Prezentatsia1 (1).pptx

- Количество слайдов: 16

Features of financial planning in a market economy. The system of financial plans and forecasts

Features of financial planning in a market economy. The system of financial plans and forecasts

• Financial planning in a market economy Finances hold a special place in economic relations. Their specificity is manifested in the fact that they always act in cash, have a distribution and reflect the development and use of different types of income and savings business entities of material production, state and participants unproductive. In modern conditions, forms of financial relations are undergoing major changes. The purpose of financial planning - to ensure the reproduction process rationale adequate financial resources, and evaluate their performance against the final financial results.

• Financial planning in a market economy Finances hold a special place in economic relations. Their specificity is manifested in the fact that they always act in cash, have a distribution and reflect the development and use of different types of income and savings business entities of material production, state and participants unproductive. In modern conditions, forms of financial relations are undergoing major changes. The purpose of financial planning - to ensure the reproduction process rationale adequate financial resources, and evaluate their performance against the final financial results.

Objectives of financial planning: -Defining the scope and structure of the capital for the operation of the organization in the planning period -Prediction of cash receipts and payments, Justification-efficient cash flow -Determination of the effectiveness of the financial and economic activities, -Implementation of control over the execution of financial tasks. There are three sections in a financial plan: · The Starting Balance Sheet · The Pro-Forma (or Forecast) Income Statement · The Cash Flow Forecast (each of these sections should have notes of explanation for the reader).

Objectives of financial planning: -Defining the scope and structure of the capital for the operation of the organization in the planning period -Prediction of cash receipts and payments, Justification-efficient cash flow -Determination of the effectiveness of the financial and economic activities, -Implementation of control over the execution of financial tasks. There are three sections in a financial plan: · The Starting Balance Sheet · The Pro-Forma (or Forecast) Income Statement · The Cash Flow Forecast (each of these sections should have notes of explanation for the reader).

Principles of Financial Planning -The principle of conformity, -The principle of the constancy of the net working capital -The principle of surplus cash, -The principle of return on investment, -The principle of balance of risk -The principle of adaptation to the needs of the market.

Principles of Financial Planning -The principle of conformity, -The principle of the constancy of the net working capital -The principle of surplus cash, -The principle of return on investment, -The principle of balance of risk -The principle of adaptation to the needs of the market.

Deficiencies in planning -The planning process at the company in the current environment is very difficult and not predictable; -Lack of management accounting; -The planning process starts from the tradition of production, not sales. -When planning sales dominated expensive pricing mechanism. -The planning process is tightened over time -Financial, accounting and planning services operate separately, which does not allow a single mechanism for the management of financial resources and the company's cash flow

Deficiencies in planning -The planning process at the company in the current environment is very difficult and not predictable; -Lack of management accounting; -The planning process starts from the tradition of production, not sales. -When planning sales dominated expensive pricing mechanism. -The planning process is tightened over time -Financial, accounting and planning services operate separately, which does not allow a single mechanism for the management of financial resources and the company's cash flow

Two types of financial plans: • - Long-term (as part of a strategic plan or business plan) and - Short-term (as an element of the current planning). • - The main purpose of the first - the definition of allowable rate of expansion of the company; - The aim of the second is to ensure the ongoing solvency of the firm.

Two types of financial plans: • - Long-term (as part of a strategic plan or business plan) and - Short-term (as an element of the current planning). • - The main purpose of the first - the definition of allowable rate of expansion of the company; - The aim of the second is to ensure the ongoing solvency of the firm.

Financial Plan Outline Starting Costs - Estimate Current Assets - Estimate Capital Assets - Estimate Start-up Expenses Starting Balance Sheet - Total Assets (from above) - Planned Investment (Equity) - Planned Loans (Liabilities) - Balance Sheet Formula - Assets = Liabilities + Equity

Financial Plan Outline Starting Costs - Estimate Current Assets - Estimate Capital Assets - Estimate Start-up Expenses Starting Balance Sheet - Total Assets (from above) - Planned Investment (Equity) - Planned Loans (Liabilities) - Balance Sheet Formula - Assets = Liabilities + Equity

Income Statement - Start-up Expenses (from above) - Forecast Revenue - Forecast Cost of Goods - Forecast Overhead Expenses - Revenue – Expenses = Net Profit Cash Flow - Estimate Monthly Sales - Adjust Monthly Sales for AR - Account for loans & investments - Calculate Total Receipts - Estimate Monthly Purchase - Adjust for AP - Estimate Monthly Overheads - Estimate Loan Repayment - Forward Start-up Costs - Calculate Disbursements - Starting Balance + Receipts – Disbursement = Ending Balance

Income Statement - Start-up Expenses (from above) - Forecast Revenue - Forecast Cost of Goods - Forecast Overhead Expenses - Revenue – Expenses = Net Profit Cash Flow - Estimate Monthly Sales - Adjust Monthly Sales for AR - Account for loans & investments - Calculate Total Receipts - Estimate Monthly Purchase - Adjust for AP - Estimate Monthly Overheads - Estimate Loan Repayment - Forward Start-up Costs - Calculate Disbursements - Starting Balance + Receipts – Disbursement = Ending Balance

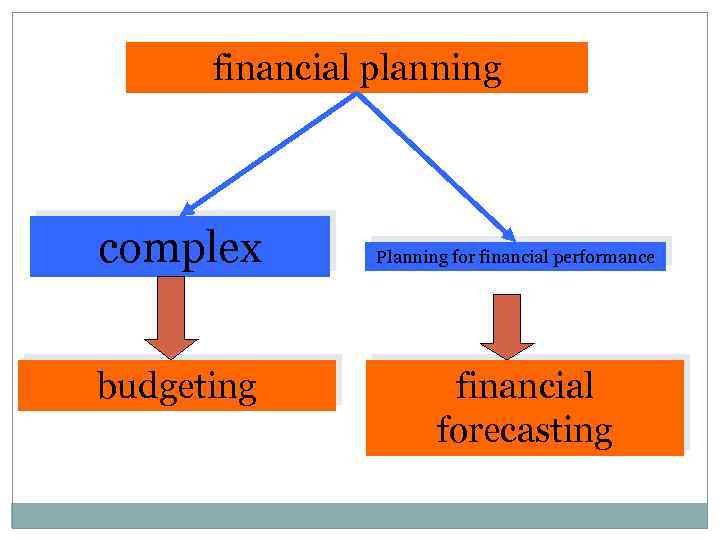

financial planning complex budgeting Planning for financial performance financial forecasting

financial planning complex budgeting Planning for financial performance financial forecasting

A financial forecast is an estimate of future financial outcomes for a company or country (for futures and currency markets). Arguably, the most difficult aspect of preparing a financial forecast is predicting revenue. Future costs can be estimated by using historical accounting data; variable costs are also a function of sales. Unlike a financial plan or a budget a financial forecast doesn't have to be used as a planning document. Outside analysts can use a financial forecast to estimate a company's success in the coming year.

A financial forecast is an estimate of future financial outcomes for a company or country (for futures and currency markets). Arguably, the most difficult aspect of preparing a financial forecast is predicting revenue. Future costs can be estimated by using historical accounting data; variable costs are also a function of sales. Unlike a financial plan or a budget a financial forecast doesn't have to be used as a planning document. Outside analysts can use a financial forecast to estimate a company's success in the coming year.

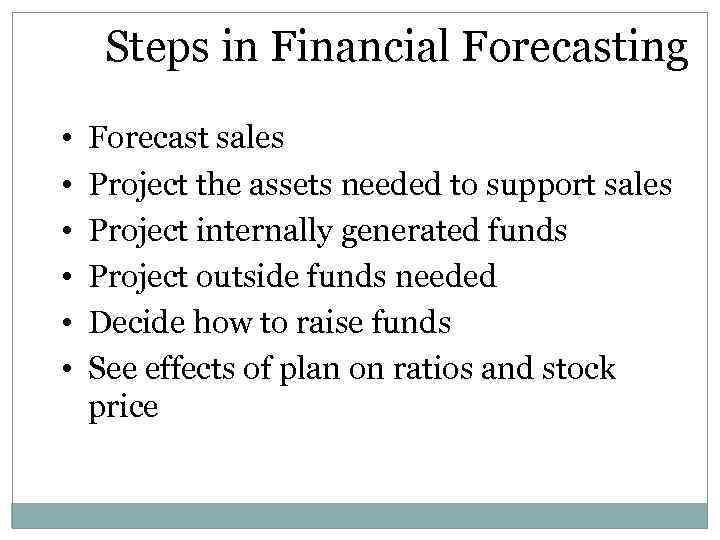

Steps in Financial Forecasting • • • Forecast sales Project the assets needed to support sales Project internally generated funds Project outside funds needed Decide how to raise funds See effects of plan on ratios and stock price

Steps in Financial Forecasting • • • Forecast sales Project the assets needed to support sales Project internally generated funds Project outside funds needed Decide how to raise funds See effects of plan on ratios and stock price

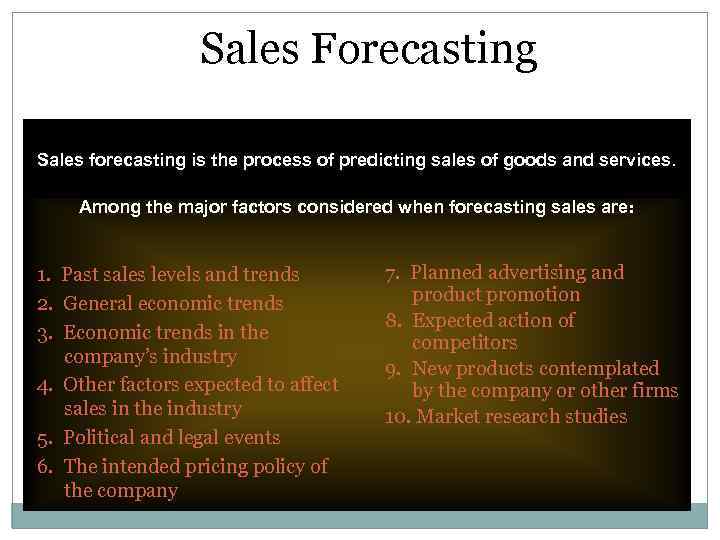

Sales Forecasting Sales forecasting is the process of predicting sales of goods and services. Among the major factors considered when forecasting sales are: 1. Past sales levels and trends 2. General economic trends 3. Economic trends in the company’s industry 4. Other factors expected to affect sales in the industry 5. Political and legal events 6. The intended pricing policy of the company 7. Planned advertising and product promotion 8. Expected action of competitors 9. New products contemplated by the company or other firms 10. Market research studies

Sales Forecasting Sales forecasting is the process of predicting sales of goods and services. Among the major factors considered when forecasting sales are: 1. Past sales levels and trends 2. General economic trends 3. Economic trends in the company’s industry 4. Other factors expected to affect sales in the industry 5. Political and legal events 6. The intended pricing policy of the company 7. Planned advertising and product promotion 8. Expected action of competitors 9. New products contemplated by the company or other firms 10. Market research studies

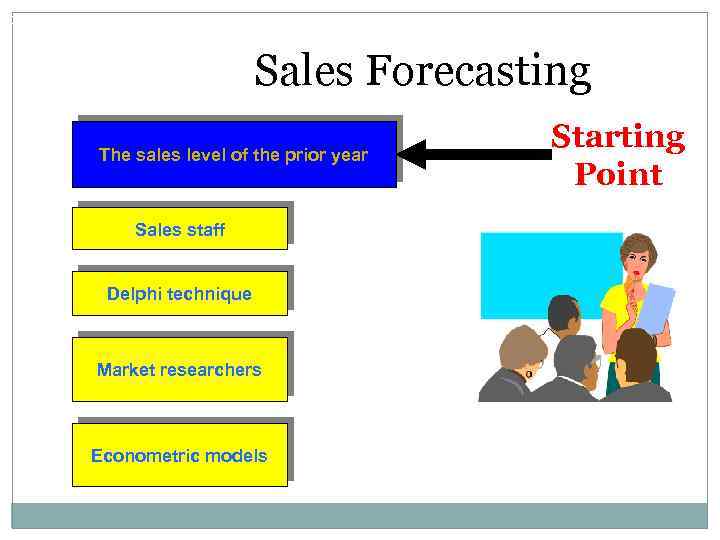

15 -13 Sales Forecasting The sales level of the prior year Sales staff Delphi technique Market researchers Econometric models Starting Point

15 -13 Sales Forecasting The sales level of the prior year Sales staff Delphi technique Market researchers Econometric models Starting Point

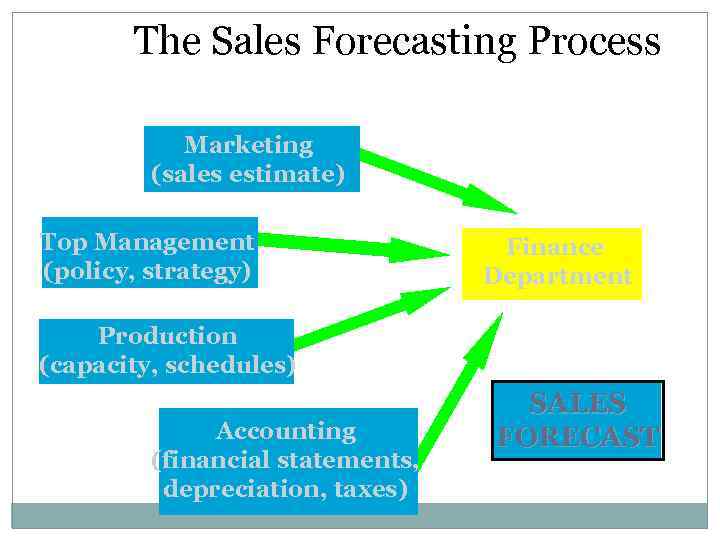

The Sales Forecasting Process Marketing (sales estimate) Top Management (policy, strategy) Finance Department Production (capacity, schedules) Accounting (financial statements, depreciation, taxes) SALES FORECAST

The Sales Forecasting Process Marketing (sales estimate) Top Management (policy, strategy) Finance Department Production (capacity, schedules) Accounting (financial statements, depreciation, taxes) SALES FORECAST

forecasting methods q. Cash-analytical q. Regulatory q. The balance q. Optimize planning decisions q. Economic and mathematical modeling.

forecasting methods q. Cash-analytical q. Regulatory q. The balance q. Optimize planning decisions q. Economic and mathematical modeling.