af03ed6a1c129e96e2689cf949352719.ppt

- Количество слайдов: 18

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Overview 31. 03. 14

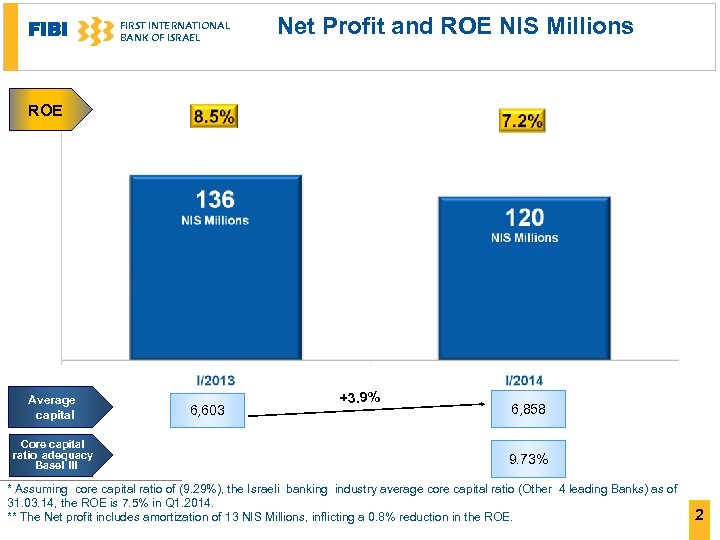

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Net Profit and ROE NIS Millions ROE 141 NIS Millions Average capital Core capital ratio adequacy Basel III 6, 603 +3. 9% 6, 858 9. 73% * Assuming core capital ratio of (9. 29%), the Israeli banking industry average core capital ratio (Other 4 leading Banks) as of 31. 03. 14, the ROE is 7. 5% in Q 1. 2014. ** The Net profit includes amortization of 13 NIS Millions, inflicting a 0. 8% reduction in the ROE. 2

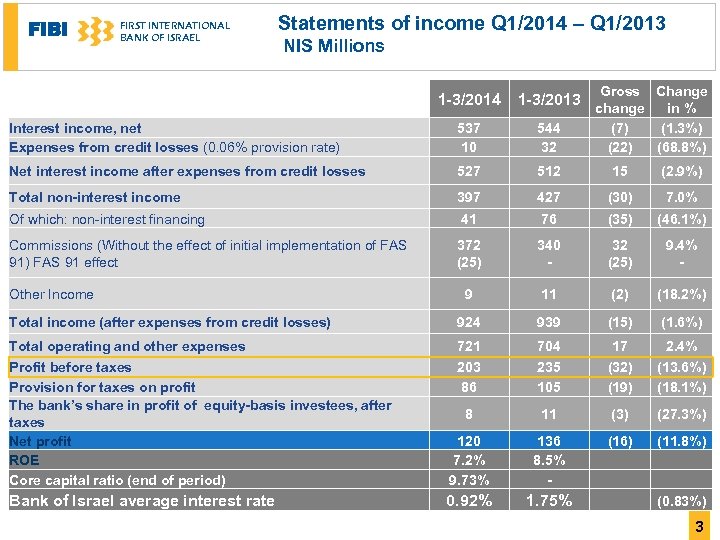

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statements of income Q 1/2014 – Q 1/2013 NIS Millions Gross Change change in % (7) (1. 3%) (22) (68. 8%) 1 -3/2014 1 -3/2013 Interest income, net Expenses from credit losses (0. 06% provision rate) 537 10 544 32 Net interest income after expenses from credit losses 527 512 15 (2. 9%) Total non-interest income 397 427 (30) 7. 0% Of which: non-interest financing 41 76 (35) (46. 1%) 372 (25) 340 - 32 (25) 9. 4% - 9 11 (2) (18. 2%) Total income (after expenses from credit losses) 924 939 (15) (1. 6%) Total operating and other expenses 721 704 17 2. 4% Profit before taxes Provision for taxes on profit The bank’s share in profit of equity-basis investees, after taxes Net profit ROE Core capital ratio (end of period) 203 86 235 105 (32) (19) (13. 6%) (18. 1%) 8 11 (3) (27. 3%) 120 7. 2% 9. 73% 136 8. 5% - (16) (11. 8%) Bank of Israel average interest rate 0. 92% 1. 75% Commissions (Without the effect of initial implementation of FAS 91) FAS 91 effect Other Income (0. 83%) 3

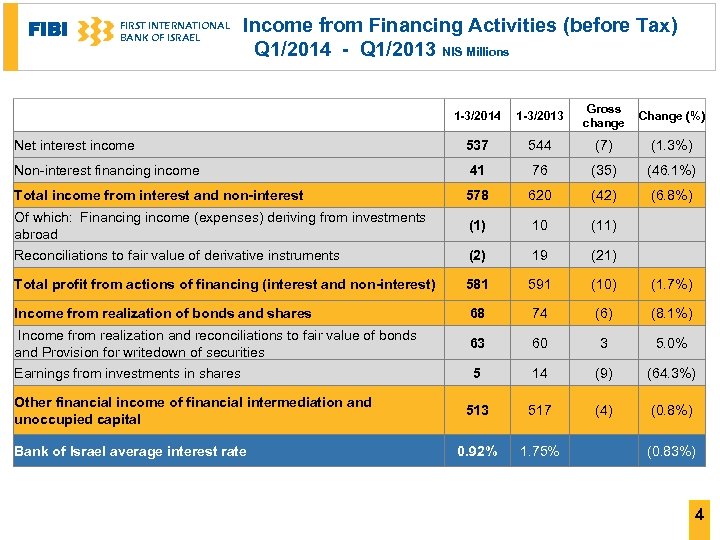

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Income from Financing Activities (before Tax) Q 1/2014 - Q 1/2013 NIS Millions 1 -3/2014 1 -3/2013 Gross change Change (%) Net interest income 537 544 (7) (1. 3%) Non-interest financing income 41 76 (35) (46. 1%) Total income from interest and non-interest 578 620 (42) (6. 8%) Of which: Financing income (expenses) deriving from investments abroad (1) 10 (11) Reconciliations to fair value of derivative instruments (2) 19 (21) Total profit from actions of financing (interest and non-interest) 581 591 (10) (1. 7%) Income from realization of bonds and shares 68 74 (6) (8. 1%) Income from realization and reconciliations to fair value of bonds and Provision for writedown of securities 63 60 3 5. 0% Earnings from investments in shares 5 14 (9) (64. 3%) 513 517 (4) (0. 8%) 0. 92% 1. 75% Other financial income of financial intermediation and unoccupied capital Bank of Israel average interest rate (0. 83%) 4

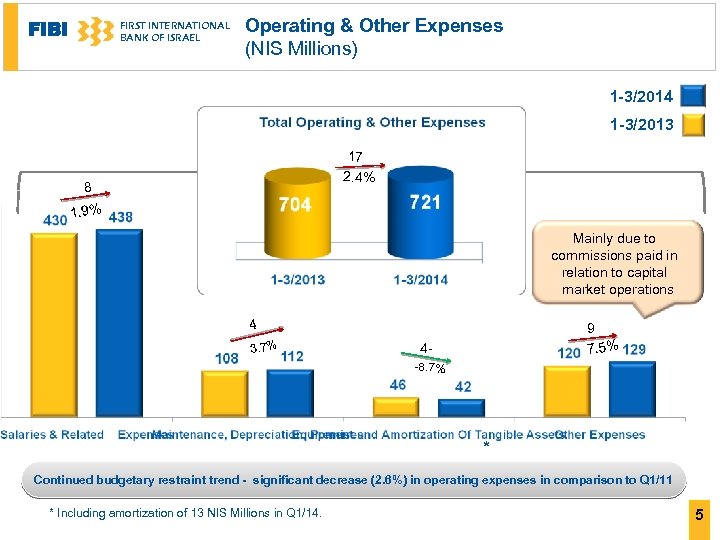

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Operating & Other Expenses (NIS Millions) 1 -3/2014 1 -3/2013 17 2. 4% 8 1. 9% Mainly due to commissions paid in relation to capital market operations 4 3. 7% 9 7. 5% 4 -8. 7% * Continued budgetary restraint trend - significant decrease (2. 6%) in operating expenses in comparison to Q 1/11 * Including amortization of 13 NIS Millions in Q 1/14. 5

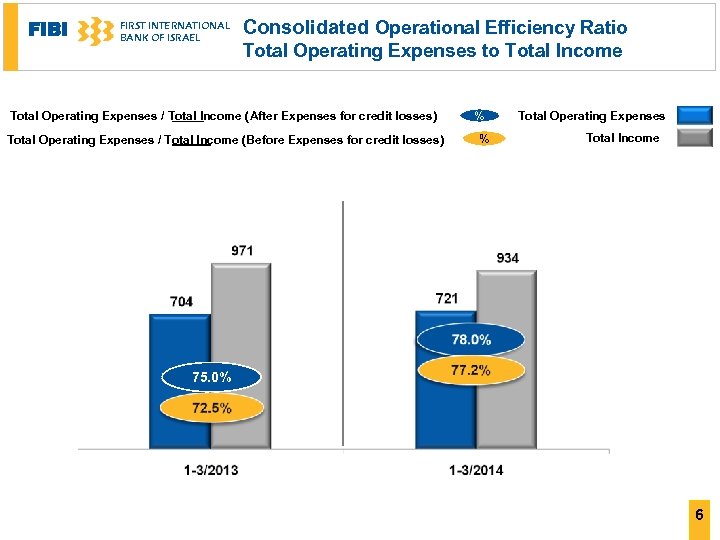

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Consolidated Operational Efficiency Ratio Total Operating Expenses to Total Income Total Operating Expenses / Total Income ( After Expenses for credit losses) Total Operating Expenses / Total Income ( Before Expenses for credit losses) % % Total Operating Expenses Total Income 75. 0% 6

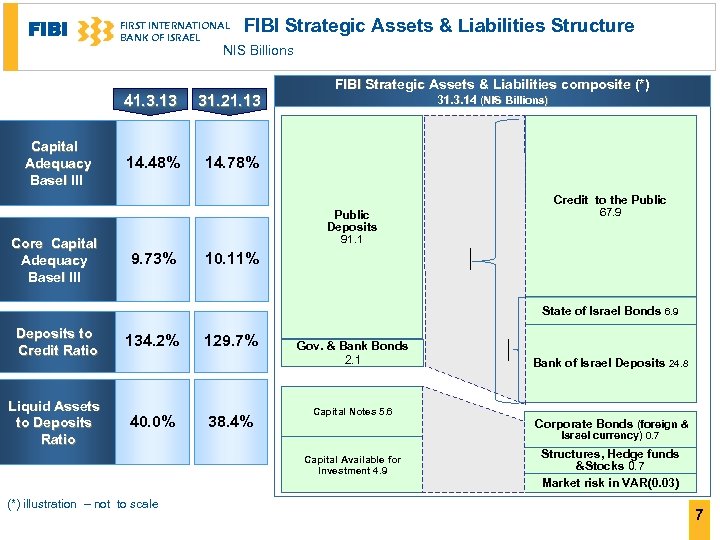

FIBI Strategic Assets & Liabilities Structure NIS Billions FIRST INTERNATIONAL BANK OF ISRAEL 41. 3. 13 Capital Adequacy Basel III 31. 21. 13 14. 48% FIBI Strategic Assets & Liabilities composite (*) 14. 78% 31. 3. 14 (NIS Billions) Credit to the Public 67. 9 Public Deposits 91. 1 9. 73% Core Capital Adequacy Basel III 10. 11% Deposits to Credit Ratio 134. 2% Liquid Assets to Deposits Ratio 40. 0% 129. 7% 38. 4% Gov. & Bank Bonds 2. 1 Bank of Israel Deposits 24. 8 Capital Notes 5. 6 Corporate Bonds (foreign & Israel currency) 0. 7 Capital Available for Investment 4. 9 (*) illustration – not to scale State of Israel Bonds 6. 9 Structures, Hedge funds &Stocks 0. 7 Market risk in VAR(0. 03) 7

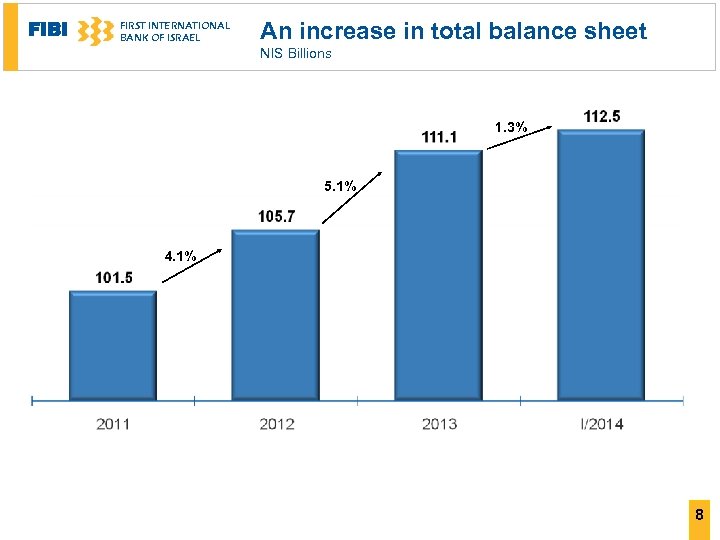

FIBI FIRST INTERNATIONAL BANK OF ISRAEL An increase in total balance sheet NIS Billions 1. 3% 5. 1% 4. 1% 8

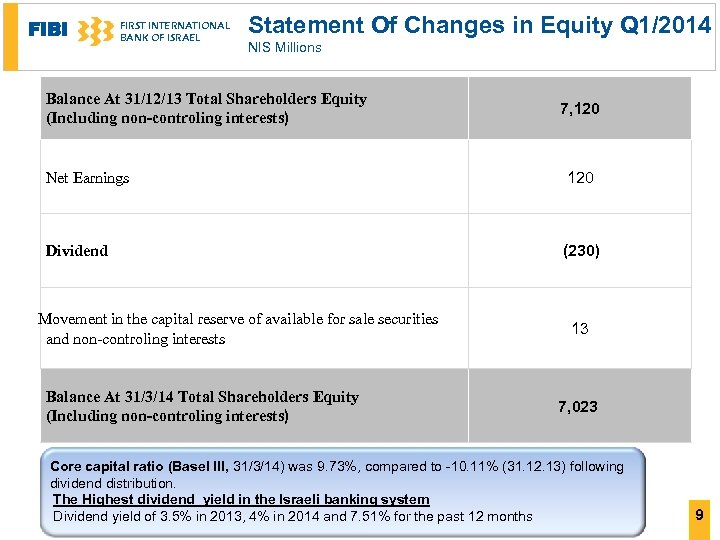

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statement Of Changes in Equity Q 1/2014 NIS Millions Balance At 31/12/13 Total Shareholders Equity (Including non-controling interests) 7, 120 Net Earnings 120 Dividend (230) Movement in the capital reserve of available for sale securities and non-controling interests Balance At 31/3/14 Total Shareholders Equity (Including non-controling interests) 13 7, 023 Core capital ratio (Basel III, 31/3/14) was 9. 73%, compared to -10. 11% (31. 12. 13) following dividend distribution. The Highest dividend yield in the Israeli banking system Dividend yield of 3. 5% in 2013, 4% in 2014 and 7. 51% for the past 12 months 9

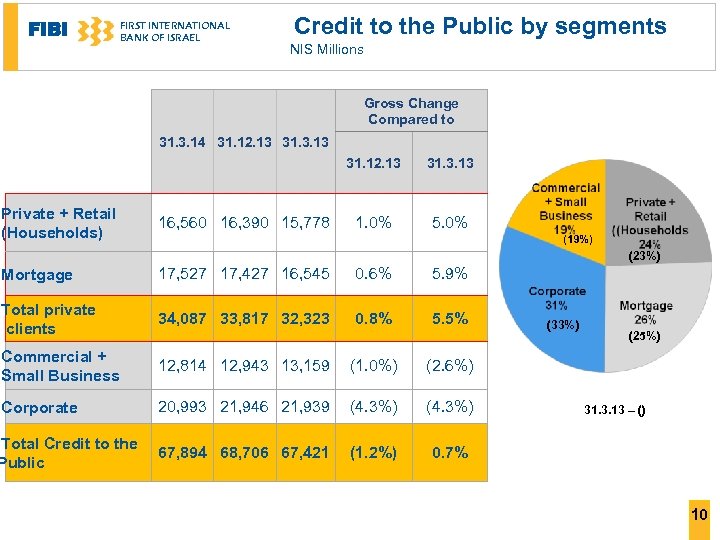

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Credit to the Public by segments NIS Millions Gross Change Compared to 31. 3. 14 31. 12. 13 31. 3. 13 31. 12. 13 Private + Retail (Households) 16, 560 16, 390 15, 778 31. 3. 13 1. 0% 5. 0% (19%) (23%) Mortgage 17, 527 17, 427 16, 545 0. 6% 5. 9% Total private clients 34, 087 33, 817 32, 323 0. 8% 5. 5% Commercial + Small Business 12, 814 12, 943 13, 159 (1. 0%) (2. 6%) Corporate 20, 993 21, 946 21, 939 (4. 3%) Total Credit to the 67, 894 68, 706 67, 421 Public (1. 2%) 0. 7% (33%) (25%) 31. 3. 13 – () 10

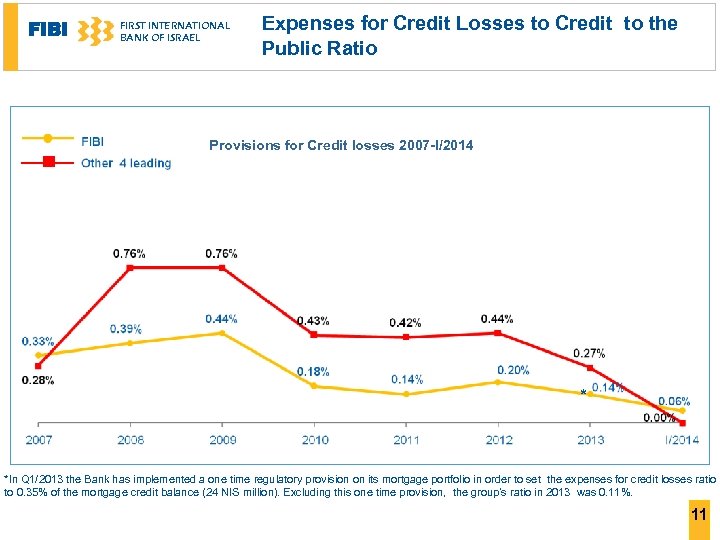

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Expenses for Credit Losses to Credit to the Public Ratio Provisions for Credit losses 2007 -I/2014 * *In Q 1/2013 the Bank has implemented a one time regulatory provision on its mortgage portfolio in order to set the expenses for credit losses ratio to 0. 35% of the mortgage credit balance (24 NIS million). Excluding this one time provision, the group’s ratio in 2013 was 0. 11%. 11

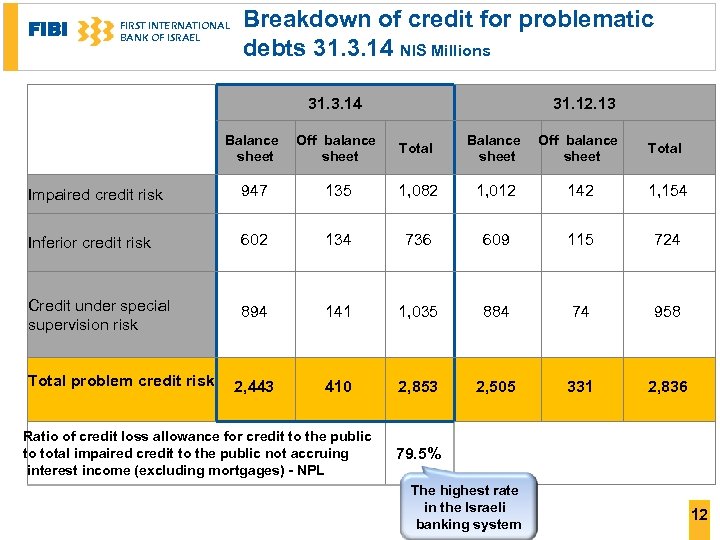

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Breakdown of credit for problematic debts 31. 3. 14 NIS Millions 31. 3. 14 Balance Off balance sheet 31. 12. 13 Total Balance Off balance sheet Total Impaired credit risk 947 135 1, 082 1, 012 142 1, 154 Inferior credit risk 602 134 736 609 115 724 Credit under special supervision risk 894 141 1, 035 884 74 958 410 2, 853 2, 505 331 2, 836 Total problem credit risk 2, 443 Ratio of credit loss allowance for credit to the public to total impaired credit to the public not accruing interest income (excluding mortgages) - NPL 79. 5% The highest rate in the Israeli banking system 12

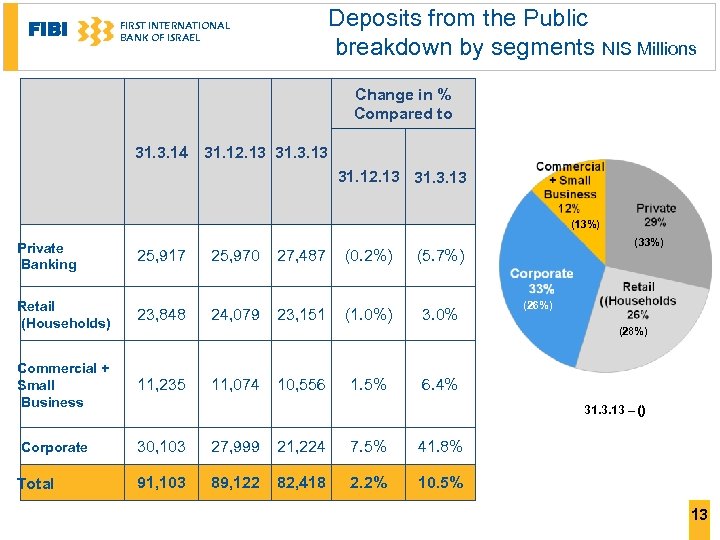

FIBI Deposits from the Public breakdown by segments NIS Millions FIRST INTERNATIONAL BANK OF ISRAEL Change in % Compared to 31. 3. 14 31. 12. 13 31. 3. 13 (13%) Private Banking 25, 917 25, 970 27, 487 (0. 2%) (5. 7%) Retail (Households) 23, 848 24, 079 23, 151 (1. 0%) 3. 0% Commercial + Small Business 11, 235 Corporate 30, 103 27, 999 21, 224 7. 5% 41. 8% 91, 103 89, 122 82, 418 2. 2% (33%) 10. 5% Total (26%) (28%) 11, 074 10, 556 1. 5% 6. 4% 31. 3. 13 – () 13

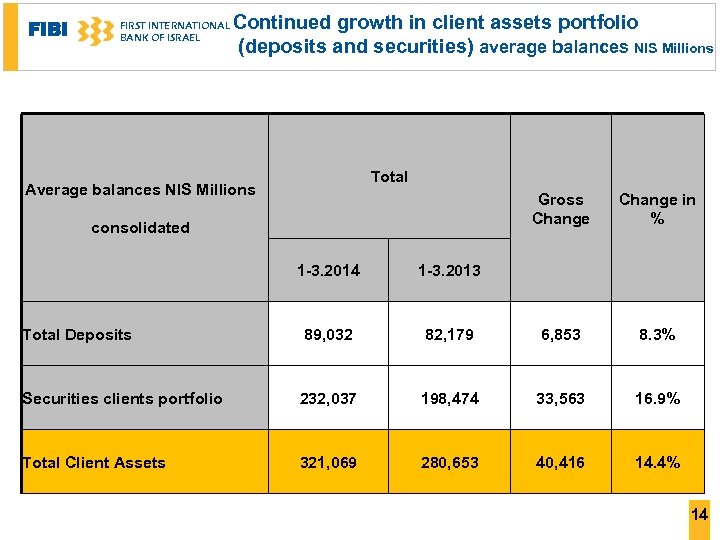

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Continued growth in client assets portfolio (deposits and securities) average balances NIS Millions Total Average balances NIS Millions Gross Change consolidated Change in % 1 -3. 2014 1 -3. 2013 Total Deposits 89, 032 82, 179 6, 853 8. 3% Securities clients portfolio 232, 037 198, 474 33, 563 16. 9% Total Client Assets 321, 069 280, 653 40, 416 14. 4% 14

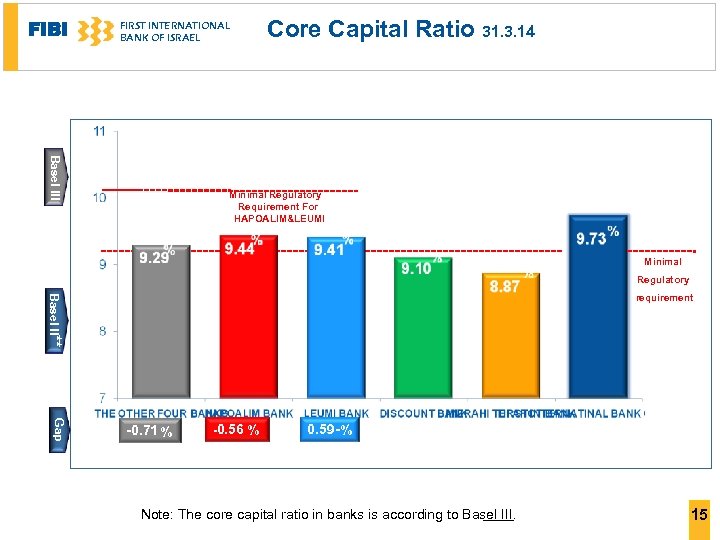

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Core Capital Ratio 31. 3. 14 Basel III * * ** Minimal Regulatory Requirement For HAPOALIM&LEUMI 14. 30% 14. 57% Minimal Regulatory Basel II** 13. 42% requirement * Gap -0. 71 % -0. 56 %* -1. 3 0. 59 - % ** Note: The core capital ratio in banks is according to Basel III. 15

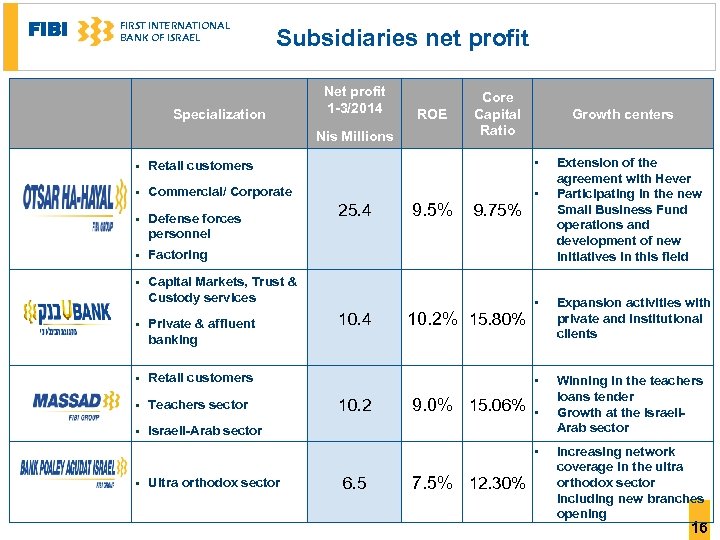

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Subsidiaries net profit Specialization Net profit 1 -3/2014 ROE Nis Millions Core Capital Ratio Growth centers § Retail customers • § Commercial/ Corporate • § Defense forces personnel § Factoring § Capital Markets, Trust & Custody services § Private & affluent banking § Teachers sector § 9. 5% 9. 75% 10. 2% 15. 80% • Expansion activities with private and institutional clients • 10. 4 Retail customers § 25. 4 Winning in the teachers loans tender Growth at the Israeli. Arab sector Israeli-Arab sector 10. 2 9. 0% 15. 06% • • § Ultra orthodox sector Extension of the agreement with Hever Participating in the new Small Business Fund operations and development of new initiatives in this field 6. 5 7. 5% 12. 30% Increasing network coverage in the ultra orthodox sector including new branches opening 16

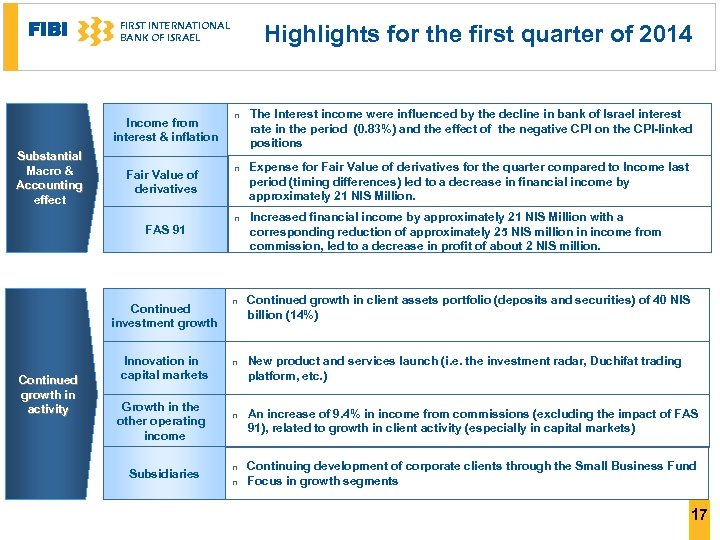

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Income from interest & inflation Substantial Macro & Accounting effect Fair Value of derivatives FAS 91 Continued investment growth Continued growth in activity Innovation in capital markets Growth in the other operating income Subsidiaries Highlights for the first quarter of 2014 n The Interest income were influenced by the decline in bank of Israel interest rate in the period (0. 83%) and the effect of the negative CPI on the CPI-linked positions n Expense for Fair Value of derivatives for the quarter compared to Income last period (timing differences) led to a decrease in financial income by approximately 21 NIS Million. n Increased financial income by approximately 21 NIS Million with a corresponding reduction of approximately 25 NIS million in income from commission, led to a decrease in profit of about 2 NIS million. n Continued growth in client assets portfolio (deposits and securities) of 40 NIS billion (14%) n New product and services launch (i. e. the investment radar, Duchifat trading platform, etc. ) n An increase of 9. 4% in income from commissions (excluding the impact of FAS 91), related to growth in client activity (especially in capital markets) n Continuing development of corporate clients through the Small Business Fund Focus in growth segments n 17

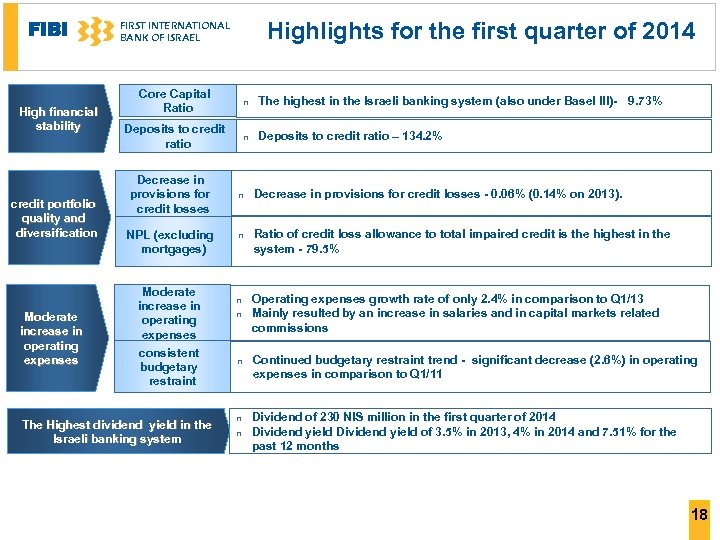

FIBI High financial stability credit portfolio quality and diversification Moderate increase in operating expenses Highlights for the first quarter of 2014 FIRST INTERNATIONAL BANK OF ISRAEL Core Capital Ratio n The highest in the Israeli banking system (also under Basel III)- 9. 73% Deposits to credit ratio n Deposits to credit ratio – 134. 2% Decrease in provisions for credit losses NPL (excluding mortgages) Moderate increase in operating expenses consistent budgetary restraint The Highest dividend yield in the Israeli banking system n Decrease in provisions for credit losses - 0. 06% (0. 14% on 2013). n Ratio of credit loss allowance to total impaired credit is the highest in the system - 79. 5% n Operating expenses growth rate of only 2. 4% in comparison to Q 1/13 Mainly resulted by an increase in salaries and in capital markets related commissions n n Continued budgetary restraint trend - significant decrease (2. 6%) in operating expenses in comparison to Q 1/11 n Dividend of 230 NIS million in the first quarter of 2014 Dividend yield of 3. 5% in 2013, 4% in 2014 and 7. 51% for the past 12 months n 18

af03ed6a1c129e96e2689cf949352719.ppt