4595cc626b5a2fcde6c072d3cd9eeda6.ppt

- Количество слайдов: 61

FEMA Thursday, 10 th March 2016 Lecture on overview of Basics of Foreign Exchange Management Act, 1999 (FEMA) at Pune Branch of WIKASA of the Institute of Chartered Accountants of India 1999 CA. Dr. Dilip V. Satbhai B. Com (Hons), LL. M. (First rank), Ph. D. (Law), F. C. A. DISA(icai), DIRM(icai) Senior Partner – Laws, Taxation & Assurance : M/s. D. V. Satbhai & Co. , Chartered Accountants, Pune Email: dvsatbhai@yahoo. com, Cell 9422031273, 9822850606 Former Chairman of Pune Branch of WIRC and Past co-opted committee member of WIRC and Central council of The Institute of Chartered Accountants of India

FEMA Thursday, 10 th March 2016 Lecture on overview of Basics of Foreign Exchange Management Act, 1999 (FEMA) at Pune Branch of WIKASA of the Institute of Chartered Accountants of India 1999 CA. Dr. Dilip V. Satbhai B. Com (Hons), LL. M. (First rank), Ph. D. (Law), F. C. A. DISA(icai), DIRM(icai) Senior Partner – Laws, Taxation & Assurance : M/s. D. V. Satbhai & Co. , Chartered Accountants, Pune Email: dvsatbhai@yahoo. com, Cell 9422031273, 9822850606 Former Chairman of Pune Branch of WIRC and Past co-opted committee member of WIRC and Central council of The Institute of Chartered Accountants of India

Difference in FERA and FEMA FERA consisted of 81 sections, and was more complex, FEMA is much simple, and consist of only 49 sections Presumption of negative intention (Mensrea) and joining hands in offence (abatement) existed in FERA, these presumptions of mensrea and abatement have been excluded in FEMA Terms like Capital Account Transaction, current Account Transaction, person, service etc. were not defined in FERA, Terms like Capital Account Transaction, current account Transaction person, service etc. , have been defined in detail in FEMA

Difference in FERA and FEMA FERA consisted of 81 sections, and was more complex, FEMA is much simple, and consist of only 49 sections Presumption of negative intention (Mensrea) and joining hands in offence (abatement) existed in FERA, these presumptions of mensrea and abatement have been excluded in FEMA Terms like Capital Account Transaction, current Account Transaction, person, service etc. were not defined in FERA, Terms like Capital Account Transaction, current account Transaction person, service etc. , have been defined in detail in FEMA

Difference in FERA and FEMA Definition of "Authorized Person" in FERA was a narrow one 2(b), The definition of Authorized person has been widened to include banks, money changes, off shore banking Units etc. 2 (c) Any offence under FERA, was a criminal offence, punishable with imprisonment as per code of criminal procedure, 1973 Here, the offence is considered to be a civil offence only punishable with some amount of money as a penalty. Imprisonment is prescribed only when one fails to pay the penalty

Difference in FERA and FEMA Definition of "Authorized Person" in FERA was a narrow one 2(b), The definition of Authorized person has been widened to include banks, money changes, off shore banking Units etc. 2 (c) Any offence under FERA, was a criminal offence, punishable with imprisonment as per code of criminal procedure, 1973 Here, the offence is considered to be a civil offence only punishable with some amount of money as a penalty. Imprisonment is prescribed only when one fails to pay the penalty

Difference in FERA and FEMA There was a big difference in the definition of "Resident", under FERA, and Income Tax Act, The provision of FEMA, are in consistent with income Tax Act, in respect to the definition of term " Resident". Now the criteria of "In India for 182 days" to make a person resident has been brought under FEMA. Therefore a person who qualifies to be a nonresident under the income Tax Act, 1961 will also be considered a non-resident (PROI) for the purposes of application of FEMA, but a person who is considered to be non-resident (PROI) under FEMA may not necessarily be a non-resident under the Income Tax Act, for instance a business man going abroad and staying in India for a period of more than 182 days with an intention to stay outside India for an indefinite period of time will become a non-resident under FEMA but not under Income tax act, 1961.

Difference in FERA and FEMA There was a big difference in the definition of "Resident", under FERA, and Income Tax Act, The provision of FEMA, are in consistent with income Tax Act, in respect to the definition of term " Resident". Now the criteria of "In India for 182 days" to make a person resident has been brought under FEMA. Therefore a person who qualifies to be a nonresident under the income Tax Act, 1961 will also be considered a non-resident (PROI) for the purposes of application of FEMA, but a person who is considered to be non-resident (PROI) under FEMA may not necessarily be a non-resident under the Income Tax Act, for instance a business man going abroad and staying in India for a period of more than 182 days with an intention to stay outside India for an indefinite period of time will become a non-resident under FEMA but not under Income tax act, 1961.

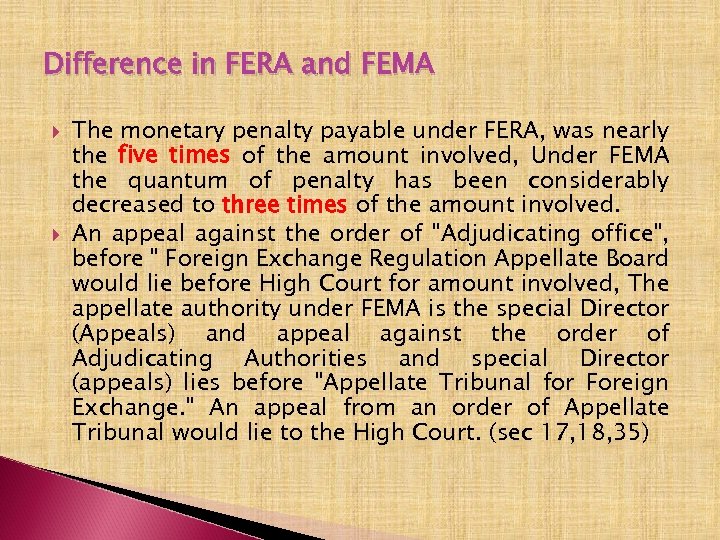

Difference in FERA and FEMA The monetary penalty payable under FERA, was nearly the five times of the amount involved, Under FEMA the quantum of penalty has been considerably decreased to three times of the amount involved. An appeal against the order of "Adjudicating office", before " Foreign Exchange Regulation Appellate Board would lie before High Court for amount involved, The appellate authority under FEMA is the special Director (Appeals) and appeal against the order of Adjudicating Authorities and special Director (appeals) lies before "Appellate Tribunal for Foreign Exchange. " An appeal from an order of Appellate Tribunal would lie to the High Court. (sec 17, 18, 35)

Difference in FERA and FEMA The monetary penalty payable under FERA, was nearly the five times of the amount involved, Under FEMA the quantum of penalty has been considerably decreased to three times of the amount involved. An appeal against the order of "Adjudicating office", before " Foreign Exchange Regulation Appellate Board would lie before High Court for amount involved, The appellate authority under FEMA is the special Director (Appeals) and appeal against the order of Adjudicating Authorities and special Director (appeals) lies before "Appellate Tribunal for Foreign Exchange. " An appeal from an order of Appellate Tribunal would lie to the High Court. (sec 17, 18, 35)

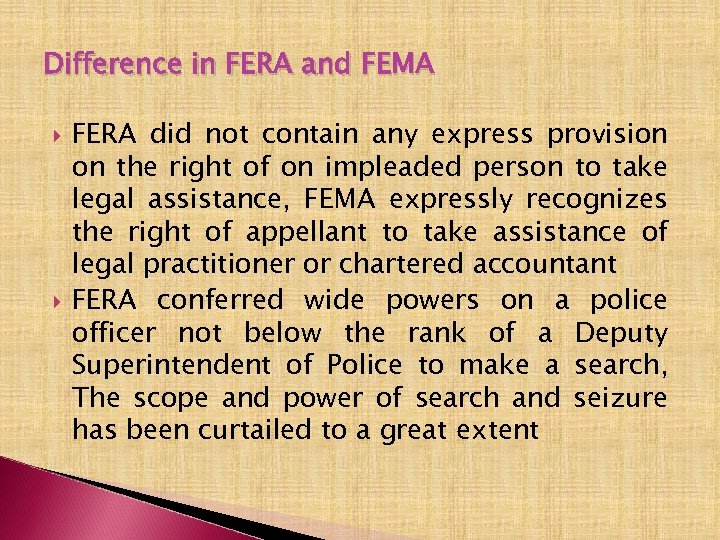

Difference in FERA and FEMA FERA did not contain any express provision on the right of on impleaded person to take legal assistance, FEMA expressly recognizes the right of appellant to take assistance of legal practitioner or chartered accountant FERA conferred wide powers on a police officer not below the rank of a Deputy Superintendent of Police to make a search, The scope and power of search and seizure has been curtailed to a great extent

Difference in FERA and FEMA FERA did not contain any express provision on the right of on impleaded person to take legal assistance, FEMA expressly recognizes the right of appellant to take assistance of legal practitioner or chartered accountant FERA conferred wide powers on a police officer not below the rank of a Deputy Superintendent of Police to make a search, The scope and power of search and seizure has been curtailed to a great extent

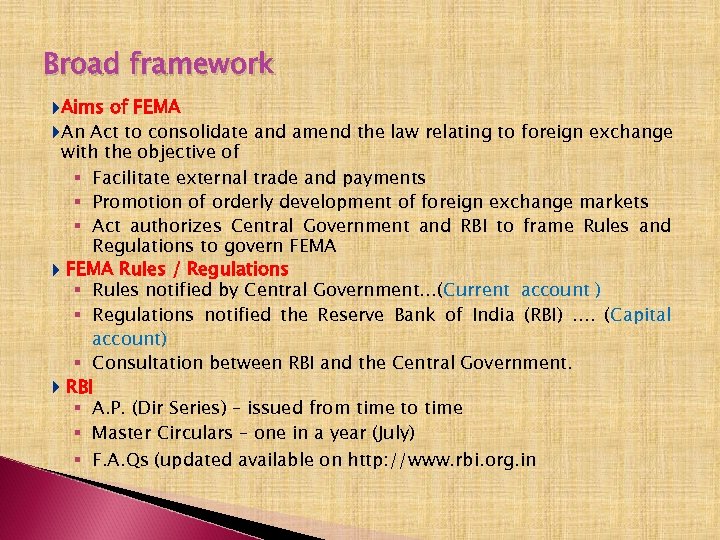

Broad framework Aims of FEMA An Act to consolidate and amend the law relating to foreign exchange with the objective of § Facilitate external trade and payments § Promotion of orderly development of foreign exchange markets § Act authorizes Central Government and RBI to frame Rules and Regulations to govern FEMA Rules / Regulations § Rules notified by Central Government…(Current account ) § Regulations notified the Reserve Bank of India (RBI) …. (Capital account) § Consultation between RBI and the Central Government. RBI § A. P. (Dir Series) – issued from time to time § Master Circulars – one in a year (July) § F. A. Qs (updated available on http: //www. rbi. org. in

Broad framework Aims of FEMA An Act to consolidate and amend the law relating to foreign exchange with the objective of § Facilitate external trade and payments § Promotion of orderly development of foreign exchange markets § Act authorizes Central Government and RBI to frame Rules and Regulations to govern FEMA Rules / Regulations § Rules notified by Central Government…(Current account ) § Regulations notified the Reserve Bank of India (RBI) …. (Capital account) § Consultation between RBI and the Central Government. RBI § A. P. (Dir Series) – issued from time to time § Master Circulars – one in a year (July) § F. A. Qs (updated available on http: //www. rbi. org. in

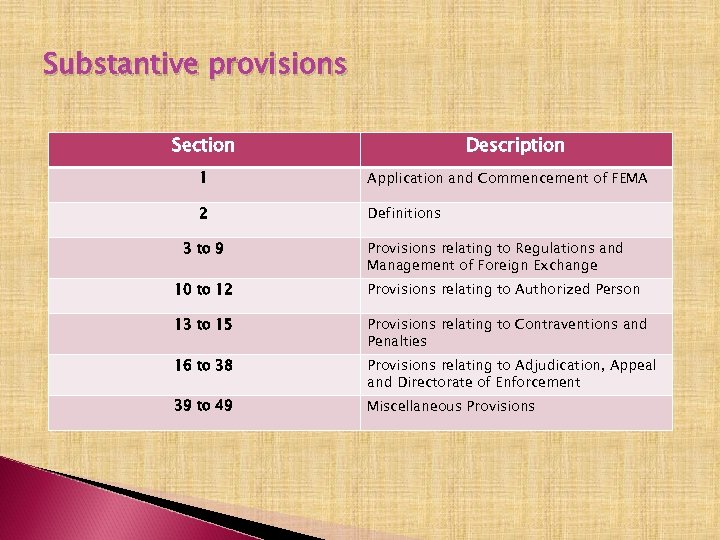

Substantive provisions Section Description 1 Application and Commencement of FEMA 2 Definitions 3 to 9 Provisions relating to Regulations and Management of Foreign Exchange 10 to 12 Provisions relating to Authorized Person 13 to 15 Provisions relating to Contraventions and Penalties 16 to 38 Provisions relating to Adjudication, Appeal and Directorate of Enforcement 39 to 49 Miscellaneous Provisions

Substantive provisions Section Description 1 Application and Commencement of FEMA 2 Definitions 3 to 9 Provisions relating to Regulations and Management of Foreign Exchange 10 to 12 Provisions relating to Authorized Person 13 to 15 Provisions relating to Contraventions and Penalties 16 to 38 Provisions relating to Adjudication, Appeal and Directorate of Enforcement 39 to 49 Miscellaneous Provisions

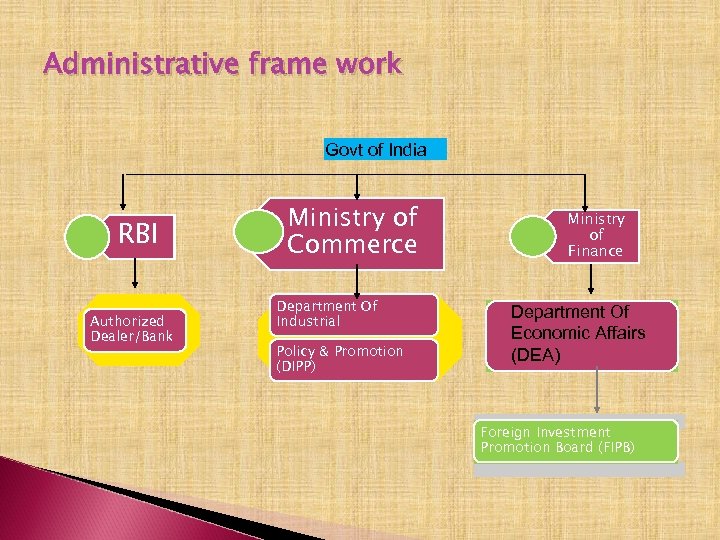

Administrative frame work Govt of India RBI Authorized Dealer/Bank Ministry of Commerce Department Of Industrial Policy & Promotion (DIPP) Ministry of Finance Department Of Economic Affairs (DEA) Foreign Investment Promotion Board (FIPB)

Administrative frame work Govt of India RBI Authorized Dealer/Bank Ministry of Commerce Department Of Industrial Policy & Promotion (DIPP) Ministry of Finance Department Of Economic Affairs (DEA) Foreign Investment Promotion Board (FIPB)

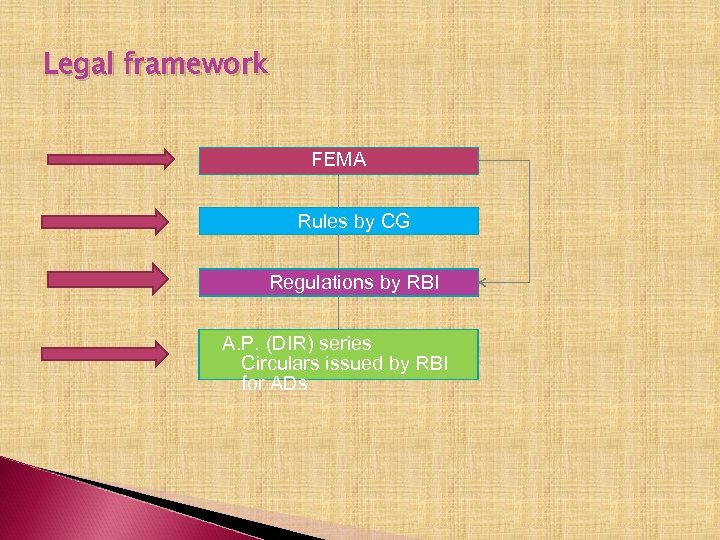

Legal framework FEMA Rules by CG Regulations by RBI A. P. (DIR) series Circulars issued by RBI for ADs

Legal framework FEMA Rules by CG Regulations by RBI A. P. (DIR) series Circulars issued by RBI for ADs

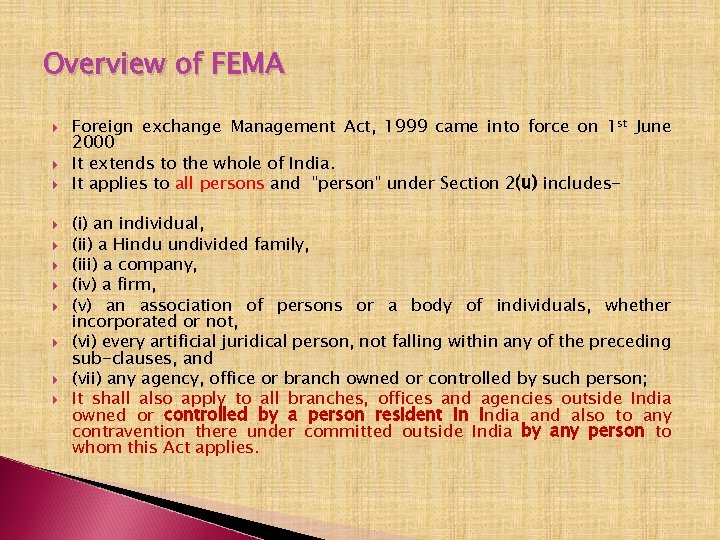

Overview of FEMA Foreign exchange Management Act, 1999 came into force on 1 st June 2000 It extends to the whole of India. It applies to all persons and "person" under Section 2(u) includes(i) an individual, (ii) a Hindu undivided family, (iii) a company, (iv) a firm, (v) an association of persons or a body of individuals, whether incorporated or not, (vi) every artificial juridical person, not falling within any of the preceding sub-clauses, and (vii) any agency, office or branch owned or controlled by such person; It shall also apply to all branches, offices and agencies outside India owned or controlled by a person resident in India and also to any contravention there under committed outside India by any person to whom this Act applies.

Overview of FEMA Foreign exchange Management Act, 1999 came into force on 1 st June 2000 It extends to the whole of India. It applies to all persons and "person" under Section 2(u) includes(i) an individual, (ii) a Hindu undivided family, (iii) a company, (iv) a firm, (v) an association of persons or a body of individuals, whether incorporated or not, (vi) every artificial juridical person, not falling within any of the preceding sub-clauses, and (vii) any agency, office or branch owned or controlled by such person; It shall also apply to all branches, offices and agencies outside India owned or controlled by a person resident in India and also to any contravention there under committed outside India by any person to whom this Act applies.

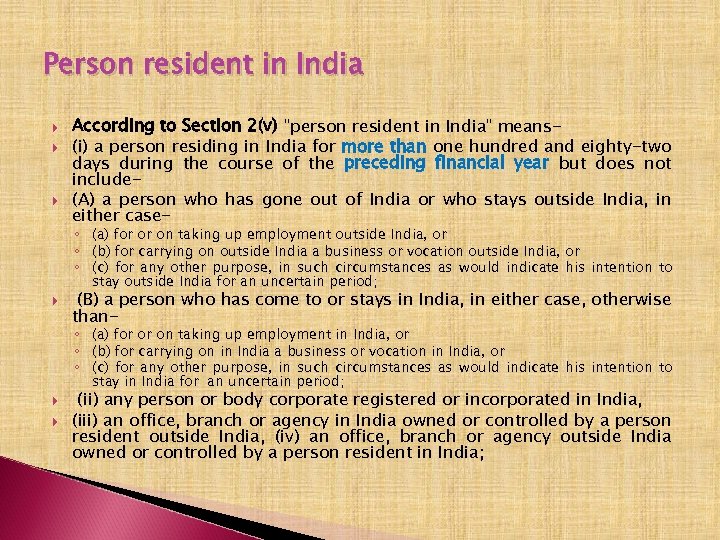

Person resident in India According to Section 2(v) "person resident in India" means(i) a person residing in India for more than one hundred and eighty-two days during the course of the preceding financial year but does not include(A) a person who has gone out of India or who stays outside India, in either case- ◦ (a) for or on taking up employment outside India, or ◦ (b) for carrying on outside India a business or vocation outside India, or ◦ (c) for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period; (B) a person who has come to or stays in India, in either case, otherwise than- ◦ (a) for or on taking up employment in India, or ◦ (b) for carrying on in India a business or vocation in India, or ◦ (c) for any other purpose, in such circumstances as would indicate his intention to stay in India for an uncertain period; (ii) any person or body corporate registered or incorporated in India, (iii) an office, branch or agency in India owned or controlled by a person resident outside India, (iv) an office, branch or agency outside India owned or controlled by a person resident in India;

Person resident in India According to Section 2(v) "person resident in India" means(i) a person residing in India for more than one hundred and eighty-two days during the course of the preceding financial year but does not include(A) a person who has gone out of India or who stays outside India, in either case- ◦ (a) for or on taking up employment outside India, or ◦ (b) for carrying on outside India a business or vocation outside India, or ◦ (c) for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period; (B) a person who has come to or stays in India, in either case, otherwise than- ◦ (a) for or on taking up employment in India, or ◦ (b) for carrying on in India a business or vocation in India, or ◦ (c) for any other purpose, in such circumstances as would indicate his intention to stay in India for an uncertain period; (ii) any person or body corporate registered or incorporated in India, (iii) an office, branch or agency in India owned or controlled by a person resident outside India, (iv) an office, branch or agency outside India owned or controlled by a person resident in India;

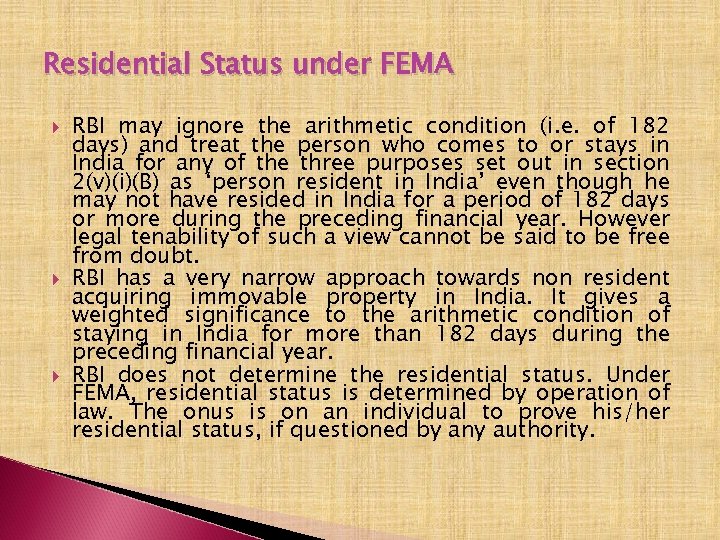

Residential Status under FEMA RBI may ignore the arithmetic condition (i. e. of 182 days) and treat the person who comes to or stays in India for any of the three purposes set out in section 2(v)(i)(B) as ‘person resident in India’ even though he may not have resided in India for a period of 182 days or more during the preceding financial year. However legal tenability of such a view cannot be said to be free from doubt. RBI has a very narrow approach towards non resident acquiring immovable property in India. It gives a weighted significance to the arithmetic condition of staying in India for more than 182 days during the preceding financial year. RBI does not determine the residential status. Under FEMA, residential status is determined by operation of law. The onus is on an individual to prove his/her residential status, if questioned by any authority.

Residential Status under FEMA RBI may ignore the arithmetic condition (i. e. of 182 days) and treat the person who comes to or stays in India for any of the three purposes set out in section 2(v)(i)(B) as ‘person resident in India’ even though he may not have resided in India for a period of 182 days or more during the preceding financial year. However legal tenability of such a view cannot be said to be free from doubt. RBI has a very narrow approach towards non resident acquiring immovable property in India. It gives a weighted significance to the arithmetic condition of staying in India for more than 182 days during the preceding financial year. RBI does not determine the residential status. Under FEMA, residential status is determined by operation of law. The onus is on an individual to prove his/her residential status, if questioned by any authority.

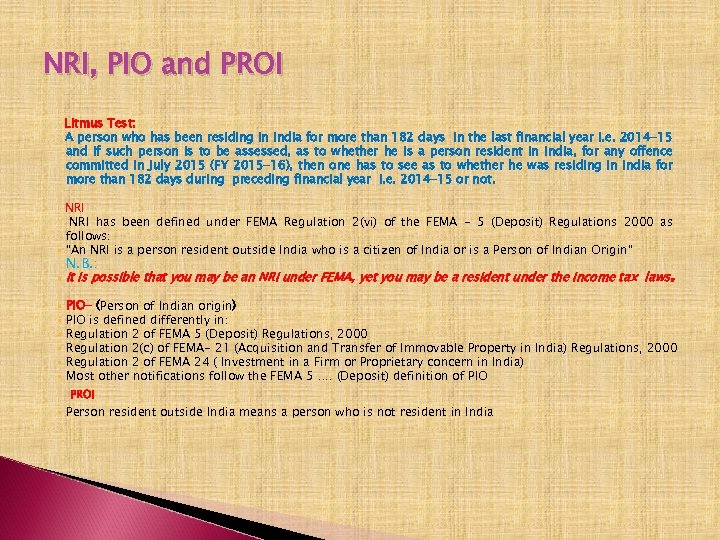

NRI, PIO and PROI Litmus Test: A person who has been residing in India for more than 182 days in the last financial year i. e. 2014 -15 and If such person is to be assessed, as to whether he is a person resident in India, for any offence committed in July 2015 (FY 2015 -16), then one has to see as to whether he was residing in India for more than 182 days during preceding financial year i. e. 2014 -15 or not. NRI has been defined under FEMA Regulation 2(vi) of the FEMA - 5 (Deposit) Regulations 2000 as follows: § “An NRI is a person resident outside India who is a citizen of India or is a Person of Indian Origin” N. B. : . § It is possible that you may be an NRI under FEMA, yet you may be a resident under the Income tax laws § § § PIO- (Person of Indian origin) PIO is defined differently in: Regulation 2 of FEMA 5 (Deposit) Regulations, 2000 Regulation 2(c) of FEMA- 21 (Acquisition and Transfer of Immovable Property in India) Regulations, 2000 Regulation 2 of FEMA 24 ( Investment in a Firm or Proprietary concern in India) Most other notifications follow the FEMA 5 …. (Deposit) definition of PIO PROI § Person resident outside India means a person who is not resident in India

NRI, PIO and PROI Litmus Test: A person who has been residing in India for more than 182 days in the last financial year i. e. 2014 -15 and If such person is to be assessed, as to whether he is a person resident in India, for any offence committed in July 2015 (FY 2015 -16), then one has to see as to whether he was residing in India for more than 182 days during preceding financial year i. e. 2014 -15 or not. NRI has been defined under FEMA Regulation 2(vi) of the FEMA - 5 (Deposit) Regulations 2000 as follows: § “An NRI is a person resident outside India who is a citizen of India or is a Person of Indian Origin” N. B. : . § It is possible that you may be an NRI under FEMA, yet you may be a resident under the Income tax laws § § § PIO- (Person of Indian origin) PIO is defined differently in: Regulation 2 of FEMA 5 (Deposit) Regulations, 2000 Regulation 2(c) of FEMA- 21 (Acquisition and Transfer of Immovable Property in India) Regulations, 2000 Regulation 2 of FEMA 24 ( Investment in a Firm or Proprietary concern in India) Most other notifications follow the FEMA 5 …. (Deposit) definition of PIO PROI § Person resident outside India means a person who is not resident in India

Case studies Case study-1 Mr. Antony was in India during FY 2013 -2014 for less than 100 days. He came to India on April 1, 2014 for business He finished business on April 30, 2015 and left India on June 30, 2015 permanently What would Mr. Patel’s residential status be during FY 2014 -2015 & 2015 -16? PROI both years Case study-2 Mitsubishi is a Japanese company having several business units all over the world. It has a subsidiary quarters in Mumbai which has a branch in Singapore What would be residential status of subsidiary and of its Singapore branch? PRII Case study-3 Ms. Hava-havai employed with PANAM Airways in Newyork. She travelled to India in 2014 -15 as a tourist for 3 months During FY 2014 -2015 however, for security reasons, she was accommodated at Mumbai for 230 days What would Ms. Hava-havai’s residential status be for FY 2014 -2015? PROI

Case studies Case study-1 Mr. Antony was in India during FY 2013 -2014 for less than 100 days. He came to India on April 1, 2014 for business He finished business on April 30, 2015 and left India on June 30, 2015 permanently What would Mr. Patel’s residential status be during FY 2014 -2015 & 2015 -16? PROI both years Case study-2 Mitsubishi is a Japanese company having several business units all over the world. It has a subsidiary quarters in Mumbai which has a branch in Singapore What would be residential status of subsidiary and of its Singapore branch? PRII Case study-3 Ms. Hava-havai employed with PANAM Airways in Newyork. She travelled to India in 2014 -15 as a tourist for 3 months During FY 2014 -2015 however, for security reasons, she was accommodated at Mumbai for 230 days What would Ms. Hava-havai’s residential status be for FY 2014 -2015? PROI

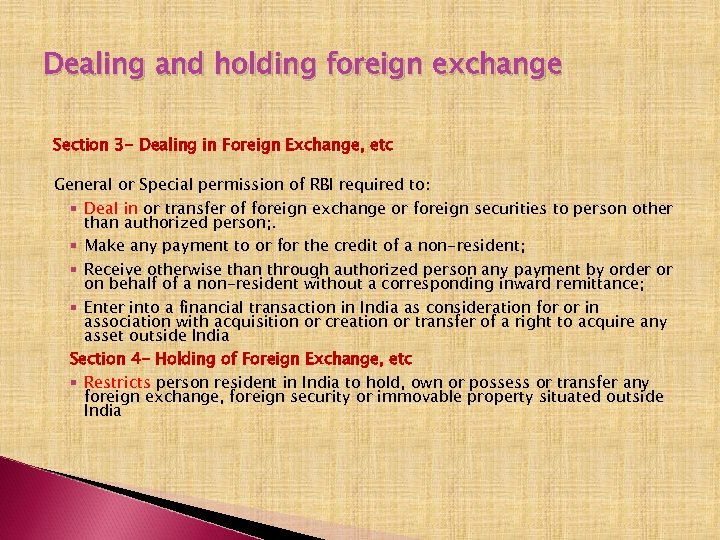

Dealing and holding foreign exchange Section 3 - Dealing in Foreign Exchange, etc General or Special permission of RBI required to: § Deal in or transfer of foreign exchange or foreign securities to person other than authorized person; . § Make any payment to or for the credit of a non-resident; § Receive otherwise than through authorized person any payment by order or on behalf of a non-resident without a corresponding inward remittance; § Enter into a financial transaction in India as consideration for or in association with acquisition or creation or transfer of a right to acquire any asset outside India Section 4 - Holding of Foreign Exchange, etc § Restricts person resident in India to hold, own or possess or transfer any foreign exchange, foreign security or immovable property situated outside India

Dealing and holding foreign exchange Section 3 - Dealing in Foreign Exchange, etc General or Special permission of RBI required to: § Deal in or transfer of foreign exchange or foreign securities to person other than authorized person; . § Make any payment to or for the credit of a non-resident; § Receive otherwise than through authorized person any payment by order or on behalf of a non-resident without a corresponding inward remittance; § Enter into a financial transaction in India as consideration for or in association with acquisition or creation or transfer of a right to acquire any asset outside India Section 4 - Holding of Foreign Exchange, etc § Restricts person resident in India to hold, own or possess or transfer any foreign exchange, foreign security or immovable property situated outside India

Current and capital account transactions Golden rules Current Account transactions are freely permitted unless prohibited - they are regulated by Central Government. Capital Account transactions are prohibited unless generally permitted /restricted- they are regulated by RBI

Current and capital account transactions Golden rules Current Account transactions are freely permitted unless prohibited - they are regulated by Central Government. Capital Account transactions are prohibited unless generally permitted /restricted- they are regulated by RBI

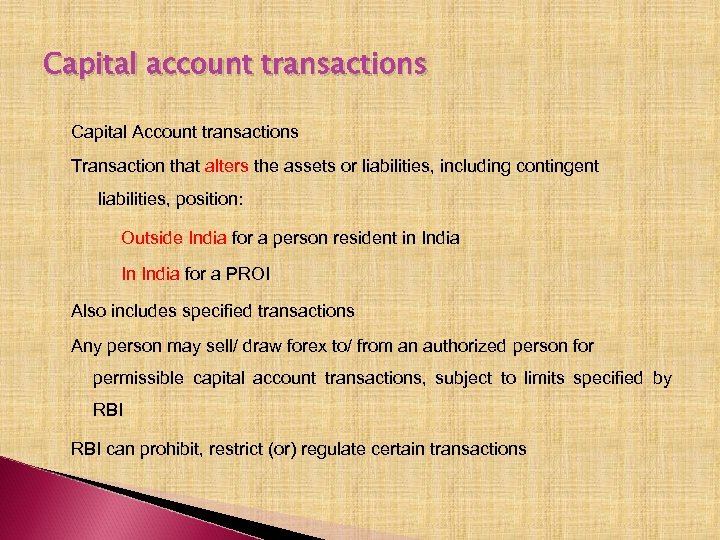

Capital account transactions Capital Account transactions Transaction that alters the assets or liabilities, including contingent liabilities, position: Outside India for a person resident in India In India for a PROI Also includes specified transactions Any person may sell/ draw forex to/ from an authorized person for permissible capital account transactions, subject to limits specified by RBI can prohibit, restrict (or) regulate certain transactions

Capital account transactions Capital Account transactions Transaction that alters the assets or liabilities, including contingent liabilities, position: Outside India for a person resident in India In India for a PROI Also includes specified transactions Any person may sell/ draw forex to/ from an authorized person for permissible capital account transactions, subject to limits specified by RBI can prohibit, restrict (or) regulate certain transactions

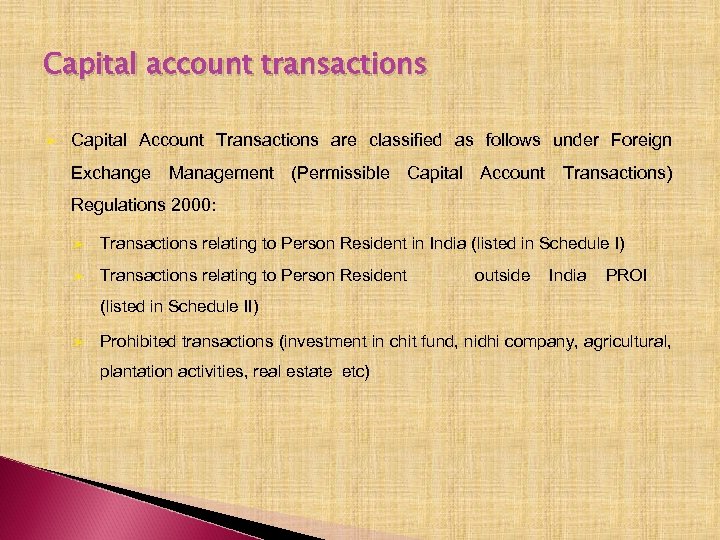

Capital account transactions ➢ Capital Account Transactions are classified as follows under Foreign Exchange Management (Permissible Capital Account Transactions) Regulations 2000: ➢ Transactions relating to Person Resident in India (listed in Schedule I) ➢ Transactions relating to Person Resident outside India PROI (listed in Schedule II) ➢ Prohibited transactions (investment in chit fund, nidhi company, agricultural, plantation activities, real estate etc)

Capital account transactions ➢ Capital Account Transactions are classified as follows under Foreign Exchange Management (Permissible Capital Account Transactions) Regulations 2000: ➢ Transactions relating to Person Resident in India (listed in Schedule I) ➢ Transactions relating to Person Resident outside India PROI (listed in Schedule II) ➢ Prohibited transactions (investment in chit fund, nidhi company, agricultural, plantation activities, real estate etc)

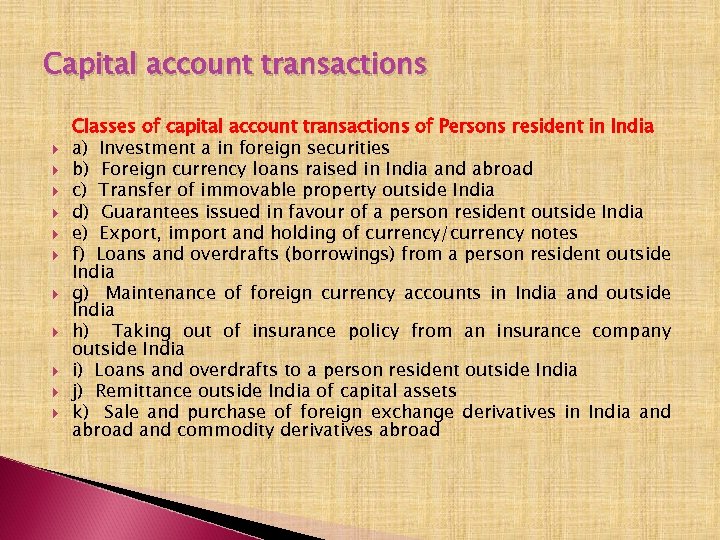

Capital account transactions Classes of capital account transactions of Persons resident in India a) Investment a in foreign securities b) Foreign currency loans raised in India and abroad c) Transfer of immovable property outside India d) Guarantees issued in favour of a person resident outside India e) Export, import and holding of currency/currency notes f) Loans and overdrafts (borrowings) from a person resident outside India g) Maintenance of foreign currency accounts in India and outside India h) Taking out of insurance policy from an insurance company outside India i) Loans and overdrafts to a person resident outside India j) Remittance outside India of capital assets k) Sale and purchase of foreign exchange derivatives in India and abroad and commodity derivatives abroad

Capital account transactions Classes of capital account transactions of Persons resident in India a) Investment a in foreign securities b) Foreign currency loans raised in India and abroad c) Transfer of immovable property outside India d) Guarantees issued in favour of a person resident outside India e) Export, import and holding of currency/currency notes f) Loans and overdrafts (borrowings) from a person resident outside India g) Maintenance of foreign currency accounts in India and outside India h) Taking out of insurance policy from an insurance company outside India i) Loans and overdrafts to a person resident outside India j) Remittance outside India of capital assets k) Sale and purchase of foreign exchange derivatives in India and abroad and commodity derivatives abroad

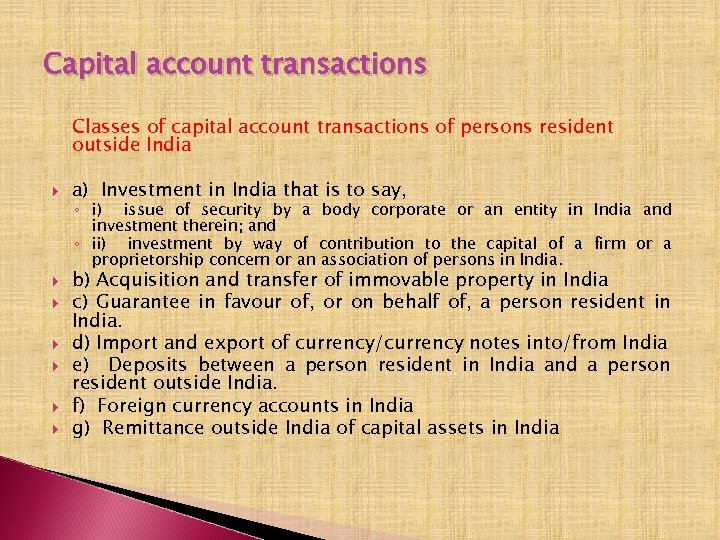

Capital account transactions Classes of capital account transactions of persons resident outside India a) Investment in India that is to say, ◦ i) issue of security by a body corporate or an entity in India and investment therein; and ◦ ii) investment by way of contribution to the capital of a firm or a proprietorship concern or an association of persons in India. b) Acquisition and transfer of immovable property in India c) Guarantee in favour of, or on behalf of, a person resident in India. d) Import and export of currency/currency notes into/from India e) Deposits between a person resident in India and a person resident outside India. f) Foreign currency accounts in India g) Remittance outside India of capital assets in India

Capital account transactions Classes of capital account transactions of persons resident outside India a) Investment in India that is to say, ◦ i) issue of security by a body corporate or an entity in India and investment therein; and ◦ ii) investment by way of contribution to the capital of a firm or a proprietorship concern or an association of persons in India. b) Acquisition and transfer of immovable property in India c) Guarantee in favour of, or on behalf of, a person resident in India. d) Import and export of currency/currency notes into/from India e) Deposits between a person resident in India and a person resident outside India. f) Foreign currency accounts in India g) Remittance outside India of capital assets in India

Capital account transactions § RBI has been empowered under section 6(2) of FEMA to specify, in consultation with the Central Government, any class or classes of Capital account transactions which are permissible [i. e. the transactions which are not included under section 6(3)]. § Section 6(3) of FEMA specifies the class of capital account transactions which are regulated by RBI. § Every transaction listed in this section is regulated by a corresponding notification

Capital account transactions § RBI has been empowered under section 6(2) of FEMA to specify, in consultation with the Central Government, any class or classes of Capital account transactions which are permissible [i. e. the transactions which are not included under section 6(3)]. § Section 6(3) of FEMA specifies the class of capital account transactions which are regulated by RBI. § Every transaction listed in this section is regulated by a corresponding notification

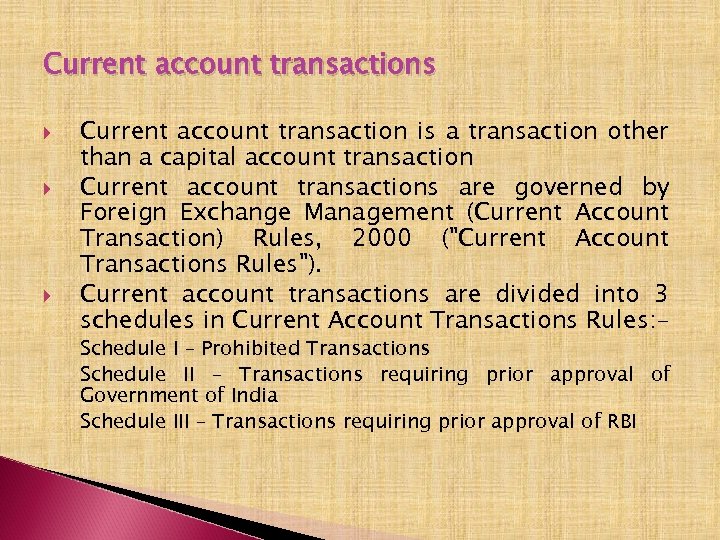

Current account transactions Current account transaction is a transaction other than a capital account transaction Current account transactions are governed by Foreign Exchange Management (Current Account Transaction) Rules, 2000 ("Current Account Transactions Rules"). Current account transactions are divided into 3 schedules in Current Account Transactions Rules: - Schedule I – Prohibited Transactions Schedule II – Transactions requiring prior approval of Government of India Schedule III – Transactions requiring prior approval of RBI

Current account transactions Current account transaction is a transaction other than a capital account transaction Current account transactions are governed by Foreign Exchange Management (Current Account Transaction) Rules, 2000 ("Current Account Transactions Rules"). Current account transactions are divided into 3 schedules in Current Account Transactions Rules: - Schedule I – Prohibited Transactions Schedule II – Transactions requiring prior approval of Government of India Schedule III – Transactions requiring prior approval of RBI

Current account transactions FEMA looks transaction from Balance of payment position of Country Examples - ◦ Import of machinery on payment of cash - Current Account transaction ◦ Machinery is purchased on hire - Capital Account transaction. There is an obligated to make future payment to the non-resident ◦ Consideration for goods & Services – Current Account transaction ◦ Transaction represents a creation or acquisition of wealth shares, loans or immovable properties – Capital Account transaction

Current account transactions FEMA looks transaction from Balance of payment position of Country Examples - ◦ Import of machinery on payment of cash - Current Account transaction ◦ Machinery is purchased on hire - Capital Account transaction. There is an obligated to make future payment to the non-resident ◦ Consideration for goods & Services – Current Account transaction ◦ Transaction represents a creation or acquisition of wealth shares, loans or immovable properties – Capital Account transaction

Current account transactions Regulation for Current Account Transaction: Any person can sell or draw foreign exchange to or from an authorized dealer (if such sale or withdrawal is a current account transaction) except for certain prohibited transactions like remittance of lottery winnings, remittance of interest income on funds held in Non-Resident Special Rupee (NRSR) account scheme, etc. Besides these cases, there are certain other transactions, for which specific RBI approval will be required. For instance, Reserve Bank approval is required for importers availing of Supplier’s Credit beyond 180 days and Buyer’s Credit irrespective of the period of credit. Authorized dealers are permitted remittance of surplus freight/passage collections by shipping/airline companies or their agents, multimodal transport operators, etc. after verification of documentary evidence in support of the remittance

Current account transactions Regulation for Current Account Transaction: Any person can sell or draw foreign exchange to or from an authorized dealer (if such sale or withdrawal is a current account transaction) except for certain prohibited transactions like remittance of lottery winnings, remittance of interest income on funds held in Non-Resident Special Rupee (NRSR) account scheme, etc. Besides these cases, there are certain other transactions, for which specific RBI approval will be required. For instance, Reserve Bank approval is required for importers availing of Supplier’s Credit beyond 180 days and Buyer’s Credit irrespective of the period of credit. Authorized dealers are permitted remittance of surplus freight/passage collections by shipping/airline companies or their agents, multimodal transport operators, etc. after verification of documentary evidence in support of the remittance

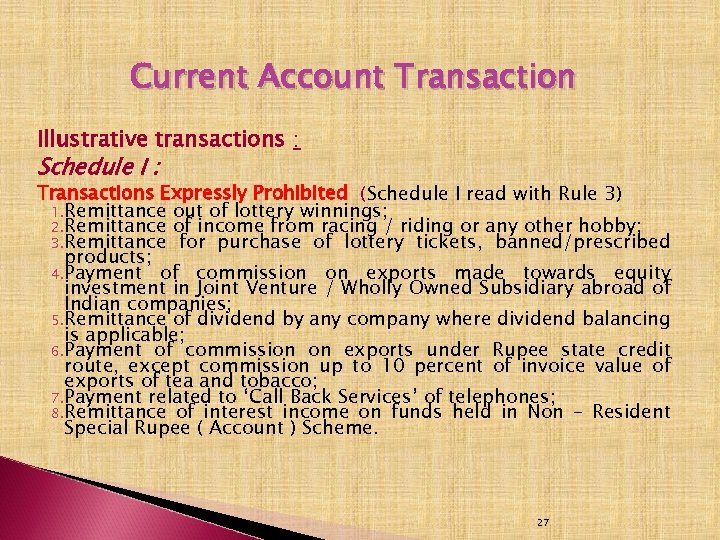

Current Account Transaction Illustrative transactions : Schedule I : Transactions Expressly Prohibited (Schedule I read with Rule 3) 1. Remittance out of lottery winnings; 2. Remittance of income from racing / riding or any other hobby; 3. Remittance for purchase of lottery tickets, banned/prescribed products; 4. Payment of commission on exports made towards equity investment in Joint Venture / Wholly Owned Subsidiary abroad of Indian companies; 5. Remittance of dividend by any company where dividend balancing is applicable; 6. Payment of commission on exports under Rupee state credit route, except commission up to 10 percent of invoice value of exports of tea and tobacco; 7. Payment related to ‘Call Back Services’ of telephones; 8. Remittance of interest income on funds held in Non – Resident Special Rupee ( Account ) Scheme. 27

Current Account Transaction Illustrative transactions : Schedule I : Transactions Expressly Prohibited (Schedule I read with Rule 3) 1. Remittance out of lottery winnings; 2. Remittance of income from racing / riding or any other hobby; 3. Remittance for purchase of lottery tickets, banned/prescribed products; 4. Payment of commission on exports made towards equity investment in Joint Venture / Wholly Owned Subsidiary abroad of Indian companies; 5. Remittance of dividend by any company where dividend balancing is applicable; 6. Payment of commission on exports under Rupee state credit route, except commission up to 10 percent of invoice value of exports of tea and tobacco; 7. Payment related to ‘Call Back Services’ of telephones; 8. Remittance of interest income on funds held in Non – Resident Special Rupee ( Account ) Scheme. 27

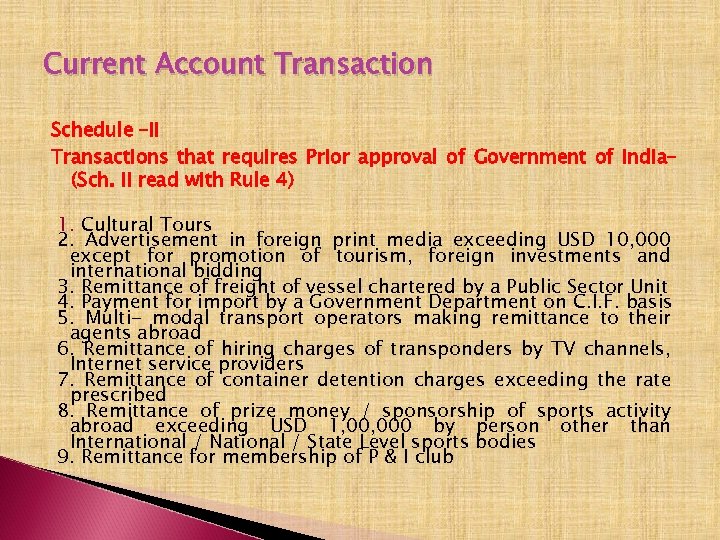

Current Account Transaction Schedule –II Transactions that requires Prior approval of Government of India– (Sch. II read with Rule 4) 1. Cultural Tours 2. Advertisement in foreign print media exceeding USD 10, 000 except for promotion of tourism, foreign investments and international bidding 3. Remittance of freight of vessel chartered by a Public Sector Unit 4. Payment for import by a Government Department on C. I. F. basis 5. Multi- modal transport operators making remittance to their agents abroad 6. Remittance of hiring charges of transponders by TV channels, Internet service providers 7. Remittance of container detention charges exceeding the rate prescribed 8. Remittance of prize money / sponsorship of sports activity abroad exceeding USD 1, 000 by person other than International / National / State Level sports bodies 9. Remittance for membership of P & I club

Current Account Transaction Schedule –II Transactions that requires Prior approval of Government of India– (Sch. II read with Rule 4) 1. Cultural Tours 2. Advertisement in foreign print media exceeding USD 10, 000 except for promotion of tourism, foreign investments and international bidding 3. Remittance of freight of vessel chartered by a Public Sector Unit 4. Payment for import by a Government Department on C. I. F. basis 5. Multi- modal transport operators making remittance to their agents abroad 6. Remittance of hiring charges of transponders by TV channels, Internet service providers 7. Remittance of container detention charges exceeding the rate prescribed 8. Remittance of prize money / sponsorship of sports activity abroad exceeding USD 1, 000 by person other than International / National / State Level sports bodies 9. Remittance for membership of P & I club

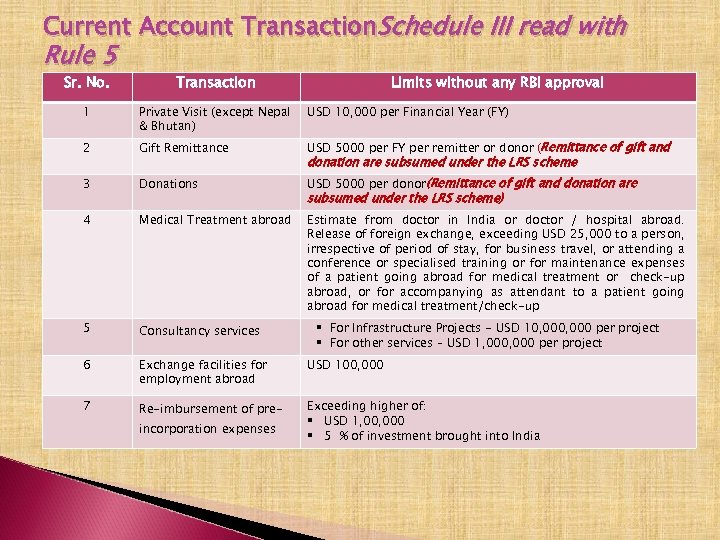

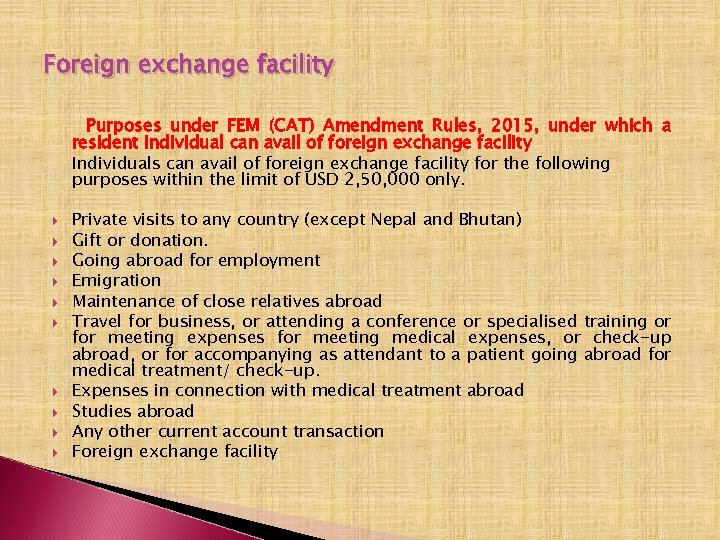

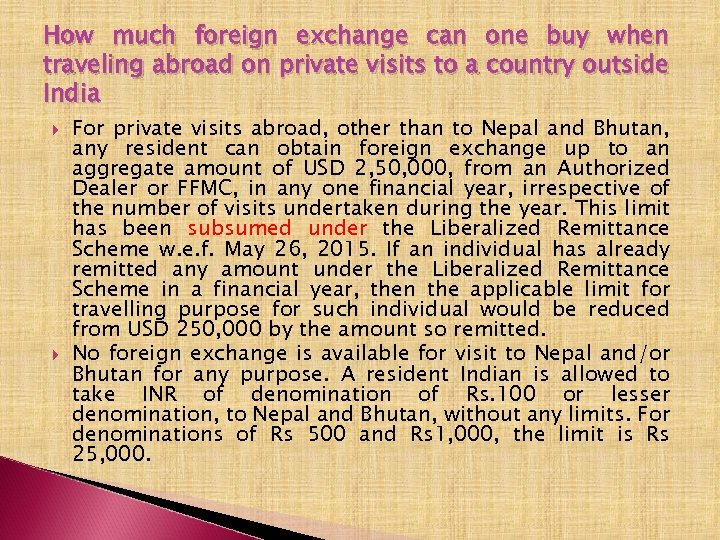

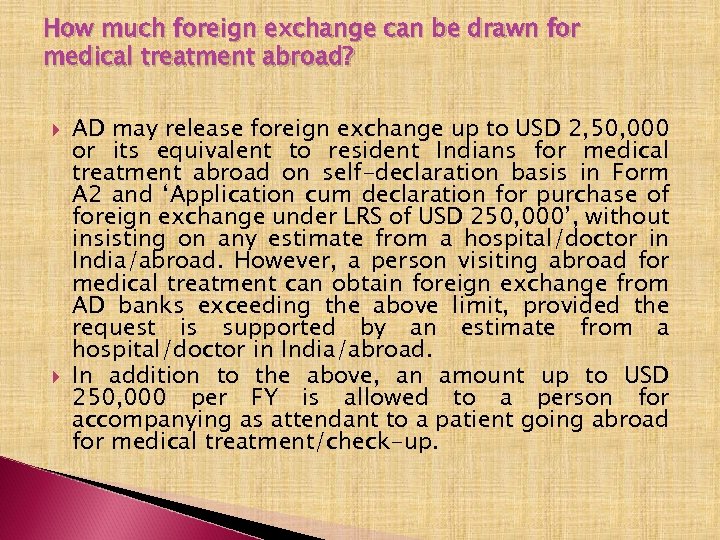

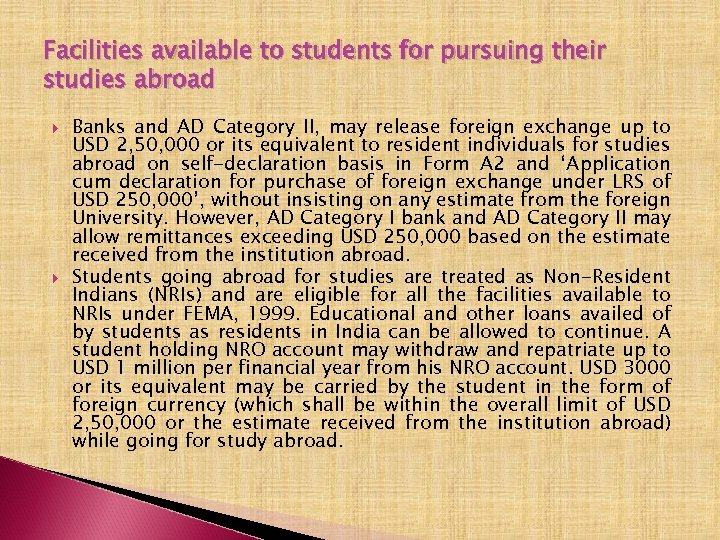

Current Account Transaction. Schedule III read with Rule 5 Sr. No. Transaction 1 Private Visit (except Nepal & Bhutan) USD 10, 000 per Financial Year (FY) 2 Gift Remittance USD 5000 per FY per remitter or donor (Remittance of gift and 3 Donations USD 5000 per donor(Remittance of gift and donation are 4 Medical Treatment abroad Estimate from doctor in India or doctor / hospital abroad. Release of foreign exchange, exceeding USD 25, 000 to a person, irrespective of period of stay, for business travel, or attending a conference or specialised training or for maintenance expenses of a patient going abroad for medical treatment or check-up abroad, or for accompanying as attendant to a patient going abroad for medical treatment/check-up 5 Consultancy services 6 Exchange facilities for employment abroad USD 100, 000 7 Re-imbursement of pre- Exceeding higher of: § USD 1, 000 § 5 % of investment brought into India incorporation expenses Limits without any RBI approval donation are subsumed under the LRS scheme) § For Infrastructure Projects - USD 10, 000 per project § For other services – USD 1, 000 per project

Current Account Transaction. Schedule III read with Rule 5 Sr. No. Transaction 1 Private Visit (except Nepal & Bhutan) USD 10, 000 per Financial Year (FY) 2 Gift Remittance USD 5000 per FY per remitter or donor (Remittance of gift and 3 Donations USD 5000 per donor(Remittance of gift and donation are 4 Medical Treatment abroad Estimate from doctor in India or doctor / hospital abroad. Release of foreign exchange, exceeding USD 25, 000 to a person, irrespective of period of stay, for business travel, or attending a conference or specialised training or for maintenance expenses of a patient going abroad for medical treatment or check-up abroad, or for accompanying as attendant to a patient going abroad for medical treatment/check-up 5 Consultancy services 6 Exchange facilities for employment abroad USD 100, 000 7 Re-imbursement of pre- Exceeding higher of: § USD 1, 000 § 5 % of investment brought into India incorporation expenses Limits without any RBI approval donation are subsumed under the LRS scheme) § For Infrastructure Projects - USD 10, 000 per project § For other services – USD 1, 000 per project

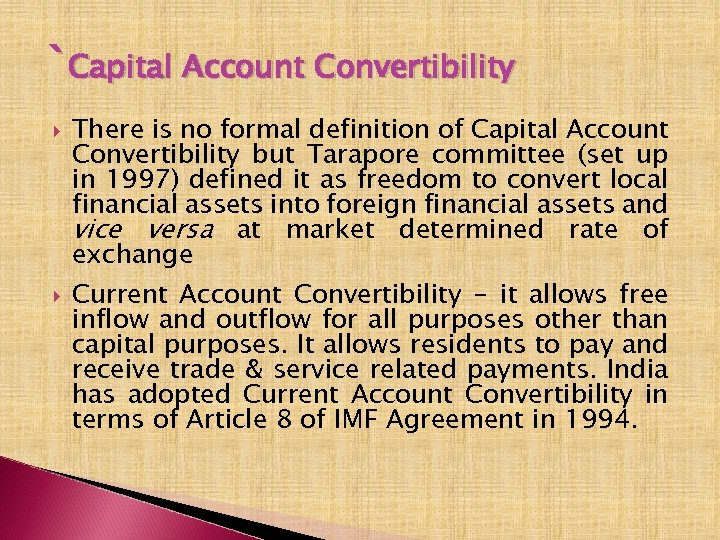

`Capital Account Convertibility There is no formal definition of Capital Account Convertibility but Tarapore committee (set up in 1997) defined it as freedom to convert local financial assets into foreign financial assets and vice versa at market determined rate of exchange Current Account Convertibility - it allows free inflow and outflow for all purposes other than capital purposes. It allows residents to pay and receive trade & service related payments. India has adopted Current Account Convertibility in terms of Article 8 of IMF Agreement in 1994.

`Capital Account Convertibility There is no formal definition of Capital Account Convertibility but Tarapore committee (set up in 1997) defined it as freedom to convert local financial assets into foreign financial assets and vice versa at market determined rate of exchange Current Account Convertibility - it allows free inflow and outflow for all purposes other than capital purposes. It allows residents to pay and receive trade & service related payments. India has adopted Current Account Convertibility in terms of Article 8 of IMF Agreement in 1994.

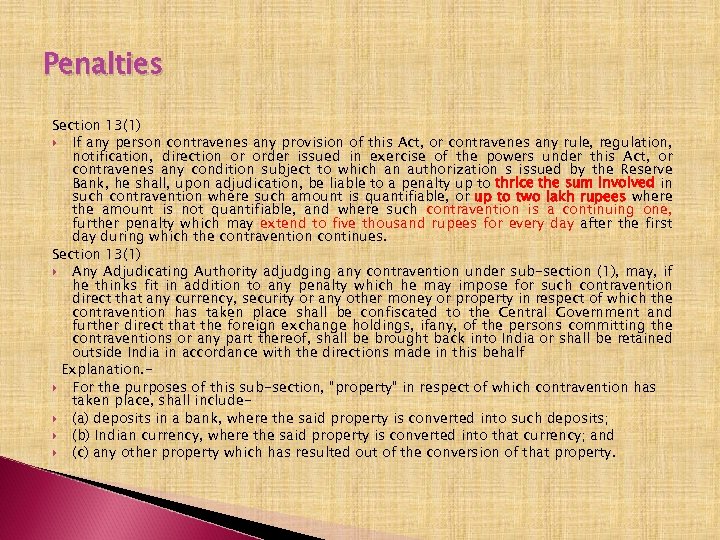

Penalties Section 13(1) If any person contravenes any provision of this Act, or contravenes any rule, regulation, notification, direction or order issued in exercise of the powers under this Act, or contravenes any condition subject to which an authorization s issued by the Reserve Bank, he shall, upon adjudication, be liable to a penalty up to thrice the sum involved in such contravention where such amount is quantifiable, or up to two lakh rupees where the amount is not quantifiable, and where such contravention is a continuing one, further penalty which may extend to five thousand rupees for every day after the first day during which the contravention continues. Section 13(1) Any Adjudicating Authority adjudging any contravention under sub-section (1), may, if he thinks fit in addition to any penalty which he may impose for such contravention direct that any currency, security or any other money or property in respect of which the contravention has taken place shall be confiscated to the Central Government and further direct that the foreign exchange holdings, ifany, of the persons committing the contraventions or any part thereof, shall be brought back into India or shall be retained outside India in accordance with the directions made in this behalf Explanation. For the purposes of this sub-section, "property" in respect of which contravention has taken place, shall include (a) deposits in a bank, where the said property is converted into such deposits; (b) Indian currency, where the said property is converted into that currency; and (c) any other property which has resulted out of the conversion of that property.

Penalties Section 13(1) If any person contravenes any provision of this Act, or contravenes any rule, regulation, notification, direction or order issued in exercise of the powers under this Act, or contravenes any condition subject to which an authorization s issued by the Reserve Bank, he shall, upon adjudication, be liable to a penalty up to thrice the sum involved in such contravention where such amount is quantifiable, or up to two lakh rupees where the amount is not quantifiable, and where such contravention is a continuing one, further penalty which may extend to five thousand rupees for every day after the first day during which the contravention continues. Section 13(1) Any Adjudicating Authority adjudging any contravention under sub-section (1), may, if he thinks fit in addition to any penalty which he may impose for such contravention direct that any currency, security or any other money or property in respect of which the contravention has taken place shall be confiscated to the Central Government and further direct that the foreign exchange holdings, ifany, of the persons committing the contraventions or any part thereof, shall be brought back into India or shall be retained outside India in accordance with the directions made in this behalf Explanation. For the purposes of this sub-section, "property" in respect of which contravention has taken place, shall include (a) deposits in a bank, where the said property is converted into such deposits; (b) Indian currency, where the said property is converted into that currency; and (c) any other property which has resulted out of the conversion of that property.

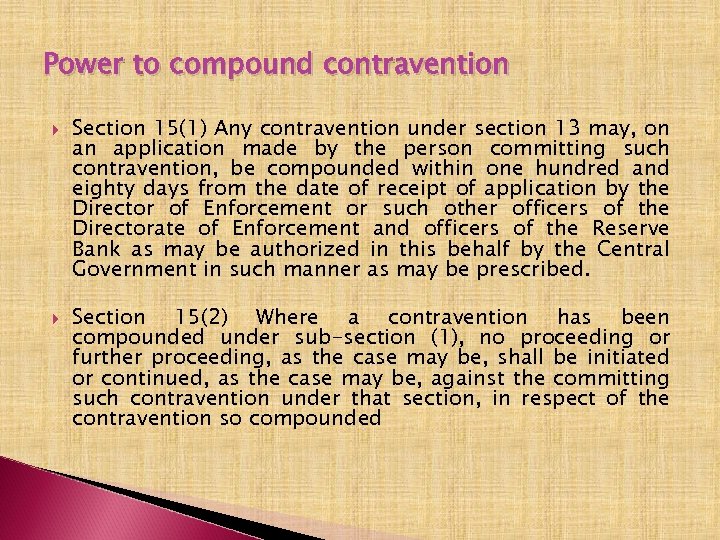

Power to compound contravention Section 15(1) Any contravention under section 13 may, on an application made by the person committing such contravention, be compounded within one hundred and eighty days from the date of receipt of application by the Director of Enforcement or such other officers of the Directorate of Enforcement and officers of the Reserve Bank as may be authorized in this behalf by the Central Government in such manner as may be prescribed. Section 15(2) Where a contravention has been compounded under sub-section (1), no proceeding or further proceeding, as the case may be, shall be initiated or continued, as the case may be, against the committing such contravention under that section, in respect of the contravention so compounded

Power to compound contravention Section 15(1) Any contravention under section 13 may, on an application made by the person committing such contravention, be compounded within one hundred and eighty days from the date of receipt of application by the Director of Enforcement or such other officers of the Directorate of Enforcement and officers of the Reserve Bank as may be authorized in this behalf by the Central Government in such manner as may be prescribed. Section 15(2) Where a contravention has been compounded under sub-section (1), no proceeding or further proceeding, as the case may be, shall be initiated or continued, as the case may be, against the committing such contravention under that section, in respect of the contravention so compounded

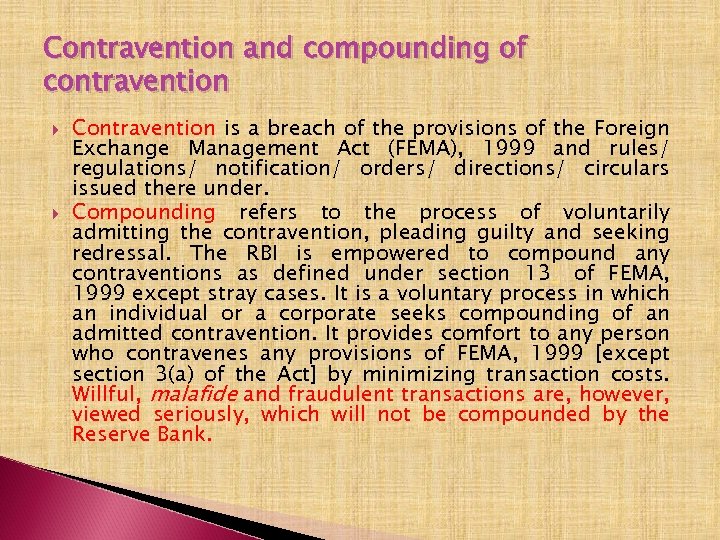

Contravention and compounding of contravention Contravention is a breach of the provisions of the Foreign Exchange Management Act (FEMA), 1999 and rules/ regulations/ notification/ orders/ directions/ circulars issued there under. Compounding refers to the process of voluntarily admitting the contravention, pleading guilty and seeking redressal. The RBI is empowered to compound any contraventions as defined under section 131 of FEMA, 1999 except stray cases. It is a voluntary process in which an individual or a corporate seeks compounding of an admitted contravention. It provides comfort to any person who contravenes any provisions of FEMA, 1999 [except section 3(a) of the Act] by minimizing transaction costs. Willful, malafide and fraudulent transactions are, however, viewed seriously, which will not be compounded by the Reserve Bank.

Contravention and compounding of contravention Contravention is a breach of the provisions of the Foreign Exchange Management Act (FEMA), 1999 and rules/ regulations/ notification/ orders/ directions/ circulars issued there under. Compounding refers to the process of voluntarily admitting the contravention, pleading guilty and seeking redressal. The RBI is empowered to compound any contraventions as defined under section 131 of FEMA, 1999 except stray cases. It is a voluntary process in which an individual or a corporate seeks compounding of an admitted contravention. It provides comfort to any person who contravenes any provisions of FEMA, 1999 [except section 3(a) of the Act] by minimizing transaction costs. Willful, malafide and fraudulent transactions are, however, viewed seriously, which will not be compounded by the Reserve Bank.

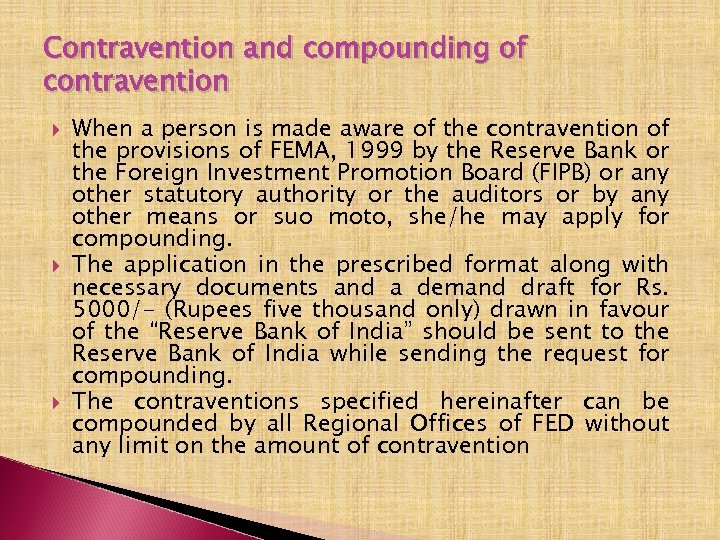

Contravention and compounding of contravention When a person is made aware of the contravention of the provisions of FEMA, 1999 by the Reserve Bank or the Foreign Investment Promotion Board (FIPB) or any other statutory authority or the auditors or by any other means or suo moto, she/he may apply for compounding. The application in the prescribed format along with necessary documents and a demand draft for Rs. 5000/- (Rupees five thousand only) drawn in favour of the “Reserve Bank of India” should be sent to the Reserve Bank of India while sending the request for compounding. The contraventions specified hereinafter can be compounded by all Regional Offices of FED without any limit on the amount of contravention

Contravention and compounding of contravention When a person is made aware of the contravention of the provisions of FEMA, 1999 by the Reserve Bank or the Foreign Investment Promotion Board (FIPB) or any other statutory authority or the auditors or by any other means or suo moto, she/he may apply for compounding. The application in the prescribed format along with necessary documents and a demand draft for Rs. 5000/- (Rupees five thousand only) drawn in favour of the “Reserve Bank of India” should be sent to the Reserve Bank of India while sending the request for compounding. The contraventions specified hereinafter can be compounded by all Regional Offices of FED without any limit on the amount of contravention

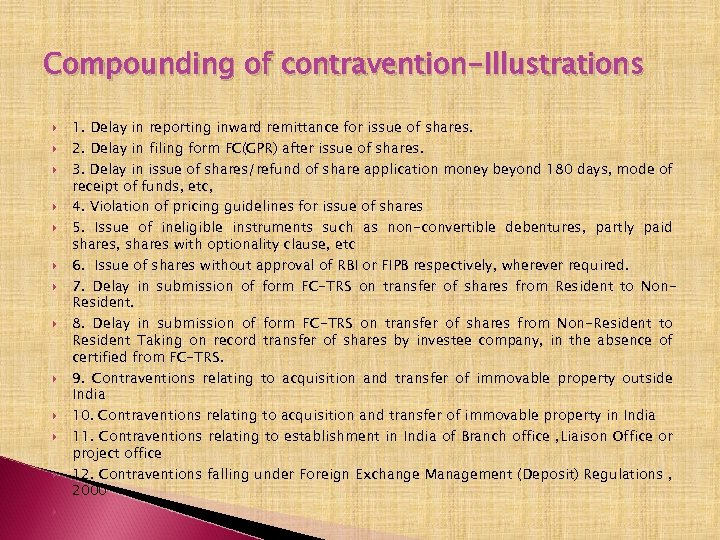

Compounding of contravention-Illustrations 1. Delay in reporting inward remittance for issue of shares. 2. Delay in filing form FC(GPR) after issue of shares. 3. Delay in issue of shares/refund of share application money beyond 180 days, mode of receipt of funds, etc, 4. Violation of pricing guidelines for issue of shares 5. Issue of ineligible instruments such as non-convertible debentures, partly paid shares, shares with optionality clause, etc 6. Issue of shares without approval of RBI or FIPB respectively, wherever required. 7. Delay in submission of form FC-TRS on transfer of shares from Resident to Non. Resident. 8. Delay in submission of form FC-TRS on transfer of shares from Non-Resident to Resident Taking on record transfer of shares by investee company, in the absence of certified from FC-TRS. 9. Contraventions relating to acquisition and transfer of immovable property outside India 10. Contraventions relating to acquisition and transfer of immovable property in India 11. Contraventions relating to establishment in India of Branch office , Liaison Office or project office 12. Contraventions falling under Foreign Exchange Management (Deposit) Regulations , 2000

Compounding of contravention-Illustrations 1. Delay in reporting inward remittance for issue of shares. 2. Delay in filing form FC(GPR) after issue of shares. 3. Delay in issue of shares/refund of share application money beyond 180 days, mode of receipt of funds, etc, 4. Violation of pricing guidelines for issue of shares 5. Issue of ineligible instruments such as non-convertible debentures, partly paid shares, shares with optionality clause, etc 6. Issue of shares without approval of RBI or FIPB respectively, wherever required. 7. Delay in submission of form FC-TRS on transfer of shares from Resident to Non. Resident. 8. Delay in submission of form FC-TRS on transfer of shares from Non-Resident to Resident Taking on record transfer of shares by investee company, in the absence of certified from FC-TRS. 9. Contraventions relating to acquisition and transfer of immovable property outside India 10. Contraventions relating to acquisition and transfer of immovable property in India 11. Contraventions relating to establishment in India of Branch office , Liaison Office or project office 12. Contraventions falling under Foreign Exchange Management (Deposit) Regulations , 2000

Compounding process The Compounding Authority passes an order indicating details of the contravention and the provisions of FEMA, 1999 that have been contravened. The sum payable for compounding the contravention is indicated in the compounding order which is to be paid within 15 days. The contravention is compounded by payment of the penalty imposed If the sum is not paid it will be treated as if the applicant has not made any compounding application to the Reserve Bank and the other provisions of FEMA, 1999 regarding contraventions will apply. Such cases will be referred to the Directorate of Enforcement for necessary action. Compounding is based on voluntary admissions and disclosures, hence there is no provision under the Compounding Rules for an appeal against the order of the Compounding Authority or for a request for reduction of amount compounded or extension of period for payment of penalty The compounding process is normally completed within 180 days from the date of receipt of the application complete in all aspects, by the Reserve Bank.

Compounding process The Compounding Authority passes an order indicating details of the contravention and the provisions of FEMA, 1999 that have been contravened. The sum payable for compounding the contravention is indicated in the compounding order which is to be paid within 15 days. The contravention is compounded by payment of the penalty imposed If the sum is not paid it will be treated as if the applicant has not made any compounding application to the Reserve Bank and the other provisions of FEMA, 1999 regarding contraventions will apply. Such cases will be referred to the Directorate of Enforcement for necessary action. Compounding is based on voluntary admissions and disclosures, hence there is no provision under the Compounding Rules for an appeal against the order of the Compounding Authority or for a request for reduction of amount compounded or extension of period for payment of penalty The compounding process is normally completed within 180 days from the date of receipt of the application complete in all aspects, by the Reserve Bank.

Court’s jurisdiction Section 34. Civil court not to have jurisdiction: No civil court shall have jurisdiction to entertain any suit or proceeding in respect of any matter which an Adjudicating Authority or the Appellate Tribunal or the Special Director (Appeals) is empowered by or under this Act to determine and no injunction shall be granted by any court or other authority in respect of any action taken or to be taken in pursuance of any power conferred by or under this Act. Section 35. Appeal to High Court : Any person aggrieved by any decision or order of the Appellate Tribunal may file an appeal to the High Court within sixty days from the date of communication of the decision or order of the Appellate Tribunal to him on any question of law arising out of such order: Provided that the High Court may, if it is satisfied that the appellant was prevented by sufficient cause from filing the appeal within the said period, allow it to be filed within a further period not exceeding sixty days. (a) the High Court within the jurisdiction of which the aggrieved party ordinarily resides or carries on business or personally works for gain; and (b) where the Central Government is the aggrieved party, the High Court within the jurisdiction of which the respondent, or in a case where there are more than one respondent, any of the respondents, ordinarily resides or carries on business or personally works for gain.

Court’s jurisdiction Section 34. Civil court not to have jurisdiction: No civil court shall have jurisdiction to entertain any suit or proceeding in respect of any matter which an Adjudicating Authority or the Appellate Tribunal or the Special Director (Appeals) is empowered by or under this Act to determine and no injunction shall be granted by any court or other authority in respect of any action taken or to be taken in pursuance of any power conferred by or under this Act. Section 35. Appeal to High Court : Any person aggrieved by any decision or order of the Appellate Tribunal may file an appeal to the High Court within sixty days from the date of communication of the decision or order of the Appellate Tribunal to him on any question of law arising out of such order: Provided that the High Court may, if it is satisfied that the appellant was prevented by sufficient cause from filing the appeal within the said period, allow it to be filed within a further period not exceeding sixty days. (a) the High Court within the jurisdiction of which the aggrieved party ordinarily resides or carries on business or personally works for gain; and (b) where the Central Government is the aggrieved party, the High Court within the jurisdiction of which the respondent, or in a case where there are more than one respondent, any of the respondents, ordinarily resides or carries on business or personally works for gain.

Acquisition and Transfer of Immovable Property in India by a person resident outside India Acquisition of immovable property in India by persons resident outside India (foreign national) is regulated in terms of section 6 (3) (i) of the Foreign Exchange Management Act (FEMA), 1999 as well as by the regulations contained in the Notification No. FEMA 21/2000 -RB dated May 3, 2000, as amended from time to time. Section 2 (v) and Section 2 (w) of FEMA, 1999 defines `person resident in India' and a `person resident outside India', respectively. Person resident outside India is categorized as Non. Resident Indian (NRI) or a foreign national of Indian Origin (PIO) or a foreign national of non-Indian origin. The Reserve Bank does not determine the residential status. Under FEMA, residential status is determined by operation of law. The onus is on an individual to prove his / her residential status, if questioned by any authority. A person resident in India who is not a citizen of India is also covered by the relevant notifications.

Acquisition and Transfer of Immovable Property in India by a person resident outside India Acquisition of immovable property in India by persons resident outside India (foreign national) is regulated in terms of section 6 (3) (i) of the Foreign Exchange Management Act (FEMA), 1999 as well as by the regulations contained in the Notification No. FEMA 21/2000 -RB dated May 3, 2000, as amended from time to time. Section 2 (v) and Section 2 (w) of FEMA, 1999 defines `person resident in India' and a `person resident outside India', respectively. Person resident outside India is categorized as Non. Resident Indian (NRI) or a foreign national of Indian Origin (PIO) or a foreign national of non-Indian origin. The Reserve Bank does not determine the residential status. Under FEMA, residential status is determined by operation of law. The onus is on an individual to prove his / her residential status, if questioned by any authority. A person resident in India who is not a citizen of India is also covered by the relevant notifications.

Acquisition and Transfer of Immovable Property in India by a person resident outside India In terms of the provisions of Section 6(5) of FEMA 1999, a person resident outside India can hold, own, transfer or invest in Indian currency, security or any immovable property situated in India if such currency, security or property was acquired, held or owned by such person when he was a resident in India or inherited from a person who was a resident in India

Acquisition and Transfer of Immovable Property in India by a person resident outside India In terms of the provisions of Section 6(5) of FEMA 1999, a person resident outside India can hold, own, transfer or invest in Indian currency, security or any immovable property situated in India if such currency, security or property was acquired, held or owned by such person when he was a resident in India or inherited from a person who was a resident in India

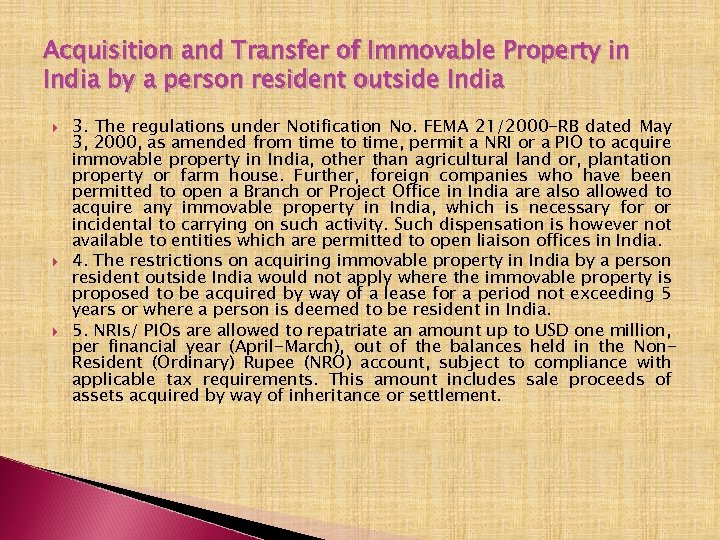

Acquisition and Transfer of Immovable Property in India by a person resident outside India 3. The regulations under Notification No. FEMA 21/2000 -RB dated May 3, 2000, as amended from time to time, permit a NRI or a PIO to acquire immovable property in India, other than agricultural land or, plantation property or farm house. Further, foreign companies who have been permitted to open a Branch or Project Office in India are also allowed to acquire any immovable property in India, which is necessary for or incidental to carrying on such activity. Such dispensation is however not available to entities which are permitted to open liaison offices in India. 4. The restrictions on acquiring immovable property in India by a person resident outside India would not apply where the immovable property is proposed to be acquired by way of a lease for a period not exceeding 5 years or where a person is deemed to be resident in India. 5. NRIs/ PIOs are allowed to repatriate an amount up to USD one million, per financial year (April-March), out of the balances held in the Non. Resident (Ordinary) Rupee (NRO) account, subject to compliance with applicable tax requirements. This amount includes sale proceeds of assets acquired by way of inheritance or settlement.

Acquisition and Transfer of Immovable Property in India by a person resident outside India 3. The regulations under Notification No. FEMA 21/2000 -RB dated May 3, 2000, as amended from time to time, permit a NRI or a PIO to acquire immovable property in India, other than agricultural land or, plantation property or farm house. Further, foreign companies who have been permitted to open a Branch or Project Office in India are also allowed to acquire any immovable property in India, which is necessary for or incidental to carrying on such activity. Such dispensation is however not available to entities which are permitted to open liaison offices in India. 4. The restrictions on acquiring immovable property in India by a person resident outside India would not apply where the immovable property is proposed to be acquired by way of a lease for a period not exceeding 5 years or where a person is deemed to be resident in India. 5. NRIs/ PIOs are allowed to repatriate an amount up to USD one million, per financial year (April-March), out of the balances held in the Non. Resident (Ordinary) Rupee (NRO) account, subject to compliance with applicable tax requirements. This amount includes sale proceeds of assets acquired by way of inheritance or settlement.

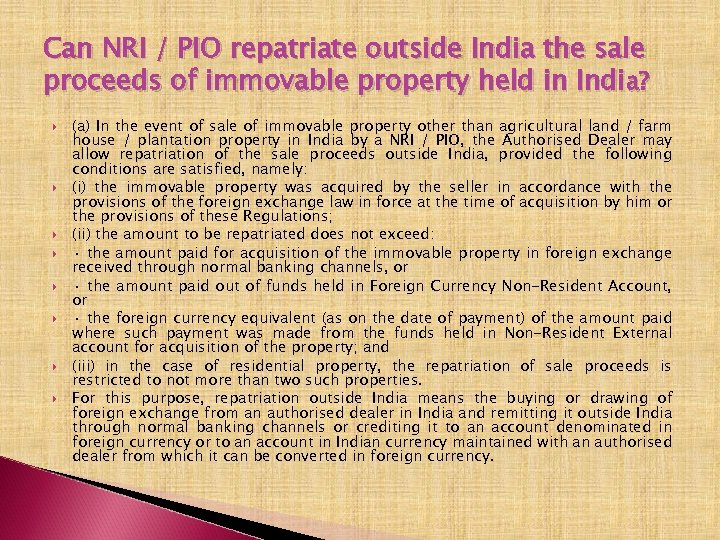

Can NRI / PIO repatriate outside India the sale proceeds of immovable property held in India? (a) In the event of sale of immovable property other than agricultural land / farm house / plantation property in India by a NRI / PIO, the Authorised Dealer may allow repatriation of the sale proceeds outside India, provided the following conditions are satisfied, namely: (i) the immovable property was acquired by the seller in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these Regulations; (ii) the amount to be repatriated does not exceed: · the amount paid for acquisition of the immovable property in foreign exchange received through normal banking channels, or · the amount paid out of funds held in Foreign Currency Non-Resident Account, or · the foreign currency equivalent (as on the date of payment) of the amount paid where such payment was made from the funds held in Non-Resident External account for acquisition of the property; and (iii) in the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties. For this purpose, repatriation outside India means the buying or drawing of foreign exchange from an authorised dealer in India and remitting it outside India through normal banking channels or crediting it to an account denominated in foreign currency or to an account in Indian currency maintained with an authorised dealer from which it can be converted in foreign currency.

Can NRI / PIO repatriate outside India the sale proceeds of immovable property held in India? (a) In the event of sale of immovable property other than agricultural land / farm house / plantation property in India by a NRI / PIO, the Authorised Dealer may allow repatriation of the sale proceeds outside India, provided the following conditions are satisfied, namely: (i) the immovable property was acquired by the seller in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these Regulations; (ii) the amount to be repatriated does not exceed: · the amount paid for acquisition of the immovable property in foreign exchange received through normal banking channels, or · the amount paid out of funds held in Foreign Currency Non-Resident Account, or · the foreign currency equivalent (as on the date of payment) of the amount paid where such payment was made from the funds held in Non-Resident External account for acquisition of the property; and (iii) in the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties. For this purpose, repatriation outside India means the buying or drawing of foreign exchange from an authorised dealer in India and remitting it outside India through normal banking channels or crediting it to an account denominated in foreign currency or to an account in Indian currency maintained with an authorised dealer from which it can be converted in foreign currency.

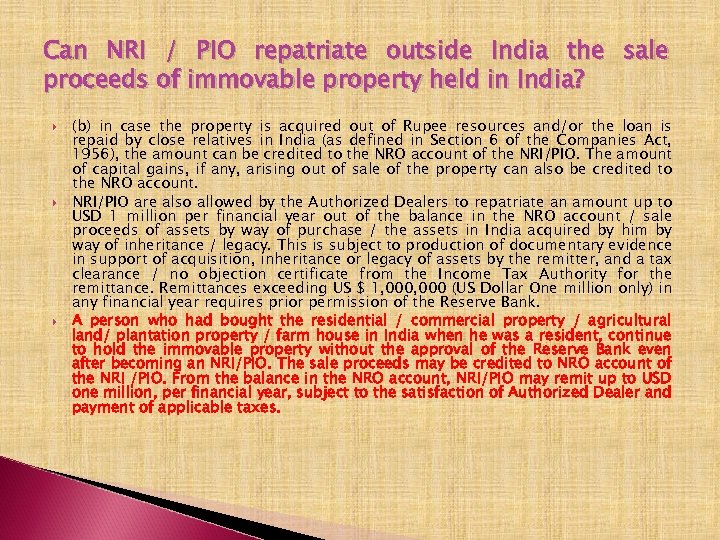

Can NRI / PIO repatriate outside India the sale proceeds of immovable property held in India? (b) in case the property is acquired out of Rupee resources and/or the loan is repaid by close relatives in India (as defined in Section 6 of the Companies Act, 1956), the amount can be credited to the NRO account of the NRI/PIO. The amount of capital gains, if any, arising out of sale of the property can also be credited to the NRO account. NRI/PIO are also allowed by the Authorized Dealers to repatriate an amount up to USD 1 million per financial year out of the balance in the NRO account / sale proceeds of assets by way of purchase / the assets in India acquired by him by way of inheritance / legacy. This is subject to production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter, and a tax clearance / no objection certificate from the Income Tax Authority for the remittance. Remittances exceeding US $ 1, 000 (US Dollar One million only) in any financial year requires prior permission of the Reserve Bank. A person who had bought the residential / commercial property / agricultural land/ plantation property / farm house in India when he was a resident, continue to hold the immovable property without the approval of the Reserve Bank even after becoming an NRI/PIO. The sale proceeds may be credited to NRO account of the NRI /PIO. From the balance in the NRO account, NRI/PIO may remit up to USD one million, per financial year, subject to the satisfaction of Authorized Dealer and payment of applicable taxes.

Can NRI / PIO repatriate outside India the sale proceeds of immovable property held in India? (b) in case the property is acquired out of Rupee resources and/or the loan is repaid by close relatives in India (as defined in Section 6 of the Companies Act, 1956), the amount can be credited to the NRO account of the NRI/PIO. The amount of capital gains, if any, arising out of sale of the property can also be credited to the NRO account. NRI/PIO are also allowed by the Authorized Dealers to repatriate an amount up to USD 1 million per financial year out of the balance in the NRO account / sale proceeds of assets by way of purchase / the assets in India acquired by him by way of inheritance / legacy. This is subject to production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter, and a tax clearance / no objection certificate from the Income Tax Authority for the remittance. Remittances exceeding US $ 1, 000 (US Dollar One million only) in any financial year requires prior permission of the Reserve Bank. A person who had bought the residential / commercial property / agricultural land/ plantation property / farm house in India when he was a resident, continue to hold the immovable property without the approval of the Reserve Bank even after becoming an NRI/PIO. The sale proceeds may be credited to NRO account of the NRI /PIO. From the balance in the NRO account, NRI/PIO may remit up to USD one million, per financial year, subject to the satisfaction of Authorized Dealer and payment of applicable taxes.

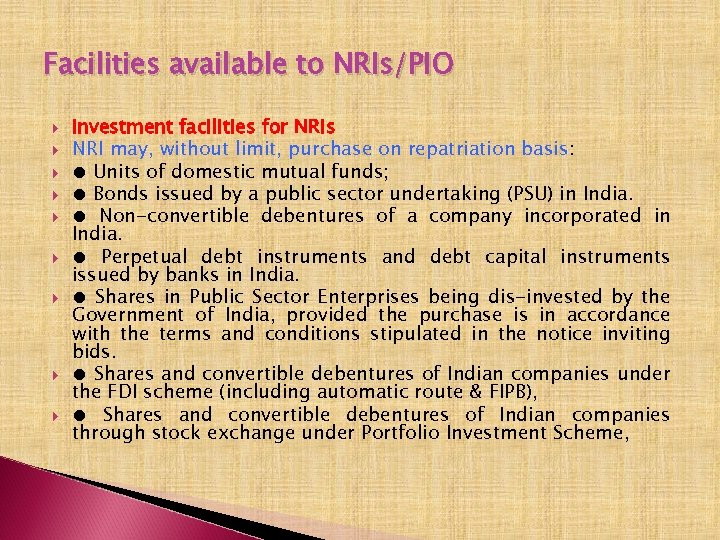

Facilities available to NRIs/PIO Investment facilities for NRIs NRI may, without limit, purchase on repatriation basis: ● Units of domestic mutual funds; ● Bonds issued by a public sector undertaking (PSU) in India. ● Non-convertible debentures of a company incorporated in India. ● Perpetual debt instruments and debt capital instruments issued by banks in India. ● Shares in Public Sector Enterprises being dis-invested by the Government of India, provided the purchase is in accordance with the terms and conditions stipulated in the notice inviting bids. ● Shares and convertible debentures of Indian companies under the FDI scheme (including automatic route & FIPB), ● Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme,

Facilities available to NRIs/PIO Investment facilities for NRIs NRI may, without limit, purchase on repatriation basis: ● Units of domestic mutual funds; ● Bonds issued by a public sector undertaking (PSU) in India. ● Non-convertible debentures of a company incorporated in India. ● Perpetual debt instruments and debt capital instruments issued by banks in India. ● Shares in Public Sector Enterprises being dis-invested by the Government of India, provided the purchase is in accordance with the terms and conditions stipulated in the notice inviting bids. ● Shares and convertible debentures of Indian companies under the FDI scheme (including automatic route & FIPB), ● Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme,

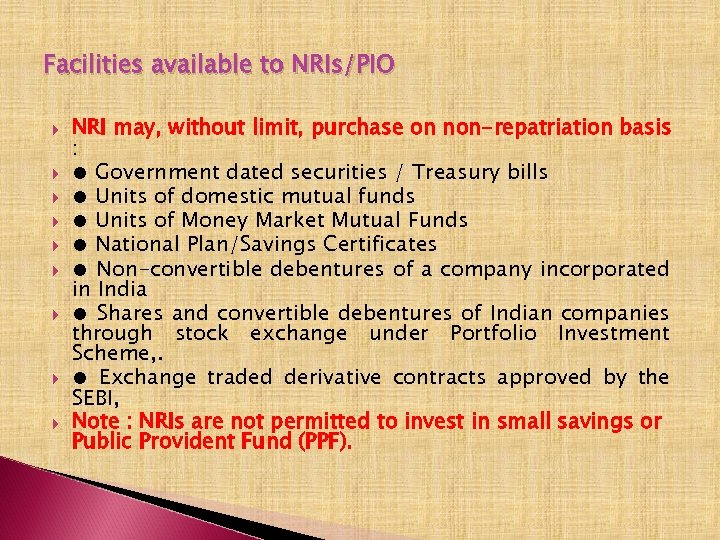

Facilities available to NRIs/PIO NRI may, without limit, purchase on non-repatriation basis : ● Government dated securities / Treasury bills ● Units of domestic mutual funds ● Units of Money Market Mutual Funds ● National Plan/Savings Certificates ● Non-convertible debentures of a company incorporated in India ● Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme, . ● Exchange traded derivative contracts approved by the SEBI, Note : NRIs are not permitted to invest in small savings or Public Provident Fund (PPF).

Facilities available to NRIs/PIO NRI may, without limit, purchase on non-repatriation basis : ● Government dated securities / Treasury bills ● Units of domestic mutual funds ● Units of Money Market Mutual Funds ● National Plan/Savings Certificates ● Non-convertible debentures of a company incorporated in India ● Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme, . ● Exchange traded derivative contracts approved by the SEBI, Note : NRIs are not permitted to invest in small savings or Public Provident Fund (PPF).

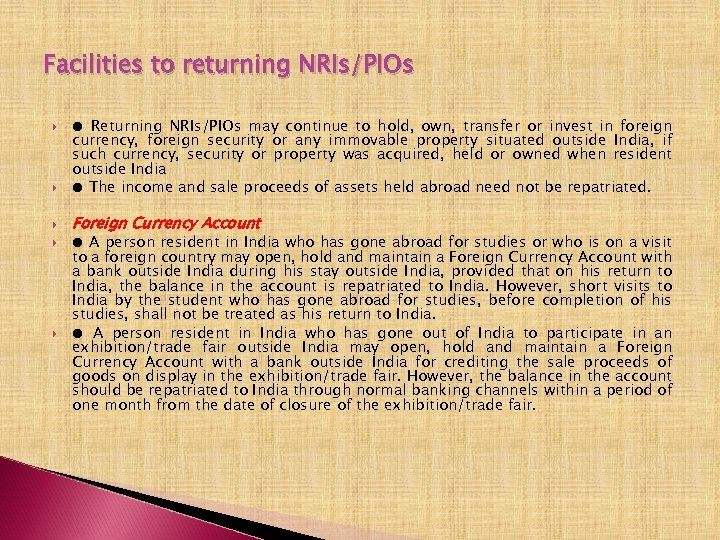

Facilities to returning NRIs/PIOs ● Returning NRIs/PIOs may continue to hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India, if such currency, security or property was acquired, held or owned when resident outside India ● The income and sale proceeds of assets held abroad need not be repatriated. Foreign Currency Account ● A person resident in India who has gone abroad for studies or who is on a visit to a foreign country may open, hold and maintain a Foreign Currency Account with a bank outside India during his stay outside India, provided that on his return to India, the balance in the account is repatriated to India. However, short visits to India by the student who has gone abroad for studies, before completion of his studies, shall not be treated as his return to India. ● A person resident in India who has gone out of India to participate in an exhibition/trade fair outside India may open, hold and maintain a Foreign Currency Account with a bank outside India for crediting the sale proceeds of goods on display in the exhibition/trade fair. However, the balance in the account should be repatriated to India through normal banking channels within a period of one month from the date of closure of the exhibition/trade fair.

Facilities to returning NRIs/PIOs ● Returning NRIs/PIOs may continue to hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India, if such currency, security or property was acquired, held or owned when resident outside India ● The income and sale proceeds of assets held abroad need not be repatriated. Foreign Currency Account ● A person resident in India who has gone abroad for studies or who is on a visit to a foreign country may open, hold and maintain a Foreign Currency Account with a bank outside India during his stay outside India, provided that on his return to India, the balance in the account is repatriated to India. However, short visits to India by the student who has gone abroad for studies, before completion of his studies, shall not be treated as his return to India. ● A person resident in India who has gone out of India to participate in an exhibition/trade fair outside India may open, hold and maintain a Foreign Currency Account with a bank outside India for crediting the sale proceeds of goods on display in the exhibition/trade fair. However, the balance in the account should be repatriated to India through normal banking channels within a period of one month from the date of closure of the exhibition/trade fair.

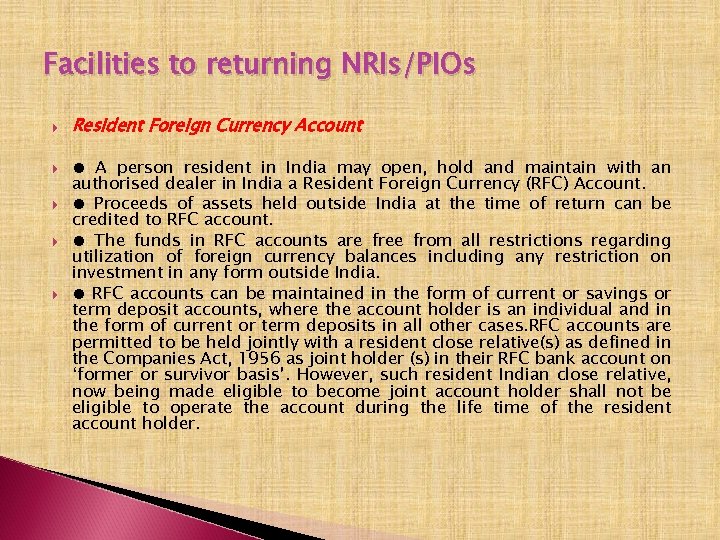

Facilities to returning NRIs/PIOs Resident Foreign Currency Account ● A person resident in India may open, hold and maintain with an authorised dealer in India a Resident Foreign Currency (RFC) Account. ● Proceeds of assets held outside India at the time of return can be credited to RFC account. ● The funds in RFC accounts are free from all restrictions regarding utilization of foreign currency balances including any restriction on investment in any form outside India. ● RFC accounts can be maintained in the form of current or savings or term deposit accounts, where the account holder is an individual and in the form of current or term deposits in all other cases. RFC accounts are permitted to be held jointly with a resident close relative(s) as defined in the Companies Act, 1956 as joint holder (s) in their RFC bank account on ‘former or survivor basis’. However, such resident Indian close relative, now being made eligible to become joint account holder shall not be eligible to operate the account during the life time of the resident account holder.

Facilities to returning NRIs/PIOs Resident Foreign Currency Account ● A person resident in India may open, hold and maintain with an authorised dealer in India a Resident Foreign Currency (RFC) Account. ● Proceeds of assets held outside India at the time of return can be credited to RFC account. ● The funds in RFC accounts are free from all restrictions regarding utilization of foreign currency balances including any restriction on investment in any form outside India. ● RFC accounts can be maintained in the form of current or savings or term deposit accounts, where the account holder is an individual and in the form of current or term deposits in all other cases. RFC accounts are permitted to be held jointly with a resident close relative(s) as defined in the Companies Act, 1956 as joint holder (s) in their RFC bank account on ‘former or survivor basis’. However, such resident Indian close relative, now being made eligible to become joint account holder shall not be eligible to operate the account during the life time of the resident account holder.

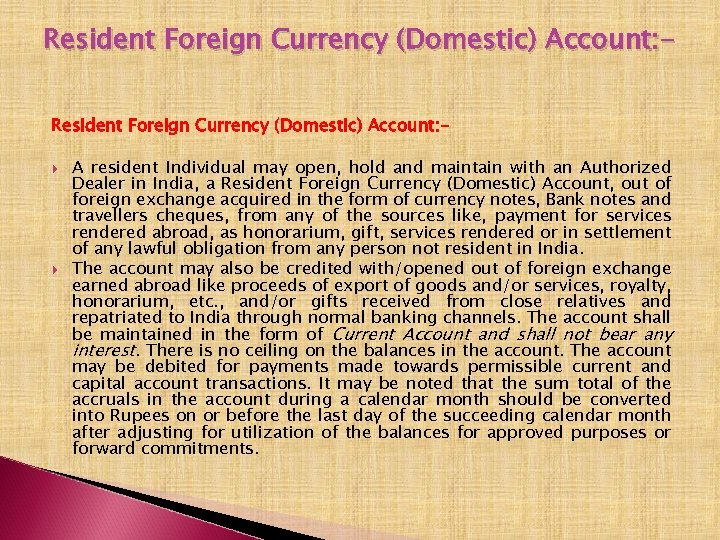

Resident Foreign Currency (Domestic) Account: A resident Individual may open, hold and maintain with an Authorized Dealer in India, a Resident Foreign Currency (Domestic) Account, out of foreign exchange acquired in the form of currency notes, Bank notes and travellers cheques, from any of the sources like, payment for services rendered abroad, as honorarium, gift, services rendered or in settlement of any lawful obligation from any person not resident in India. The account may also be credited with/opened out of foreign exchange earned abroad like proceeds of export of goods and/or services, royalty, honorarium, etc. , and/or gifts received from close relatives and repatriated to India through normal banking channels. The account shall be maintained in the form of Current Account and shall not bear any interest. There is no ceiling on the balances in the account. The account may be debited for payments made towards permissible current and capital account transactions. It may be noted that the sum total of the accruals in the account during a calendar month should be converted into Rupees on or before the last day of the succeeding calendar month after adjusting for utilization of the balances for approved purposes or forward commitments.

Resident Foreign Currency (Domestic) Account: A resident Individual may open, hold and maintain with an Authorized Dealer in India, a Resident Foreign Currency (Domestic) Account, out of foreign exchange acquired in the form of currency notes, Bank notes and travellers cheques, from any of the sources like, payment for services rendered abroad, as honorarium, gift, services rendered or in settlement of any lawful obligation from any person not resident in India. The account may also be credited with/opened out of foreign exchange earned abroad like proceeds of export of goods and/or services, royalty, honorarium, etc. , and/or gifts received from close relatives and repatriated to India through normal banking channels. The account shall be maintained in the form of Current Account and shall not bear any interest. There is no ceiling on the balances in the account. The account may be debited for payments made towards permissible current and capital account transactions. It may be noted that the sum total of the accruals in the account during a calendar month should be converted into Rupees on or before the last day of the succeeding calendar month after adjusting for utilization of the balances for approved purposes or forward commitments.

Exchange Earner's Foreign Currency (EEFC) Account Exchange Earners' Foreign Currency Account (EEFC) is an account maintained in foreign currency with an Authorised Dealer i. e. a bank dealing in foreign exchange. It is a facility provided to the foreign exchange earners, including exporters, to credit 100 per cent of their foreign exchange earnings to the account, so that the account holders do not have to convert foreign exchange into Rupees and vice versa, thereby minimizing the transaction costs. An EEFC account can be held only in the form of a current account. No interest is payable on EEFC accounts.

Exchange Earner's Foreign Currency (EEFC) Account Exchange Earners' Foreign Currency Account (EEFC) is an account maintained in foreign currency with an Authorised Dealer i. e. a bank dealing in foreign exchange. It is a facility provided to the foreign exchange earners, including exporters, to credit 100 per cent of their foreign exchange earnings to the account, so that the account holders do not have to convert foreign exchange into Rupees and vice versa, thereby minimizing the transaction costs. An EEFC account can be held only in the form of a current account. No interest is payable on EEFC accounts.

Diamond Dollar Account (DDA): Diamond Dollar Account (DDA): Under the scheme of Government of India, firms and companies dealing in purchase / sale of rough or cut and polished diamonds / precious metal jewellery plain, minakari and / or studded with / without diamond and / or other stones, with a track record of at least 2 years in import / export of diamonds / coloured gemstones / diamond and coloured gemstones studded jewellery / plain gold jewellery and having an average annual turnover of Rs. 3 crores or above during the preceding three licensing years (licensing year is from April to March) are permitted to transact their business through Diamond Dollar Accounts. It may be noted that the sum total of the accruals in the account during a calendar month should be converted into Rupees on or before the last day of the succeeding calendar month after adjusting for utilization of the balances for approved purposes or forward commitments. Such firms and companies may be allowed to open not more than five Diamond Dollar Accounts with their banks.

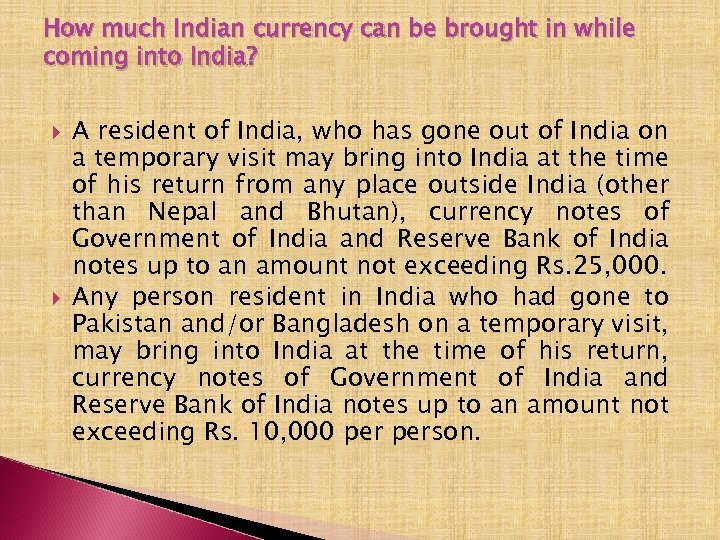

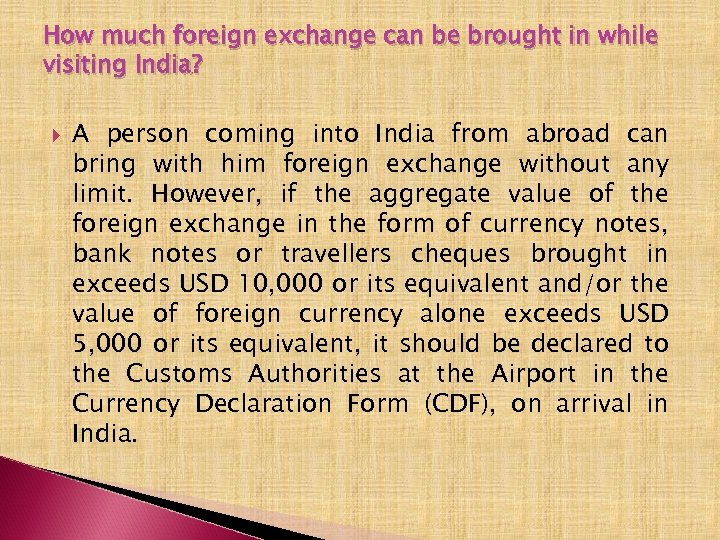

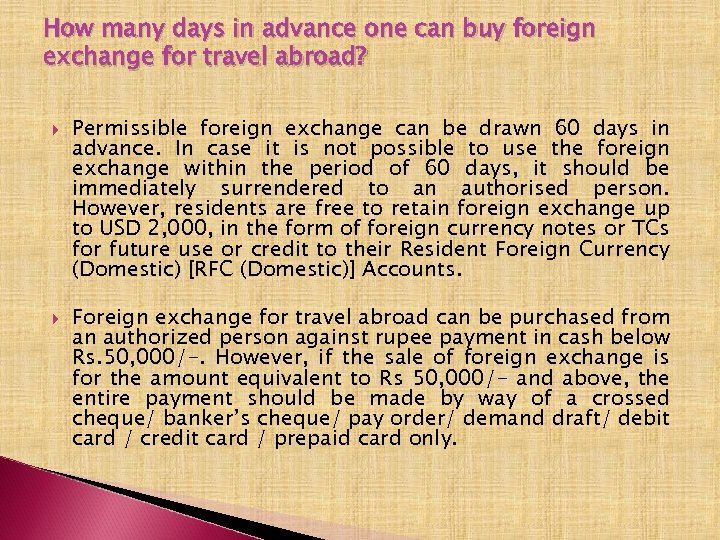

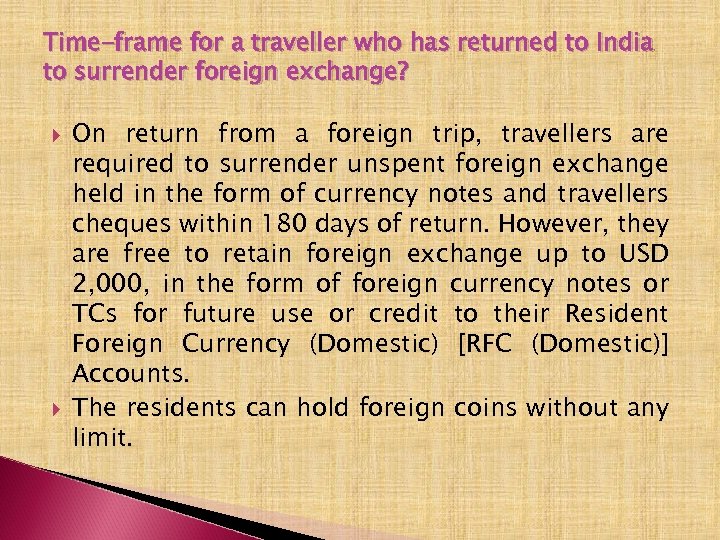

Diamond Dollar Account (DDA): Diamond Dollar Account (DDA): Under the scheme of Government of India, firms and companies dealing in purchase / sale of rough or cut and polished diamonds / precious metal jewellery plain, minakari and / or studded with / without diamond and / or other stones, with a track record of at least 2 years in import / export of diamonds / coloured gemstones / diamond and coloured gemstones studded jewellery / plain gold jewellery and having an average annual turnover of Rs. 3 crores or above during the preceding three licensing years (licensing year is from April to March) are permitted to transact their business through Diamond Dollar Accounts. It may be noted that the sum total of the accruals in the account during a calendar month should be converted into Rupees on or before the last day of the succeeding calendar month after adjusting for utilization of the balances for approved purposes or forward commitments. Such firms and companies may be allowed to open not more than five Diamond Dollar Accounts with their banks.