4eac048a0a17fbbc804d2bc86e603c73.ppt

- Количество слайдов: 41

FIN 40500: International Finance Exchange Rates and the Balance of Trade

FIN 40500: International Finance Exchange Rates and the Balance of Trade

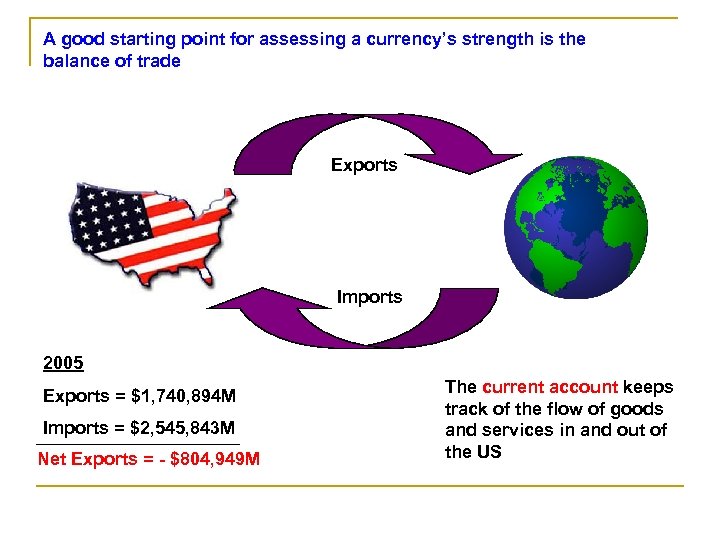

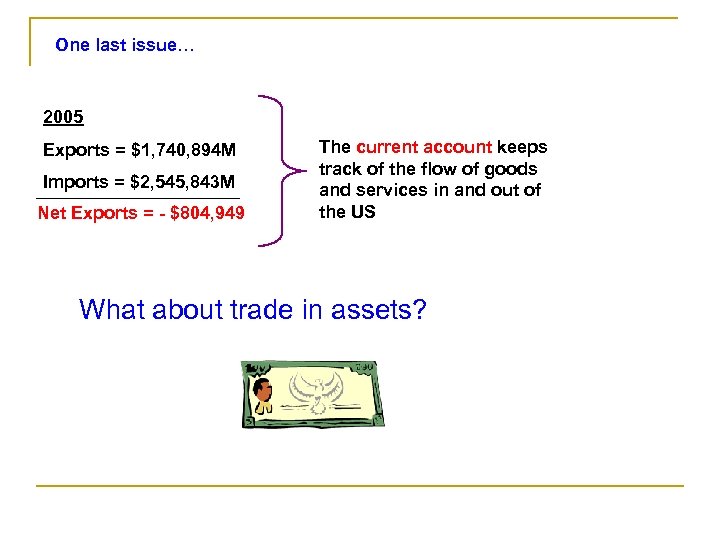

A good starting point for assessing a currency’s strength is the balance of trade Exports Imports 2005 Exports = $1, 740, 894 M Imports = $2, 545, 843 M Net Exports = - $804, 949 M The current account keeps track of the flow of goods and services in and out of the US

A good starting point for assessing a currency’s strength is the balance of trade Exports Imports 2005 Exports = $1, 740, 894 M Imports = $2, 545, 843 M Net Exports = - $804, 949 M The current account keeps track of the flow of goods and services in and out of the US

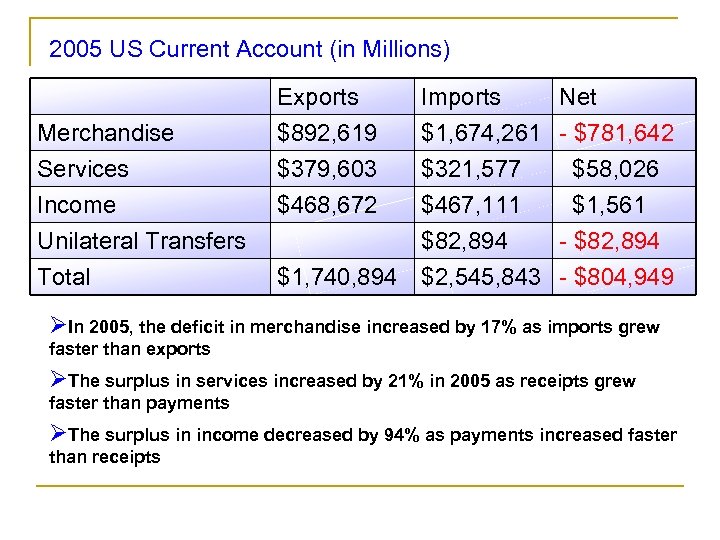

2005 US Current Account (in Millions) Merchandise Services Income Exports $892, 619 $379, 603 $468, 672 Imports Net $1, 674, 261 - $781, 642 $321, 577 $58, 026 $467, 111 $1, 561 Unilateral Transfers Total $82, 894 - $82, 894 $1, 740, 894 $2, 545, 843 - $804, 949 ØIn 2005, the deficit in merchandise increased by 17% as imports grew faster than exports ØThe surplus in services increased by 21% in 2005 as receipts grew faster than payments ØThe surplus in income decreased by 94% as payments increased faster than receipts

2005 US Current Account (in Millions) Merchandise Services Income Exports $892, 619 $379, 603 $468, 672 Imports Net $1, 674, 261 - $781, 642 $321, 577 $58, 026 $467, 111 $1, 561 Unilateral Transfers Total $82, 894 - $82, 894 $1, 740, 894 $2, 545, 843 - $804, 949 ØIn 2005, the deficit in merchandise increased by 17% as imports grew faster than exports ØThe surplus in services increased by 21% in 2005 as receipts grew faster than payments ØThe surplus in income decreased by 94% as payments increased faster than receipts

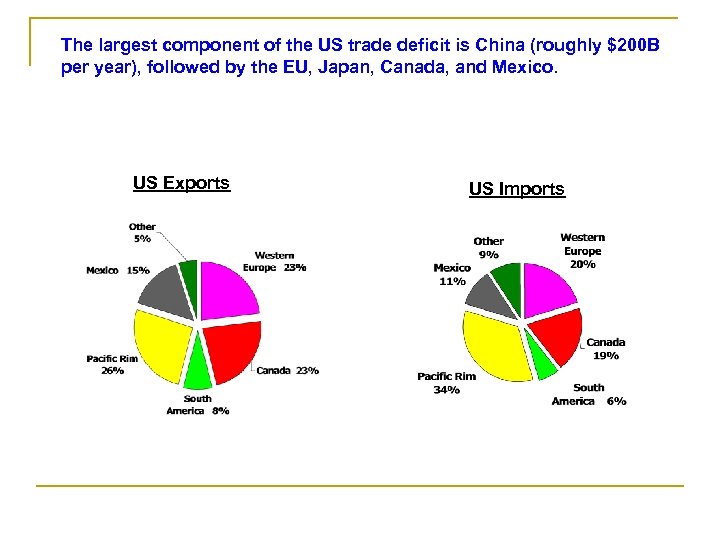

The largest component of the US trade deficit is China (roughly $200 B per year), followed by the EU, Japan, Canada, and Mexico. US Exports US Imports

The largest component of the US trade deficit is China (roughly $200 B per year), followed by the EU, Japan, Canada, and Mexico. US Exports US Imports

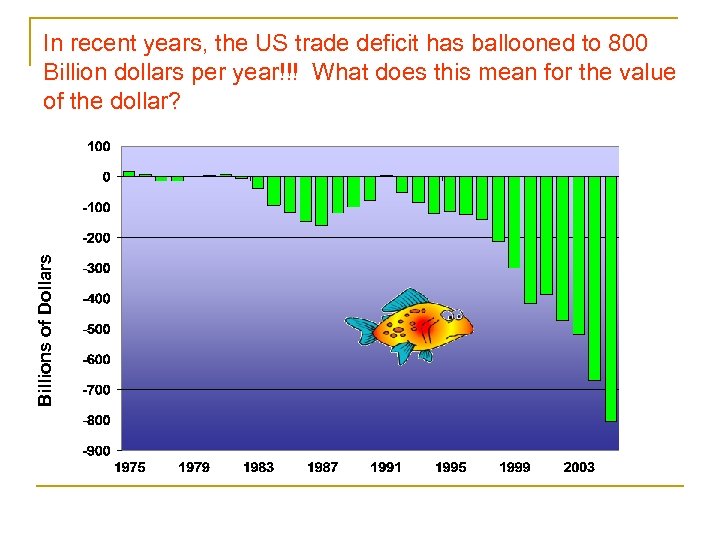

Billions of Dollars In recent years, the US trade deficit has ballooned to 800 Billion dollars per year!!! What does this mean for the value of the dollar?

Billions of Dollars In recent years, the US trade deficit has ballooned to 800 Billion dollars per year!!! What does this mean for the value of the dollar?

Lets examine the market for US currency Currency Market US importers must use their dollars to buy foreign currency – they will represent the supply of dollars Supply/Demand in the currency market will determine the price of a dollar in terms of foreign currency Foreigners buying US exports must use their foreign currency to buy dollars – they represent the demand for dollars

Lets examine the market for US currency Currency Market US importers must use their dollars to buy foreign currency – they will represent the supply of dollars Supply/Demand in the currency market will determine the price of a dollar in terms of foreign currency Foreigners buying US exports must use their foreign currency to buy dollars – they represent the demand for dollars

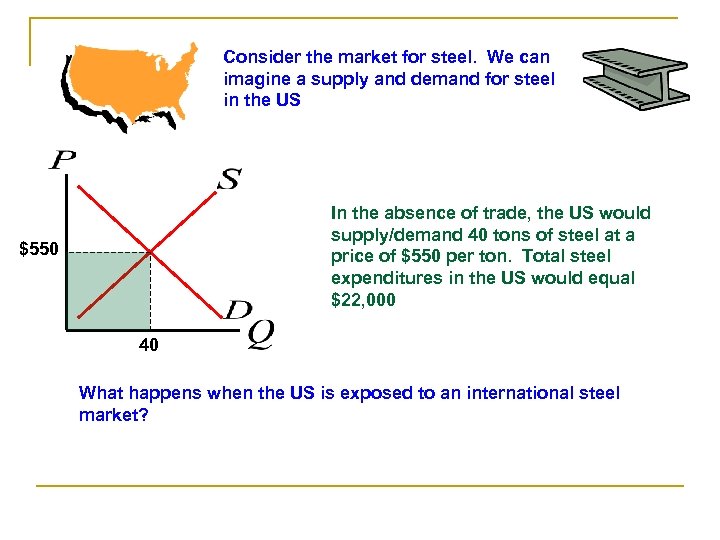

Consider the market for steel. We can imagine a supply and demand for steel in the US In the absence of trade, the US would supply/demand 40 tons of steel at a price of $550 per ton. Total steel expenditures in the US would equal $22, 000 $550 40 What happens when the US is exposed to an international steel market?

Consider the market for steel. We can imagine a supply and demand for steel in the US In the absence of trade, the US would supply/demand 40 tons of steel at a price of $550 per ton. Total steel expenditures in the US would equal $22, 000 $550 40 What happens when the US is exposed to an international steel market?

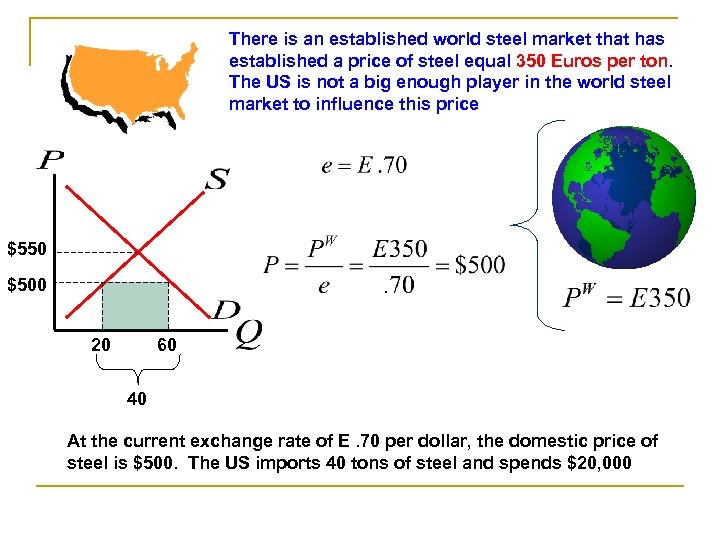

There is an established world steel market that has established a price of steel equal 350 Euros per ton. The US is not a big enough player in the world steel market to influence this price $550 $500 20 60 40 At the current exchange rate of E. 70 per dollar, the domestic price of steel is $500. The US imports 40 tons of steel and spends $20, 000

There is an established world steel market that has established a price of steel equal 350 Euros per ton. The US is not a big enough player in the world steel market to influence this price $550 $500 20 60 40 At the current exchange rate of E. 70 per dollar, the domestic price of steel is $500. The US imports 40 tons of steel and spends $20, 000

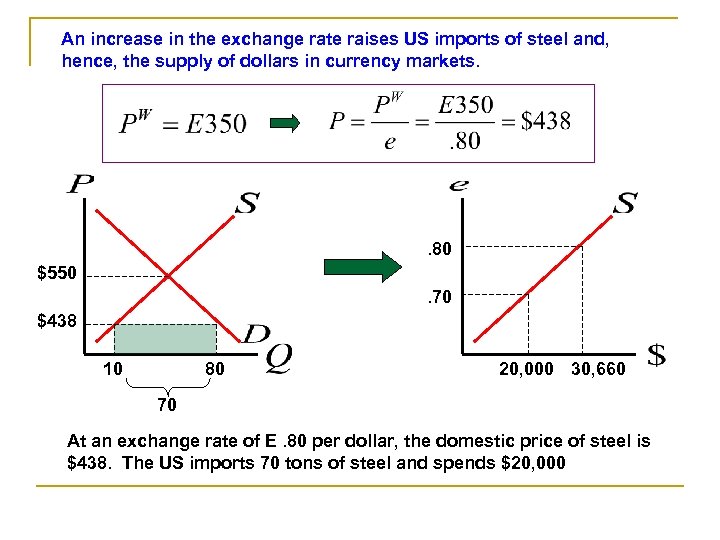

An increase in the exchange rate raises US imports of steel and, hence, the supply of dollars in currency markets. . 80 $550. 70 $438 10 80 20, 000 30, 660 70 At an exchange rate of E. 80 per dollar, the domestic price of steel is $438. The US imports 70 tons of steel and spends $20, 000

An increase in the exchange rate raises US imports of steel and, hence, the supply of dollars in currency markets. . 80 $550. 70 $438 10 80 20, 000 30, 660 70 At an exchange rate of E. 80 per dollar, the domestic price of steel is $438. The US imports 70 tons of steel and spends $20, 000

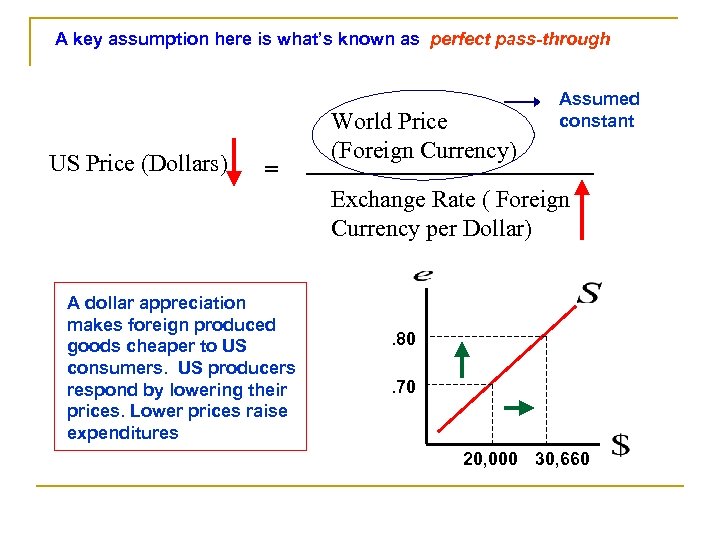

A key assumption here is what’s known as perfect pass-through US Price (Dollars) = World Price (Foreign Currency) Assumed constant Exchange Rate ( Foreign Currency per Dollar) A dollar appreciation makes foreign produced goods cheaper to US consumers. US producers respond by lowering their prices. Lower prices raise expenditures . 80. 70 20, 000 30, 660

A key assumption here is what’s known as perfect pass-through US Price (Dollars) = World Price (Foreign Currency) Assumed constant Exchange Rate ( Foreign Currency per Dollar) A dollar appreciation makes foreign produced goods cheaper to US consumers. US producers respond by lowering their prices. Lower prices raise expenditures . 80. 70 20, 000 30, 660

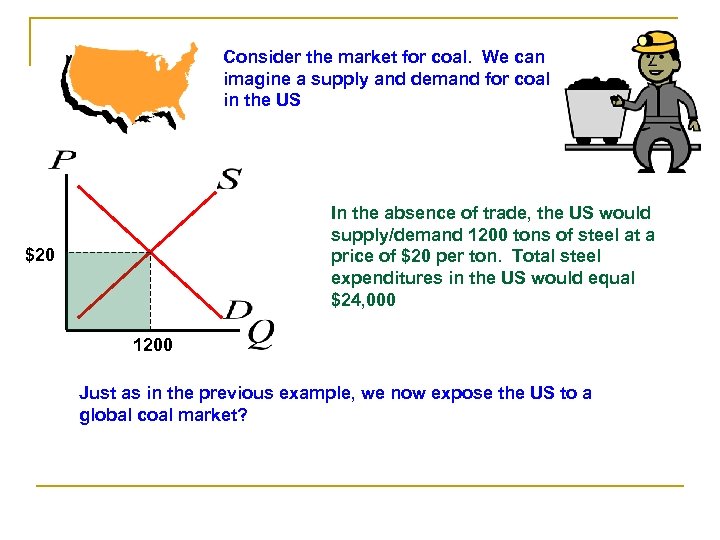

Consider the market for coal. We can imagine a supply and demand for coal in the US In the absence of trade, the US would supply/demand 1200 tons of steel at a price of $20 per ton. Total steel expenditures in the US would equal $24, 000 $20 1200 Just as in the previous example, we now expose the US to a global coal market?

Consider the market for coal. We can imagine a supply and demand for coal in the US In the absence of trade, the US would supply/demand 1200 tons of steel at a price of $20 per ton. Total steel expenditures in the US would equal $24, 000 $20 1200 Just as in the previous example, we now expose the US to a global coal market?

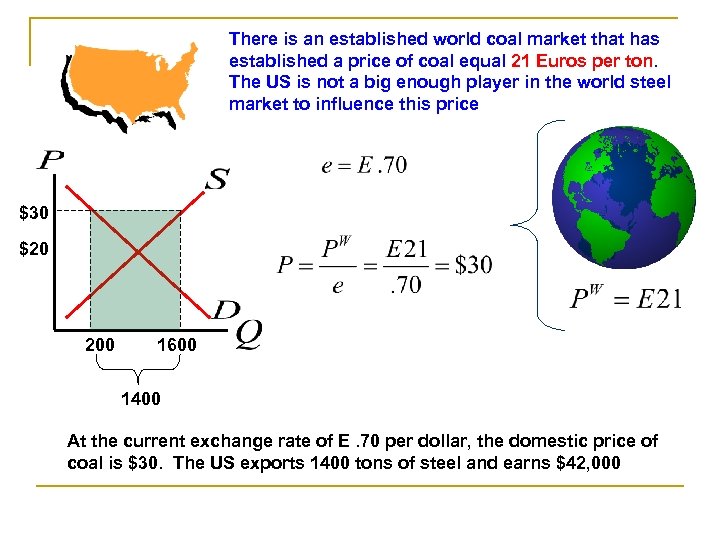

There is an established world coal market that has established a price of coal equal 21 Euros per ton. The US is not a big enough player in the world steel market to influence this price $30 $20 200 1600 1400 At the current exchange rate of E. 70 per dollar, the domestic price of coal is $30. The US exports 1400 tons of steel and earns $42, 000

There is an established world coal market that has established a price of coal equal 21 Euros per ton. The US is not a big enough player in the world steel market to influence this price $30 $20 200 1600 1400 At the current exchange rate of E. 70 per dollar, the domestic price of coal is $30. The US exports 1400 tons of steel and earns $42, 000

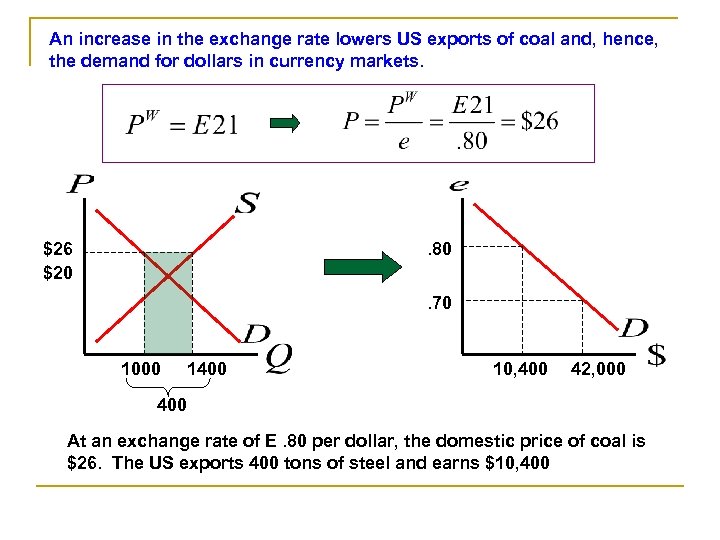

An increase in the exchange rate lowers US exports of coal and, hence, the demand for dollars in currency markets. $26 $20 . 80. 70 1000 1400 10, 400 42, 000 400 At an exchange rate of E. 80 per dollar, the domestic price of coal is $26. The US exports 400 tons of steel and earns $10, 400

An increase in the exchange rate lowers US exports of coal and, hence, the demand for dollars in currency markets. $26 $20 . 80. 70 1000 1400 10, 400 42, 000 400 At an exchange rate of E. 80 per dollar, the domestic price of coal is $26. The US exports 400 tons of steel and earns $10, 400

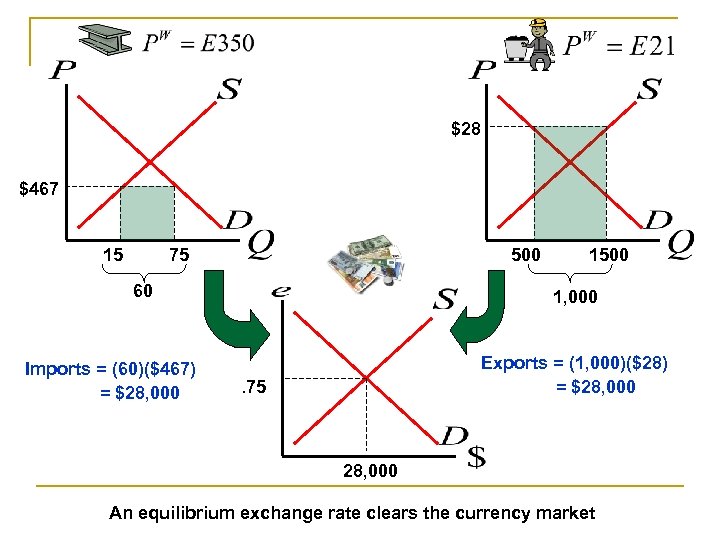

$28 $467 15 75 500 60 Imports = (60)($467) = $28, 000 1500 1, 000 Exports = (1, 000)($28) = $28, 000 . 75 28, 000 An equilibrium exchange rate clears the currency market

$28 $467 15 75 500 60 Imports = (60)($467) = $28, 000 1500 1, 000 Exports = (1, 000)($28) = $28, 000 . 75 28, 000 An equilibrium exchange rate clears the currency market

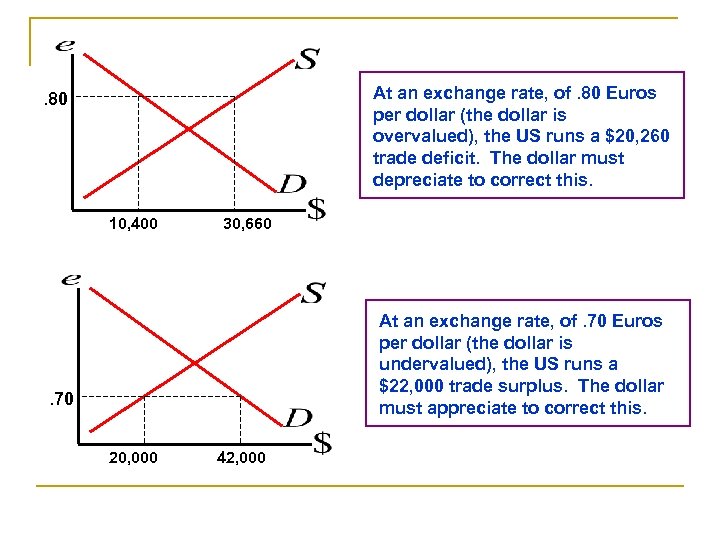

At an exchange rate, of. 80 Euros per dollar (the dollar is overvalued), the US runs a $20, 260 trade deficit. The dollar must depreciate to correct this. . 80 10, 400 30, 660 At an exchange rate, of. 70 Euros per dollar (the dollar is undervalued), the US runs a $22, 000 trade surplus. The dollar must appreciate to correct this. . 70 20, 000 42, 000

At an exchange rate, of. 80 Euros per dollar (the dollar is overvalued), the US runs a $20, 260 trade deficit. The dollar must depreciate to correct this. . 80 10, 400 30, 660 At an exchange rate, of. 70 Euros per dollar (the dollar is undervalued), the US runs a $22, 000 trade surplus. The dollar must appreciate to correct this. . 70 20, 000 42, 000

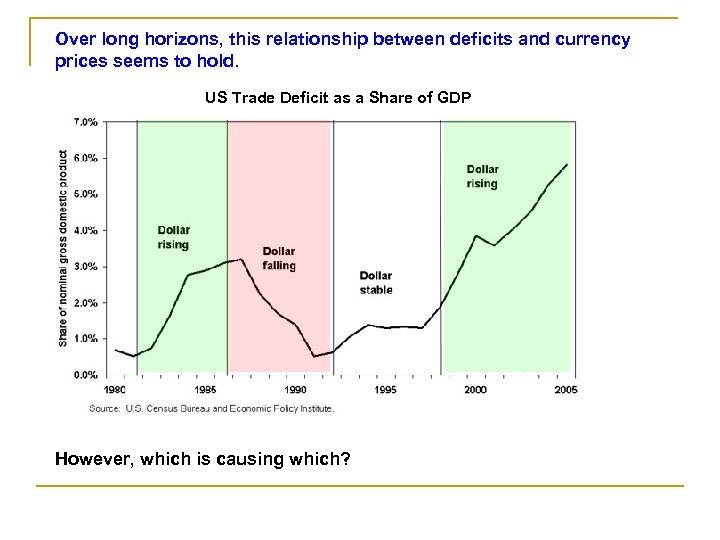

Over long horizons, this relationship between deficits and currency prices seems to hold. US Trade Deficit as a Share of GDP However, which is causing which?

Over long horizons, this relationship between deficits and currency prices seems to hold. US Trade Deficit as a Share of GDP However, which is causing which?

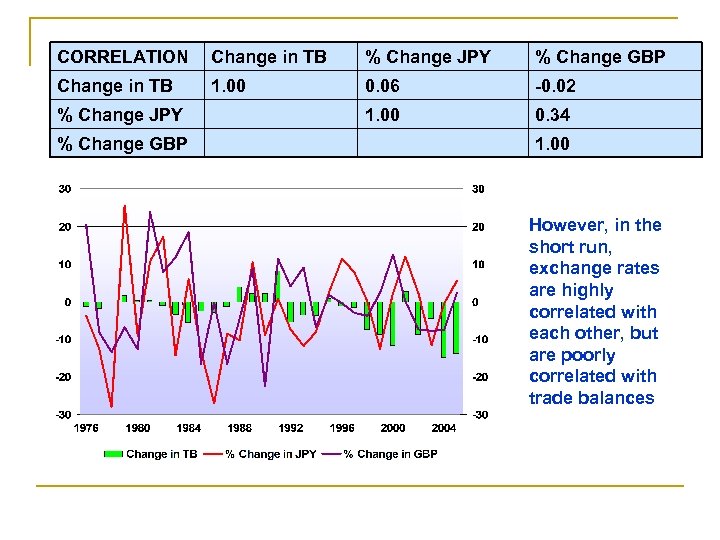

CORRELATION Change in TB % Change JPY % Change GBP Change in TB 1. 00 0. 06 -0. 02 1. 00 0. 34 % Change JPY % Change GBP 1. 00 However, in the short run, exchange rates are highly correlated with each other, but are poorly correlated with trade balances

CORRELATION Change in TB % Change JPY % Change GBP Change in TB 1. 00 0. 06 -0. 02 1. 00 0. 34 % Change JPY % Change GBP 1. 00 However, in the short run, exchange rates are highly correlated with each other, but are poorly correlated with trade balances

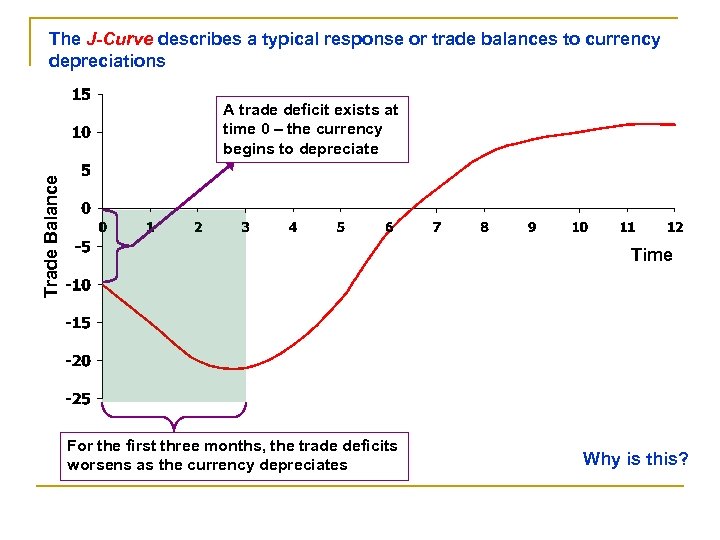

The J-Curve describes a typical response or trade balances to currency depreciations Trade Balance A trade deficit exists at time 0 – the currency begins to depreciate Time For the first three months, the trade deficits worsens as the currency depreciates Why is this?

The J-Curve describes a typical response or trade balances to currency depreciations Trade Balance A trade deficit exists at time 0 – the currency begins to depreciate Time For the first three months, the trade deficits worsens as the currency depreciates Why is this?

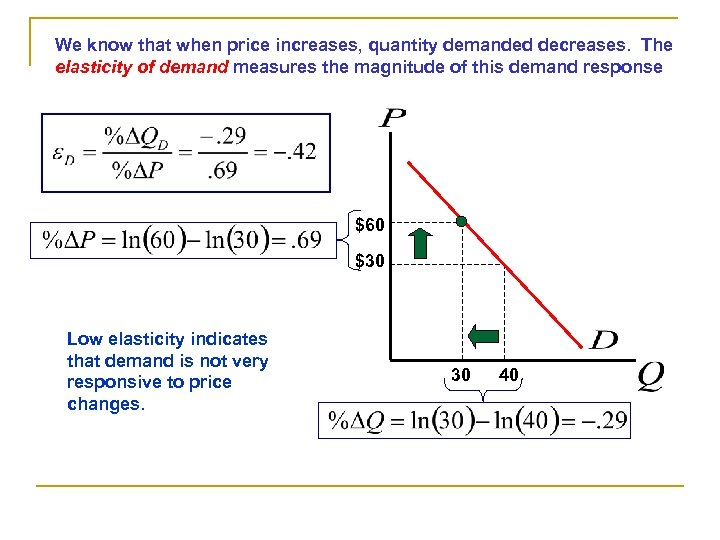

We know that when price increases, quantity demanded decreases. The elasticity of demand measures the magnitude of this demand response $60 $30 Low elasticity indicates that demand is not very responsive to price changes. 30 40

We know that when price increases, quantity demanded decreases. The elasticity of demand measures the magnitude of this demand response $60 $30 Low elasticity indicates that demand is not very responsive to price changes. 30 40

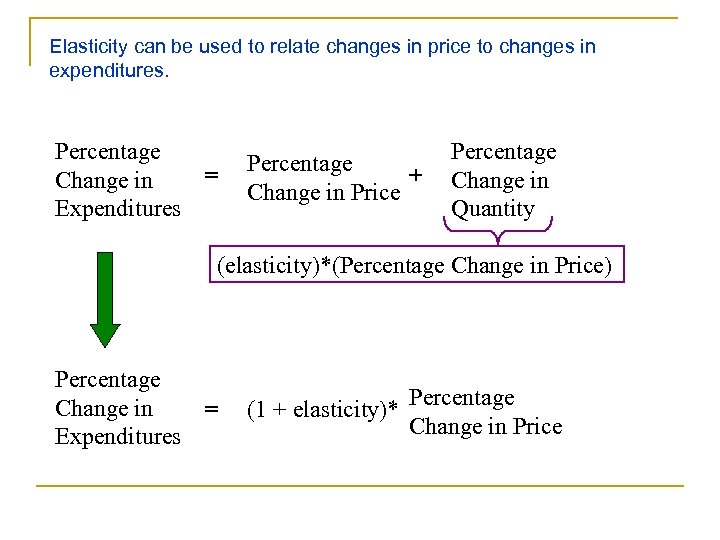

Elasticity can be used to relate changes in price to changes in expenditures. Percentage = Change in Expenditures Percentage + Change in Price Percentage Change in Quantity (elasticity)*(Percentage Change in Price) Percentage Change in = Expenditures (1 + elasticity)* Percentage Change in Price

Elasticity can be used to relate changes in price to changes in expenditures. Percentage = Change in Expenditures Percentage + Change in Price Percentage Change in Quantity (elasticity)*(Percentage Change in Price) Percentage Change in = Expenditures (1 + elasticity)* Percentage Change in Price

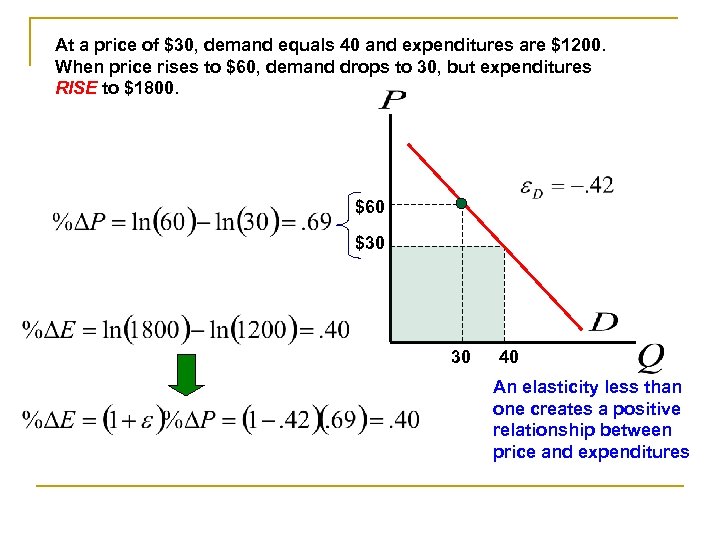

At a price of $30, demand equals 40 and expenditures are $1200. When price rises to $60, demand drops to 30, but expenditures RISE to $1800. $60 $30 30 40 An elasticity less than one creates a positive relationship between price and expenditures

At a price of $30, demand equals 40 and expenditures are $1200. When price rises to $60, demand drops to 30, but expenditures RISE to $1800. $60 $30 30 40 An elasticity less than one creates a positive relationship between price and expenditures

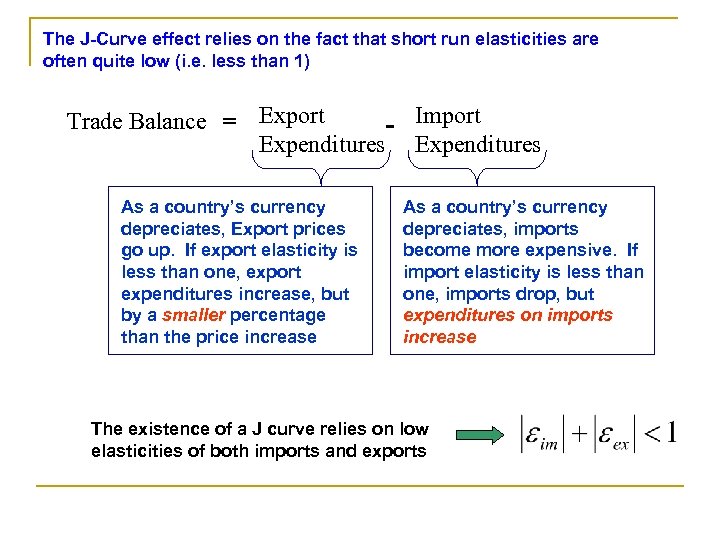

The J-Curve effect relies on the fact that short run elasticities are often quite low (i. e. less than 1) Trade Balance = Export - Import Expenditures As a country’s currency depreciates, Export prices go up. If export elasticity is less than one, export expenditures increase, but by a smaller percentage than the price increase As a country’s currency depreciates, imports become more expensive. If import elasticity is less than one, imports drop, but expenditures on imports increase The existence of a J curve relies on low elasticities of both imports and exports

The J-Curve effect relies on the fact that short run elasticities are often quite low (i. e. less than 1) Trade Balance = Export - Import Expenditures As a country’s currency depreciates, Export prices go up. If export elasticity is less than one, export expenditures increase, but by a smaller percentage than the price increase As a country’s currency depreciates, imports become more expensive. If import elasticity is less than one, imports drop, but expenditures on imports increase The existence of a J curve relies on low elasticities of both imports and exports

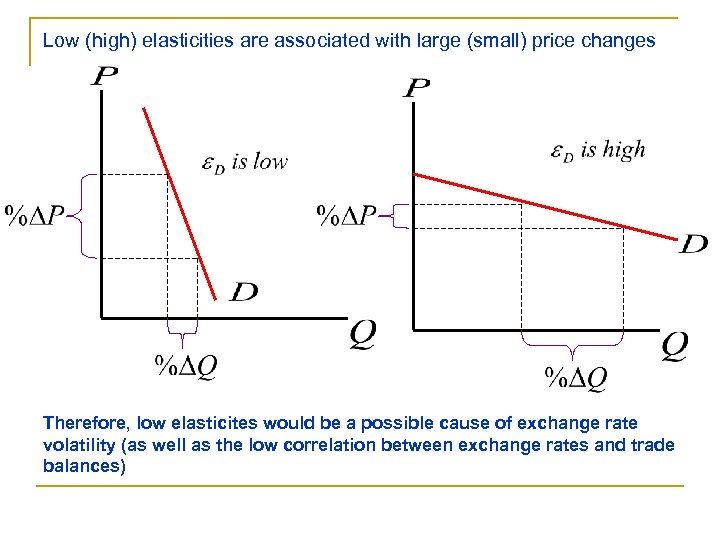

Low (high) elasticities are associated with large (small) price changes Therefore, low elasticites would be a possible cause of exchange rate volatility (as well as the low correlation between exchange rates and trade balances)

Low (high) elasticities are associated with large (small) price changes Therefore, low elasticites would be a possible cause of exchange rate volatility (as well as the low correlation between exchange rates and trade balances)

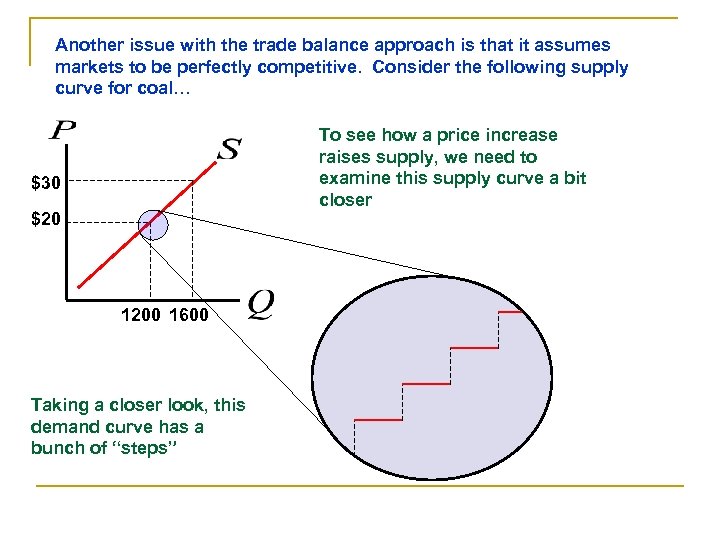

Another issue with the trade balance approach is that it assumes markets to be perfectly competitive. Consider the following supply curve for coal… To see how a price increase raises supply, we need to examine this supply curve a bit closer $30 $20 1200 1600 Taking a closer look, this demand curve has a bunch of “steps”

Another issue with the trade balance approach is that it assumes markets to be perfectly competitive. Consider the following supply curve for coal… To see how a price increase raises supply, we need to examine this supply curve a bit closer $30 $20 1200 1600 Taking a closer look, this demand curve has a bunch of “steps”

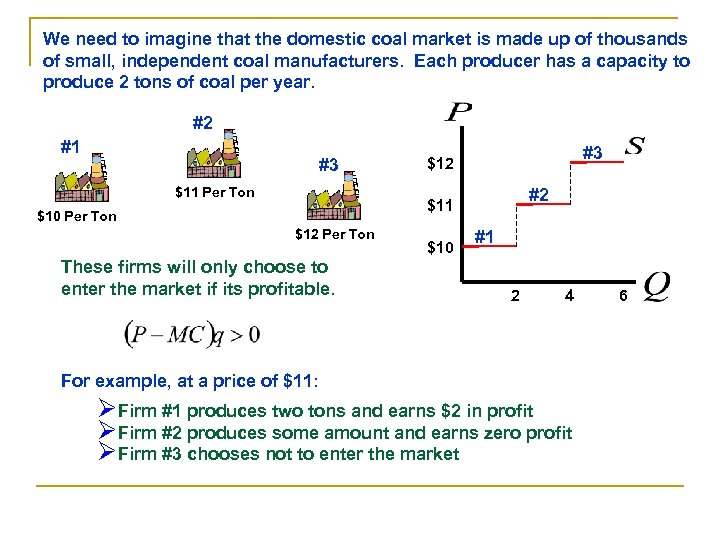

We need to imagine that the domestic coal market is made up of thousands of small, independent coal manufacturers. Each producer has a capacity to produce 2 tons of coal per year. #2 #1 #3 $11 Per Ton #3 $12 #2 $11 $10 Per Ton $12 Per Ton These firms will only choose to enter the market if its profitable. $10 #1 2 4 For example, at a price of $11: ØFirm #1 produces two tons and earns $2 in profit ØFirm #2 produces some amount and earns zero profit ØFirm #3 chooses not to enter the market 6

We need to imagine that the domestic coal market is made up of thousands of small, independent coal manufacturers. Each producer has a capacity to produce 2 tons of coal per year. #2 #1 #3 $11 Per Ton #3 $12 #2 $11 $10 Per Ton $12 Per Ton These firms will only choose to enter the market if its profitable. $10 #1 2 4 For example, at a price of $11: ØFirm #1 produces two tons and earns $2 in profit ØFirm #2 produces some amount and earns zero profit ØFirm #3 chooses not to enter the market 6

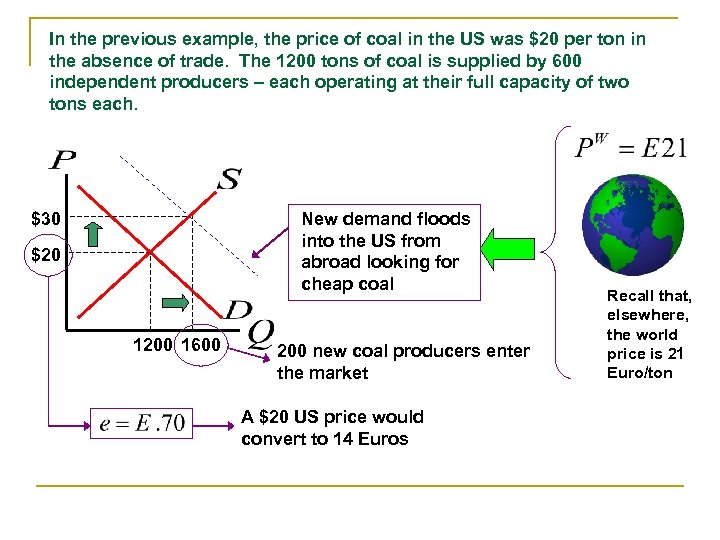

In the previous example, the price of coal in the US was $20 per ton in the absence of trade. The 1200 tons of coal is supplied by 600 independent producers – each operating at their full capacity of two tons each. $30 New demand floods into the US from abroad looking for cheap coal $20 1200 1600 200 new coal producers enter the market A $20 US price would convert to 14 Euros Recall that, elsewhere, the world price is 21 Euro/ton

In the previous example, the price of coal in the US was $20 per ton in the absence of trade. The 1200 tons of coal is supplied by 600 independent producers – each operating at their full capacity of two tons each. $30 New demand floods into the US from abroad looking for cheap coal $20 1200 1600 200 new coal producers enter the market A $20 US price would convert to 14 Euros Recall that, elsewhere, the world price is 21 Euro/ton

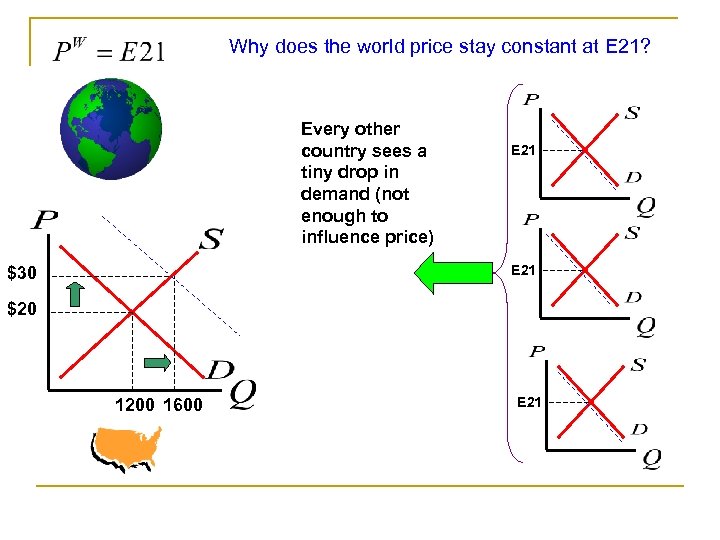

Why does the world price stay constant at E 21? Every other country sees a tiny drop in demand (not enough to influence price) E 21 $30 $20 1200 1600 E 21

Why does the world price stay constant at E 21? Every other country sees a tiny drop in demand (not enough to influence price) E 21 $30 $20 1200 1600 E 21

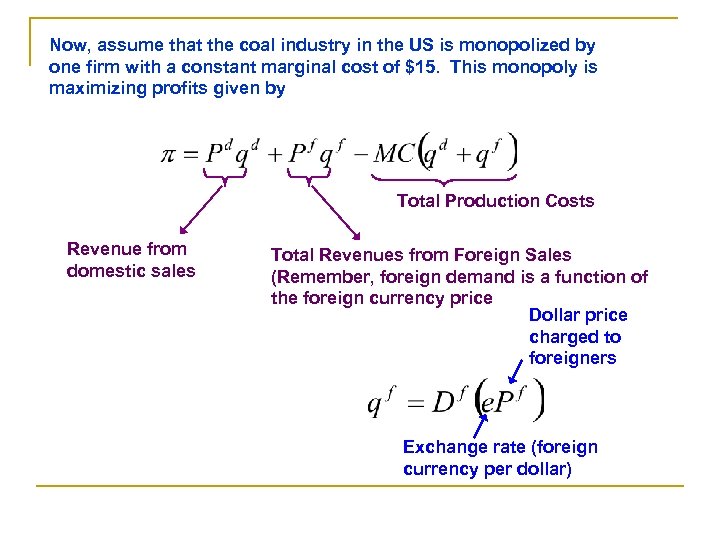

Now, assume that the coal industry in the US is monopolized by one firm with a constant marginal cost of $15. This monopoly is maximizing profits given by Total Production Costs Revenue from domestic sales Total Revenues from Foreign Sales (Remember, foreign demand is a function of the foreign currency price Dollar price charged to foreigners Exchange rate (foreign currency per dollar)

Now, assume that the coal industry in the US is monopolized by one firm with a constant marginal cost of $15. This monopoly is maximizing profits given by Total Production Costs Revenue from domestic sales Total Revenues from Foreign Sales (Remember, foreign demand is a function of the foreign currency price Dollar price charged to foreigners Exchange rate (foreign currency per dollar)

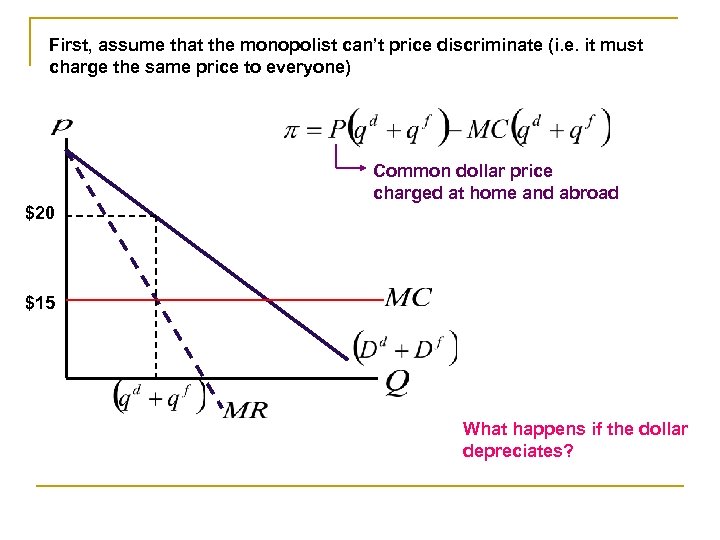

First, assume that the monopolist can’t price discriminate (i. e. it must charge the same price to everyone) Common dollar price charged at home and abroad $20 $15 What happens if the dollar depreciates?

First, assume that the monopolist can’t price discriminate (i. e. it must charge the same price to everyone) Common dollar price charged at home and abroad $20 $15 What happens if the dollar depreciates?

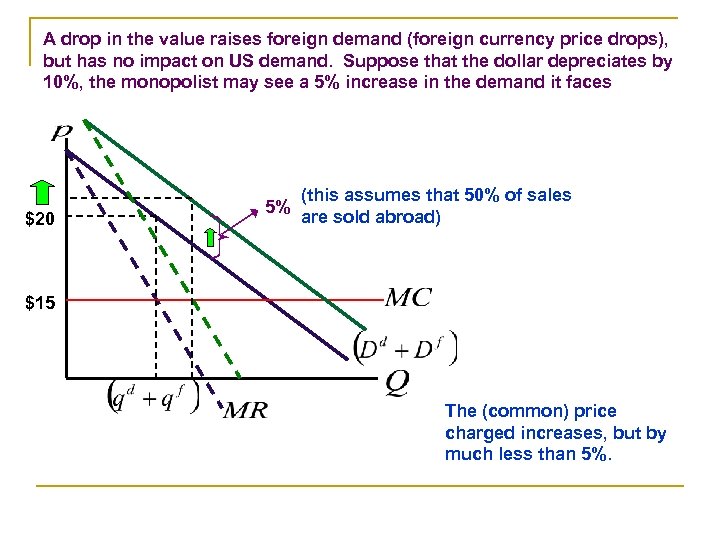

A drop in the value raises foreign demand (foreign currency price drops), but has no impact on US demand. Suppose that the dollar depreciates by 10%, the monopolist may see a 5% increase in the demand it faces $20 5% (this assumes that 50% of sales are sold abroad) $15 The (common) price charged increases, but by much less than 5%.

A drop in the value raises foreign demand (foreign currency price drops), but has no impact on US demand. Suppose that the dollar depreciates by 10%, the monopolist may see a 5% increase in the demand it faces $20 5% (this assumes that 50% of sales are sold abroad) $15 The (common) price charged increases, but by much less than 5%.

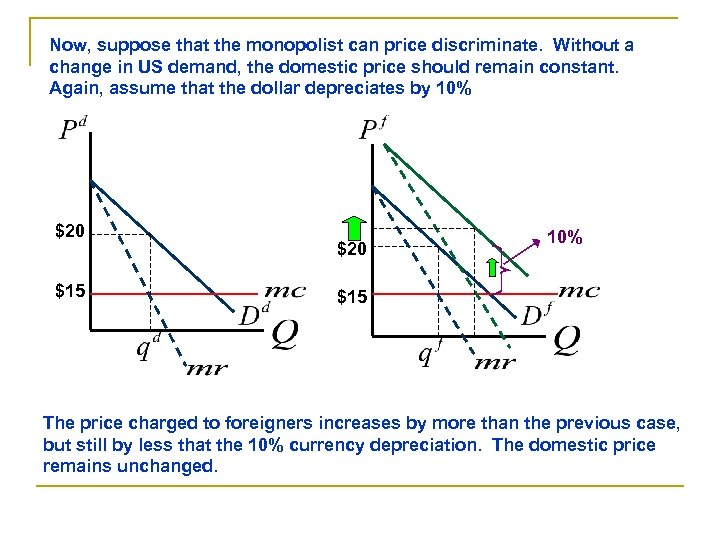

Now, suppose that the monopolist can price discriminate. Without a change in US demand, the domestic price should remain constant. Again, assume that the dollar depreciates by 10% $20 $15 $20 10% $15 The price charged to foreigners increases by more than the previous case, but still by less that the 10% currency depreciation. The domestic price remains unchanged.

Now, suppose that the monopolist can price discriminate. Without a change in US demand, the domestic price should remain constant. Again, assume that the dollar depreciates by 10% $20 $15 $20 10% $15 The price charged to foreigners increases by more than the previous case, but still by less that the 10% currency depreciation. The domestic price remains unchanged.

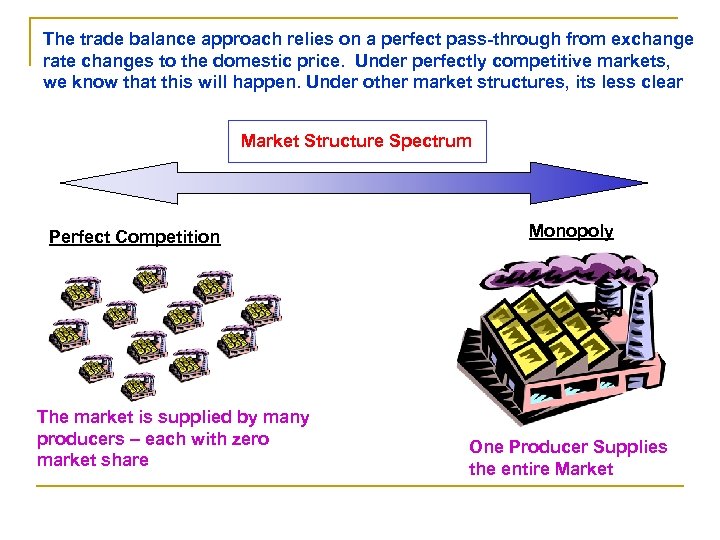

The trade balance approach relies on a perfect pass-through from exchange rate changes to the domestic price. Under perfectly competitive markets, we know that this will happen. Under other market structures, its less clear Market Structure Spectrum Perfect Competition The market is supplied by many producers – each with zero market share Monopoly One Producer Supplies the entire Market

The trade balance approach relies on a perfect pass-through from exchange rate changes to the domestic price. Under perfectly competitive markets, we know that this will happen. Under other market structures, its less clear Market Structure Spectrum Perfect Competition The market is supplied by many producers – each with zero market share Monopoly One Producer Supplies the entire Market

One last issue… 2005 Exports = $1, 740, 894 M Imports = $2, 545, 843 M Net Exports = - $804, 949 The current account keeps track of the flow of goods and services in and out of the US What about trade in assets?

One last issue… 2005 Exports = $1, 740, 894 M Imports = $2, 545, 843 M Net Exports = - $804, 949 The current account keeps track of the flow of goods and services in and out of the US What about trade in assets?

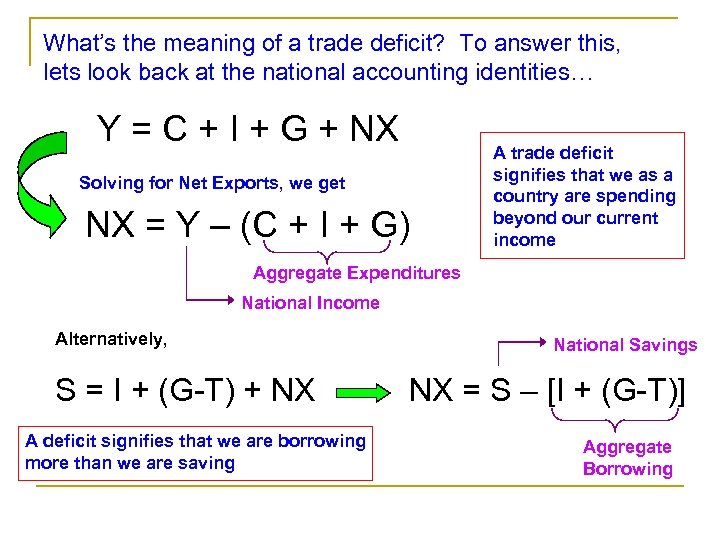

What’s the meaning of a trade deficit? To answer this, lets look back at the national accounting identities… Y = C + I + G + NX Solving for Net Exports, we get NX = Y – (C + I + G) A trade deficit signifies that we as a country are spending beyond our current income Aggregate Expenditures National Income Alternatively, S = I + (G-T) + NX A deficit signifies that we are borrowing more than we are saving National Savings NX = S – [I + (G-T)] Aggregate Borrowing

What’s the meaning of a trade deficit? To answer this, lets look back at the national accounting identities… Y = C + I + G + NX Solving for Net Exports, we get NX = Y – (C + I + G) A trade deficit signifies that we as a country are spending beyond our current income Aggregate Expenditures National Income Alternatively, S = I + (G-T) + NX A deficit signifies that we are borrowing more than we are saving National Savings NX = S – [I + (G-T)] Aggregate Borrowing

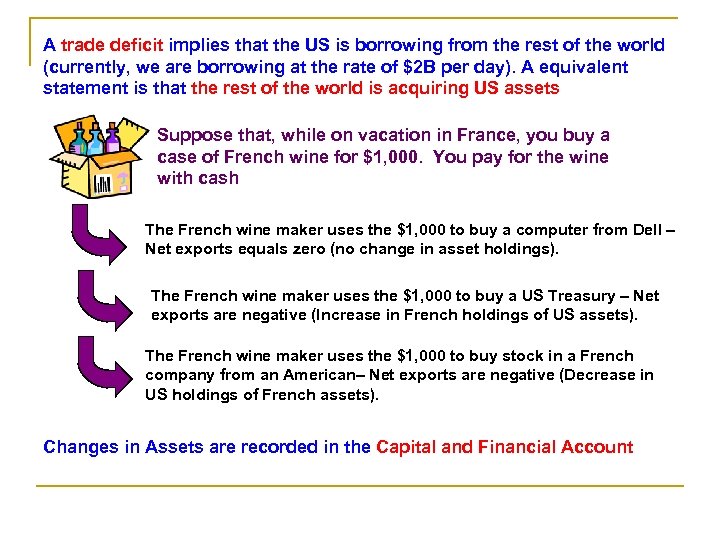

A trade deficit implies that the US is borrowing from the rest of the world (currently, we are borrowing at the rate of $2 B per day). A equivalent statement is that the rest of the world is acquiring US assets Suppose that, while on vacation in France, you buy a case of French wine for $1, 000. You pay for the wine with cash The French wine maker uses the $1, 000 to buy a computer from Dell – Net exports equals zero (no change in asset holdings). The French wine maker uses the $1, 000 to buy a US Treasury – Net exports are negative (Increase in French holdings of US assets). The French wine maker uses the $1, 000 to buy stock in a French company from an American– Net exports are negative (Decrease in US holdings of French assets). Changes in Assets are recorded in the Capital and Financial Account

A trade deficit implies that the US is borrowing from the rest of the world (currently, we are borrowing at the rate of $2 B per day). A equivalent statement is that the rest of the world is acquiring US assets Suppose that, while on vacation in France, you buy a case of French wine for $1, 000. You pay for the wine with cash The French wine maker uses the $1, 000 to buy a computer from Dell – Net exports equals zero (no change in asset holdings). The French wine maker uses the $1, 000 to buy a US Treasury – Net exports are negative (Increase in French holdings of US assets). The French wine maker uses the $1, 000 to buy stock in a French company from an American– Net exports are negative (Decrease in US holdings of French assets). Changes in Assets are recorded in the Capital and Financial Account

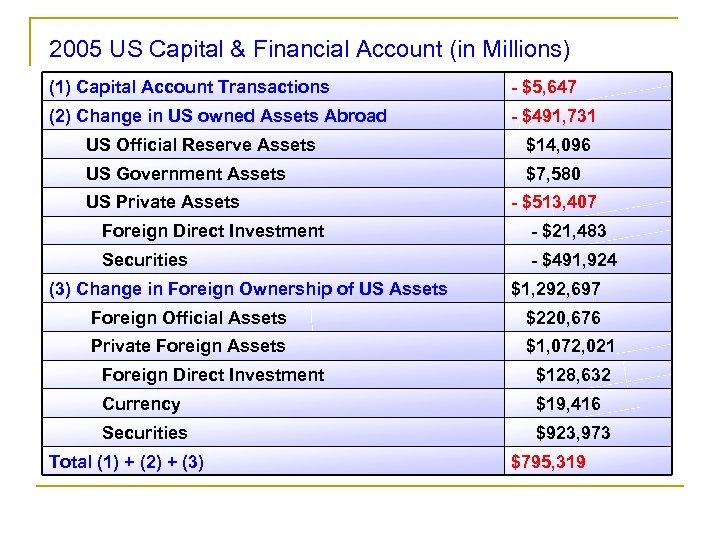

2005 US Capital & Financial Account (in Millions) (1) Capital Account Transactions - $5, 647 (2) Change in US owned Assets Abroad - $491, 731 US Official Reserve Assets $14, 096 US Government Assets $7, 580 US Private Assets - $513, 407 Foreign Direct Investment - $21, 483 Securities - $491, 924 (3) Change in Foreign Ownership of US Assets $1, 292, 697 Foreign Official Assets $220, 676 Private Foreign Assets $1, 072, 021 Foreign Direct Investment $128, 632 Currency $19, 416 Securities $923, 973 Total (1) + (2) + (3) $795, 319

2005 US Capital & Financial Account (in Millions) (1) Capital Account Transactions - $5, 647 (2) Change in US owned Assets Abroad - $491, 731 US Official Reserve Assets $14, 096 US Government Assets $7, 580 US Private Assets - $513, 407 Foreign Direct Investment - $21, 483 Securities - $491, 924 (3) Change in Foreign Ownership of US Assets $1, 292, 697 Foreign Official Assets $220, 676 Private Foreign Assets $1, 072, 021 Foreign Direct Investment $128, 632 Currency $19, 416 Securities $923, 973 Total (1) + (2) + (3) $795, 319

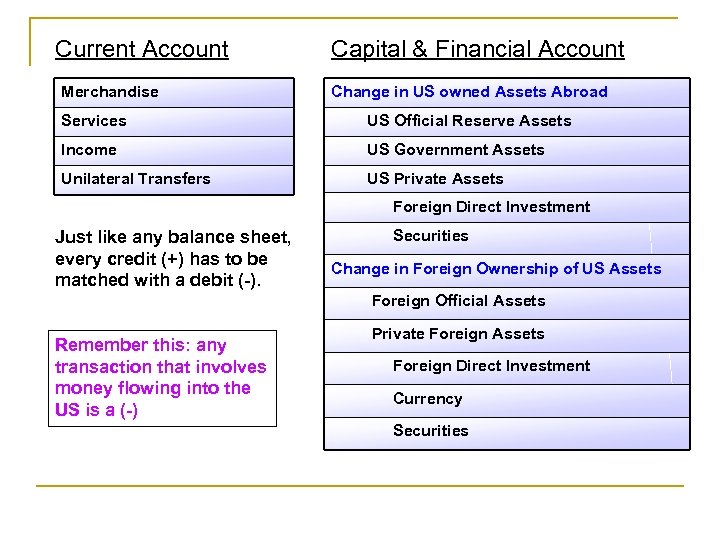

Current Account Merchandise Capital & Financial Account Change in US owned Assets Abroad Services US Official Reserve Assets Income US Government Assets Unilateral Transfers US Private Assets Foreign Direct Investment Just like any balance sheet, every credit (+) has to be matched with a debit (-). Securities Change in Foreign Ownership of US Assets Foreign Official Assets Remember this: any transaction that involves money flowing into the US is a (-) Private Foreign Assets Foreign Direct Investment Currency Securities

Current Account Merchandise Capital & Financial Account Change in US owned Assets Abroad Services US Official Reserve Assets Income US Government Assets Unilateral Transfers US Private Assets Foreign Direct Investment Just like any balance sheet, every credit (+) has to be matched with a debit (-). Securities Change in Foreign Ownership of US Assets Foreign Official Assets Remember this: any transaction that involves money flowing into the US is a (-) Private Foreign Assets Foreign Direct Investment Currency Securities

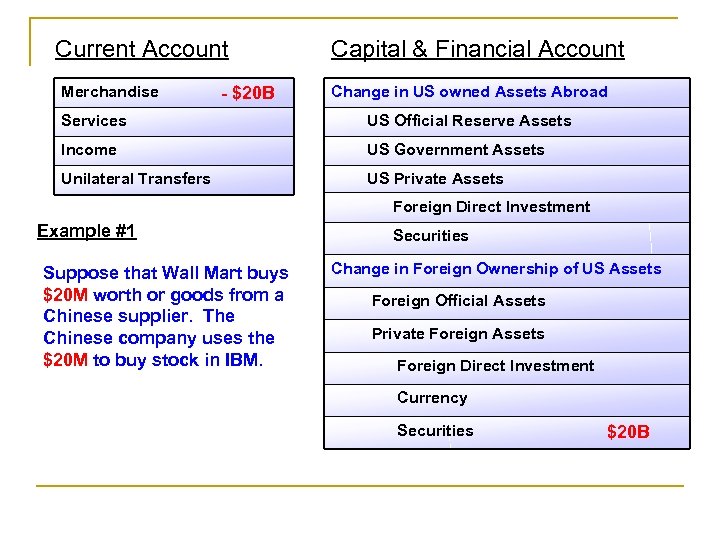

Current Account Merchandise - $20 B Capital & Financial Account Change in US owned Assets Abroad Services US Official Reserve Assets Income US Government Assets Unilateral Transfers US Private Assets Foreign Direct Investment Example #1 Suppose that Wall Mart buys $20 M worth or goods from a Chinese supplier. The Chinese company uses the $20 M to buy stock in IBM. Securities Change in Foreign Ownership of US Assets Foreign Official Assets Private Foreign Assets Foreign Direct Investment Currency Securities $20 B

Current Account Merchandise - $20 B Capital & Financial Account Change in US owned Assets Abroad Services US Official Reserve Assets Income US Government Assets Unilateral Transfers US Private Assets Foreign Direct Investment Example #1 Suppose that Wall Mart buys $20 M worth or goods from a Chinese supplier. The Chinese company uses the $20 M to buy stock in IBM. Securities Change in Foreign Ownership of US Assets Foreign Official Assets Private Foreign Assets Foreign Direct Investment Currency Securities $20 B

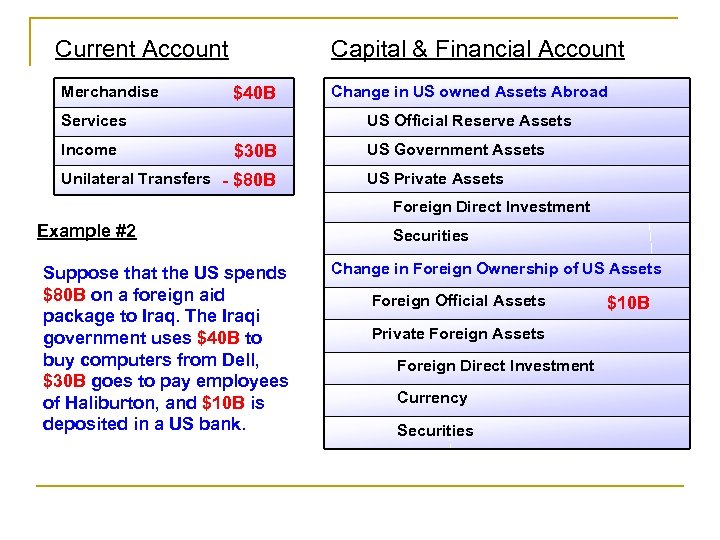

Current Account Merchandise Capital & Financial Account $40 B Services Income Change in US owned Assets Abroad US Official Reserve Assets $30 B Unilateral Transfers - $80 B US Government Assets US Private Assets Foreign Direct Investment Example #2 Suppose that the US spends $80 B on a foreign aid package to Iraq. The Iraqi government uses $40 B to buy computers from Dell, $30 B goes to pay employees of Haliburton, and $10 B is deposited in a US bank. Securities Change in Foreign Ownership of US Assets Foreign Official Assets Private Foreign Assets Foreign Direct Investment Currency Securities $10 B

Current Account Merchandise Capital & Financial Account $40 B Services Income Change in US owned Assets Abroad US Official Reserve Assets $30 B Unilateral Transfers - $80 B US Government Assets US Private Assets Foreign Direct Investment Example #2 Suppose that the US spends $80 B on a foreign aid package to Iraq. The Iraqi government uses $40 B to buy computers from Dell, $30 B goes to pay employees of Haliburton, and $10 B is deposited in a US bank. Securities Change in Foreign Ownership of US Assets Foreign Official Assets Private Foreign Assets Foreign Direct Investment Currency Securities $10 B

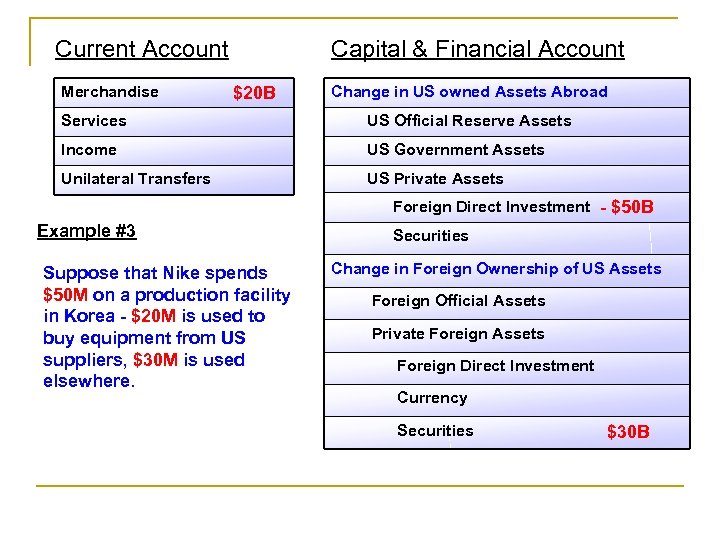

Current Account Merchandise Capital & Financial Account $20 B Change in US owned Assets Abroad Services US Official Reserve Assets Income US Government Assets Unilateral Transfers US Private Assets Foreign Direct Investment - $50 B Example #3 Suppose that Nike spends $50 M on a production facility in Korea - $20 M is used to buy equipment from US suppliers, $30 M is used elsewhere. Securities Change in Foreign Ownership of US Assets Foreign Official Assets Private Foreign Assets Foreign Direct Investment Currency Securities $30 B

Current Account Merchandise Capital & Financial Account $20 B Change in US owned Assets Abroad Services US Official Reserve Assets Income US Government Assets Unilateral Transfers US Private Assets Foreign Direct Investment - $50 B Example #3 Suppose that Nike spends $50 M on a production facility in Korea - $20 M is used to buy equipment from US suppliers, $30 M is used elsewhere. Securities Change in Foreign Ownership of US Assets Foreign Official Assets Private Foreign Assets Foreign Direct Investment Currency Securities $30 B

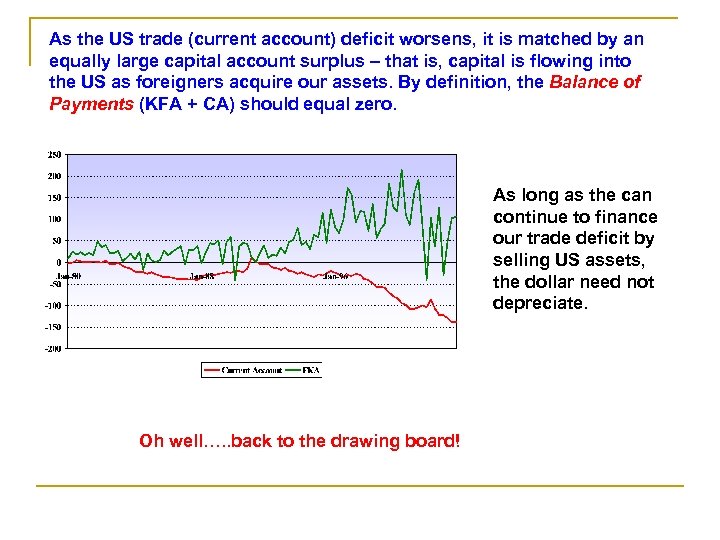

As the US trade (current account) deficit worsens, it is matched by an equally large capital account surplus – that is, capital is flowing into the US as foreigners acquire our assets. By definition, the Balance of Payments (KFA + CA) should equal zero. As long as the can continue to finance our trade deficit by selling US assets, the dollar need not depreciate. Oh well…. . back to the drawing board!

As the US trade (current account) deficit worsens, it is matched by an equally large capital account surplus – that is, capital is flowing into the US as foreigners acquire our assets. By definition, the Balance of Payments (KFA + CA) should equal zero. As long as the can continue to finance our trade deficit by selling US assets, the dollar need not depreciate. Oh well…. . back to the drawing board!