563ddcfb0a15913480469215a4573991.ppt

- Количество слайдов: 22

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Overview 31/12/15

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main events in the last year - Efficiency processes UBANK merging The merger of UBANK ended successfully on 30/9/15, while maintaining the brand name – a leading brand in private banking PAGI merging The merger of PAGI ended successfully on 31/12/15, while maintaining the brand name – a leading brand in ultra-orthodox sector Improving the group synergy on the revenue side Dealing with regulatory barriers related to the activities of small banks Reducing employees in the headquarters Reducing group’s real estate space (about 1, 400 SF) 2

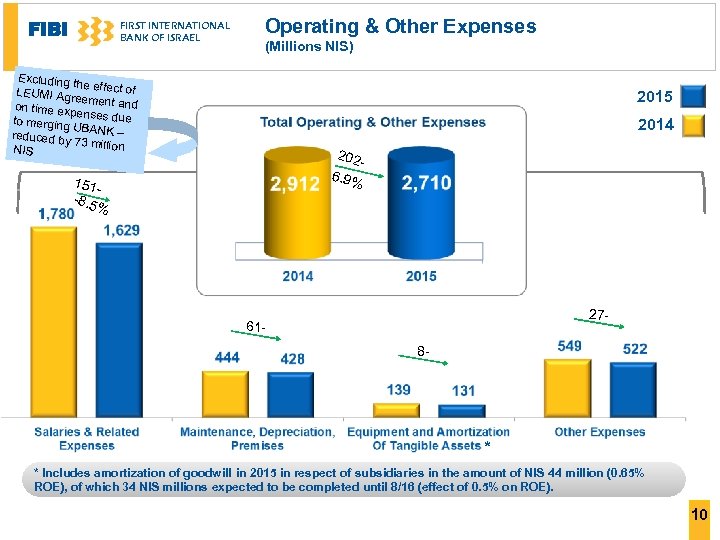

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main events in the last year –Efficiency processes § 7% decrease in operating and other expenses , despite merger related expenses (excluding the effects of Leumi salaries agreement and the expenses related 7% Decrease in Expenses Regional HQ Integration § to the merger of UBANK – a decrease of 4. 5%). 202 million NIS decrease in bank expenses: § 151 million NIS decrease in salaries, effected by a salary decrease in § § Leumi salaries agreement (72 million NIS) that was partly offset with onetime expense of 25 million NIS for the UBANK merger. 5. 2% decrease in number of employees during 2015 Decrease in other expenses as well: maintenance and depreciation and other expenses as a result of real estate reduction processes in the group. § Regional HQ (3 regions) integration to the retail division HQ in the beginning of 2016 n Continued efficiency processes in branch deployment: Ø Closuremerger of branches and savings in branch area –reduction of 7 branches in the group (4 last year) Ø Cancellation of Cashier's positions in some of the group branches and improve efficiency processes in branches n An agreement was signed with the bank employees union in which the employees commit to three years of “peace” Branch Deployment Efficiency Labor Dispute Termination 3

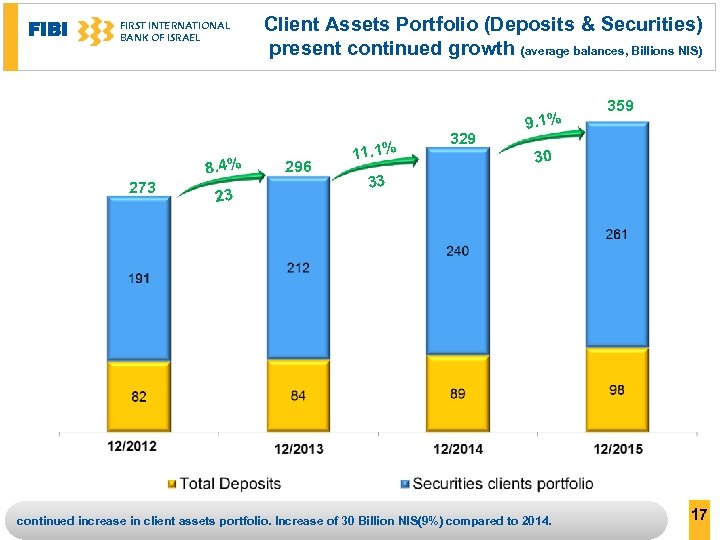

FIBI Credit Growth Continued Growth in Clients’ Assets OTSAR HA -HAYAL wins the ministry of defense tender FIRST INTERNATIONAL BANK OF ISRAEL Main events in the last year – Growth in main activities of FIBI’s Group: § 8% increase in credit to retail customers (excluding mortgages) § Continued growth in mortgages – 10% increase § 3% increase in commercial (Middle Market) credit § In the 4 th quarter, continued growth in all customer segments. 10% growth in corporate credit. § 30 Billion NIS growth (9%) in client’s assets portfolio to a total of 359 Billion NIS (average balance). n Winning the tender for banking and loan services to the Israeli security forces. winning in this long term tender enables: Ø Continued growth for OTSAR HA-HAYAL Ø Establishing leadership in this growing customer segment Ø Realization of efficiency measures and improvement in credit profitability in comparison with the pervious tender (interest adjustment). 4

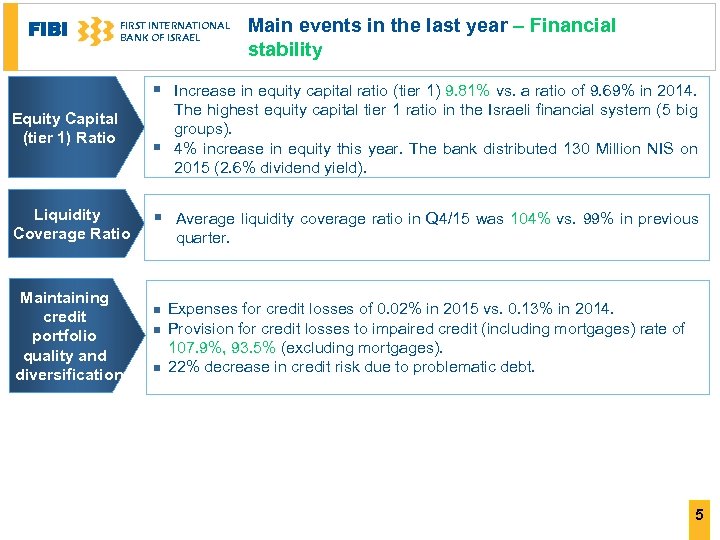

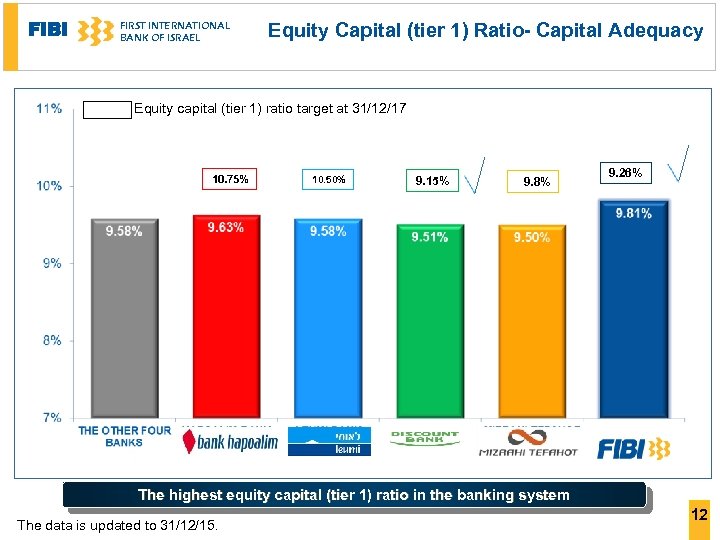

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main events in the last year – Financial stability § Increase in equity capital ratio (tier 1) 9. 81% vs. a ratio of 9. 69% in 2014. Equity Capital (tier 1) Ratio Liquidity Coverage Ratio Maintaining credit portfolio quality and diversification § The highest equity capital tier 1 ratio in the Israeli financial system (5 big groups). 4% increase in equity this year. The bank distributed 130 Million NIS on 2015 (2. 6% dividend yield). § Average liquidity coverage ratio in Q 4/15 was 104% vs. 99% in previous quarter. n n n Expenses for credit losses of 0. 02% in 2015 vs. 0. 13% in 2014. Provision for credit losses to impaired credit (including mortgages) rate of 107. 9%, 93. 5% (excluding mortgages). 22% decrease in credit risk due to problematic debt. 5

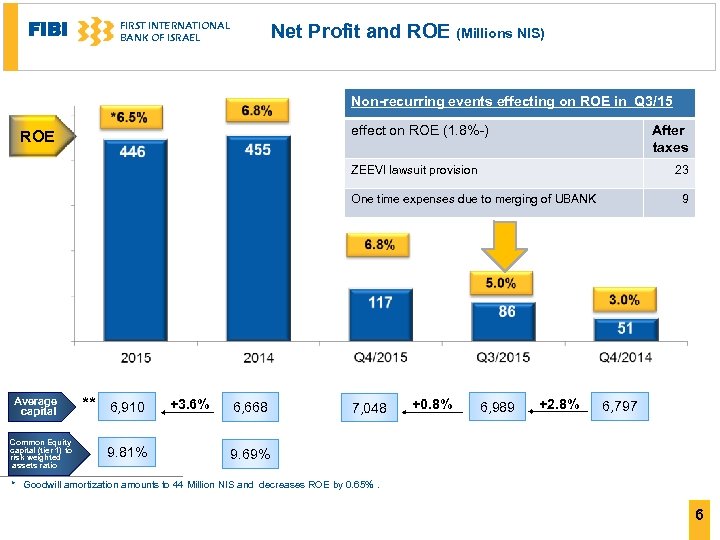

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Net Profit and ROE (Millions NIS) Non-recurring events effecting on ROE in Q 3/15 effect on ROE (1. 8%-) ROE After taxes ZEEVI lawsuit provision 23 One time expenses due to merging of UBANK Average capital Common Equity capital (tier 1) to risk weighted assets ratio ** 6, 910 9. 81% +3. 6% 6, 668 7, 048 +0. 8% 6, 989 +2. 8% 9 6, 797 9. 69% * Goodwill amortization amounts to 44 Million NIS and decreases ROE by 0. 65%. 6

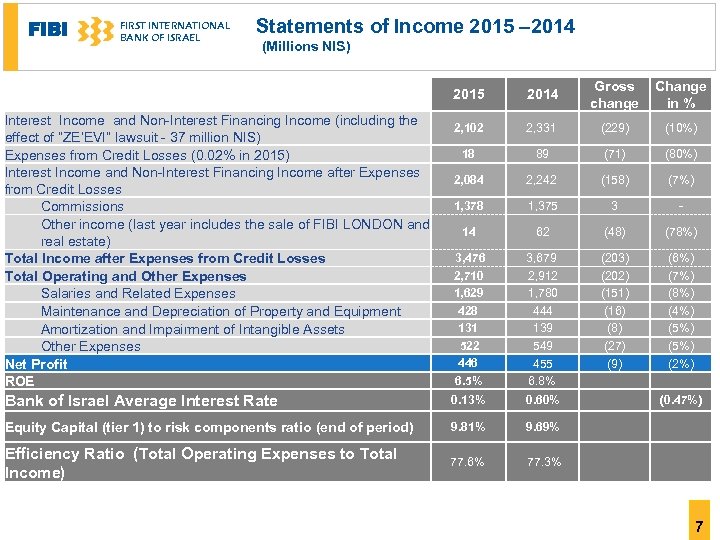

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statements of Income 2015 – 2014 (Millions NIS) 2015 2014 Gross change Change in % 2, 102 2, 331 (229) (10%) 18 89 (71) (80%) 2, 084 2, 242 (158) (7%) 1, 378 1, 375 3 - 14 62 (48) (78%) 3, 476 2, 710 1, 629 428 131 522 446 6. 5% 3, 679 2, 912 1, 780 444 139 549 455 6. 8% (203) (202) (151) (16) (8) (27) (9) (6%) (7%) (8%) (4%) (5%) (2%) Bank of Israel Average Interest Rate 0. 13% 0. 60% (0. 47%) Equity Capital (tier 1) to risk components ratio (end of period) 9. 81% 9. 69% Efficiency Ratio (Total Operating Expenses to Total Income) 77. 6% 77. 3% Interest Income and Non-Interest Financing Income (including the effect of “ZE’EVI” lawsuit - 37 million NIS) Expenses from Credit Losses (0. 02% in 2015) Interest Income and Non-Interest Financing Income after Expenses from Credit Losses Commissions Other income (last year includes the sale of FIBI LONDON and real estate) Total Income after Expenses from Credit Losses Total Operating and Other Expenses Salaries and Related Expenses Maintenance and Depreciation of Property and Equipment Amortization and Impairment of Intangible Assets Other Expenses Net Profit ROE 7

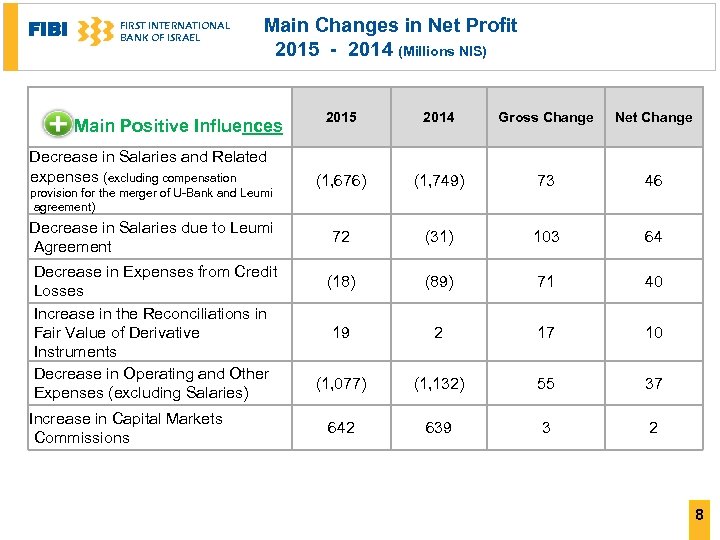

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main Changes in Net Profit 2015 - 2014 (Millions NIS) Main Positive Influences Decrease in Salaries and Related expenses (excluding compensation provision for the merger of U-Bank and Leumi agreement) Decrease in Salaries due to Leumi Agreement Decrease in Expenses from Credit Losses Increase in the Reconciliations in Fair Value of Derivative Instruments Decrease in Operating and Other Expenses (excluding Salaries) Increase in Capital Markets Commissions Gross Change Net Change השפעות חיוביות 2015 2014 (1, 676) (1, 749) 73 46 72 (31) 103 64 (18) (89) 71 40 19 2 17 10 (1, 077) (1, 132) 55 37 642 639 3 2 8

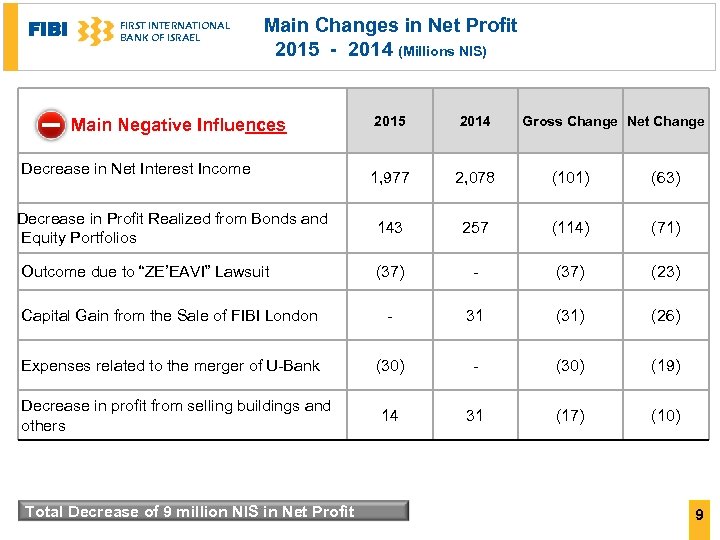

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main Changes in Net Profit 2015 - 2014 (Millions NIS) Main Negative Influences Decrease in Net Interest Income 2015 2014 השפעות שליליות Gross Change Net Change 1, 977 2, 078 (101) (63) Decrease in Profit Realized from Bonds and Equity Portfolios 143 257 (114) (71) Outcome due to “ZE’EAVI” Lawsuit (37) - (37) (23) Capital Gain from the Sale of FIBI London - 31 (31) (26) Expenses related to the merger of U-Bank (30) - (30) (19) 14 31 (17) (10) Decrease in profit from selling buildings and others Total Decrease of 9 million NIS in Net Profit 9

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Operating & Other Expenses (Millions NIS) Excluding t he effect o f LEUMI Agre ement and on time exp enses due to merging UBANK – reduced by 73 million NIS 2015 2014 202 6. 9% 151 -8. 5 % 27 - 618 - * * Includes amortization of goodwill in 2015 in respect of subsidiaries in the amount of NIS 44 million (0. 65% ROE), of which 34 NIS millions expected to be completed until 8/16 (effect of 0. 5% on ROE). 10

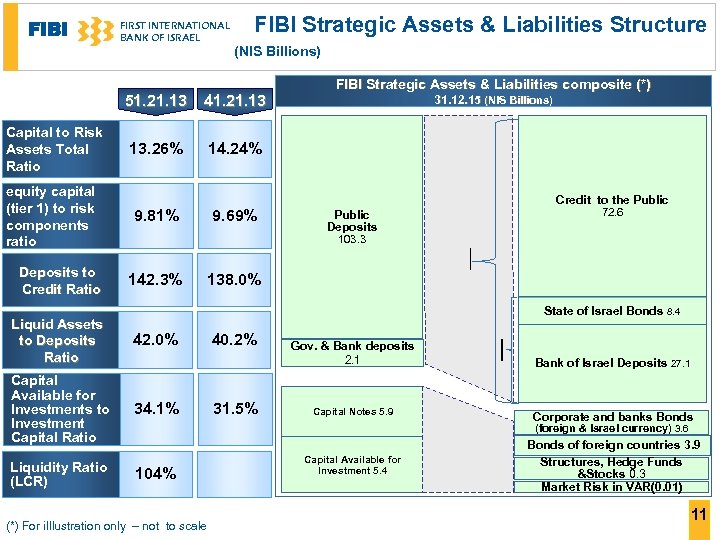

FIBI FIRST INTERNATIONAL BANK OF ISRAEL FIBI Strategic Assets & Liabilities Structure (NIS Billions) 51. 21. 13 41. 21. 13 Capital to Risk Assets Total Ratio 13. 26% 14. 24% equity capital (tier 1) to risk components ratio 9. 81% 9. 69% Deposits to Credit Ratio 142. 3% FIBI Strategic Assets & Liabilities composite (*) Credit to the Public 72. 6 Public Deposits 103. 3 138. 0% 42. 0% Capital Available for Investments to Investment Capital Ratio 34. 1% 40. 2% 31. 5% Gov. & Bank deposits 2. 1 Capital Notes 5. 9 State of Israel Bonds 8. 4 Liquid Assets to Deposits Ratio Liquidity Ratio (LCR) 31. 12. 15 (NIS Billions) Bank of Israel Deposits 27. 1 Corporate and banks Bonds (foreign & Israel currency) 3. 6 104% (*) For i. Illustration only – not to scale Capital Available for Investment 5. 4 Bonds of foreign countries 3. 9 Structures, Hedge Funds &Stocks 0. 3 Market Risk in VAR(0. 01) 11

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Equity Capital (tier 1) Ratio- Capital Adequacy Equity capital (tier 1) ratio target at 31/12/17 * 10. 75% 10. 50% 9. 15% 9. 8% 9. 26% * 14. 30% 14. 57% 13. 42% * The highest equity capital (tier 1) ratio in the banking system The data is updated to 31/12/15. 12

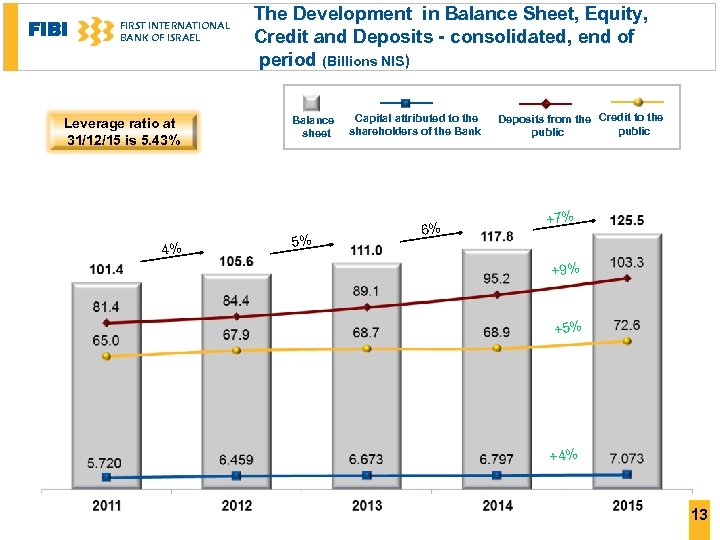

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Leverage ratio at 31/12/15 is 5. 43% 4% The Development in Balance Sheet, Equity, Credit and Deposits - consolidated, end of period (Billions NIS) Balance sheet 5% Capital attributed to the shareholders of the Bank 6% Deposits from the Credit to the public +7% +9% +5% +4% 13

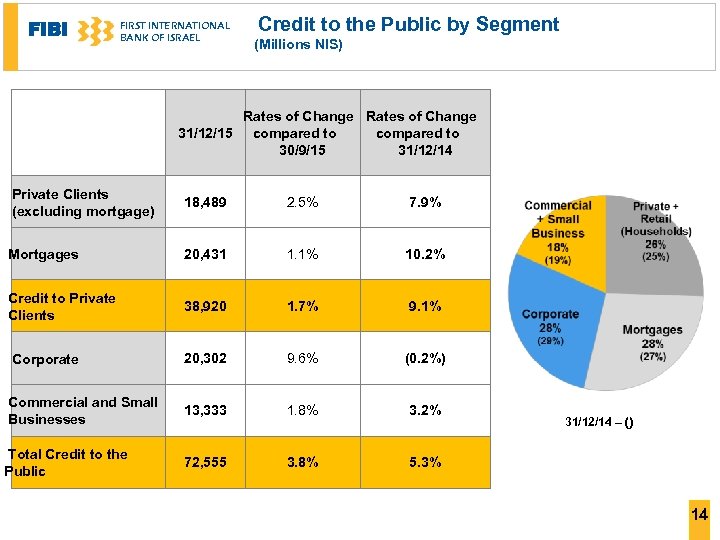

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Credit to the Public by Segment (Millions NIS) Rates of Change 31/12/15 compared to 30/9/15 31/12/14 Private Clients (excluding mortgage) 18, 489 2. 5% 7. 9% Mortgages 20, 431 1. 1% 10. 2% Credit to Private Clients 38, 920 1. 7% 9. 1% Corporate 20, 302 9. 6% (0. 2%) Commercial and Small Businesses 13, 333 1. 8% 3. 2% Total Credit to the Public 72, 555 3. 8% 5. 3% 31/12/14 – () 14

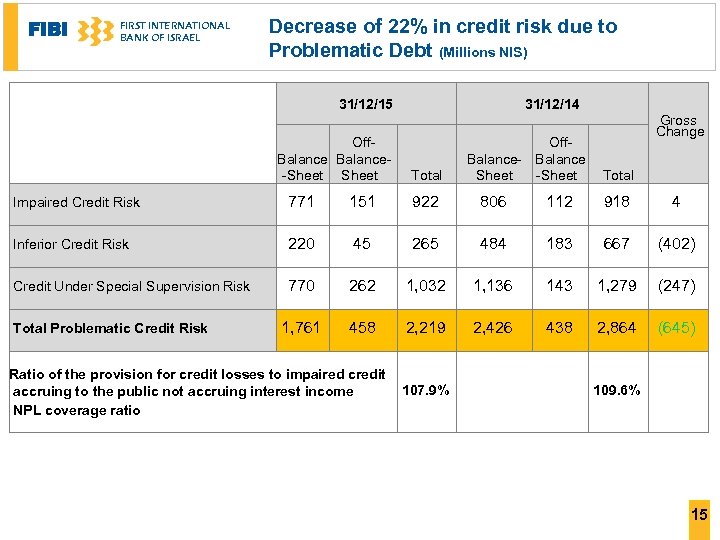

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Decrease of 22% in credit risk due to Problematic Debt (Millions NIS) 31/12/15 Off. Balance-Sheet 31/12/14 Total Off. Balance- Balance Sheet -Sheet Gross Change Total Impaired Credit Risk 771 151 922 806 112 918 4 Inferior Credit Risk 220 45 265 484 183 667 (402) Credit Under Special Supervision Risk 770 262 1, 032 1, 136 143 1, 279 (247) 1, 761 458 2, 219 2, 426 438 2, 864 (645) Total Problematic Credit Risk Ratio of the provision for credit losses to impaired credit 107. 9% accruing to the public not accruing interest income NPL coverage ratio 109. 6% 15

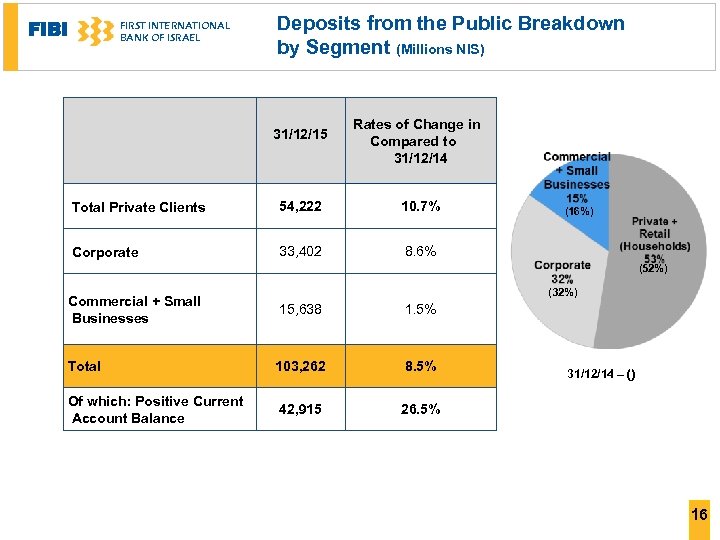

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Deposits from the Public Breakdown by Segment (Millions NIS) 31/12/15 Rates of Change in Compared to 31/12/14 Total Private Clients 54, 222 10. 7% Corporate 33, 402 8. 6% (16%) (52%) (32%) Commercial + Small Businesses 15, 638 1. 5% Total 103, 262 8. 5% Of which: Positive Current Account Balance 42, 915 26. 5% 31/12/14 – () 16

FIBI FIRST INTERNATIONAL BANK OF ISRAEL 8. 4% 273 23 Client Assets Portfolio (Deposits & Securities) present continued growth (average balances, Billions NIS) 296 11. 1% 329 9. 1% 359 30 33 continued increase in client assets portfolio. Increase of 30 Billion NIS(9%) compared to 2014. 17

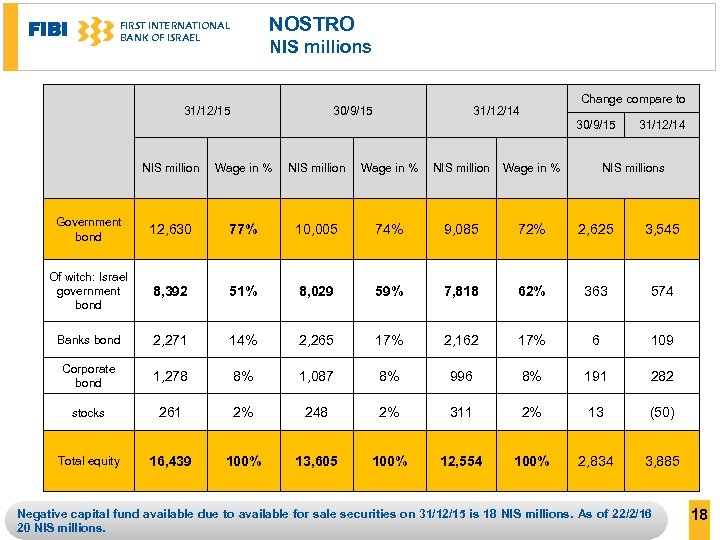

FIBI NOSTRO FIRST INTERNATIONAL BANK OF ISRAEL NIS millions 31/12/15 30/9/15 Change compare to 31/12/14 30/9/15 31/12/14 NIS million Wage in % NIS millions Government bond 12, 630 77% 10, 005 74% 9, 085 72% 2, 625 3, 545 Of witch: Israel government bond 8, 392 51% 8, 029 59% 7, 818 62% 363 574 Banks bond 2, 271 14% 2, 265 17% 2, 162 17% 6 109 Corporate bond 1, 278 8% 1, 087 8% 996 8% 191 282 stocks 261 2% 248 2% 311 2% 13 (50) Total equity 16, 439 100% 13, 605 100% 12, 554 100% 2, 834 3, 885 Negative capital fund available due to available for sale securities on 31/12/15 is 18 NIS millions. As of 22/2/16 20 NIS millions. 18

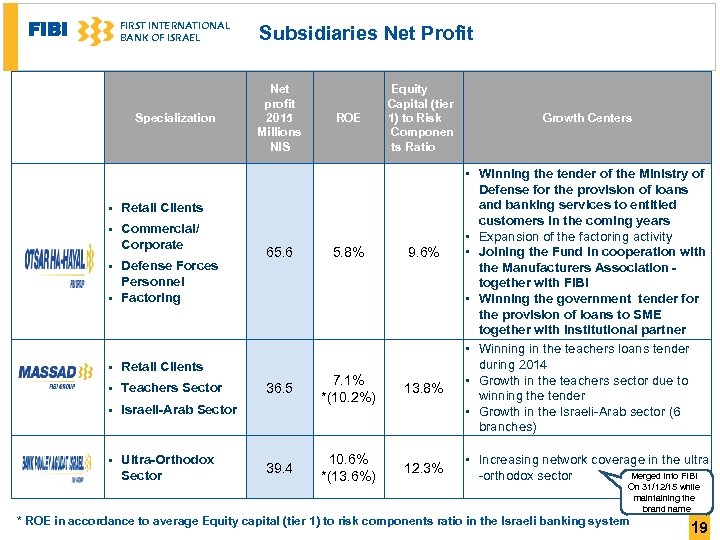

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Specialization § Commercial/ Corporate § § Defense Forces Personnel Factoring § Retail Clients § Teachers Sector § Israeli-Arab Sector § Ultra-Orthodox Sector Net profit 2015 Millions NIS ROE Equity Capital (tier 1) to Risk Componen ts Ratio Retail Clients § Subsidiaries Net Profit 65. 6 5. 8% 9. 6% 36. 5 7. 1% *(10. 2%) 13. 8% 39. 4 10. 6% *(13. 6%) 12. 3% Growth Centers • Winning the tender of the Ministry of Defense for the provision of loans and banking services to entitled customers in the coming years • Expansion of the factoring activity • Joining the Fund in cooperation with the Manufacturers Association - together with FIBI • Winning the government tender for the provision of loans to SME together with institutional partner • Winning in the teachers loans tender during 2014 • Growth in the teachers sector due to winning the tender • Growth in the Israeli-Arab sector (6 branches) • Increasing network coverage in the ultra Merged into FIBI -orthodox sector On 31/12/15 while maintaining the brand name * ROE in accordance to average Equity capital (tier 1) to risk components ratio in the Israeli banking system 19

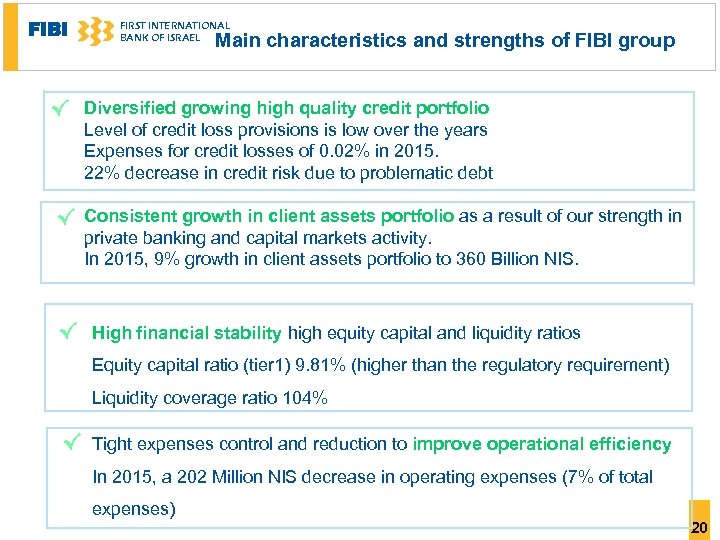

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main characteristics and strengths of FIBI group √ Diversified growing high quality credit portfolio Level of credit loss provisions is low over the years Expenses for credit losses of 0. 02% in 2015. 22% decrease in credit risk due to problematic debt √ Consistent growth in client assets portfolio as a result of our strength in private banking and capital markets activity. In 2015, 9% growth in client assets portfolio to 360 Billion NIS. √ High financial stability high equity capital and liquidity ratios Equity capital ratio (tier 1) 9. 81% (higher than the regulatory requirement) Liquidity coverage ratio 104% √ Tight expenses control and reduction to improve operational efficiency In 2015, a 202 Million NIS decrease in operating expenses (7% of total expenses) 20

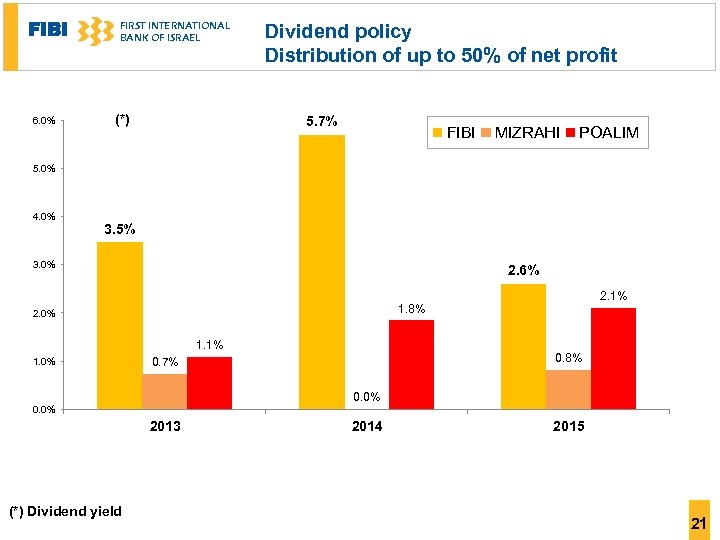

FIBI 6. 0% FIRST INTERNATIONAL BANK OF ISRAEL (*) Dividend policy Distribution of up to 50% of net profit 5. 7% FIBI MIZRAHI POALIM 5. 0% 4. 0% 3. 5% 3. 0% 2. 6% 2. 1% 1. 8% 2. 0% 1. 1% 1. 0% 0. 8% 0. 7% 0. 0% 2013 (*) Dividend yield 2014 2015 21

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Disclaimer 1. Without derogating from the generality of the conditions of use specified in the First International Bank of Israel Ltd. (the “Bank”) website, the content exhibited in this presentation has been prepared by the Bank solely for use of the Bank’s presentation of the quarterly and/or annual financial reports as well as strategic updates. 2. The content contained herein is partial and may include information and/or data that have not been independently verified by any outside entity. It is further emphasized that this presentation does not constitute an offer or invitation to purchase any securities and/or investments of any kind whatsoever. 3. This presentation should not be relied upon in connection with any transaction, contract, commitment or investment. For full and complete overview of the Bank’s financial situation and results of operation, please view the Bank’s quarterly and/or annual financial reports. 4. Neither the Bank nor any of its employees or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss and/or damages of any kind whatsoever arising, directly or indirectly, from any use of the content presented in this file or otherwise arising in connection with this file. 5. It is hereby emphasized that portions of the information exhibited herein are regarded as forecasts about the future prospects of the Bank and the actual results of the Bank may differ materially from those contemplated taking into account the various risk factors, including but notwithstanding, changes in legislation and governmental supervision policies, changing economic conditions and uncertainties which exist regarding the Bank’s business and the result of various operations. For a more accurate and detailed description see forward looking information section in the Banks financial statements. 22

563ddcfb0a15913480469215a4573991.ppt