662a703512ab824a1ae4b0aaf5fa035d.ppt

- Количество слайдов: 44

February 2016

Agenda Housekeeping Background Hawaii Retail Webco 2016 Moving forward & extending our talent 2

Housekeeping 3

Housekeeping Moving forward & extending our talent 4

Housekeeping Moving forward & extending our talent Background 5

Hawaii Market Dynamics 98% Vast Pacific Ocean makes Hawaii the most isolated market in the world of goods need to be shipped over water $ Development limited to 5 % of 6, 400 sq. mi. of land leading to high land costs There is success in retailing in Hawaii. • No. 1 Costco in their chain • All Hawaii, Walmarts in top 25 nationally • Longs stores do 7 X the volume of a CVS • Walgreen’s Hawaii stores do 8 X a mainland store Small 1. 4 M resident population, augmented by 8. 8 M tourist spending $18 B annually 6

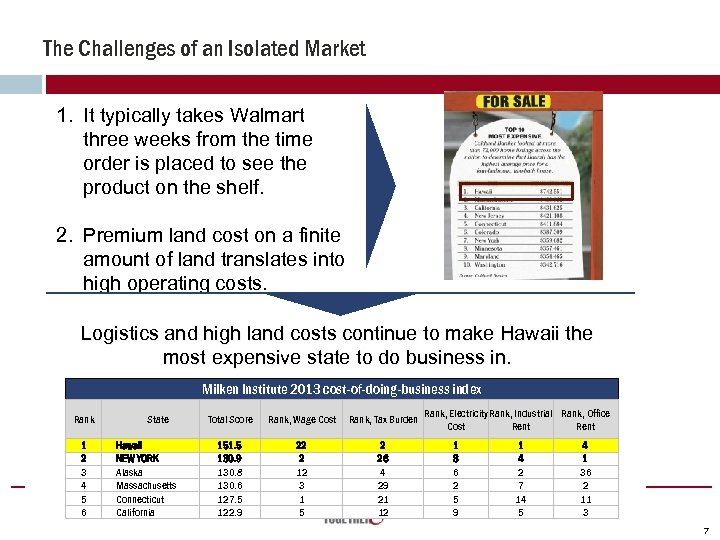

The Challenges of an Isolated Market 1. It typically takes Walmart three weeks from the time order is placed to see the product on the shelf. 2. Premium land cost on a finite amount of land translates into high operating costs. Logistics and high land costs continue to make Hawaii the most expensive state to do business in. Milken Institute 2013 cost-of-doing-business index Rank 1 2 3 4 5 6 State Hawaii NEW YORK Alaska Massachusetts Connecticut California Total Score Rank, Wage Cost Rank, Tax Burden 151. 5 130. 9 130. 8 130. 6 127. 5 122. 9 22 2 12 3 1 5 2 26 4 29 21 12 Rank, Electricity Rank, Industrial Rank, Office Cost Rent 1 8 6 2 5 9 1 4 2 7 14 5 4 1 36 2 11 3 7

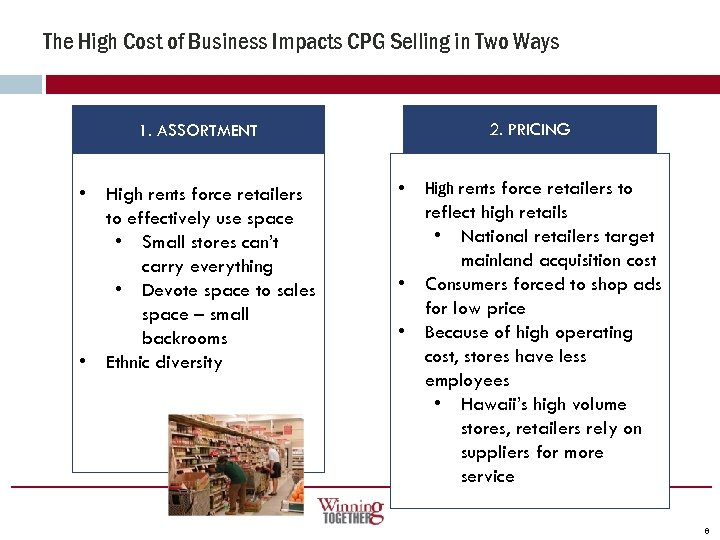

The High Cost of Business Impacts CPG Selling in Two Ways 2. PRICING 1. ASSORTMENT • High rents force retailers to effectively use space • Small stores can’t carry everything • Devote space to sales space – small backrooms • Ethnic diversity • High rents force retailers to reflect high retails • National retailers target mainland acquisition cost • Consumers forced to shop ads for low price • Because of high operating cost, stores have less employees • Hawaii’s high volume stores, retailers rely on suppliers for more service 8

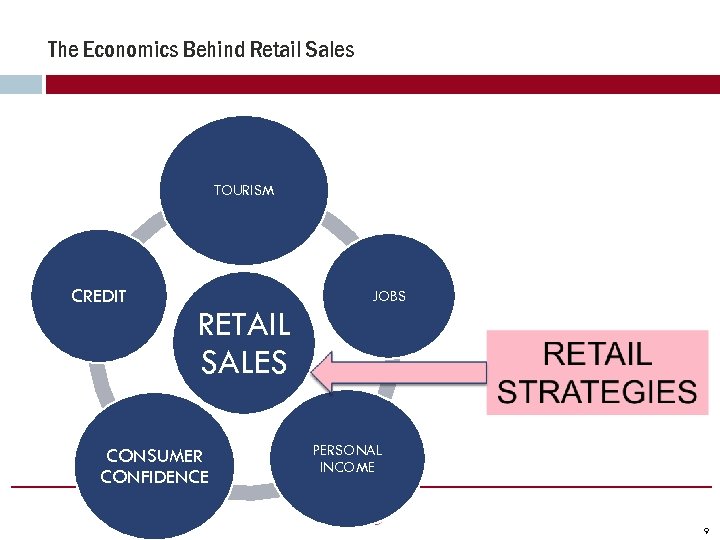

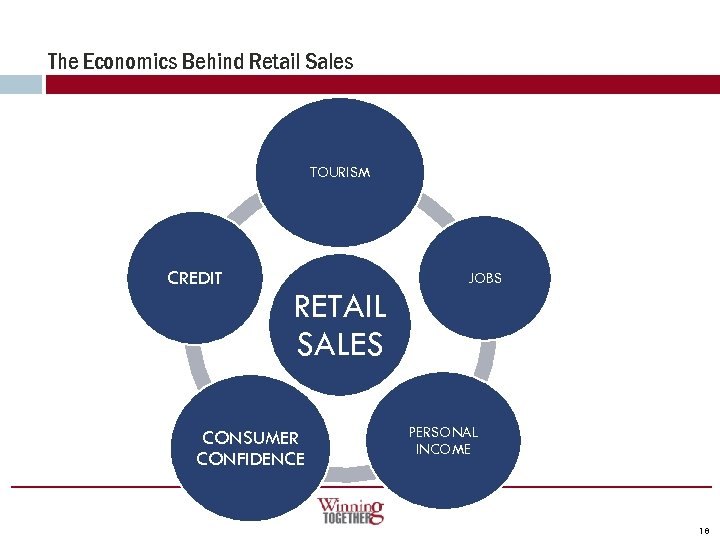

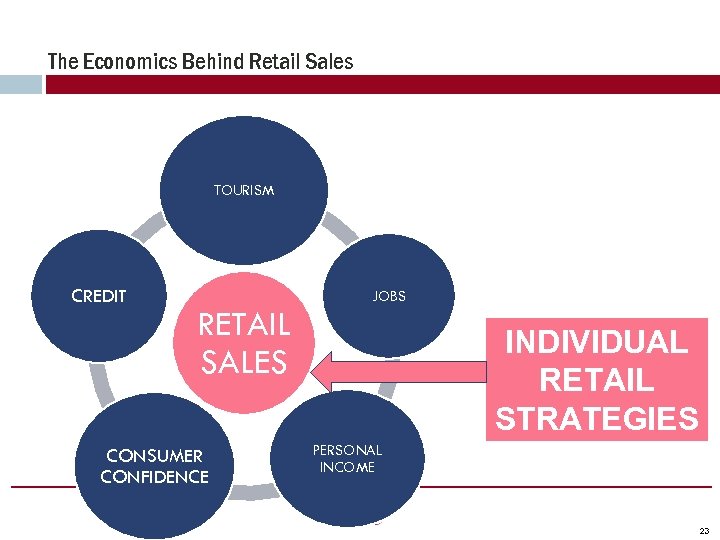

The Economics Behind Retail Sales TOURISM CREDIT RETAIL SALES CONSUMER CONFIDENCE JOBS PERSONAL INCOME 9

The Economics Behind Retail Sales RETAIL SALES TOURISM 10

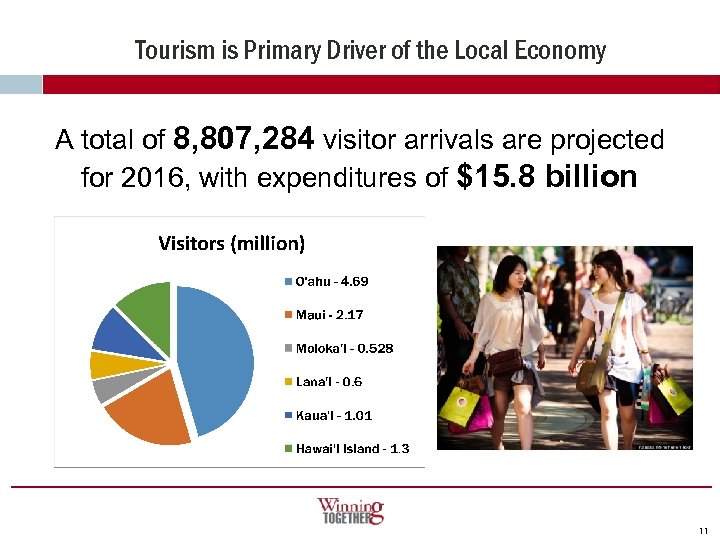

Tourism is Primary Driver of the Local Economy A total of 8, 807, 284 visitor arrivals are projected for 2016, with expenditures of $15. 8 billion 11

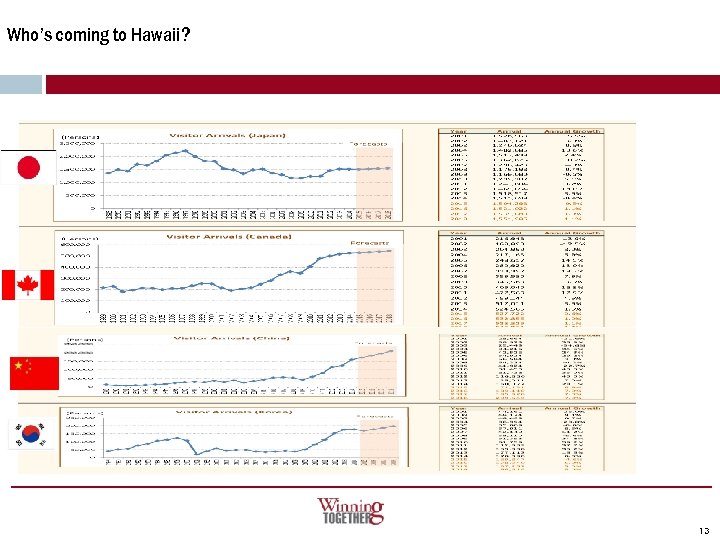

Who’s coming to Hawai’i? 5, 383, 718 Total US Visitors 12

Who’s coming to Hawaii? 13

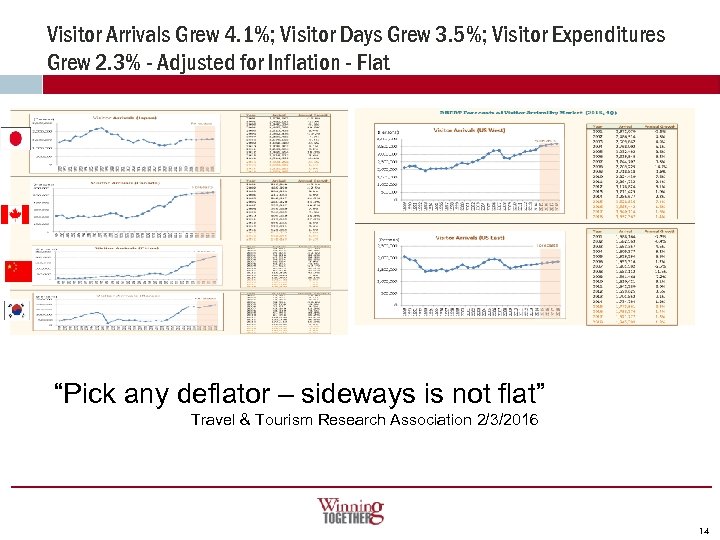

Visitor Arrivals Grew 4. 1%; Visitor Days Grew 3. 5%; Visitor Expenditures Grew 2. 3% - Adjusted for Inflation - Flat “Pick any deflator – sideways is not flat” Travel & Tourism Research Association 2/3/2016 14

The Economics Behind Retail Sales TOURISM RETAIL SALES PERSONAL INCOME 15

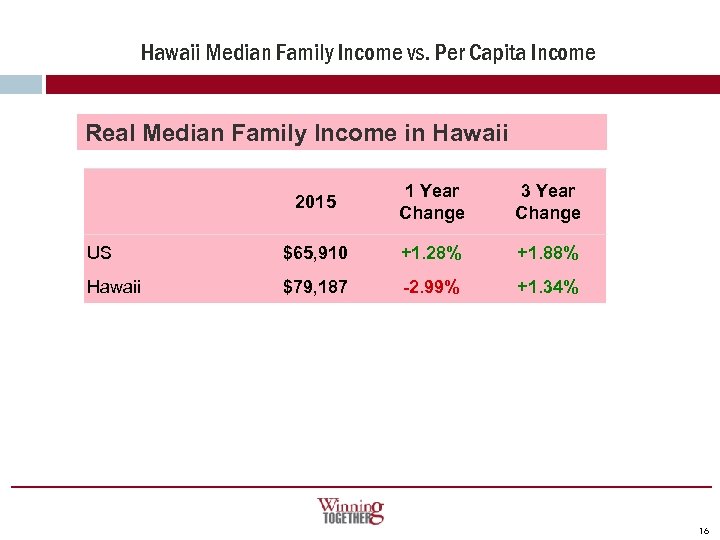

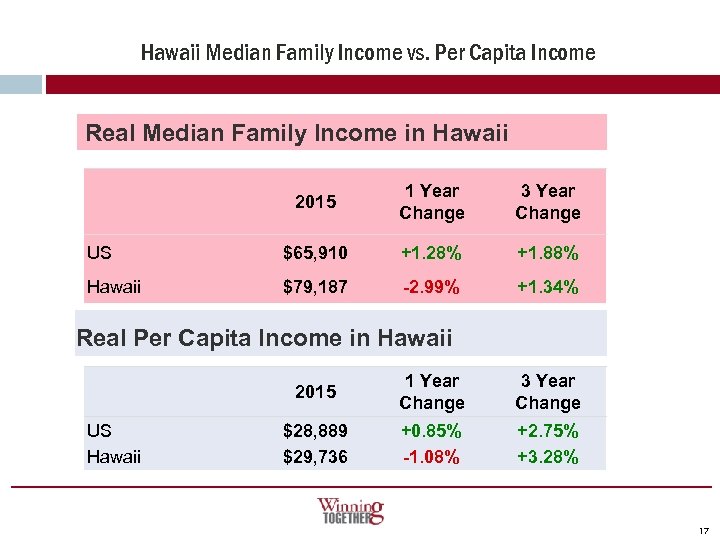

Hawaii Median Family Income vs. Per Capita Income Real Median Family Income in Hawaii 2015 1 Year Change 3 Year Change US $65, 910 +1. 28% +1. 88% Hawaii $79, 187 -2. 99% +1. 34% 16

Hawaii Median Family Income vs. Per Capita Income Real Median Family Income in Hawaii 2015 1 Year Change 3 Year Change US $65, 910 +1. 28% +1. 88% Hawaii $79, 187 -2. 99% +1. 34% Real Per Capita Income in Hawaii 2015 US Hawaii 1 Year Change 3 Year Change $28, 889 $29, 736 +0. 85% -1. 08% +2. 75% +3. 28% 17

The Economics Behind Retail Sales TOURISM CREDIT RETAIL SALES CONSUMER CONFIDENCE JOBS PERSONAL INCOME 18

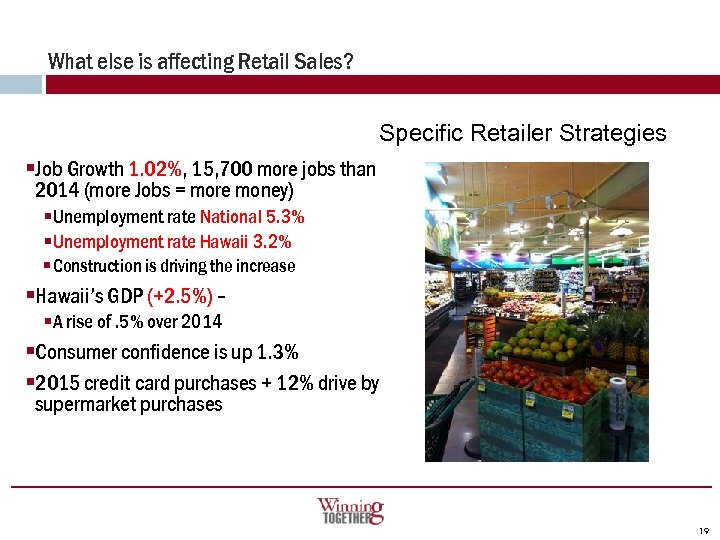

What else is affecting Retail Sales? Specific Retailer Strategies §Job Growth 1. 02%, 15, 700 more jobs than 2014 (more Jobs = more money) §Unemployment rate National 5. 3% §Unemployment rate Hawaii 3. 2% § Construction is driving the increase §Hawaii’s GDP (+2. 5%) – §A rise of. 5% over 2014 §Consumer confidence is up 1. 3% § 2015 credit card purchases + 12% drive by supermarket purchases 19

Housekeeping Moving forward & extending our talent Background Hawaii Retail 20

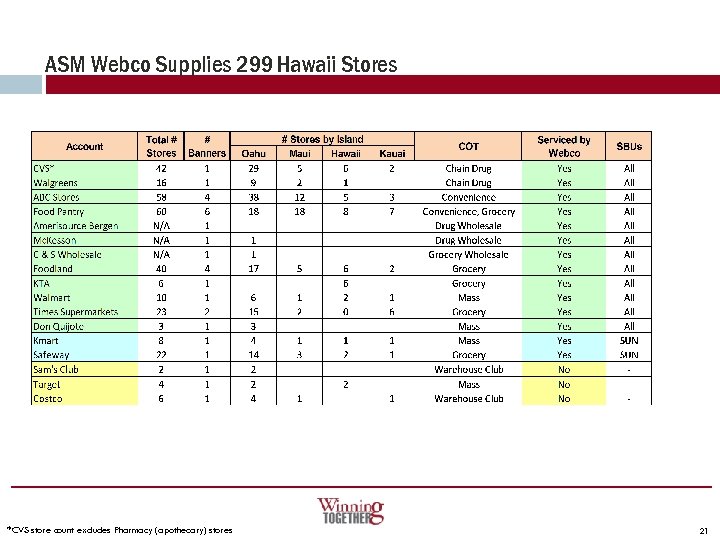

ASM Webco Supplies 299 Hawaii Stores *CVS store count excludes Pharmacy (apothecary) stores 21

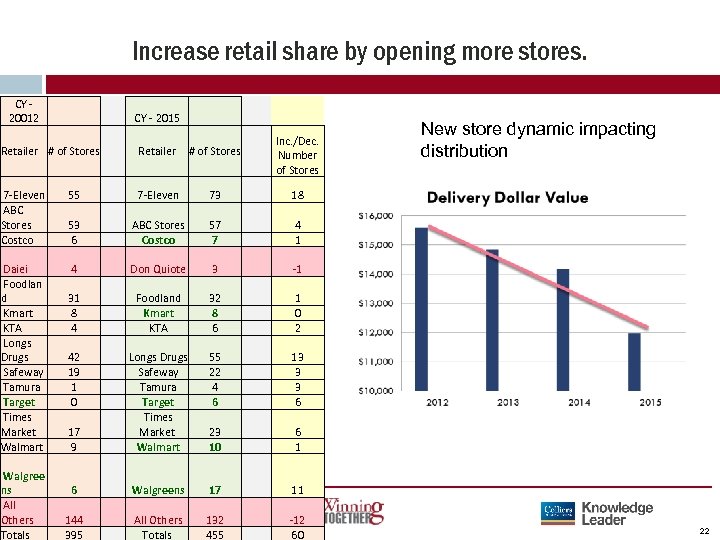

Increase retail share by opening more stores. CY - 20012 Retailer # of Stores CY - 2015 Retailer Inc. /Dec. Number of Stores # of Stores 7 -Eleven ABC Stores Costco 55 7 -Eleven 73 18 53 6 ABC Stores Costco 57 7 4 1 Daiei Foodlan d Kmart KTA Longs Drugs Safeway Tamura Target Times Market Walmart 4 Don Quiote 3 -1 31 8 4 Foodland Kmart KTA 32 8 6 1 0 2 42 19 1 0 55 22 4 6 13 3 3 6 17 9 Longs Drugs Safeway Tamura Target Times Market Walmart 23 10 6 1 6 Walgreens 17 11 144 395 All Others Totals 132 455 -12 60 New store dynamic impacting distribution Walgree ns All Others Totals 22

The Economics Behind Retail Sales TOURISM CREDIT RETAIL SALES CONSUMER CONFIDENCE JOBS INDIVIDUAL RETAIL STRATEGIES PERSONAL INCOME 23

Specific Retail Strategies 24

Agenda Housekeeping Moving forward & extending our talent Background Hawaii Retail Webco 2016 25

Vision: Simply be the Best 2016 26

Mission Statement “We create customized solutions bridging our manufacturers and customers with 1. exemplary value 2. products 3. and services. … and will exceed expectations by creating a culture that embraces the strengths of our employees while enriching our community. ” 27

Integrity: We express integrity by allowing these core values to drive our behaviors in a transparent manner. We exercise good judgment, honesty and fairness with the highest ethical standards. Leadership: We continuously learn, develop, and improve ourselves, striving to be masters in our field. Through our actions we inspire and empower others to do the same. Professionalism: We engage our employees and customers with a respectful communication style and integrity that exemplifies the behaviors of an industry leader. Accountability: We are problem solvers, not blamers. When issues arise, we step up, collect data and seek solutions. We honor our commitments, take responsibility for our actions, and learn from our mistakes. Change Readiness: We approach challenge and change by being adaptive and open while proactively meeting the evolving needs of our company and our partnerships. It starts with me. Innovation: We value being the best at what we do. We encourage new ideas, progressive action, and new technologies that support our commitment to excellence. 28

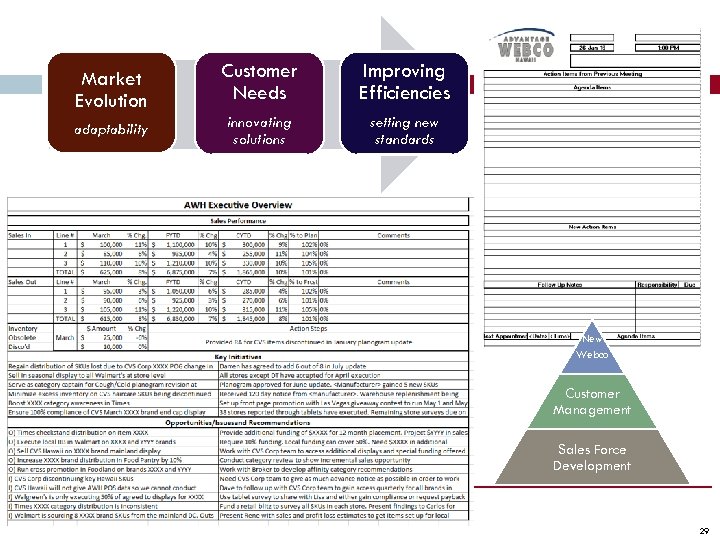

Market Evolution Customer Needs Improving Efficiencies adaptability innovating solutions setting new standards New Webco Customer Management Sales Force Development 29

Cultivating our Partnerships for Excellence MANUFACTURER • • • Mastery of the Marketplace Champions of your Brand Operational Excellence Dependable & Accountable Indispensable Partnership RETAILER • • • Objective Alignment Superior Service/ Reliability Valued products Seamless Execution Indispensable Partnership EMPLOYEES • • • Valued & Appreciated Challenged for Innovation Dependable & Accountable Supported & Equipped Indispensable Partnership 30

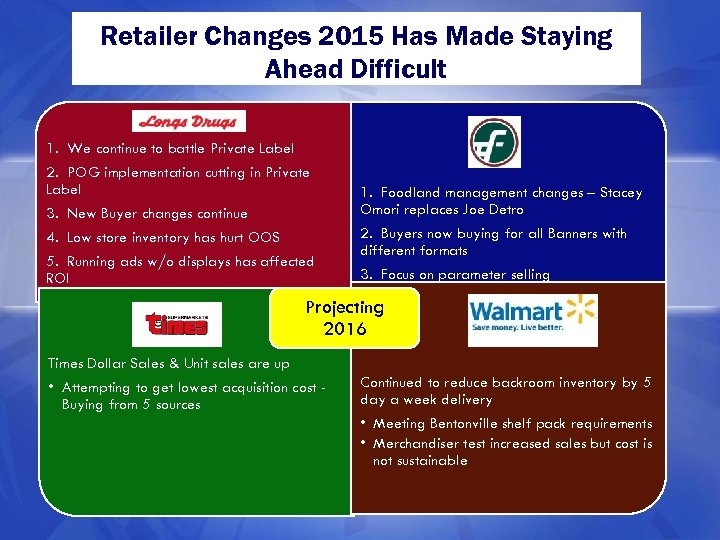

Retailer Changes 2015 Has Made Staying Ahead Difficult 1. We continue to battle Private Label 2. POG implementation cutting in Private Label 3. New Buyer changes continue 4. Low store inventory has hurt OOS 5. Running ads w/o displays has affected ROI 1. Foodland management changes – Stacey Omori replaces Joe Detro 2. Buyers now buying for all Banners with different formats 3. Focus on parameter selling Projecting 2016 Times Dollar Sales & Unit sales are up • Attempting to get lowest acquisition cost Buying from 5 sources Continued to reduce backroom inventory by 5 day a week delivery • Meeting Bentonville shelf pack requirements • Merchandiser test increased sales but cost is not sustainable 31

Here is our strategy for 2016 32

We have a strategy to make 2016 a very good year!! 33

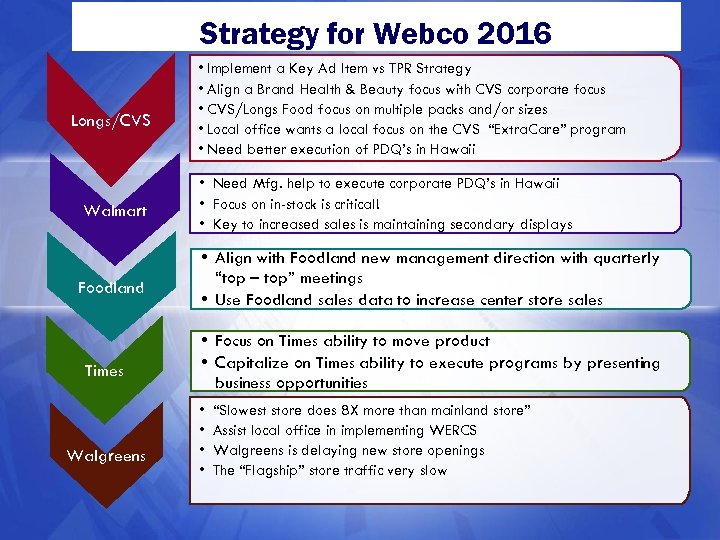

Strategy for Webco 2016 Longs/CVS Walmart Foodland Times Walgreens • Implement a Key Ad Item vs TPR Strategy • Align a Brand Health & Beauty focus with CVS corporate focus • CVS/Longs Food focus on multiple packs and/or sizes • Local office wants a local focus on the CVS “Extra. Care” program • Need better execution of PDQ’s in Hawaii • Need Mfg. help to execute corporate PDQ’s in Hawaii • Focus on in-stock is critical! • Key to increased sales is maintaining secondary displays • Align with Foodland new management direction with quarterly “top – top” meetings • Use Foodland sales data to increase center store sales • Focus on Times ability to move product • Capitalize on Times ability to execute programs by presenting business opportunities • • “Slowest store does 8 X more than mainland store” Assist local office in implementing WERCS Walgreens is delaying new store openings The “Flagship” store traffic very slow 34

Appendix 35

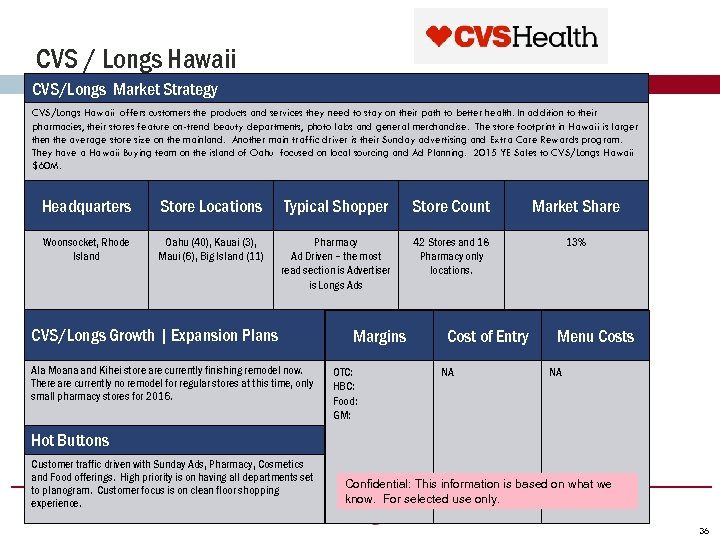

CVS / Longs Hawaii CVS/Longs Market Strategy CVS/Longs Hawaii offers customers the products and services they need to stay on their path to better health. In addition to their pharmacies, their stores feature on-trend beauty departments, photo labs and general merchandise. The store footprint in Hawaii is larger then the average store size on the mainland. Another main traffic driver is their Sunday advertising and Extra Care Rewards program. They have a Hawaii Buying team on the island of Oahu focused on local sourcing and Ad Planning. 2015 YE Sales to CVS/Longs Hawaii $60 M. Headquarters Store Locations Typical Shopper Store Count Market Share Woonsocket, Rhode Island Oahu (40), Kauai (3), Maui (6), Big Island (11) Pharmacy Ad Driven – the most read section is Advertiser is Longs Ads 42 Stores and 18 Pharmacy only locations. 13% CVS/Longs Growth | Expansion Plans Ala Moana and Kihei store are currently finishing remodel now. There are currently no remodel for regular stores at this time, only small pharmacy stores for 2016. Margins OTC: HBC: Food: GM: Cost of Entry NA Menu Costs NA Hot Buttons Customer traffic driven with Sunday Ads, Pharmacy, Cosmetics and Food offerings. High priority is on having all departments set to planogram. Customer focus is on clean floor shopping experience. Confidential: This information is based on what we know. For selected use only. 36

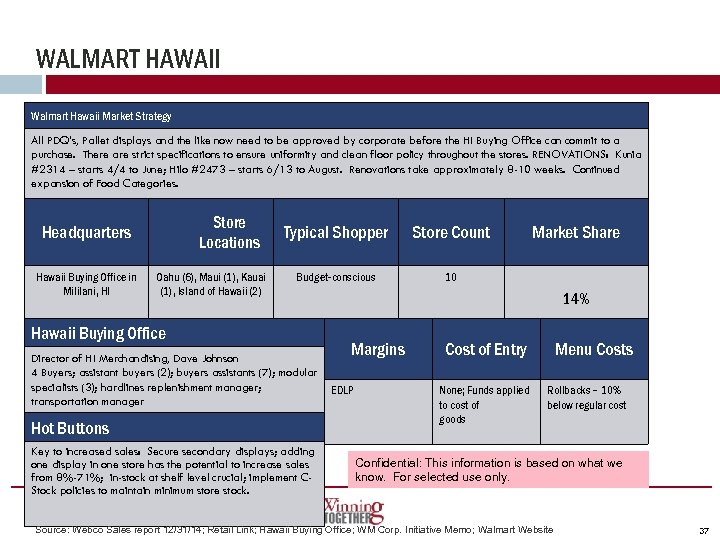

WALMART HAWAII Walmart Hawaii Market Strategy All PDQ’s, Pallet displays and the like now need to be approved by corporate before the HI Buying Office can commit to a purchase. There are strict specifications to ensure uniformity and clean floor policy throughout the stores. RENOVATIONS: Kunia #2314 – starts 4/4 to June; Hilo #2473 – starts 6/13 to August. Renovations take approximately 8 -10 weeks. Continued expansion of Food Categories. Store Locations Headquarters Hawaii Buying Office in Mililani, HI Oahu (6), Maui (1), Kauai (1), Island of Hawaii (2) Typical Shopper Store Count Budget-conscious 10 Hawaii Buying Office Director of HI Merchandising, Dave Johnson 4 Buyers; assistant buyers (2); buyers assistants (7); modular specialists (3); hardlines replenishment manager; transportation manager Hot Buttons Key to increased sales: Secure secondary displays; adding one display in one store has the potential to increase sales from 8%-71%; in-stock at shelf level crucial; implement CStock policies to maintain minimum store stock. Market Share 14% Margins EDLP Cost of Entry None; Funds applied to cost of goods Menu Costs Rollbacks – 10% below regular cost Confidential: This information is based on what we know. For selected use only. Source: Webco Sales report 12/31/14; Retail Link; Hawaii Buying Office; WM Corp. Initiative Memo; Walmart Website 37

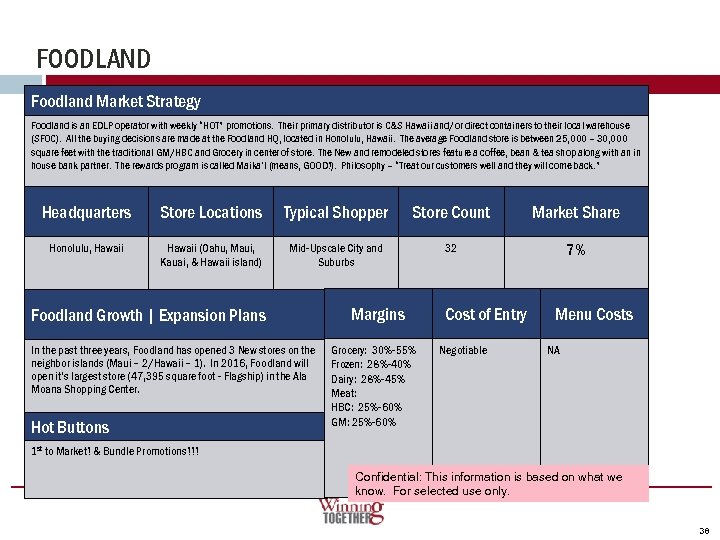

FOODLAND Foodland Market Strategy Foodland is an EDLP operator with weekly “HOT” promotions. Their primary distributor is C&S Hawaii and/or direct containers to their local warehouse (SFOC). All the buying decisions are made at the Foodland HQ, located in Honolulu, Hawaii. The average Foodland store is between 25, 000 – 30, 000 square feet with the traditional GM/HBC and Grocery in center of store. The New and remodeled stores feature a coffee, bean & tea shop along with an in house bank partner. The rewards program is called Maika’I (means, GOOD!). Philosophy – “Treat our customers well and they will come back. ” Headquarters Store Locations Typical Shopper Store Count Market Share Honolulu, Hawaii (Oahu, Maui, Kauai, & Hawaii island) Mid-Upscale City and Suburbs 32 7% Foodland Growth | Expansion Plans In the past three years, Foodland has opened 3 New stores on the neighbor islands (Maui – 2/Hawaii – 1). In 2016, Foodland will open it’s largest store (47, 395 square foot - Flagship) in the Ala Moana Shopping Center. Hot Buttons Margins Grocery: 30%-55% Frozen: 28%-40% Dairy: 28%-45% Meat: HBC: 25%-60% GM: 25%-60% Cost of Entry Negotiable Menu Costs NA 1 st to Market! & Bundle Promotions!!! Confidential: This information is based on what we know. For selected use only. 38

TIMES SUPERMARKETS Times Market Strategy Times Super Market is an EDLP operator of 8, 000+ items. UG is their preferred supplier. No club card required to save on everyday specials! PAQ is the parent company of Times Super Market. The Times HQ and buying office is located in Honolulu, HI. and their warehouse is located in Waipahu, HI. Times promotes and supports local farms /produce and made in Hawaii products. All the stores are between 20, 000 to 35, 000 square feet. Headquarters Store Locations Typical Shopper Store Count Market Share Honolulu, HI Oahu, Maui and Kauai Middle Income, Senior community 23 7% Times Growth | Expansion Plans No news on expansions to date! Hot Buttons Full – service seafood bar , deli, and pharmacy (12 stores) and expanded ethnics food sections… Margins Grocery: 20%-40% Frozen: 35% Dairy: 35% Meat: % HBC: 22%-47% GM: 25%-50% Cost of Entry Negotiable Menu Costs NA Confidential: This information is based on what we know. For selected use only. 39

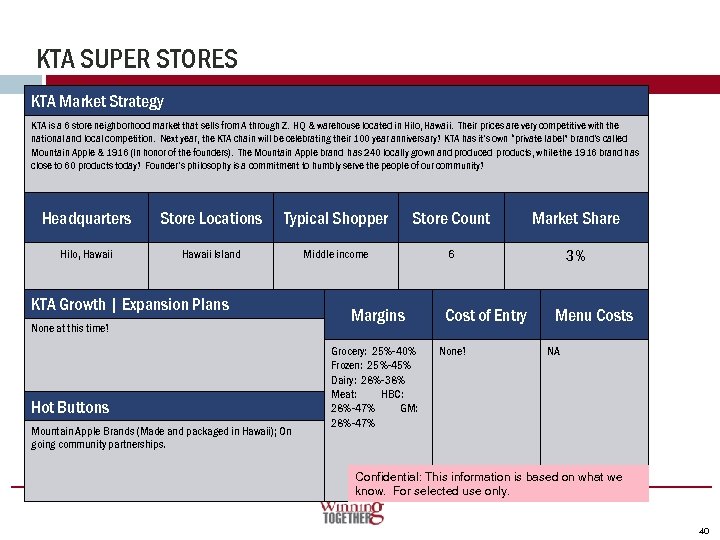

KTA SUPER STORES KTA Market Strategy KTA is a 6 store neighborhood market that sells from A through Z. HQ & warehouse located in Hilo, Hawaii. Their prices are very competitive with the national and local competition. Next year, the KTA chain will be celebrating their 100 year anniversary! KTA has it’s own “private label” brand’s called Mountain Apple & 1916 (In honor of the founders). The Mountain Apple brand has 240 locally grown and produced products, while the 1916 brand has close to 60 products today! Founder’s philosophy is a commitment to humbly serve the people of our community! Headquarters Store Locations Typical Shopper Store Count Market Share Hilo, Hawaii Island Middle income 6 3% KTA Growth | Expansion Plans None at this time! Hot Buttons Mountain Apple Brands (Made and packaged in Hawaii); On going community partnerships. Margins Grocery: 25%-40% Frozen: 25%-45% Dairy: 28%-38% Meat: HBC: 28%-47% GM: 28%-47% Cost of Entry None! Menu Costs NA Confidential: This information is based on what we know. For selected use only. 40

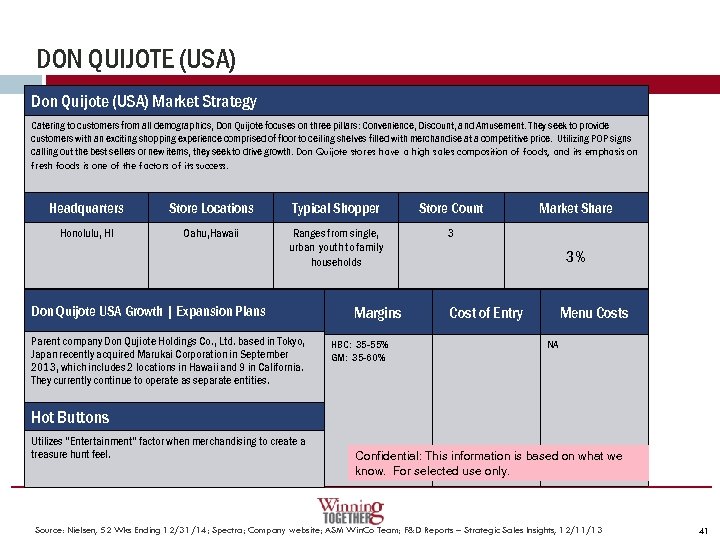

DON QUIJOTE (USA) Don Quijote (USA) Market Strategy Catering to customers from all demographics, Don Quijote focuses on three pillars: Convenience, Discount, and Amusement. They seek to provide customers with an exciting shopping experience comprised of floor to ceiling shelves filled with merchandise at a competitive price. Utilizing POP signs calling out the best sellers or new items, they seek to drive growth. Don Quijote stores have a high sales composition of foods, and its emphasis on fresh foods is one of the factors of its success. Headquarters Store Locations Typical Shopper Store Count Honolulu, HI Oahu, Hawaii Ranges from single, urban youth to family households 3 Don Quijote USA Growth | Expansion Plans Parent company Don Qujiote Holdings Co. , Ltd. based in Tokyo, Japan recently acquired Marukai Corporation in September 2013, which includes 2 locations in Hawaii and 9 in California. They currently continue to operate as separate entities. Margins HBC: 35 -55% GM: 35 -60% Market Share 3% Cost of Entry Menu Costs NA Hot Buttons Utilizes “Entertainment” factor when merchandising to create a treasure hunt feel. Confidential: This information is based on what we know. For selected use only. Source: Nielsen, 52 Wks Ending 12/31/14; Spectra; Company website; ASM Win. Co Team; F&D Reports – Strategic Sales Insights, 12/11/13 41

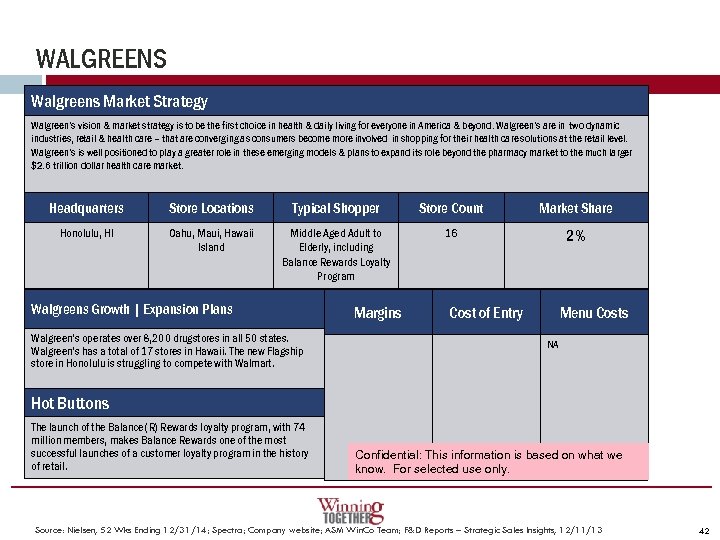

WALGREENS Walgreens Market Strategy Walgreen’s vision & market strategy is to be the first choice in health & daily living for everyone in America & beyond. Walgreen’s are in two dynamic industries, retail & health care – that are converging as consumers become more involved in shopping for their health care solutions at the retail level. Walgreen’s is well positioned to play a greater role in these emerging models & plans to expand its role beyond the pharmacy market to the much larger $2. 6 trillion dollar health care market. Headquarters Store Locations Typical Shopper Store Count Market Share Honolulu, HI Oahu, Maui, Hawaii Island Middle Aged Adult to Elderly, including Balance Rewards Loyalty Program 16 2% Walgreens Growth | Expansion Plans Walgreen’s operates over 8, 200 drugstores in all 50 states. Walgreen’s has a total of 17 stores in Hawaii. The new Flagship store in Honolulu is struggling to compete with Walmart. Margins Cost of Entry Menu Costs NA Hot Buttons The launch of the Balance( R) Rewards loyalty program, with 74 million members, makes Balance Rewards one of the most successful launches of a customer loyalty program in the history of retail. Confidential: This information is based on what we know. For selected use only. Source: Nielsen, 52 Wks Ending 12/31/14; Spectra; Company website; ASM Win. Co Team; F&D Reports – Strategic Sales Insights, 12/11/13 42

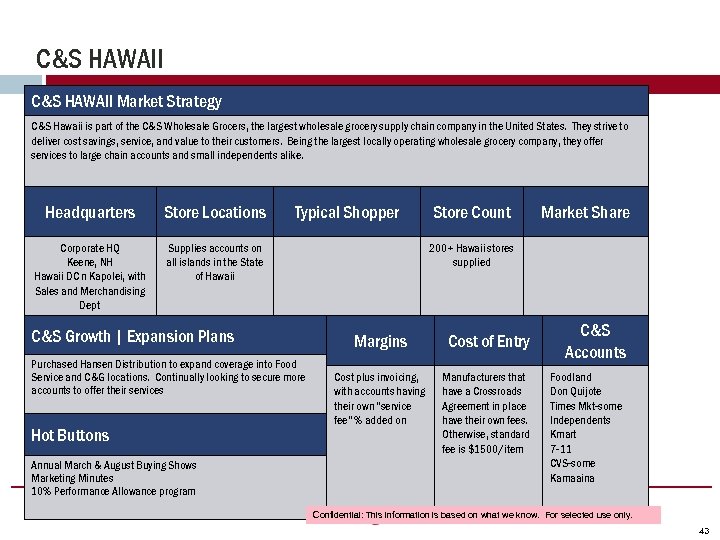

C&S HAWAII Market Strategy C&S Hawaii is part of the C&S Wholesale Grocers, the largest wholesale grocery supply chain company in the United States. They strive to deliver cost savings, service, and value to their customers. Being the largest locally operating wholesale grocery company, they offer services to large chain accounts and small independents alike. Headquarters Store Locations Corporate HQ Keene, NH Hawaii DC n Kapolei, with Sales and Merchandising Dept Typical Shopper Supplies accounts on all islands in the State of Hawaii C&S Growth | Expansion Plans Purchased Hansen Distribution to expand coverage into Food Service and C&G locations. Continually looking to secure more accounts to offer their services Hot Buttons Annual March & August Buying Shows Marketing Minutes 10% Performance Allowance program Store Count Market Share 200+ Hawaii stores supplied Margins Cost of Entry Cost plus invoicing, with accounts having their own “service fee” % added on Manufacturers that have a Crossroads Agreement in place have their own fees. Otherwise, standard fee is $1500/item C&S Accounts Foodland Don Quijote Times Mkt-some Independents Kmart 7 -11 CVS-some Kamaaina Confidential: This information is based on what we know. For selected use only. 43

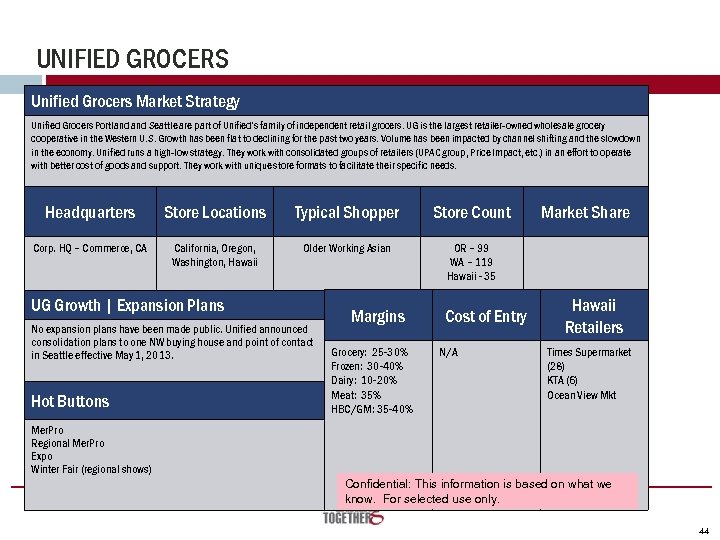

UNIFIED GROCERS Unified Grocers Market Strategy Unified Grocers Portland Seattle are part of Unified’s family of independent retail grocers. UG is the largest retailer-owned wholesale grocery cooperative in the Western U. S. Growth has been flat to declining for the past two years. Volume has been impacted by channel shifting and the slowdown in the economy. Unified runs a high-low strategy. They work with consolidated groups of retailers (UPAC group, Price Impact, etc. ) in an effort to operate with better cost of goods and support. They work with unique store formats to facilitate their specific needs. Headquarters Store Locations Typical Shopper Store Count Corp. HQ – Commerce, CA California, Oregon, Washington, Hawaii Older Working Asian OR – 99 WA – 119 Hawaii - 35 UG Growth | Expansion Plans No expansion plans have been made public. Unified announced consolidation plans to one NW buying house and point of contact in Seattle effective May 1, 2013. Hot Buttons Margins Grocery: 25 -30% Frozen: 30 -40% Dairy: 10 -20% Meat: 35% HBC/GM: 35 -40% Cost of Entry N/A Market Share Hawaii Retailers Times Supermarket (28) KTA (6) Ocean View Mkt Mer. Pro Regional Mer. Pro Expo Winter Fair (regional shows) Confidential: This information is based on what we know. For selected use only. 44

662a703512ab824a1ae4b0aaf5fa035d.ppt