9bd030102ecdce6c57ba815259aac4b4.ppt

- Количество слайдов: 22

Federal Grid Company Capital Markets Day: Presentation of 2010 Results Andrey Kazachenkov Deputy Chairman of the Management Board Page May 11 th, 2011 Moscow, Russia

Federal Grid Company Capital Markets Day: Presentation of 2010 Results Andrey Kazachenkov Deputy Chairman of the Management Board Page May 11 th, 2011 Moscow, Russia

Disclaimer The materials comprising this Presentation have been prepared by the Company solely for use by the Company’s management at investor meetings with a limited number of institutional investors who have agreed to attend such meetings and to be subject to obligations to maintain the confidentiality of this Presentation. This Presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of the Company or any of its subsidiaries in any jurisdiction or an inducement to enter into investment activity. No part of this Presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. This Presentation does not constitute a recommendation regarding the securities of the Company. This Presentation is not directed at, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. The forward-looking statements in this Presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. These assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control and it may not achieve or accomplish these expectations, beliefs or projections. In addition, important factors that, in the view of the Company, could cause actual results to differ materially from those discussed in the forward-looking statements include the achievement of the anticipated levels of profitability, growth, cost and its recent acquisitions, the timely development of new projects, the impact of competitive pricing, the ability to obtain necessary regulatory approvals, and the impact of general business and global economic conditions. Past performance should not be taken as an indication or guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance. Стр Page 1

Disclaimer The materials comprising this Presentation have been prepared by the Company solely for use by the Company’s management at investor meetings with a limited number of institutional investors who have agreed to attend such meetings and to be subject to obligations to maintain the confidentiality of this Presentation. This Presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of the Company or any of its subsidiaries in any jurisdiction or an inducement to enter into investment activity. No part of this Presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. This Presentation does not constitute a recommendation regarding the securities of the Company. This Presentation is not directed at, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. The forward-looking statements in this Presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. These assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control and it may not achieve or accomplish these expectations, beliefs or projections. In addition, important factors that, in the view of the Company, could cause actual results to differ materially from those discussed in the forward-looking statements include the achievement of the anticipated levels of profitability, growth, cost and its recent acquisitions, the timely development of new projects, the impact of competitive pricing, the ability to obtain necessary regulatory approvals, and the impact of general business and global economic conditions. Past performance should not be taken as an indication or guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance. Стр Page 1

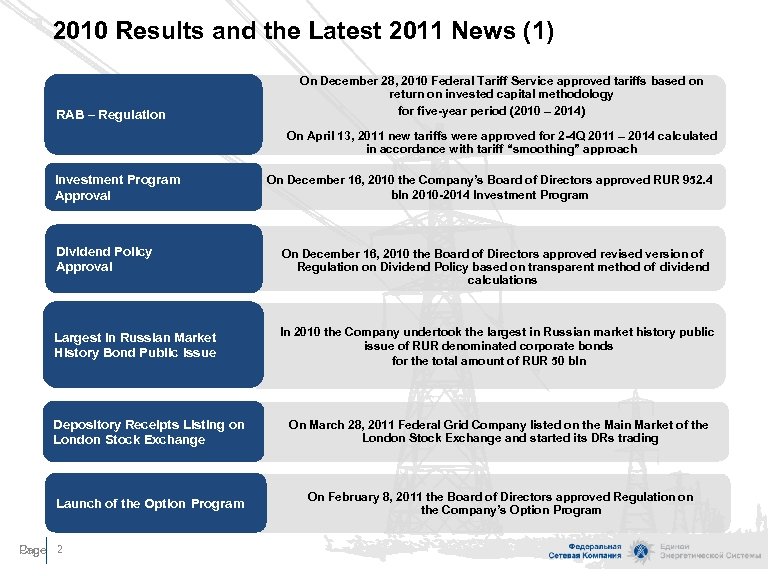

2010 Results and the Latest 2011 News (1) RAB – Regulation On December 28, 2010 Federal Tariff Service approved tariffs based on return on invested capital methodology for five-year period (2010 – 2014) On April 13, 2011 new tariffs were approved for 2 -4 Q 2011 – 2014 calculated in accordance with tariff “smoothing” approach Investment Program Approval On December 16, 2010 the Company’s Board of Directors approved RUR 952. 4 bln 2010 -2014 Investment Program Dividend Policy Approval On December 16, 2010 the Board of Directors approved revised version of Regulation on Dividend Policy based on transparent method of dividend calculations Largest in Russian Market History Bond Public Issue In 2010 the Company undertook the largest in Russian market history public issue of RUR denominated corporate bonds for the total amount of RUR 50 bln Depository Receipts Listing on London Stock Exchange On March 28, 2011 Federal Grid Company listed on the Main Market of the London Stock Exchange and started its DRs trading Launch of the Option Program On February 8, 2011 the Board of Directors approved Regulation on the Company’s Option Program Стр Page 2

2010 Results and the Latest 2011 News (1) RAB – Regulation On December 28, 2010 Federal Tariff Service approved tariffs based on return on invested capital methodology for five-year period (2010 – 2014) On April 13, 2011 new tariffs were approved for 2 -4 Q 2011 – 2014 calculated in accordance with tariff “smoothing” approach Investment Program Approval On December 16, 2010 the Company’s Board of Directors approved RUR 952. 4 bln 2010 -2014 Investment Program Dividend Policy Approval On December 16, 2010 the Board of Directors approved revised version of Regulation on Dividend Policy based on transparent method of dividend calculations Largest in Russian Market History Bond Public Issue In 2010 the Company undertook the largest in Russian market history public issue of RUR denominated corporate bonds for the total amount of RUR 50 bln Depository Receipts Listing on London Stock Exchange On March 28, 2011 Federal Grid Company listed on the Main Market of the London Stock Exchange and started its DRs trading Launch of the Option Program On February 8, 2011 the Board of Directors approved Regulation on the Company’s Option Program Стр Page 2

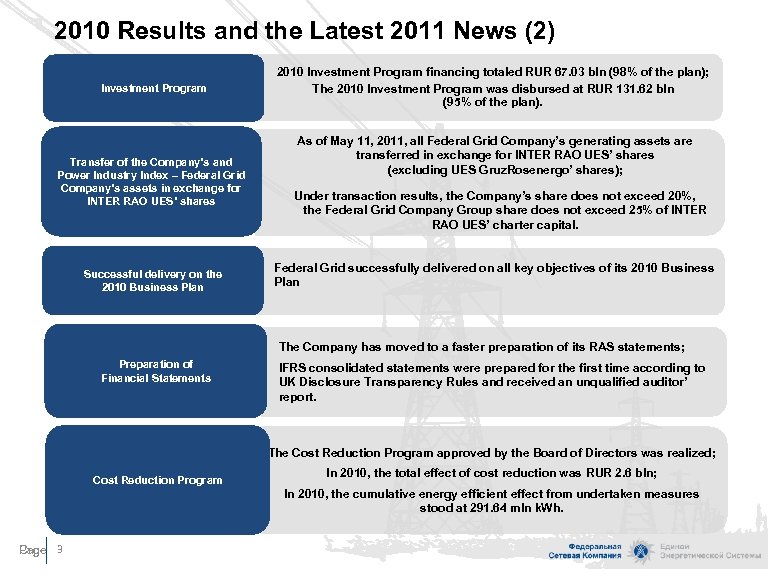

2010 Results and the Latest 2011 News (2) Investment Program Transfer of the Company’s and Power Industry Index – Federal Grid Company’s assets in exchange for INTER RAO UES’ shares Successful delivery on the 2010 Business Plan 2010 Investment Program financing totaled RUR 67. 03 bln (98% of the plan); The 2010 Investment Program was disbursed at RUR 131. 62 bln (95% of the plan). As of May 11, 2011, all Federal Grid Company’s generating assets are transferred in exchange for INTER RAO UES’ shares (excluding UES Gruz. Rosenergo’ shares); Under transaction results, the Company’s share does not exceed 20%, the Federal Grid Company Group share does not exceed 25% of INTER RAO UES’ charter capital. Federal Grid successfully delivered on all key objectives of its 2010 Business Plan The Company has moved to a faster preparation of its RAS statements; Preparation of Financial Statements IFRS consolidated statements were prepared for the first time according to UK Disclosure Transparency Rules and received an unqualified auditor’ report. The Cost Reduction Program approved by the Board of Directors was realized; Cost Reduction Program In 2010, the total effect of cost reduction was RUR 2. 6 bln; In 2010, the cumulative energy efficient effect from undertaken measures stood at 291. 64 mln k. Wh. Стр Page 3

2010 Results and the Latest 2011 News (2) Investment Program Transfer of the Company’s and Power Industry Index – Federal Grid Company’s assets in exchange for INTER RAO UES’ shares Successful delivery on the 2010 Business Plan 2010 Investment Program financing totaled RUR 67. 03 bln (98% of the plan); The 2010 Investment Program was disbursed at RUR 131. 62 bln (95% of the plan). As of May 11, 2011, all Federal Grid Company’s generating assets are transferred in exchange for INTER RAO UES’ shares (excluding UES Gruz. Rosenergo’ shares); Under transaction results, the Company’s share does not exceed 20%, the Federal Grid Company Group share does not exceed 25% of INTER RAO UES’ charter capital. Federal Grid successfully delivered on all key objectives of its 2010 Business Plan The Company has moved to a faster preparation of its RAS statements; Preparation of Financial Statements IFRS consolidated statements were prepared for the first time according to UK Disclosure Transparency Rules and received an unqualified auditor’ report. The Cost Reduction Program approved by the Board of Directors was realized; Cost Reduction Program In 2010, the total effect of cost reduction was RUR 2. 6 bln; In 2010, the cumulative energy efficient effect from undertaken measures stood at 291. 64 mln k. Wh. Стр Page 3

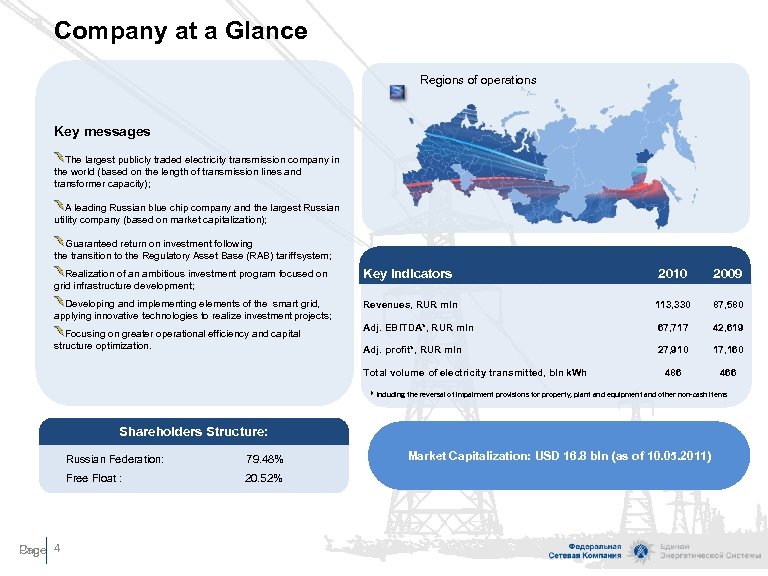

Company at a Glance Regions of operations Key messages The largest publicly traded electricity transmission company in the world (based on the length of transmission lines and transformer capacity); A leading Russian blue chip company and the largest Russian utility company (based on market capitalization); Guaranteed return on investment following the transition to the Regulatory Asset Base (RAB) tariff system; Realization of an ambitious investment program focused on grid infrastructure development; Key Indicators 2010 2009 Developing and implementing elements of the smart grid, applying innovative technologies to realize investment projects; Revenues, RUR mln 113, 330 87, 580 Adj. EBITDA*, RUR mln 67, 717 42, 619 Adj. profit*, RUR mln 27, 910 17, 160 486 466 Focusing on greater operational efficiency and capital structure optimization. Total volume of electricity transmitted, bln k. Wh * Including the reversal of impairment provisions for property, plant and equipment and other non-cash items Shareholders Structure: Russian Federation: Free Float : Стр Page 4 79. 48% 20. 52% Market Capitalization: USD 16. 8 bln (as of 10. 05. 2011)

Company at a Glance Regions of operations Key messages The largest publicly traded electricity transmission company in the world (based on the length of transmission lines and transformer capacity); A leading Russian blue chip company and the largest Russian utility company (based on market capitalization); Guaranteed return on investment following the transition to the Regulatory Asset Base (RAB) tariff system; Realization of an ambitious investment program focused on grid infrastructure development; Key Indicators 2010 2009 Developing and implementing elements of the smart grid, applying innovative technologies to realize investment projects; Revenues, RUR mln 113, 330 87, 580 Adj. EBITDA*, RUR mln 67, 717 42, 619 Adj. profit*, RUR mln 27, 910 17, 160 486 466 Focusing on greater operational efficiency and capital structure optimization. Total volume of electricity transmitted, bln k. Wh * Including the reversal of impairment provisions for property, plant and equipment and other non-cash items Shareholders Structure: Russian Federation: Free Float : Стр Page 4 79. 48% 20. 52% Market Capitalization: USD 16. 8 bln (as of 10. 05. 2011)

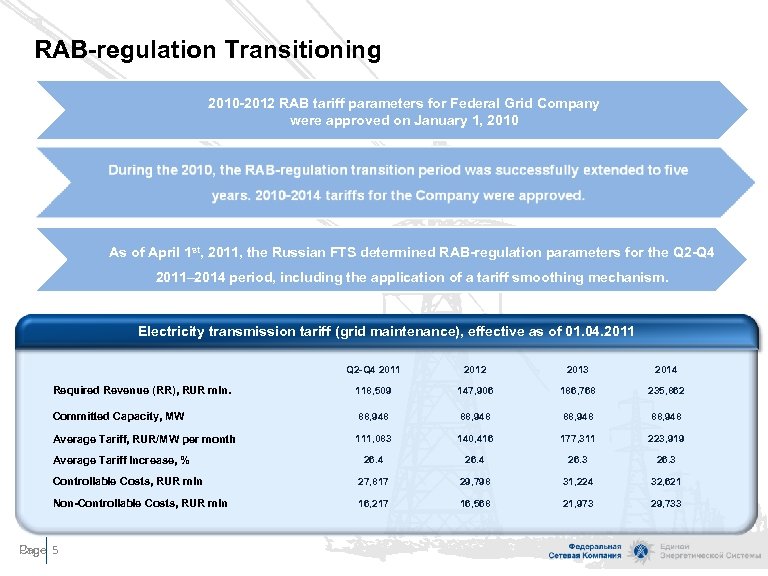

RAB-regulation Transitioning 2010 -2012 RAB tariff parameters for Federal Grid Company were approved on January 1, 2010 As of April 1 st, 2011, the Russian FTS determined RAB-regulation parameters for the Q 2 -Q 4 2011– 2014 period, including the application of a tariff smoothing mechanism. Electricity transmission tariff (grid maintenance), effective as of 01. 04. 2011 Q 2 -Q 4 2011 2012 2013 2014 Required Revenue (RR), RUR mln. 118, 509 147, 906 186, 768 235, 862 Committed Capacity, MW 88, 948 Average Tariff, RUR/MW per month 111, 083 140, 416 177, 311 223, 919 26. 4 26. 3 Controllable Costs, RUR mln 27, 817 29, 798 31, 224 32, 621 Non-Controllable Costs, RUR mln 16, 217 16, 568 21, 973 29, 733 Average Tariff Increase, % Стр Page 5

RAB-regulation Transitioning 2010 -2012 RAB tariff parameters for Federal Grid Company were approved on January 1, 2010 As of April 1 st, 2011, the Russian FTS determined RAB-regulation parameters for the Q 2 -Q 4 2011– 2014 period, including the application of a tariff smoothing mechanism. Electricity transmission tariff (grid maintenance), effective as of 01. 04. 2011 Q 2 -Q 4 2011 2012 2013 2014 Required Revenue (RR), RUR mln. 118, 509 147, 906 186, 768 235, 862 Committed Capacity, MW 88, 948 Average Tariff, RUR/MW per month 111, 083 140, 416 177, 311 223, 919 26. 4 26. 3 Controllable Costs, RUR mln 27, 817 29, 798 31, 224 32, 621 Non-Controllable Costs, RUR mln 16, 217 16, 568 21, 973 29, 733 Average Tariff Increase, % Стр Page 5

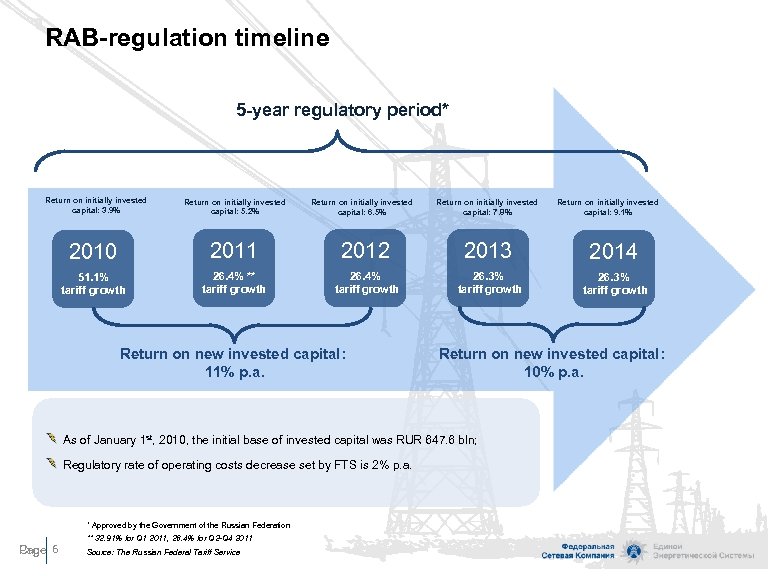

RAB-regulation timeline 5 -year regulatory period* Return on initially invested capital: 3. 9% Return on initially invested capital: 5. 2% Return on initially invested capital: 6. 5% Return on initially invested capital: 7. 8% Return on initially invested capital: 9. 1% 2010 2011 2012 2013 2014 51. 1% tariff growth 26. 4% ** tariff growth 26. 4% tariff growth 26. 3% tariff growth Return on new invested capital: 11% p. a. Return on new invested capital: 10% p. a. As of January 1 st, 2010, the initial base of invested capital was RUR 647. 6 bln; Regulatory rate of operating costs decrease set by FTS is 2% p. a. * Approved by the Government of the Russian Federation Стр Page 6 ** 32. 91% for Q 1 2011, 26. 4% for Q 2 -Q 4 2011 Source: The Russian Federal Tariff Service

RAB-regulation timeline 5 -year regulatory period* Return on initially invested capital: 3. 9% Return on initially invested capital: 5. 2% Return on initially invested capital: 6. 5% Return on initially invested capital: 7. 8% Return on initially invested capital: 9. 1% 2010 2011 2012 2013 2014 51. 1% tariff growth 26. 4% ** tariff growth 26. 4% tariff growth 26. 3% tariff growth Return on new invested capital: 11% p. a. Return on new invested capital: 10% p. a. As of January 1 st, 2010, the initial base of invested capital was RUR 647. 6 bln; Regulatory rate of operating costs decrease set by FTS is 2% p. a. * Approved by the Government of the Russian Federation Стр Page 6 ** 32. 91% for Q 1 2011, 26. 4% for Q 2 -Q 4 2011 Source: The Russian Federal Tariff Service

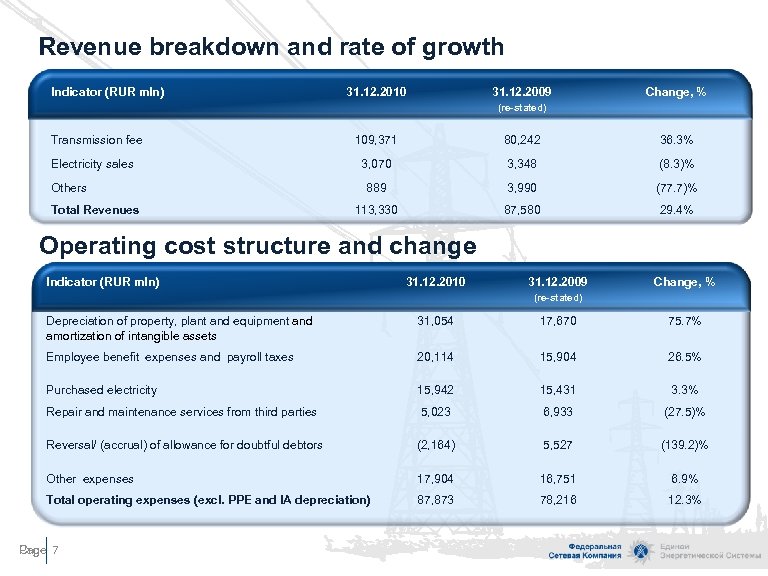

Revenue breakdown and rate of growth Indicator (RUR mln) 31. 12. 2010 31. 12. 2009 Change, % (re-stated) Transmission fee Electricity sales Others Total Revenues 109, 371 80, 242 36. 3% 3, 070 3, 348 (8. 3)% 889 3, 990 (77. 7)% 113, 330 87, 580 29. 4% Operating cost structure and change Indicator (RUR mln) 31. 12. 2010 31. 12. 2009 Change, % (re-stated) Depreciation of property, plant and equipment and amortization of intangible assets 31, 054 17, 670 75. 7% Employee benefit expenses and payroll taxes 20, 114 15, 904 26. 5% Purchased electricity 15, 942 15, 431 3. 3% Repair and maintenance services from third parties 5, 023 6, 933 (27. 5)% Reversal/ (accrual) of allowance for doubtful debtors (2, 164) 5, 527 (139. 2)% Other expenses 17, 904 16, 751 6. 9% Total operating expenses (excl. PPE and IA depreciation) 87, 873 78, 216 12. 3% Стр Page 7

Revenue breakdown and rate of growth Indicator (RUR mln) 31. 12. 2010 31. 12. 2009 Change, % (re-stated) Transmission fee Electricity sales Others Total Revenues 109, 371 80, 242 36. 3% 3, 070 3, 348 (8. 3)% 889 3, 990 (77. 7)% 113, 330 87, 580 29. 4% Operating cost structure and change Indicator (RUR mln) 31. 12. 2010 31. 12. 2009 Change, % (re-stated) Depreciation of property, plant and equipment and amortization of intangible assets 31, 054 17, 670 75. 7% Employee benefit expenses and payroll taxes 20, 114 15, 904 26. 5% Purchased electricity 15, 942 15, 431 3. 3% Repair and maintenance services from third parties 5, 023 6, 933 (27. 5)% Reversal/ (accrual) of allowance for doubtful debtors (2, 164) 5, 527 (139. 2)% Other expenses 17, 904 16, 751 6. 9% Total operating expenses (excl. PPE and IA depreciation) 87, 873 78, 216 12. 3% Стр Page 7

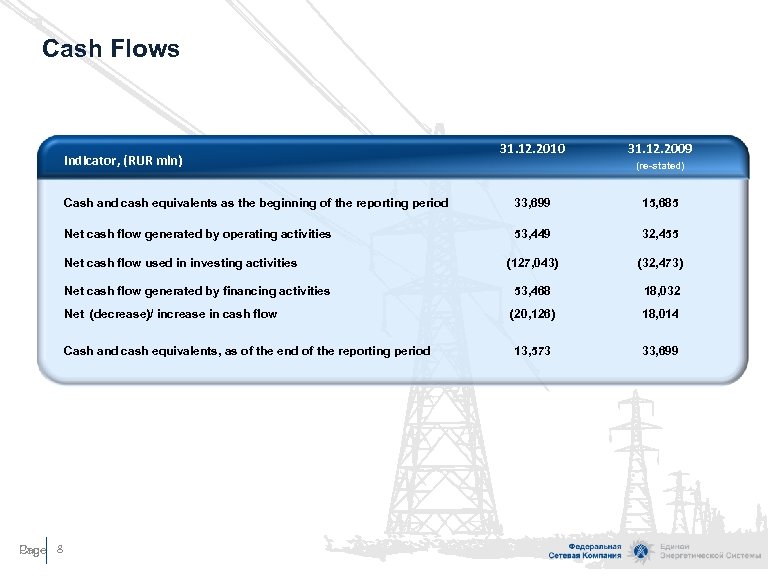

Cash Flows Indicator, (RUR mln) 31. 12. 2010 31. 12. 2009 (re-stated) Cash and cash equivalents as the beginning of the reporting period 33, 699 15, 685 Net cash flow generated by operating activities 53, 449 32, 455 (127, 043) (32, 473) 53, 468 18, 032 (20, 126) 18, 014 13, 573 33, 699 Net cash flow used in investing activities Net cash flow generated by financing activities Net (decrease)/ increase in cash flow Cash and cash equivalents, as of the end of the reporting period Стр Page 8

Cash Flows Indicator, (RUR mln) 31. 12. 2010 31. 12. 2009 (re-stated) Cash and cash equivalents as the beginning of the reporting period 33, 699 15, 685 Net cash flow generated by operating activities 53, 449 32, 455 (127, 043) (32, 473) 53, 468 18, 032 (20, 126) 18, 014 13, 573 33, 699 Net cash flow used in investing activities Net cash flow generated by financing activities Net (decrease)/ increase in cash flow Cash and cash equivalents, as of the end of the reporting period Стр Page 8

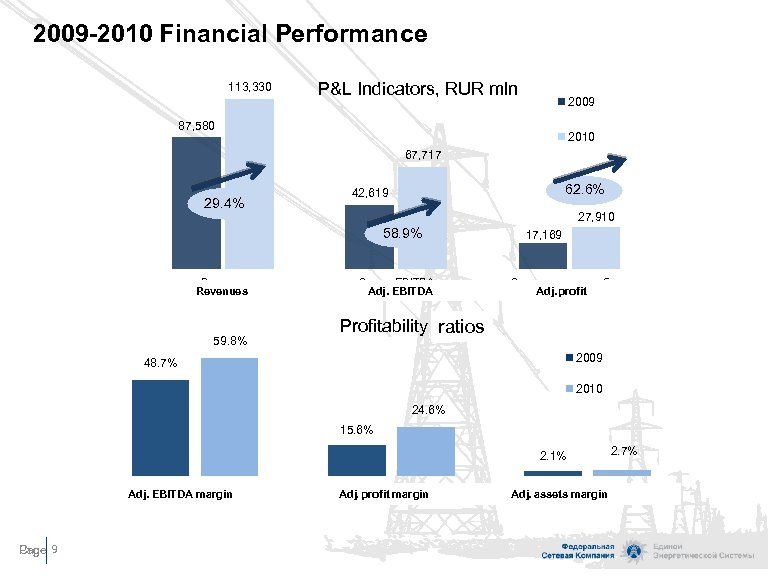

2009 -2010 Financial Performance 113, 330 P&L Indicators, RUR mln 2009 87, 580 2010 67, 717 29. 4% 62. 6% 42, 619 27, 910 58. 9% Выручка Revenues 59. 8% Скорр. EBITDA Adj. EBITDA 17, 169 Скорр. чистая прибыль Adj. profit Profitability rates ratios 2009 48. 7% 2010 24. 6% 15. 6% 2. 1% Рент-ть скорр. EBITDA Adj. EBITDA margin Стр Page 9 Рент-ть скорр. чистой прибыли Adj. profit margin 2. 7% Рент-ть margin Adj. assetsактивов (скорр. )

2009 -2010 Financial Performance 113, 330 P&L Indicators, RUR mln 2009 87, 580 2010 67, 717 29. 4% 62. 6% 42, 619 27, 910 58. 9% Выручка Revenues 59. 8% Скорр. EBITDA Adj. EBITDA 17, 169 Скорр. чистая прибыль Adj. profit Profitability rates ratios 2009 48. 7% 2010 24. 6% 15. 6% 2. 1% Рент-ть скорр. EBITDA Adj. EBITDA margin Стр Page 9 Рент-ть скорр. чистой прибыли Adj. profit margin 2. 7% Рент-ть margin Adj. assetsактивов (скорр. )

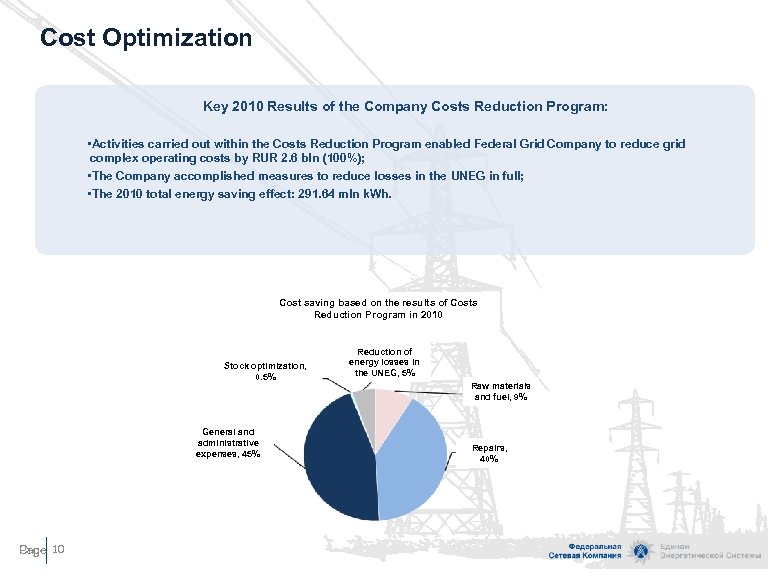

Cost Optimization Key 2010 Results of the Company Costs Reduction Program: • Activities carried out within the Costs Reduction Program enabled Federal Grid Company to reduce grid complex operating costs by RUR 2. 6 bln (100%); • The Company accomplished measures to reduce losses in the UNEG in full; • The 2010 total energy saving effect: 291. 64 mln k. Wh. Cost saving based on the results of Costs Reduction Program in 2010 Stock optimization, 0. 5% General and administrative expenses, 45% Стр Page 10 Reduction of energy losses in the UNEG, 5% Raw materials and fuel, 9% Repairs, 40%

Cost Optimization Key 2010 Results of the Company Costs Reduction Program: • Activities carried out within the Costs Reduction Program enabled Federal Grid Company to reduce grid complex operating costs by RUR 2. 6 bln (100%); • The Company accomplished measures to reduce losses in the UNEG in full; • The 2010 total energy saving effect: 291. 64 mln k. Wh. Cost saving based on the results of Costs Reduction Program in 2010 Stock optimization, 0. 5% General and administrative expenses, 45% Стр Page 10 Reduction of energy losses in the UNEG, 5% Raw materials and fuel, 9% Repairs, 40%

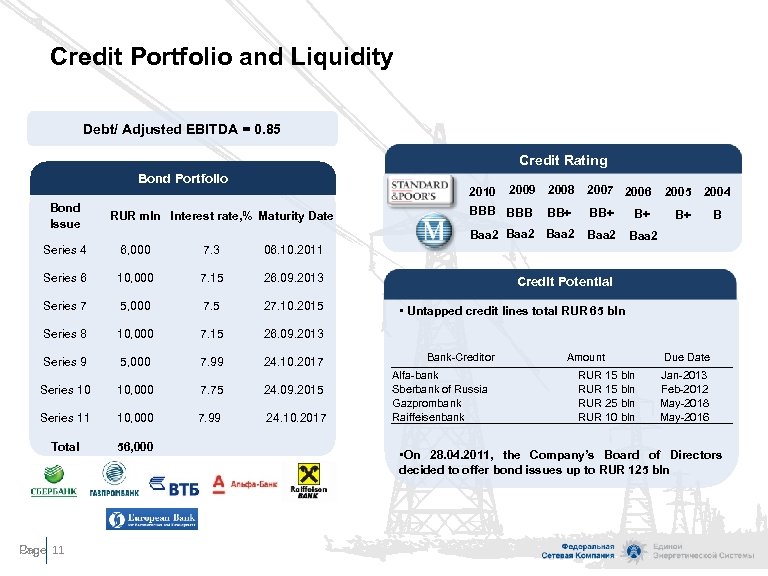

Credit Portfolio and Liquidity Debt/ Adjusted EBITDA = 0. 85 Credit Rating Bond Portfolio Bond Issue 2010 2009 2008 BBB 2007 2006 Series 4 6, 000 7. 3 10, 000 7. 15 5, 000 7. 5 27. 10. 2015 Series 8 10, 000 7. 15 5, 000 7. 99 24. 10. 2017 Baa 2 B+ B 26. 09. 2013 Series 9 B+ 26. 09. 2013 Series 7 BB+ 2004 06. 10. 2011 Series 6 BB+ Baa 2 RUR mln Interest rate, % Maturity Date 2005 Series 10 10, 000 7. 75 24. 09. 2015 Series 11 10, 000 7. 99 24. 10. 2017 Total 56, 000 Стр Page 11 Credit Potential • Untapped credit lines total RUR 65 bln Bank-Creditor Alfa-bank Sberbank of Russia Gazprombank Raiffeisenbank Amount RUR 15 bln RUR 25 bln RUR 10 bln Due Date Jan-2013 Feb-2012 May-2018 May-2016 • On 28. 04. 2011, the Company’s Board of Directors decided to offer bond issues up to RUR 125 bln

Credit Portfolio and Liquidity Debt/ Adjusted EBITDA = 0. 85 Credit Rating Bond Portfolio Bond Issue 2010 2009 2008 BBB 2007 2006 Series 4 6, 000 7. 3 10, 000 7. 15 5, 000 7. 5 27. 10. 2015 Series 8 10, 000 7. 15 5, 000 7. 99 24. 10. 2017 Baa 2 B+ B 26. 09. 2013 Series 9 B+ 26. 09. 2013 Series 7 BB+ 2004 06. 10. 2011 Series 6 BB+ Baa 2 RUR mln Interest rate, % Maturity Date 2005 Series 10 10, 000 7. 75 24. 09. 2015 Series 11 10, 000 7. 99 24. 10. 2017 Total 56, 000 Стр Page 11 Credit Potential • Untapped credit lines total RUR 65 bln Bank-Creditor Alfa-bank Sberbank of Russia Gazprombank Raiffeisenbank Amount RUR 15 bln RUR 25 bln RUR 10 bln Due Date Jan-2013 Feb-2012 May-2018 May-2016 • On 28. 04. 2011, the Company’s Board of Directors decided to offer bond issues up to RUR 125 bln

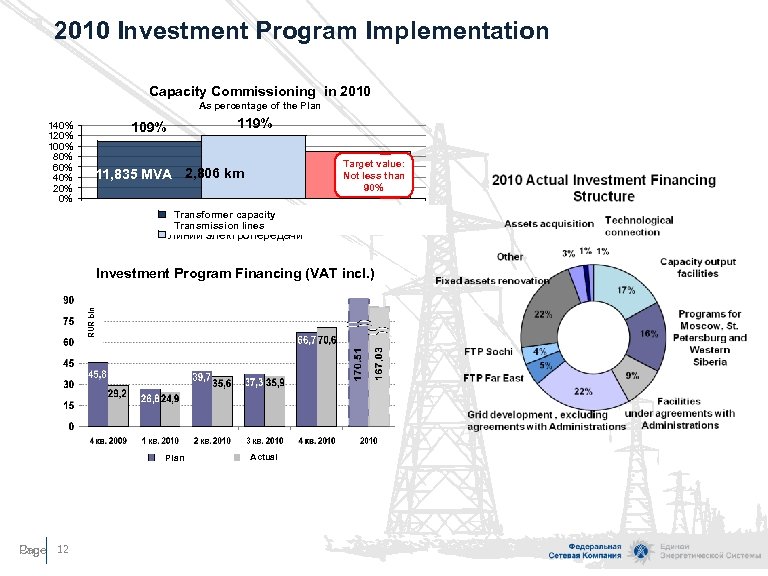

2010 Investment Program Implementation Capacity Commissioning in 2010 As percentage of the Plan 140% 120% 100% 80% 60% 40% 20% 0% 119% 109% Target value: Not less than 90% 11, 835 MVA 2, 806 km 1 Transformer capacity Трансформаторная мощность Transmission lines Линии электропередачи RUR bln Investment Program Financing (VAT incl. ) Plan Стр Page 12 Actual

2010 Investment Program Implementation Capacity Commissioning in 2010 As percentage of the Plan 140% 120% 100% 80% 60% 40% 20% 0% 119% 109% Target value: Not less than 90% 11, 835 MVA 2, 806 km 1 Transformer capacity Трансформаторная мощность Transmission lines Линии электропередачи RUR bln Investment Program Financing (VAT incl. ) Plan Стр Page 12 Actual

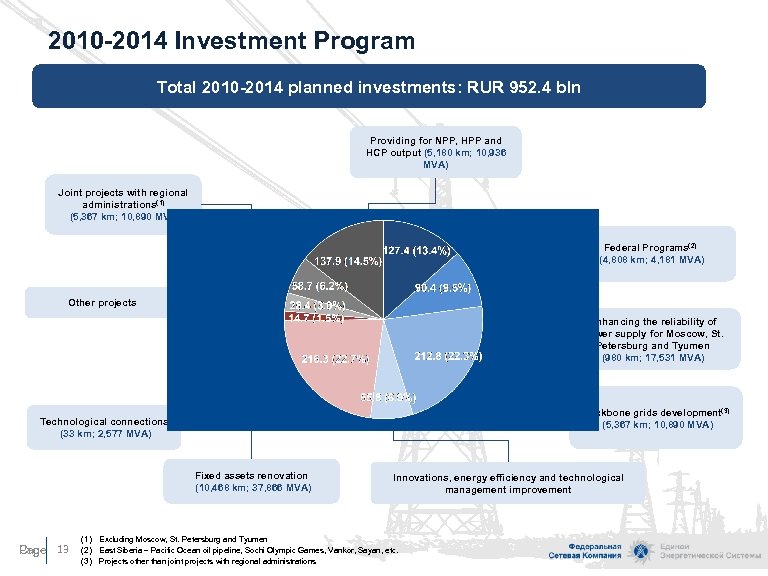

2010 -2014 Investment Program Total 2010 -2014 planned investments: RUR 952. 4 bln Providing for NPP, HPP and HCP output (5, 180 km; 10, 936 MVA) Joint projects with regional administrations(1) (5, 367 km; 10, 890 MVA) Federal Programs(2) (4, 808 km; 4, 181 MVA) Other projects Enhancing the reliability of power supply for Moscow, St. Petersburg and Tyumen (980 km; 17, 531 MVA) Backbone grids development(3) (5, 367 km; 10, 890 MVA) Technological connections (33 km; 2, 577 MVA) Fixed assets renovation (10, 468 km; 37, 866 MVA) Стр Page 13 Innovations, energy efficiency and technological management improvement (1) Excluding Moscow, St. Petersburg and Tyumen (2) East Siberia – Pacific Ocean oil pipeline, Sochi Olympic Games, Vankor, Sayan, etc. (3) Projects other than joint projects with regional administrations

2010 -2014 Investment Program Total 2010 -2014 planned investments: RUR 952. 4 bln Providing for NPP, HPP and HCP output (5, 180 km; 10, 936 MVA) Joint projects with regional administrations(1) (5, 367 km; 10, 890 MVA) Federal Programs(2) (4, 808 km; 4, 181 MVA) Other projects Enhancing the reliability of power supply for Moscow, St. Petersburg and Tyumen (980 km; 17, 531 MVA) Backbone grids development(3) (5, 367 km; 10, 890 MVA) Technological connections (33 km; 2, 577 MVA) Fixed assets renovation (10, 468 km; 37, 866 MVA) Стр Page 13 Innovations, energy efficiency and technological management improvement (1) Excluding Moscow, St. Petersburg and Tyumen (2) East Siberia – Pacific Ocean oil pipeline, Sochi Olympic Games, Vankor, Sayan, etc. (3) Projects other than joint projects with regional administrations

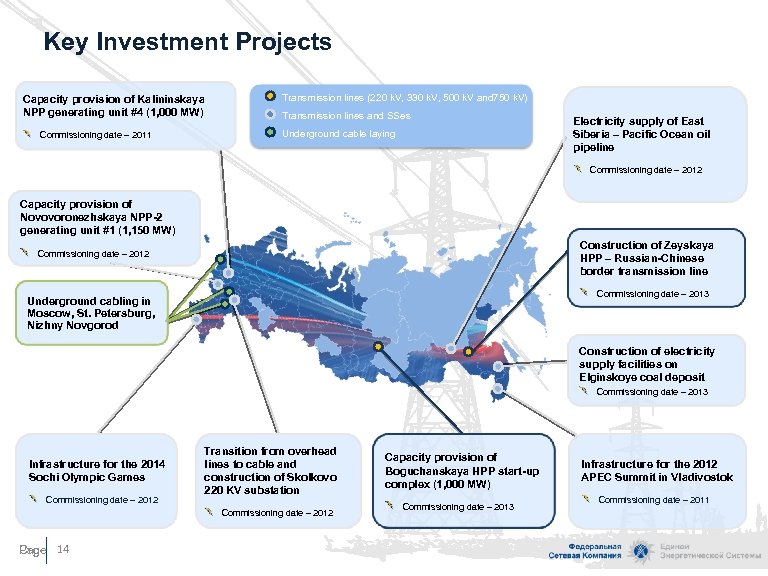

Key Investment Projects Capacity provision of Kalininskaya NPP generating unit #4 (1, 000 MW) Commissioning date – 2011 Transmission lines (220 k. V, 330 k. V, 500 k. V and 750 k. V) Transmission lines and SSes Underground cable laying Electricity supply of East Siberia – Pacific Ocean oil pipeline Commissioning date – 2012 Capacity provision of Novovoronezhskaya NPP-2 generating unit #1 (1, 150 MW) Construction of Zeyskaya HPP – Russian-Chinese border transmission line Commissioning date – 2012 Commissioning date – 2013 Underground cabling in Moscow, St. Petersburg, Nizhny Novgorod Construction of electricity supply facilities on Elginskoye coal deposit Commissioning date – 2013 Infrastructure for the 2014 Sochi Olympic Games Commissioning date – 2012 Transition from overhead lines to cable and construction of Skolkovo 220 KV substation Commissioning date – 2012 Стр Page 14 Capacity provision of Boguchanskaya HPP start-up complex (1, 000 MW) Commissioning date – 2013 Infrastructure for the 2012 APEC Summit in Vladivostok Commissioning date – 2011

Key Investment Projects Capacity provision of Kalininskaya NPP generating unit #4 (1, 000 MW) Commissioning date – 2011 Transmission lines (220 k. V, 330 k. V, 500 k. V and 750 k. V) Transmission lines and SSes Underground cable laying Electricity supply of East Siberia – Pacific Ocean oil pipeline Commissioning date – 2012 Capacity provision of Novovoronezhskaya NPP-2 generating unit #1 (1, 150 MW) Construction of Zeyskaya HPP – Russian-Chinese border transmission line Commissioning date – 2012 Commissioning date – 2013 Underground cabling in Moscow, St. Petersburg, Nizhny Novgorod Construction of electricity supply facilities on Elginskoye coal deposit Commissioning date – 2013 Infrastructure for the 2014 Sochi Olympic Games Commissioning date – 2012 Transition from overhead lines to cable and construction of Skolkovo 220 KV substation Commissioning date – 2012 Стр Page 14 Capacity provision of Boguchanskaya HPP start-up complex (1, 000 MW) Commissioning date – 2013 Infrastructure for the 2012 APEC Summit in Vladivostok Commissioning date – 2011

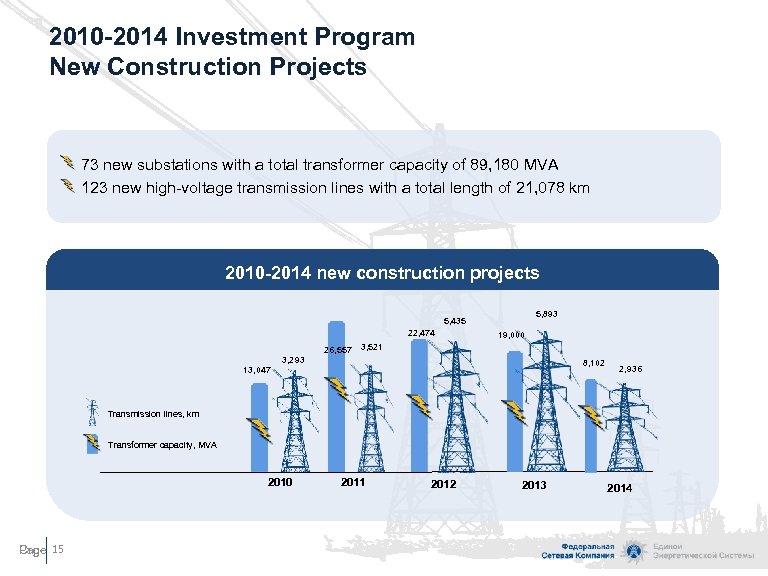

2010 -2014 Investment Program New Construction Projects 73 new substations with a total transformer capacity of 89, 180 MVA 123 new high-voltage transmission lines with a total length of 21, 078 km 2010 -2014 new construction projects 5, 893 5, 435 22, 474 3, 293 26, 557 19, 000 3, 521 8, 102 13, 047 2, 936 Transmission lines, km Transformer capacity, MVA 2010 Стр Page 15 2011 2012 2013 2014

2010 -2014 Investment Program New Construction Projects 73 new substations with a total transformer capacity of 89, 180 MVA 123 new high-voltage transmission lines with a total length of 21, 078 km 2010 -2014 new construction projects 5, 893 5, 435 22, 474 3, 293 26, 557 19, 000 3, 521 8, 102 13, 047 2, 936 Transmission lines, km Transformer capacity, MVA 2010 Стр Page 15 2011 2012 2013 2014

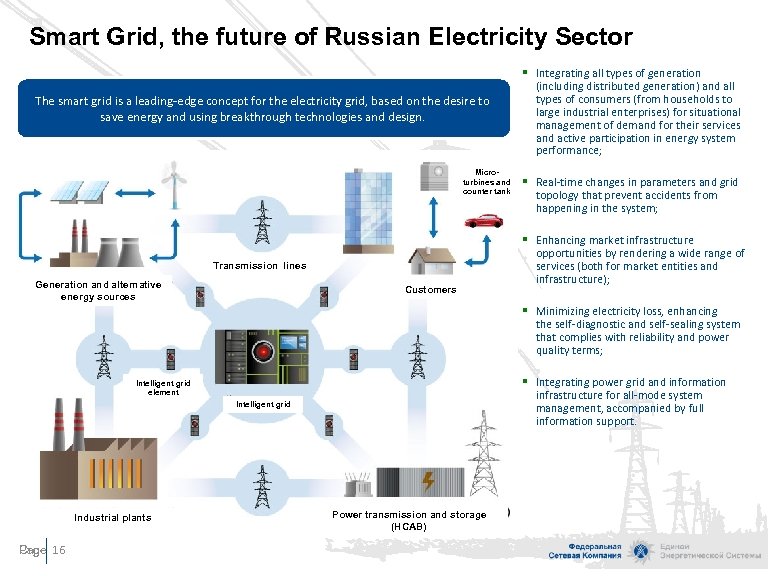

Smart Grid, the future of Russian Electricity Sector The smart grid is a leading-edge concept for the electricity grid, based on the desire to save energy and using breakthrough technologies and design. Microturbines and counter tank Transmission lines Generation and alternative energy sources Customers § Integrating all types of generation (including distributed generation) and all types of consumers (from households to large industrial enterprises) for situational management of demand for their services and active participation in energy system performance; § Real-time changes in parameters and grid topology that prevent accidents from happening in the system; § Enhancing market infrastructure opportunities by rendering a wide range of services (both for market entities and infrastructure); § Minimizing electricity loss, enhancing the self-diagnostic and self-sealing system that complies with reliability and power quality terms; § Integrating power grid and information infrastructure for all-mode system management, accompanied by full information support. Intelligent grid element Intelligent grid Industrial plants Стр Page 16 Power transmission and storage (HCAB)

Smart Grid, the future of Russian Electricity Sector The smart grid is a leading-edge concept for the electricity grid, based on the desire to save energy and using breakthrough technologies and design. Microturbines and counter tank Transmission lines Generation and alternative energy sources Customers § Integrating all types of generation (including distributed generation) and all types of consumers (from households to large industrial enterprises) for situational management of demand for their services and active participation in energy system performance; § Real-time changes in parameters and grid topology that prevent accidents from happening in the system; § Enhancing market infrastructure opportunities by rendering a wide range of services (both for market entities and infrastructure); § Minimizing electricity loss, enhancing the self-diagnostic and self-sealing system that complies with reliability and power quality terms; § Integrating power grid and information infrastructure for all-mode system management, accompanied by full information support. Intelligent grid element Intelligent grid Industrial plants Стр Page 16 Power transmission and storage (HCAB)

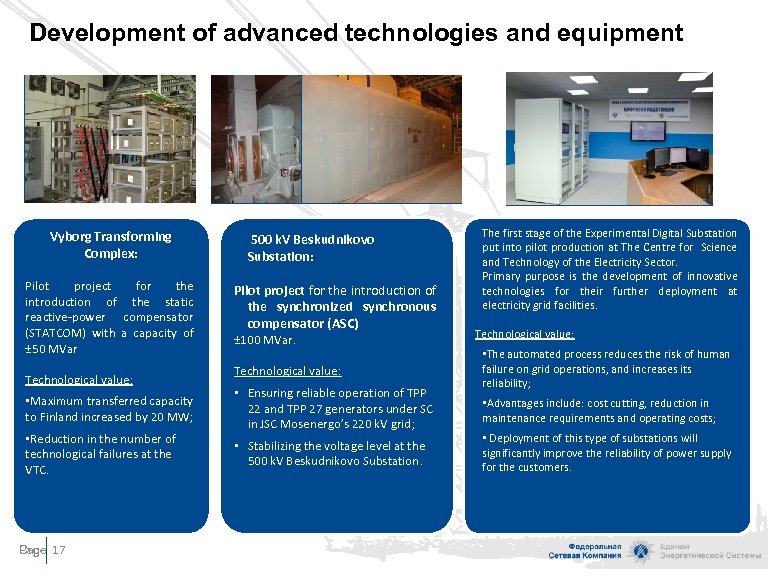

Development of advanced technologies and equipment Vyborg Transforming Complex: Pilot project for the introduction of the static reactive-power compensator (STATCOM) with a capacity of ± 50 MVar Technological value: • Maximum transferred capacity to Finland increased by 20 MW; • Reduction in the number of technological failures at the VTC. Стр Page 17 500 k. V Beskudnikovo Substation: Pilot project for the introduction of the synchronized synchronous compensator (ASC) ± 100 MVar. Technological value: • Ensuring reliable operation of TPP 22 and TPP 27 generators under SC in JSC Mosenergo’s 220 k. V grid; • Stabilizing the voltage level at the 500 k. V Beskudnikovo Substation. The first stage of the Experimental Digital Substation put into pilot production at The Centre for Science and Technology of the Electricity Sector. Primary purpose is the development of innovative technologies for their further deployment at electricity grid facilities. Technological value: • The automated process reduces the risk of human failure on grid operations, and increases its reliability; • Advantages include: cost cutting, reduction in maintenance requirements and operating costs; • Deployment of this type of substations will significantly improve the reliability of power supply for the customers.

Development of advanced technologies and equipment Vyborg Transforming Complex: Pilot project for the introduction of the static reactive-power compensator (STATCOM) with a capacity of ± 50 MVar Technological value: • Maximum transferred capacity to Finland increased by 20 MW; • Reduction in the number of technological failures at the VTC. Стр Page 17 500 k. V Beskudnikovo Substation: Pilot project for the introduction of the synchronized synchronous compensator (ASC) ± 100 MVar. Technological value: • Ensuring reliable operation of TPP 22 and TPP 27 generators under SC in JSC Mosenergo’s 220 k. V grid; • Stabilizing the voltage level at the 500 k. V Beskudnikovo Substation. The first stage of the Experimental Digital Substation put into pilot production at The Centre for Science and Technology of the Electricity Sector. Primary purpose is the development of innovative technologies for their further deployment at electricity grid facilities. Technological value: • The automated process reduces the risk of human failure on grid operations, and increases its reliability; • Advantages include: cost cutting, reduction in maintenance requirements and operating costs; • Deployment of this type of substations will significantly improve the reliability of power supply for the customers.

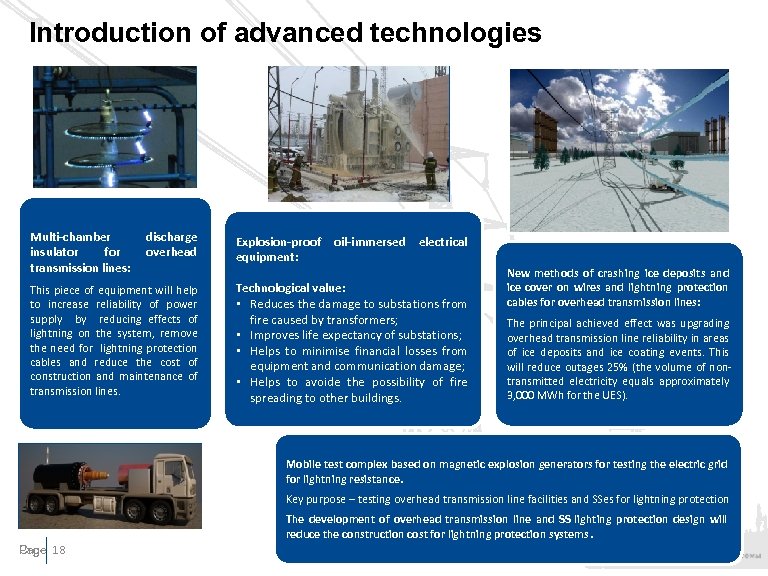

Introduction of advanced technologies Multi-chamber insulator for transmission lines: discharge overhead This piece of equipment will help to increase reliability of power supply by reducing effects of lightning on the system, remove the need for lightning protection cables and reduce the cost of construction and maintenance of transmission lines. Explosion-proof equipment: oil-immersed electrical Technological value: • Reduces the damage to substations from fire caused by transformers; • Improves life expectancy of substations; • Helps to minimise financial losses from equipment and communication damage; • Helps to avoide the possibility of fire spreading to other buildings. New methods of crashing ice deposits and ice cover on wires and lightning protection cables for overhead transmission lines: The principal achieved effect was upgrading overhead transmission line reliability in areas of ice deposits and ice coating events. This will reduce outages 25% (the volume of nontransmitted electricity equals approximately 3, 000 MWh for the UES). Mobile test complex based on magnetic explosion generators for testing the electric grid for lightning resistance. Key purpose – testing overhead transmission line facilities and SSes for lightning protection The development of overhead transmission line and SS lighting protection design will reduce the construction cost for lightning protection systems. Стр Page 18

Introduction of advanced technologies Multi-chamber insulator for transmission lines: discharge overhead This piece of equipment will help to increase reliability of power supply by reducing effects of lightning on the system, remove the need for lightning protection cables and reduce the cost of construction and maintenance of transmission lines. Explosion-proof equipment: oil-immersed electrical Technological value: • Reduces the damage to substations from fire caused by transformers; • Improves life expectancy of substations; • Helps to minimise financial losses from equipment and communication damage; • Helps to avoide the possibility of fire spreading to other buildings. New methods of crashing ice deposits and ice cover on wires and lightning protection cables for overhead transmission lines: The principal achieved effect was upgrading overhead transmission line reliability in areas of ice deposits and ice coating events. This will reduce outages 25% (the volume of nontransmitted electricity equals approximately 3, 000 MWh for the UES). Mobile test complex based on magnetic explosion generators for testing the electric grid for lightning resistance. Key purpose – testing overhead transmission line facilities and SSes for lightning protection The development of overhead transmission line and SS lighting protection design will reduce the construction cost for lightning protection systems. Стр Page 18

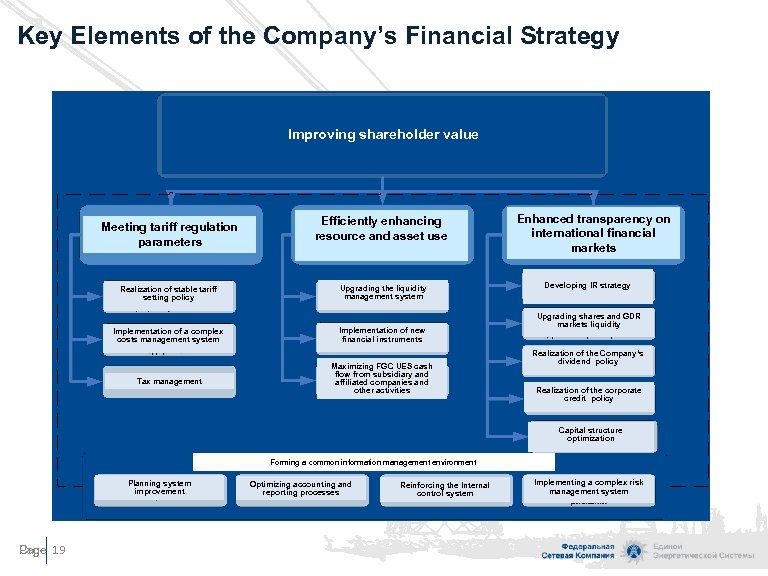

Key Elements of the Company’s Financial Strategy Improving shareholder value Meeting tariff regulation parameters Realization of stable tariff setting policy Efficiently enhancing resource and asset use Upgrading the liquidity management system Implementation of a complex costs management system Implementation of new financial instruments Tax management Maximizing FGC UES cash flow from subsidiary and affiliated companies and other activities Enhanced transparency on international financial markets Developing IR strategy Upgrading shares and GDR markets liquidity Realization of the Company’s dividend policy Realization of the corporate credit policy Capital structure optimization Forming a common information management environment Planning system improvement Стр Page 19 Optimizing accounting and reporting processes Reinforcing the Internal control system Implementing a complex risk management system

Key Elements of the Company’s Financial Strategy Improving shareholder value Meeting tariff regulation parameters Realization of stable tariff setting policy Efficiently enhancing resource and asset use Upgrading the liquidity management system Implementation of a complex costs management system Implementation of new financial instruments Tax management Maximizing FGC UES cash flow from subsidiary and affiliated companies and other activities Enhanced transparency on international financial markets Developing IR strategy Upgrading shares and GDR markets liquidity Realization of the Company’s dividend policy Realization of the corporate credit policy Capital structure optimization Forming a common information management environment Planning system improvement Стр Page 19 Optimizing accounting and reporting processes Reinforcing the Internal control system Implementing a complex risk management system

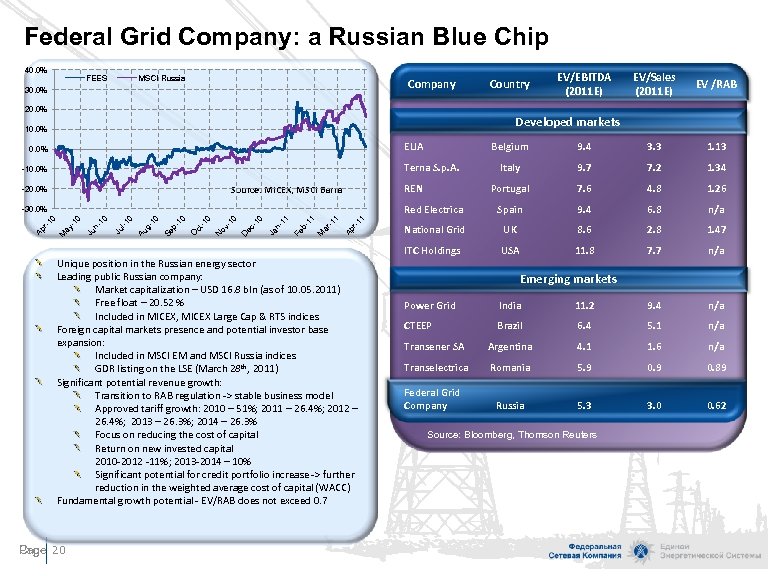

Federal Grid Company: a Russian Blue Chip 40. 0% FEES MSCI Russia Company 30. 0% 20. 0% EV/EBITDA (2011 E) EV/Sales (2011 E) EV /RAB Developed markets 10. 0% ELIA Belgium 9. 4 3. 3 1. 13 Italy 9. 7 7. 2 1. 34 Portugal 7. 6 4. 8 1. 26 Red Electrica 0. 0% Spain 9. 4 6. 8 n/a National Grid UK 8. 6 2. 8 1. 47 ITC Holdings USA 11. 8 7. 7 n/a Terna S. p. A. -10. 0% REN Source: MICEX, MSCI Barra -20. 0% 1 1 Ap r-1 11 -1 M ar Fe b- 0 11 Ja n- 0 ec -1 D ov -1 N -1 0 ct O 10 10 Se p- Au g- l-1 0 Ju 10 Ju n- M ay - 0 10 -30. 0% Ap r-1 Country Unique position in the Russian energy sector Leading public Russian company: Market capitalization – USD 16. 8 bln (as of 10. 05. 2011) Free float – 20. 52 % Included in MICEX, MICEX Large Cap & RTS indices Foreign capital markets presence and potential investor base expansion: Included in MSCI EM and MSCI Russia indices GDR listing on the LSE (March 28 th, 2011) Significant potential revenue growth: Transition to RAB regulation -> stable business model Approved tariff growth: 2010 – 51%; 2011 – 26. 4%; 2012 – 26. 4%; 2013 – 26. 3%; 2014 – 26. 3% Focus on reducing the cost of capital Return on new invested capital 2010 -2012 -11%; 2013 -2014 – 10% Significant potential for credit portfolio increase -> further reduction in the weighted average cost of capital (WACC) Fundamental growth potential - EV/RAB does not exceed 0. 7 Стр Page 20 Emerging markets Power Grid India 11. 2 9. 4 n/a CTEEP Brazil 6. 4 5. 1 n/a Transener SA Argentina 4. 1 1. 6 n/a Transelectrica Romania 5. 9 0. 89 Russia 5. 3 3. 0 0. 62 Federal Grid Company Source: Bloomberg, Thomson Reuters

Federal Grid Company: a Russian Blue Chip 40. 0% FEES MSCI Russia Company 30. 0% 20. 0% EV/EBITDA (2011 E) EV/Sales (2011 E) EV /RAB Developed markets 10. 0% ELIA Belgium 9. 4 3. 3 1. 13 Italy 9. 7 7. 2 1. 34 Portugal 7. 6 4. 8 1. 26 Red Electrica 0. 0% Spain 9. 4 6. 8 n/a National Grid UK 8. 6 2. 8 1. 47 ITC Holdings USA 11. 8 7. 7 n/a Terna S. p. A. -10. 0% REN Source: MICEX, MSCI Barra -20. 0% 1 1 Ap r-1 11 -1 M ar Fe b- 0 11 Ja n- 0 ec -1 D ov -1 N -1 0 ct O 10 10 Se p- Au g- l-1 0 Ju 10 Ju n- M ay - 0 10 -30. 0% Ap r-1 Country Unique position in the Russian energy sector Leading public Russian company: Market capitalization – USD 16. 8 bln (as of 10. 05. 2011) Free float – 20. 52 % Included in MICEX, MICEX Large Cap & RTS indices Foreign capital markets presence and potential investor base expansion: Included in MSCI EM and MSCI Russia indices GDR listing on the LSE (March 28 th, 2011) Significant potential revenue growth: Transition to RAB regulation -> stable business model Approved tariff growth: 2010 – 51%; 2011 – 26. 4%; 2012 – 26. 4%; 2013 – 26. 3%; 2014 – 26. 3% Focus on reducing the cost of capital Return on new invested capital 2010 -2012 -11%; 2013 -2014 – 10% Significant potential for credit portfolio increase -> further reduction in the weighted average cost of capital (WACC) Fundamental growth potential - EV/RAB does not exceed 0. 7 Стр Page 20 Emerging markets Power Grid India 11. 2 9. 4 n/a CTEEP Brazil 6. 4 5. 1 n/a Transener SA Argentina 4. 1 1. 6 n/a Transelectrica Romania 5. 9 0. 89 Russia 5. 3 3. 0 0. 62 Federal Grid Company Source: Bloomberg, Thomson Reuters

Contacts: Federal Grid Company 5 A Akademika Chelomeya Street, Moscow, Russia, 117630 Investor Relations E-mail: ir@fsk-ees. ru Стр Page 21

Contacts: Federal Grid Company 5 A Akademika Chelomeya Street, Moscow, Russia, 117630 Investor Relations E-mail: ir@fsk-ees. ru Стр Page 21