4f1c565c409db0df70fb89990856c53c.ppt

- Количество слайдов: 23

Fighting Procrastination in the Workplace: An Experiment XIMENA CADENA (IDEAS 42 AT HARVARD) ALEXANDRA CRISTEA (IDEAS 42) HEBER DELGADO (IDEAS 42) ANTOINETTE SCHOAR (MIT)

Fighting Procrastination in the Workplace: An Experiment XIMENA CADENA (IDEAS 42 AT HARVARD) ALEXANDRA CRISTEA (IDEAS 42) HEBER DELGADO (IDEAS 42) ANTOINETTE SCHOAR (MIT)

Motivation • A large literature has documented the impact of behavioral biases on individual decision making, especially procrastination • • Laibson (1997) on hyperbolic discounting, O’Donoghue and Rabin (2000) on procrastination, Fudenberg and Levine (2005) on dual selves Ariely and Wenterbroch (2002) Della. Vigna and Malmendier (2006) • Very limited research on planning fallacies within firms • Hossain and List (2009) find impact of framing on incentives and performance • Kaur, Kremer and Mullainathan (2010) study peer effects on productivity at the work place

Motivation • A large literature has documented the impact of behavioral biases on individual decision making, especially procrastination • • Laibson (1997) on hyperbolic discounting, O’Donoghue and Rabin (2000) on procrastination, Fudenberg and Levine (2005) on dual selves Ariely and Wenterbroch (2002) Della. Vigna and Malmendier (2006) • Very limited research on planning fallacies within firms • Hossain and List (2009) find impact of framing on incentives and performance • Kaur, Kremer and Mullainathan (2010) study peer effects on productivity at the work place

Questions • Do planning fallacies or procrastination affect employee behavior and performance in the workplace? • Do interventions to encourage employees to plan better improve performance? or create deviations from the first best? • Does the structure of (financial) incentives matter? • Is it just a matter of the level (steepness) of bonuses? • Does periodicity and frequency of incentives matter, e. g. are small frequent incentives more effective than large, end of period bonuses? • Do non-pecuniary interventions that help employees plan have an impact on performance?

Questions • Do planning fallacies or procrastination affect employee behavior and performance in the workplace? • Do interventions to encourage employees to plan better improve performance? or create deviations from the first best? • Does the structure of (financial) incentives matter? • Is it just a matter of the level (steepness) of bonuses? • Does periodicity and frequency of incentives matter, e. g. are small frequent incentives more effective than large, end of period bonuses? • Do non-pecuniary interventions that help employees plan have an impact on performance?

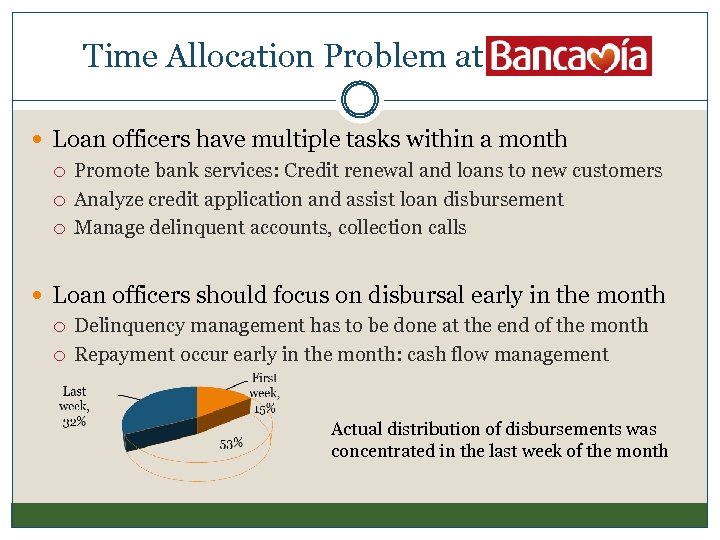

Time Allocation Problem at Bancamia Loan officers have multiple tasks within a month Promote bank services: Credit renewal and loans to new customers Analyze credit application and assist loan disbursement Manage delinquent accounts, collection calls Loan officers should focus on disbursal early in the month Delinquency management has to be done at the end of the month Repayment occur early in the month: cash flow management Actual distribution of disbursements was concentrated in the last week of the month

Time Allocation Problem at Bancamia Loan officers have multiple tasks within a month Promote bank services: Credit renewal and loans to new customers Analyze credit application and assist loan disbursement Manage delinquent accounts, collection calls Loan officers should focus on disbursal early in the month Delinquency management has to be done at the end of the month Repayment occur early in the month: cash flow management Actual distribution of disbursements was concentrated in the last week of the month

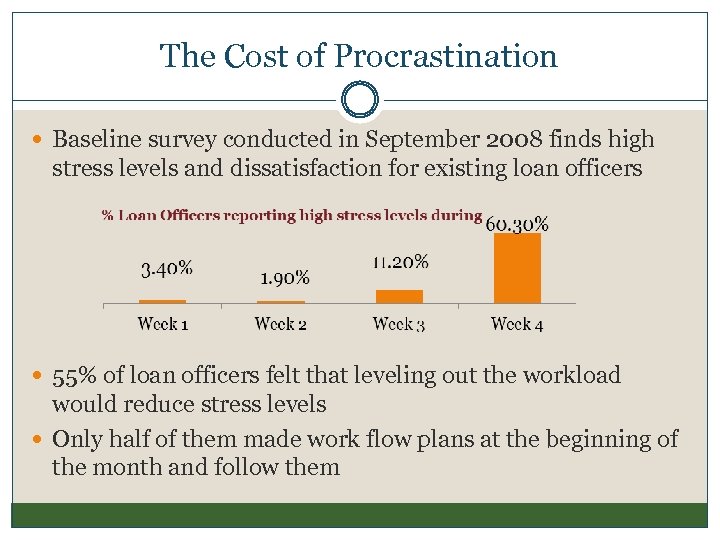

The Cost of Procrastination Baseline survey conducted in September 2008 finds high stress levels and dissatisfaction for existing loan officers 55% of loan officers felt that leveling out the workload would reduce stress levels Only half of them made work flow plans at the beginning of the month and follow them

The Cost of Procrastination Baseline survey conducted in September 2008 finds high stress levels and dissatisfaction for existing loan officers 55% of loan officers felt that leveling out the workload would reduce stress levels Only half of them made work flow plans at the beginning of the month and follow them

Current Bonus System Bonuses are based on portfolio growth and quality Individual incentives to encourage different tasks Weight of incentives are roughly 25% for each task Bancamia previously introduced monthly incentives to encourage goal achievement : 5% reduction of potential commission as penalty for every week that a loan officer does not hit new loans targets consistent to monthly targets (25% each week of the 4) Goals depend on geography, prior experience of loan officer Bonuses are paid and calculated at the end of each month

Current Bonus System Bonuses are based on portfolio growth and quality Individual incentives to encourage different tasks Weight of incentives are roughly 25% for each task Bancamia previously introduced monthly incentives to encourage goal achievement : 5% reduction of potential commission as penalty for every week that a loan officer does not hit new loans targets consistent to monthly targets (25% each week of the 4) Goals depend on geography, prior experience of loan officer Bonuses are paid and calculated at the end of each month

The Intervention: Madrugador Program Introduce weekly incentives to reward loan placement during the first 2 weeks of the month Specific weekly goals for new loans and credit renewals Small positive incentives Gift certificates for movies, phone cards, restaurants etc ($15) 2% of average monthly salary Winner and runner-up got additional prize: vacation and ipod Reminders and recognition, constant feed-back Weekly meetings with branch managers to track performance Madrugador Monthly Bulletin

The Intervention: Madrugador Program Introduce weekly incentives to reward loan placement during the first 2 weeks of the month Specific weekly goals for new loans and credit renewals Small positive incentives Gift certificates for movies, phone cards, restaurants etc ($15) 2% of average monthly salary Winner and runner-up got additional prize: vacation and ipod Reminders and recognition, constant feed-back Weekly meetings with branch managers to track performance Madrugador Monthly Bulletin

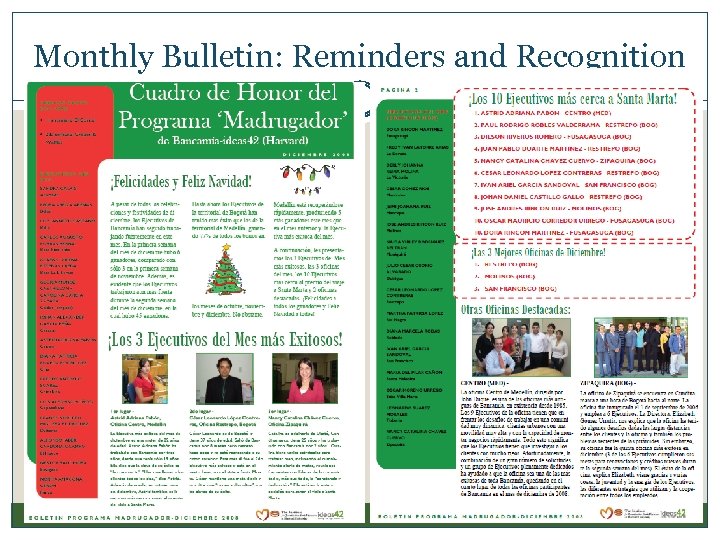

Monthly Bulletin: Reminders and Recognition

Monthly Bulletin: Reminders and Recognition

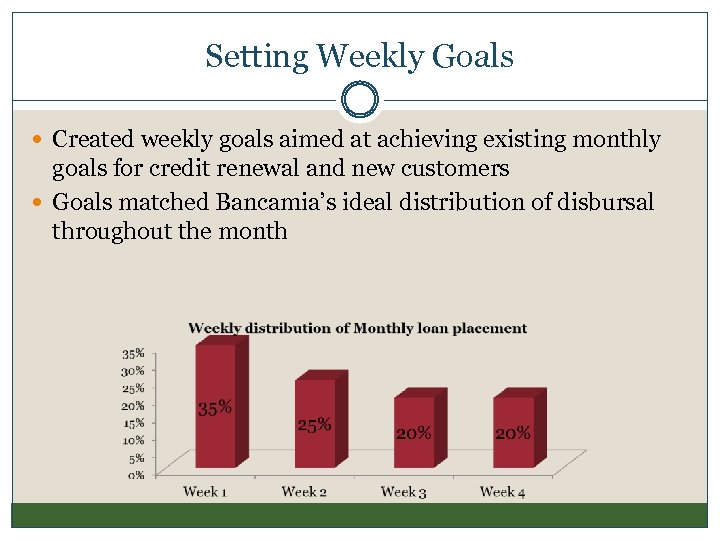

Setting Weekly Goals Created weekly goals aimed at achieving existing monthly goals for credit renewal and new customers Goals matched Bancamia’s ideal distribution of disbursal throughout the month

Setting Weekly Goals Created weekly goals aimed at achieving existing monthly goals for credit renewal and new customers Goals matched Bancamia’s ideal distribution of disbursal throughout the month

Research Design and Set up Randomized control trial with Bancamia – – – November 2008 to April 2009 61 branches in 6 regions 31 bank branches were randomly selected to receive the treatment and 30 to be in the control and continue unchanged Intervention was designed at the branch level – – – Equality within branch staff Logistics of implementing bonus system Performance and bonuses are evaluated individually Second phase: Branch managers were included to receive incentives and help employees set weekly planning goals February 2009 to April 2009

Research Design and Set up Randomized control trial with Bancamia – – – November 2008 to April 2009 61 branches in 6 regions 31 bank branches were randomly selected to receive the treatment and 30 to be in the control and continue unchanged Intervention was designed at the branch level – – – Equality within branch staff Logistics of implementing bonus system Performance and bonuses are evaluated individually Second phase: Branch managers were included to receive incentives and help employees set weekly planning goals February 2009 to April 2009

Data Collection Bank’s IT system Loan officer performance and compensation, branch and portfolio characteristics, program winners Pre-treatment: July-October 2008 Post-treatment: November 2008 - April 2009 Post–intervention: October-December 2010 Surveys: Phone interviews of loan officers Socioeconomic characteristics, stress levels, job satisfaction, work practices Conducted by a professional survey firm Baseline: September-October 2008 (98% response) Endline: May 2009 (96% response rate, 66% in both surveys)

Data Collection Bank’s IT system Loan officer performance and compensation, branch and portfolio characteristics, program winners Pre-treatment: July-October 2008 Post-treatment: November 2008 - April 2009 Post–intervention: October-December 2010 Surveys: Phone interviews of loan officers Socioeconomic characteristics, stress levels, job satisfaction, work practices Conducted by a professional survey firm Baseline: September-October 2008 (98% response) Endline: May 2009 (96% response rate, 66% in both surveys)

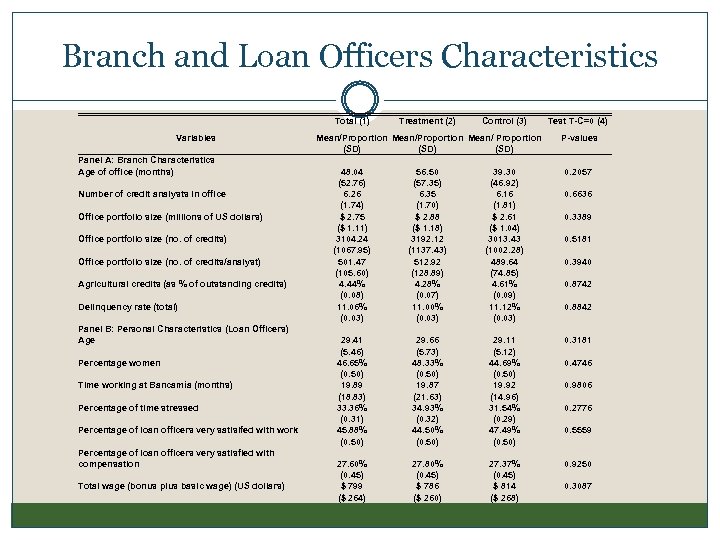

Branch and Loan Officers Characteristics Total (1) Variables Panel A: Branch Characteristics Age of office (months) Number of credit analysts in office Office portfolio size (millions of US dollars) Office portfolio size (no. of credits/analyst) Agricultural credits (as % of outstanding credits) Delinquency rate (total) Panel B: Personal Characteristics (Loan Officers) Age Percentage women Time working at Bancamía (months) Percentage of time stressed Percentage of loan officers very satisifed with work Percentage of loan officers very satisfied with compensation Total wage (bonus plus basic wage) (US dollars) Treatment (2) Control (3) Mean/Proportion Mean/ Proportion (SD) Test T-C=0 (4) P-values 48. 04 (52. 76) 6. 26 (1. 74) $ 2. 75 ($ 1. 11) 3104. 24 (1067. 95) 501. 47 (105. 60) 4. 44% (0. 08) 11. 06% (0. 03) 56. 50 (57. 35) 6. 35 (1. 70) $ 2. 88 ($ 1. 18) 3192. 12 (1137. 43) 512. 92 (128. 89) 4. 28% (0. 07) 11. 00% (0. 03) 39. 30 (46. 92) 6. 16 (1. 81) $ 2. 61 ($ 1. 04) 3013. 43 (1002. 28) 489. 64 (74. 85) 4. 61% (0. 09) 11. 12% (0. 03) 0. 2057 29. 41 (5. 46) 46. 65% (0. 50) 19. 89 (18. 83) 33. 36% (0. 31) 45. 88% (0. 50) 29. 66 (5. 73) 48. 33% (0. 50) 19. 87 (21. 63) 34. 93% (0. 32) 44. 50% (0. 50) 29. 11 (5. 12) 44. 69% (0. 50) 19. 92 (14. 96) 31. 54% (0. 29) 47. 49% (0. 50) 0. 3181 27. 60% (0. 45) $ 799 ($ 264) 27. 80% (0. 45) $ 786 ($ 260) 27. 37% (0. 45) $ 814 ($ 268) 0. 9250 0. 6636 0. 3389 0. 5181 0. 3940 0. 8742 0. 8842 0. 4746 0. 9806 0. 2776 0. 5559 0. 3087

Branch and Loan Officers Characteristics Total (1) Variables Panel A: Branch Characteristics Age of office (months) Number of credit analysts in office Office portfolio size (millions of US dollars) Office portfolio size (no. of credits/analyst) Agricultural credits (as % of outstanding credits) Delinquency rate (total) Panel B: Personal Characteristics (Loan Officers) Age Percentage women Time working at Bancamía (months) Percentage of time stressed Percentage of loan officers very satisifed with work Percentage of loan officers very satisfied with compensation Total wage (bonus plus basic wage) (US dollars) Treatment (2) Control (3) Mean/Proportion Mean/ Proportion (SD) Test T-C=0 (4) P-values 48. 04 (52. 76) 6. 26 (1. 74) $ 2. 75 ($ 1. 11) 3104. 24 (1067. 95) 501. 47 (105. 60) 4. 44% (0. 08) 11. 06% (0. 03) 56. 50 (57. 35) 6. 35 (1. 70) $ 2. 88 ($ 1. 18) 3192. 12 (1137. 43) 512. 92 (128. 89) 4. 28% (0. 07) 11. 00% (0. 03) 39. 30 (46. 92) 6. 16 (1. 81) $ 2. 61 ($ 1. 04) 3013. 43 (1002. 28) 489. 64 (74. 85) 4. 61% (0. 09) 11. 12% (0. 03) 0. 2057 29. 41 (5. 46) 46. 65% (0. 50) 19. 89 (18. 83) 33. 36% (0. 31) 45. 88% (0. 50) 29. 66 (5. 73) 48. 33% (0. 50) 19. 87 (21. 63) 34. 93% (0. 32) 44. 50% (0. 50) 29. 11 (5. 12) 44. 69% (0. 50) 19. 92 (14. 96) 31. 54% (0. 29) 47. 49% (0. 50) 0. 3181 27. 60% (0. 45) $ 799 ($ 264) 27. 80% (0. 45) $ 786 ($ 260) 27. 37% (0. 45) $ 814 ($ 268) 0. 9250 0. 6636 0. 3389 0. 5181 0. 3940 0. 8742 0. 8842 0. 4746 0. 9806 0. 2776 0. 5559 0. 3087

Impact on Branch Level Outcomes Difference-in- Difference strategy Measure loan disbursal, goal achievement and portfolio performance at the branch level : Branch and month fixed effects Separate treatment dummies for the first and second phase of intervention Additional dummy for post-intervention period Cluster at branch level

Impact on Branch Level Outcomes Difference-in- Difference strategy Measure loan disbursal, goal achievement and portfolio performance at the branch level : Branch and month fixed effects Separate treatment dummies for the first and second phase of intervention Additional dummy for post-intervention period Cluster at branch level

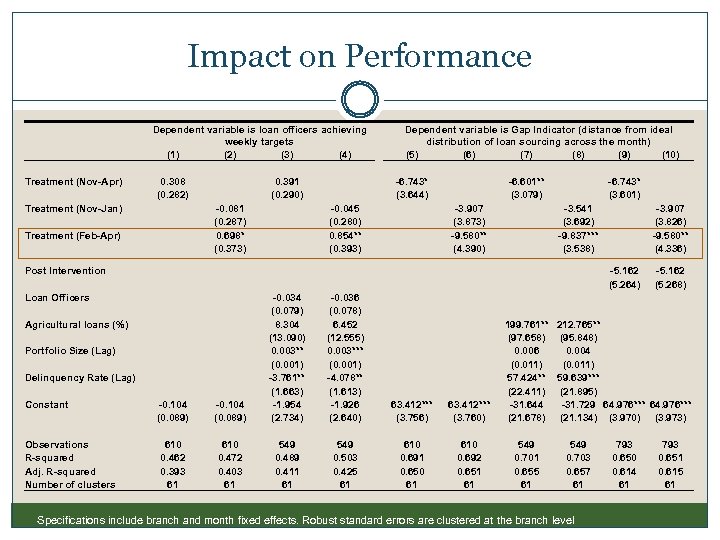

Impact on Performance Dependent variable is loan officers achieving weekly targets (1) (2) (3) (4) Treatment (Nov-Apr) 0. 308 (0. 282) Treatment (Nov-Jan) 0. 391 (0. 290) -0. 081 (0. 287) 0. 698* (0. 373) Treatment (Feb-Apr) Dependent variable is Gap Indicator (distance from ideal distribution of loan sourcing across the month) (5) (6) (7) (8) (9) (10) -6. 743* (3. 644) -0. 045 (0. 280) 0. 854** (0. 393) -6. 601** (3. 079) -3. 907 (3. 873) -9. 580** (4. 390) -6. 743* (3. 601) -3. 541 (3. 692) -9. 837*** (3. 538) Post Intervention -5. 162 (5. 264) Loan Officers -0. 104 (0. 089) -0. 034 (0. 079) 8. 304 (13. 090) 0. 003** (0. 001) -3. 761** (1. 663) -1. 954 (2. 734) 610 0. 462 0. 393 61 610 0. 472 0. 403 61 549 0. 489 0. 411 61 Agricultural loans (%) Portfolio Size (Lag) Delinquency Rate (Lag) Constant Observations R-squared Adj. R-squared Number of clusters -3. 907 (3. 826) -9. 580** (4. 336) -0. 036 (0. 078) 6. 452 (12. 555) 0. 003*** (0. 001) -4. 078** (1. 613) -1. 926 (2. 640) 63. 412*** (3. 756) 63. 412*** (3. 760) 549 0. 503 0. 425 61 610 0. 691 0. 650 61 610 0. 692 0. 651 61 -5. 162 (5. 268) 199. 761** 212. 765** (97. 658) (95. 848) 0. 006 0. 004 (0. 011) 57. 424** 59. 639*** (22. 411) (21. 895) -31. 644 -31. 729 64. 976*** (21. 678) (21. 134) (3. 970) (3. 973) 549 0. 701 0. 655 61 549 0. 703 0. 657 61 Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level 793 0. 650 0. 614 61 793 0. 651 0. 615 61

Impact on Performance Dependent variable is loan officers achieving weekly targets (1) (2) (3) (4) Treatment (Nov-Apr) 0. 308 (0. 282) Treatment (Nov-Jan) 0. 391 (0. 290) -0. 081 (0. 287) 0. 698* (0. 373) Treatment (Feb-Apr) Dependent variable is Gap Indicator (distance from ideal distribution of loan sourcing across the month) (5) (6) (7) (8) (9) (10) -6. 743* (3. 644) -0. 045 (0. 280) 0. 854** (0. 393) -6. 601** (3. 079) -3. 907 (3. 873) -9. 580** (4. 390) -6. 743* (3. 601) -3. 541 (3. 692) -9. 837*** (3. 538) Post Intervention -5. 162 (5. 264) Loan Officers -0. 104 (0. 089) -0. 034 (0. 079) 8. 304 (13. 090) 0. 003** (0. 001) -3. 761** (1. 663) -1. 954 (2. 734) 610 0. 462 0. 393 61 610 0. 472 0. 403 61 549 0. 489 0. 411 61 Agricultural loans (%) Portfolio Size (Lag) Delinquency Rate (Lag) Constant Observations R-squared Adj. R-squared Number of clusters -3. 907 (3. 826) -9. 580** (4. 336) -0. 036 (0. 078) 6. 452 (12. 555) 0. 003*** (0. 001) -4. 078** (1. 613) -1. 926 (2. 640) 63. 412*** (3. 756) 63. 412*** (3. 760) 549 0. 503 0. 425 61 610 0. 691 0. 650 61 610 0. 692 0. 651 61 -5. 162 (5. 268) 199. 761** 212. 765** (97. 658) (95. 848) 0. 006 0. 004 (0. 011) 57. 424** 59. 639*** (22. 411) (21. 895) -31. 644 -31. 729 64. 976*** (21. 678) (21. 134) (3. 970) (3. 973) 549 0. 701 0. 655 61 549 0. 703 0. 657 61 Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level 793 0. 650 0. 614 61 793 0. 651 0. 615 61

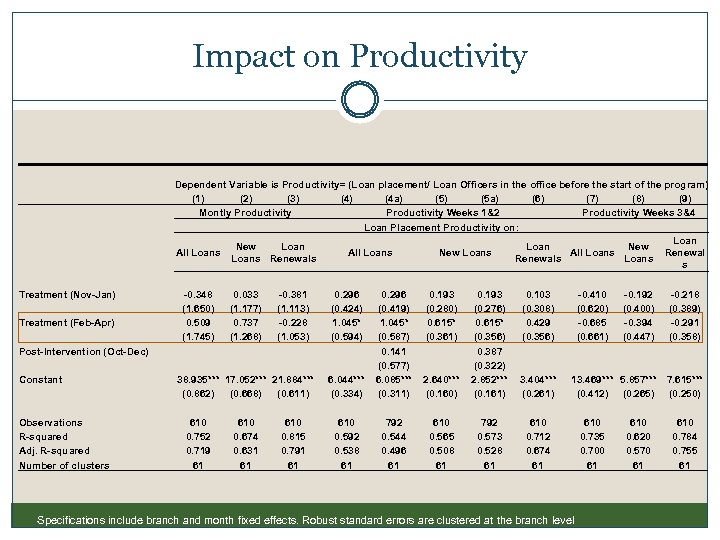

Impact on Productivity Dependent Variable is Productivity= (Loan placement/ Loan Officers in the office before the start of the program) (1) (2) (3) (4) (4 a) (5 a) (6) (7) (8) (9) Montly Productivity Weeks 1&2 Productivity Weeks 3&4 Loan Placement Productivity on: Loan New All Loans New Loans All Loans Renewals Loans s Treatment (Nov-Jan) Treatment (Feb-Apr) -0. 348 (1. 650) 0. 509 (1. 745) 0. 033 (1. 177) 0. 737 (1. 268) -0. 381 (1. 113) -0. 228 (1. 053) 0. 296 (0. 424) 1. 045* (0. 594) 6. 044*** (0. 334) 0. 296 (0. 419) 1. 045* (0. 587) 0. 141 (0. 577) 6. 085*** (0. 311) 610 0. 592 0. 538 61 792 0. 544 0. 496 61 Post-Intervention (Oct-Dec) Constant Observations R-squared Adj. R-squared Number of clusters 38. 935*** 17. 052*** 21. 884*** (0. 862) (0. 668) (0. 611) 610 0. 752 0. 719 61 610 0. 674 0. 631 61 610 0. 815 0. 791 61 0. 193 (0. 280) 0. 615* (0. 361) 2. 640*** (0. 160) 0. 193 (0. 276) 0. 615* (0. 356) 0. 387 (0. 322) 2. 852*** (0. 161) 0. 103 (0. 308) 0. 429 (0. 356) 3. 404*** (0. 261) 610 0. 565 0. 508 61 792 0. 573 0. 528 61 610 0. 712 0. 674 61 -0. 410 (0. 620) -0. 685 (0. 661) -0. 192 (0. 400) -0. 394 (0. 447) -0. 218 (0. 389) -0. 291 (0. 358) 13. 469*** 5. 857*** 7. 615*** (0. 412) (0. 265) (0. 250) Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level 610 0. 735 0. 700 61 610 0. 620 0. 570 61 610 0. 784 0. 755 61

Impact on Productivity Dependent Variable is Productivity= (Loan placement/ Loan Officers in the office before the start of the program) (1) (2) (3) (4) (4 a) (5 a) (6) (7) (8) (9) Montly Productivity Weeks 1&2 Productivity Weeks 3&4 Loan Placement Productivity on: Loan New All Loans New Loans All Loans Renewals Loans s Treatment (Nov-Jan) Treatment (Feb-Apr) -0. 348 (1. 650) 0. 509 (1. 745) 0. 033 (1. 177) 0. 737 (1. 268) -0. 381 (1. 113) -0. 228 (1. 053) 0. 296 (0. 424) 1. 045* (0. 594) 6. 044*** (0. 334) 0. 296 (0. 419) 1. 045* (0. 587) 0. 141 (0. 577) 6. 085*** (0. 311) 610 0. 592 0. 538 61 792 0. 544 0. 496 61 Post-Intervention (Oct-Dec) Constant Observations R-squared Adj. R-squared Number of clusters 38. 935*** 17. 052*** 21. 884*** (0. 862) (0. 668) (0. 611) 610 0. 752 0. 719 61 610 0. 674 0. 631 61 610 0. 815 0. 791 61 0. 193 (0. 280) 0. 615* (0. 361) 2. 640*** (0. 160) 0. 193 (0. 276) 0. 615* (0. 356) 0. 387 (0. 322) 2. 852*** (0. 161) 0. 103 (0. 308) 0. 429 (0. 356) 3. 404*** (0. 261) 610 0. 565 0. 508 61 792 0. 573 0. 528 61 610 0. 712 0. 674 61 -0. 410 (0. 620) -0. 685 (0. 661) -0. 192 (0. 400) -0. 394 (0. 447) -0. 218 (0. 389) -0. 291 (0. 358) 13. 469*** 5. 857*** 7. 615*** (0. 412) (0. 265) (0. 250) Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level 610 0. 735 0. 700 61 610 0. 620 0. 570 61 610 0. 784 0. 755 61

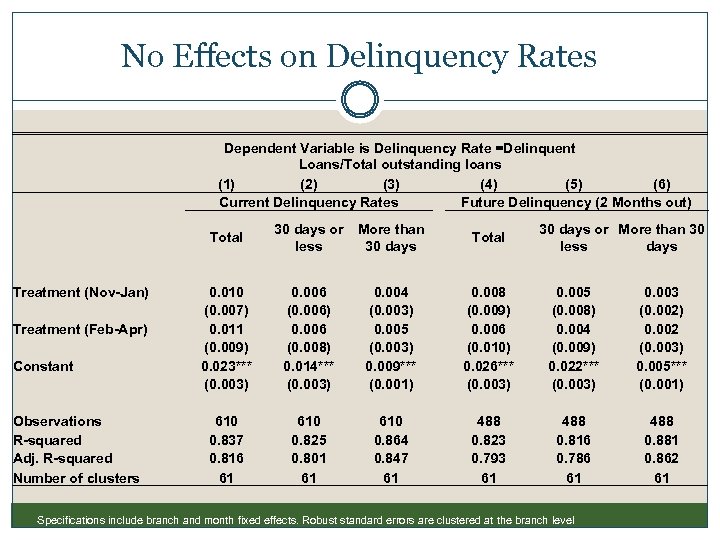

No Effects on Delinquency Rates Dependent Variable is Delinquency Rate =Delinquent Loans/Total outstanding loans (1) (2) (3) (4) (5) (6) Current Delinquency Rates Future Delinquency (2 Months out) Total Treatment (Nov-Jan) Treatment (Feb-Apr) Constant Observations R-squared Adj. R-squared Number of clusters 30 days or More than less 30 days Total 30 days or More than 30 less days 0. 010 (0. 007) 0. 011 (0. 009) 0. 023*** (0. 003) 0. 006 (0. 006) 0. 006 (0. 008) 0. 014*** (0. 003) 0. 004 (0. 003) 0. 005 (0. 003) 0. 009*** (0. 001) 0. 008 (0. 009) 0. 006 (0. 010) 0. 026*** (0. 003) 0. 005 (0. 008) 0. 004 (0. 009) 0. 022*** (0. 003) 0. 003 (0. 002) 0. 002 (0. 003) 0. 005*** (0. 001) 610 0. 837 0. 816 61 610 0. 825 0. 801 61 610 0. 864 0. 847 61 488 0. 823 0. 793 61 488 0. 816 0. 786 61 488 0. 881 0. 862 61 Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level

No Effects on Delinquency Rates Dependent Variable is Delinquency Rate =Delinquent Loans/Total outstanding loans (1) (2) (3) (4) (5) (6) Current Delinquency Rates Future Delinquency (2 Months out) Total Treatment (Nov-Jan) Treatment (Feb-Apr) Constant Observations R-squared Adj. R-squared Number of clusters 30 days or More than less 30 days Total 30 days or More than 30 less days 0. 010 (0. 007) 0. 011 (0. 009) 0. 023*** (0. 003) 0. 006 (0. 006) 0. 006 (0. 008) 0. 014*** (0. 003) 0. 004 (0. 003) 0. 005 (0. 003) 0. 009*** (0. 001) 0. 008 (0. 009) 0. 006 (0. 010) 0. 026*** (0. 003) 0. 005 (0. 008) 0. 004 (0. 009) 0. 022*** (0. 003) 0. 003 (0. 002) 0. 002 (0. 003) 0. 005*** (0. 001) 610 0. 837 0. 816 61 610 0. 825 0. 801 61 610 0. 864 0. 847 61 488 0. 823 0. 793 61 488 0. 816 0. 786 61 488 0. 881 0. 862 61 Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level

Results Intervention was effective in changing loan officer behavior only after branch managers were included in the treatment Loan officers in treatment branches were 7 o% more likely to achieve weekly goals Distance to the ideal time distribution of loan placement was significantly reduced with the program Overall monthly productivity did not change, but significant change in loan disbursal towards weeks 1 and 2 Especially for new loans, which are more tied to loan officer effort Effects on performance did not last after program stopped No impact effects on delinquency rates (loan quality)

Results Intervention was effective in changing loan officer behavior only after branch managers were included in the treatment Loan officers in treatment branches were 7 o% more likely to achieve weekly goals Distance to the ideal time distribution of loan placement was significantly reduced with the program Overall monthly productivity did not change, but significant change in loan disbursal towards weeks 1 and 2 Especially for new loans, which are more tied to loan officer effort Effects on performance did not last after program stopped No impact effects on delinquency rates (loan quality)

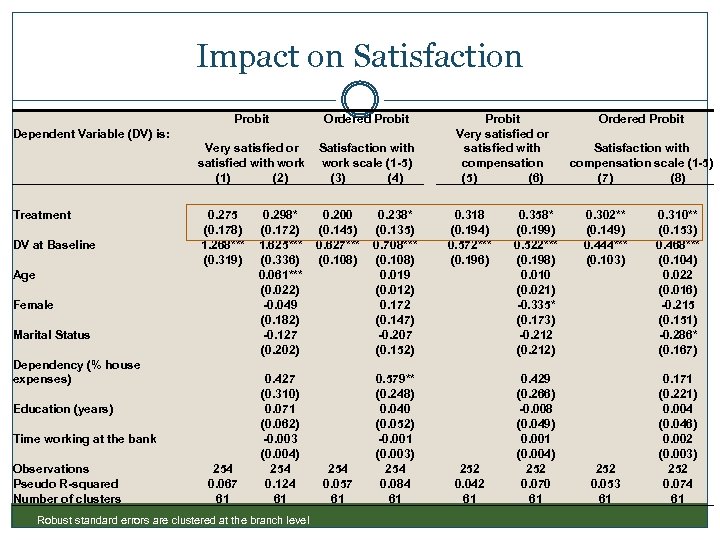

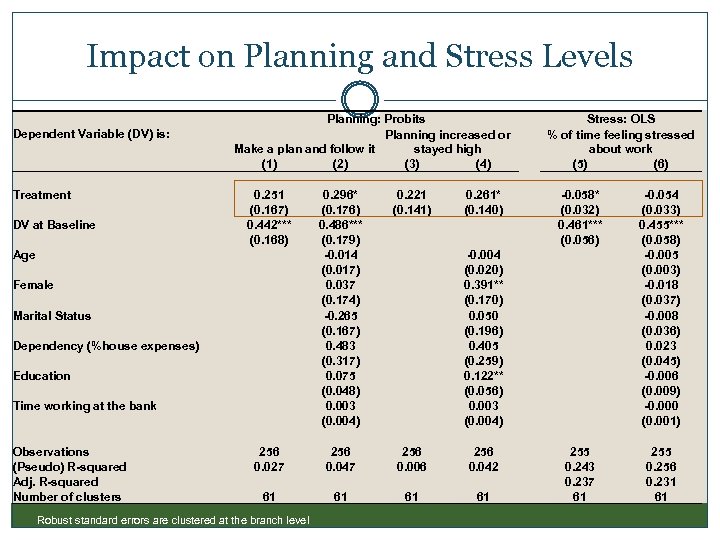

Impact on Individual Level Outcomes Intervention impacted satisfaction and stress levels Measured at individual level in baseline and end-line surveys Cannot differentiate timing of impact in first and second phase Cluster at branch level Results Loan officers in treatment branches were 5 -6% more satisfied with work and compensation More likely to make plans and follow them (8%) and felt less stressed (5%)

Impact on Individual Level Outcomes Intervention impacted satisfaction and stress levels Measured at individual level in baseline and end-line surveys Cannot differentiate timing of impact in first and second phase Cluster at branch level Results Loan officers in treatment branches were 5 -6% more satisfied with work and compensation More likely to make plans and follow them (8%) and felt less stressed (5%)

Impact on Satisfaction Probit Very satisfied or satisfied with work (1) (2) Satisfaction with work scale (1 -5) (3) (4) 0. 275 (0. 178) 1. 268*** (0. 319) 0. 200 (0. 145) 0. 627*** (0. 108) Ordered Probit Treatment DV at Baseline Age Female Marital Status Dependency (% house expenses) Education (years) Time working at the bank Observations Pseudo R-squared Number of clusters 254 0. 067 61 0. 298* (0. 172) 1. 625*** (0. 336) 0. 061*** (0. 022) -0. 049 (0. 182) -0. 127 (0. 202) 0. 427 (0. 310) 0. 071 (0. 062) -0. 003 (0. 004) 254 0. 124 61 Robust standard errors are clustered at the branch level 254 0. 057 61 0. 238* (0. 135) 0. 708*** (0. 108) 0. 019 (0. 012) 0. 172 (0. 147) -0. 207 (0. 152) 0. 579** (0. 248) 0. 040 (0. 052) -0. 001 (0. 003) 254 0. 084 61 Probit Very satisfied or satisfied with compensation (5) (6) Dependent Variable (DV) is: 0. 318 (0. 194) 0. 572*** (0. 196) 252 0. 042 61 0. 358* (0. 199) 0. 522*** (0. 198) 0. 010 (0. 021) -0. 335* (0. 173) -0. 212 (0. 212) 0. 429 (0. 266) -0. 008 (0. 049) 0. 001 (0. 004) 252 0. 070 61 Ordered Probit Satisfaction with compensation scale (1 -5) (7) (8) 0. 302** (0. 149) 0. 444*** (0. 103) 252 0. 053 61 0. 310** (0. 153) 0. 468*** (0. 104) 0. 022 (0. 016) -0. 215 (0. 151) -0. 286* (0. 167) 0. 171 (0. 221) 0. 004 (0. 046) 0. 002 (0. 003) 252 0. 074 61

Impact on Satisfaction Probit Very satisfied or satisfied with work (1) (2) Satisfaction with work scale (1 -5) (3) (4) 0. 275 (0. 178) 1. 268*** (0. 319) 0. 200 (0. 145) 0. 627*** (0. 108) Ordered Probit Treatment DV at Baseline Age Female Marital Status Dependency (% house expenses) Education (years) Time working at the bank Observations Pseudo R-squared Number of clusters 254 0. 067 61 0. 298* (0. 172) 1. 625*** (0. 336) 0. 061*** (0. 022) -0. 049 (0. 182) -0. 127 (0. 202) 0. 427 (0. 310) 0. 071 (0. 062) -0. 003 (0. 004) 254 0. 124 61 Robust standard errors are clustered at the branch level 254 0. 057 61 0. 238* (0. 135) 0. 708*** (0. 108) 0. 019 (0. 012) 0. 172 (0. 147) -0. 207 (0. 152) 0. 579** (0. 248) 0. 040 (0. 052) -0. 001 (0. 003) 254 0. 084 61 Probit Very satisfied or satisfied with compensation (5) (6) Dependent Variable (DV) is: 0. 318 (0. 194) 0. 572*** (0. 196) 252 0. 042 61 0. 358* (0. 199) 0. 522*** (0. 198) 0. 010 (0. 021) -0. 335* (0. 173) -0. 212 (0. 212) 0. 429 (0. 266) -0. 008 (0. 049) 0. 001 (0. 004) 252 0. 070 61 Ordered Probit Satisfaction with compensation scale (1 -5) (7) (8) 0. 302** (0. 149) 0. 444*** (0. 103) 252 0. 053 61 0. 310** (0. 153) 0. 468*** (0. 104) 0. 022 (0. 016) -0. 215 (0. 151) -0. 286* (0. 167) 0. 171 (0. 221) 0. 004 (0. 046) 0. 002 (0. 003) 252 0. 074 61

Impact on Planning and Stress Levels Dependent Variable (DV) is: Treatment DV at Baseline 0. 251 (0. 167) 0. 442*** (0. 168) 0. 296* (0. 176) 0. 486*** (0. 179) -0. 014 (0. 017) 0. 037 (0. 174) -0. 265 (0. 167) 0. 483 (0. 317) 0. 075 (0. 048) 0. 003 (0. 004) 0. 221 (0. 141) 256 0. 027 256 0. 047 256 0. 006 61 61 Female Marital Status Dependency (%house expenses) Education Time working at the bank Robust standard errors are clustered at the branch level Stress: OLS % of time feeling stressed about work (5) (6) 256 0. 042 Age Observations (Pseudo) R-squared Adj. R-squared Number of clusters Planning: Probits Planning increased or Make a plan and follow it stayed high (1) (2) (3) (4) 0. 261* (0. 140) -0. 058* (0. 032) 0. 461*** (0. 056) -0. 054 (0. 033) 0. 455*** (0. 058) -0. 005 (0. 003) -0. 018 (0. 037) -0. 008 (0. 036) 0. 023 (0. 045) -0. 006 (0. 009) -0. 000 (0. 001) 255 0. 243 0. 237 61 255 0. 256 0. 231 61 -0. 004 (0. 020) 0. 391** (0. 170) 0. 050 (0. 196) 0. 405 (0. 259) 0. 122** (0. 056) 0. 003 (0. 004)

Impact on Planning and Stress Levels Dependent Variable (DV) is: Treatment DV at Baseline 0. 251 (0. 167) 0. 442*** (0. 168) 0. 296* (0. 176) 0. 486*** (0. 179) -0. 014 (0. 017) 0. 037 (0. 174) -0. 265 (0. 167) 0. 483 (0. 317) 0. 075 (0. 048) 0. 003 (0. 004) 0. 221 (0. 141) 256 0. 027 256 0. 047 256 0. 006 61 61 Female Marital Status Dependency (%house expenses) Education Time working at the bank Robust standard errors are clustered at the branch level Stress: OLS % of time feeling stressed about work (5) (6) 256 0. 042 Age Observations (Pseudo) R-squared Adj. R-squared Number of clusters Planning: Probits Planning increased or Make a plan and follow it stayed high (1) (2) (3) (4) 0. 261* (0. 140) -0. 058* (0. 032) 0. 461*** (0. 056) -0. 054 (0. 033) 0. 455*** (0. 058) -0. 005 (0. 003) -0. 018 (0. 037) -0. 008 (0. 036) 0. 023 (0. 045) -0. 006 (0. 009) -0. 000 (0. 001) 255 0. 243 0. 237 61 255 0. 256 0. 231 61 -0. 004 (0. 020) 0. 391** (0. 170) 0. 050 (0. 196) 0. 405 (0. 259) 0. 122** (0. 056) 0. 003 (0. 004)

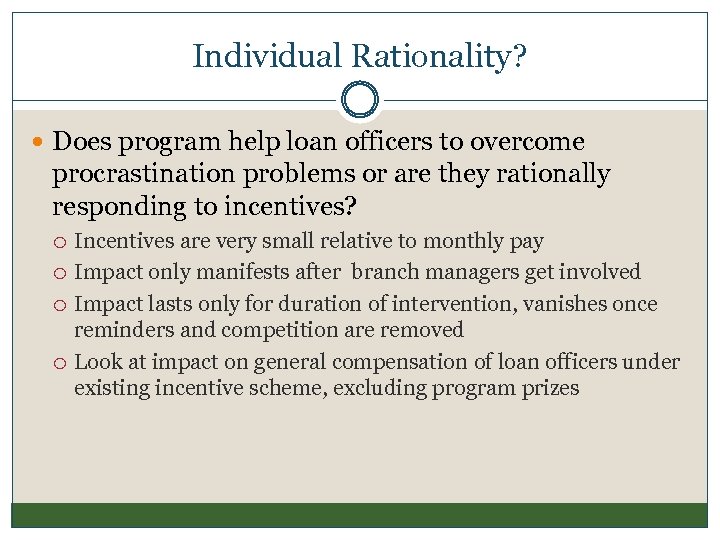

Individual Rationality? Does program help loan officers to overcome procrastination problems or are they rationally responding to incentives? Incentives are very small relative to monthly pay Impact only manifests after branch managers get involved Impact lasts only for duration of intervention, vanishes once reminders and competition are removed Look at impact on general compensation of loan officers under existing incentive scheme, excluding program prizes

Individual Rationality? Does program help loan officers to overcome procrastination problems or are they rationally responding to incentives? Incentives are very small relative to monthly pay Impact only manifests after branch managers get involved Impact lasts only for duration of intervention, vanishes once reminders and competition are removed Look at impact on general compensation of loan officers under existing incentive scheme, excluding program prizes

Impact on Individual Compensation Sample is: Loan officers with compensation data for: Treatment (Nov-Apr) (1) Total Compensation (Salary + Bonus) (2) (3) (4) Any period between June 08 and April 09 421, 469*** (45, 501) Log (Total Compensation) Bonus (5) (6) (7) 7 or more Any period between June 08 periods and April 09 334, 133*** (43, 650) Treatment (Nov-Jan) 402, 426*** (49, 156) 439, 158*** (52, 208) Treatment (Feb-Apr) 321, 658*** (49, 577) 345, 802*** (48, 566) 177, 763*** (49, 844) 219, 222*** (55, 484) 0. 356*** (0. 0403) 0. 334*** (0. 0352) 203, 042*** (37, 066) 228, 628*** (45, 954) 4, 320 0. 284 0. 272 61 4, 716 0. 248 0. 237 61 4, 951 0. 293 0. 282 61 Age Female 3, 395 (3, 557) 95, 553** (44, 499) -44, 851 (40, 699) 75, 404 (61, 213) 19, 086* (11, 253) Marital Status Dependency Education (years) Time working at the bank Observations R-squared Adj. R-squared Number of clusters 4, 716 0. 258 0. 247 61 4, 701 0. 363 0. 352 61 3, 403 (3, 556) 95, 494** (44, 460) -44, 829 (40, 690) 75, 451 (61, 195) 19, 093* (11, 252) 4, 716 0. 258 0. 247 61 4, 701 0. 363 0. 352 61 Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level

Impact on Individual Compensation Sample is: Loan officers with compensation data for: Treatment (Nov-Apr) (1) Total Compensation (Salary + Bonus) (2) (3) (4) Any period between June 08 and April 09 421, 469*** (45, 501) Log (Total Compensation) Bonus (5) (6) (7) 7 or more Any period between June 08 periods and April 09 334, 133*** (43, 650) Treatment (Nov-Jan) 402, 426*** (49, 156) 439, 158*** (52, 208) Treatment (Feb-Apr) 321, 658*** (49, 577) 345, 802*** (48, 566) 177, 763*** (49, 844) 219, 222*** (55, 484) 0. 356*** (0. 0403) 0. 334*** (0. 0352) 203, 042*** (37, 066) 228, 628*** (45, 954) 4, 320 0. 284 0. 272 61 4, 716 0. 248 0. 237 61 4, 951 0. 293 0. 282 61 Age Female 3, 395 (3, 557) 95, 553** (44, 499) -44, 851 (40, 699) 75, 404 (61, 213) 19, 086* (11, 253) Marital Status Dependency Education (years) Time working at the bank Observations R-squared Adj. R-squared Number of clusters 4, 716 0. 258 0. 247 61 4, 701 0. 363 0. 352 61 3, 403 (3, 556) 95, 494** (44, 460) -44, 829 (40, 690) 75, 451 (61, 195) 19, 093* (11, 252) 4, 716 0. 258 0. 247 61 4, 701 0. 363 0. 352 61 Specifications include branch and month fixed effects. Robust standard errors are clustered at the branch level

Conclusions • Intervention was effective in shifting behavior of loan officers within month to desired allocation – No effects on total monthly productivity or loan quality • Significantly increased well being – Increased job satisfaction and reduced stress levles – Improved planning behavior and managing monthly tasks – Increased compensation and bonuses • Positive effects of the program are materialized only after branch managers were included – Seem to work mainly through encouragement, reminders and recognition, incentives alone are no sufficient to fight procrastination

Conclusions • Intervention was effective in shifting behavior of loan officers within month to desired allocation – No effects on total monthly productivity or loan quality • Significantly increased well being – Increased job satisfaction and reduced stress levles – Improved planning behavior and managing monthly tasks – Increased compensation and bonuses • Positive effects of the program are materialized only after branch managers were included – Seem to work mainly through encouragement, reminders and recognition, incentives alone are no sufficient to fight procrastination