0ce1c2b41b3b90704932df76a67c14a3.ppt

- Количество слайдов: 18

FINANCE 7. Capital Budgeting (2) Professor André Farber Solvay Business School Université Libre de Bruxelles Fall 2007 MBA 2007 - Capital Budgeting (2)

Investment decisions (2) • Objectives for this session : • A project is not a black box • Timing: – How long to invest? – When to invest? • Project with different lifes: Equivalent Annual Cost MBA 2007 - Capital Budgeting (2) 2

A project is not a black box • Sensitivity analysis: – analysis of the effects of changes in sales, costs, . . on a project. • Scenario analysis: – project analysis given a particular combination of assumptions. • Simulation analysis: – estimations of the probabilities of different outcomes. • Break even analysis – analysis of the level of sales at which the company breaks even. MBA 2007 - Capital Budgeting (2) 3

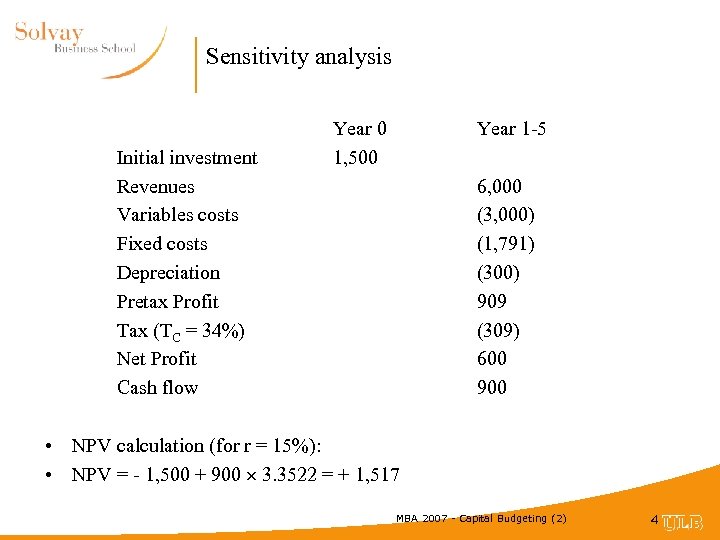

Sensitivity analysis Initial investment Revenues Variables costs Fixed costs Depreciation Pretax Profit Tax (TC = 34%) Net Profit Cash flow Year 0 1, 500 Year 1 -5 6, 000 (3, 000) (1, 791) (300) 909 (309) 600 900 • NPV calculation (for r = 15%): • NPV = - 1, 500 + 900 3. 3522 = + 1, 517 MBA 2007 - Capital Budgeting (2) 4

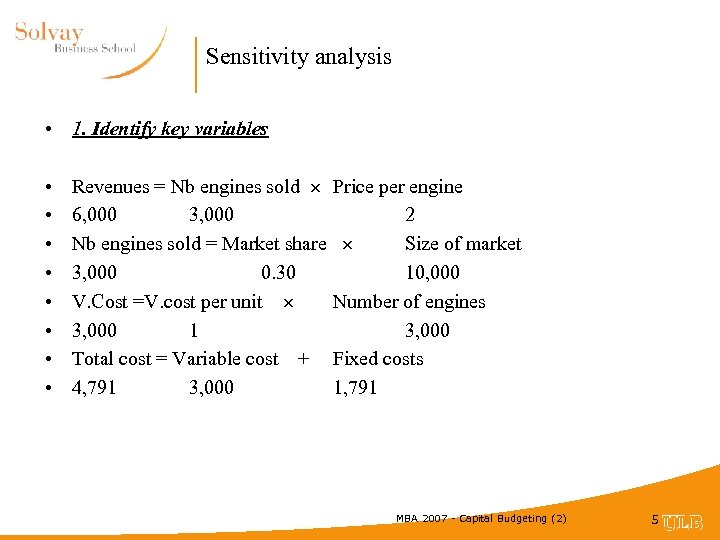

Sensitivity analysis • 1. Identify key variables • • Revenues = Nb engines sold 6, 000 3, 000 Nb engines sold = Market share 3, 000 0. 30 V. Cost =V. cost per unit 3, 000 1 Total cost = Variable cost + 4, 791 3, 000 Price per engine 2 Size of market 10, 000 Number of engines 3, 000 Fixed costs 1, 791 MBA 2007 - Capital Budgeting (2) 5

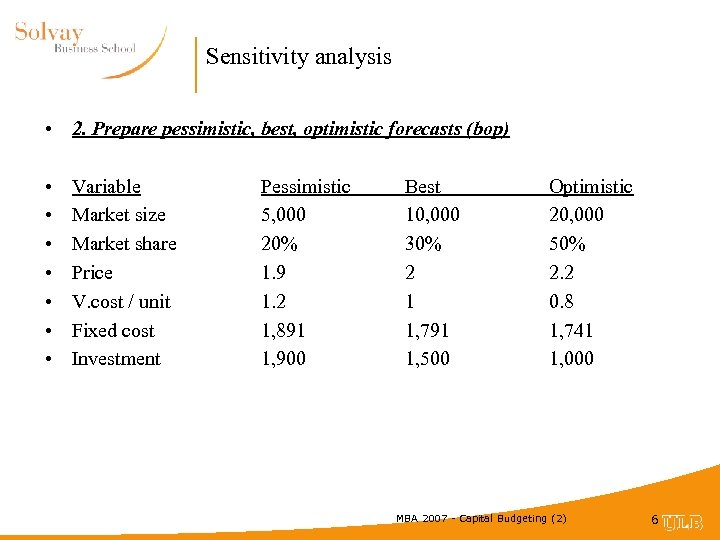

Sensitivity analysis • 2. Prepare pessimistic, best, optimistic forecasts (bop) • • Variable Market size Market share Price V. cost / unit Fixed cost Investment Pessimistic 5, 000 20% 1. 9 1. 2 1, 891 1, 900 Best 10, 000 30% 2 1 1, 791 1, 500 Optimistic 20, 000 50% 2. 2 0. 8 1, 741 1, 000 MBA 2007 - Capital Budgeting (2) 6

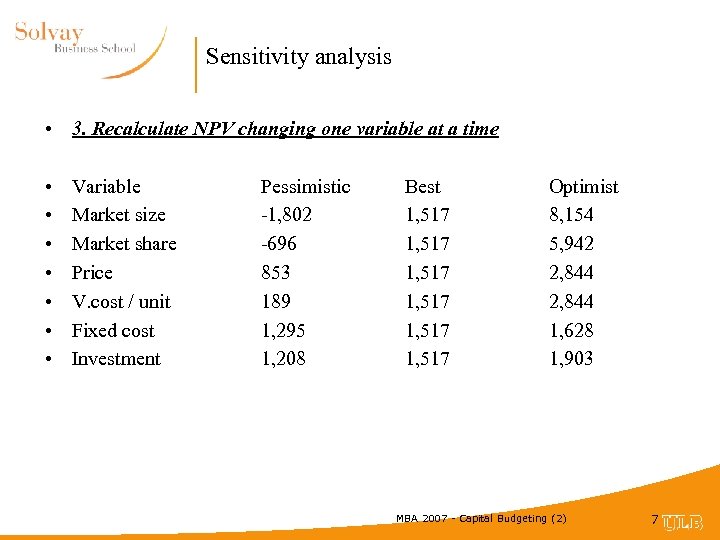

Sensitivity analysis • 3. Recalculate NPV changing one variable at a time • • Variable Market size Market share Price V. cost / unit Fixed cost Investment Pessimistic -1, 802 -696 853 189 1, 295 1, 208 Best 1, 517 1, 517 Optimist 8, 154 5, 942 2, 844 1, 628 1, 903 MBA 2007 - Capital Budgeting (2) 7

Scenario analysis • Consider plausible combinations of variables • Ex: If recession - market share low - variable cost high - price low MBA 2007 - Capital Budgeting (2) 8

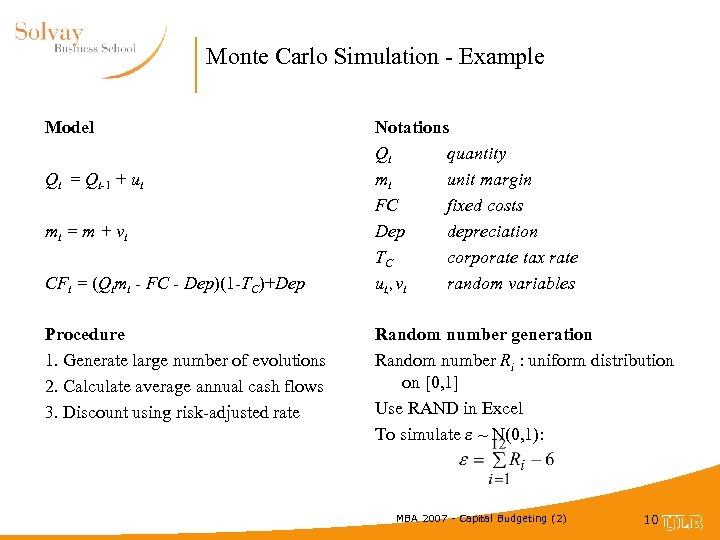

Monte Carlo simulation • Tool for considering all combinations • model the project • specify probabilities forecast errors • select numbers forecast errors and calculate cash flows • Outcome: simulated distribution of cash flows MBA 2007 - Capital Budgeting (2) 9

Monte Carlo Simulation - Example Model Qt = Qt-1 + ut mt = m + v t CFt = (Qtmt - FC - Dep)(1 -TC)+Dep Procedure 1. Generate large number of evolutions 2. Calculate average annual cash flows 3. Discount using risk-adjusted rate Notations Qt quantity mt unit margin FC fixed costs Dep depreciation TC corporate tax rate ut, , vt random variables Random number generation Random number Ri : uniform distribution on [0, 1] Use RAND in Excel To simulate ~ N(0, 1): MBA 2007 - Capital Budgeting (2) 10

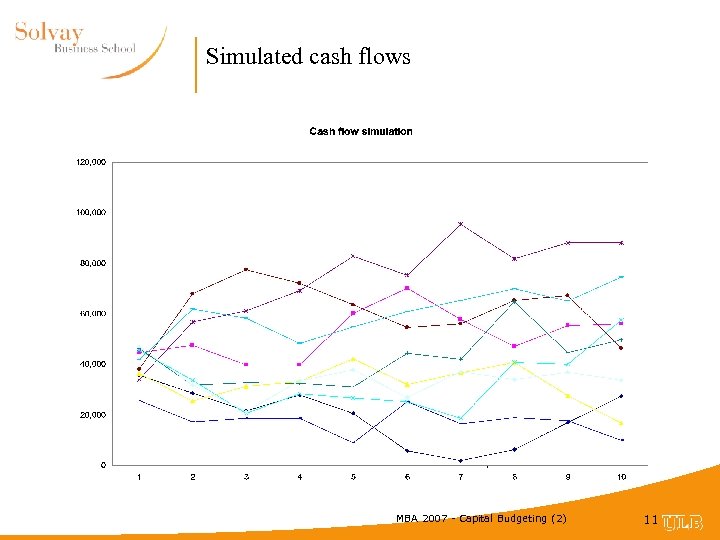

Simulated cash flows MBA 2007 - Capital Budgeting (2) 11

Break even analysis • Sales level to break-even? 2 views • Account Profit Break-Even Point: » Accounting profit = 0 • Present Value Break-Even Point: » NPV = 0 MBA 2007 - Capital Budgeting (2) 12

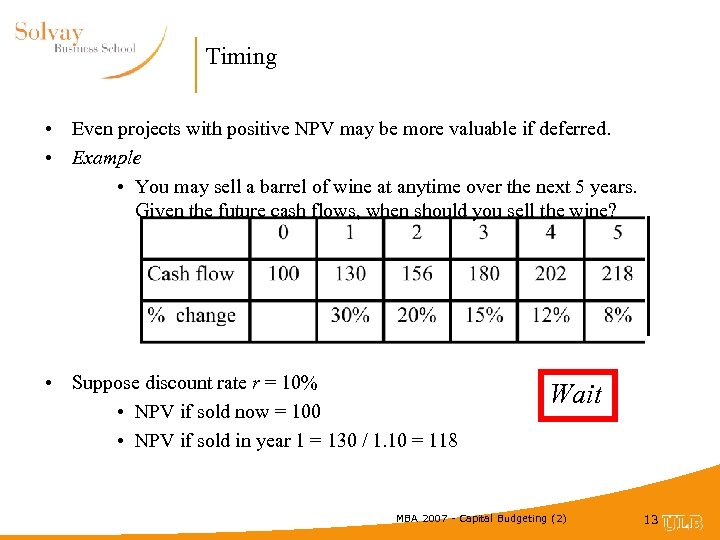

Timing • Even projects with positive NPV may be more valuable if deferred. • Example • You may sell a barrel of wine at anytime over the next 5 years. Given the future cash flows, when should you sell the wine? • Suppose discount rate r = 10% • NPV if sold now = 100 • NPV if sold in year 1 = 130 / 1. 10 = 118 Wait MBA 2007 - Capital Budgeting (2) 13

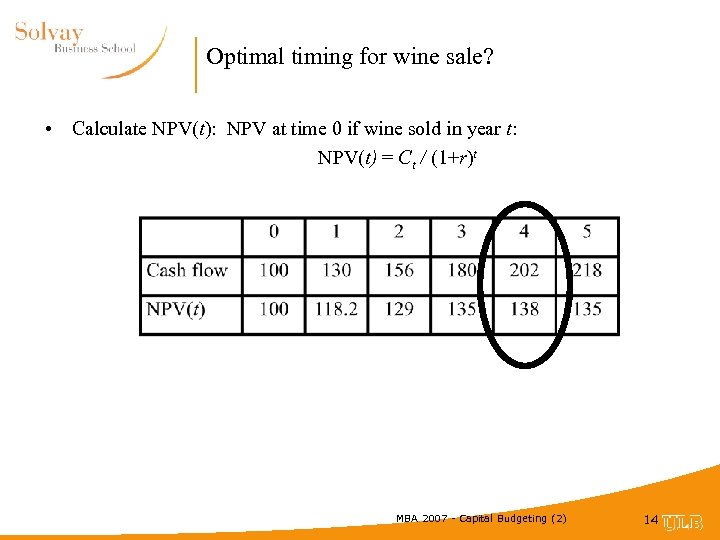

Optimal timing for wine sale? • Calculate NPV(t): NPV at time 0 if wine sold in year t: NPV(t) = Ct / (1+r)t MBA 2007 - Capital Budgeting (2) 14

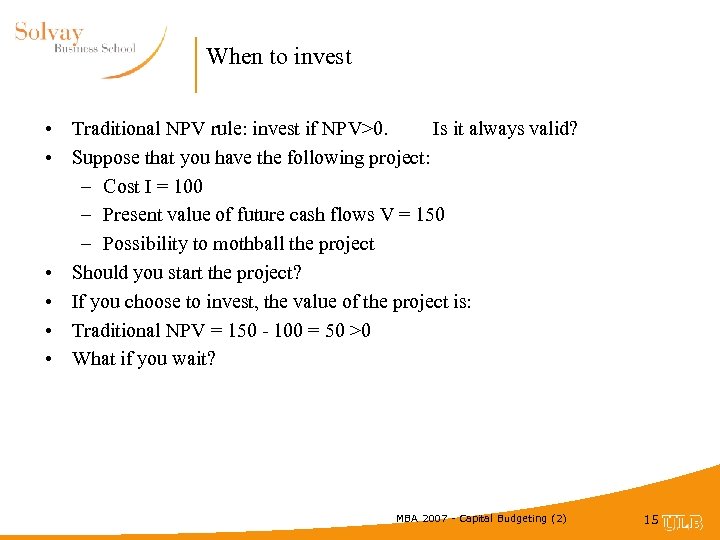

When to invest • Traditional NPV rule: invest if NPV>0. Is it always valid? • Suppose that you have the following project: – Cost I = 100 – Present value of future cash flows V = 150 – Possibility to mothball the project • Should you start the project? • If you choose to invest, the value of the project is: • Traditional NPV = 150 - 100 = 50 >0 • What if you wait? MBA 2007 - Capital Budgeting (2) 15

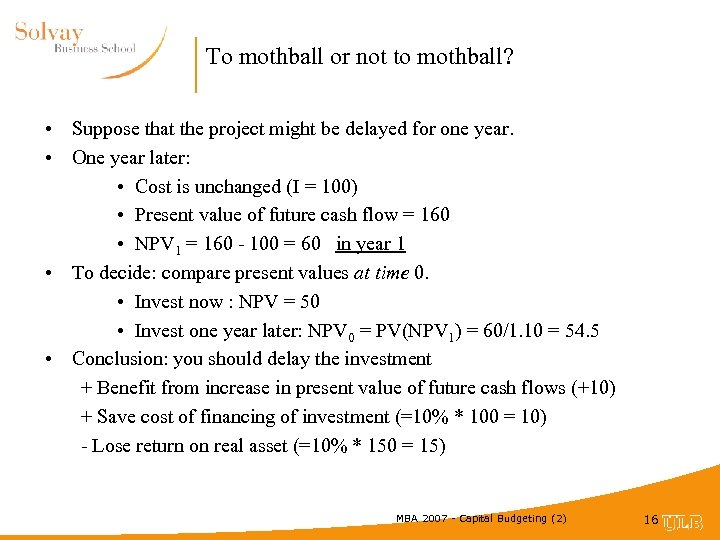

To mothball or not to mothball? • Suppose that the project might be delayed for one year. • One year later: • Cost is unchanged (I = 100) • Present value of future cash flow = 160 • NPV 1 = 160 - 100 = 60 in year 1 • To decide: compare present values at time 0. • Invest now : NPV = 50 • Invest one year later: NPV 0 = PV(NPV 1) = 60/1. 10 = 54. 5 • Conclusion: you should delay the investment + Benefit from increase in present value of future cash flows (+10) + Save cost of financing of investment (=10% * 100 = 10) - Lose return on real asset (=10% * 150 = 15) MBA 2007 - Capital Budgeting (2) 16

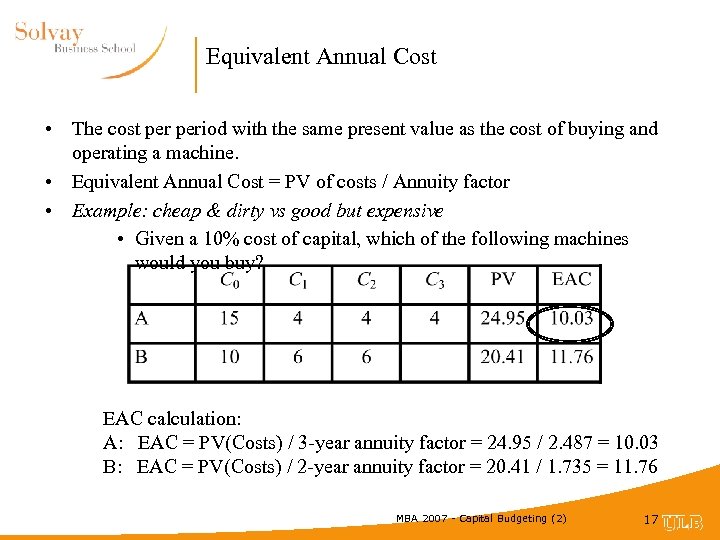

Equivalent Annual Cost • The cost period with the same present value as the cost of buying and operating a machine. • Equivalent Annual Cost = PV of costs / Annuity factor • Example: cheap & dirty vs good but expensive • Given a 10% cost of capital, which of the following machines would you buy? EAC calculation: A: EAC = PV(Costs) / 3 -year annuity factor = 24. 95 / 2. 487 = 10. 03 B: EAC = PV(Costs) / 2 -year annuity factor = 20. 41 / 1. 735 = 11. 76 MBA 2007 - Capital Budgeting (2) 17

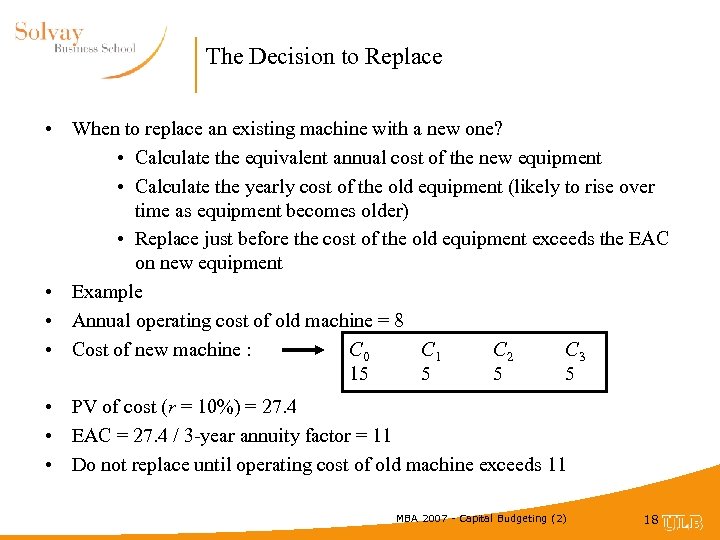

The Decision to Replace • When to replace an existing machine with a new one? • Calculate the equivalent annual cost of the new equipment • Calculate the yearly cost of the old equipment (likely to rise over time as equipment becomes older) • Replace just before the cost of the old equipment exceeds the EAC on new equipment • Example • Annual operating cost of old machine = 8 C 0 C 1 C 2 C 3 • Cost of new machine : 15 5 • PV of cost (r = 10%) = 27. 4 • EAC = 27. 4 / 3 -year annuity factor = 11 • Do not replace until operating cost of old machine exceeds 11 MBA 2007 - Capital Budgeting (2) 18

0ce1c2b41b3b90704932df76a67c14a3.ppt