11a824b5dc80a45f6700692901c97c5f.ppt

- Количество слайдов: 47

Finance School of Management Chapter 10: An Overview of Risk Management Objective • Risk and Financial Decision Making • Conceptual Framework for Risk Management • Efficient Allocation of Risk-Bearing 1

Finance School of Management Chapter 10: An Overview of Risk Management Objective • Risk and Financial Decision Making • Conceptual Framework for Risk Management • Efficient Allocation of Risk-Bearing 1

School of Management Finance Contents v v v v v What is Risk? Risk and Economic Decisions The Risk Management Process The Three Dimensions of Risk Transfer and Economic Efficiency Institutions for Risk Management Portfolio Theory: Quantitative Analysis for Optimal Risk Management Probability Distributions of Returns Standard Deviation as a Measure of Risk 2

School of Management Finance Contents v v v v v What is Risk? Risk and Economic Decisions The Risk Management Process The Three Dimensions of Risk Transfer and Economic Efficiency Institutions for Risk Management Portfolio Theory: Quantitative Analysis for Optimal Risk Management Probability Distributions of Returns Standard Deviation as a Measure of Risk 2

School of Management Finance Roles of Risk Management v One of the three analytical “pillars” to finance v Risk allocation (redistribution) 3

School of Management Finance Roles of Risk Management v One of the three analytical “pillars” to finance v Risk allocation (redistribution) 3

School of Management Finance Concept of Risk v Uncertainty that matters v Illustration: Preparing foods for your party v Gains & losses, “upside” potential & “downside” possibility 4

School of Management Finance Concept of Risk v Uncertainty that matters v Illustration: Preparing foods for your party v Gains & losses, “upside” potential & “downside” possibility 4

School of Management Finance Risk Aversion v A characteristic of an individual’s preference in risk-taking situations − Experiment Prefer lower risk given same expected value v Decreasing marginal utility of income v Rational behavior assumed to be risk-averse v A measure of willingness to pay to reducing risk v 5

School of Management Finance Risk Aversion v A characteristic of an individual’s preference in risk-taking situations − Experiment Prefer lower risk given same expected value v Decreasing marginal utility of income v Rational behavior assumed to be risk-averse v A measure of willingness to pay to reducing risk v 5

School of Management Finance Risk Management v The process of formulating the benefit-cost tradeoffs of risk reduction and deciding on the course of action to take. − The appropriateness of a risk-management decision should be judged in the light of the information available at the time the decision is made. − Skill and lucky in risk management. 6

School of Management Finance Risk Management v The process of formulating the benefit-cost tradeoffs of risk reduction and deciding on the course of action to take. − The appropriateness of a risk-management decision should be judged in the light of the information available at the time the decision is made. − Skill and lucky in risk management. 6

School of Management Finance Risk Exposure v Particular types of risk one faces due to one’s circumstances (job, business, and pattern of consumption, etc. ) v Illustrations – the risk of a crop failure and the risk of a decline in the price for a farmer – the risks of fire, theft, storm damage, earthquake damage for a house owner – the currency risk for a person whose business involves imports or exports of goods 7

School of Management Finance Risk Exposure v Particular types of risk one faces due to one’s circumstances (job, business, and pattern of consumption, etc. ) v Illustrations – the risk of a crop failure and the risk of a decline in the price for a farmer – the risks of fire, theft, storm damage, earthquake damage for a house owner – the currency risk for a person whose business involves imports or exports of goods 7

Finance School of Management Speculators and Hedgers v Hedgers: taking positions to reduce their exposures. v Speculators: taking positions that increase their exposure to certain risks in the hope of increasing their wealth. v The riskiness of an asset or a transaction cannot be assessed in isolation or in abstract. 8

Finance School of Management Speculators and Hedgers v Hedgers: taking positions to reduce their exposures. v Speculators: taking positions that increase their exposure to certain risks in the hope of increasing their wealth. v The riskiness of an asset or a transaction cannot be assessed in isolation or in abstract. 8

School of Management Finance Risks Facing Households v Sickness, disability, and death v Unemployment v Consumer-durable asset risk v Liability risk v Financial-asset risk 9

School of Management Finance Risks Facing Households v Sickness, disability, and death v Unemployment v Consumer-durable asset risk v Liability risk v Financial-asset risk 9

School of Management Finance Risks Facing Firms v Production risk and R&D risk v Price risk of outputs v Price risk of inputs 10

School of Management Finance Risks Facing Firms v Production risk and R&D risk v Price risk of outputs v Price risk of inputs 10

School of Management Finance The Risk-Management Process v A systematic attempt to analyze and deal with risk v Steps – – – Risk identification Risk assessment Selection of risk-management techniques Implementation Review 11

School of Management Finance The Risk-Management Process v A systematic attempt to analyze and deal with risk v Steps – – – Risk identification Risk assessment Selection of risk-management techniques Implementation Review 11

School of Management Finance Risk Identification Figuring out what the most important risk exposures are for the unity of analysis. v The perspective of the entity as a whole v – Career and stock-market risk – The net exposure to exchange-rate risk of a firm buying inputs and selling products abroad – Price risk and quantity risk of farms 12

School of Management Finance Risk Identification Figuring out what the most important risk exposures are for the unity of analysis. v The perspective of the entity as a whole v – Career and stock-market risk – The net exposure to exchange-rate risk of a firm buying inputs and selling products abroad – Price risk and quantity risk of farms 12

School of Management Finance Risk Assessment v The quantification of the costs associated with the risks that have been identified v Health-insurance and actuaries v Professional investment advisors 13

School of Management Finance Risk Assessment v The quantification of the costs associated with the risks that have been identified v Health-insurance and actuaries v Professional investment advisors 13

School of Management Finance Risk-Management Techniques v Risk avoidance v Loss prevention and control v Risk retention v Risk transfer 14

School of Management Finance Risk-Management Techniques v Risk avoidance v Loss prevention and control v Risk retention v Risk transfer 14

School of Management Finance Implementation v The basic principle is to minimize the costs of implementation. – The lowest premium for health insurance – The costs of investing in the stock market through mutual fund or a broker 15

School of Management Finance Implementation v The basic principle is to minimize the costs of implementation. – The lowest premium for health insurance – The costs of investing in the stock market through mutual fund or a broker 15

School of Management Finance Review v Risk management is a dynamic “feedback” process, in which decisions are periodically reviewed and revised. 16

School of Management Finance Review v Risk management is a dynamic “feedback” process, in which decisions are periodically reviewed and revised. 16

Finance School of Management Risk Transfer and Economic Efficiency v Transfering some or all of the risk to others is where the financial system plays the greatest role. 17

Finance School of Management Risk Transfer and Economic Efficiency v Transfering some or all of the risk to others is where the financial system plays the greatest role. 17

Finance School of Management Risk Transfer and Economic Efficiency v Institutional arrangements for the transfer of risk contribute to economic efficiency in two fundamental ways. – To reallocate existing risks to those most willing to bear the risks, – To cause a reallocation of resources to production and consumption in accordance with the new distribution of risk-bearing. 18

Finance School of Management Risk Transfer and Economic Efficiency v Institutional arrangements for the transfer of risk contribute to economic efficiency in two fundamental ways. – To reallocate existing risks to those most willing to bear the risks, – To cause a reallocation of resources to production and consumption in accordance with the new distribution of risk-bearing. 18

Finance School of Management Efficient Bearing of Existing Risks v v A retired widow, whose sole source of income is $100, 000 in the form of a portfolio of stocks. A college student, who has a wealth of $100, 000 in a bank CD. The different attitudes towards future and risk. Exchange (swap) their assets. 19

Finance School of Management Efficient Bearing of Existing Risks v v A retired widow, whose sole source of income is $100, 000 in the form of a portfolio of stocks. A college student, who has a wealth of $100, 000 in a bank CD. The different attitudes towards future and risk. Exchange (swap) their assets. 19

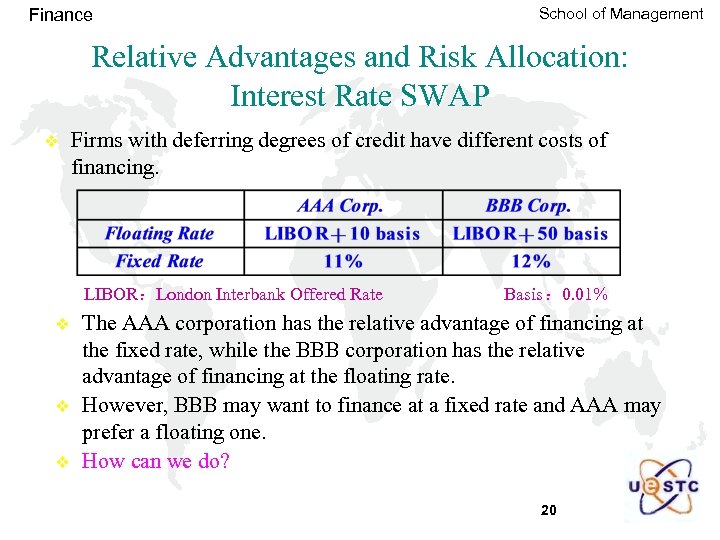

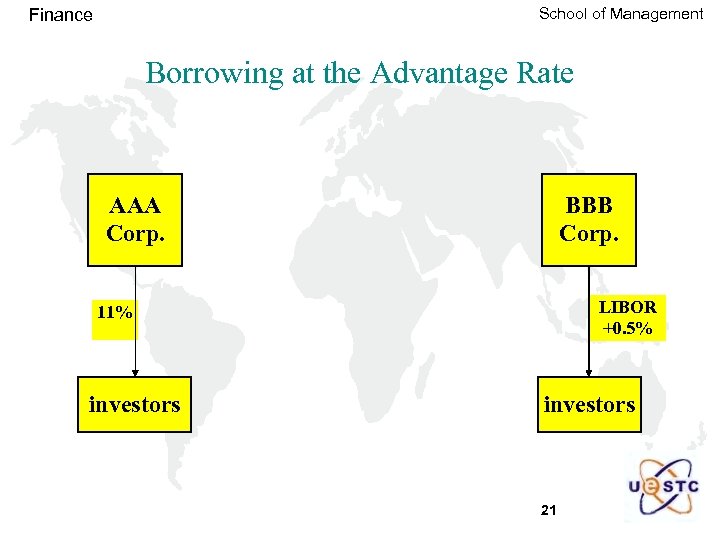

Finance School of Management Relative Advantages and Risk Allocation: Interest Rate SWAP v Firms with deferring degrees of credit have different costs of financing. LIBOR:London Interbank Offered Rate v v v Basis: 0. 01% The AAA corporation has the relative advantage of financing at the fixed rate, while the BBB corporation has the relative advantage of financing at the floating rate. However, BBB may want to finance at a fixed rate and AAA may prefer a floating one. How can we do? 20

Finance School of Management Relative Advantages and Risk Allocation: Interest Rate SWAP v Firms with deferring degrees of credit have different costs of financing. LIBOR:London Interbank Offered Rate v v v Basis: 0. 01% The AAA corporation has the relative advantage of financing at the fixed rate, while the BBB corporation has the relative advantage of financing at the floating rate. However, BBB may want to finance at a fixed rate and AAA may prefer a floating one. How can we do? 20

School of Management Finance Borrowing at the Advantage Rate AAA Corp. BBB Corp. LIBOR +0. 5% 11% investors 21

School of Management Finance Borrowing at the Advantage Rate AAA Corp. BBB Corp. LIBOR +0. 5% 11% investors 21

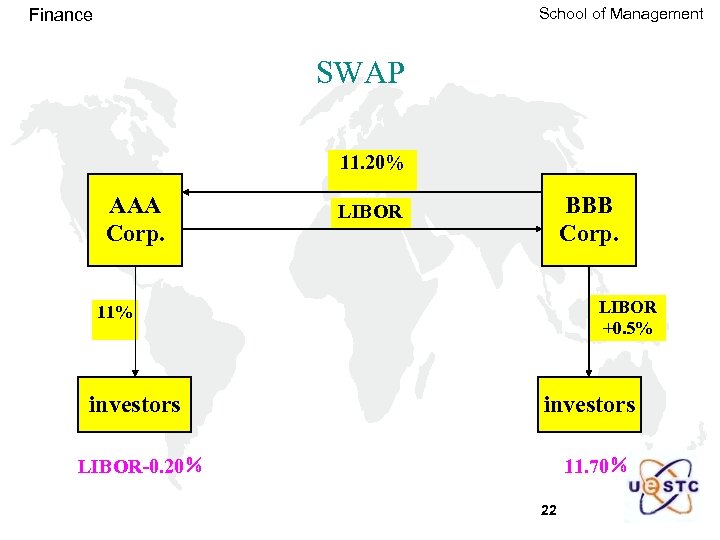

School of Management Finance SWAP 11. 20% AAA Corp. BBB Corp. LIBOR +0. 5% 11% investors LIBOR-0. 20% 11. 70% 22

School of Management Finance SWAP 11. 20% AAA Corp. BBB Corp. LIBOR +0. 5% 11% investors LIBOR-0. 20% 11. 70% 22

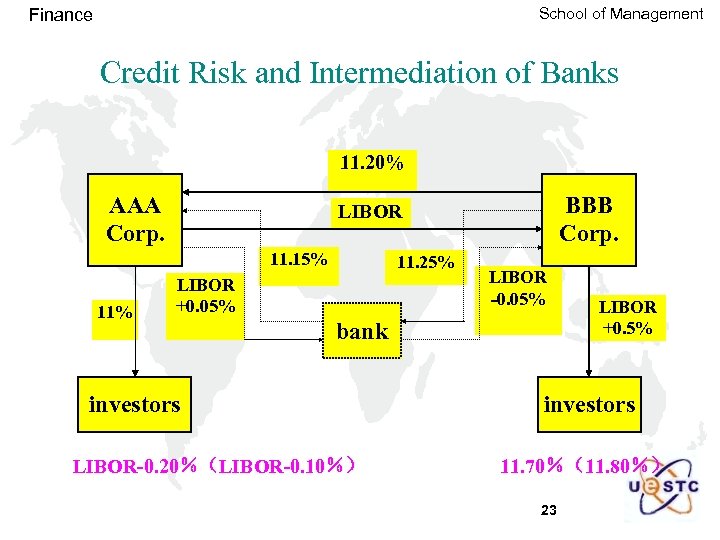

School of Management Finance Credit Risk and Intermediation of Banks 11. 20% AAA Corp. 11. 15% 11% BBB Corp. LIBOR 11. 25% LIBOR +0. 05% LIBOR -0. 05% bank investors LIBOR-0. 20%(LIBOR-0. 10%) LIBOR +0. 5% investors 11. 70%(11. 80%) 23

School of Management Finance Credit Risk and Intermediation of Banks 11. 20% AAA Corp. 11. 15% 11% BBB Corp. LIBOR 11. 25% LIBOR +0. 05% LIBOR -0. 05% bank investors LIBOR-0. 20%(LIBOR-0. 10%) LIBOR +0. 5% investors 11. 70%(11. 80%) 23

Finance School of Management Risk and Resource Allocation v v A scientist discovers a new drug designed to treat the common cold. She requires $1, 000 to develop, test and produce it. At this stage, the drug has a small probability of commercial success. Using her own money or setting up a firm? 24

Finance School of Management Risk and Resource Allocation v v A scientist discovers a new drug designed to treat the common cold. She requires $1, 000 to develop, test and produce it. At this stage, the drug has a small probability of commercial success. Using her own money or setting up a firm? 24

Finance School of Management Risk and Resource Allocation v v risk pooling and sharing/specialization in the bearing of risks. By allowing people to reduce their exposure to the risk of undertaking certain business ventures, the function of the financial system to facilitate the transfer of risks may encourage entrepreneurial behavior that can have a benefit to society. 25

Finance School of Management Risk and Resource Allocation v v risk pooling and sharing/specialization in the bearing of risks. By allowing people to reduce their exposure to the risk of undertaking certain business ventures, the function of the financial system to facilitate the transfer of risks may encourage entrepreneurial behavior that can have a benefit to society. 25

School of Management Finance Complete Markets for Risk v A world in which there exist such a wide range of institutional mechanisms that people can pick and choose exactly those risks they wish to bear and those they want to shed. Kenneth Arrow, 1953 – A hypothetical, ideal world – Limiting case for efficient risk allocation – Separation: production and risk bearing 26

School of Management Finance Complete Markets for Risk v A world in which there exist such a wide range of institutional mechanisms that people can pick and choose exactly those risks they wish to bear and those they want to shed. Kenneth Arrow, 1953 – A hypothetical, ideal world – Limiting case for efficient risk allocation – Separation: production and risk bearing 26

Finance School of Management Acceleration of Financial Innovations v v v Insurance, stock, and future markets (400 yrs) Debt or equity: design of securities (400 yrs) The supply side New discoveries in telecommunications, information processing, and finance theory have significantly lowered the costs of achieving global diversification and specialization in the bearing of risks. v The demand side Increased volatility of exchange rates, interest rates, and commodity prices have increased the demand for ways to manage risk. v Complete markets: not possible 27

Finance School of Management Acceleration of Financial Innovations v v v Insurance, stock, and future markets (400 yrs) Debt or equity: design of securities (400 yrs) The supply side New discoveries in telecommunications, information processing, and finance theory have significantly lowered the costs of achieving global diversification and specialization in the bearing of risks. v The demand side Increased volatility of exchange rates, interest rates, and commodity prices have increased the demand for ways to manage risk. v Complete markets: not possible 27

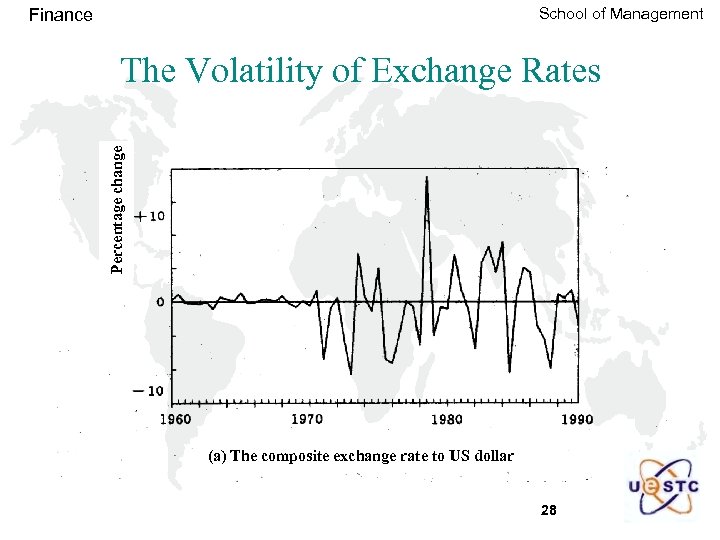

School of Management Finance Percentage change The Volatility of Exchange Rates (a) The composite exchange rate to US dollar 28

School of Management Finance Percentage change The Volatility of Exchange Rates (a) The composite exchange rate to US dollar 28

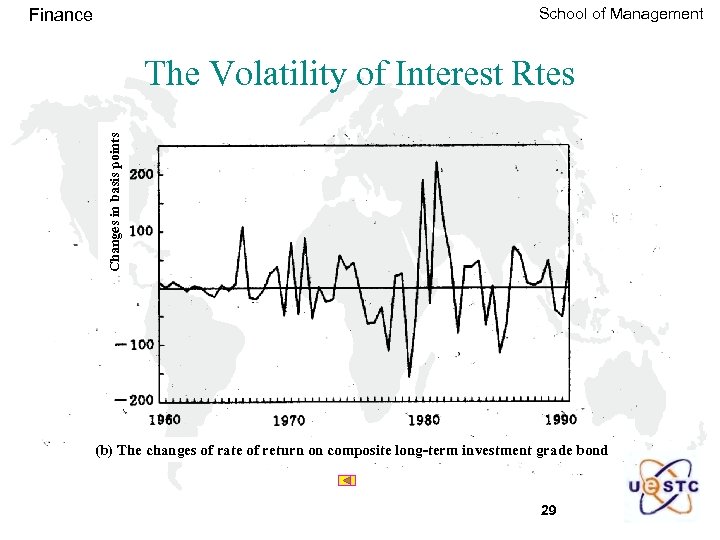

School of Management Finance Changes in basis points The Volatility of Interest Rtes (b) The changes of rate of return on composite long-term investment grade bond 29

School of Management Finance Changes in basis points The Volatility of Interest Rtes (b) The changes of rate of return on composite long-term investment grade bond 29

Finance School of Management Real-world Limitations to Efficient Risk Allocation v Transactions costs v Incentive problems – moral-hazard: having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss. – adverse selection: those who purchase insurance against risk are more likely than the general population to be at risk 30

Finance School of Management Real-world Limitations to Efficient Risk Allocation v Transactions costs v Incentive problems – moral-hazard: having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss. – adverse selection: those who purchase insurance against risk are more likely than the general population to be at risk 30

Finance School of Management Three Dimensions of Risk Transfer v The simple way of risk transfer: selling the asset that makes the owner exposed to risk. v The three dimensions of risk transfer: hedging, insuring, and diversifying. 31

Finance School of Management Three Dimensions of Risk Transfer v The simple way of risk transfer: selling the asset that makes the owner exposed to risk. v The three dimensions of risk transfer: hedging, insuring, and diversifying. 31

School of Management Finance Hedging v The action taken to reduce one’s exposure to a loss but also causing the hedger to give up the possibility of a gain. v Example: farmers v Other examples 32

School of Management Finance Hedging v The action taken to reduce one’s exposure to a loss but also causing the hedger to give up the possibility of a gain. v Example: farmers v Other examples 32

School of Management Finance Insuring v Paying a premium to avoid losses but retaining the potential for gain. v Example: import/export business v Other examples: health insurance, traveling to Jiuzhaigou. 33

School of Management Finance Insuring v Paying a premium to avoid losses but retaining the potential for gain. v Example: import/export business v Other examples: health insurance, traveling to Jiuzhaigou. 33

School of Management Finance Diversifying Holding similar amounts of many risky assets instead of concentrating all of your investment in only one. v Example: investing in the biotechnology business v – initial capital: $100, 000 – probability of success: 50% – uncertainty: quadrupling the investment or losing the entire investment – independence of successes 34

School of Management Finance Diversifying Holding similar amounts of many risky assets instead of concentrating all of your investment in only one. v Example: investing in the biotechnology business v – initial capital: $100, 000 – probability of success: 50% – uncertainty: quadrupling the investment or losing the entire investment – independence of successes 34

School of Management Finance Further Points on Diversification v Reduce chances of either big gains or losses v Perfect correlation: do not reduce risk v Aggregate uncertainty: not reduced v “genius”, “dunce” and “average” investors: Good luck or skill? 35

School of Management Finance Further Points on Diversification v Reduce chances of either big gains or losses v Perfect correlation: do not reduce risk v Aggregate uncertainty: not reduced v “genius”, “dunce” and “average” investors: Good luck or skill? 35

Finance School of Management Basics of Portfolio Theory A quantitative analysis for optimal risk management. v Solve the problem: How to choose among financial alternatives so as to maximize investors’ given preferences. v Optimal choice: trade-offs between higher expected return and greater risk. v 36

Finance School of Management Basics of Portfolio Theory A quantitative analysis for optimal risk management. v Solve the problem: How to choose among financial alternatives so as to maximize investors’ given preferences. v Optimal choice: trade-offs between higher expected return and greater risk. v 36

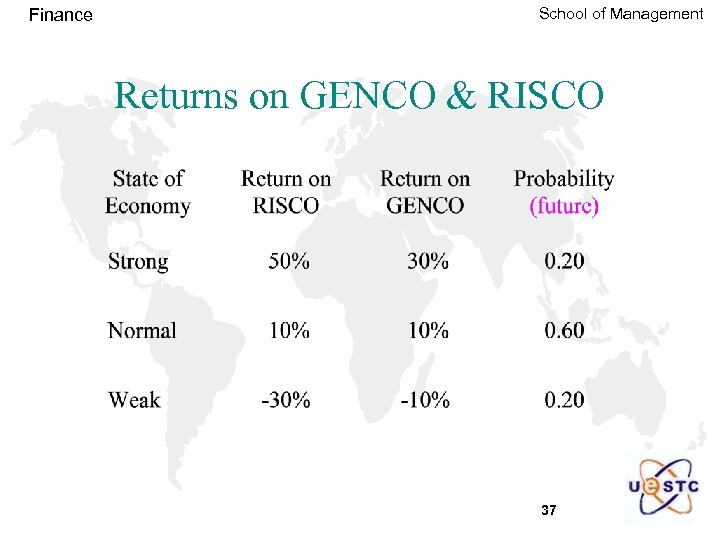

Finance School of Management Returns on GENCO & RISCO 37

Finance School of Management Returns on GENCO & RISCO 37

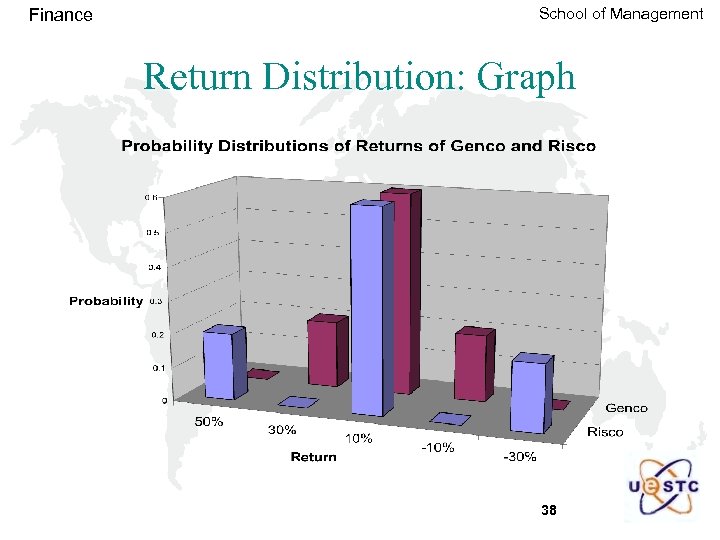

Finance School of Management Return Distribution: Graph 38

Finance School of Management Return Distribution: Graph 38

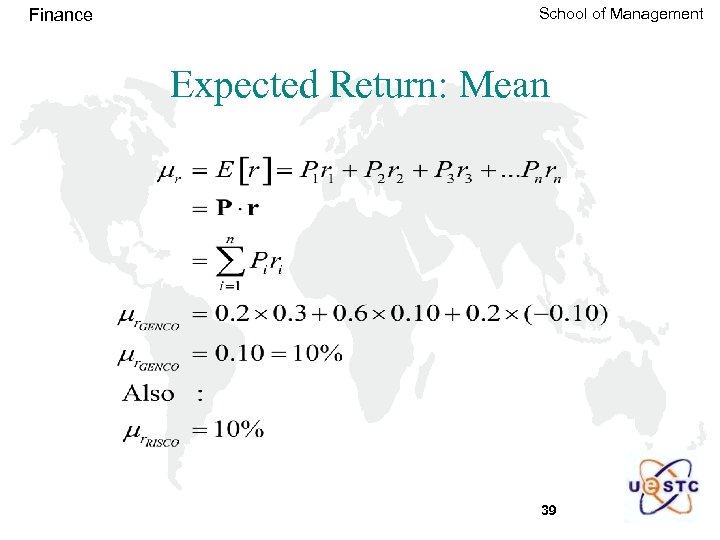

Finance School of Management Expected Return: Mean 39

Finance School of Management Expected Return: Mean 39

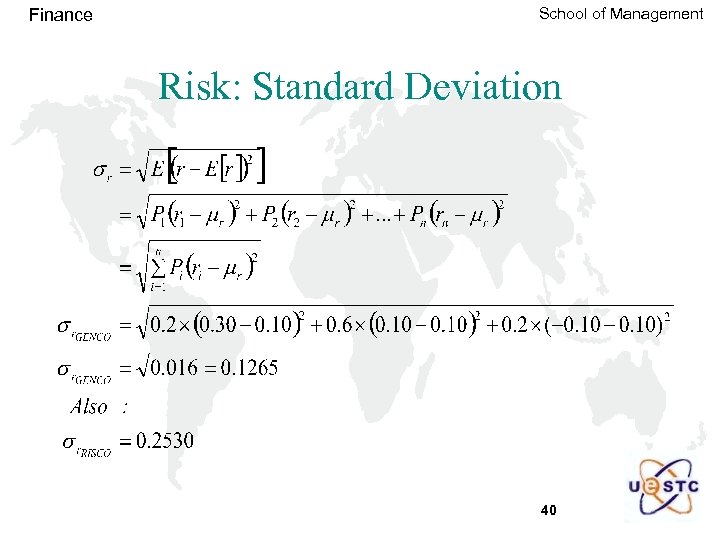

Finance School of Management Risk: Standard Deviation 40

Finance School of Management Risk: Standard Deviation 40

School of Management Finance Volatility Standard deviation of returns. v A measure of risk (or uncertainty): The first risk measure (Markowitz, 1952). v Volatility is 0: no risk; future return certain. v Larger volatility => wider range of returns => more uncertain (greater risk). v 41

School of Management Finance Volatility Standard deviation of returns. v A measure of risk (or uncertainty): The first risk measure (Markowitz, 1952). v Volatility is 0: no risk; future return certain. v Larger volatility => wider range of returns => more uncertain (greater risk). v 41

Finance School of Management Probability Distribution of Return v v v Observables: history of prices or returns. Past implies future. Computable: mean & standard deviation. Unknown: distribution of probability. Assumption: Normal distribution of return (from discrete to continuous). Accuracy depends on assumption! 42

Finance School of Management Probability Distribution of Return v v v Observables: history of prices or returns. Past implies future. Computable: mean & standard deviation. Unknown: distribution of probability. Assumption: Normal distribution of return (from discrete to continuous). Accuracy depends on assumption! 42

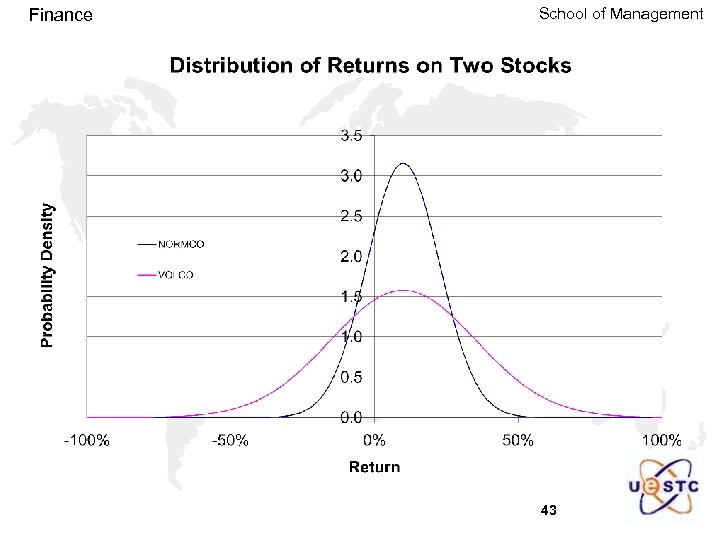

Finance School of Management 43

Finance School of Management 43

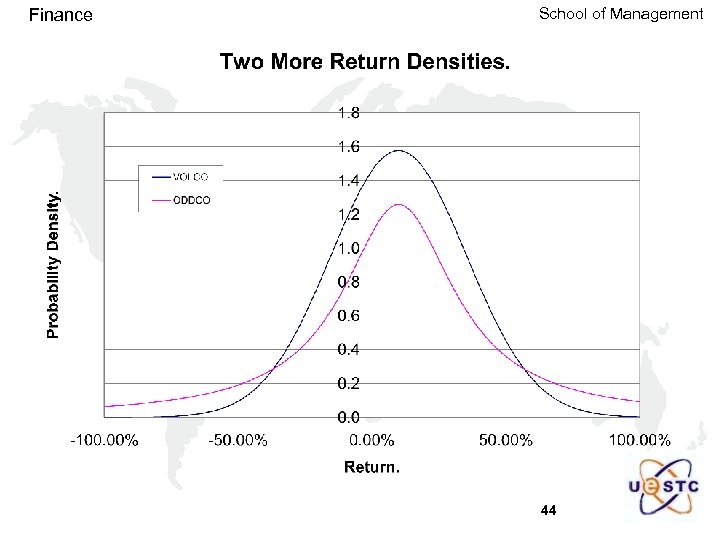

Finance School of Management 44

Finance School of Management 44

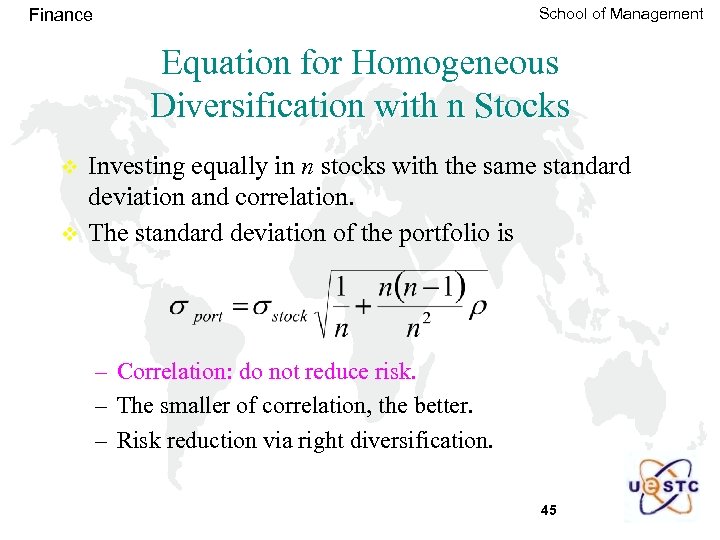

School of Management Finance Equation for Homogeneous Diversification with n Stocks v v Investing equally in n stocks with the same standard deviation and correlation. The standard deviation of the portfolio is – Correlation: do not reduce risk. – The smaller of correlation, the better. – Risk reduction via right diversification. 45

School of Management Finance Equation for Homogeneous Diversification with n Stocks v v Investing equally in n stocks with the same standard deviation and correlation. The standard deviation of the portfolio is – Correlation: do not reduce risk. – The smaller of correlation, the better. – Risk reduction via right diversification. 45

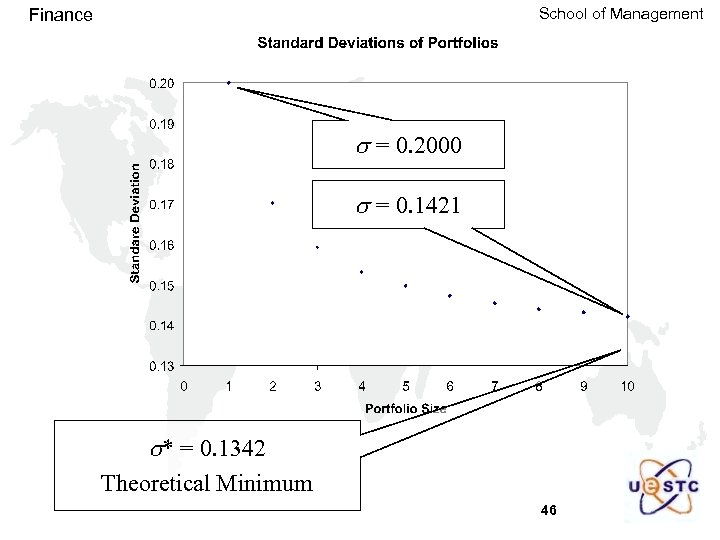

School of Management Finance s = 0. 2000 s = 0. 1421 s* = 0. 1342 Theoretical Minimum 46

School of Management Finance s = 0. 2000 s = 0. 1421 s* = 0. 1342 Theoretical Minimum 46

Finance School of Management Summary: Main Points v v v Risk: bad uncertainty Risk aversion: prefer lower risk Risk measure: volatility Portfolio: many components Risk mgmt: reduce risks at a reasonable cost Hedge, insure, diversify 47

Finance School of Management Summary: Main Points v v v Risk: bad uncertainty Risk aversion: prefer lower risk Risk measure: volatility Portfolio: many components Risk mgmt: reduce risks at a reasonable cost Hedge, insure, diversify 47