be9202e1c5be28d47e8ee33735e83e40.ppt

- Количество слайдов: 11

FIA Expo 2005 Implementing FIXML Original Investment to Payoff November 8, 2005 Paul D. Kern, Fimat USA, LLC

FIA Expo 2005 Implementing FIXML Original Investment to Payoff November 8, 2005 Paul D. Kern, Fimat USA, LLC

STP – Straight through Processing STP Continues to be Key Industry Goal for processing improvements and reduced costs • FIX provided First Benefits for Front Office: ü FIX standards: Buy-side and sell-side Efficiencies ü Front-end processing of order routing – Implement Quickly, Accurately ü Drop Copy for Risk Management – Track Positions at Firm-level RT • FIXML standards bring efficiencies to Back Office/Exchange ü Homogenize Exchange Clearing Interfaces ü Eliminate required synchronized upgrade of fixed-position formats • FIX/FIXML standards bring efficiencies to Middle/Back Office: ü FIX provides front-office drop-copy to Middle Office Allocations ü FIXML provides internal standard that allows reuse of components ü FIXML is easily interfaced to best practice APIs (Web Services/XML)

STP – Straight through Processing STP Continues to be Key Industry Goal for processing improvements and reduced costs • FIX provided First Benefits for Front Office: ü FIX standards: Buy-side and sell-side Efficiencies ü Front-end processing of order routing – Implement Quickly, Accurately ü Drop Copy for Risk Management – Track Positions at Firm-level RT • FIXML standards bring efficiencies to Back Office/Exchange ü Homogenize Exchange Clearing Interfaces ü Eliminate required synchronized upgrade of fixed-position formats • FIX/FIXML standards bring efficiencies to Middle/Back Office: ü FIX provides front-office drop-copy to Middle Office Allocations ü FIXML provides internal standard that allows reuse of components ü FIXML is easily interfaced to best practice APIs (Web Services/XML)

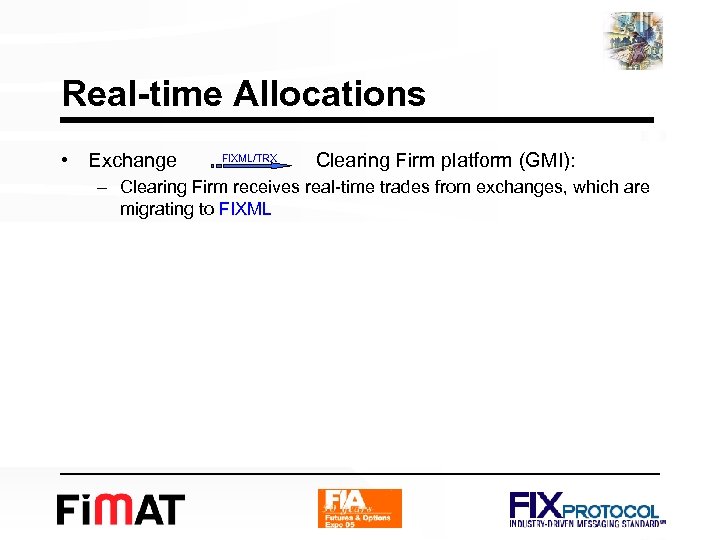

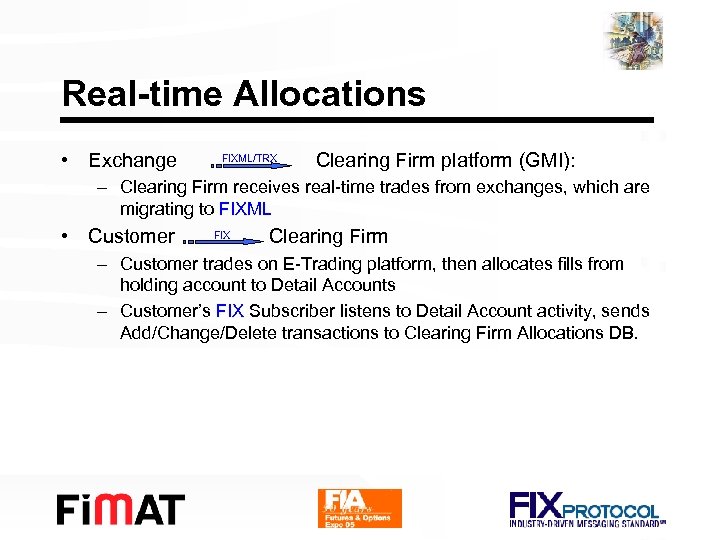

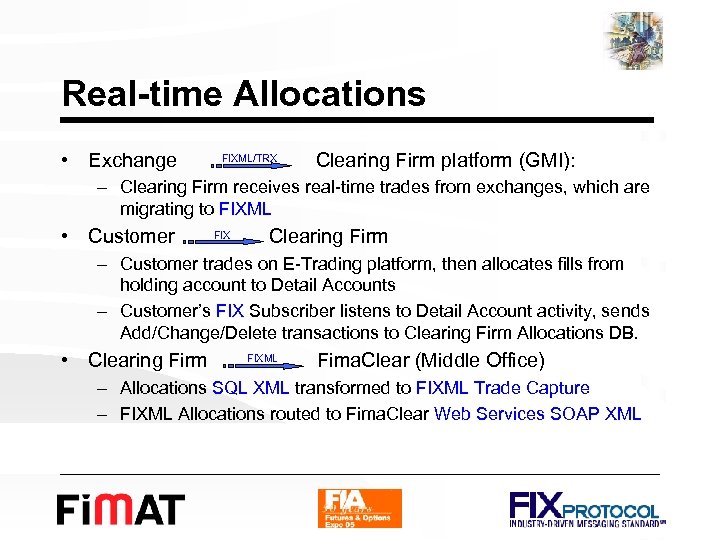

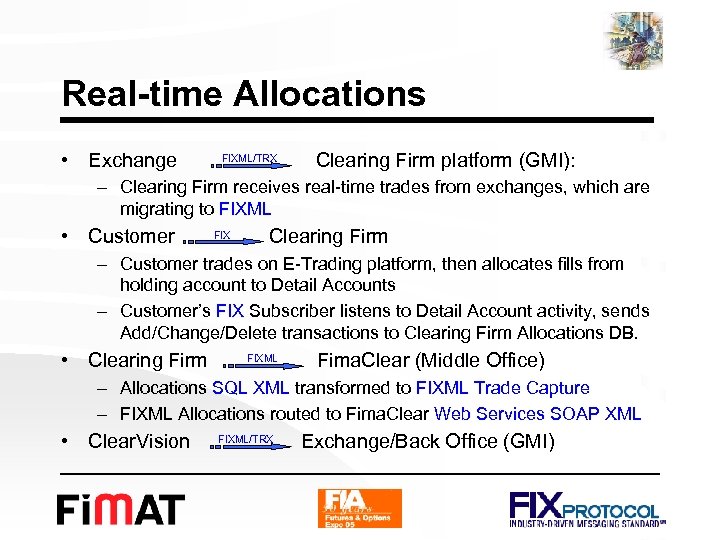

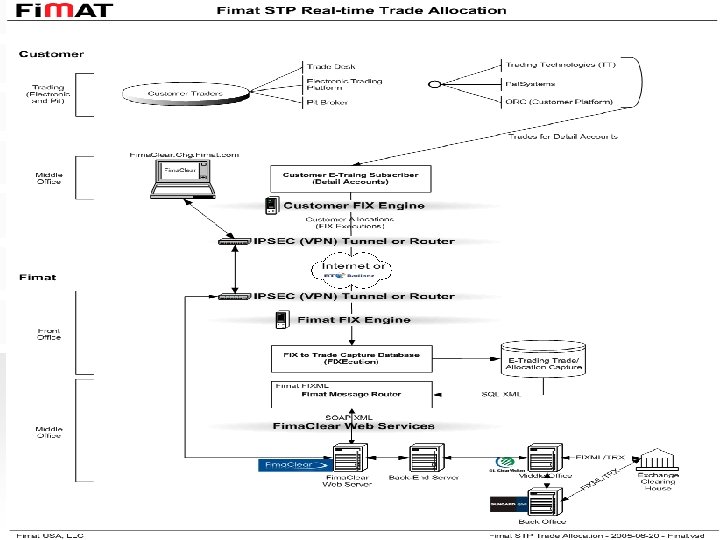

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

Real-time Allocations • Exchange FIXML/TRX Clearing Firm platform (GMI): – Clearing Firm receives real-time trades from exchanges, which are migrating to FIXML • Customer FIX Clearing Firm – Customer trades on E-Trading platform, then allocates fills from holding account to Detail Accounts – Customer’s FIX Subscriber listens to Detail Account activity, sends Add/Change/Delete transactions to Clearing Firm Allocations DB. • Clearing Firm FIXML Fima. Clear (Middle Office) – Allocations SQL XML transformed to FIXML Trade Capture – FIXML Allocations routed to Fima. Clear Web Services SOAP XML • Clear. Vision FIXML/TRX Exchange/Back Office (GMI)

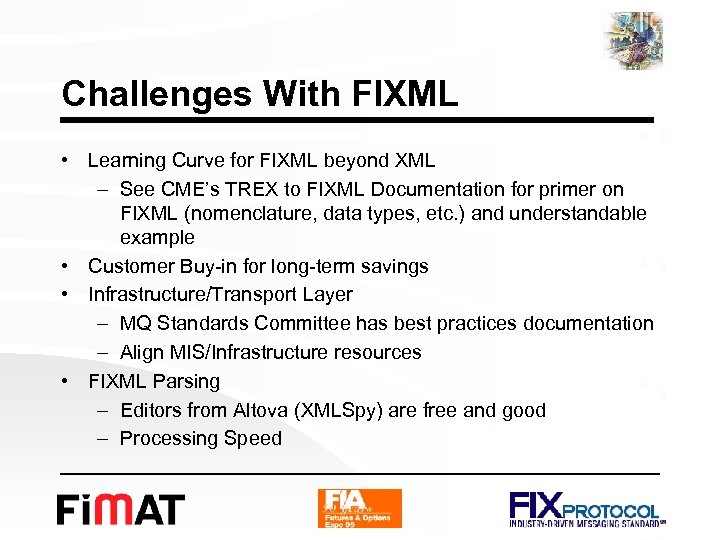

Challenges With FIXML • Learning Curve for FIXML beyond XML – See CME’s TREX to FIXML Documentation for primer on FIXML (nomenclature, data types, etc. ) and understandable example • Customer Buy-in for long-term savings • Infrastructure/Transport Layer – MQ Standards Committee has best practices documentation – Align MIS/Infrastructure resources • FIXML Parsing – Editors from Altova (XMLSpy) are free and good – Processing Speed

Challenges With FIXML • Learning Curve for FIXML beyond XML – See CME’s TREX to FIXML Documentation for primer on FIXML (nomenclature, data types, etc. ) and understandable example • Customer Buy-in for long-term savings • Infrastructure/Transport Layer – MQ Standards Committee has best practices documentation – Align MIS/Infrastructure resources • FIXML Parsing – Editors from Altova (XMLSpy) are free and good – Processing Speed

Challenges With FIXML (cont’d) • Clearly document message flow with customer • Clearly document agreed upon message format, with examples.

Challenges With FIXML (cont’d) • Clearly document message flow with customer • Clearly document agreed upon message format, with examples.

Summary – Firm Perspective Firm to customer is now seeing payoff from original investments • Started with customer front office match-off with firm Back-office • Components are re-used for Middle-office Real-time allocation of trades to Middle-office platforms (Clear. Vision and proprietary systems) • FIXML as a standard allows focus new applications and posting transactions correctly Front to Middle to Back Office to Exchange systems.

Summary – Firm Perspective Firm to customer is now seeing payoff from original investments • Started with customer front office match-off with firm Back-office • Components are re-used for Middle-office Real-time allocation of trades to Middle-office platforms (Clear. Vision and proprietary systems) • FIXML as a standard allows focus new applications and posting transactions correctly Front to Middle to Back Office to Exchange systems.

Summary – Industry Perspective • STP has been progressing forward over the last several years • FIXML efforts are seen to be the impetus that will inject STP with some acceleration. • Changes being implemented by all aspects of the industry for FIXML adoption and use, senior management will see opportunities to utilize this change momentum to provide real savings to middle and back office of the firms. • This will likely not so much reduce head count, but rather reallocate manual posting time of existing staff to spend more time on value-added analysis and additional service to the customers.

Summary – Industry Perspective • STP has been progressing forward over the last several years • FIXML efforts are seen to be the impetus that will inject STP with some acceleration. • Changes being implemented by all aspects of the industry for FIXML adoption and use, senior management will see opportunities to utilize this change momentum to provide real savings to middle and back office of the firms. • This will likely not so much reduce head count, but rather reallocate manual posting time of existing staff to spend more time on value-added analysis and additional service to the customers.