6291d227281f85c3df134a9966948f9e.ppt

- Количество слайдов: 10

Finance 300 Financial Markets Lecture 19 Professor J. Petry, Fall, 2002© http: //www. cba. uiuc. edu/jpetry/Fin_300_fa 02/ http: //webboard. cites. uiuc. edu/

Finance 300 Financial Markets Lecture 19 Professor J. Petry, Fall, 2002© http: //www. cba. uiuc. edu/jpetry/Fin_300_fa 02/ http: //webboard. cites. uiuc. edu/

Housekeeping Agenda – Exam III is Tuesday, November 5 th. – – Stewardship reports are due Thursday, November 7 th. – – Will cover Chapters VI, VII. We will NOT cover Chapter VIII. We will not cover convertibles bonds (p. 238 -39; TTD; VII-9, parts d, e, f. ) Exam will be similar in layout and emphasis as prior exams. » 30 -40 multiple choice questions. » Study notes, and book. » Problems as well as conceptual questions. » Formula sheet will be provided. A copy is on the web. » Office Hours: Friday, 1: 00 -2: 50; Monday, 2: 00 -4: 00. See webpage and back of book for template and completed examples. TAs are available for help on Bond Project. See Web. Board for office hours. 2

Housekeeping Agenda – Exam III is Tuesday, November 5 th. – – Stewardship reports are due Thursday, November 7 th. – – Will cover Chapters VI, VII. We will NOT cover Chapter VIII. We will not cover convertibles bonds (p. 238 -39; TTD; VII-9, parts d, e, f. ) Exam will be similar in layout and emphasis as prior exams. » 30 -40 multiple choice questions. » Study notes, and book. » Problems as well as conceptual questions. » Formula sheet will be provided. A copy is on the web. » Office Hours: Friday, 1: 00 -2: 50; Monday, 2: 00 -4: 00. See webpage and back of book for template and completed examples. TAs are available for help on Bond Project. See Web. Board for office hours. 2

TTD VII-2 -- In 2000 P&G issues at par 10, 000 in 7% bonds maturing October 2, 2030. The bond is callable after 10 years with a call premium of 10%, declining ½% per year after that. A. What is the yield to maturity? B. What is the yield to call? Assume that in 2010 the market yield for P&G 7% 2030 bond is 7%. C. What is the call price of the bond? D. What would be the price of the bond if it were not callable? E. Will P& G call the bond? F. If John Q. Investor purchased $10, 000 in P&G bonds at par in 2000 and sells the bonds in 2010 at 10, 000, what is holding period yield? Assume that in 2015 the required yield for the P&G 7% 2030 bond is 5%. G. What is the call price of the bond? H. What would be the price of the bond if it were not callable? I. If P&G calls the issue and finances the recall with a new 15 year bond issue at 5% how much does P&G save on its semi-annual coupon payment and principal repayment? 3 J. What is the net present value of this saving?

TTD VII-2 -- In 2000 P&G issues at par 10, 000 in 7% bonds maturing October 2, 2030. The bond is callable after 10 years with a call premium of 10%, declining ½% per year after that. A. What is the yield to maturity? B. What is the yield to call? Assume that in 2010 the market yield for P&G 7% 2030 bond is 7%. C. What is the call price of the bond? D. What would be the price of the bond if it were not callable? E. Will P& G call the bond? F. If John Q. Investor purchased $10, 000 in P&G bonds at par in 2000 and sells the bonds in 2010 at 10, 000, what is holding period yield? Assume that in 2015 the required yield for the P&G 7% 2030 bond is 5%. G. What is the call price of the bond? H. What would be the price of the bond if it were not callable? I. If P&G calls the issue and finances the recall with a new 15 year bond issue at 5% how much does P&G save on its semi-annual coupon payment and principal repayment? 3 J. What is the net present value of this saving?

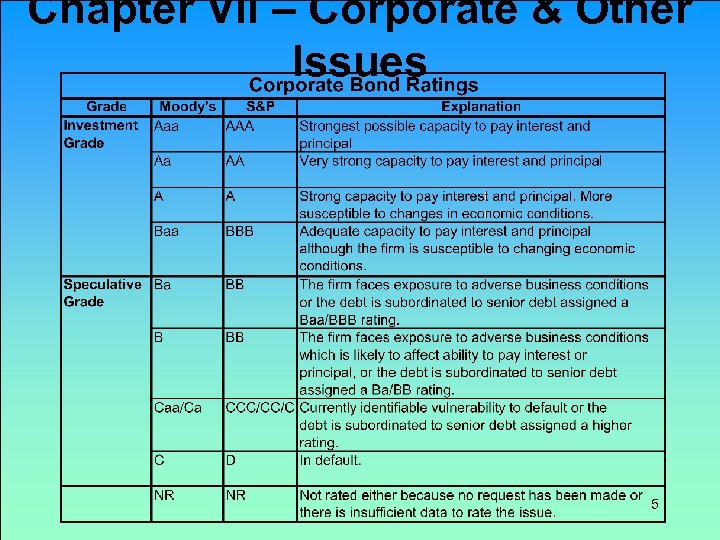

Chapter VII – Corporate & Other Issues Corporate Bond Ratings – Bonds are rated to provide investors with information regarding the default risk of a bond. S&P and Moody’s are by far the most commonly referenced bond rating companies. – There are two basic classifications for corporate bonds. 1. Investment Grade: Also known as High Grade. Bonds that have been assigned to one of the top four ratings groups (AAA, A, BBB by S&P or Aaa, A or Baa for Moody’s). These bonds are perceived to be reasonably safe investments. 2. Speculative Grade: Also known as Junk Bonds or High Yield bonds. Bonds which have been assigned a lower rating (BB, B, CCC, C or D by S&P or Ba, B, Caa, 4 Ca, or C by Moody’s). If a bond loses its investment grade

Chapter VII – Corporate & Other Issues Corporate Bond Ratings – Bonds are rated to provide investors with information regarding the default risk of a bond. S&P and Moody’s are by far the most commonly referenced bond rating companies. – There are two basic classifications for corporate bonds. 1. Investment Grade: Also known as High Grade. Bonds that have been assigned to one of the top four ratings groups (AAA, A, BBB by S&P or Aaa, A or Baa for Moody’s). These bonds are perceived to be reasonably safe investments. 2. Speculative Grade: Also known as Junk Bonds or High Yield bonds. Bonds which have been assigned a lower rating (BB, B, CCC, C or D by S&P or Ba, B, Caa, 4 Ca, or C by Moody’s). If a bond loses its investment grade

Chapter VII – Corporate & Other Issues 5

Chapter VII – Corporate & Other Issues 5

Chapter VII – Corporate & Other Issues Corporate Bonds—Yield Structure – There are six primary attributes that are significant in valuing a bond: 1. Term to maturity 3. Call provisions 5. Risk of default – – 2. Coupon rate 4. Liquidity (marketability) 6. Tax status Yield Structure: The overall pattern of yields that reflect these attributes. All six attributes impact yields in some way, and hence are considered part of the yield structure. To simplify our lives, we usually deal with one aspect of yield structure at a time. Yield Spread: Often just referred to as “spread” is the difference in yield of a liquid corporate issue and the Treasury issue of a similar coupon and maturity. The yield spread generally increases with term to maturity. • If IBM 2013 trades at 81/2% and a Treasury trades at 6%, then 6 the yield spread is 2. 5% or 250 bps. IBM trades 250 bps over

Chapter VII – Corporate & Other Issues Corporate Bonds—Yield Structure – There are six primary attributes that are significant in valuing a bond: 1. Term to maturity 3. Call provisions 5. Risk of default – – 2. Coupon rate 4. Liquidity (marketability) 6. Tax status Yield Structure: The overall pattern of yields that reflect these attributes. All six attributes impact yields in some way, and hence are considered part of the yield structure. To simplify our lives, we usually deal with one aspect of yield structure at a time. Yield Spread: Often just referred to as “spread” is the difference in yield of a liquid corporate issue and the Treasury issue of a similar coupon and maturity. The yield spread generally increases with term to maturity. • If IBM 2013 trades at 81/2% and a Treasury trades at 6%, then 6 the yield spread is 2. 5% or 250 bps. IBM trades 250 bps over

Chapter VII – Corporate & Other Issues Corporate Bonds—Risk Structure – – – Risk Structure: The set of yields for bonds with similar coupon, term, liquidity etc, but with different default risks is called the risk structure. Risk Premium: The difference between the expected yield-to-maturity and the yield to maturity of the riskfree bond. The risk premium arises out of economywide or market-wide risk and thus reflects systematic risk. Default Premium: The difference between the expected yield to maturity of a bond and the promised yield to maturity. The former is different from the latter to the extent default is considered possible. One can assign probabilities to this possibility. The weighted 7 average of expected returns becomes the expected

Chapter VII – Corporate & Other Issues Corporate Bonds—Risk Structure – – – Risk Structure: The set of yields for bonds with similar coupon, term, liquidity etc, but with different default risks is called the risk structure. Risk Premium: The difference between the expected yield-to-maturity and the yield to maturity of the riskfree bond. The risk premium arises out of economywide or market-wide risk and thus reflects systematic risk. Default Premium: The difference between the expected yield to maturity of a bond and the promised yield to maturity. The former is different from the latter to the extent default is considered possible. One can assign probabilities to this possibility. The weighted 7 average of expected returns becomes the expected

Chapter VII – Corporate & Other Issues Corporate Bonds—Risk Structure • We estimate the 6% IBM 2013 has a 4% probability of default. It is currently yielding 7. 50%. The 6% 2013 Treasury yields 6%. 0. 04 probability * 0. 00% return if default 0. 96 probability * 7. 50% promised yield to maturity 7. 20% expected yield to maturity Risk premium = 7. 20% - 6. 00% (risk free rate) = 1. 20% or 120 bps Default premium = 7. 50% - 7. 20% =. 30% or 30 bps. – TTD: VII-6 6% 2013 Treasuries yield 6%; the 6% IBM 2013 with a 4% probability of default yields 7. 5%; and the 6% Hypothetical Resources 2013 with a 10% probability of default yields 7. 90%. Should you buy the IBM or the HR bond? 8

Chapter VII – Corporate & Other Issues Corporate Bonds—Risk Structure • We estimate the 6% IBM 2013 has a 4% probability of default. It is currently yielding 7. 50%. The 6% 2013 Treasury yields 6%. 0. 04 probability * 0. 00% return if default 0. 96 probability * 7. 50% promised yield to maturity 7. 20% expected yield to maturity Risk premium = 7. 20% - 6. 00% (risk free rate) = 1. 20% or 120 bps Default premium = 7. 50% - 7. 20% =. 30% or 30 bps. – TTD: VII-6 6% 2013 Treasuries yield 6%; the 6% IBM 2013 with a 4% probability of default yields 7. 5%; and the 6% Hypothetical Resources 2013 with a 10% probability of default yields 7. 90%. Should you buy the IBM or the HR bond? 8

Chapter VII – Corporate & Other Issues Corporate Bonds—Yield Structure – Things to Do: VII-8 From your experience as an investment manager for Investments Unlimited you know that normally the yield spread between Baa and Aaa rated 20 year corporates is 40 bps, and the yield spread between Aaa rated 20 year corporates and 20 year Treasury Bonds is 80 bps. This morning your computer tells you that 20 year bonds are trading at the following yields. 6. 80% T-bonds 7. 35% Aaa/AAA rated corporates 7. 90% Baa/BBB rated corporates You immediately jump into action. What do you do? 9

Chapter VII – Corporate & Other Issues Corporate Bonds—Yield Structure – Things to Do: VII-8 From your experience as an investment manager for Investments Unlimited you know that normally the yield spread between Baa and Aaa rated 20 year corporates is 40 bps, and the yield spread between Aaa rated 20 year corporates and 20 year Treasury Bonds is 80 bps. This morning your computer tells you that 20 year bonds are trading at the following yields. 6. 80% T-bonds 7. 35% Aaa/AAA rated corporates 7. 90% Baa/BBB rated corporates You immediately jump into action. What do you do? 9

Chapter VII – Corporate & Other Issues Corporate Bonds While we have not covered every item in the course-packet, unless it is specifically mentioned as not on the exam, it is fair game. That includes: Bond Market Indeces Preferred Shares Medium Term Notes Warrants 10

Chapter VII – Corporate & Other Issues Corporate Bonds While we have not covered every item in the course-packet, unless it is specifically mentioned as not on the exam, it is fair game. That includes: Bond Market Indeces Preferred Shares Medium Term Notes Warrants 10