463bd503f1551c032b26eefd92abc6d7.ppt

- Количество слайдов: 10

Federal Reserve Bank of Atlanta 2009 Financial Markets Conference Chuck Vice, President and COO, ICE May 12, 2009 www. theice. com

ICE INTRODUCTION ICE is a leading global exchange operator with proprietary trading technology, three regulated futures exchanges and clearing houses in the energy, agricultural commodities, equity index and currency markets; ICE also operates leading OTC energy and credit derivatives markets and clearing houses Global distribution • Screens distributed in 57 countries • Regulated futures exchanges and clearing houses in the U. S. , Europe and Canada, as well as Global OTC markets Diversified markets • Energy, agricultural, equity index, currency and credit products • Futures, OTC and Options Leading-edge technology • Sophisticated, scalable infrastructure, highly accessible platform • ICE offices in Asia, Canada, Europe and the U. S.

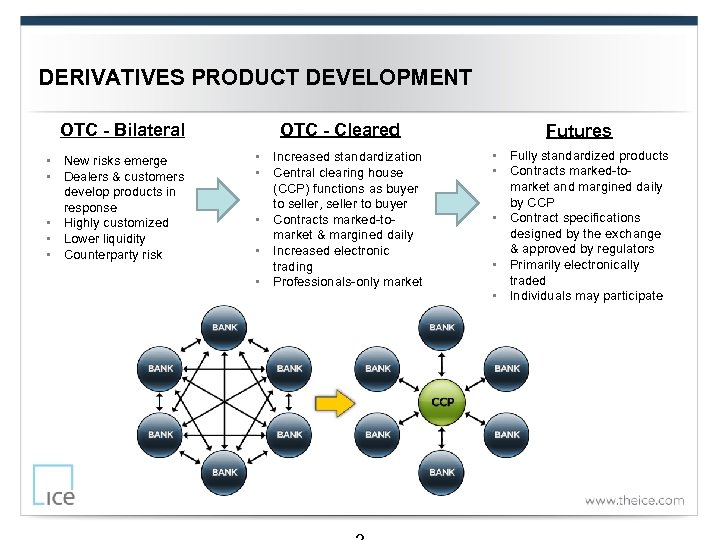

DERIVATIVES PRODUCT DEVELOPMENT OTC - Bilateral • New risks emerge • Dealers & customers develop products in response • Highly customized • Lower liquidity • Counterparty risk OTC - Cleared Futures • Increased standardization • Central clearing house (CCP) functions as buyer to seller, seller to buyer • Contracts marked-tomarket & margined daily • Increased electronic trading • Professionals-only market • Fully standardized products • Contracts marked-tomarket and margined daily by CCP • Contract specifications designed by the exchange & approved by regulators • Primarily electronically traded • Individuals may participate

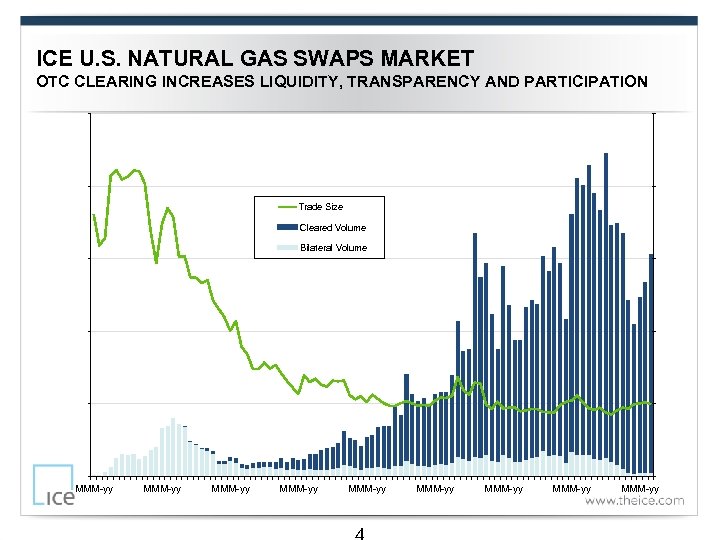

ICE U. S. NATURAL GAS SWAPS MARKET OTC CLEARING INCREASES LIQUIDITY, TRANSPARENCY AND PARTICIPATION Trade Size Cleared Volume Bilateral Volume MMM-yy MMM-yy MMM-yy

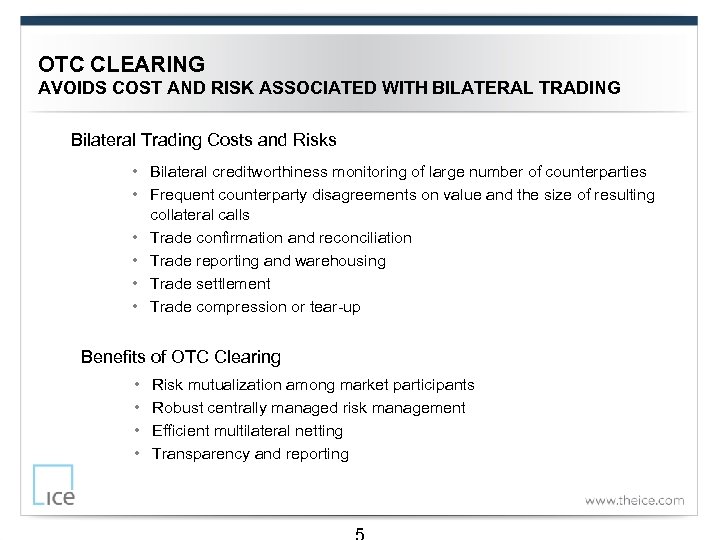

OTC CLEARING AVOIDS COST AND RISK ASSOCIATED WITH BILATERAL TRADING Bilateral Trading Costs and Risks • Bilateral creditworthiness monitoring of large number of counterparties • Frequent counterparty disagreements on value and the size of resulting collateral calls • Trade confirmation and reconciliation • Trade reporting and warehousing • Trade settlement • Trade compression or tear-up Benefits of OTC Clearing • • Risk mutualization among market participants Robust centrally managed risk management Efficient multilateral netting Transparency and reporting

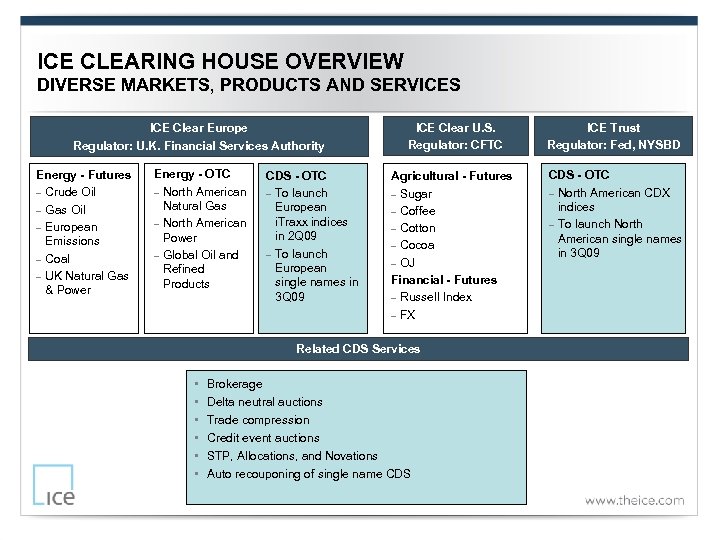

ICE CLEARING HOUSE OVERVIEW DIVERSE MARKETS, PRODUCTS AND SERVICES ICE Clear Europe Regulator: U. K. Financial Services Authority ICE Clear U. S. Regulator: CFTC ICE Trust Regulator: Fed, NYSBD Energy - OTC – North American Natural Gas – North American Power – Global Oil and Refined Products Agricultural - Futures – Sugar – Coffee – Cotton – Cocoa – OJ Financial - Futures – Russell Index – FX CDS - OTC – North American CDX indices – To launch North American single names in 3 Q 09 Energy - Futures – Crude Oil – Gas Oil – European Emissions – Coal – UK Natural Gas & Power CDS - OTC – To launch European i. Traxx indices in 2 Q 09 – To launch European single names in 3 Q 09 Related CDS Services • • • Brokerage Delta neutral auctions Trade compression Credit event auctions STP, Allocations, and Novations Auto recouponing of single name CDS

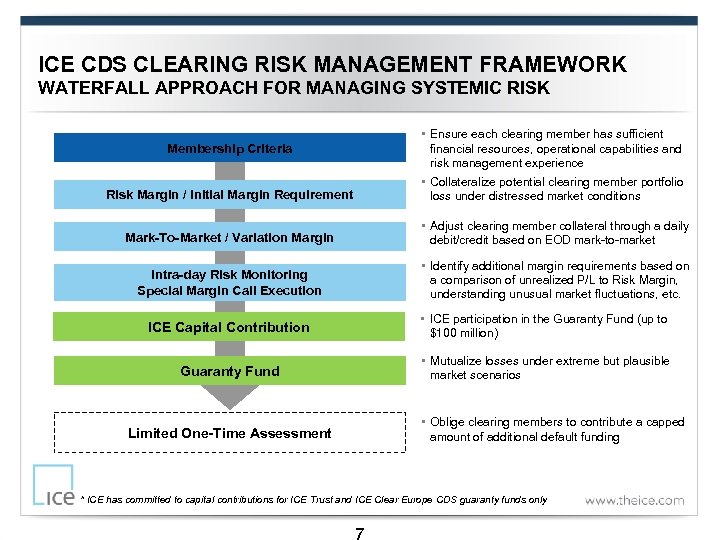

ICE CDS CLEARING RISK MANAGEMENT FRAMEWORK WATERFALL APPROACH FOR MANAGING SYSTEMIC RISK Membership Criteria • Ensure each clearing member has sufficient financial resources, operational capabilities and risk management experience Risk Margin / Initial Margin Requirement • Collateralize potential clearing member portfolio loss under distressed market conditions Mark-To-Market / Variation Margin • Adjust clearing member collateral through a daily debit/credit based on EOD mark-to-market Intra-day Risk Monitoring Special Margin Call Execution • Identify additional margin requirements based on a comparison of unrealized P/L to Risk Margin, understanding unusual market fluctuations, etc. ICE Capital Contribution * • ICE participation in the Guaranty Fund (up to $100 million) Guaranty Fund • Mutualize losses under extreme but plausible market scenarios Limited One-Time Assessment • Oblige clearing members to contribute a capped amount of additional default funding * ICE has committed to capital contributions for ICE Trust and ICE Clear Europe CDS guaranty funds only

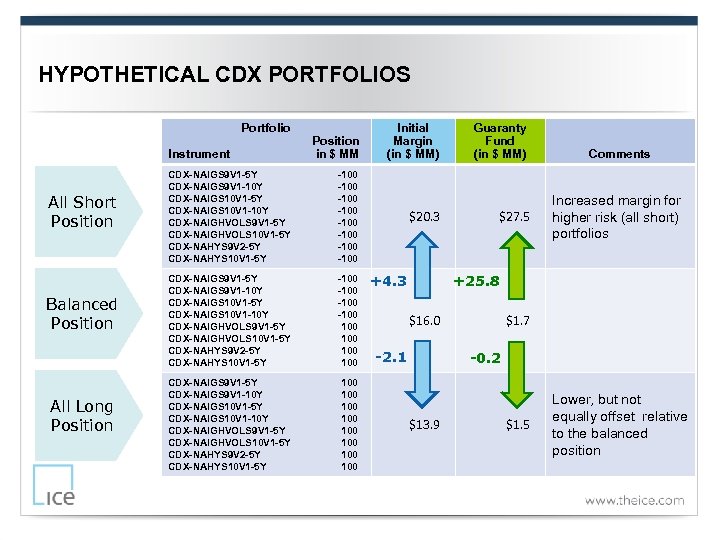

HYPOTHETICAL CDX PORTFOLIOS Portfolio Instrument All Short Position Balanced Position All Long Position in $ MM CDX-NAIGS 9 V 1 -5 Y CDX-NAIGS 9 V 1 -10 Y CDX-NAIGS 10 V 1 -5 Y CDX-NAIGS 10 V 1 -10 Y CDX-NAIGHVOLS 9 V 1 -5 Y CDX-NAIGHVOLS 10 V 1 -5 Y CDX-NAHYS 9 V 2 -5 Y CDX-NAHYS 10 V 1 -5 Y -100 -100 CDX-NAIGS 9 V 1 -5 Y CDX-NAIGS 9 V 1 -10 Y CDX-NAIGS 10 V 1 -5 Y CDX-NAIGS 10 V 1 -10 Y CDX-NAIGHVOLS 9 V 1 -5 Y CDX-NAIGHVOLS 10 V 1 -5 Y CDX-NAHYS 9 V 2 -5 Y CDX-NAHYS 10 V 1 -5 Y -100 100 100 CDX-NAIGS 9 V 1 -5 Y CDX-NAIGS 9 V 1 -10 Y CDX-NAIGS 10 V 1 -5 Y CDX-NAIGS 10 V 1 -10 Y CDX-NAIGHVOLS 9 V 1 -5 Y CDX-NAIGHVOLS 10 V 1 -5 Y CDX-NAHYS 9 V 2 -5 Y CDX-NAHYS 10 V 1 -5 Y 100 100 Initial Margin (in $ MM) $20. 3 +4. 3 Guaranty Fund (in $ MM) $27. 5 Comments Increased margin for higher risk (all short) portfolios +25. 8 $16. 0 -2. 1 $1. 7 -0. 2 $13. 9 $1. 5 Lower, but not equally offset relative to the balanced position

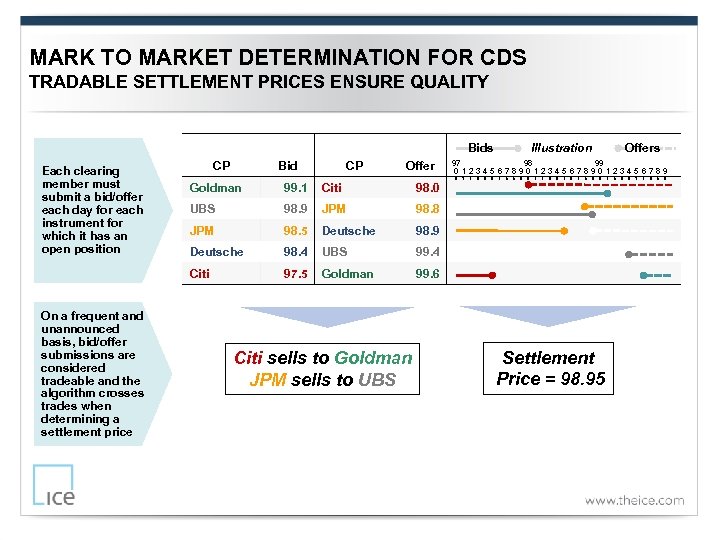

MARK TO MARKET DETERMINATION FOR CDS TRADABLE SETTLEMENT PRICES ENSURE QUALITY Bids Each clearing member must submit a bid/offer each day for each instrument for which it has an open position CP Bid CP Offer 99. 1 Citi UBS 98. 9 JPM 98. 8 JPM 98. 5 Deutsche 98. 9 Deutsche 98. 4 UBS 99. 4 97. 5 Goldman 99. 6 Citi sells to Goldman JPM sells to UBS Offers 97 98 99 01234567890123456789 98. 0 Citi On a frequent and unannounced basis, bid/offer submissions are considered tradeable and the algorithm crosses trades when determining a settlement price Goldman Illustration Settlement Price = 98. 95

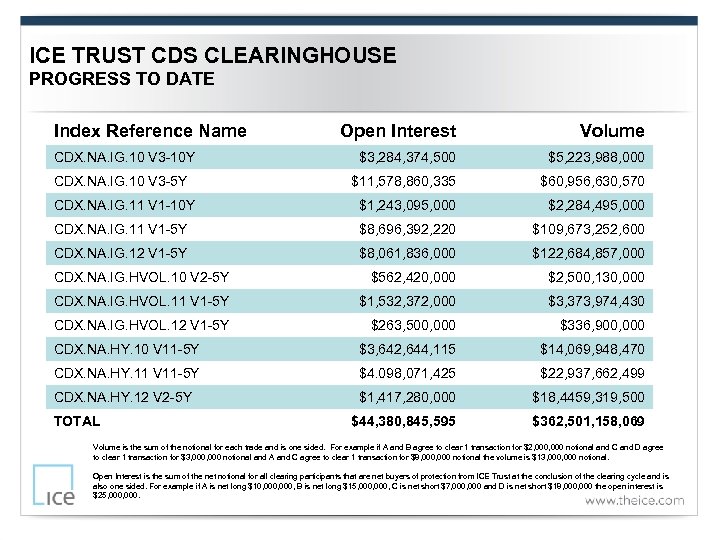

ICE TRUST CDS CLEARINGHOUSE PROGRESS TO DATE Index Reference Name Open Interest Volume CDX. NA. IG. 10 V 3 -10 Y $3, 284, 374, 500 $5, 223, 988, 000 CDX. NA. IG. 10 V 3 -5 Y $11, 578, 860, 335 $60, 956, 630, 570 CDX. NA. IG. 11 V 1 -10 Y $1, 243, 095, 000 $2, 284, 495, 000 CDX. NA. IG. 11 V 1 -5 Y $8, 696, 392, 220 $109, 673, 252, 600 CDX. NA. IG. 12 V 1 -5 Y $8, 061, 836, 000 $122, 684, 857, 000 CDX. NA. IG. HVOL. 10 V 2 -5 Y $562, 420, 000 $2, 500, 130, 000 CDX. NA. IG. HVOL. 11 V 1 -5 Y $1, 532, 372, 000 $3, 373, 974, 430 CDX. NA. IG. HVOL. 12 V 1 -5 Y $263, 500, 000 $336, 900, 000 CDX. NA. HY. 10 V 11 -5 Y $3, 642, 644, 115 $14, 069, 948, 470 CDX. NA. HY. 11 V 11 -5 Y $4. 098, 071, 425 $22, 937, 662, 499 CDX. NA. HY. 12 V 2 -5 Y $1, 417, 280, 000 $18, 4459, 319, 500 $44, 380, 845, 595 $362, 501, 158, 069 TOTAL Volume is the sum of the notional for each trade and is one sided. For example if A and B agree to clear 1 transaction for $2, 000 notional and C and D agree to clear 1 transaction for $3, 000 notional and A and C agree to clear 1 transaction for $8, 000 notional the volume is $13, 000 notional. Open Interest is the sum of the net notional for all clearing participants that are net buyers of protection from ICE Trust at the conclusion of the clearing cycle and is also one sided. For example if A is net long $10, 000, B is net long $15, 000, C is net short $7, 000 and D is net short $18, 000 the open interest is $25, 000.

463bd503f1551c032b26eefd92abc6d7.ppt