562a47f4c26d194708df374126cbaf7f.ppt

- Количество слайдов: 24

February 2005 OTC: WHIT

Forward-Looking Statement This presentation includes forward-looking statements made in reliance on the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on Whittier's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements. Risks, uncertainties and assumptions include (i) risks inherent in the exploration for and development and production of oil and gas and in estimating reserves, (ii) the presence or recoverability of estimated reserves, (iii) the ability to replace reserves, (iv) unexpected future capital expenditures, (v) general economic conditions, (vi) oil and gas price volatility, (vii) the success of our risk management activities, (viii) competition, (ix) regulatory changes, (x) the ability of management to execute its plans to meet its goals and (xi) other factors discussed in Whittier's filings with the United States Securities and Exchange Commission. Whittier assumes no obligation to publicly update or revise any forward-looking statements contained in this presentation, whether as a result of new information, future events, or otherwise. 2

Cautionary Note to U. S. Investors The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation, such as "Potential Reserve Range, " that the SEC's guidelines strictly prohibit us from including in filings with the SEC. U. S. Investors are urged to consider closely the disclosure in our Form 10 KSB, File No. 000 -30598, as amended, available from us at Whittier Energy Corporation - Investor Relations and Company Information, 333 Clay Street, Suite 1100, Houston, Texas, 77002. You also may obtain this information at the SEC's public reference room, located at 450 Fifth Street NW, Washington, D. C. 20549. Please call the SEC at 1 -800 -SEC-0330 for further information on the public reference room. This filing is also available at the internet website maintained by SEC at http: //www. sec. gov. 3

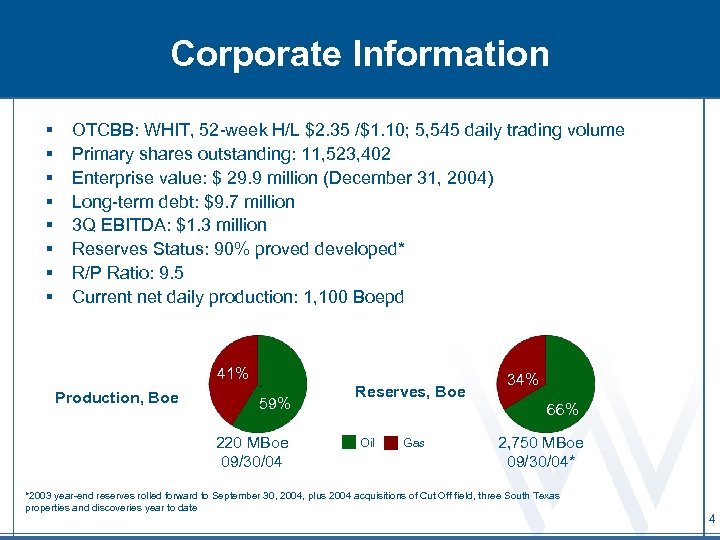

Corporate Information § § § § OTCBB: WHIT, 52 -week H/L $2. 35 /$1. 10; 5, 545 daily trading volume Primary shares outstanding: 11, 523, 402 Enterprise value: $ 29. 9 million (December 31, 2004) Long-term debt: $9. 7 million 3 Q EBITDA: $1. 3 million Reserves Status: 90% proved developed* R/P Ratio: 9. 5 Current net daily production: 1, 100 Boepd 41% Production, Boe 59% 220 MBoe 09/30/04 Reserves, Boe 34% 66% Oil Gas 2, 750 MBoe 09/30/04* *2003 year-end reserves rolled forward to September 30, 2004, plus 2004 acquisitions of Cut Off field, three South Texas properties and discoveries year to date 4

Company History and Overview § Whittier family has been active in the California oil industry since late 1800 s § Participated in discovery and development of several major California fields § Notable transactions: § 1979 sale of Belridge Oil Co. to Shell ($3. 67 billion) § 1998 sale to Seneca Energy ($152 million) § Whittier Energy Company incorporated in 1991 § Contributed South Texas royalty and non-operated working interests § Mandate to grow asset base by reinvesting cash flow § Whittier Energy initiated aggressive growth phase in 2002 § § § Began acquiring operated properties Used leverage with a revolving line of credit Went public via reverse merger in September 2003 Raised $2. 4 million in new equity in June, 2004 Whittier group reduced ownership to approximately 79% of outstanding stock 5

Management Team Experienced management team with a significant stake in the company Daniel H. Silverman V. P. & Chief Operating Officer § § Over 25 years of energy industry experience Former V. P. and investment manager - Whittier Energy Director of PYR Energy Corp. since 1999 Education: MBA – Stanford Univ. ; BA Geology, BA Biology – UC Santa Cruz § Bryce W. Rhodes President & Chief Executive Officer Former Managing Director of Acquisition and Divestitures and Director for Torch Energy Advisors Former manager of acquisitions and divestitures for Apache Corp. Over 17 years of energy industry experience Education: MS Mineral Econ - Colorado School of Mines; BS Pet Eng - UT Austin § § § Michael B. Young, CPA V. P. & Chief Financial Officer § § Over 12 years of financial accounting experience Former V. P. and CFO of Chaparral Resources, Inc. Significant public company experience Education: MPA – UT Austin; BBA - UT Austin 6

Business Plan § Acquire Gulf Coast producing properties and explore in Gulf Coast, Mid-Continent, Rockies and California § Regions offer low-risk property acquisitions and impactive exploration and exploitation opportunities § Maintain a disciplined portfolio investment approach § Continuously review acquisition and exploration opportunities § Allocate 70% to acquisitions and 30% to exploitation/exploration projects § Divest under-performing and non-core assets § Target impactive acquisitions § Detailed technical analysis to define opportunities § Focus on niche of transactions less than $10 MM § Exploitation with exploration upside § Reduce operating costs § Create sustainable per share growth in value § Goal: Attain at least $100 MM Enterprise Value (EV) in 3 -5 years § Monetize value at appropriate time 7

Achievements from 1/1/02 through 9/30/04 § Accelerated Growth § Went public with reverse merger (September 2003) § Acquired 8 operated producing properties in Texas and Louisiana, including: § Cut Off Field in Louisiana - $2 million (April 2004 & August 2004) § Three South Texas gas fields - $7. 5 million (June 2004) § Proforma 9/30/04 proved reserves: up over 900% to 2. 750 MMBoe § 3 rd Quarter 2004 total assets: up over 350% to $25. 6 MM § Proforma average finding and development costs: approx. $6. 20/Boe § Current Production (November 15, 2004) § Gross operated: Grew from no operations to 1, 367 Boepd § Total company net: Grew 600% from 180 Boepd to 1, 100 Boepd § Reached Enterprise Value of $29. 9 million (December 31, 2004) 8

Rincon Energy Partners, LLC § 10% interest in Rincon Energy Partners, LLC § Rincon Energy LLC – Managing Member § Consulting G&G and Prospect Generation Group § 3 D data set – 4600 Sq. Miles § In-house seismic re-processing and AVO analysis § Prospect sales – Fees, Orri’s, Carried & Working Interests § Completing 1 st partnership well in Ventura Basin, California § Seven additional prospects to be drilled in 2005 § Numerous prospects in various stages of development § Consultant to Whittier 9

Our Properties Lost Dome Greater Mayfield Rayne Operated Non-Operated Big Wells Beaver Dam Creek Hamel Bonnie View Cut Off Tom Lyne Scott & Hopper N. Rincon 10

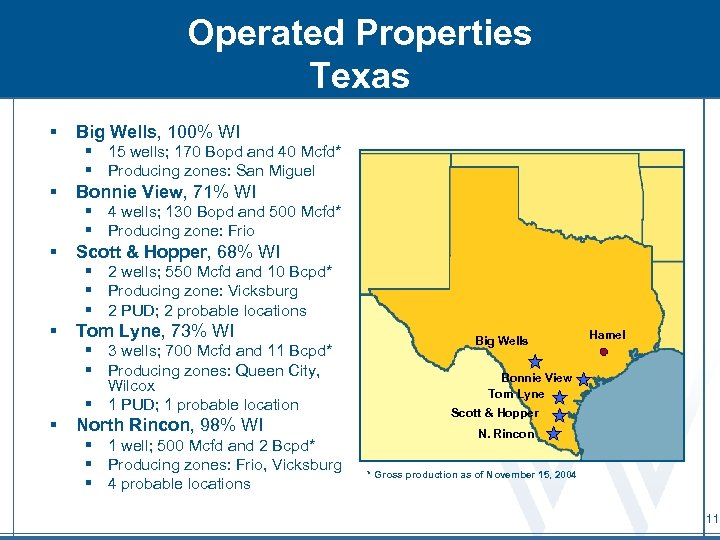

Operated Properties Texas § Big Wells, 100% WI § 15 wells; 170 Bopd and 40 Mcfd* § Producing zones: San Miguel § Bonnie View, 71% WI § 4 wells; 130 Bopd and 500 Mcfd* § Producing zone: Frio § Scott & Hopper, 68% WI § 2 wells; 550 Mcfd and 10 Bcpd* § Producing zone: Vicksburg § 2 PUD; 2 probable locations § Tom Lyne, 73% WI § 3 wells; 700 Mcfd and 11 Bcpd* § Producing zones: Queen City, Wilcox § 1 PUD; 1 probable location § North Rincon, 98% WI § 1 well; 500 Mcfd and 2 Bcpd* § Producing zones: Frio, Vicksburg § 4 probable locations Big Wells Hamel Bonnie View Tom Lyne Scott & Hopper N. Rincon * Gross production as of November 15, 2004 11

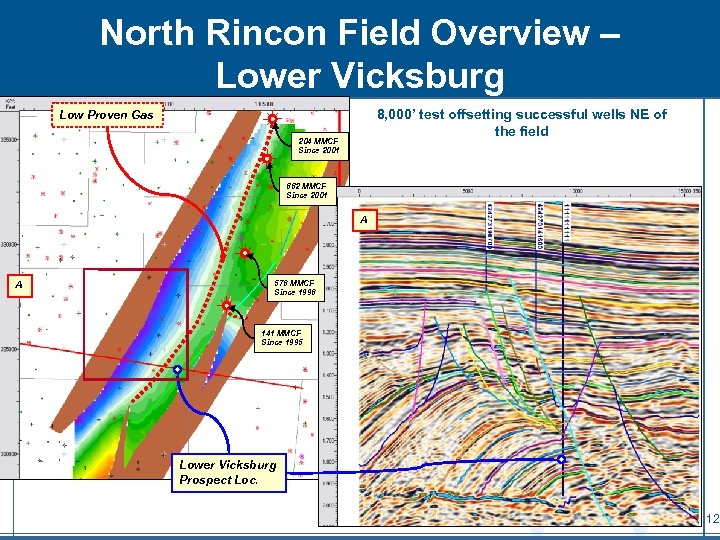

North Rincon Field Overview – Lower Vicksburg 8, 000’ test offsetting successful wells NE of the field Low Proven Gas 204 MMCF Since 2001 882 MMCF Since 2001 A A 576 MMCF Since 1996 141 MMCF Since 1995 Lower Vicksburg Prospect Loc. 12

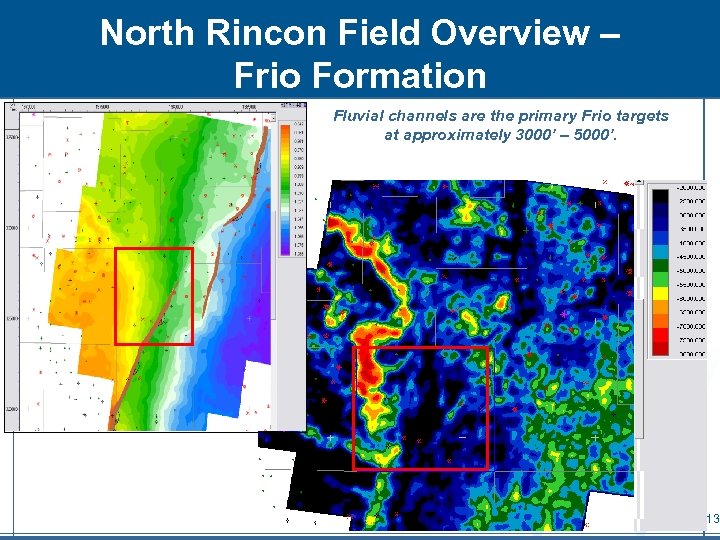

North Rincon Field Overview – Frio Formation Fluvial channels are the primary Frio targets at approximately 3000’ – 5000’. 13

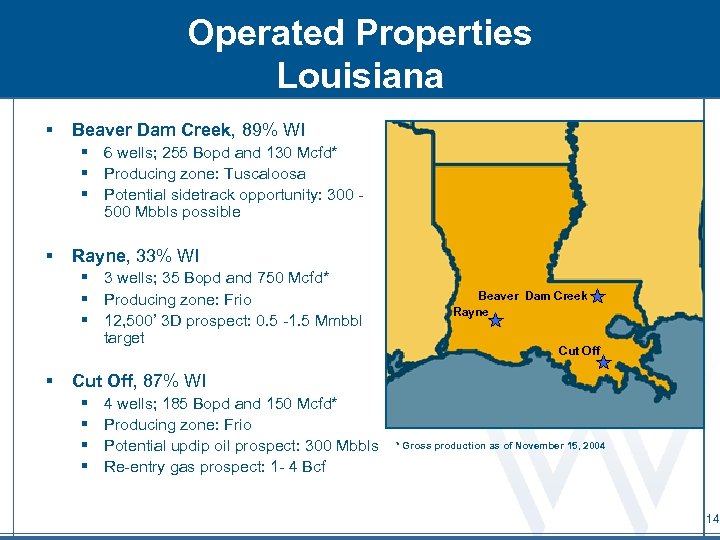

Operated Properties Louisiana § Beaver Dam Creek, 89% WI § 6 wells; 255 Bopd and 130 Mcfd* § Producing zone: Tuscaloosa § Potential sidetrack opportunity: 300 500 Mbbls possible § Rayne, 33% WI § 3 wells; 35 Bopd and 750 Mcfd* § Producing zone: Frio § 12, 500’ 3 D prospect: 0. 5 -1. 5 Mmbbl target § Beaver Dam Creek Rayne Cut Off, 87% WI § § 4 wells; 185 Bopd and 150 Mcfd* Producing zone: Frio Potential updip oil prospect: 300 Mbbls Re-entry gas prospect: 1 - 4 Bcf * Gross production as of November 15, 2004 14

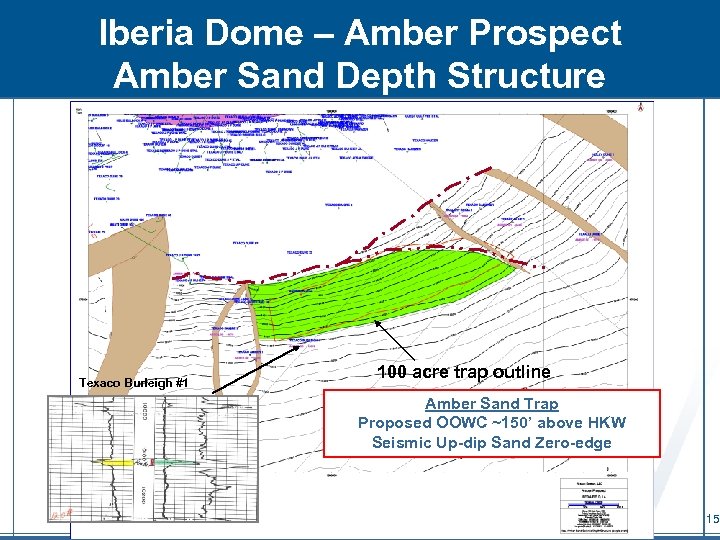

Iberia Dome – Amber Prospect Amber Sand Depth Structure Texaco Burleigh #1 100 acre trap outline Amber Sand Trap Proposed OOWC ~150’ above HKW Seismic Up-dip Sand Zero-edge 15

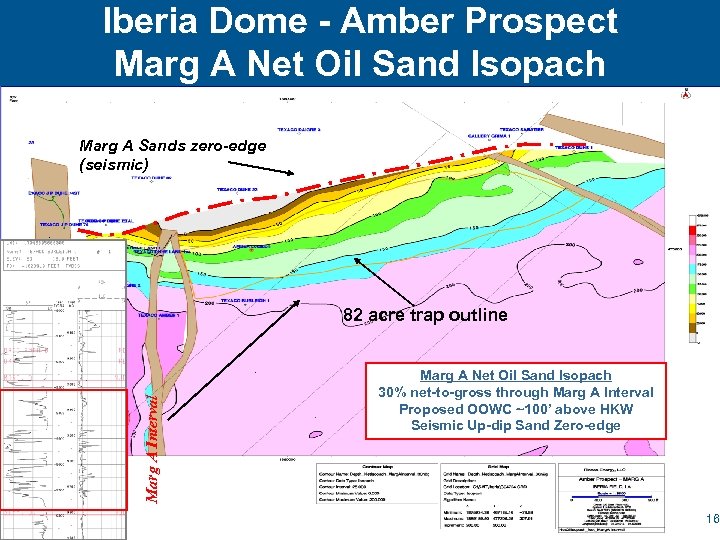

Iberia Dome - Amber Prospect Marg A Net Oil Sand Isopach Marg A Sands zero-edge (seismic) Marg A Interval 82 acre trap outline Marg A Net Oil Sand Isopach 30% net-to-gross through Marg A Interval Proposed OOWC ~100’ above HKW Seismic Up-dip Sand Zero-edge 16

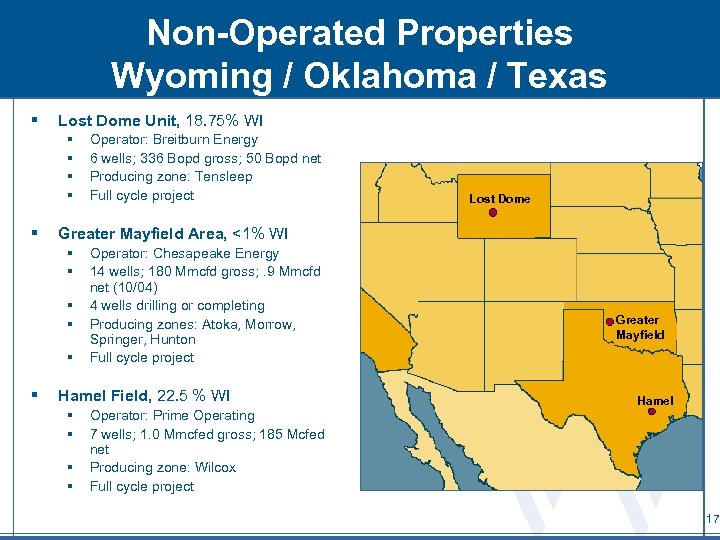

Non-Operated Properties Wyoming / Oklahoma / Texas § Lost Dome Unit, 18. 75% WI § § § Lost Dome Greater Mayfield Area, <1% WI § § § Operator: Breitburn Energy 6 wells; 336 Bopd gross; 50 Bopd net Producing zone: Tensleep Full cycle project Operator: Chesapeake Energy 14 wells; 180 Mmcfd gross; . 9 Mmcfd net (10/04) 4 wells drilling or completing Producing zones: Atoka, Morrow, Springer, Hunton Full cycle project Hamel Field, 22. 5 % WI § § Operator: Prime Operating 7 wells; 1. 0 Mmcfed gross; 185 Mcfed net Producing zone: Wilcox Full cycle project Greater Mayfield Hamel 17

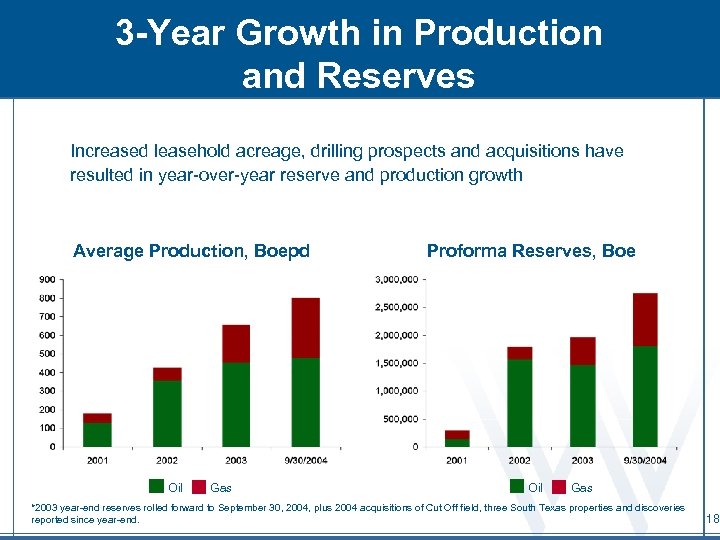

3 -Year Growth in Production and Reserves Increased leasehold acreage, drilling prospects and acquisitions have resulted in year-over-year reserve and production growth Average Production, Boepd Oil Gas Proforma Reserves, Boe Oil Gas *2003 year-end reserves rolled forward to September 30, 2004, plus 2004 acquisitions of Cut Off field, three South Texas properties and discoveries reported since year-end. 18

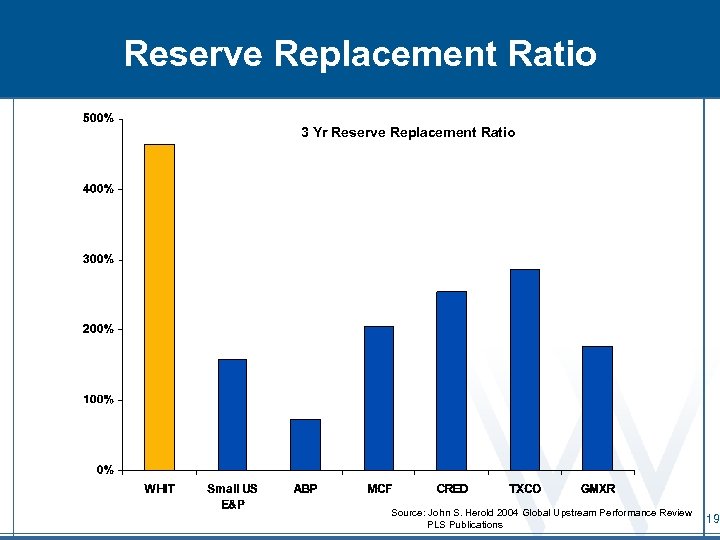

Reserve Replacement Ratio 3 Yr Reserve Replacement Ratio Source: John S. Herold 2004 Global Upstream Performance Review PLS Publications 19

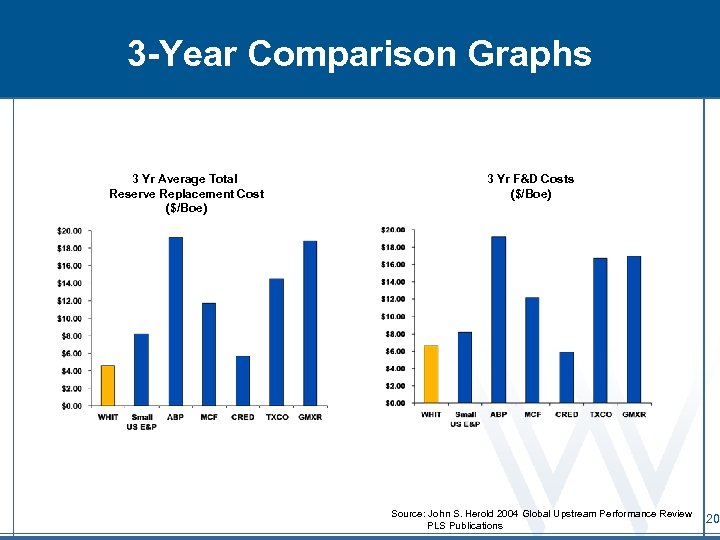

3 -Year Comparison Graphs 3 Yr Average Total Reserve Replacement Cost ($/Boe) 3 Yr F&D Costs ($/Boe) Source: John S. Herold 2004 Global Upstream Performance Review PLS Publications 20

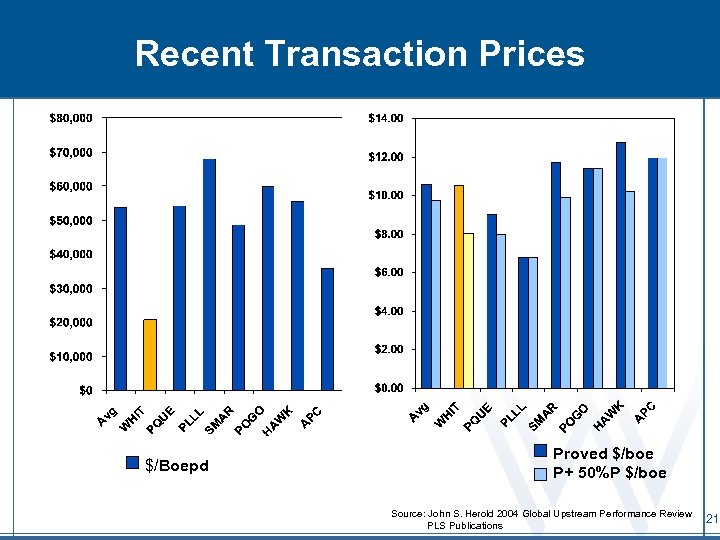

Recent Transaction Prices $/Boepd Proved $/boe P+ 50%P $/boe Source: John S. Herold 2004 Global Upstream Performance Review PLS Publications 21

Summary of Whittier Energy Strengths § Diversified, long life, and stable reserve base § Dedicated, experienced management team § Track record of annual growth (1/1/02 to 9/30/04) § Proved reserves: up over 900% § Average daily production: up over 600% § Portfolio of low cost, low risk exploitation projects in our core area § Both operated and non-operated § Two-pronged growth strategy – acquisitions and drilling § Whittier is an early stage growth company § Small transactions & exploration successes can materially impact the bottom line § Strong balance sheet that provides flexibility for growth Additional information available at company website www. whittierenergy. com 22

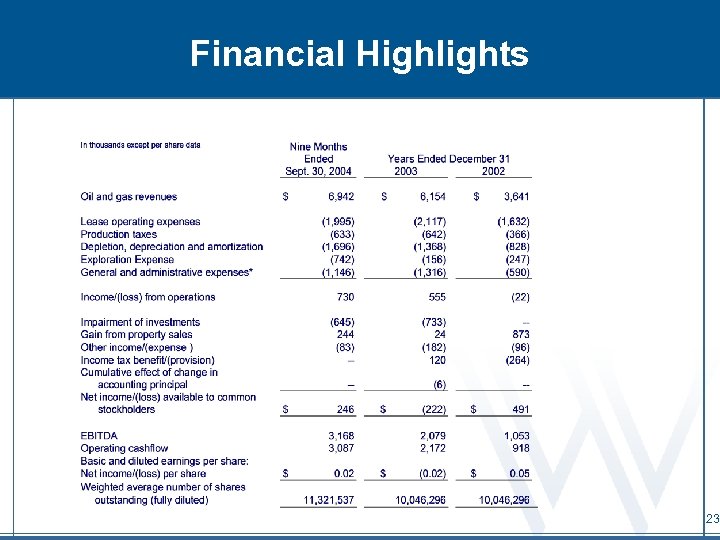

Financial Highlights 23

February 2005 OTC: WHIT

562a47f4c26d194708df374126cbaf7f.ppt