $10 par common stock outstanding at December 31, 2006. If the Board of Directors declares a $6, 000 cash dividend on December 31, the entire amount will go preferred stockholders because their annual dividend is $8, 000, (1, 000 shares x $8). Date Account Dec 31 Retained earnings Debit Credit 6, 000 Dividends payable (payment of cash dividend) Preferred dividends are now $2000 in arrears 6, 000

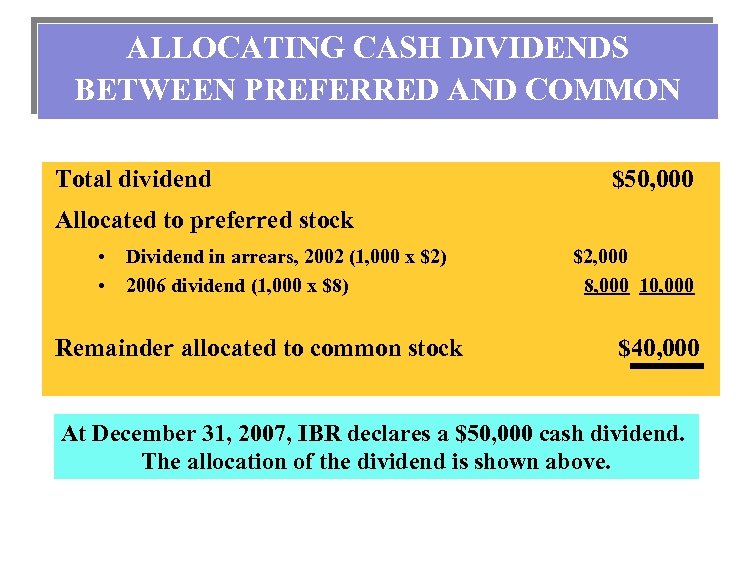

ALLOCATING CASH DIVIDENDS BETWEEN PREFERRED AND COMMON Total dividend $50, 000 Allocated to preferred stock • • Dividend in arrears, 2002 (1, 000 x $2) 2006 dividend (1, 000 x $8) Remainder allocated to common stock $2, 000 8, 000 10, 000 $40, 000 At December 31, 2007, IBR declares a $50, 000 cash dividend. The allocation of the dividend is shown above.

ALLOCATING CASH DIVIDENDS BETWEEN PREFERRED AND COMMON Total dividend $50, 000 Allocated to preferred stock • • Dividend in arrears, 2002 (1, 000 x $2) 2006 dividend (1, 000 x $8) Remainder allocated to common stock $2, 000 8, 000 10, 000 $40, 000 At December 31, 2007, IBR declares a $50, 000 cash dividend. The allocation of the dividend is shown above.

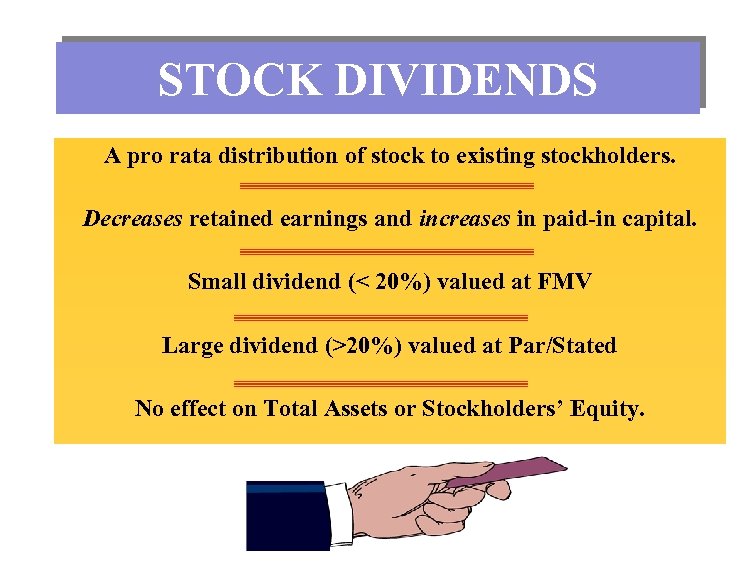

STOCK DIVIDENDS A pro rata distribution of stock to existing stockholders. Decreases retained earnings and increases in paid-in capital. Small dividend (< 20%) valued at FMV Large dividend (>20%) valued at Par/Stated No effect on Total Assets or Stockholders’ Equity.

STOCK DIVIDENDS A pro rata distribution of stock to existing stockholders. Decreases retained earnings and increases in paid-in capital. Small dividend (< 20%) valued at FMV Large dividend (>20%) valued at Par/Stated No effect on Total Assets or Stockholders’ Equity.

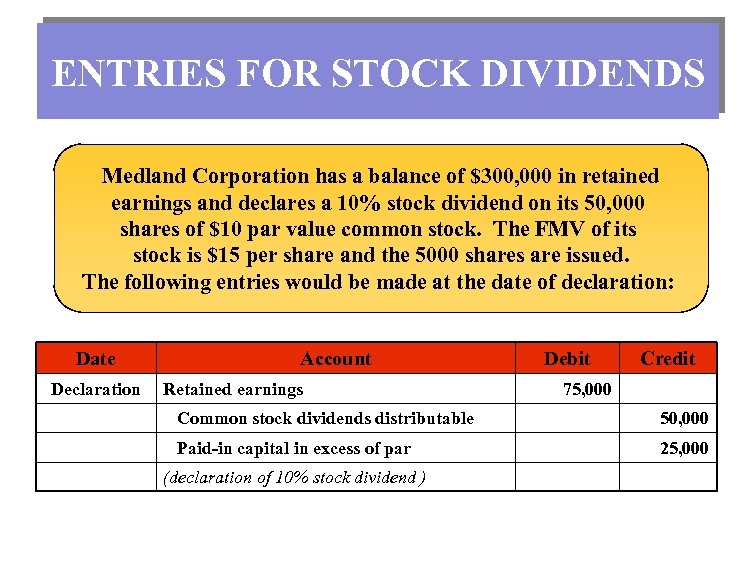

ENTRIES FOR STOCK DIVIDENDS Medland Corporation has a balance of $300, 000 in retained earnings and declares a 10% stock dividend on its 50, 000 shares of $10 par value common stock. The FMV of its stock is $15 per share and the 5000 shares are issued. The following entries would be made at the date of declaration: Date Declaration Account Retained earnings Debit Credit 75, 000 Common stock dividends distributable 50, 000 Paid-in capital in excess of par 25, 000 (declaration of 10% stock dividend )

ENTRIES FOR STOCK DIVIDENDS Medland Corporation has a balance of $300, 000 in retained earnings and declares a 10% stock dividend on its 50, 000 shares of $10 par value common stock. The FMV of its stock is $15 per share and the 5000 shares are issued. The following entries would be made at the date of declaration: Date Declaration Account Retained earnings Debit Credit 75, 000 Common stock dividends distributable 50, 000 Paid-in capital in excess of par 25, 000 (declaration of 10% stock dividend )

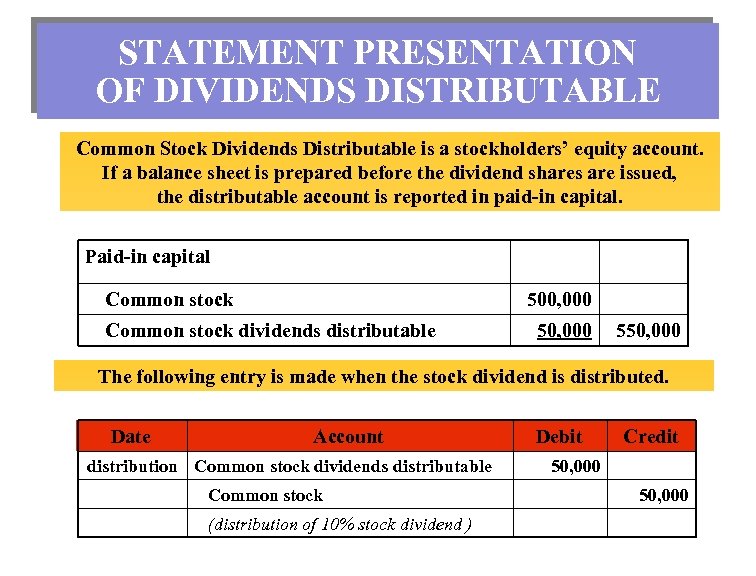

STATEMENT PRESENTATION OF DIVIDENDS DISTRIBUTABLE Common Stock Dividends Distributable is a stockholders’ equity account. If a balance sheet is prepared before the dividend shares are issued, the distributable account is reported in paid-in capital. Paid-in capital Common stock 500, 000 Common stock dividends distributable 50, 000 550, 000 The following entry is made when the stock dividend is distributed. Date Account distribution Common stock dividends distributable Common stock (distribution of 10% stock dividend ) Debit Credit 50, 000

STATEMENT PRESENTATION OF DIVIDENDS DISTRIBUTABLE Common Stock Dividends Distributable is a stockholders’ equity account. If a balance sheet is prepared before the dividend shares are issued, the distributable account is reported in paid-in capital. Paid-in capital Common stock 500, 000 Common stock dividends distributable 50, 000 550, 000 The following entry is made when the stock dividend is distributed. Date Account distribution Common stock dividends distributable Common stock (distribution of 10% stock dividend ) Debit Credit 50, 000

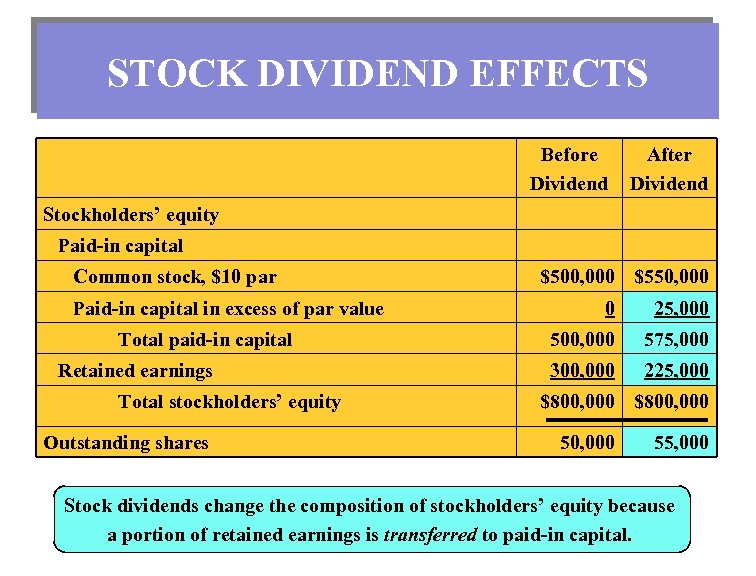

STOCK DIVIDEND EFFECTS Before Dividend After Dividend Stockholders’ equity Paid-in capital Common stock, $10 par Paid-in capital in excess of par value Total paid-in capital Retained earnings Total stockholders’ equity Outstanding shares $500, 000 $550, 000 0 25, 000 500, 000 575, 000 300, 000 225, 000 $800, 000 50, 000 55, 000 Stock dividends change the composition of stockholders’ equity because a portion of retained earnings is transferred to paid-in capital.

STOCK DIVIDEND EFFECTS Before Dividend After Dividend Stockholders’ equity Paid-in capital Common stock, $10 par Paid-in capital in excess of par value Total paid-in capital Retained earnings Total stockholders’ equity Outstanding shares $500, 000 $550, 000 0 25, 000 500, 000 575, 000 300, 000 225, 000 $800, 000 50, 000 55, 000 Stock dividends change the composition of stockholders’ equity because a portion of retained earnings is transferred to paid-in capital.

STOCK SPLITS A multiple of existing shares issued to existing stockholders. Total number of shares increases, par value decreases. No effect on total stockholders’ equity. No journal entry required.

STOCK SPLITS A multiple of existing shares issued to existing stockholders. Total number of shares increases, par value decreases. No effect on total stockholders’ equity. No journal entry required.

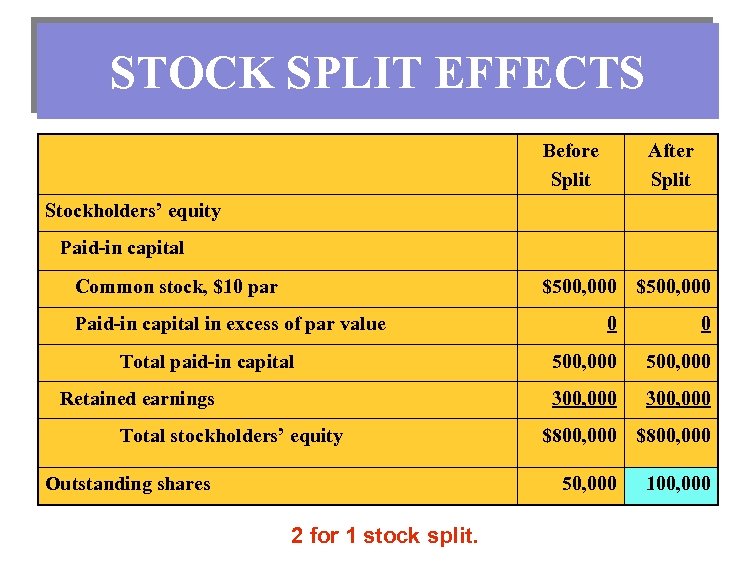

STOCK SPLIT EFFECTS Before Split After Split Stockholders’ equity Paid-in capital Common stock, $10 par $500, 000 Paid-in capital in excess of par value Retained earnings Total stockholders’ equity Outstanding shares 0 500, 000 300, 000 Total paid-in capital 0 300, 000 $800, 000 50, 000 2 for 1 stock split. 100, 000

STOCK SPLIT EFFECTS Before Split After Split Stockholders’ equity Paid-in capital Common stock, $10 par $500, 000 Paid-in capital in excess of par value Retained earnings Total stockholders’ equity Outstanding shares 0 500, 000 300, 000 Total paid-in capital 0 300, 000 $800, 000 50, 000 2 for 1 stock split. 100, 000

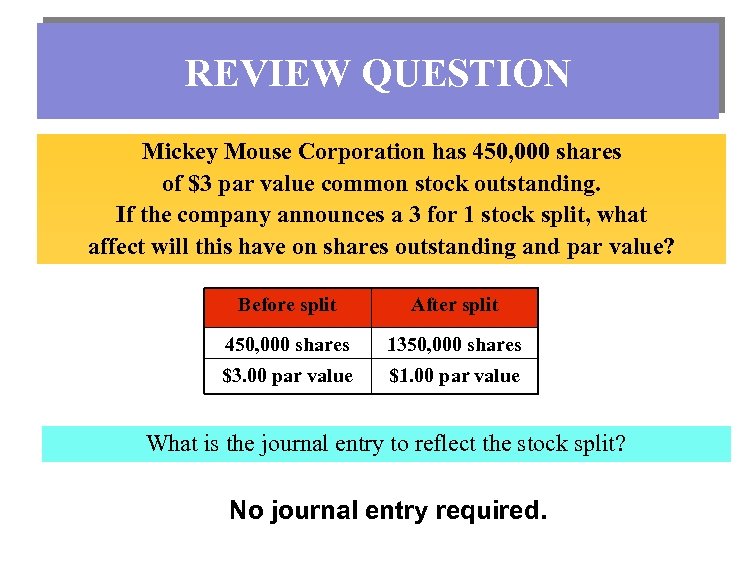

REVIEW QUESTION Mickey Mouse Corporation has 450, 000 shares of $3 par value common stock outstanding. If the company announces a 3 for 1 stock split, what affect will this have on shares outstanding and par value? Before split After split 450, 000 shares 1350, 000 shares $3. 00 par value $1. 00 par value What is the journal entry to reflect the stock split? No journal entry required.

REVIEW QUESTION Mickey Mouse Corporation has 450, 000 shares of $3 par value common stock outstanding. If the company announces a 3 for 1 stock split, what affect will this have on shares outstanding and par value? Before split After split 450, 000 shares 1350, 000 shares $3. 00 par value $1. 00 par value What is the journal entry to reflect the stock split? No journal entry required.

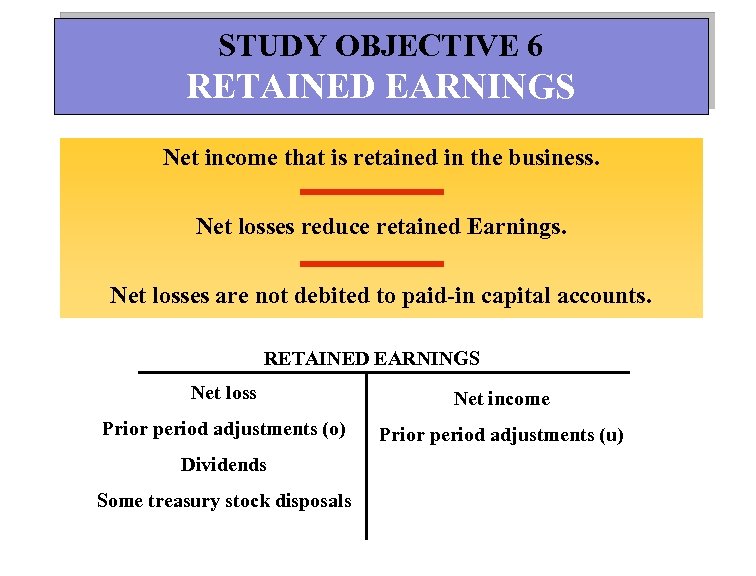

STUDY OBJECTIVE 6 RETAINED EARNINGS Net income that is retained in the business. Net losses reduce retained Earnings. Net losses are not debited to paid-in capital accounts. RETAINED EARNINGS Net loss Net income Prior period adjustments (o) Prior period adjustments (u) Dividends Some treasury stock disposals

STUDY OBJECTIVE 6 RETAINED EARNINGS Net income that is retained in the business. Net losses reduce retained Earnings. Net losses are not debited to paid-in capital accounts. RETAINED EARNINGS Net loss Net income Prior period adjustments (o) Prior period adjustments (u) Dividends Some treasury stock disposals

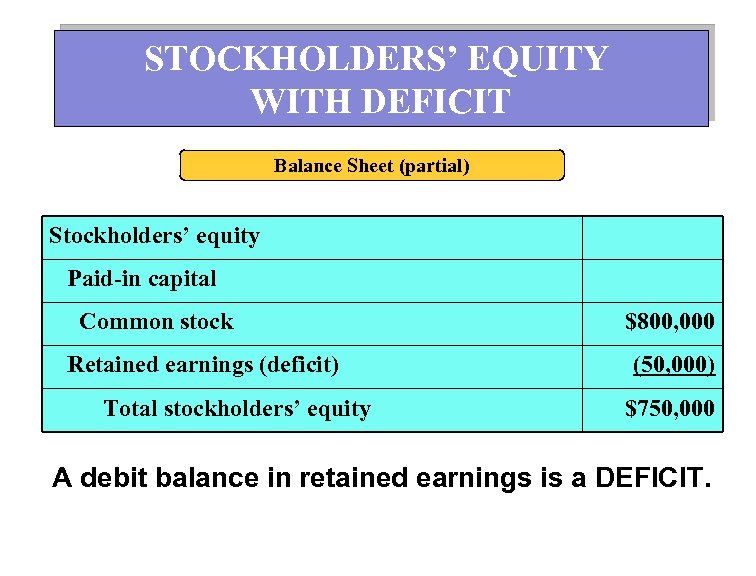

STOCKHOLDERS’ EQUITY WITH DEFICIT Balance Sheet (partial) Stockholders’ equity Paid-in capital Common stock Retained earnings (deficit) Total stockholders’ equity $800, 000 (50, 000) $750, 000 A debit balance in retained earnings is a DEFICIT.

STOCKHOLDERS’ EQUITY WITH DEFICIT Balance Sheet (partial) Stockholders’ equity Paid-in capital Common stock Retained earnings (deficit) Total stockholders’ equity $800, 000 (50, 000) $750, 000 A debit balance in retained earnings is a DEFICIT.

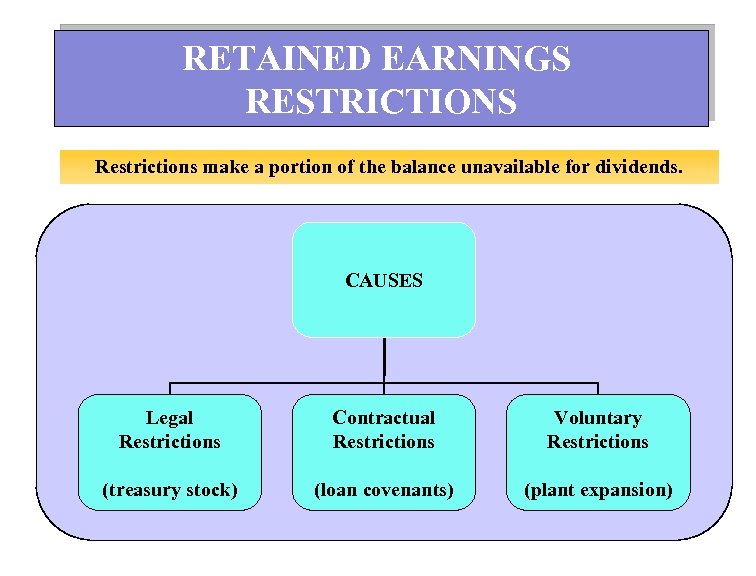

RETAINED EARNINGS RESTRICTIONS Restrictions make a portion of the balance unavailable for dividends. CAUSES Legal Restrictions Contractual Restrictions Voluntary Restrictions (treasury stock) (loan covenants) (plant expansion)

RETAINED EARNINGS RESTRICTIONS Restrictions make a portion of the balance unavailable for dividends. CAUSES Legal Restrictions Contractual Restrictions Voluntary Restrictions (treasury stock) (loan covenants) (plant expansion)

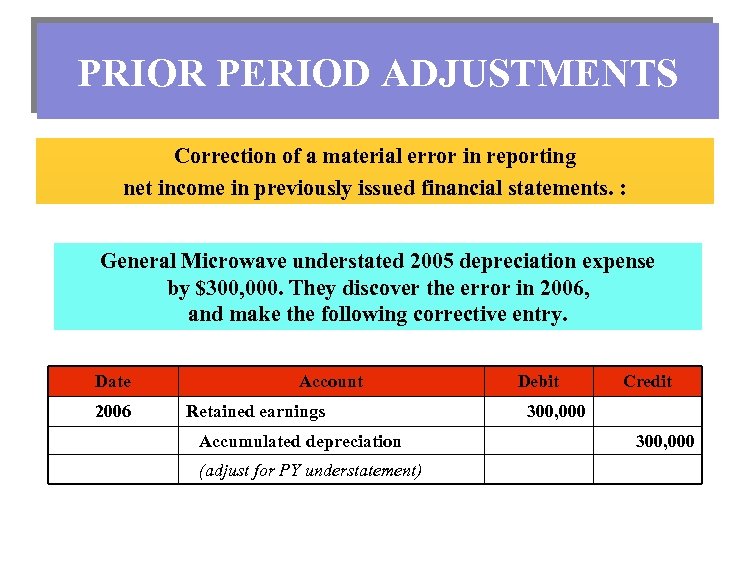

PRIOR PERIOD ADJUSTMENTS Correction of a material error in reporting net income in previously issued financial statements. : General Microwave understated 2005 depreciation expense by $300, 000. They discover the error in 2006, and make the following corrective entry. Date 2006 Account Retained earnings Accumulated depreciation (adjust for PY understatement) Debit Credit 300, 000

PRIOR PERIOD ADJUSTMENTS Correction of a material error in reporting net income in previously issued financial statements. : General Microwave understated 2005 depreciation expense by $300, 000. They discover the error in 2006, and make the following corrective entry. Date 2006 Account Retained earnings Accumulated depreciation (adjust for PY understatement) Debit Credit 300, 000

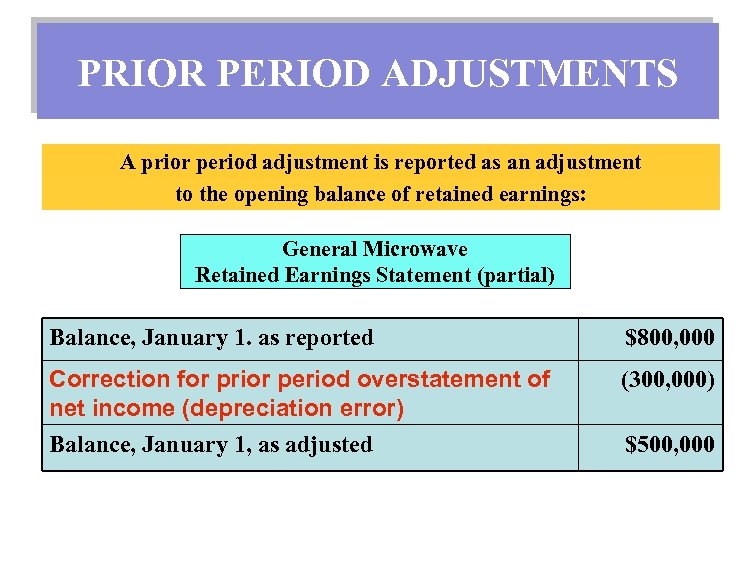

PRIOR PERIOD ADJUSTMENTS A prior period adjustment is reported as an adjustment to the opening balance of retained earnings: General Microwave Retained Earnings Statement (partial) Balance, January 1. as reported $800, 000 Correction for prior period overstatement of net income (depreciation error) Balance, January 1, as adjusted (300, 000) $500, 000

PRIOR PERIOD ADJUSTMENTS A prior period adjustment is reported as an adjustment to the opening balance of retained earnings: General Microwave Retained Earnings Statement (partial) Balance, January 1. as reported $800, 000 Correction for prior period overstatement of net income (depreciation error) Balance, January 1, as adjusted (300, 000) $500, 000

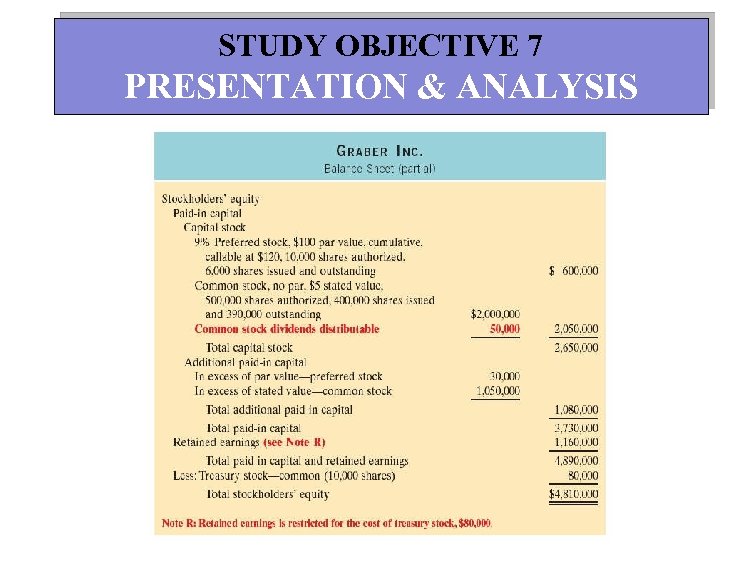

STUDY OBJECTIVE 7 PRESENTATION & ANALYSIS

STUDY OBJECTIVE 7 PRESENTATION & ANALYSIS

RETURN ON EQUITY Measures how many dollars of net income were earned For every dollar invested by common stockholders Net income less Average Common preferred dividends Stockholders Equity = Return on Common Stockholders’ Equity

RETURN ON EQUITY Measures how many dollars of net income were earned For every dollar invested by common stockholders Net income less Average Common preferred dividends Stockholders Equity = Return on Common Stockholders’ Equity

COPYRIGHT Copyright © 2006 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written consent of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

COPYRIGHT Copyright © 2006 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written consent of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.