b2700ace2246c095c53a484e8705af30.ppt

- Количество слайдов: 25

Federal Reserve Bank of Chicago Global Automotive Sourcing An India/China Discussion Chicago April 27, 2004

Summary n Motivations for global sourcing are varied – they need to be analysed in the context of business drivers (revenues, costs) and market impact (away vs. home) n Nature of emerging Asian markets strongly differ from mature markets such as North America • Manufacturers need to follow a “build where you sell” strategy • Majority of Asian activity by manufacturers is for local market consumption n Two segments of global automotive sourcing – manufacturing and services • Manufacturing based exports (vehicles, components) from China/India growing rapidly but from a small base • Exploiting export opportunities requires careful study – to address supply chain, regulatory and economic factors • Services based exports very strong and growing – significant future growth expected n India appears to lead in engineering driven outsourcing; China competes on scale and cost • However, the automotive industry base in these countries is very fragmented and can be tough to navigate n A. T. Kearney’s 2004 Offshore Location Index ranks India and China are the top two destinations for services offshoring n Economic liberalization, improved connectivity, reduced cost of telecom in addition to large available pools of technical talent are driving outsourcing of services A. T. Kearney 82/7041 2

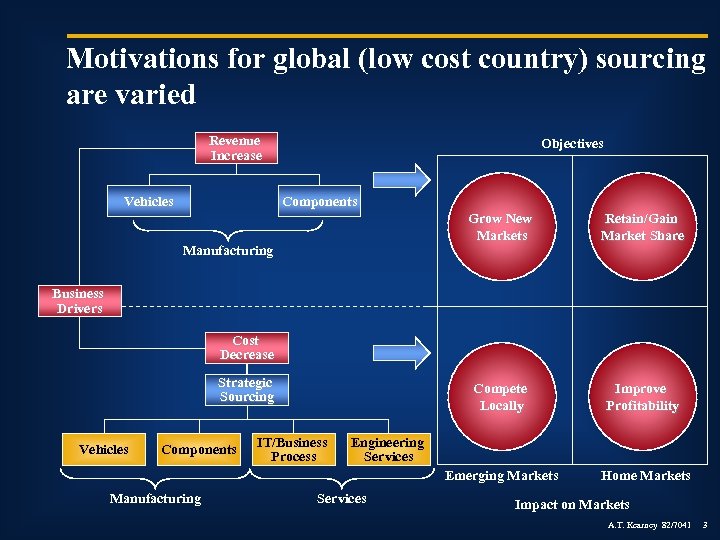

Motivations for global (low cost country) sourcing are varied Revenue Increase Vehicles Objectives Components Grow New Markets Compete Locally Improve Profitability Emerging Markets Manufacturing Retain/Gain Market Share Home Markets Business Drivers Cost Decrease Strategic Sourcing Vehicles Components Manufacturing IT/Business Process Engineering Services Impact on Markets A. T. Kearney 82/7041 3

Manufacturing A. T. Kearney 82/7041 4

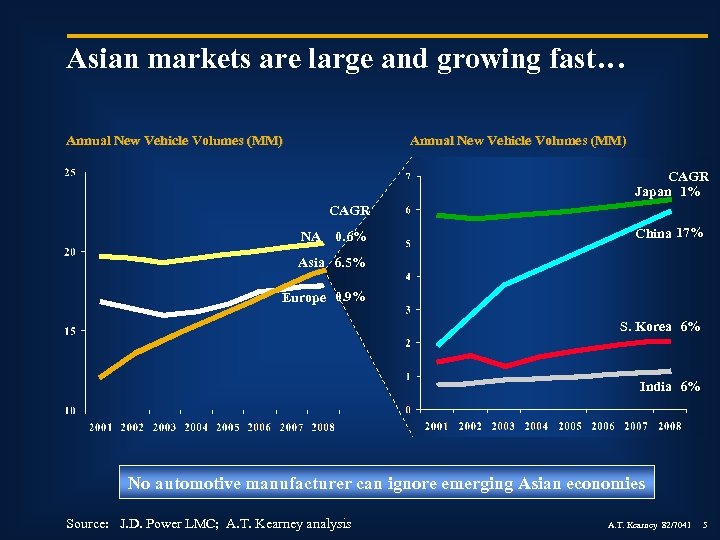

Asian markets are large and growing fast… Annual New Vehicle Volumes (MM) CAGR Japan 1% CAGR NA 0. 6% China 17% Asia 6. 5% Europe 0. 9% S. Korea 6% India 6% No automotive manufacturer can ignore emerging Asian economies Source: J. D. Power LMC; A. T. Kearney analysis A. T. Kearney 82/7041 5

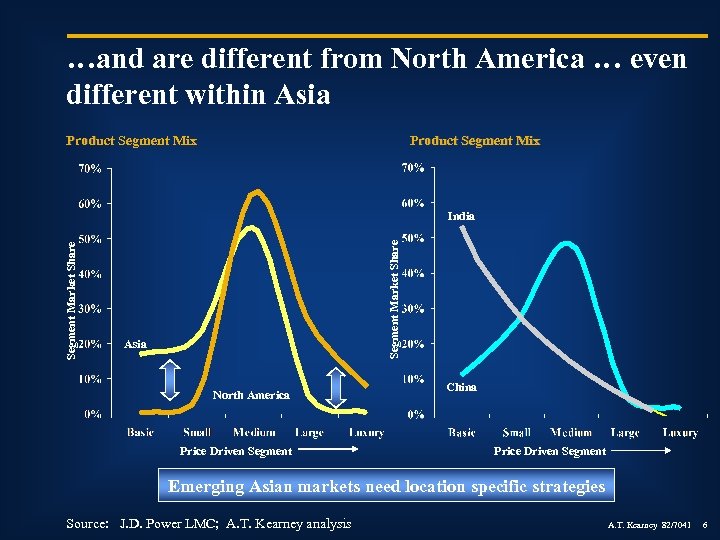

…and are different from North America … even different within Asia Product Segment Mix Segment Market Share India Asia North America Price Driven Segment China Price Driven Segment Emerging Asian markets need location specific strategies Source: J. D. Power LMC; A. T. Kearney analysis A. T. Kearney 82/7041 6

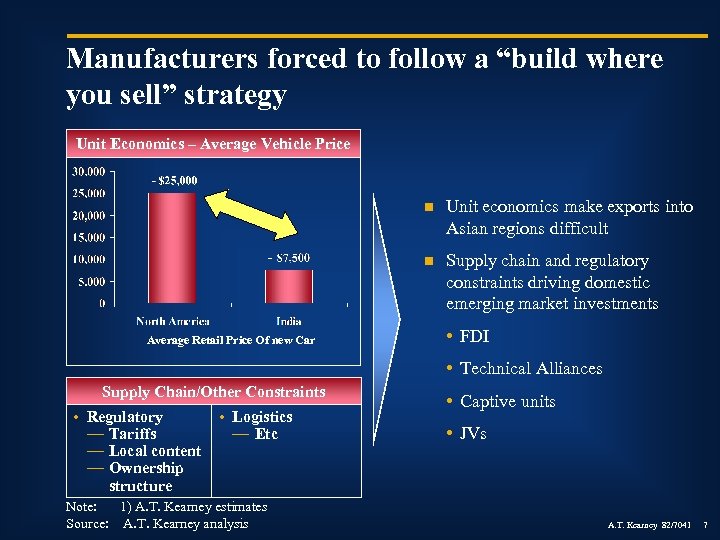

Manufacturers forced to follow a “build where you sell” strategy Unit Economics – Average Vehicle Price n n Average Retail Price Of new Car Unit economics make exports into Asian regions difficult Supply chain and regulatory constraints driving domestic emerging market investments • FDI • Technical Alliances Supply Chain/Other Constraints • Regulatory — Tariffs — Local content — Ownership structure • Logistics — Etc Note: 1) A. T. Kearney estimates Source: A. T. Kearney analysis • Captive units • JVs A. T. Kearney 82/7041 7

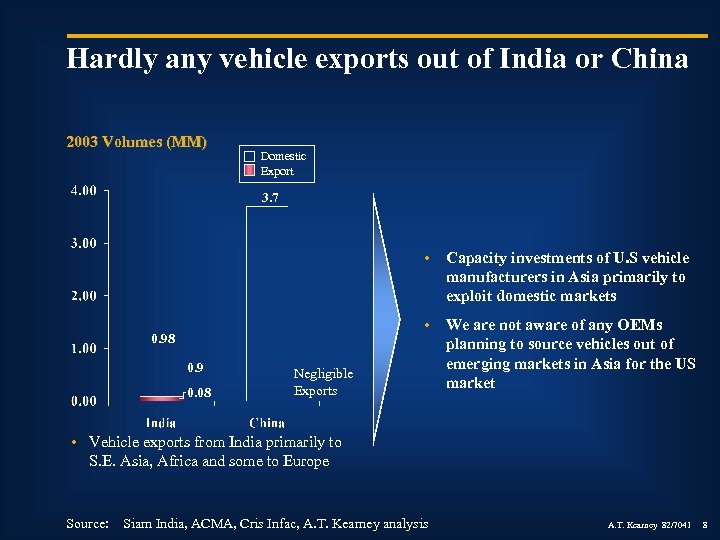

Hardly any vehicle exports out of India or China 2003 Volumes (MM) Domestic Export 3. 7 • Capacity investments of U. S vehicle manufacturers in Asia primarily to exploit domestic markets 0. 98 0. 9 0. 08 Negligible Exports • We are not aware of any OEMs planning to source vehicles out of emerging markets in Asia for the US market • Vehicle exports from India primarily to S. E. Asia, Africa and some to Europe Source: Siam India, ACMA, Cris Infac, A. T. Kearney analysis A. T. Kearney 82/7041 8

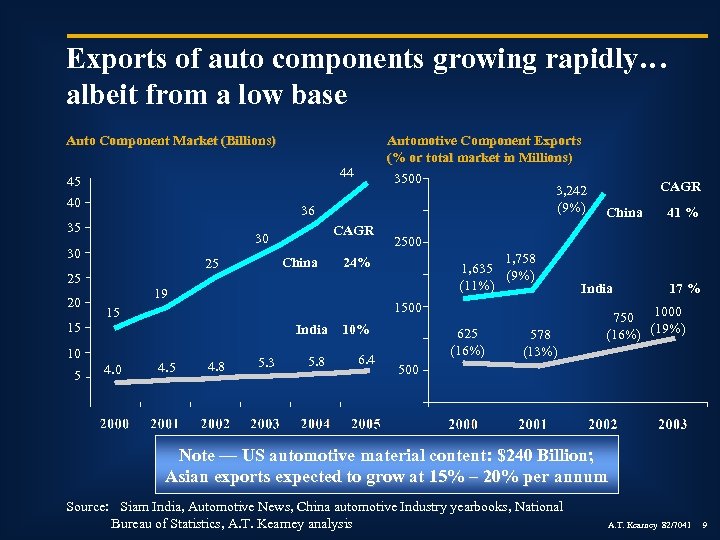

Exports of auto components growing rapidly… albeit from a low base Auto Component Market (Billions) 44 45 40 China 25 25 3, 242 (9%) India 4. 0 4. 5 1, 758 1, 635 (9%) (11%) 1500 15 4. 8 5. 3 5. 8 10% 6. 4 CAGR China 41 % 2500 24% 19 10 5 CAGR 30 30 15 3500 36 35 20 Automotive Component Exports (% or total market in Millions) 625 (16%) 578 (13%) India 17 % 750 1000 (16%) (19%) 500 Note — US automotive material content: $240 Billion; Asian exports expected to grow at 15% – 20% per annum Source: Siam India, Automotive News, China automotive Industry yearbooks, National Bureau of Statistics, A. T. Kearney analysis A. T. Kearney 82/7041 9

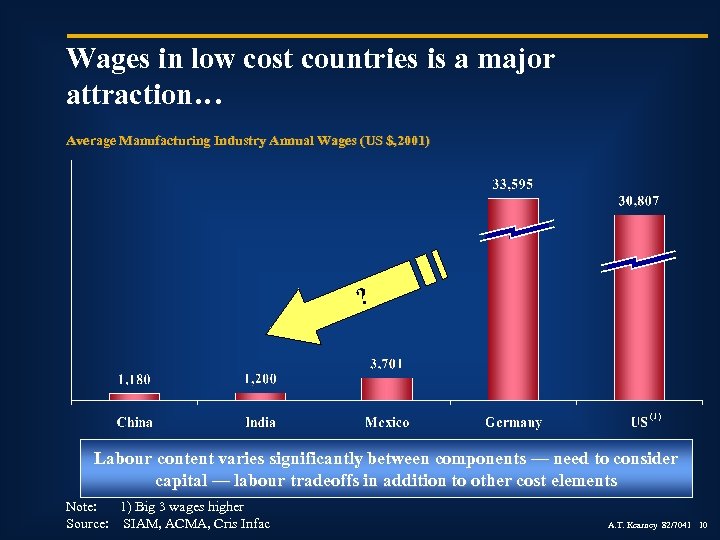

Wages in low cost countries is a major attraction… Average Manufacturing Industry Annual Wages (US $, 2001) ? (1) Labour content varies significantly between components — need to consider capital — labour tradeoffs in addition to other cost elements Note: 1) Big 3 wages higher Source: SIAM, ACMA, Cris Infac A. T. Kearney 82/7041 10

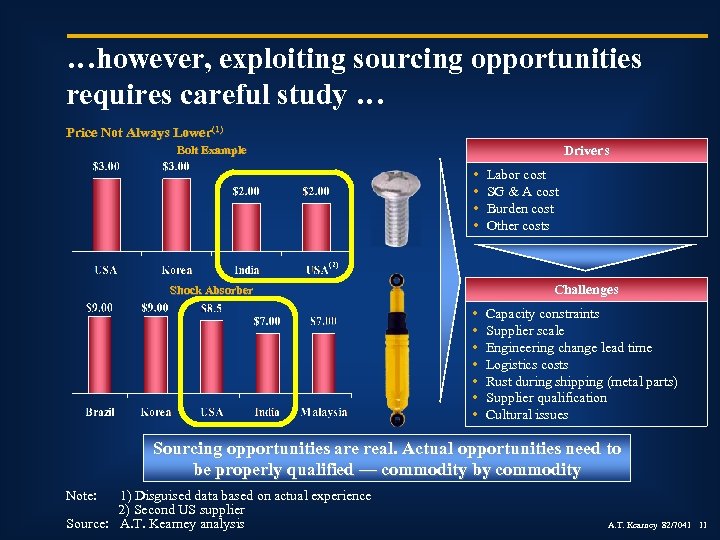

…however, exploiting sourcing opportunities requires careful study … Price Not Always Lower(1) Drivers Bolt Example • • Labor cost SG & A cost Burden cost Other costs (2) Challenges Shock Absorber • • Capacity constraints Supplier scale Engineering change lead time Logistics costs Rust during shipping (metal parts) Supplier qualification Cultural issues Sourcing opportunities are real. Actual opportunities need to be properly qualified — commodity by commodity Note: 1) Disguised data based on actual experience 2) Second US supplier Source: A. T. Kearney analysis A. T. Kearney 82/7041 11

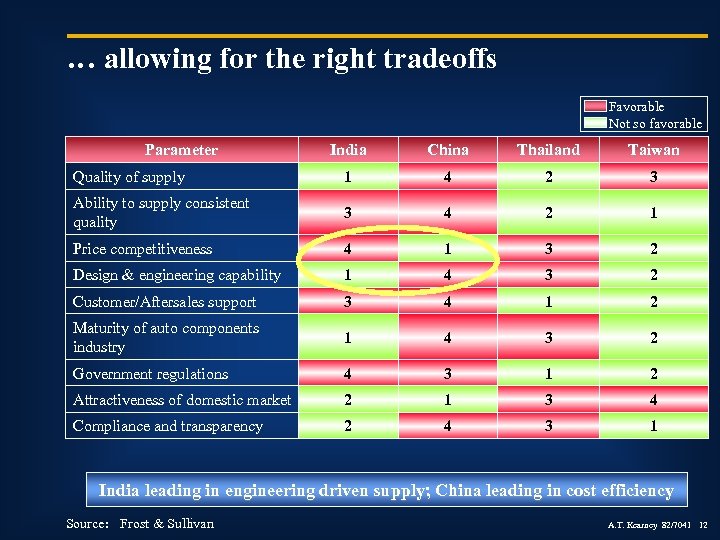

… allowing for the right tradeoffs Favorable Not so favorable Parameter India China Thailand Taiwan Quality of supply 1 4 2 3 Ability to supply consistent quality 3 4 2 1 Price competitiveness 4 1 3 2 Design & engineering capability 1 4 3 2 Customer/Aftersales support 3 4 1 2 Maturity of auto components industry 1 4 3 2 Government regulations 4 3 1 2 Attractiveness of domestic market 2 1 3 4 Compliance and transparency 2 4 3 1 India leading in engineering driven supply; China leading in cost efficiency Source: Frost & Sullivan A. T. Kearney 82/7041 12

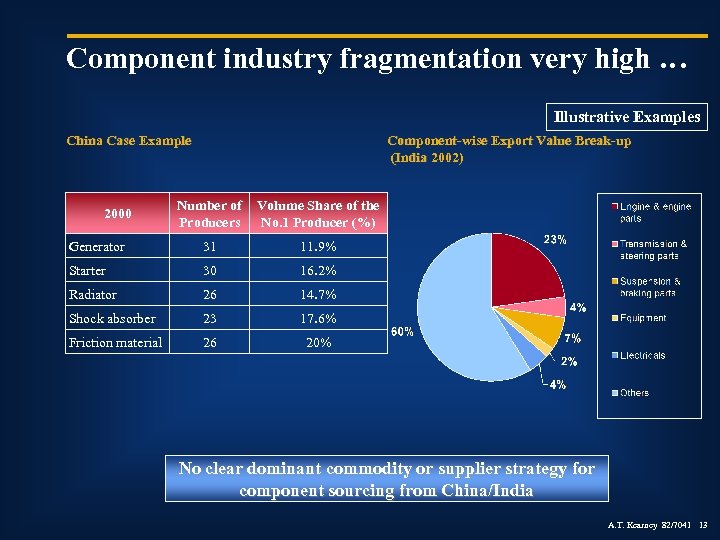

Component industry fragmentation very high … Illustrative Examples China Case Example Component-wise Export Value Break-up (India 2002) Number of Producers Volume Share of the No. 1 Producer (%) Generator 31 11. 9% Starter 30 16. 2% Radiator 26 14. 7% Shock absorber 23 17. 6% Friction material 26 20% 2000 No clear dominant commodity or supplier strategy for component sourcing from China/India A. T. Kearney 82/7041 13

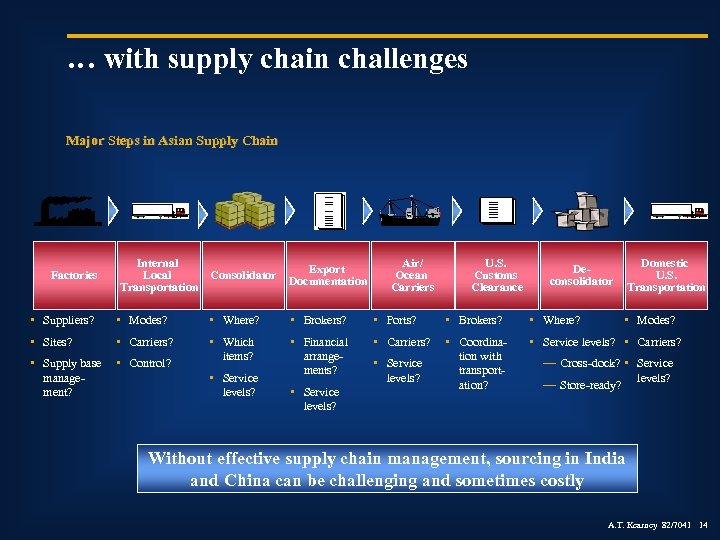

… with supply chain challenges Major Steps in Asian Supply Chain Factories Internal Export Local Consolidator Documentation Transportation Air/ Ocean Carriers U. S. Customs Clearance Domestic U. S. Transportation Deconsolidator • Suppliers? • Modes? • Where? • Brokers? • Ports? • Brokers? • Where? • Sites? • Carriers? • Which items? • Financial arrangements? • Carriers? • Coordination with transportation? • Service levels? • Carriers? • Supply base • Control? management? • Service levels? • Modes? — Cross-dock? • Service levels? — Store-ready? Without effective supply chain management, sourcing in India and China can be challenging and sometimes costly A. T. Kearney 82/7041 14

Services (i. e. non-manufacturing) A. T. Kearney 82/7041 15

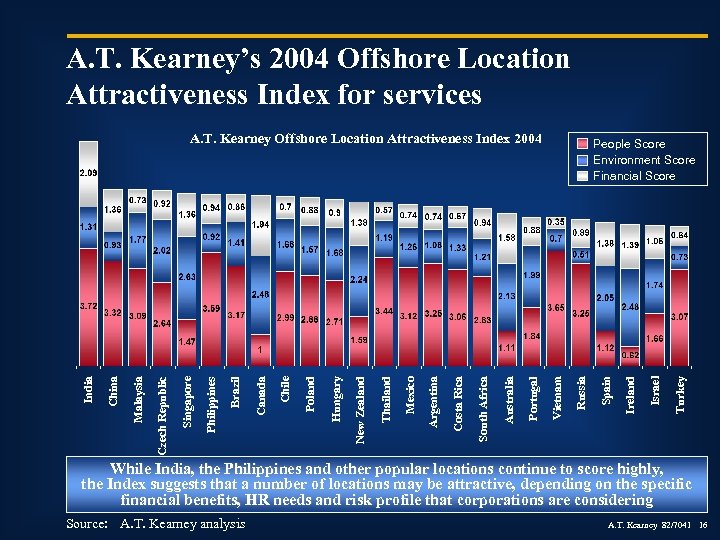

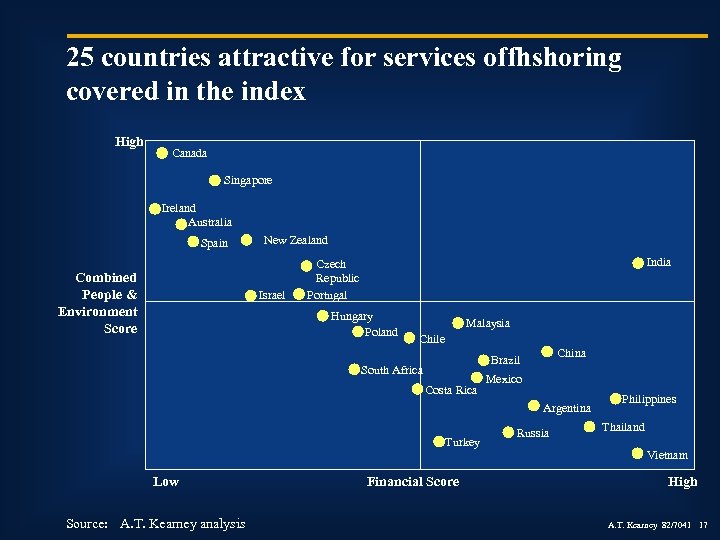

A. T. Kearney’s 2004 Offshore Location Attractiveness Index for services Turkey Israel Ireland Spain Russia People Score Environment Score Financial Score Vietnam Portugal Australia South Africa Costa Rica Argentina Mexico Thailand New Zealand Hungary Poland Chile Canada Brazil Philippines Singapore Czech Republic Malaysia China India A. T. Kearney Offshore Location Attractiveness Index 2004 While India, the Philippines and other popular locations continue to score highly, the Index suggests that a number of locations may be attractive, depending on the specific financial benefits, HR needs and risk profile that corporations are considering Source: A. T. Kearney analysis A. T. Kearney 82/7041 16

25 countries attractive for services offhshoring covered in the index High Canada Singapore Ireland Australia Spain Combined People & Environment Score New Zealand Israel India Czech Republic Portugal Hungary Poland Malaysia Chile China Brazil South Africa Costa Rica Mexico Argentina Turkey Low Source: A. T. Kearney analysis Financial Score Russia Philippines Thailand Vietnam High A. T. Kearney 82/7041 17

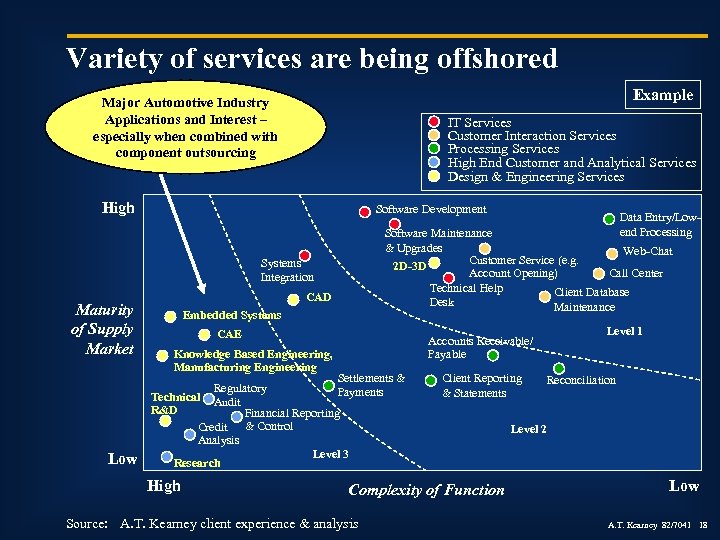

Variety of services are being offshored Example Major Automotive Industry Applications and Interest – especially when combined with component outsourcing IT Services Customer Interaction Services Processing Services High End Customer and Analytical Services Design & Engineering Services High Software Development Software Maintenance & Upgrades Web-Chat Customer Service (e. g. 2 D-3 D Account Opening) Call Center Technical Help Client Database Desk Maintenance Systems Integration Maturity of Supply Market Low CAD Embedded Systems CAE Level 1 Accounts Receivable/ Payable Knowledge Based Engineering, Manufacturing Engineering Settlements & Regulatory Payments Technical Audit R&D Financial Reporting Credit & Control Analysis Level 3 Research High Data Entry/Lowend Processing Client Reporting & Statements Complexity of Function Source: A. T. Kearney client experience & analysis Reconciliation Level 2 Low A. T. Kearney 82/7041 18

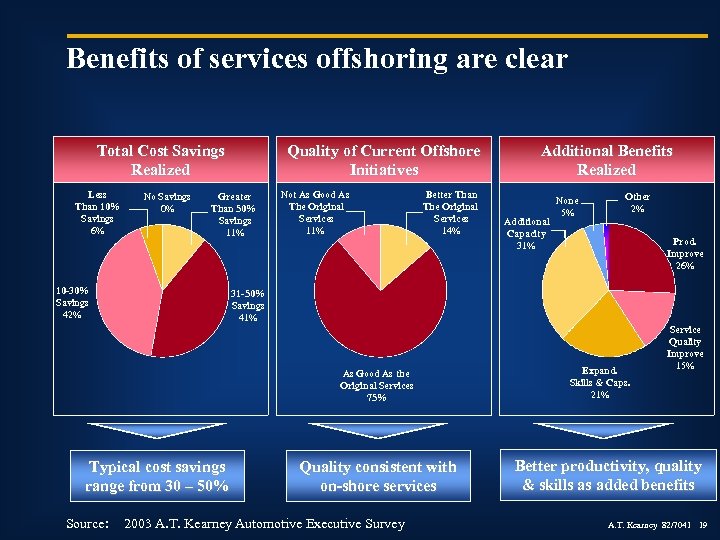

Benefits of services offshoring are clear Total Cost Savings Realized Less Than 10% Savings 6% No Savings 0% Quality of Current Offshore Initiatives Greater Than 50% Savings 11% 10 -30% Savings 42% Not As Good As The Original Services 11% Better Than The Original Services 14% Additional Capacity 31% None 5% Other 2% Prod. Improve 26% 31 -50% Savings 41% As Good As the Original Services 75% Typical cost savings range from 30 – 50% Additional Benefits Realized Quality consistent with on-shore services Source: 2003 A. T. Kearney Automotive Executive Survey Expand. Skills & Caps. 21% Service Quality Improve 15% Better productivity, quality & skills as added benefits A. T. Kearney 82/7041 19

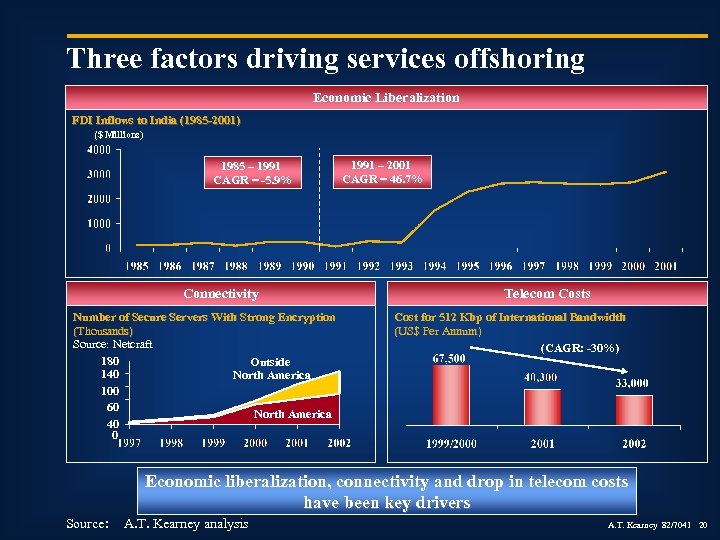

Three factors driving services offshoring Economic Liberalization FDI Inflows to India (1985 -2001) ($ Millions) 1985 – 1991 CAGR = -5. 9% Connectivity Number of Secure Servers With Strong Encryption (Thousands) Source: Netcraft 180 Outside 140 North America 100 60 North America 40 0 1991 – 2001 CAGR = 46. 7% Telecom Costs Cost for 512 Kbp of International Bandwidth (US$ Per Annum) (CAGR: -30%) Economic liberalization, connectivity and drop in telecom costs have been key drivers Source: A. T. Kearney analysis A. T. Kearney 82/7041 20

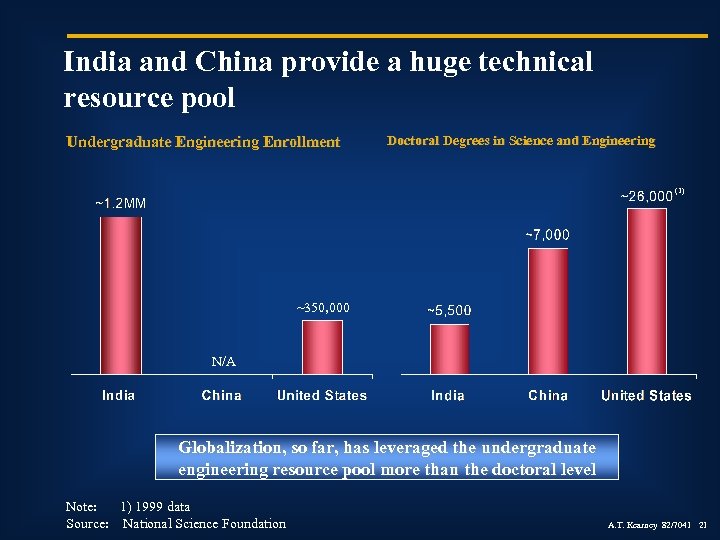

India and China provide a huge technical resource pool Undergraduate Engineering Enrollment Doctoral Degrees in Science and Engineering (1) ~350, 000 N/A Globalization, so far, has leveraged the undergraduate engineering resource pool more than the doctoral level Note: 1) 1999 data Source: National Science Foundation A. T. Kearney 82/7041 21

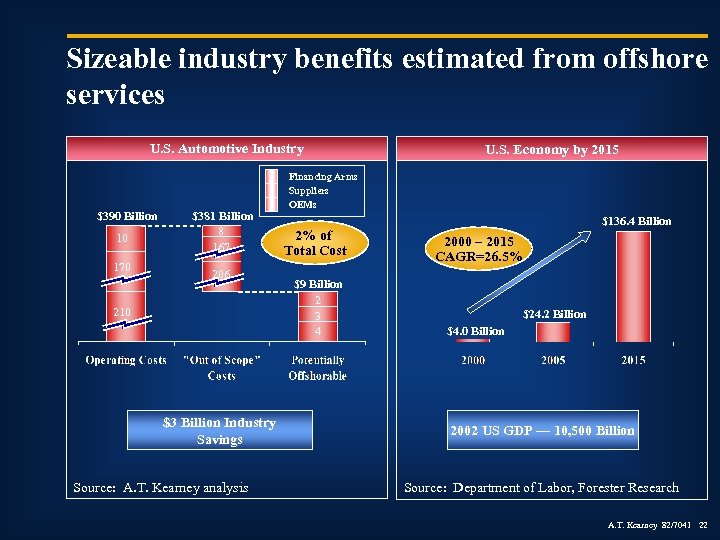

Sizeable industry benefits estimated from offshore services U. S. Automotive Industry $390 Billion 10 170 $381 Billion 8 167 206 210 $3 Billion Industry Savings Source: A. T. Kearney analysis U. S. Economy by 2015 Financing Arms Suppliers OEMs 2% of Total Cost $9 Billion 2 3 4 $136. 4 Billion 2000 – 2015 CAGR=26. 5% $24. 2 Billion $4. 0 Billion 2002 US GDP — 10, 500 Billion Source: Department of Labor, Forester Research A. T. Kearney 82/7041 22

Thank You! For More Information Contact Nagi Palle, Principal Taj Mahal Hotel, Suite 1001 2000 Town Center, Suite 1600 One Mansingh Road Southfield, MI 48075 New Delhi 110011 USA India Tel: + 1 (248) 354 2226 Tel: + 91 11 2302 6162 Ext 1001 A. T. Kearney 82/7041 23

Additional A. T. Kearney 82/7041 24

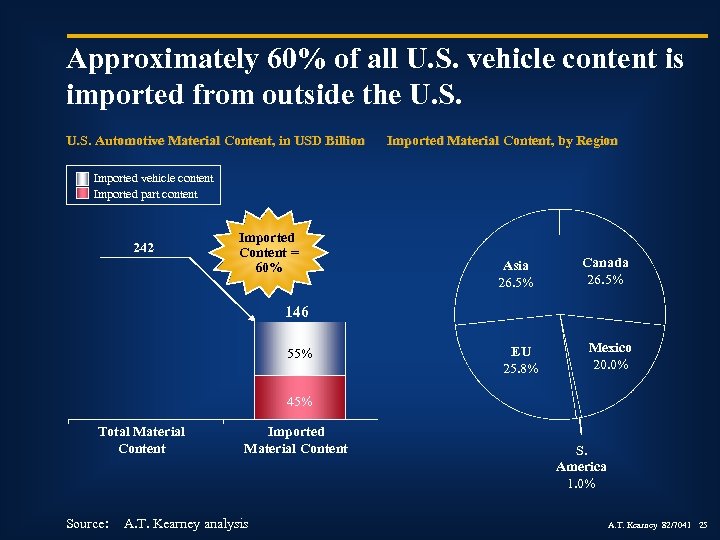

Approximately 60% of all U. S. vehicle content is imported from outside the U. S. Automotive Material Content, in USD Billion Imported Material Content, by Region Imported vehicle content Imported part content 242 Imported Content = 60% Asia 26. 5% Canada 26. 5% 146 55% EU 25. 8% Mexico 20. 0% 45% Total Material Content Imported Material Content Source: A. T. Kearney analysis S. America 1. 0% A. T. Kearney 82/7041 25

b2700ace2246c095c53a484e8705af30.ppt