66aa6def2e817cef34aecef17aa178d8.ppt

- Количество слайдов: 20

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Overview 30. 09. 14

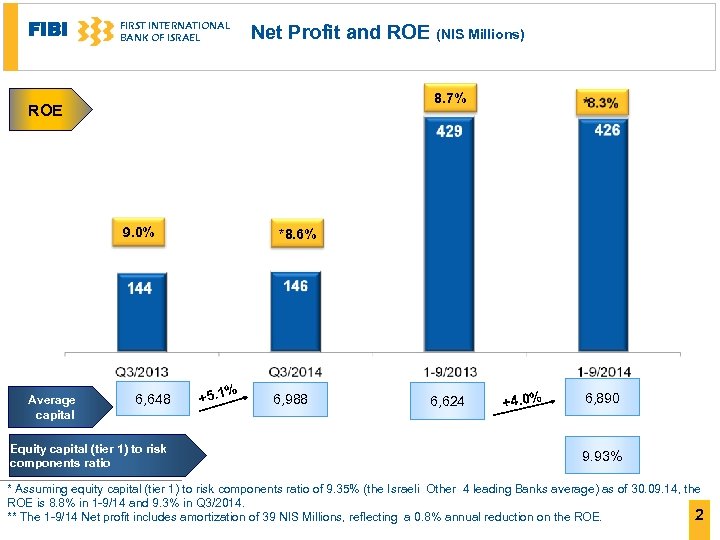

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Net Profit and ROE (NIS Millions) 8. 7% ROE 9. 0% Average capital 6, 648 Equity capital (tier 1) to risk components ratio *8. 6% % +5. 1 6, 988 6, 624 +4. 0% 6, 890 9. 93% * Assuming equity capital (tier 1) to risk components ratio of 9. 35% (the Israeli Other 4 leading Banks average) as of 30. 09. 14, the ROE is 8. 8% in 1 -9/14 and 9. 3% in Q 3/2014. 2 ** The 1 -9/14 Net profit includes amortization of 39 NIS Millions, reflecting a 0. 8% annual reduction on the ROE.

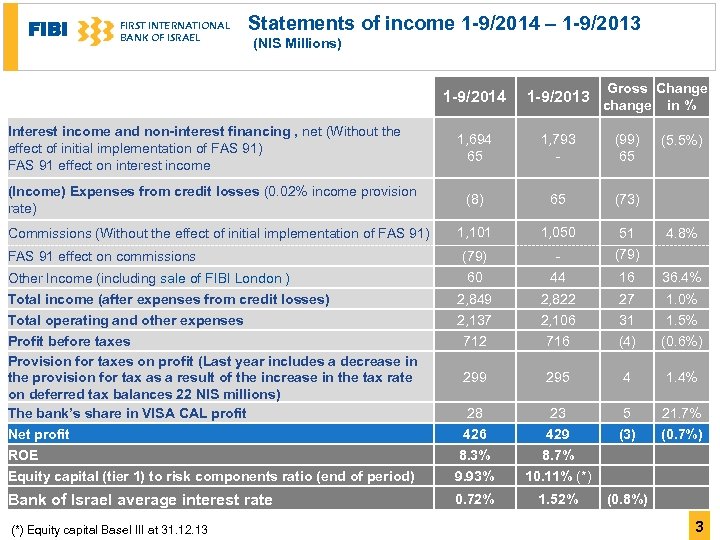

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statements of income 1 -9/2014 – 1 -9/2013 (NIS Millions) Interest income and non-interest financing , net (Without the effect of initial implementation of FAS 91) FAS 91 effect on interest income (Income) Expenses from credit losses (0. 02% income provision rate) Commissions (Without the effect of initial implementation of FAS 91) FAS 91 effect on commissions Other Income (including sale of FIBI London ) Gross Change change in % 1 -9/2014 1 -9/2013 1, 694 65 1, 793 - (99) 65 (8) 65 (73) 1, 101 1, 050 51 (79) - (79) 60 44 16 36. 4% 2, 849 2, 137 712 2, 822 2, 106 716 27 31 (4) 1. 0% 1. 5% (0. 6%) (5. 5%) 4. 8% Total income (after expenses from credit losses) Total operating and other expenses Profit before taxes Provision for taxes on profit (Last year includes a decrease in the provision for tax as a result of the increase in the tax rate on deferred tax balances 22 NIS millions) The bank’s share in VISA CAL profit Net profit ROE Equity capital (tier 1) to risk components ratio (end of period) 299 295 4 1. 4% 28 426 8. 3% 9. 93% 23 429 8. 7% 10. 11% (*) 5 (3) 21. 7% (0. 7%) Bank of Israel average interest rate 0. 72% 1. 52% (0. 8%) (*) Equity capital Basel III at 31. 12. 13 3

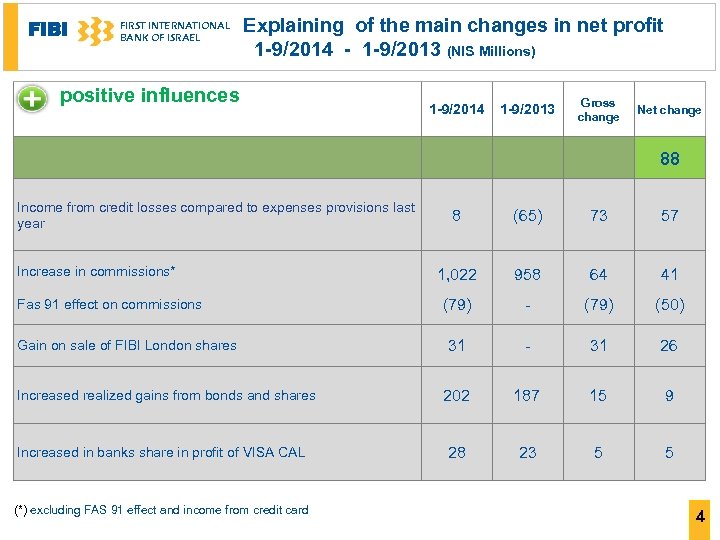

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Explaining of the main changes in net profit 1 -9/2014 - 1 -9/2013 (NIS Millions) positive influences Income from credit losses compared to expenses provisions last year Increase in commissions* Fas 91 effect on commissions Gain on sale of FIBI London shares Increased realized gains from bonds and shares Increased in banks share in profit of VISA CAL (*) excluding FAS 91 effect and income from credit card 1 -9/2014 1 -9/2013 Gross change Net change 88 8 (65) 73 57 1, 022 958 64 41 (79) - (79) (50) 31 - 31 26 202 187 15 9 28 23 5 5 4

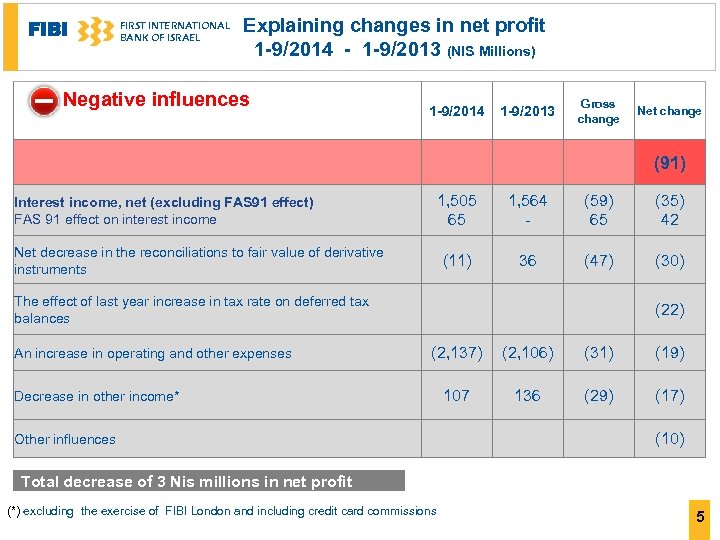

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Explaining changes in net profit 1 -9/2014 - 1 -9/2013 (NIS Millions) Negative influences Gross change 1 -9/2014 1 -9/2013 1, 505 65 1, 564 - (59) 65 (35) 42 (11) 36 (47) (30) (22) (2, 137) (2, 106) (31) (19) 107 136 (29) (17) Interest income, net (excluding FAS 91 effect) FAS 91 effect on interest income Net decrease in the reconciliations to fair value of derivative instruments The effect of last year increase in tax rate on deferred tax balances An increase in operating and other expenses Decrease in other income* Other influences Net change (91) (10) Total decrease of 3 Nis millions in net profit (*) excluding the exercise of FIBI London and including credit card commissions 5

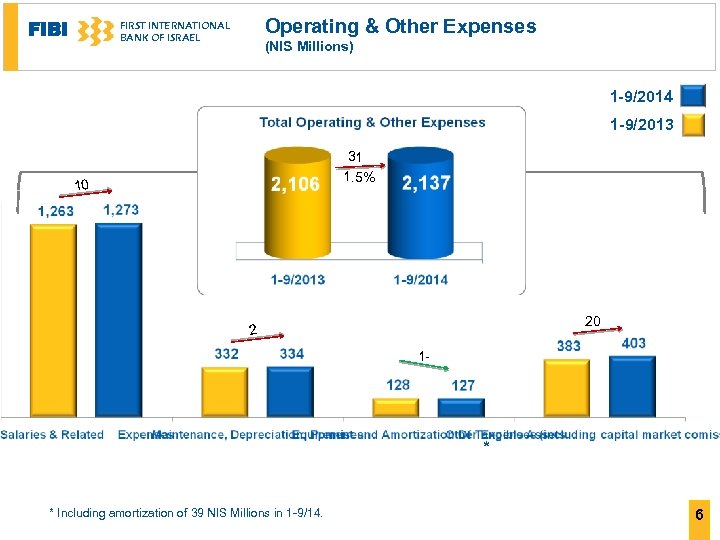

FIBI Operating & Other Expenses FIRST INTERNATIONAL BANK OF ISRAEL (NIS Millions) 1 -9/2014 1 -9/2013 31 1. 5% 10 20 2 1 - * * Including amortization of 39 NIS Millions in 1 -9/14. 6

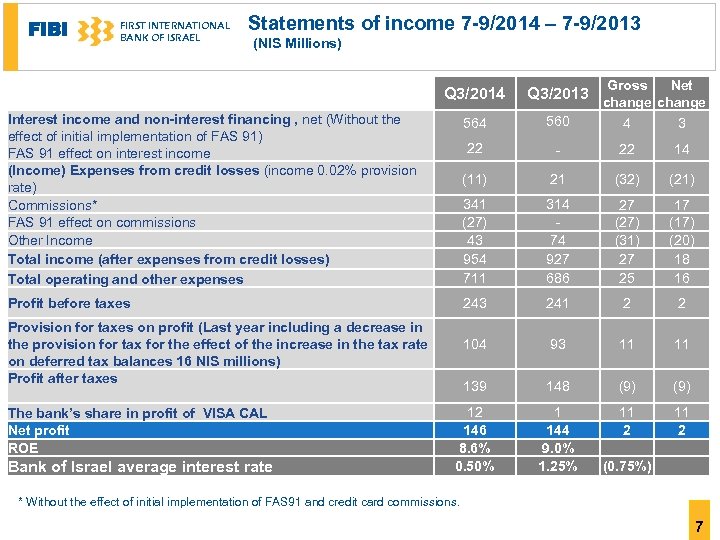

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statements of income 7 -9/2014 – 7 -9/2013 (NIS Millions) Interest income and non-interest financing , net (Without the effect of initial implementation of FAS 91) FAS 91 effect on interest income (Income) Expenses from credit losses (income 0. 02% provision rate) Commissions* FAS 91 effect on commissions Other Income Total income (after expenses from credit losses) Total operating and other expenses Profit before taxes Provision for taxes on profit (Last year including a decrease in the provision for tax for the effect of the increase in the tax rate on deferred tax balances 16 NIS millions) Profit after taxes The bank’s share in profit of VISA CAL Net profit ROE Bank of Israel average interest rate Gross Net change 4 3 Q 3/2014 Q 3/2013 564 560 22 - 22 14 (11) 21 (32) (21) 341 (27) 43 954 711 314 74 927 686 27 (27) (31) 27 25 17 (17) (20) 18 16 243 241 2 2 104 93 11 11 139 148 (9) 12 146 8. 6% 0. 50% 1 144 9. 0% 1. 25% 11 2 (0. 75%) * Without the effect of initial implementation of FAS 91 and credit card commissions. 7

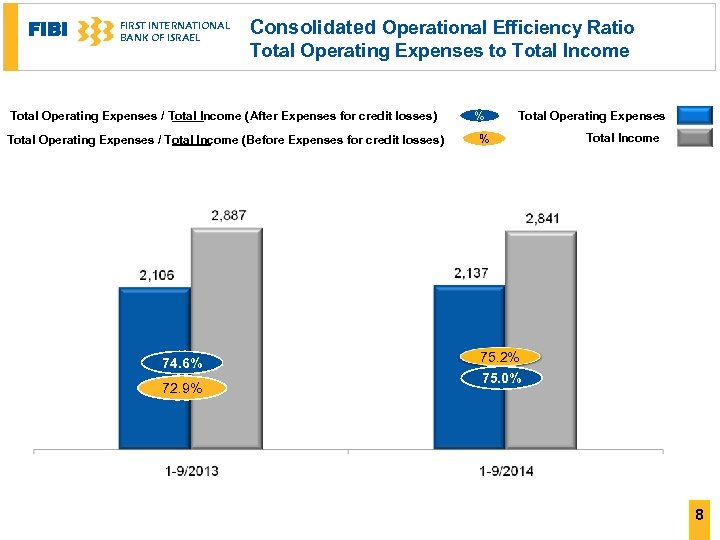

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Consolidated Operational Efficiency Ratio Total Operating Expenses to Total Income Total Operating Expenses / Total Income ( After Expenses for credit losses) Total Operating Expenses / Total Income ( Before Expenses for credit losses) 74. 6% 72. 9% % Total Operating Expenses % Total Income 75. 2% 75. 0% 8

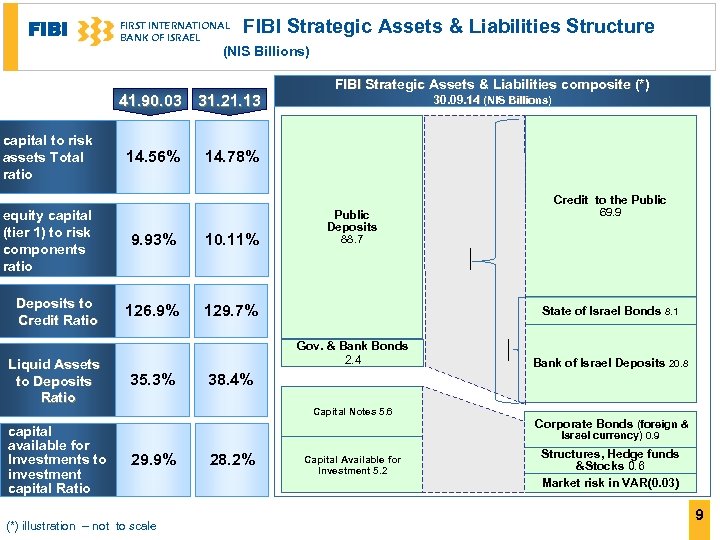

FIBI FIRST INTERNATIONAL BANK OF ISRAEL FIBI Strategic Assets & Liabilities Structure (NIS Billions) 41. 90. 03 capital to risk assets Total ratio 31. 21. 13 14. 56% FIBI Strategic Assets & Liabilities composite (*) 14. 78% 30. 09. 14 (NIS Billions) Credit to the Public 10. 11% Deposits to Credit Ratio 126. 9% 129. 7% Liquid Assets to Deposits Ratio capital available for Investments to investment capital Ratio 88. 7 State of Israel Bonds 8. 1 Gov. & Bank Bonds 2. 4 35. 3% 9. 93% 69. 9 equity capital (tier 1) to risk components ratio Public Deposits Bank of Israel Deposits 20. 8 38. 4% Capital Notes 5. 6 Corporate Bonds (foreign & Israel currency) 0. 9 29. 9% (*) illustration – not to scale 28. 2% Capital Available for Investment 5. 2 Structures, Hedge funds &Stocks 0. 6 Market risk in VAR(0. 03) 9

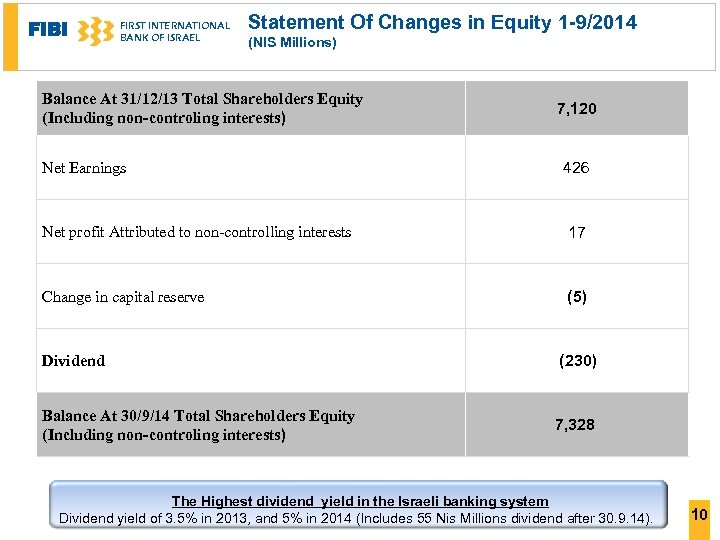

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Statement Of Changes in Equity 1 -9/2014 (NIS Millions) Balance At 31/12/13 Total Shareholders Equity (Including non-controling interests) 7, 120 Net Earnings 426 Net profit Attributed to non-controlling interests 17 Change in capital reserve (5) Dividend (230) Balance At 30/9/14 Total Shareholders Equity (Including non-controling interests) 7, 328 The Highest dividend yield in the Israeli banking system Dividend yield of 3. 5% in 2013, and 5% in 2014 (Includes 55 Nis Millions dividend after 30. 9. 14). 10

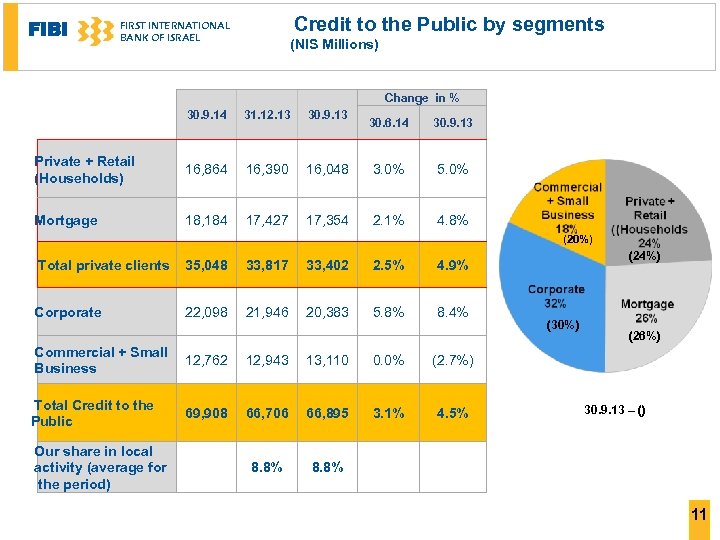

FIBI Credit to the Public by segments FIRST INTERNATIONAL BANK OF ISRAEL (NIS Millions) Change in % 30. 9. 14 31. 12. 13 30. 9. 13 Private + Retail (Households) 16, 864 16, 390 Mortgage 18, 184 17, 427 30. 6. 14 30. 9. 13 16, 048 3. 0% 5. 0% 17, 354 2. 1% 4. 8% (20%) Total private clients 35, 048 33, 817 33, 402 2. 5% Corporate 22, 098 21, 946 20, 383 5. 8% 8. 4% (24%) 4. 9% Commercial + Small 12, 762 Business 12, 943 13, 110 0. 0% 66, 706 66, 895 3. 1% 4. 5% 8. 8% (26%) (2. 7%) Total Credit to the Public (30%) 8. 8% Our share in local activity (average for the period) 69, 908 30. 9. 13 – () 11

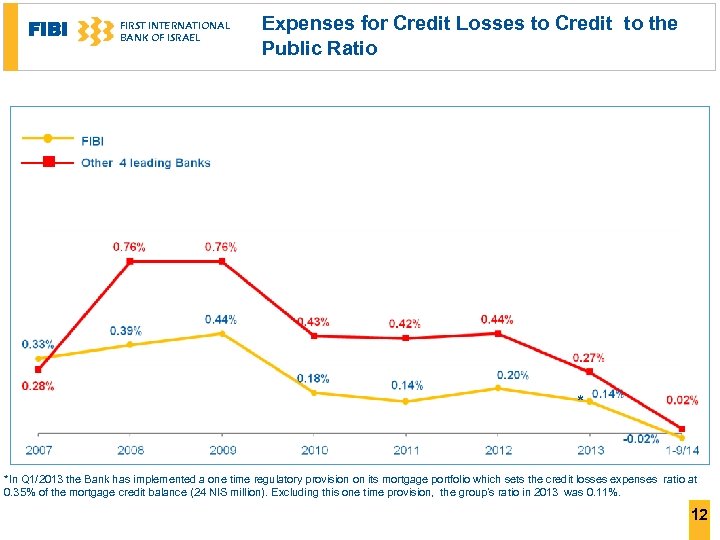

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Expenses for Credit Losses to Credit to the Public Ratio * *In Q 1/2013 the Bank has implemented a one time regulatory provision on its mortgage portfolio which sets the credit losses expenses ratio at 0. 35% of the mortgage credit balance (24 NIS million). Excluding this one time provision, the group’s ratio in 2013 was 0. 11%. 12

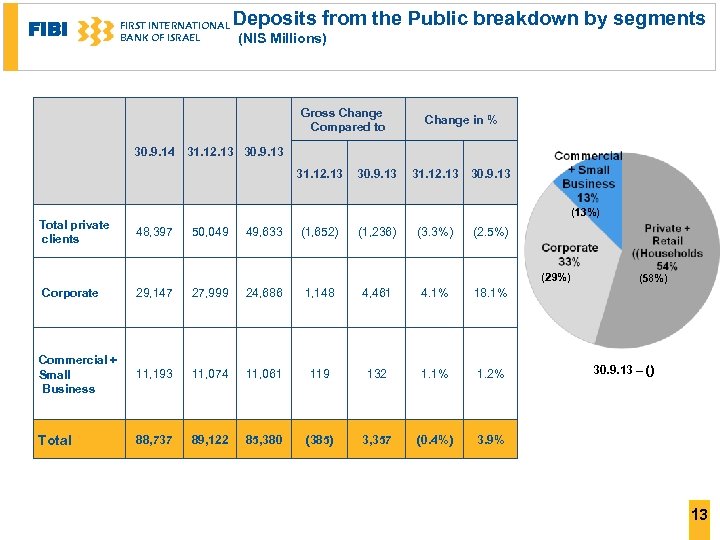

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Deposits from the Public breakdown by segments (NIS Millions) Gross Change Compared to 30. 9. 14 Change in % 31. 12. 13 30. 9. 13 (13%) Total private clients 48, 397 50, 049 49, 633 (1, 652) (1, 236) (3. 3%) (2. 5%) (29%) Corporate 29, 147 27, 999 24, 686 1, 148 4, 461 4. 1% 18. 1% Commercial + Small Business 11, 193 11, 074 11, 061 119 132 1. 1% 1. 2% 88, 737 89, 122 85, 380 (385) 3, 357 (0. 4%) (58%) 3. 9% Total 30. 9. 13 – () 13

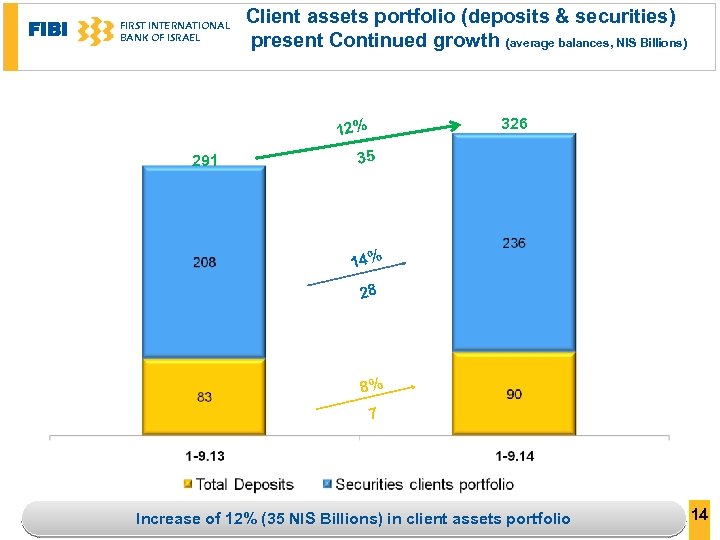

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Client assets portfolio (deposits & securities) present Continued growth (average balances, NIS Billions) 326 12% 291 35 14% 28 8% 7 Increase of 12% (35 NIS Billions) in client assets portfolio 14

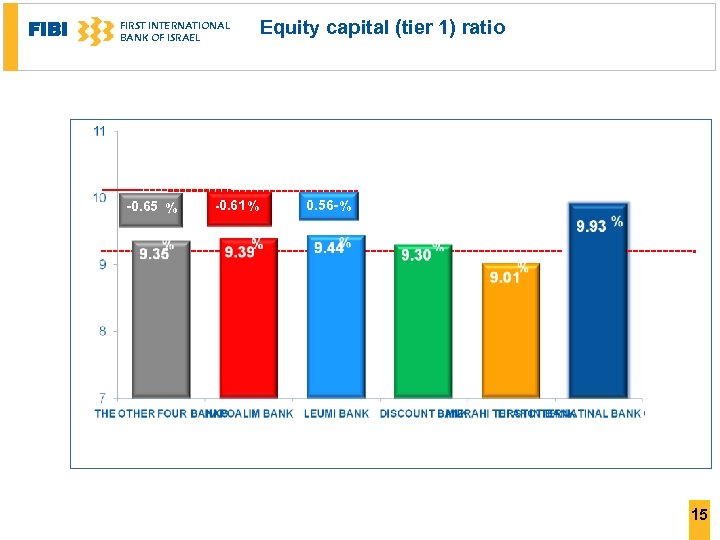

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Equity capital (tier 1) ratio * -0. 65 % -0. 61 %* * -1. 3 0. 56 - % 14. 30% ** 14. 57% 13. 42% * % 15

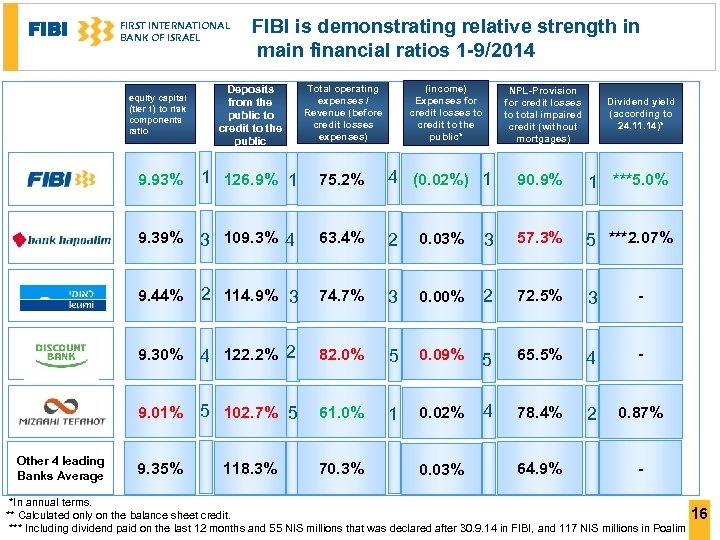

FIBI FIRST INTERNATIONAL BANK OF ISRAEL FIBI is demonstrating relative strength in main financial ratios 1 -9/2014 Deposits from the public to credit to the public Total operating expenses / Revenue (before credit losses expenses) 9. 93% 1 126. 9% 1 75. 2% 4 (0. 02%) 1 90. 9% 1 ***5. 0% 9. 39% 3 109. 3% 4 63. 4% 2 0. 03% 3 57. 3% 5 ***2. 07% 9. 44% 2 114. 9% 3 74. 7% 3 0. 00% 2 72. 5% 3 - 9. 30% 4 122. 2% 2 82. 0% 5 0. 09% 5 65. 5% 4 - 9. 01% 5 102. 7% 5 61. 0% 1 0. 02% 4 78. 4% 2 0. 87% 9. 35% 118. 3% 70. 3% equity capital (tier 1) to risk components ratio Other 4 leading Banks Average (income) Expenses for credit losses to credit to the public* 0. 03% NPL-Provision for credit losses to total impaired credit (without mortgages) 64. 9% Dividend yield (according to 24. 11. 14)* - *In annual terms. ** Calculated only on the balance sheet credit. *** Including dividend paid on the last 12 months and 55 NIS millions that was declared after 30. 9. 14 in FIBI, and 117 NIS millions in Poalim 16

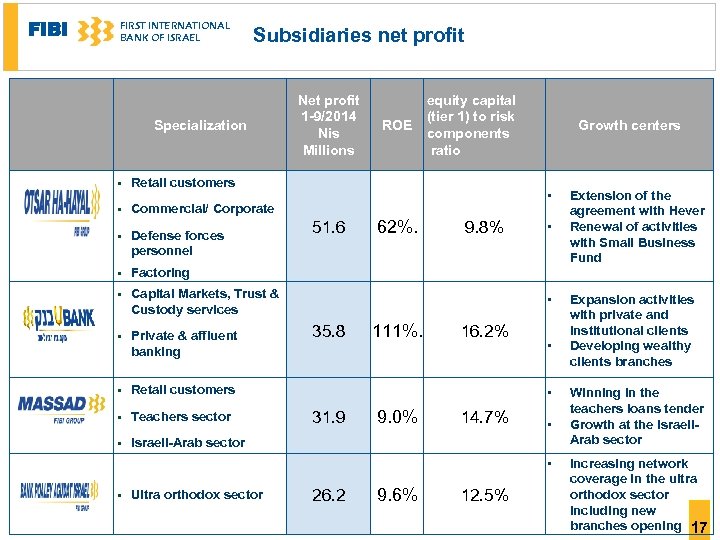

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Subsidiaries net profit Specialization § Commercial/ Corporate § Defense forces personnel § Capital Markets, Trust & Custody services § Private & affluent banking § Retail customers § Teachers sector § Growth centers Factoring § equity capital (tier 1) to risk components ratio Retail customers § Net profit 1 -9/2014 ROE Nis Millions Israeli-Arab sector • 51. 6 62%. 9. 8% • • 35. 8 111%. 16. 2% • • 31. 9 9. 0% 14. 7% • • § Ultra orthodox sector 26. 2 9. 6% 12. 5% Extension of the agreement with Hever Renewal of activities with Small Business Fund Expansion activities with private and institutional clients Developing wealthy clients branches Winning in the teachers loans tender Growth at the Israeli. Arab sector Increasing network coverage in the ultra orthodox sector including new branches opening 17

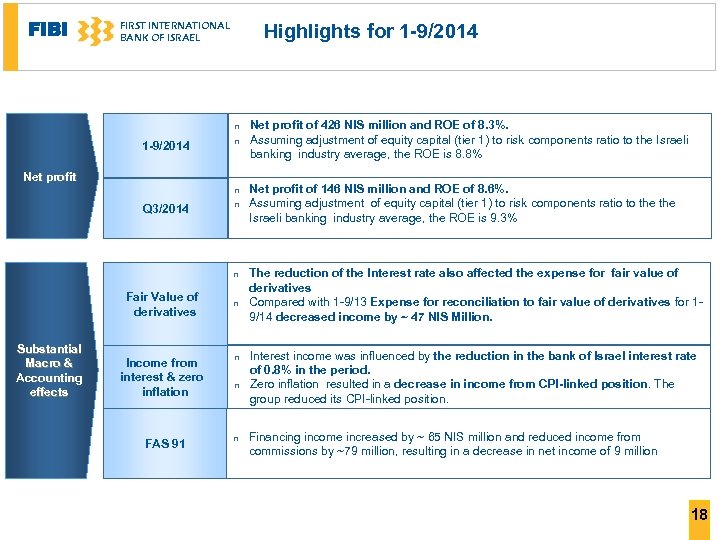

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Highlights for 1 -9/2014 n Net profit n Q 3/2014 n n Fair Value of derivatives Substantial Macro & Accounting effects n Income from interest & zero inflation n FAS 91 n n Net profit of 426 NIS million and ROE of 8. 3%. Assuming adjustment of equity capital (tier 1) to risk components ratio to the Israeli banking industry average, the ROE is 8. 8% Net profit of 146 NIS million and ROE of 8. 6%. Assuming adjustment of equity capital (tier 1) to risk components ratio to the Israeli banking industry average, the ROE is 9. 3% The reduction of the Interest rate also affected the expense for fair value of derivatives Compared with 1 -9/13 Expense for reconciliation to fair value of derivatives for 19/14 decreased income by ~ 47 NIS Million. Interest income was influenced by the reduction in the bank of Israel interest rate of 0. 8% in the period. Zero inflation resulted in a decrease in income from CPI-linked position. The group reduced its CPI-linked position. Financing income increased by ~ 65 NIS million and reduced income from commissions by ~79 million, resulting in a decrease in net income of 9 million 18

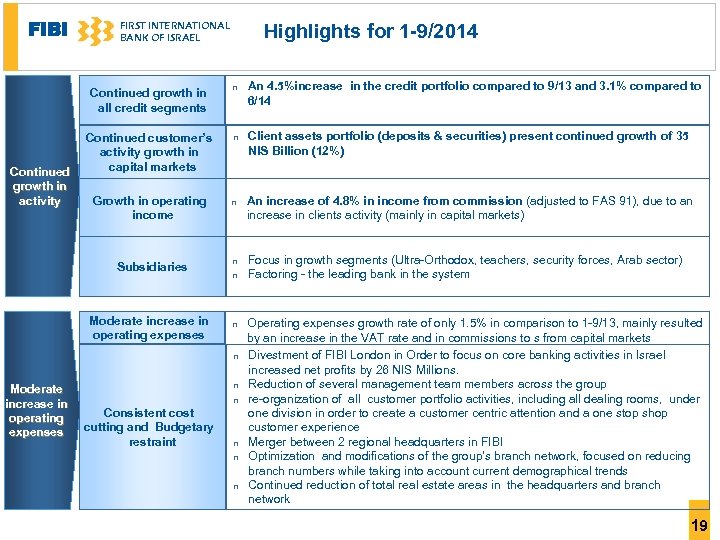

FIBI FIRST INTERNATIONAL BANK OF ISRAEL Highlights for 1 -9/2014 Continued growth in all credit segments An 4. 5%increase in the credit portfolio compared to 9/13 and 3. 1% compared to 6/14 Continued customer’s activity growth in capital markets n Client assets portfolio (deposits & securities) present continued growth of 35 NIS Billion (12%) Growth in operating income n An increase of 4. 8% in income from commission (adjusted to FAS 91), due to an increase in clients activity (mainly in capital markets) Subsidiaries Continued growth in activity n n Focus in growth segments (Ultra-Orthodox, teachers, security forces, Arab sector) Factoring - the leading bank in the system Moderate increase in operating expenses n n n Moderate increase in operating expenses n n Consistent cost cutting and Budgetary restraint n n n Operating expenses growth rate of only 1. 5% in comparison to 1 -9/13, mainly resulted by an increase in the VAT rate and in commissions to s from capital markets Divestment of FIBI London in Order to focus on core banking activities in Israel increased net profits by 26 NIS Millions. Reduction of several management team members across the group re-organization of all customer portfolio activities, including all dealing rooms, under one division in order to create a customer centric attention and a one stop shop customer experience Merger between 2 regional headquarters in FIBI Optimization and modifications of the group’s branch network, focused on reducing branch numbers while taking into account current demographical trends Continued reduction of total real estate areas in the headquarters and branch network 19

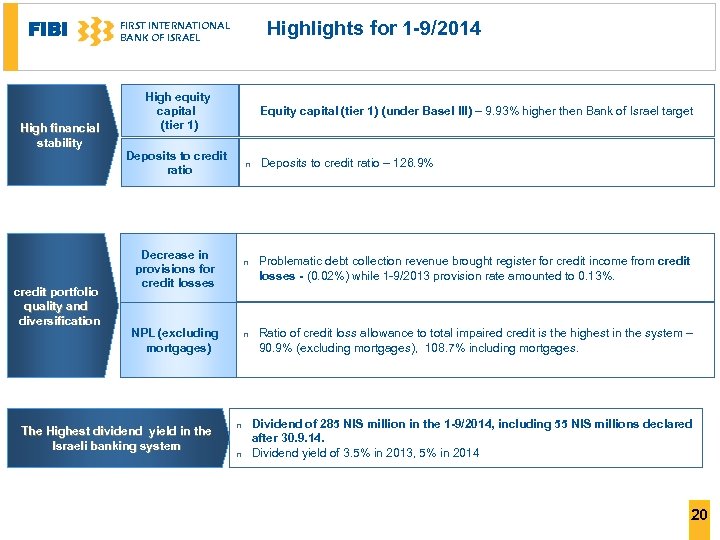

FIBI High financial stability credit portfolio quality and diversification Highlights for 1 -9/2014 FIRST INTERNATIONAL BANK OF ISRAEL High equity capital (tier 1) Equity capital (tier 1) (under Basel III) – 9. 93% higher then Bank of Israel target Deposits to credit ratio n n NPL (excluding mortgages) The Highest dividend yield in the Israeli banking system n n Problematic debt collection revenue brought register for credit income from credit losses - (0. 02%) while 1 -9/2013 provision rate amounted to 0. 13%. n Decrease in provisions for credit losses Deposits to credit ratio – 126. 9% Ratio of credit loss allowance to total impaired credit is the highest in the system – 90. 9% (excluding mortgages), 108. 7% including mortgages. Dividend of 285 NIS million in the 1 -9/2014, including 55 NIS millions declared after 30. 9. 14. Dividend yield of 3. 5% in 2013, 5% in 2014 20

66aa6def2e817cef34aecef17aa178d8.ppt