7051f6e7f3079185c6d84eb7f1ca2f04.ppt

- Количество слайдов: 30

Finance Lecture 3

Finance Lecture 3

Outline Lecture 3 • A Target Capital Structure and What It Implies • New Stock Issuances, Stock Repurchases • Principal-Agent Problems in Corporations Keating F&A 3 -2 Spring 2008

Outline Lecture 3 • A Target Capital Structure and What It Implies • New Stock Issuances, Stock Repurchases • Principal-Agent Problems in Corporations Keating F&A 3 -2 Spring 2008

Last Lecture, We Talked About Options For Raising Money • Retained earnings are easiest • Debt is tax-advantaged, but it comes with bankruptcy risk • New equity dilutes existing equity, may send a negative signal Keating F&A 3 -3 Spring 2008

Last Lecture, We Talked About Options For Raising Money • Retained earnings are easiest • Debt is tax-advantaged, but it comes with bankruptcy risk • New equity dilutes existing equity, may send a negative signal Keating F&A 3 -3 Spring 2008

Many Firms Have A “Target Capital Structure” • A pre-determined ratio of debt to equity finance that management is to follow, e. g. , 40% debt, 60% equity • As earnings are retained (profits not paid out as dividends), equity investment grows - A moderate amount of new debt can be taken on in proportion to growth in retained earnings, preserving target capital structure Keating F&A 3 -4 Spring 2008

Many Firms Have A “Target Capital Structure” • A pre-determined ratio of debt to equity finance that management is to follow, e. g. , 40% debt, 60% equity • As earnings are retained (profits not paid out as dividends), equity investment grows - A moderate amount of new debt can be taken on in proportion to growth in retained earnings, preserving target capital structure Keating F&A 3 -4 Spring 2008

A Target Capital Structure Implies Higgins’ Sustainable Growth Rate • Profits generate new retained earnings • New retained earnings allow new borrowing in accord with target capital structure • Sales can grow “sustainably” in parallel to the “natural” increase in equity and debt levels - “Sustainability, ” in this context, means growth without need for new equity finance (beyond new retained earnings) Keating F&A 3 -5 Spring 2008

A Target Capital Structure Implies Higgins’ Sustainable Growth Rate • Profits generate new retained earnings • New retained earnings allow new borrowing in accord with target capital structure • Sales can grow “sustainably” in parallel to the “natural” increase in equity and debt levels - “Sustainability, ” in this context, means growth without need for new equity finance (beyond new retained earnings) Keating F&A 3 -5 Spring 2008

Suppose You Want A Sales Growth Rate Greater Than The “Sustainable” Rate • You can cut the dividend rate, increasing retained earnings • You can change the target capital structure to tilt more toward debt • You can issue new equity (along with commensurate new debt) Keating F&A 3 -6 Spring 2008

Suppose You Want A Sales Growth Rate Greater Than The “Sustainable” Rate • You can cut the dividend rate, increasing retained earnings • You can change the target capital structure to tilt more toward debt • You can issue new equity (along with commensurate new debt) Keating F&A 3 -6 Spring 2008

Empirical Evidence On “Target Capital Structure” Is Less Overwhelming Than Theory Is Elegant • Most firms, in fact, use both equity and debt • Firms with tangible assets, e. g. , factories, do borrow more - Tangible assets can be put up as collateral, reducing borrowing costs • Actual debt levels vary widely across apparently similar firms Keating F&A 3 -7 Spring 2008

Empirical Evidence On “Target Capital Structure” Is Less Overwhelming Than Theory Is Elegant • Most firms, in fact, use both equity and debt • Firms with tangible assets, e. g. , factories, do borrow more - Tangible assets can be put up as collateral, reducing borrowing costs • Actual debt levels vary widely across apparently similar firms Keating F&A 3 -7 Spring 2008

Modigliani And Miller Wrote A Famous Nihilistic Paper On Capital Structure • A firm’s value is unaffected by its capital structure - It doesn’t matter how a firm finances itself in equilibrium -“A pizza is still a pizza no matter how you slice it” • Perturbations of MM tend to lead to corner solutions - The corporate income tax code favors debt financing so firms should take on as much debt as possible • More on MM in Higgins’ Chapter 6 Keating F&A 3 -8 Spring 2008

Modigliani And Miller Wrote A Famous Nihilistic Paper On Capital Structure • A firm’s value is unaffected by its capital structure - It doesn’t matter how a firm finances itself in equilibrium -“A pizza is still a pizza no matter how you slice it” • Perturbations of MM tend to lead to corner solutions - The corporate income tax code favors debt financing so firms should take on as much debt as possible • More on MM in Higgins’ Chapter 6 Keating F&A 3 -8 Spring 2008

As A Practical Matter, Debt Past A Certain Level Is Impossible • Real world bankruptcy costs discourage 100% debt financing - Legal costs of bankruptcy - Employees quit - Suppliers want cash up-front • Most bonds have covenants limiting future bond issuances • Bondholders don’t want to lend to a safe firm today that transforms into a risky firm Keating F&A 3 -9 Spring 2008

As A Practical Matter, Debt Past A Certain Level Is Impossible • Real world bankruptcy costs discourage 100% debt financing - Legal costs of bankruptcy - Employees quit - Suppliers want cash up-front • Most bonds have covenants limiting future bond issuances • Bondholders don’t want to lend to a safe firm today that transforms into a risky firm Keating F&A 3 -9 Spring 2008

Outline Lecture 3 • A Target Capital Structure and What It Implies • New Stock Issuances, Stock Repurchases • Principal-Agent Problems in Corporations Keating F&A 3 -10 Spring 2008

Outline Lecture 3 • A Target Capital Structure and What It Implies • New Stock Issuances, Stock Repurchases • Principal-Agent Problems in Corporations Keating F&A 3 -10 Spring 2008

A Stock Issuance Starts With Some Preliminary Steps • Existing stockholders’ preemptive rights must be honored - Existing stockholders have the first chance to buy any new shares issue - Prevents fraudulent dilution, e. g. , management sells under-valued shares to cronies to maintain control • Choice must be made between private placement and public offering Keating F&A 3 -11 Spring 2008

A Stock Issuance Starts With Some Preliminary Steps • Existing stockholders’ preemptive rights must be honored - Existing stockholders have the first chance to buy any new shares issue - Prevents fraudulent dilution, e. g. , management sells under-valued shares to cronies to maintain control • Choice must be made between private placement and public offering Keating F&A 3 -11 Spring 2008

A Private Placement Directly Sells Stock To A Large Investor • Can reduce flotation costs • Can be done quietly • But have you obtained a fair price? Keating F&A 3 -12 Spring 2008

A Private Placement Directly Sells Stock To A Large Investor • Can reduce flotation costs • Can be done quietly • But have you obtained a fair price? Keating F&A 3 -12 Spring 2008

If You Do A Public Offering, SEC Paperwork Is Considerable • Registration Statement • Prospectus • Must report on insider trading activities • Must follow proxy rules • Goal is to make markets fair, open Keating F&A 3 -13 Spring 2008

If You Do A Public Offering, SEC Paperwork Is Considerable • Registration Statement • Prospectus • Must report on insider trading activities • Must follow proxy rules • Goal is to make markets fair, open Keating F&A 3 -13 Spring 2008

You Probably Need An Investment Broker To Do Public Offering • Are market conditions favorable? • Best efforts assistance or underwriting? • Investment banker owns then re-sells stock in underwriting (often leading a syndicate) Keating F&A 3 -14 Spring 2008

You Probably Need An Investment Broker To Do Public Offering • Are market conditions favorable? • Best efforts assistance or underwriting? • Investment banker owns then re-sells stock in underwriting (often leading a syndicate) Keating F&A 3 -14 Spring 2008

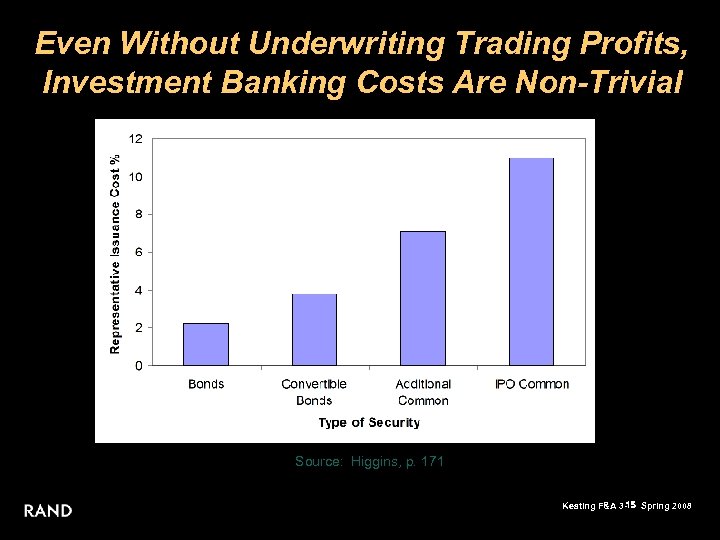

Even Without Underwriting Trading Profits, Investment Banking Costs Are Non-Trivial Source: Higgins, p. 171 Keating F&A 3 -15 Spring 2008

Even Without Underwriting Trading Profits, Investment Banking Costs Are Non-Trivial Source: Higgins, p. 171 Keating F&A 3 -15 Spring 2008

One Wants Issuing Price To Be Fairly Close To Market Price • Underwriter loses if issue is overpriced • Firm forfeits possible funds if issue underpriced • Investment bank doesn’t want reputation for gross underpricing (though it is tempting!) Keating F&A 3 -16 Spring 2008

One Wants Issuing Price To Be Fairly Close To Market Price • Underwriter loses if issue is overpriced • Firm forfeits possible funds if issue underpriced • Investment bank doesn’t want reputation for gross underpricing (though it is tempting!) Keating F&A 3 -16 Spring 2008

Allegedly Chronic IPO Underpricing Is Controversial • Underpricing, if it occurs, takes money away from the issuing firm • Do investment bankers use underpriced IPOs to reward important insiders? • Do issuing firms underprice as a form of advertising? • Does underpricing help firm’s future issuances? Keating F&A 3 -17 Spring 2008

Allegedly Chronic IPO Underpricing Is Controversial • Underpricing, if it occurs, takes money away from the issuing firm • Do investment bankers use underpriced IPOs to reward important insiders? • Do issuing firms underprice as a form of advertising? • Does underpricing help firm’s future issuances? Keating F&A 3 -17 Spring 2008

The Magnitude Of Stock Price Decrease From New Issuance Is Unclear • New issuance thought to be a negative signal • How profitably are you investing extra funds? • How horizontal is demand curve for firm’s stock? Keating F&A 3 -18 Spring 2008

The Magnitude Of Stock Price Decrease From New Issuance Is Unclear • New issuance thought to be a negative signal • How profitably are you investing extra funds? • How horizontal is demand curve for firm’s stock? Keating F&A 3 -18 Spring 2008

Some Firms Pay Dividends While Issuing New Stock • Seems wasteful: New stock issuance is costly, dividend recipients pay income taxes • Clientele effect: Existing stockholders may have come to count on dividends • Stockholders may not trust managers so may welcome scrutiny accompanying new stock issuance Keating F&A 3 -19 Spring 2008

Some Firms Pay Dividends While Issuing New Stock • Seems wasteful: New stock issuance is costly, dividend recipients pay income taxes • Clientele effect: Existing stockholders may have come to count on dividends • Stockholders may not trust managers so may welcome scrutiny accompanying new stock issuance Keating F&A 3 -19 Spring 2008

From A Tax Perspective, A Stock Repurchase May Be Preferred To Dividends • Corporation buys up some existing shares • Smaller pool of remaining stockholders to share future flows • (Hopefully) Resultant stock price increase a capital gain, not ordinary income Keating F&A 3 -20 Spring 2008

From A Tax Perspective, A Stock Repurchase May Be Preferred To Dividends • Corporation buys up some existing shares • Smaller pool of remaining stockholders to share future flows • (Hopefully) Resultant stock price increase a capital gain, not ordinary income Keating F&A 3 -20 Spring 2008

Stock Repurchases Have Other Advantages • Sale of stock is up to investor; receipt of taxable dividend is involuntary • Allows use of short-term excess cash without commitment of dividend increase • A mechanism for large scale reduction in equity share in capital structure, if so desired Keating F&A 3 -21 Spring 2008

Stock Repurchases Have Other Advantages • Sale of stock is up to investor; receipt of taxable dividend is involuntary • Allows use of short-term excess cash without commitment of dividend increase • A mechanism for large scale reduction in equity share in capital structure, if so desired Keating F&A 3 -21 Spring 2008

The IRS Can Get Concerned About Repurchases, However • Not supposed to take actions solely to reduce income taxation of stockholders • Management needs a “business justification” • Probably not a problem if done in moderation Keating F&A 3 -22 Spring 2008

The IRS Can Get Concerned About Repurchases, However • Not supposed to take actions solely to reduce income taxation of stockholders • Management needs a “business justification” • Probably not a problem if done in moderation Keating F&A 3 -22 Spring 2008

In Contrast To Repurchases, Splits And Stock Dividends Are Fairly Meaningless • Split of stock gives everyone more shares, but of lower value • Stock dividend similar • Want to keep price in “optimal” range? • Perhaps a favorable signal • Much ado about very little? Keating F&A 3 -23 Spring 2008

In Contrast To Repurchases, Splits And Stock Dividends Are Fairly Meaningless • Split of stock gives everyone more shares, but of lower value • Stock dividend similar • Want to keep price in “optimal” range? • Perhaps a favorable signal • Much ado about very little? Keating F&A 3 -23 Spring 2008

Outline Lecture 3 • A Target Capital Structure and What It Implies • New Stock Issuances, Stock Repurchases • Principal-Agent Problems in Corporations Keating F&A 3 -24 Spring 2008

Outline Lecture 3 • A Target Capital Structure and What It Implies • New Stock Issuances, Stock Repurchases • Principal-Agent Problems in Corporations Keating F&A 3 -24 Spring 2008

There Is A Motif Of Stockholders Not Trusting Managers • One rationale presented, for instance, for new stock issuances concurrent with dividend payments is that stockholders welcome the scrutiny accompanying new stock issuances • Another example is that stockholders may not want managers to have an open line of credit - Credit access allows quick action if opportunities arise - But will managers just buy private jets for themselves? → This is a Principal-Agent problem Keating F&A 3 -25 Spring 2008

There Is A Motif Of Stockholders Not Trusting Managers • One rationale presented, for instance, for new stock issuances concurrent with dividend payments is that stockholders welcome the scrutiny accompanying new stock issuances • Another example is that stockholders may not want managers to have an open line of credit - Credit access allows quick action if opportunities arise - But will managers just buy private jets for themselves? → This is a Principal-Agent problem Keating F&A 3 -25 Spring 2008

Principal-Agent Problems Are Heavily Studied In Economics • Principal: Stockholders • Agent: Corporate management • How do stockholders (the principal) make sure managers (the agent) behave in a way that maximizes stockholder wealth? - Effort is not directly observable - Observed outcomes include randomness and external factors not within managers’ control Keating F&A 3 -26 Spring 2008

Principal-Agent Problems Are Heavily Studied In Economics • Principal: Stockholders • Agent: Corporate management • How do stockholders (the principal) make sure managers (the agent) behave in a way that maximizes stockholder wealth? - Effort is not directly observable - Observed outcomes include randomness and external factors not within managers’ control Keating F&A 3 -26 Spring 2008

It Is Widely Suspected Managers Want To Build Empires • Compensation believed to be related to the size, not the profitability, of an enterprise • The same theory has been presented for managers/bureaucrats in government agencies Keating F&A 3 -27 Spring 2008

It Is Widely Suspected Managers Want To Build Empires • Compensation believed to be related to the size, not the profitability, of an enterprise • The same theory has been presented for managers/bureaucrats in government agencies Keating F&A 3 -27 Spring 2008

One Incentive Correction Is To Tie Compensation To The Stock’s Price • You want managers to “think like stockholders” - Risk averse managers probably don’t want too high a percentage of their wealth in the firm’s stock • Call options provide especially strong incentives - A call option is only valuable if the stock price is above the option exercise price upon expiration of the option - Some executive have made gargantuan amounts from options - There are issues about how options are handled from a tax perspective Keating F&A 3 -28 Spring 2008

One Incentive Correction Is To Tie Compensation To The Stock’s Price • You want managers to “think like stockholders” - Risk averse managers probably don’t want too high a percentage of their wealth in the firm’s stock • Call options provide especially strong incentives - A call option is only valuable if the stock price is above the option exercise price upon expiration of the option - Some executive have made gargantuan amounts from options - There are issues about how options are handled from a tax perspective Keating F&A 3 -28 Spring 2008

Takeover Threat Is A Major Check On Managers • If a company is poorly run, an outsider could take on debt to buy out its stockholders and replace management - “Takeover artists, ” “Corporate raiders” - Leveraged buyout • While negatively depicted (by hardly disinterested managers), even the threat of takeover benefits stockholders by improving manager motivation • “Poison pills” that discourage takeovers are not in shareholders’ best interests Keating F&A 3 -29 Spring 2008

Takeover Threat Is A Major Check On Managers • If a company is poorly run, an outsider could take on debt to buy out its stockholders and replace management - “Takeover artists, ” “Corporate raiders” - Leveraged buyout • While negatively depicted (by hardly disinterested managers), even the threat of takeover benefits stockholders by improving manager motivation • “Poison pills” that discourage takeovers are not in shareholders’ best interests Keating F&A 3 -29 Spring 2008