85d8077d3fe8b25b5a53febe8e7cc46e.ppt

- Количество слайдов: 26

February 2011 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

We are always curious to know more about … When will my son get married? How long will I live? OUR FUTURE Will my daughter become a doctor or a banker? Will I be able to purchase my dream house? This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

BECAUSE The Future is … Uncertain Unknown You may or may not be there for your family Unexpected expenses may eat into your savings Unpredictable Your goals may remain unfulfilled This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

But what if you could … …do away with the uncertainty? …protect your savings against unforeseen events? …secure your goals in the future? This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Introducing… A goal based savings solution which secures your future goals … • Achieve your goals with lumpsum maturity benefit • Grow your savings with regular bonus additions • Safeguard against unforeseen events with life cover This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

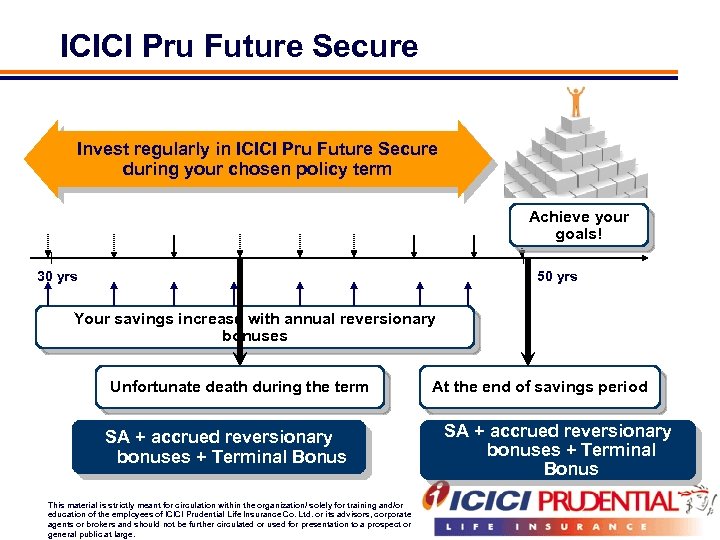

ICICI Pru Future Secure Invest regularly in ICICI Pru Future Secure during your chosen policy term Achieve your goals! 30 yrs 50 yrs Your savings increase with annual reversionary bonuses Unfortunate death during the term SA + accrued reversionary bonuses + Terminal Bonus This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large. At the end of savings period SA + accrued reversionary bonuses + Terminal Bonus

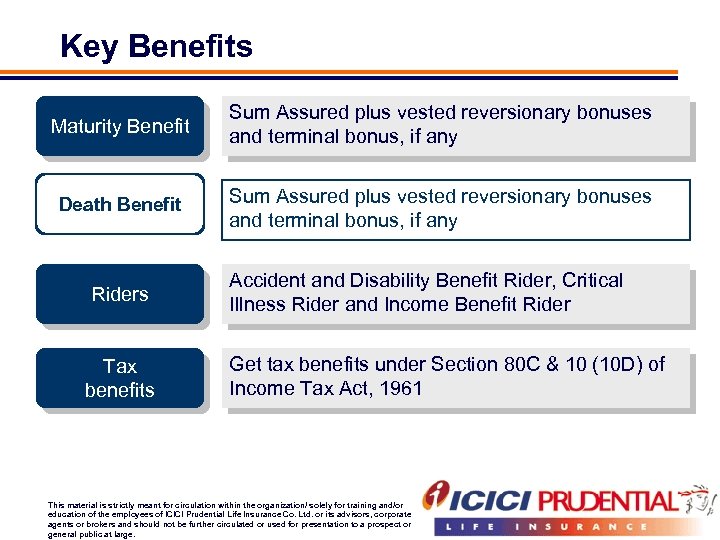

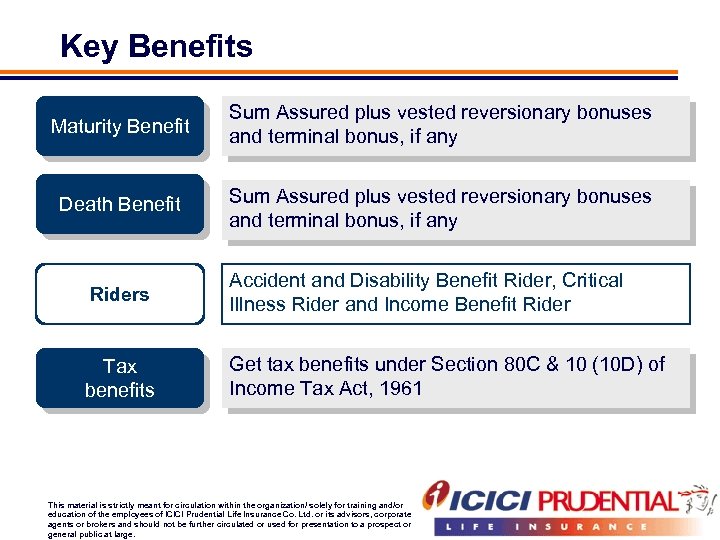

Key Benefits Maturity Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Death Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Riders Tax benefits Accident and Disability Benefit Rider, Critical Illness Rider and Income Benefit Rider Get tax benefits under Section 80 C & 10 (10 D) of Income Tax Act, 1961 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Key Benefits Maturity Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Death Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Riders Tax benefits Accident and Disability Benefit Rider, Critical Illness Rider and Income Benefit Rider Get tax benefits under Section 80 C & 10 (10 D) of Income Tax Act, 1961 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

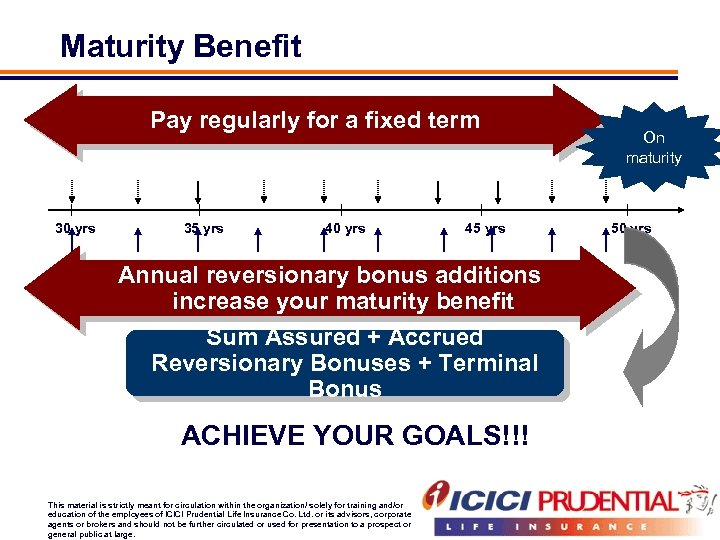

Maturity Benefit Pay regularly for a fixed term 30 yrs 35 yrs 40 yrs 45 yrs Annual reversionary bonus additions increase your maturity benefit Sum Assured + Accrued Reversionary Bonuses + Terminal Bonus ACHIEVE YOUR GOALS!!! This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large. On maturity 50 yrs

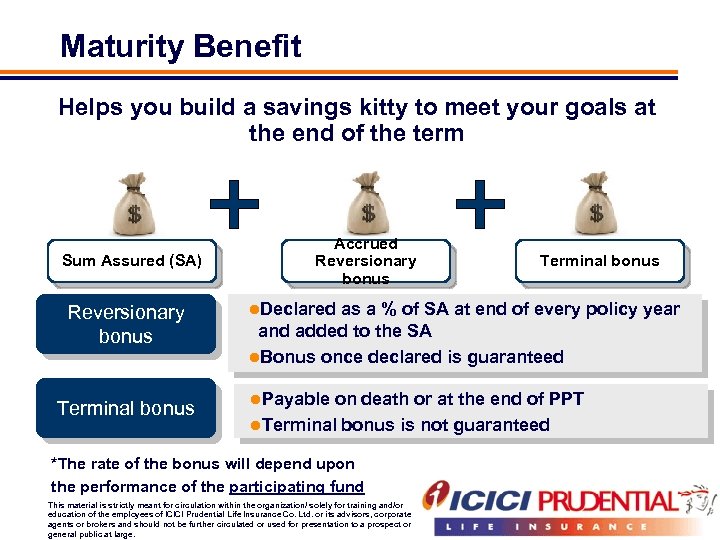

Maturity Benefit Helps you build a savings kitty to meet your goals at the end of the term Sum Assured (SA) Reversionary bonus Terminal bonus Accrued Reversionary bonus Terminal bonus l. Declared as a % of SA at end of every policy year and added to the SA l. Bonus once declared is guaranteed l. Payable on death or at the end of PPT l. Terminal bonus is not guaranteed *The rate of the bonus will depend upon the performance of the participating fund This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

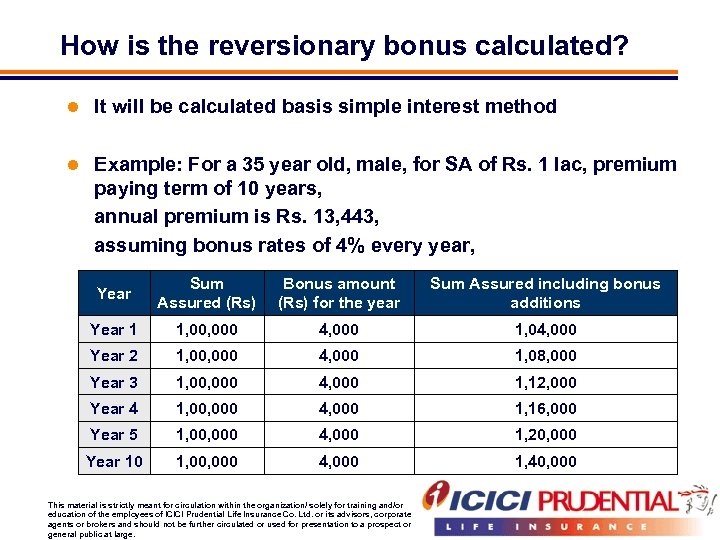

How is the reversionary bonus calculated? l It will be calculated basis simple interest method l Example: For a 35 year old, male, for SA of Rs. 1 lac, premium paying term of 10 years, annual premium is Rs. 13, 443, assuming bonus rates of 4% every year, Year Sum Assured (Rs) Bonus amount (Rs) for the year Sum Assured including bonus additions Year 1 1, 000 4, 000 1, 04, 000 Year 2 1, 000 4, 000 1, 08, 000 Year 3 1, 000 4, 000 1, 12, 000 Year 4 1, 000 4, 000 1, 16, 000 Year 5 1, 000 4, 000 1, 20, 000 Year 10 1, 000 4, 000 1, 40, 000 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

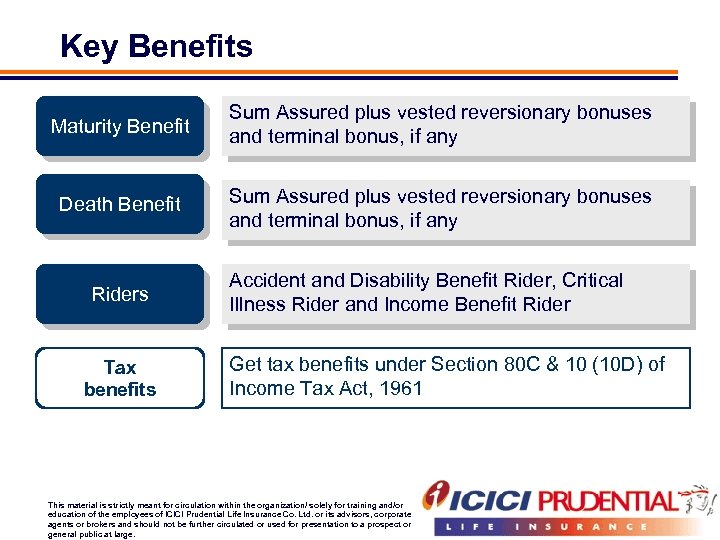

Key Benefits Maturity Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Death Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Riders Tax benefits Accident and Disability Benefit Rider, Critical Illness Rider and Income Benefit Rider Get tax benefits under Section 80 C & 10 (10 D) of Income Tax Act, 1961 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

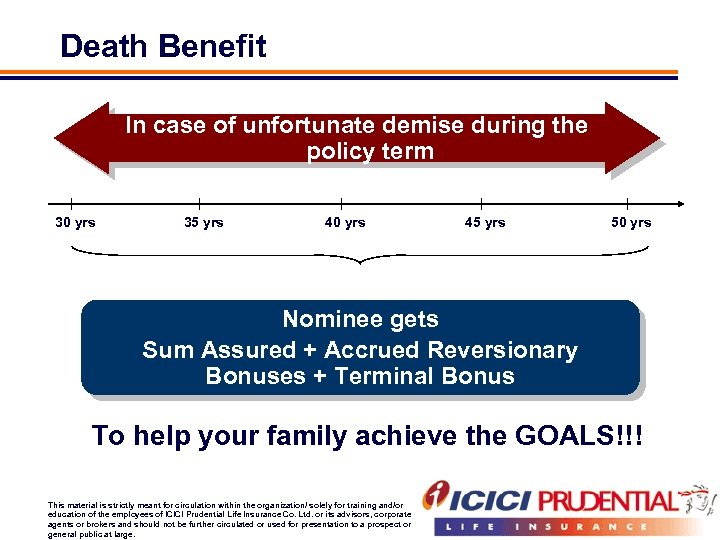

Death Benefit In case of unfortunate demise during the policy term 30 yrs 35 yrs 40 yrs 45 yrs 50 yrs Nominee gets Sum Assured + Accrued Reversionary Bonuses + Terminal Bonus To help your family achieve the GOALS!!! This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Key Benefits Maturity Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Death Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Riders Accident and Disability Benefit Rider, Critical Illness Rider and Income Benefit Rider Tax benefits Get tax benefits under Section 80 C & 10 (10 D) of Income Tax Act, 1961 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

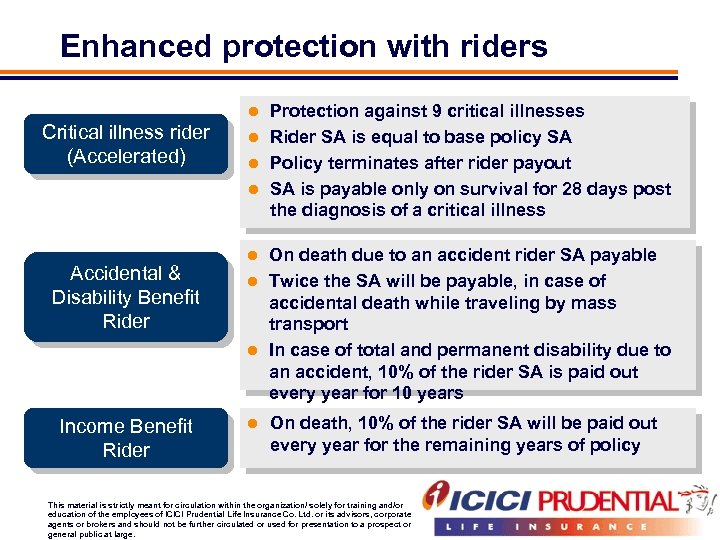

Enhanced protection with riders Protection against 9 critical illnesses l Rider SA is equal to base policy SA l Policy terminates after rider payout l SA is payable only on survival for 28 days post the diagnosis of a critical illness l Critical illness rider (Accelerated) Accidental & Disability Benefit Rider Income Benefit Rider On death due to an accident rider SA payable l Twice the SA will be payable, in case of accidental death while traveling by mass transport l In case of total and permanent disability due to an accident, 10% of the rider SA is paid out every year for 10 years l l On death, 10% of the rider SA will be paid out every year for the remaining years of policy This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

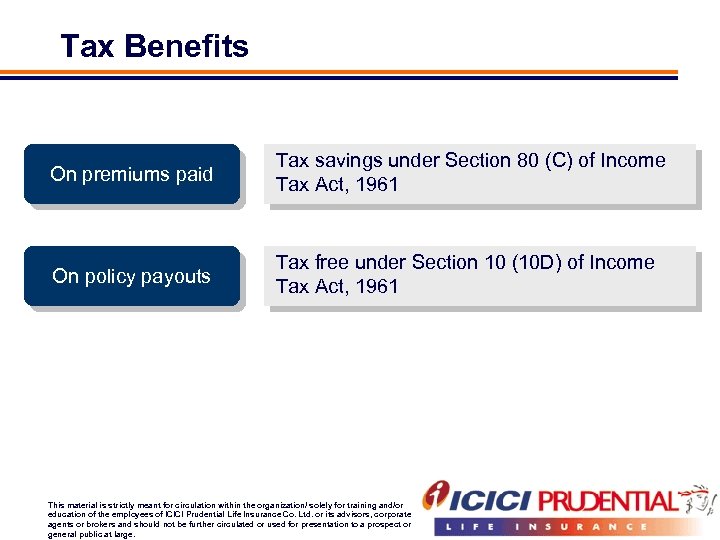

Key Benefits Maturity Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Death Benefit Sum Assured plus vested reversionary bonuses and terminal bonus, if any Riders Tax benefits Accident and Disability Benefit Rider, Critical Illness Rider and Income Benefit Rider Get tax benefits under Section 80 C & 10 (10 D) of Income Tax Act, 1961 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Tax Benefits On premiums paid Tax savings under Section 80 (C) of Income Tax Act, 1961 On policy payouts Tax free under Section 10 (10 D) of Income Tax Act, 1961 This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

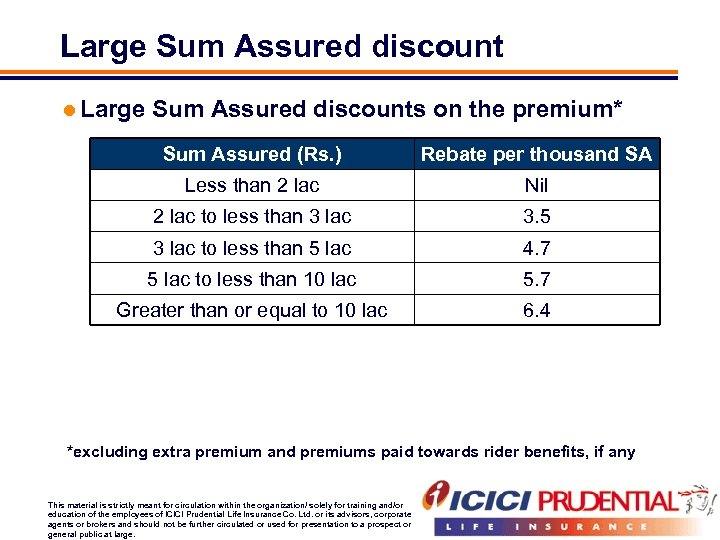

Large Sum Assured discount l Large Sum Assured discounts on the premium* Sum Assured (Rs. ) Rebate per thousand SA Less than 2 lac Nil 2 lac to less than 3 lac 3. 5 3 lac to less than 5 lac 4. 7 5 lac to less than 10 lac 5. 7 Greater than or equal to 10 lac 6. 4 *excluding extra premium and premiums paid towards rider benefits, if any This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

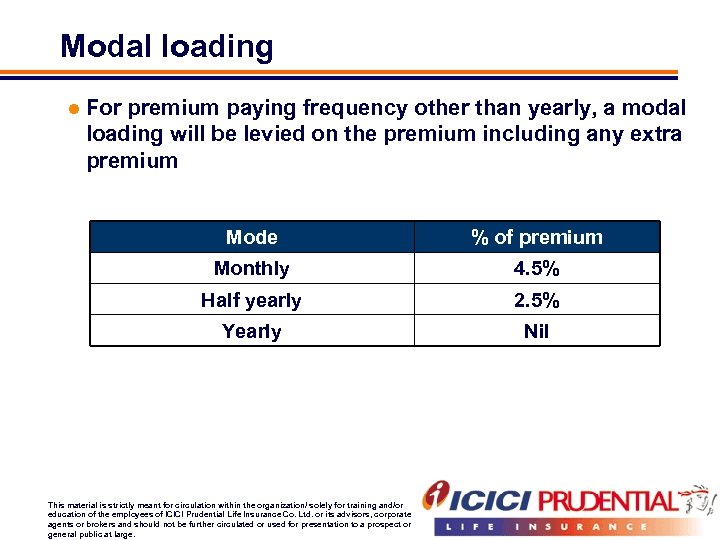

Modal loading l For premium paying frequency other than yearly, a modal loading will be levied on the premium including any extra premium Mode % of premium Monthly 4. 5% Half yearly 2. 5% Yearly Nil This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

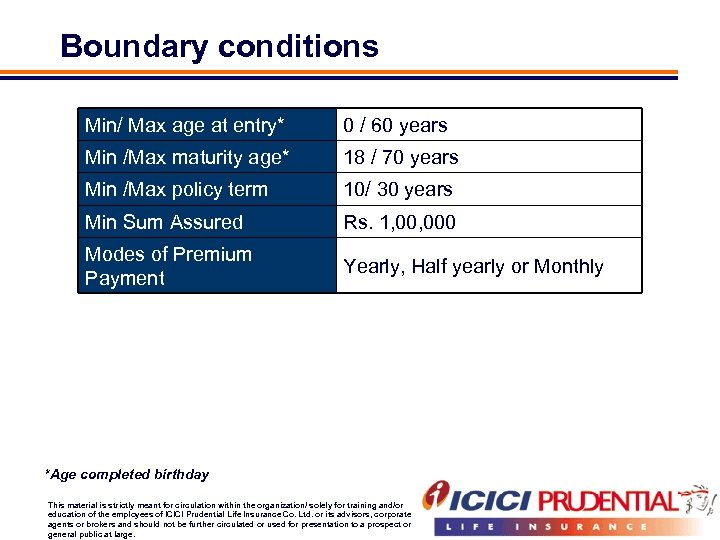

Boundary conditions Min/ Max age at entry* 0 / 60 years Min /Max maturity age* 18 / 70 years Min /Max policy term 10/ 30 years Min Sum Assured Rs. 1, 000 Modes of Premium Payment Yearly, Half yearly or Monthly *Age completed birthday This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Loan against the policy Loan can be availed after the completion of three policy years provided premiums have been paid for the first three policy years and the policy has attained a Surrender Value l Loan of up to 80% of the Surrender Value can be availed l This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Surrender Value l The policy will acquire a Guaranteed Surrender Value (GSV) on payment of premium for at least 3 policy years. l It will be equal to 35% of the base policy premiums paid less the first year's premium. A discounted value of the bonuses allocated will also be added. l The Non Guaranteed Surrender Value (NGSV) Surrender Value payable will depend on Sum Assured, vested reversionary bonus, policy term and the number of premiums paid. l Higher of GSV or NGSV would be payable l Any extra premiums paid and premiums paid towards riders shall be excluded. This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Paid up policy l Once the policy has acquired a Surrender Value and no future premiums are paid, the policy may continue as a 'Paidup' policy for a reduced Sum Assured (Paid-up Sum Assured), as indicated below: Paid-up SA = SA X (Total number of premiums paid / Total number of premiums payable) l Bonuses already vested to the policy will be added to this amount. l The policy will however not be eligible for any future bonuses. l The rider benefits will cease to be payable in case of a paidup policy. This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Lapsation and policy revival l Failure to pay premiums for the first 3 years would result in the policy becoming lapsed. No benefits would be payable under a lapsed policy. l A lapsed policy may be revived subject to the following: l Allowed within 2 years from the due date of the first unpaid premium and before the end of the PPT l Revival will be based on the revival norms then applicable l The Policyholder furnishes, at his own expense, satisfactory evidence of health of the Life Assured, as required by the Company l The arrears of premiums together with interest, at such rate as the Company may declare from time to time, for late payment of premiums are paid This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Thank you This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

Thank you This material is strictly meant for circulation within the organization/ solely for training and/or education of the employees of ICICI Prudential Life Insurance Co. Ltd. or its advisors, corporate agents or brokers and should not be further circulated or used for presentation to a prospect or general public at large.

85d8077d3fe8b25b5a53febe8e7cc46e.ppt