4d85100909af0258a1546ef8a830c671.ppt

- Количество слайдов: 10

FIGURE 2. 1 ENRON STOCK CHART, WEEKLY PRIES, 1997 -2002 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

FIGURE 2. 1 ENRON STOCK CHART, WEEKLY PRIES, 1997 -2002 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 1 IMPACT OF THE RAPTORS ON EARNINGS, IN MILLIONS QUARTER REPORTED EARNINGS WITHOUT RAPTORS' CONTRIBUTION TO EARNINGS 3 Q 2000 $ $ $ 364 295 69 4 Q 2000 286 (176) 462 1 Q 2001 536 281 255 2 Q 2001 530 490 40 3 Q 2001 (210) (461) 251 TOTAL $ 1, 506 $ 429 $ 1, 077 * Third quarter 2001 figures exclude the $710 million pre-tax charge to earnings related to the termination of the Raptors. L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 1 IMPACT OF THE RAPTORS ON EARNINGS, IN MILLIONS QUARTER REPORTED EARNINGS WITHOUT RAPTORS' CONTRIBUTION TO EARNINGS 3 Q 2000 $ $ $ 364 295 69 4 Q 2000 286 (176) 462 1 Q 2001 536 281 255 2 Q 2001 530 490 40 3 Q 2001 (210) (461) 251 TOTAL $ 1, 506 $ 429 $ 1, 077 * Third quarter 2001 figures exclude the $710 million pre-tax charge to earnings related to the termination of the Raptors. L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

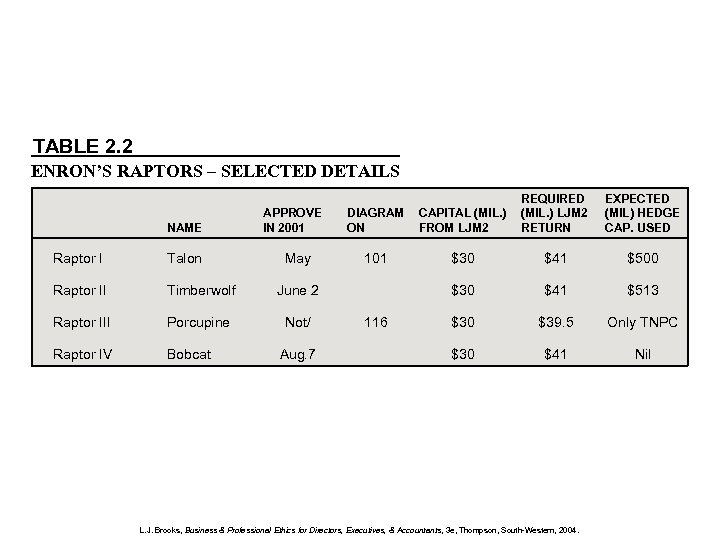

TABLE 2. 2 ENRON’S RAPTORS – SELECTED DETAILS NAME APPROVE IN 2001 Raptor I Talon May Raptor II Timberwolf Porcupine Not/ Raptor IV Bobcat CAPITAL (MIL. ) FROM LJM 2 101 $30 $41 $500 $30 $41 $513 $30 $39. 5 Only TNPC $30 $41 Nil June 2 Raptor III DIAGRAM ON REQUIRED (MIL. ) LJM 2 RETURN Aug. 7 116 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004. EXPECTED (MIL) HEDGE CAP. USED

TABLE 2. 2 ENRON’S RAPTORS – SELECTED DETAILS NAME APPROVE IN 2001 Raptor I Talon May Raptor II Timberwolf Porcupine Not/ Raptor IV Bobcat CAPITAL (MIL. ) FROM LJM 2 101 $30 $41 $500 $30 $41 $513 $30 $39. 5 Only TNPC $30 $41 Nil June 2 Raptor III DIAGRAM ON REQUIRED (MIL. ) LJM 2 RETURN Aug. 7 116 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004. EXPECTED (MIL) HEDGE CAP. USED

TABLE 2. 3 PAYMENTS TO FASTOW & HELPERS INVESTMENT RETURN, IN MILLIONS OTHER, IN MILLIONS A. Fastow $25, 000 $ 4. 5 in 2 mo. $30 + stock options M. Kopper 125, 000 10. 0 incl. Dodson B. Glisan 5, 800 1. 0 K. Mordaunt 5, 800 $2 in fees 1. 0 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 3 PAYMENTS TO FASTOW & HELPERS INVESTMENT RETURN, IN MILLIONS OTHER, IN MILLIONS A. Fastow $25, 000 $ 4. 5 in 2 mo. $30 + stock options M. Kopper 125, 000 10. 0 incl. Dodson B. Glisan 5, 800 1. 0 K. Mordaunt 5, 800 $2 in fees 1. 0 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 4 ENRON WHISTLE-BLOWERS BLEW TO ACTION SUBSEQUENTLY Cliff Baxter, Vice Chair Lay None Exercised $32 mil in stock options, just agreed to testify to Congress when found shot dead in his car–an apparent suicide–on Jan. 25, 2002 Mc. Mahon, Treasurer Fastow None Reassigned, later returned as CEO Kaminski, Risk Mgr. Fastow and others None Continued None Discussed with Skilling and asked Vinson & Elkins to review Sherron Watkins Lay L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 4 ENRON WHISTLE-BLOWERS BLEW TO ACTION SUBSEQUENTLY Cliff Baxter, Vice Chair Lay None Exercised $32 mil in stock options, just agreed to testify to Congress when found shot dead in his car–an apparent suicide–on Jan. 25, 2002 Mc. Mahon, Treasurer Fastow None Reassigned, later returned as CEO Kaminski, Risk Mgr. Fastow and others None Continued None Discussed with Skilling and asked Vinson & Elkins to review Sherron Watkins Lay L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 5 ENRON STOCK PROCEEDS, OCTOBER 1998 TO NOVEMBER 2001, OVER $30 MILLION Lou Pal Chairman, Enron Accelerator $353. 7 million Ken Lay Chairman 101. 3 Rebecca Mark-Jusbasche Director 79. 5 Ken Harrison Director, Portland General Electrics 75. 2 Kenneth Rice Chairman, Enron Broadband 72. 8 Jeffrey Skilling Director (former CEO) 66. 9 Mark Frevert Vice Chairman 50. 3 Stanley Horton Global Chairman 45. 5 Joseph Sutton Vice Chairman 40. 1 J. Clifford Baxter Vice Chairman 35. 2 Joseph Hirco CEO, Enron Broadband 35. 2 Andrew Fastow Chief Financial Officer 30. 5 SOURCE: © 2002 The Washington Post. Reprinted with permission. L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 5 ENRON STOCK PROCEEDS, OCTOBER 1998 TO NOVEMBER 2001, OVER $30 MILLION Lou Pal Chairman, Enron Accelerator $353. 7 million Ken Lay Chairman 101. 3 Rebecca Mark-Jusbasche Director 79. 5 Ken Harrison Director, Portland General Electrics 75. 2 Kenneth Rice Chairman, Enron Broadband 72. 8 Jeffrey Skilling Director (former CEO) 66. 9 Mark Frevert Vice Chairman 50. 3 Stanley Horton Global Chairman 45. 5 Joseph Sutton Vice Chairman 40. 1 J. Clifford Baxter Vice Chairman 35. 2 Joseph Hirco CEO, Enron Broadband 35. 2 Andrew Fastow Chief Financial Officer 30. 5 SOURCE: © 2002 The Washington Post. Reprinted with permission. L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

FIGURE 2. 2 ENRON’S COVERNANCE AND CONTROL STRUCTURE WAS SHORT-CIRCUITED Outside Law Firm Finan. SPEs Reports Board Ken Lay: Chair; Co-chair ZZZ Audit, Compensation Cees. Management Lay, Skilling: CEO Fastow, CFO; Koppers Causey, CAO; Buy, CRO Watkins; Kaminsky; Mc. Mahon Consultant: Arthur Andersen Compliance Auditor Arthur Andersen Guidance Missing Suspended Company Policies Code of Conduct Internal Audit ? Whistleblowers ? L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

FIGURE 2. 2 ENRON’S COVERNANCE AND CONTROL STRUCTURE WAS SHORT-CIRCUITED Outside Law Firm Finan. SPEs Reports Board Ken Lay: Chair; Co-chair ZZZ Audit, Compensation Cees. Management Lay, Skilling: CEO Fastow, CFO; Koppers Causey, CAO; Buy, CRO Watkins; Kaminsky; Mc. Mahon Consultant: Arthur Andersen Compliance Auditor Arthur Andersen Guidance Missing Suspended Company Policies Code of Conduct Internal Audit ? Whistleblowers ? L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 6 SELECTED ENRON FINANCIAL STATEMENT DETAILS 2000 1999 1998 $101, 789 1, 953 2, 482 979 1. 22 1. 12 $40, 112 802 1, 995 1, 024 893 1. 17 1. 10 $31, 260 1, 378 1, 582 703 1. 07 1. 01 Detail of IBIT (millions) Transport & distribution Trans. Services Portland General Wholesale Services Retail Energy Services Broadband Services Exploration & prod. Corporate and other IBIT $391 341 2, 260 165 (60) (615) 2, 482 $380 305 1, 317 (68) $351 286 968 (119) 65 (4) 1, 995 128 (32) 1, 582 Summary Balance Sheet (billions) Current assets Investments, other Property, plant, equip, net Total Assets ……………. $30. 4 23. 4 11. 7 65. 5 $7. 3 15. 4 10. 7 33. 4 Current liabilities Long-term Debt Deferred credits and other Shareholders’ Equity 28. 4 8. 6 13. 8 11. 5 6. 8 7. 2 6. 5 9. 6 Total Liabilities & Shareholders’ Equity 65. 5 33. 4 Summary Income Statement (millions) Revenues Operating income IBIT Net Income before Cumulative Accounting Changes Net Income EPS (in dollars)- basic - diluted L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 6 SELECTED ENRON FINANCIAL STATEMENT DETAILS 2000 1999 1998 $101, 789 1, 953 2, 482 979 1. 22 1. 12 $40, 112 802 1, 995 1, 024 893 1. 17 1. 10 $31, 260 1, 378 1, 582 703 1. 07 1. 01 Detail of IBIT (millions) Transport & distribution Trans. Services Portland General Wholesale Services Retail Energy Services Broadband Services Exploration & prod. Corporate and other IBIT $391 341 2, 260 165 (60) (615) 2, 482 $380 305 1, 317 (68) $351 286 968 (119) 65 (4) 1, 995 128 (32) 1, 582 Summary Balance Sheet (billions) Current assets Investments, other Property, plant, equip, net Total Assets ……………. $30. 4 23. 4 11. 7 65. 5 $7. 3 15. 4 10. 7 33. 4 Current liabilities Long-term Debt Deferred credits and other Shareholders’ Equity 28. 4 8. 6 13. 8 11. 5 6. 8 7. 2 6. 5 9. 6 Total Liabilities & Shareholders’ Equity 65. 5 33. 4 Summary Income Statement (millions) Revenues Operating income IBIT Net Income before Cumulative Accounting Changes Net Income EPS (in dollars)- basic - diluted L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

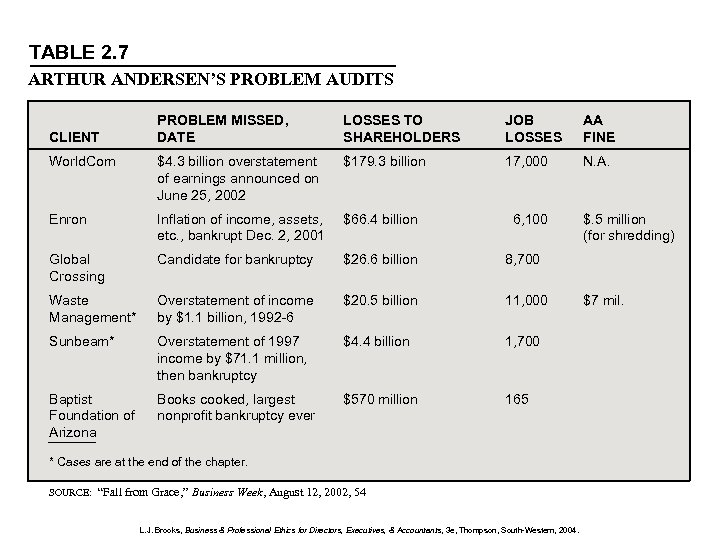

TABLE 2. 7 ARTHUR ANDERSEN’S PROBLEM AUDITS PROBLEM MISSED, DATE LOSSES TO SHAREHOLDERS JOB LOSSES AA FINE World. Com $4. 3 billion overstatement of earnings announced on June 25, 2002 $179. 3 billion 17, 000 N. A. Enron Inflation of income, assets, etc. , bankrupt Dec. 2, 2001 $66. 4 billion 6, 100 Global Crossing Candidate for bankruptcy $26. 6 billion 8, 700 Waste Management* Overstatement of income by $1. 1 billion, 1992 -6 $20. 5 billion 11, 000 Sunbeam* Overstatement of 1997 income by $71. 1 million, then bankruptcy $4. 4 billion 1, 700 Baptist Foundation of Arizona Books cooked, largest nonprofit bankruptcy ever $570 million 165 CLIENT * Cases are at the end of the chapter. SOURCE: “Fall from Grace, ” Business Week, August 12, 2002, 54 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004. $. 5 million (for shredding) $7 mil.

TABLE 2. 7 ARTHUR ANDERSEN’S PROBLEM AUDITS PROBLEM MISSED, DATE LOSSES TO SHAREHOLDERS JOB LOSSES AA FINE World. Com $4. 3 billion overstatement of earnings announced on June 25, 2002 $179. 3 billion 17, 000 N. A. Enron Inflation of income, assets, etc. , bankrupt Dec. 2, 2001 $66. 4 billion 6, 100 Global Crossing Candidate for bankruptcy $26. 6 billion 8, 700 Waste Management* Overstatement of income by $1. 1 billion, 1992 -6 $20. 5 billion 11, 000 Sunbeam* Overstatement of 1997 income by $71. 1 million, then bankruptcy $4. 4 billion 1, 700 Baptist Foundation of Arizona Books cooked, largest nonprofit bankruptcy ever $570 million 165 CLIENT * Cases are at the end of the chapter. SOURCE: “Fall from Grace, ” Business Week, August 12, 2002, 54 L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004. $. 5 million (for shredding) $7 mil.

TABLE 2. 8 SOME KEY GUIDELINES AND REGULATORY CHANGES ANNOUNCED SOURCE OF CHANGE 1994 The Dey Report, “Where were the Directors? ”, Toronto Stock Exchange To review corporate governance and make recommendations for best practice. 1999 Five Years to the Dey Report on Corporate Governance, Toronto Stock Exchange and The Institute of Corporate Directors To survey and analyze governance procedures at TSE companies. May 2000 The Combined Code: Principles of Good Governance and Principles of Best Practice Based on the Hempel (1998), the Cadbury (1992) and Greenbury Reports (1995), used by companies listed on the London Stock Exchange. 2000 Guidance for Directors on the Combined Code, The Turnbull Report, Nov. 21, 2001 The Saucier Report, “Beyond Compliance: Building a Governance Culture”, Joint Committee on Corporate Governance, CICA/TSE To review the current state of corporate governance in Canada, compare Canadian and international best practices, and make recommendations for changes that will ensure Canadian corporate governance is among the best in the world. Apr. 26, 2002 Toronto Stock Exchange (TSX) Guidelines Amended Revisions effective Dec. 31, 2002 to adopt some Saucier Report recommendations. Apr. 4, 2002 Various June 6, 2002 SEC Blue Ribbon Committee Discussions Business Roundtable – various statements NYSE Corporate Governance Listing Requirements, Effective Aug. 2002, after SEC approval A review at the request of Harvey Pitt, SEC Chairman, to enhance the accountability, integrity, and transparency of companies listed on the NYSE. June 28, 2002 SEC Order effective Aug, 14, 2002 CEO and CFO to certify 8 -K, quarterly and annual financial reports. July 9, 2002 President George Bush’s Proposals Speech See Combined Code purpose. Visit the text’s Website for links to the organizations’ Websites L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.

TABLE 2. 8 SOME KEY GUIDELINES AND REGULATORY CHANGES ANNOUNCED SOURCE OF CHANGE 1994 The Dey Report, “Where were the Directors? ”, Toronto Stock Exchange To review corporate governance and make recommendations for best practice. 1999 Five Years to the Dey Report on Corporate Governance, Toronto Stock Exchange and The Institute of Corporate Directors To survey and analyze governance procedures at TSE companies. May 2000 The Combined Code: Principles of Good Governance and Principles of Best Practice Based on the Hempel (1998), the Cadbury (1992) and Greenbury Reports (1995), used by companies listed on the London Stock Exchange. 2000 Guidance for Directors on the Combined Code, The Turnbull Report, Nov. 21, 2001 The Saucier Report, “Beyond Compliance: Building a Governance Culture”, Joint Committee on Corporate Governance, CICA/TSE To review the current state of corporate governance in Canada, compare Canadian and international best practices, and make recommendations for changes that will ensure Canadian corporate governance is among the best in the world. Apr. 26, 2002 Toronto Stock Exchange (TSX) Guidelines Amended Revisions effective Dec. 31, 2002 to adopt some Saucier Report recommendations. Apr. 4, 2002 Various June 6, 2002 SEC Blue Ribbon Committee Discussions Business Roundtable – various statements NYSE Corporate Governance Listing Requirements, Effective Aug. 2002, after SEC approval A review at the request of Harvey Pitt, SEC Chairman, to enhance the accountability, integrity, and transparency of companies listed on the NYSE. June 28, 2002 SEC Order effective Aug, 14, 2002 CEO and CFO to certify 8 -K, quarterly and annual financial reports. July 9, 2002 President George Bush’s Proposals Speech See Combined Code purpose. Visit the text’s Website for links to the organizations’ Websites L. J. Brooks, Business & Professional Ethics for Directors, Executives, & Accountants, 3 e, Thompson, South-Western, 2004.