1a2a8161cf5ee1c70931ef8682e8d59e.ppt

- Количество слайдов: 20

Finance: Net Present Value 10. 1 aa ECON 201 Jun 9, 2009

Finance: Net Present Value 10. 1 aa ECON 201 Jun 9, 2009

Firm’s Financing Decision • Firm’s desire to expand purchase new capital stock can be financed by: – Loan (repay with interest) • Borrow $X from a lending institution (bank) – Issue bonds (debt) • Promise to pay back bond holders later for obtaining $X today – Sell stock (corporate holdings, stock splits) • Decrease stock price in the short-run – Venture Capital

Firm’s Financing Decision • Firm’s desire to expand purchase new capital stock can be financed by: – Loan (repay with interest) • Borrow $X from a lending institution (bank) – Issue bonds (debt) • Promise to pay back bond holders later for obtaining $X today – Sell stock (corporate holdings, stock splits) • Decrease stock price in the short-run – Venture Capital

Benefit/Cost Analysis • Basic Issue in Business or Personal Finance Decisions – How to evaluate projects/investment opportunities that have a flow of benefits and costs over time • Approach – Stream of benefits and costs are discounted over time (Net Present Value) • Accounts for opportunity costs of money – Time rate of preference

Benefit/Cost Analysis • Basic Issue in Business or Personal Finance Decisions – How to evaluate projects/investment opportunities that have a flow of benefits and costs over time • Approach – Stream of benefits and costs are discounted over time (Net Present Value) • Accounts for opportunity costs of money – Time rate of preference

Why Firms Seek Funds • The most common reason for firms to seek funds (financial capital) is to pay for plant and equipment (physical capital).

Why Firms Seek Funds • The most common reason for firms to seek funds (financial capital) is to pay for plant and equipment (physical capital).

The Net Benefits from an Investment • The net benefit of an investment project is the difference between the revenue generated by the project and the project’s cost, including opportunity cost.

The Net Benefits from an Investment • The net benefit of an investment project is the difference between the revenue generated by the project and the project’s cost, including opportunity cost.

Interest • Interest is an important part of the investment decision for two reasons: – First, interest must be paid to borrow funds. – Second, interest is the opportunity cost of using money to pay for an investment project. • Money used to purchase capital could have been deposited in a bank to earn interest.

Interest • Interest is an important part of the investment decision for two reasons: – First, interest must be paid to borrow funds. – Second, interest is the opportunity cost of using money to pay for an investment project. • Money used to purchase capital could have been deposited in a bank to earn interest.

Interest (cont’d) • Lenders charge interest: – To compensate themselves for not being able to use their own money to buy the things they want – To compensate themselves for the risk they assume when they make a loan – Because rising prices will reduce the purchasing power of the money when it is repaid

Interest (cont’d) • Lenders charge interest: – To compensate themselves for not being able to use their own money to buy the things they want – To compensate themselves for the risk they assume when they make a loan – Because rising prices will reduce the purchasing power of the money when it is repaid

Time Value of Money • Money today is more valuable than the same amount of money at some point in the future. – If you have money today, you could deposit it in a bank and earn interest.

Time Value of Money • Money today is more valuable than the same amount of money at some point in the future. – If you have money today, you could deposit it in a bank and earn interest.

Present and Future Value • The present value (PV) of money received in the future is equal to its value today. – In other words, it is the maximum amount that someone would pay today to receive the money in the future.

Present and Future Value • The present value (PV) of money received in the future is equal to its value today. – In other words, it is the maximum amount that someone would pay today to receive the money in the future.

Present and Future Value (cont’d) • The future value (FV) of money is what an amount of money will be worth at some point in the future.

Present and Future Value (cont’d) • The future value (FV) of money is what an amount of money will be worth at some point in the future.

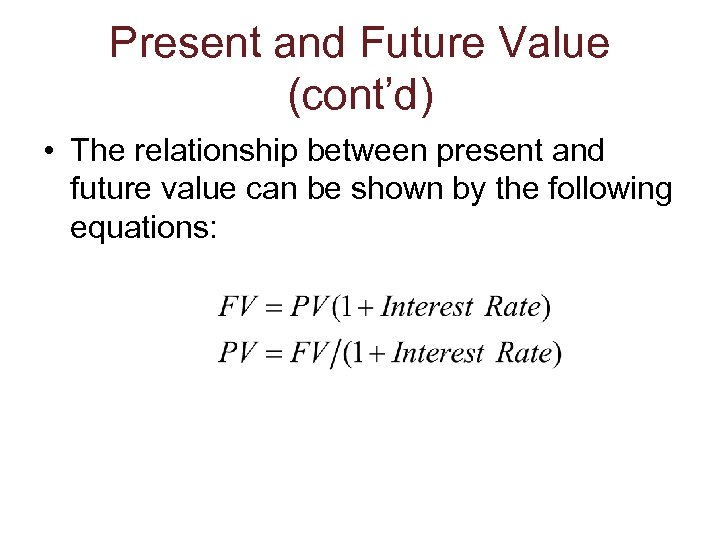

Present and Future Value (cont’d) • The relationship between present and future value can be shown by the following equations:

Present and Future Value (cont’d) • The relationship between present and future value can be shown by the following equations:

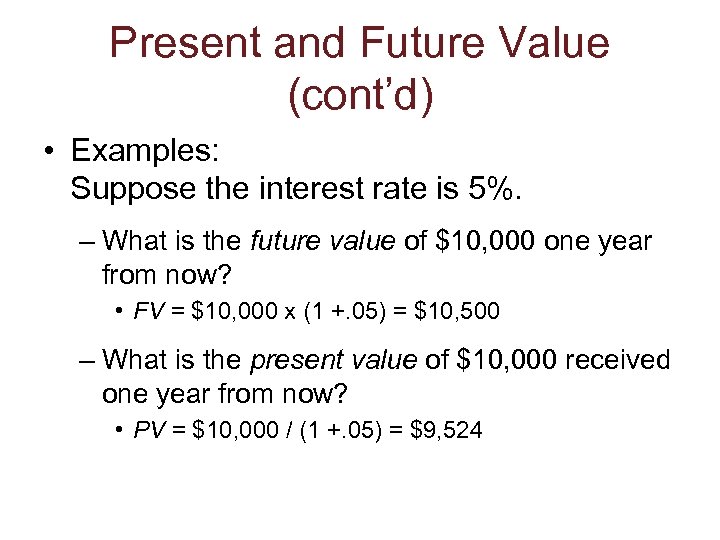

Present and Future Value (cont’d) • Examples: Suppose the interest rate is 5%. – What is the future value of $10, 000 one year from now? • FV = $10, 000 x (1 +. 05) = $10, 500 – What is the present value of $10, 000 received one year from now? • PV = $10, 000 / (1 +. 05) = $9, 524

Present and Future Value (cont’d) • Examples: Suppose the interest rate is 5%. – What is the future value of $10, 000 one year from now? • FV = $10, 000 x (1 +. 05) = $10, 500 – What is the present value of $10, 000 received one year from now? • PV = $10, 000 / (1 +. 05) = $9, 524

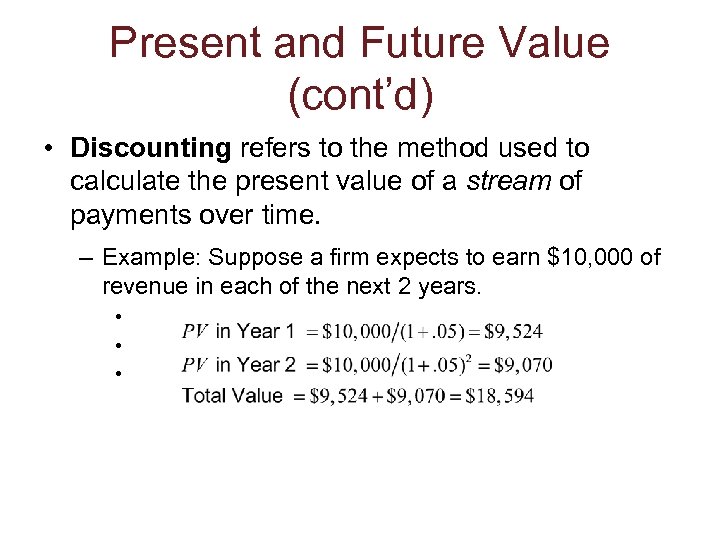

Present and Future Value (cont’d) • Discounting refers to the method used to calculate the present value of a stream of payments over time. – Example: Suppose a firm expects to earn $10, 000 of revenue in each of the next 2 years. • • •

Present and Future Value (cont’d) • Discounting refers to the method used to calculate the present value of a stream of payments over time. – Example: Suppose a firm expects to earn $10, 000 of revenue in each of the next 2 years. • • •

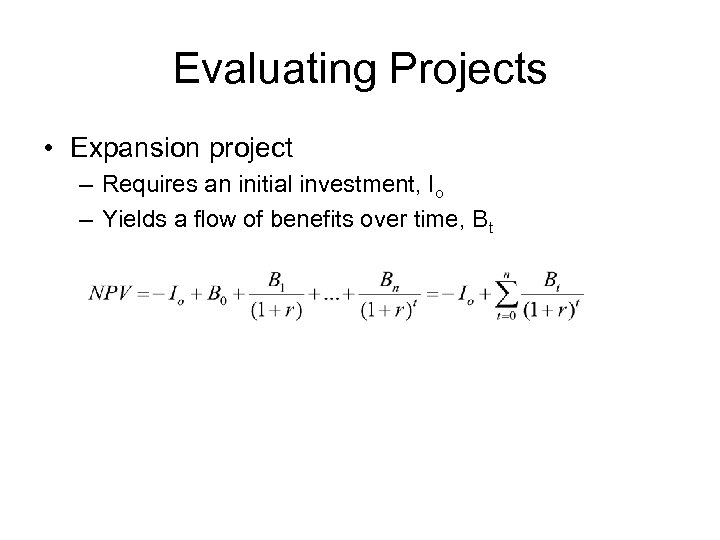

Evaluating Projects • Expansion project – Requires an initial investment, Io – Yields a flow of benefits over time, Bt

Evaluating Projects • Expansion project – Requires an initial investment, Io – Yields a flow of benefits over time, Bt

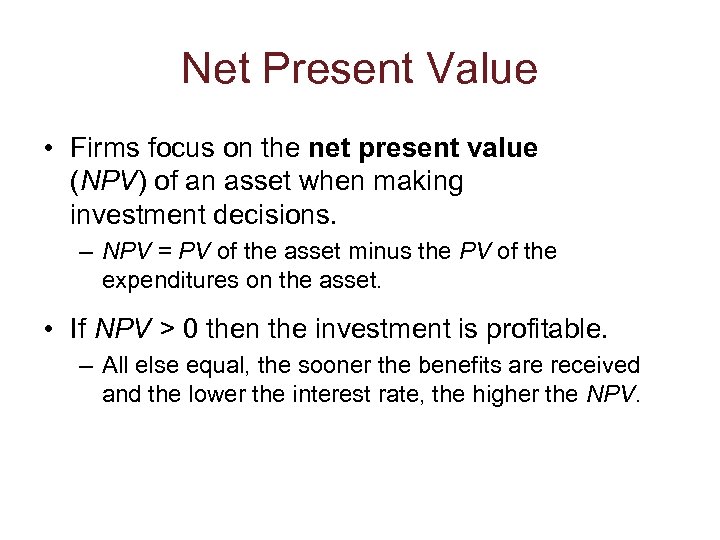

Net Present Value • Firms focus on the net present value (NPV) of an asset when making investment decisions. – NPV = PV of the asset minus the PV of the expenditures on the asset. • If NPV > 0 then the investment is profitable. – All else equal, the sooner the benefits are received and the lower the interest rate, the higher the NPV.

Net Present Value • Firms focus on the net present value (NPV) of an asset when making investment decisions. – NPV = PV of the asset minus the PV of the expenditures on the asset. • If NPV > 0 then the investment is profitable. – All else equal, the sooner the benefits are received and the lower the interest rate, the higher the NPV.

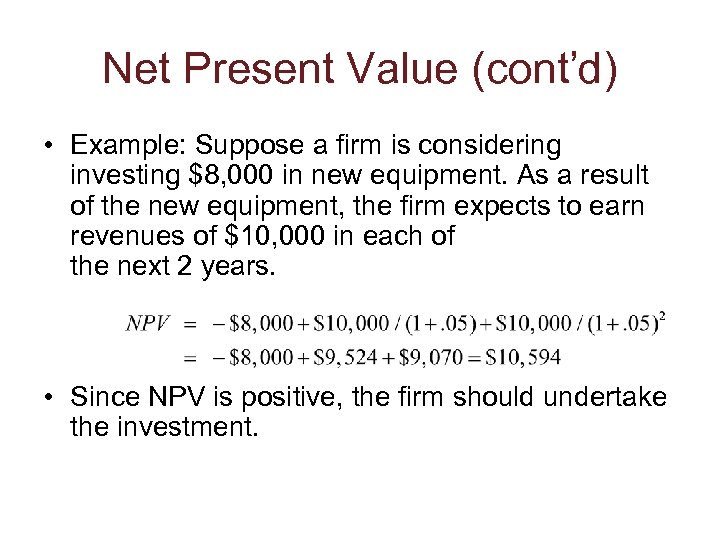

Net Present Value (cont’d) • Example: Suppose a firm is considering investing $8, 000 in new equipment. As a result of the new equipment, the firm expects to earn revenues of $10, 000 in each of the next 2 years. • Since NPV is positive, the firm should undertake the investment.

Net Present Value (cont’d) • Example: Suppose a firm is considering investing $8, 000 in new equipment. As a result of the new equipment, the firm expects to earn revenues of $10, 000 in each of the next 2 years. • Since NPV is positive, the firm should undertake the investment.

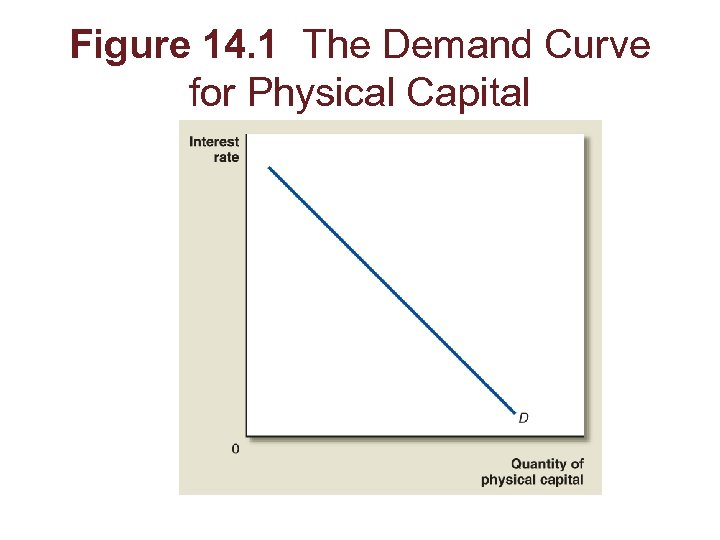

Interest and the Demand for Capital • The interest rate represents the opportunity cost of purchasing capital. Therefore, as the interest rate increases, the quantity of capital demanded will fall.

Interest and the Demand for Capital • The interest rate represents the opportunity cost of purchasing capital. Therefore, as the interest rate increases, the quantity of capital demanded will fall.

Figure 14. 1 The Demand Curve for Physical Capital

Figure 14. 1 The Demand Curve for Physical Capital

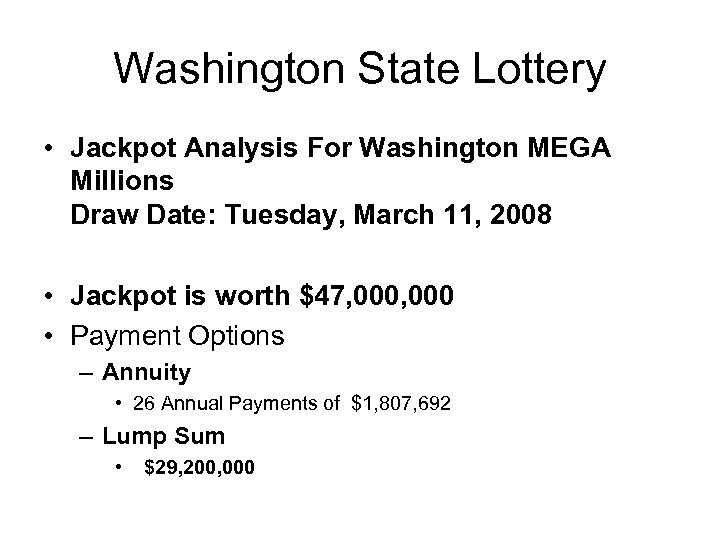

Washington State Lottery • Jackpot Analysis For Washington MEGA Millions Draw Date: Tuesday, March 11, 2008 • Jackpot is worth $47, 000 • Payment Options – Annuity • 26 Annual Payments of $1, 807, 692 – Lump Sum • $29, 200, 000

Washington State Lottery • Jackpot Analysis For Washington MEGA Millions Draw Date: Tuesday, March 11, 2008 • Jackpot is worth $47, 000 • Payment Options – Annuity • 26 Annual Payments of $1, 807, 692 – Lump Sum • $29, 200, 000

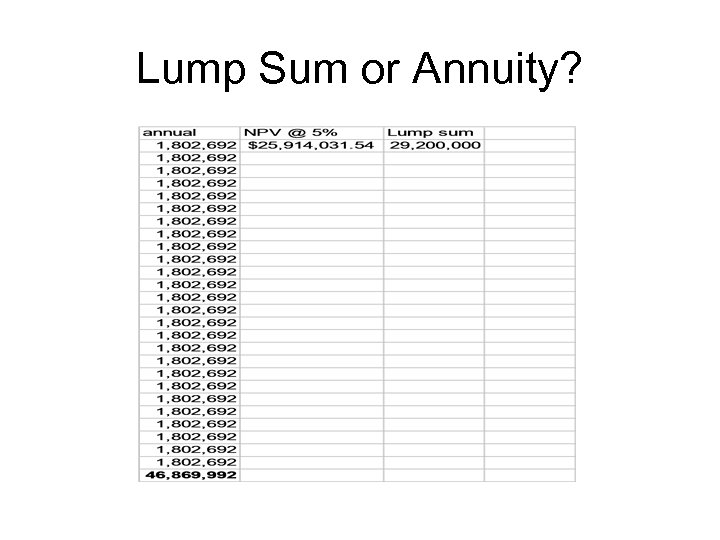

Lump Sum or Annuity?

Lump Sum or Annuity?