5f42cf815abc75648677f4ee31477b91.ppt

- Количество слайдов: 52

Finance and the Securities Market Exploring Business Chapter 13 Tuesday 9/13/11

Developing A Financial Plan v Establish a Business Plan, Marketing Plan, and Financial Plan v Calculate Funds Needed v Do a “Pro Forma” Profitability Analysis & Cash Flow v. Estimate Sales v. Project Costs v Getting The Money v. Owner’s Personal Assets v. Loans- Family/Friends v. Bank Loans v Making The Financing Decision

Capital Budgeting and Financial Planning • Capital budgeting is the process of analyzing the needs of business and selecting the assets that will maximize its value – Assessing risk • Every investment in capital assets has its own risk

Qualitative Assessment of Capital Budgeting Risk Highest Risk Introduce a New Product in Foreign Markets (risk depends on stability of country) Expand into a New Market Introduce a New Product in a Familiar Area Add to a Product Line Buy New Equipment for an Established Market Repair Old Machinery Lowest Risk

Where Small & Start-up Businesses Get Funding

Loan Characteristics 1) 2) 3) • • • Maturity Short-Term, Intermediate, Long-Term Line of Credit Amortization • • Security Collateral Unsecured Interest Exploring Business © 2009 Flat. World Knowledge 13 -6

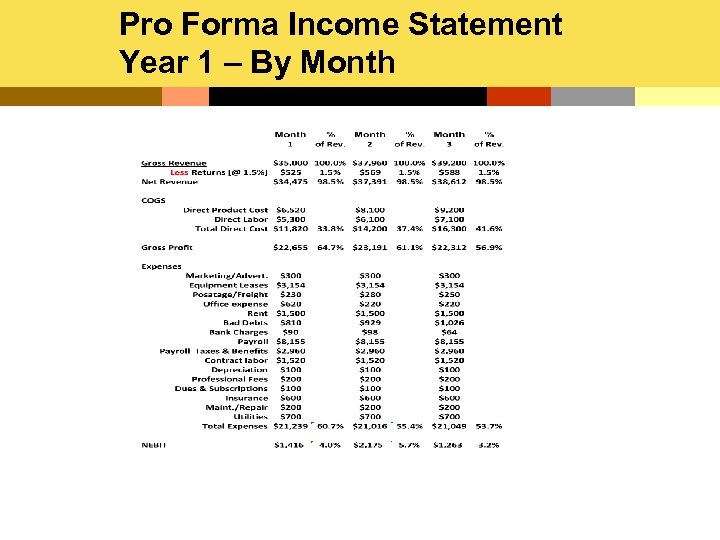

Pro Forma Income Statement Year 1 – By Month

Pro Forma Income Statement Year 1 Through Year 5

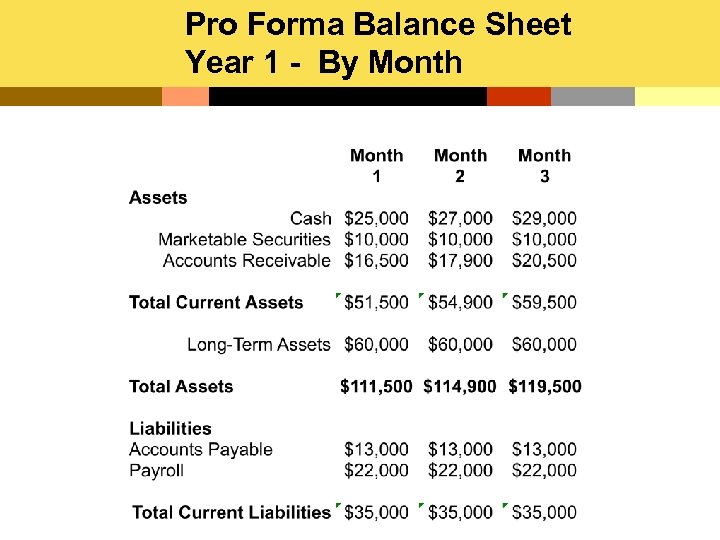

Pro Forma Balance Sheet Year 1 - By Month

Pro Forma Balance Sheet Year 1 Through Year 5

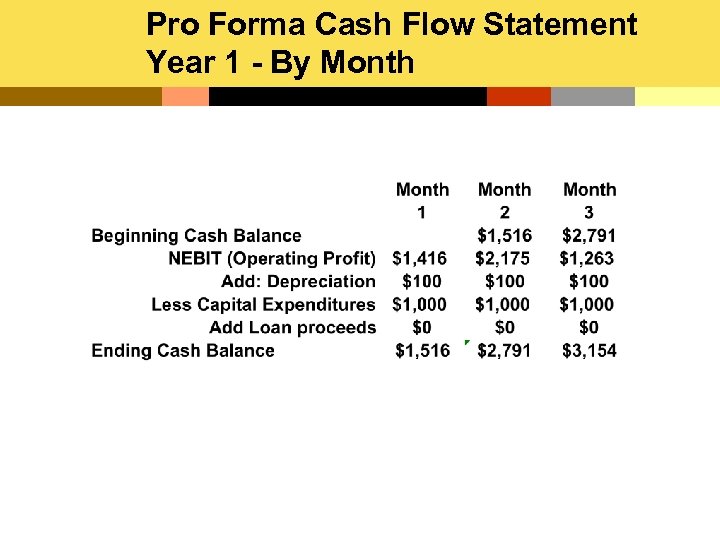

Pro Forma Cash Flow Statement Year 1 - By Month

Pro Forma Cash Flow Statement Year 1 Through Year 5

Users Of Financial Information Owners & Managers Investors & Creditors

Growth Stage Financing ÏManaging • Cash Flow • Accounts Receivable • Accounts Payable- Trade Credit ÏBudgeting- financial plan • Cash • Capital Exploring Business © 2009 Flat. World Knowledge 13 -14

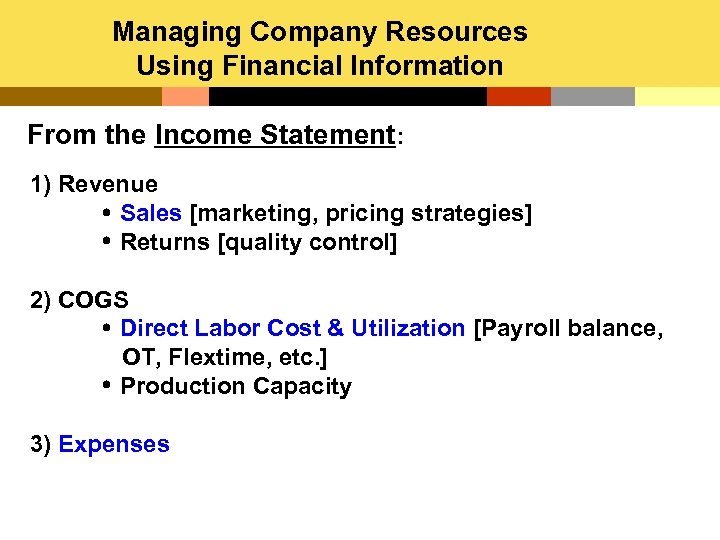

Managing Company Resources Using Financial Information From the Income Statement: 1) Revenue Sales [marketing, pricing strategies] Returns [quality control] 2) COGS Direct Labor Cost & Utilization [Payroll balance, OT, Flextime, etc. ] Production Capacity 3) Expenses

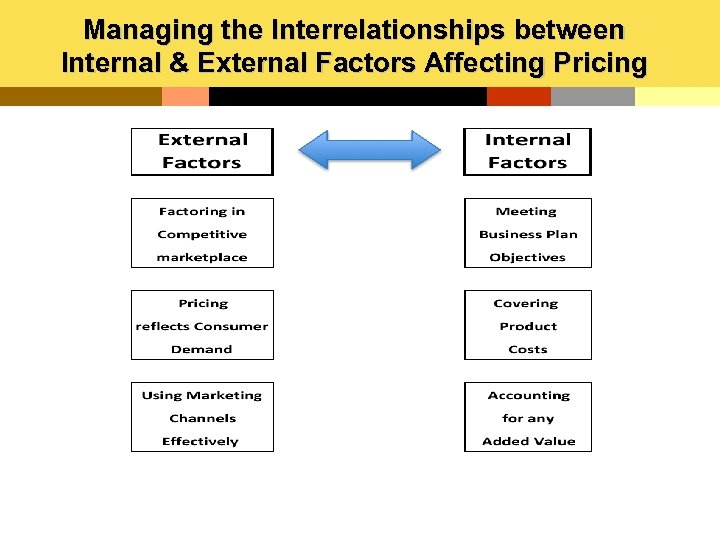

Understanding the Interrelationships between Internal & External Pricing Strategies and Sales External Factors Internal Factors

Managing the Interrelationships between Internal & External Factors Affecting Pricing

Implementing Pricing Strategies to Effect Sales

Managing Direct Payroll Costs Payroll: Incorporating balance between cash used for payroll and cash flow. Pay bi-monthly, 26 pay periods per year, etc. How: Keeping Payroll In-house Outsourcing Payroll Outsourcing Employees & Payroll Utilizing Contingent Workforce

Managing Direct Costs Utilization • Having a Handle on Production Capacity • Analyzing trade-offs between manpower experience vs. cost • Effective manpower utilization - when & where to implement – OT – Flextime – Other incentives

Managing Expenses

Managing Company Current Resources Using Financial Information From the Balance Sheet Current assets are short-term resources Cash Investments Accounts receivable Inventory Current liabilities are short-term debts Accounts payable Accrued salaries Accrued taxes Short-term bank loans

Managing Current Assets Investing Idle Cash • Marketable securities • US Treasury bills (T-bills) • Commercial certificates of deposit (CDs) • Commercial paper • International investments – the Eurodollar market

Managing Current Assets Inventory and A/R Inventory - The objective is to maximize inventory investment without production cutbacks because of materials shortfalls or lost sales due to insufficient finished goods inventories Putting as much time between A/P and A/R to conserve cash Incorporating JIT Spreading supply risk over several suppliers Accounts Receivable Putting as little time between Invoicing and A/R to speed up cash inflow

Managing Current Assets – Accounts Receivable • Each credit sale represents an account receivable-money owed to a business by credit customers • General – Typical- due within 30 days Net 30 • Incentives – 2% discount off invoice if paid between within 10 days of invoice date. Otherwise, Net 30 days due. 2% 10 Net 30 • Late Fee – 1. 5% per month [18% APR] penalty charged if invoice is paid late

Managing Long-Term Assets Using Financial Information • Long-term (fixed) assets: – Plant – Offices – Equipment – Heavy machinery – Automobiles

Managing Current Liabilities – Accounts Payable - Taking every advantage of trade discounts offered by most suppliers Staff Salaries - Analyzing trade-offs between manpower experience vs. cost Short-term Loans – Utiilizing the most cost-effective financial resources available.

Managing Long-Term Liabilities • Long-term Debt: Debts that will be repaid over a number of years – Long-term loans – Bond issues

The Securities Market Equities Common Stock Preferred Stock Warrants, Rights, ADRs Retained Earnings Debt Corporate Debt U. S. Government Debt Muni Debt Money Market Euro Dollar Debt

Equity Securities Common Stock ”Owner” of a corporation Stockholder Rights: Right to Vote for Board of Directors Approve any Board decision that might dilute their equity position [stock splits, reverse stock splits, issuance of convertible bonds or preferred stock, issue stock options. Last in line during liquidation Board Actions not requiring a Stockholder Vote : Declaration of cash or stock dividends, rights (to buy more shares) distributions and repurchase of shares for its Treasury May or may not get dividend – up to the Board

Equity Securities Common Stock • Purchase stock through Broker/Dealers [Merrill Lynch, Charles Schwab, etc. ] • New offerings [IPOs] • Trade for existing shares

Equity Securities Special Securities • Rights – Short-term option to buy stock at a fixed price. Typically issued for 30 to 60 days and then expire. Issued under an offering of new commonshares to existing shareholders. • Warrants (trade separately from underlying stock) – Long-term option to buy stock at a fixed price. Typically attached to the sale of a new stock or bond issue as a “sweetener” to make it more attractive. Typical expirations are 5 years.

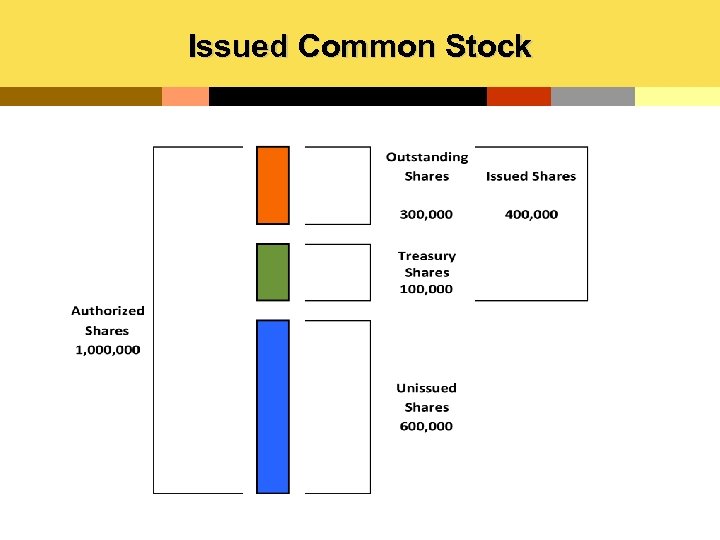

Issued Common Stock

Equity Securities Preferred Stock • Typically issued with $100 par value with a stated fixed dividend rate. For example, a company issues $100 par at 10% preferred stock. Preferred dividends (if declared by the Board) are paid semi-annually, with each dividend payment = $5 per share. • Preferred differs from Common in that it pays a fixed dividend rate over its life • Preferred stockholders are paid dividends ahead of common stock holders. Dividends are not guaranteed in any one year

Equity Securities Preferred Stock Preferred stock acts more like bonds – their market value is influenced by interest rate moves. Preferred stockholders have no voting rights or preemptive rights. Have features similar to bonds. Theoretical Market price = Annual Dividend Income/ Market Yield $100 = $10 / 10%

Debt Securities Bonds • A bond is a debt security that obligates the issuer to pay interest [usually semi-annually] and to the repay principal when the debt matures (at a set date) • Bonds are issued with a stated par value (usually $1, 000 minimum) and a stated rate of interest (the “Nominal” or “Coupon” rate which never changes) on the debt. For example, a $1, 000 par value bond is issued with a stated coupon rate of 8% by XYZ Corporation in 2011. The maturity on the debt is 2031 (20 years). XYZ Corp must pay $80 of interest annually to the bondholder for each of the 20 years the bond is outstanding. • Bondholders are ahead of Preferred stockholders and Common stockholders if a company liquidates.

Corporate and U. S. Government Debt Corporate Debt – Corporations issue debt in order to raise capital. The debt can take the form of long-term bonds, intermediate-term bonds, or short-term notes known as commercial paper. U. S. Government Debt – The U. S. Government issues debt in order to raise finance the running of the government. Negotiable debt issues can be long-term bonds, intermediate term notes, and short-term notes known as Treasury Bills.

Muni Debt – Municipal Bonds are debt issues of state and local governments, territories and political subdivisions (such as special districts, agencies and authorities). One special feature of most Muni bonds is the Fed. interest exemption. After-Tax Return – When comparing competing investments (like a Corporate Bond yielding 5% vs a Muni Bond at 4% tax exempt), one must look at a person’s Federal tax bracket to get an “equivalent yield”. In this case, if a person were in a 25% tax bracket, you would divide the 4% by 100% - 25%, i. e, . 04/. 75 = 5. 3%. The muni bond would be a better choice Types and Financing: General Obligation bonds [ad valorem taxes] Revenue Bonds [self-supporting] Special Assessment, Moral Obligation & Special Tax bonds

Money Market Debt Money Market – A debt obligation that matures in one year or less. Very liquid. Used by the FED for open market operations [buying and selling money market instruments], to loosen or tighten credit. Some Types: Treasury bills Treasury notes Commercial paper Bankers’ Acceptance Time drafts Negotiable CDs

Debt Outside the U. S. - Euro Bond Market • Euro. Bond Market: Centered in London, the market is larger than the U. S. Corporate bond market. • Provides a huge competitive market for US corporations, U. S. , state and local governments, foreign coporations, and other soverign governments. • What makes them attractive are: – No currency exchange risk – Low interest rates – Lower issuance expense • Bonds are denominated in U. S. dollars or foreign currencies (Euro, British pound)

13 -41 Securities Markets o Markets • Primary – new issues being sold to public for first time • Secondary – trading of issued securities o Organized Exchanges • New York & Regional Stock Exchanges [3, 000 listed companies • NASDAQ [ 3, 200 companies traded] • Over-The-Counter [> 10, 000 companies traded] Exploring Business © 2009 Flat. World Knowledge

Measuring Market Performance ü Market Indexes • Dow Jones Industrial Average – 30 large diverse 13 -42 issues, mostly NYSE listed, that mirror US economy • NASDAQ Composite sampling of NASDAQ issues • S & P 500 consists of 500 or largest US corporations in US • Specialty Indexes • Wilshire, Russell 2000, Value Line, etc. ü Reading a Stock Listing ü Bull vs. Bear Market Exploring Business © 2009 Flat. World Knowledge

The 30 Stocks in the Dow Jones Industrial Average

Analysis Tools Fundamentals Analysis - An analysis of a prospective company’s income and balance sheet statements in order to forecast anticipated stock movements based on historical records of assets, earnings, sales, products, management and markets. 1) Appraisal of company’s prospects 2) Assessment of whether a stock or group of stocks is undervalued or overvalued at current market prices 3) Not concerned with stock price and volume movements

Analysis Tools Technical Analysis – Looks at the demand supply for a stock or group of stocks based on trading volume and prices. 1) Not concerned with financial condition of company 2) Use charts and computer programs to identify and project price trends.

Types of Investment Risk Business Risk – associated with specific securities, not whole market. Market [“systemic”] Risk – investment risk that can’t be avoided even by diversification. Tied to economy as a whole. Interest Rate Risk – affects the market price of fixed-income securities [bonds, preferred stock], whose price movements are affected by interst rate movements. Inflation [“purchasing power”] Risk – risk that invested capital will decline in value due to inflation, or won’t keep pace with inflation. Regulatory Risk – investments affected by tax law changes Liquidity Risk – some investments face additional risk because no secondary market is available to quickly sell security without taking a loss.

Assessing Investment Needs: Evaluating Stocks for Return vs. Risk Safety Corporate – Blue chip stocks US Gov’t Securities – highest ratings Growth & Emerging Growth Companies in a growth period due to rapid market expansion or unique products New ventures – high risk/ potentially high reward. Earnings are typically plowed back into the company, rather than distributed Income Mature companies with high dividend payout ratios Defensive – companies remain unaffected during business cycles Speculative – feast or famine type companies Special Situations – Companies going through take-overs, restructuring, etc.

Portfolio Management Strategies Strategic Asset Allocation – investment strategy that allocates Funds between appropriate asset classes [i. e. , investments with similar risk & return characteristics]. Example, corporate, government and muni bonds are an asset class. Tactical Asset Allocation – an investment strategy that engages In market timing in an attempt to “beat the market”. Deviations from the normal asset mix are made in response to perceived changing market opportunities. Assessment methods include reliance on business cycle analysis and economic forecasting.

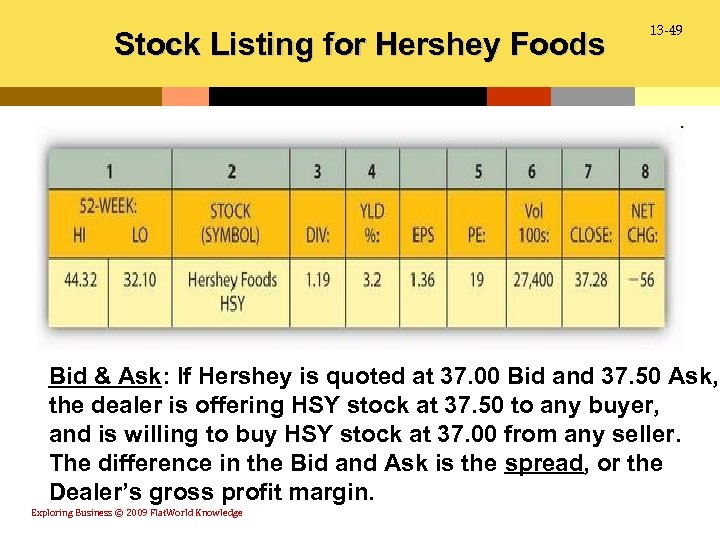

Stock Listing for Hershey Foods 13 -49 Bid & Ask: If Hershey is quoted at 37. 00 Bid and 37. 50 Ask, the dealer is offering HSY stock at 37. 50 to any buyer, and is willing to buy HSY stock at 37. 00 from any seller. The difference in the Bid and Ask is the spread, or the Dealer’s gross profit margin. Exploring Business © 2009 Flat. World Knowledge

Interpreting A Stock Quotation Term Explanation 52 -Week HI Highest price in last year 52 -Week LO Lowest price in last year Stock (Symbol) Symbol of listing DIV Annual dividend per share YLD % D/E yield on closing price PE Investors pay on $1 earnings VOL Volume of shares traded Close Price at close of business day Exploring Business © 2009 Flat. World Knowledge 13 -50

Valuation Ratios Price/Earnings Ratio – calculated by dividing the current market price of a stock by its earnings per share. For example, a stock With a current market price of $20 and annual earnings per share of $2, has a P/E ratio of 10. The stock is currently selling at 10 times earnings. It’s also known as the “multiple” and is an indication of how much an investor is paying for a company’s earning power. The higher the P/E, the more investors paying for the expectation of earnings growth. Earnings per Share – Annual earnings divided by the number of outstanding shares.

Bus 20 Class Tuesday 9/13/11 Article 1 Assignment 1. Select an article that is relevant to the topics being covered in the class. Be sure to choose only articles that are written in the "real" business press: no blogs, no web search results. Look in the business section of local newspapers, weekly news magazines, or business dailies and weeklies. 2. Include you name, date, and course/section number, and a title. 3. Write just three paragraphs: Article title, author, publication, date, and relevance to course topic. Summary in your own words of what the article discussed. Your thoughts about the subject. Paragraphs are made up of sentences, and papers should be written in business English, printed (no handwritten submissions!), and turned in during class on the day they are due. Plagiarism is just wrong, and you'll get an F on the assignment the first time. Second time, you'll be dropped from the class. If you don't know what plagiarism is, FIND OUT! Due Thursday 9/15/11

5f42cf815abc75648677f4ee31477b91.ppt