0538c18da40057de0a90924e8039beb6.ppt

- Количество слайдов: 19

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Overview 30. 9. 15

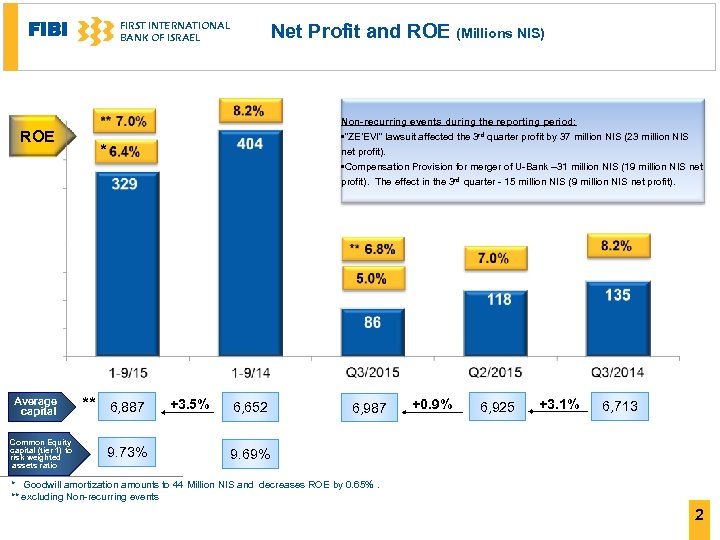

FIBI FIRST INTERNATIONAL BANK OF ISRAEL ROE Net Profit and ROE (Millions NIS) Non-recurring events during the reporting period: • “ZE’EVI” lawsuit affected the 3 rd quarter profit by 37 million NIS (23 million NIS net profit). • Compensation Provision for merger of U-Bank – 31 million NIS (19 million NIS net * profit). The effect in the 3 rd quarter - 15 million NIS (9 million NIS net profit). Average capital Common Equity capital (tier 1) to risk weighted assets ratio ** 6, 887 9. 73% +3. 5% 6, 652 6, 987 +0. 9% 6, 925 +3. 1% 6, 713 9. 69% * Goodwill amortization amounts to 44 Million NIS and decreases ROE by 0. 65%. ** excluding Non-recurring events 2

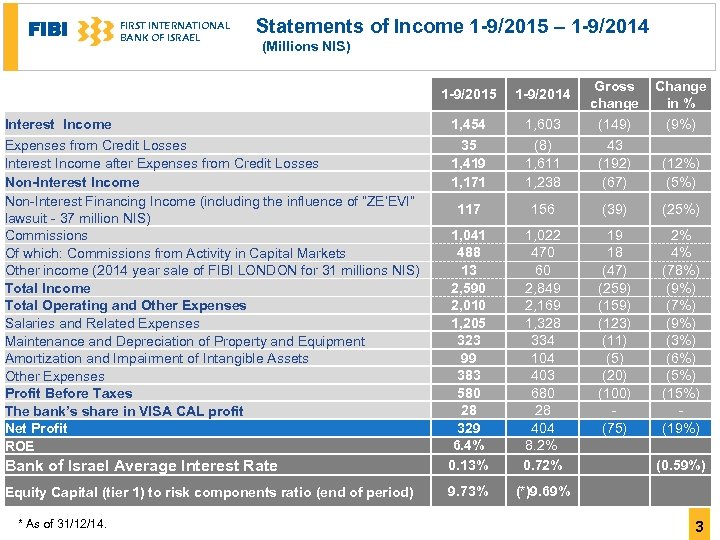

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statements of Income 1 -9/2015 – 1 -9/2014 (Millions NIS) 1, 603 Gross change (149) Change in % (9%) 35 1, 419 1, 171 (8) 1, 611 1, 238 43 (192) (67) (12%) (5%) 117 156 (39) (25%) Bank of Israel Average Interest Rate 1, 041 488 13 2, 590 2, 010 1, 205 323 99 383 580 28 329 6. 4% 0. 13% 1, 022 470 60 2, 849 2, 169 1, 328 334 104 403 680 28 404 8. 2% 0. 72% 19 18 (47) (259) (123) (11) (5) (20) (100) (75) 2% 4% (78%) (9%) (7%) (9%) (3%) (6%) (5%) (19%) (0. 59%) Equity Capital (tier 1) to risk components ratio (end of period) 9. 73% (*)9. 69% 1 -9/2015 1 -9/2014 Interest Income 1, 454 Expenses from Credit Losses Interest Income after Expenses from Credit Losses Non-Interest Income Non-Interest Financing Income (including the influence of “ZE’EVI” lawsuit - 37 million NIS) Commissions Of which: Commissions from Activity in Capital Markets Other income (2014 year sale of FIBI LONDON for 31 millions NIS) Total Income Total Operating and Other Expenses Salaries and Related Expenses Maintenance and Depreciation of Property and Equipment Amortization and Impairment of Intangible Assets Other Expenses Profit Before Taxes The bank’s share in VISA CAL profit Net Profit ROE * As of 31/12/14. 3

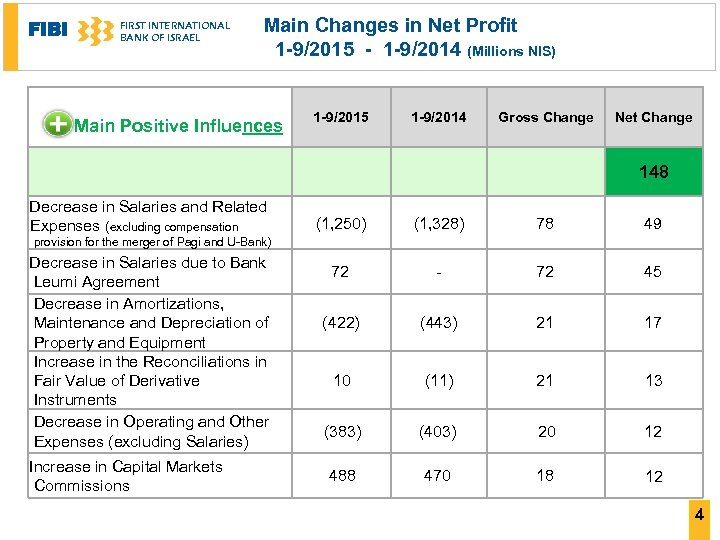

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main Changes in Net Profit 1 -9/2015 - 1 -9/2014 (Millions NIS) Gross Change Net Change השפעות חיוביות Decrease in Salaries and Related Expenses (excluding compensation 1 -9/2015 1 -9/2014 Main Positive Influences 148 (1, 250) (1, 328) 78 49 72 - 72 45 (422) (443) 21 17 10 (11) 21 13 (383) (403) 20 12 488 470 18 12 provision for the merger of Pagi and U-Bank) Decrease in Salaries due to Bank Leumi Agreement Decrease in Amortizations, Maintenance and Depreciation of Property and Equipment Increase in the Reconciliations in Fair Value of Derivative Instruments Decrease in Operating and Other Expenses (excluding Salaries) Increase in Capital Markets Commissions 4

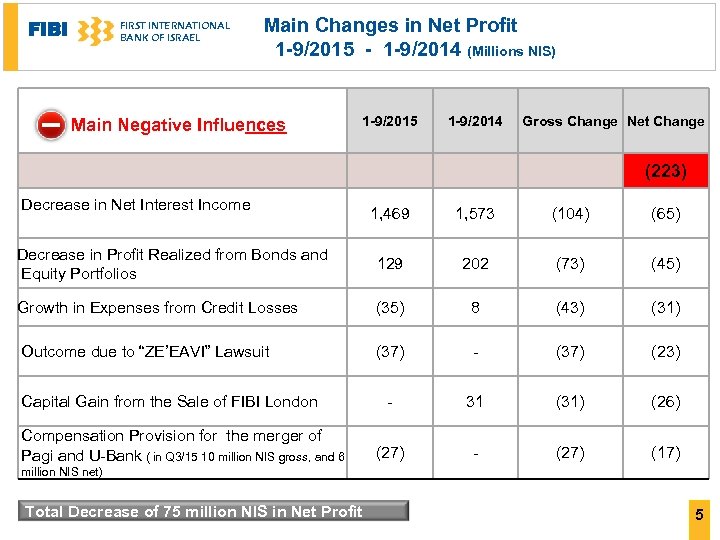

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Main Changes in Net Profit 1 -9/2015 - 1 -9/2014 (Millions NIS) Main Negative Influences 1 -9/2015 1 -9/2014 Gross Change Net Change השפעות שליליות (223) 1, 469 1, 573 (104) (65) Decrease in Profit Realized from Bonds and Equity Portfolios 129 202 (73) (45) Growth in Expenses from Credit Losses (35) 8 (43) (31) Outcome due to “ZE’EAVI” Lawsuit (37) - (37) (23) - 31 (31) (26) (27) - (27) (17) Decrease in Net Interest Income Capital Gain from the Sale of FIBI London Compensation Provision for the merger of Pagi and U-Bank ( in Q 3/15 10 million NIS gross, and 6 million NIS net) Total Decrease of 75 million NIS in Net Profit 5

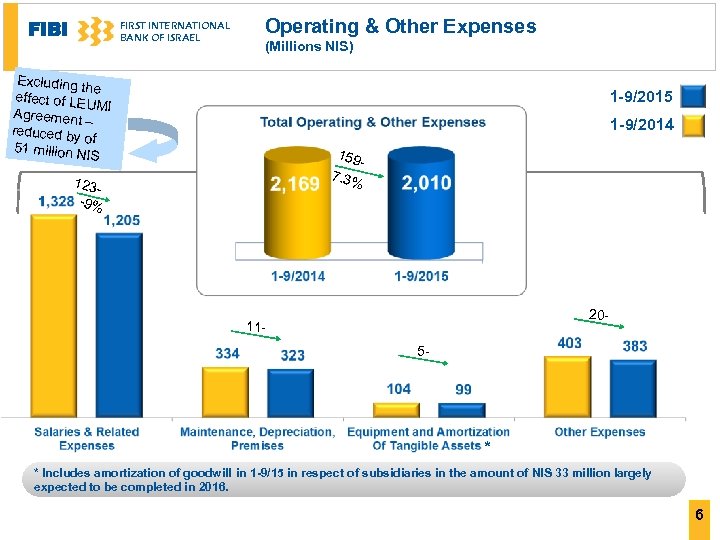

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Operating & Other Expenses (Millions NIS) Excluding t he effect of LE UMI Agreement – reduced by of 51 million N IS 1 -9/2015 1 -9/2014 159 7. 3% 123 -9% 20 - 115 - * * Includes amortization of goodwill in 1 -9/15 in respect of subsidiaries in the amount of NIS 33 million largely expected to be completed in 2016. 6

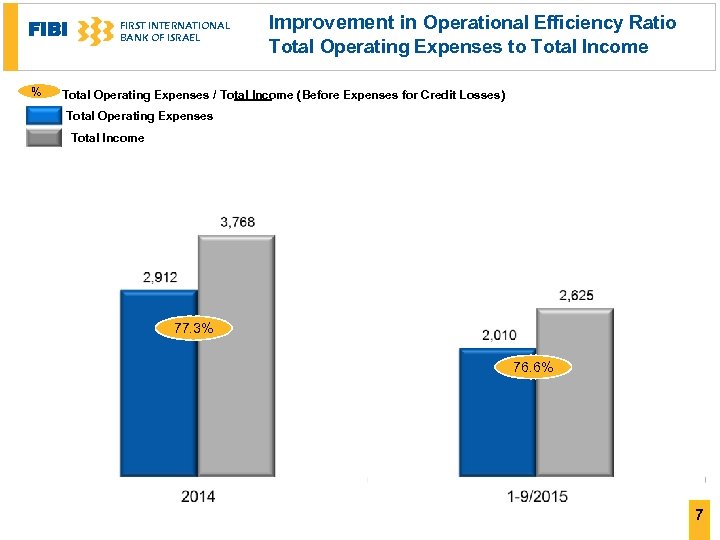

FIBI % FIRST INTERNATIONAL BANK OF ISRAEL Improvement in Operational Efficiency Ratio Total Operating Expenses to Total Income Total Operating Expenses / Total Income ( Before Expenses for Credit Losses) Total Operating Expenses Total Income 77. 3% 76. 6% 7

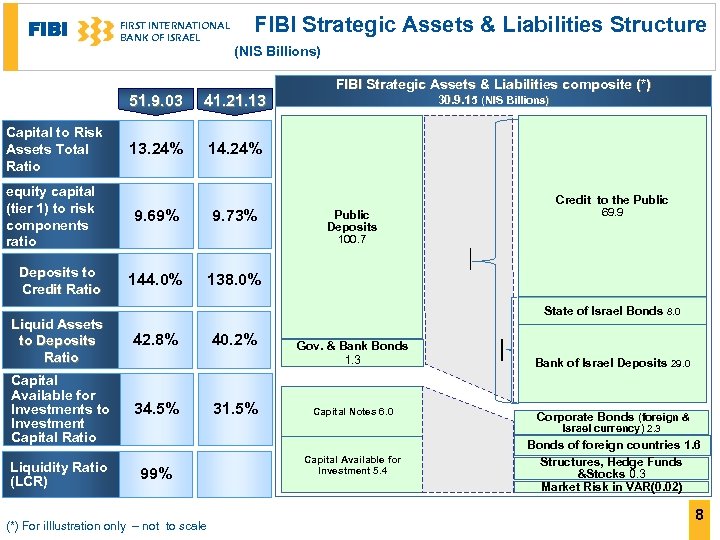

FIBI FIRST INTERNATIONAL BANK OF ISRAEL FIBI Strategic Assets & Liabilities Structure (NIS Billions) 51. 9. 03 41. 21. 13 Capital to Risk Assets Total Ratio 13. 24% 14. 24% equity capital (tier 1) to risk components ratio 9. 69% 9. 73% Deposits to Credit Ratio 144. 0% FIBI Strategic Assets & Liabilities composite (*) Credit to the Public 69. 9 Public Deposits 100. 7 138. 0% 42. 8% Capital Available for Investments to Investment Capital Ratio 34. 5% 40. 2% 31. 5% Gov. & Bank Bonds 1. 3 Capital Notes 6. 0 State of Israel Bonds 8. 0 Liquid Assets to Deposits Ratio Liquidity Ratio (LCR) 30. 9. 15 (NIS Billions) 30. . 15 (NIS Billions) Bank of Israel Deposits 29. 0 Corporate Bonds (foreign & Israel currency) 2. 3 99% (*) For i. Illustration only – not to scale Capital Available for Investment 5. 4 Bonds of foreign countries 1. 6 Structures, Hedge Funds &Stocks 0. 3 Market Risk in VAR(0. 02) 8

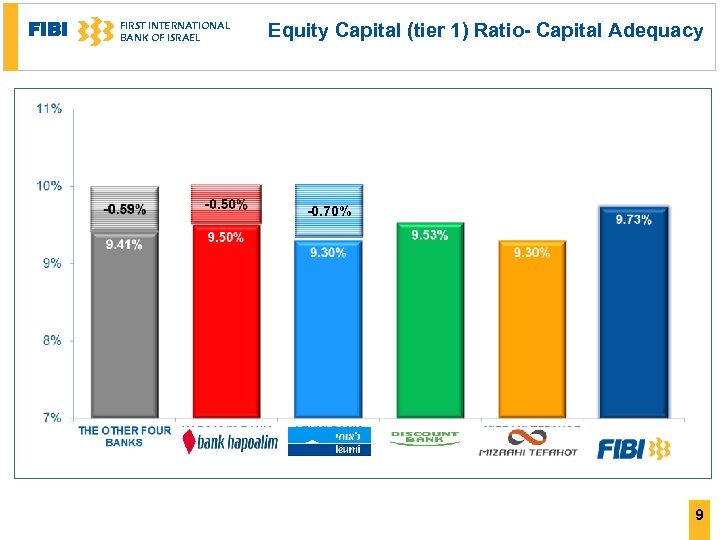

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Equity Capital (tier 1) Ratio- Capital Adequacy * * -0. 70% 14. 30% 14. 57% 13. 42% * 9

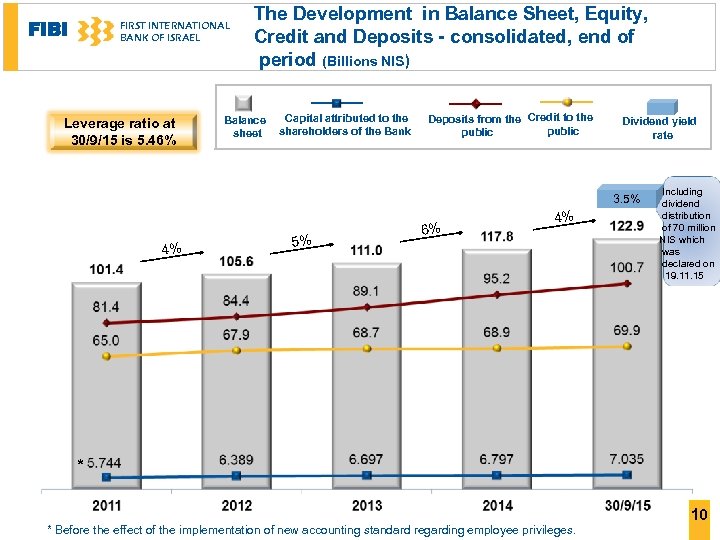

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Leverage ratio at 30/9/15 is 5. 46% The Development in Balance Sheet, Equity, Credit and Deposits - consolidated, end of period (Billions NIS) Balance Capital attributed to the shareholders of the Bank sheet Deposits from the Credit to the public Dividend yield rate 3. 5% 4% 5% 6% 4% Including dividend distribution of 70 million NIS which was declared on 19. 11. 15 * * Before the effect of the implementation of new accounting standard regarding employee privileges. 10

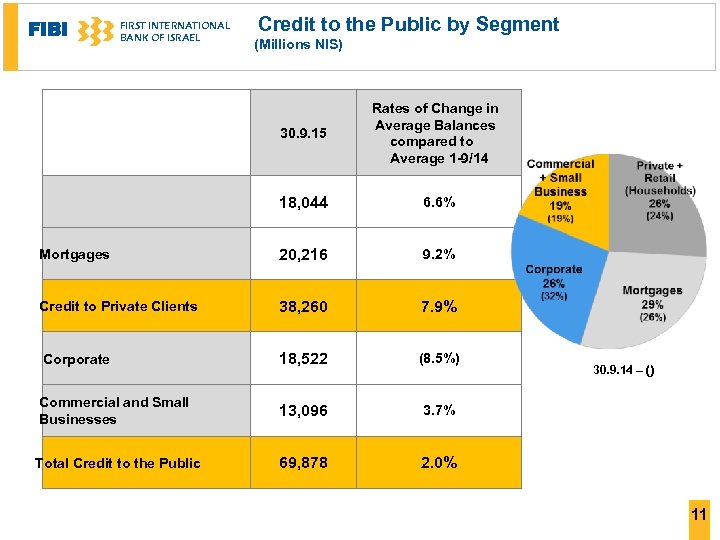

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Credit to the Public by Segment (Millions NIS) 30. 9. 15 Rates of Change in Average Balances compared to Average 1 -9/14 18, 044 6. 6% Mortgages 20, 216 9. 2% Credit to Private Clients 38, 260 7. 9% Corporate 18, 522 (8. 5%) Commercial and Small Businesses 13, 096 3. 7% Total Credit to the Public 69, 878 2. 0% 30. 9. 14 – () 11

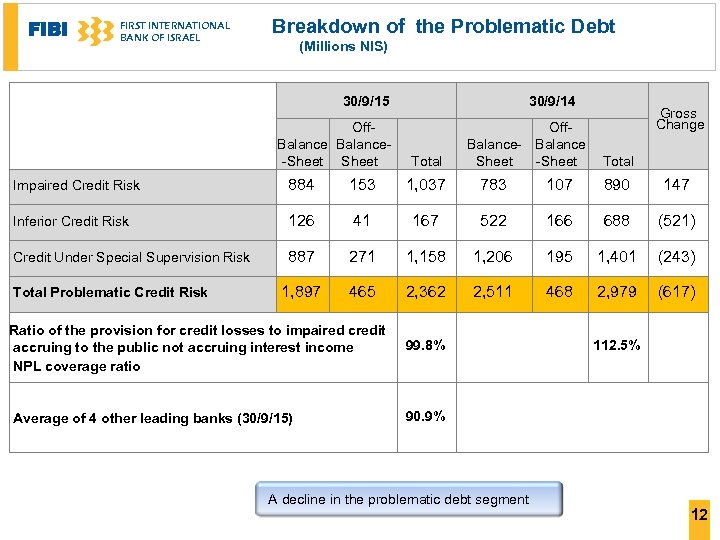

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Breakdown of the Problematic Debt (Millions NIS) 30/9/15 Off. Balance-Sheet 30/9/14 Total Off. Balance- Balance Sheet -Sheet Gross Change Total Impaired Credit Risk 884 153 1, 037 783 107 890 147 Inferior Credit Risk 126 41 167 522 166 688 (521) Credit Under Special Supervision Risk 887 271 1, 158 1, 206 195 1, 401 (243) 1, 897 465 2, 362 2, 511 468 2, 979 (617) Total Problematic Credit Risk Ratio of the provision for credit losses to impaired credit accruing to the public not accruing interest income NPL coverage ratio 99. 8% Average of 4 other leading banks (30/9/15) 90. 9% A decline in the problematic debt segment 112. 5% 12

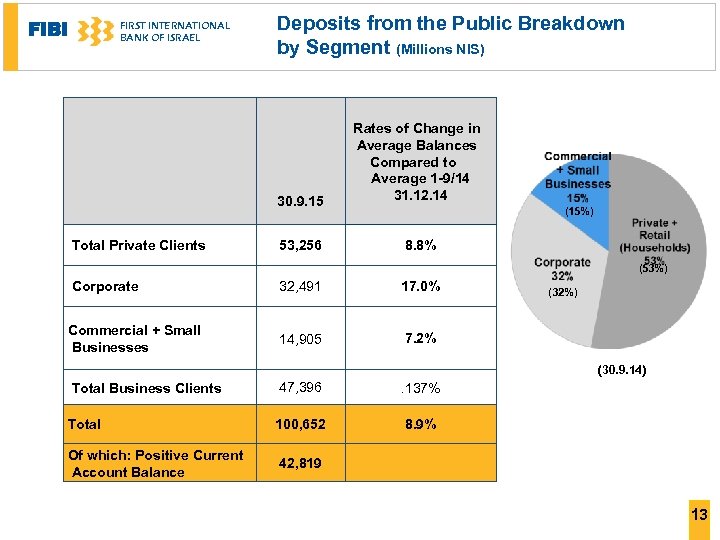

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Deposits from the Public Breakdown by Segment (Millions NIS) 30. 9. 15 Total Private Clients Rates of Change in Average Balances Compared to Average 1 -9/14 31. 12. 14 53, 256 8. 8% (15%) (53%) Corporate 32, 491 17. 0% Commercial + Small Businesses 14, 905 7. 2% (32%) (30. 9. 14) 47, 396 . 137% Total 100, 652 8. 9% Of which: Positive Current Account Balance 42, 819 Total Business Clients 13

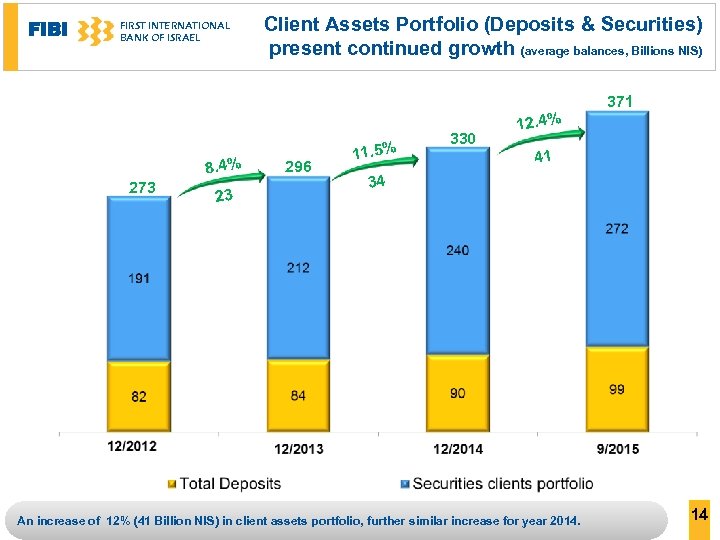

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Client Assets Portfolio (Deposits & Securities) present continued growth (average balances, Billions NIS) 371 8. 4% 273 23 296 11. 5% 330 12. 4% 41 34 An increase of 12% (41 Billion NIS) in client assets portfolio, further similar increase for year 2014. 14

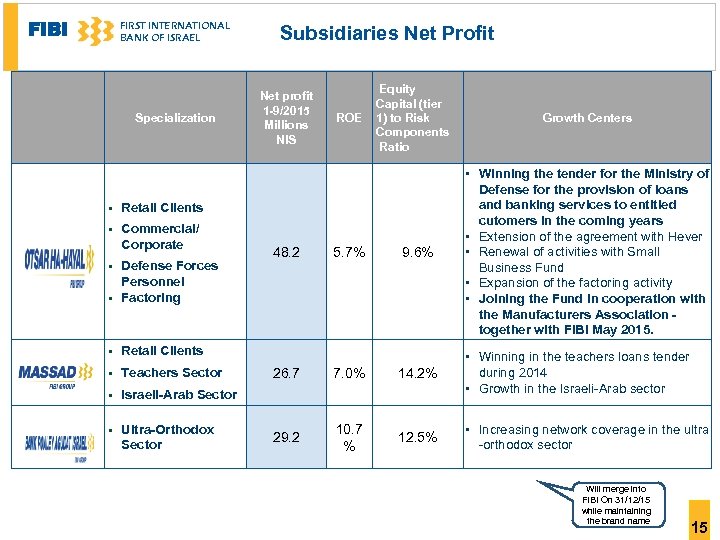

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Specialization § Commercial/ Corporate § § Defense Forces Personnel Factoring § Teachers Sector § Ultra-Orthodox Sector 48. 2 5. 7% Growth Centers 9. 6% • Winning the tender for the Ministry of Defense for the provision of loans and banking services to entitled cutomers in the coming years • Extension of the agreement with Hever • Renewal of activities with Small Business Fund • Expansion of the factoring activity • Joining the Fund in cooperation with the Manufacturers Association - together with FIBI May 2015. Israeli-Arab Sector § Equity Capital (tier 1) to Risk Components Ratio Retail Clients § Net profit 1 -9/2015 ROE Millions NIS Retail Clients § Subsidiaries Net Profit 26. 7 7. 0% 14. 2% • Winning in the teachers loans tender during 2014 • Growth in the Israeli-Arab sector 29. 2 10. 7 % 12. 5% • Increasing network coverage in the ultra -orthodox sector Will merge into FIBI On 31/12/15 while maintaining the brand name 15

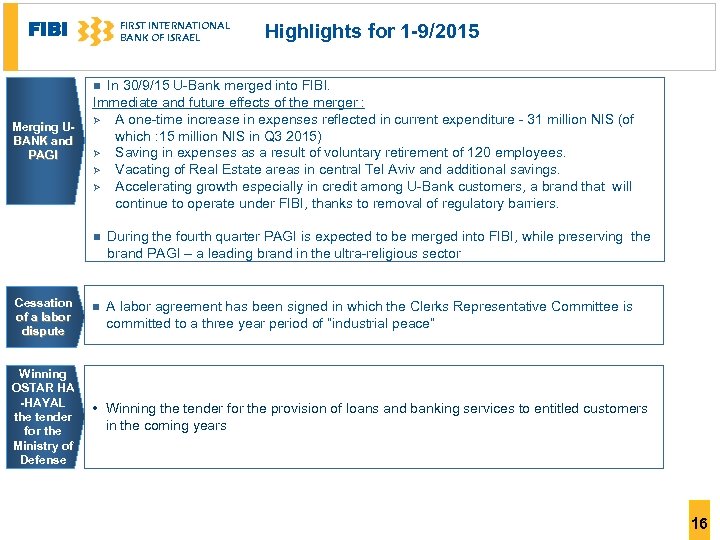

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Highlights for 1 -9/2015 In 30/9/15 U-Bank merged into FIBI. Immediate and future effects of the merger : Ø A one-time increase in expenses reflected in current expenditure - 31 million NIS (of which : 15 million NIS in Q 3 2015) Ø Saving in expenses as a result of voluntary retirement of 120 employees. Ø Vacating of Real Estate areas in central Tel Aviv and additional savings. Ø Accelerating growth especially in credit among U-Bank customers, a brand that will continue to operate under FIBI, thanks to removal of regulatory barriers. n Merging UBANK and PAGI n Cessation of a labor dispute Winning OSTAR HA -HAYAL the tender for the Ministry of Defense During the fourth quarter PAGI is expected to be merged into FIBI, while preserving the brand PAGI – a leading brand in the ultra-religious sector n A labor agreement has been signed in which the Clerks Representative Committee is committed to a three year period of “industrial peace” • Winning the tender for the provision of loans and banking services to entitled customers in the coming years 16

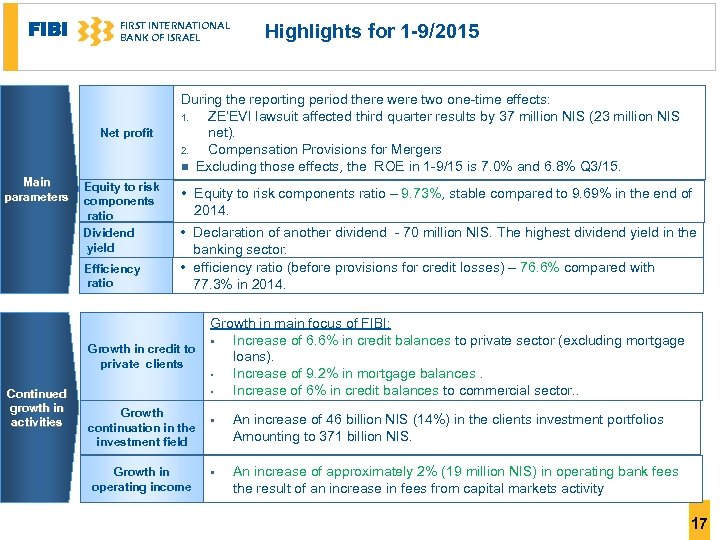

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Net profit Main parameters Equity to risk components ratio Dividend yield Efficiency ratio Continued growth in activities Highlights for 1 -9/2015 During the reporting period there were two one-time effects: 1. ZE’EVI lawsuit affected third quarter results by 37 million NIS (23 million NIS net). 2. Compensation Provisions for Mergers n Excluding those effects, the ROE in 1 -9/15 is 7. 0% and 6. 8% Q 3/15. • Equity to risk components ratio – 9. 73%, stable compared to 9. 69% in the end of 2014. • Declaration of another dividend - 70 million NIS. The highest dividend yield in the banking sector. • efficiency ratio (before provisions for credit losses) – 76. 6% compared with 77. 3% in 2014. Growth in main focus of FIBI: § Increase of 6. 6% in credit balances to private sector (excluding mortgage Growth in credit to loans). private clients • Increase of 9. 2% in mortgage balances. • Increase of 6% in credit balances to commercial sector. . Growth § continuation in the investment field Growth in operating income § An increase of 46 billion NIS (14%) in the clients investment portfolios Amounting to 371 billion NIS. An increase of approximately 2% (19 million NIS) in operating bank fees the result of an increase in fees from capital markets activity 17

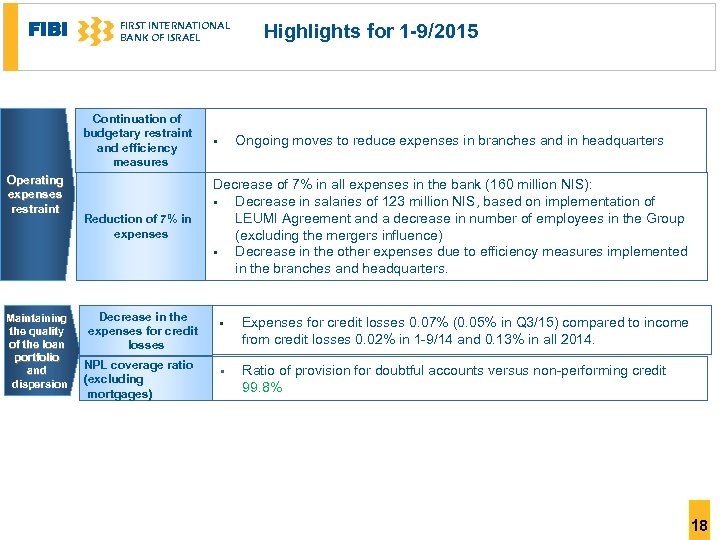

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Highlights for 1 -9/2015 Continuation of budgetary restraint and efficiency measures Operating expenses restraint Maintaining the quality of the loan portfolio and dispersion § Reduction of 7% in expenses Decrease of 7% in all expenses in the bank (160 million NIS): § Decrease in salaries of 123 million NIS, based on implementation of LEUMI Agreement and a decrease in number of employees in the Group (excluding the mergers influence) § Decrease in the other expenses due to efficiency measures implemented in the branches and headquarters. Decrease in the expenses for credit losses NPL coverage ratio (excluding mortgages) Ongoing moves to reduce expenses in branches and in headquarters § Expenses for credit losses 0. 07% (0. 05% in Q 3/15) compared to income from credit losses 0. 02% in 1 -9/14 and 0. 13% in all 2014. § Ratio of provision for doubtful accounts versus non-performing credit 99. 8% 18

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Disclaimer 1. Without derogating from the generality of the conditions of use specified in the First International Bank of Israel Ltd. (the “Bank”) website, the content exhibited in this presentation has been prepared by the Bank solely for use of the Bank’s presentation of the quarterly and/or annual financial reports as well as strategic updates. 2. The content contained herein is partial and may include information and/or data that have not been independently verified by any outside entity. It is further emphasized that this presentation does not constitute an offer or invitation to purchase any securities and/or investments of any kind whatsoever. 3. This presentation should not be relied upon in connection with any transaction, contract, commitment or investment. For full and complete overview of the Bank’s financial situation and results of operation, please view the Bank’s quarterly and/or annual financial reports. 4. Neither the Bank nor any of its employees or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss and/or damages of any kind whatsoever arising, directly or indirectly, from any use of the content presented in this file or otherwise arising in connection with this file. 5. It is hereby emphasized that portions of the information exhibited herein are regarded as forecasts about the future prospects of the Bank and the actual results of the Bank may differ materially from those contemplated taking into account the various risk factors, including but notwithstanding, changes in legislation and governmental supervision policies, changing economic conditions and uncertainties which exist regarding the Bank’s business and the result of various operations. For a more accurate and detailed description see forward looking information section in the Banks financial statements. 19

0538c18da40057de0a90924e8039beb6.ppt