f76df28d2ee0dcef98046a783622d42a.ppt

- Количество слайдов: 40

FDIC San Francisco Region Regulatory Teleconference Flood Insurance Best Practices – Protecting You and Your Customer June 18, 2008 1

FDIC San Francisco Region Regulatory Teleconference Flood Insurance Best Practices – Protecting You and Your Customer June 18, 2008 1

Introductions Opening Remarks Robert J. Wirtz Assistant Regional Director – Compliance Presenters Hollee Oberholzer Senior Compliance Examiner Heather Gilliams Compliance Review Examiner 2

Introductions Opening Remarks Robert J. Wirtz Assistant Regional Director – Compliance Presenters Hollee Oberholzer Senior Compliance Examiner Heather Gilliams Compliance Review Examiner 2

Overview l Regulatory Requirements l Coverage Calculations l Flood Compliance – Problem Areas l FEMA Guide Changes l Proposed Revisions to Interagency Q&As l Best Practices l Resources l Question and Answer Session 3

Overview l Regulatory Requirements l Coverage Calculations l Flood Compliance – Problem Areas l FEMA Guide Changes l Proposed Revisions to Interagency Q&As l Best Practices l Resources l Question and Answer Session 3

Regulatory Requirements l Determinations l Notifications l Coverage l Escrow l Force Placement 4

Regulatory Requirements l Determinations l Notifications l Coverage l Escrow l Force Placement 4

Determination Requirements l Completion of Standard Flood Hazard Determination Form (SFHDF) l Use of prior determination l Retain copy of SFHDF over life of loan 5

Determination Requirements l Completion of Standard Flood Hazard Determination Form (SFHDF) l Use of prior determination l Retain copy of SFHDF over life of loan 5

Notification Requirements l Notice to borrower and servicer l Required for structures located in participating and non-participating communities l Delivery of notice within reasonable time prior to closing l New notice required for each origination, extension, increase, and renewal 6

Notification Requirements l Notice to borrower and servicer l Required for structures located in participating and non-participating communities l Delivery of notice within reasonable time prior to closing l New notice required for each origination, extension, increase, and renewal 6

Coverage Requirements Mandatory Purchase Provision If improved property located in Special Flood Hazard Area (SFHA), lender CANNOT: l l Make Extend Renew Increase Without sufficient flood insurance coverage over the life of the loan 7

Coverage Requirements Mandatory Purchase Provision If improved property located in Special Flood Hazard Area (SFHA), lender CANNOT: l l Make Extend Renew Increase Without sufficient flood insurance coverage over the life of the loan 7

Coverage Requirements (cont. ) Minimum Coverage Equal To Lesser of: l Outstanding principal balance of loan(s); or l Maximum NFIP coverage available; or l Full insurable value (100% replacement cost value [RCV]) of building and/or contents 8

Coverage Requirements (cont. ) Minimum Coverage Equal To Lesser of: l Outstanding principal balance of loan(s); or l Maximum NFIP coverage available; or l Full insurable value (100% replacement cost value [RCV]) of building and/or contents 8

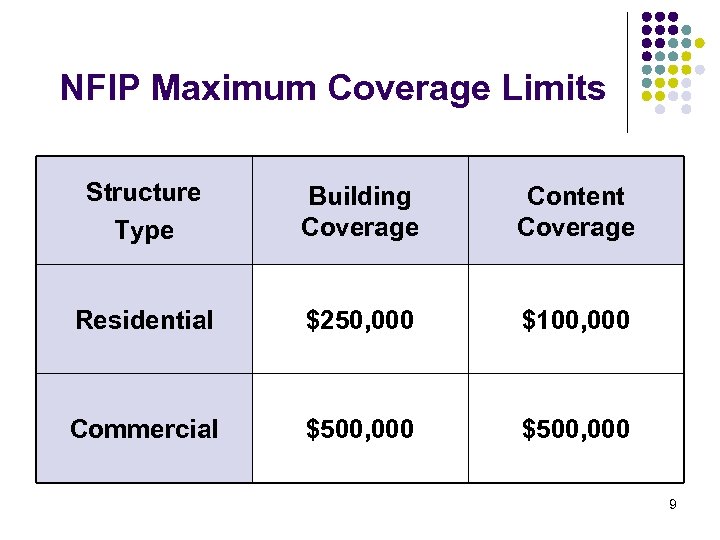

NFIP Maximum Coverage Limits Structure Type Building Coverage Content Coverage Residential $250, 000 $100, 000 Commercial $500, 000 9

NFIP Maximum Coverage Limits Structure Type Building Coverage Content Coverage Residential $250, 000 $100, 000 Commercial $500, 000 9

Escrow Requirements l Flood insurance premiums must be escrowed when lender requires escrow for other purposes, such as taxes or hazard insurance l Not required for voluntary escrow accounts l Types of property covered: l l l Single-family Multi-family Manufactured homes 10

Escrow Requirements l Flood insurance premiums must be escrowed when lender requires escrow for other purposes, such as taxes or hazard insurance l Not required for voluntary escrow accounts l Types of property covered: l l l Single-family Multi-family Manufactured homes 10

Force Placement Requirements If lender determines that property is not adequately insured: l Provide notice to borrower of requirement to obtain adequate coverage l Provide borrower opportunity to obtain necessary insurance (45 days) l If borrower fails to obtain coverage within 45 days, must purchase insurance on behalf of borrower l May charge borrower cost of premiums and fees incurred 11

Force Placement Requirements If lender determines that property is not adequately insured: l Provide notice to borrower of requirement to obtain adequate coverage l Provide borrower opportunity to obtain necessary insurance (45 days) l If borrower fails to obtain coverage within 45 days, must purchase insurance on behalf of borrower l May charge borrower cost of premiums and fees incurred 11

Calculating Coverage l Multiple Structures l l l Requirements Example Condominium Coverage l l l Requirements Example – RCBAP exists Example – no RCBAP exists 12

Calculating Coverage l Multiple Structures l l l Requirements Example Condominium Coverage l l l Requirements Example – RCBAP exists Example – no RCBAP exists 12

Multiple Structures l Only one policy can be issued per structure l Each insurable structure located in a SFHA must have insurance l Aggregated insurance coverage must be adequate to cover loan (unless maximum RCV or NFIP limit has been reached) l Distribution of coverage among buildings is at lender’s discretion 13

Multiple Structures l Only one policy can be issued per structure l Each insurable structure located in a SFHA must have insurance l Aggregated insurance coverage must be adequate to cover loan (unless maximum RCV or NFIP limit has been reached) l Distribution of coverage among buildings is at lender’s discretion 13

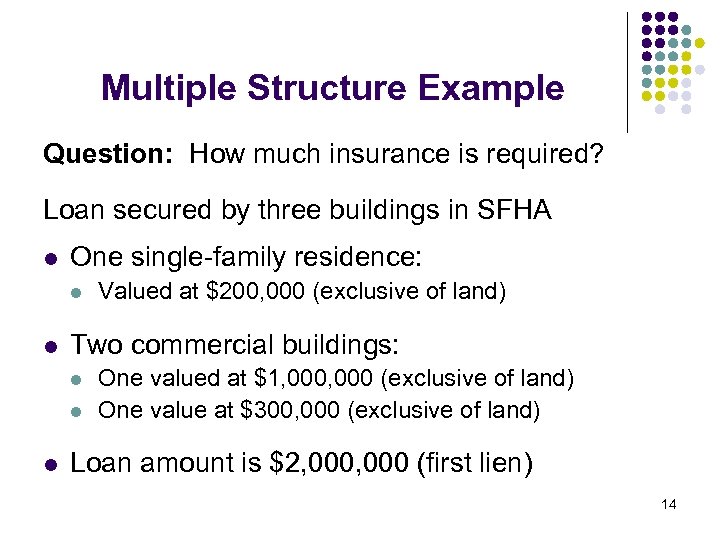

Multiple Structure Example Question: How much insurance is required? Loan secured by three buildings in SFHA l One single-family residence: l l Two commercial buildings: l l l Valued at $200, 000 (exclusive of land) One valued at $1, 000 (exclusive of land) One value at $300, 000 (exclusive of land) Loan amount is $2, 000 (first lien) 14

Multiple Structure Example Question: How much insurance is required? Loan secured by three buildings in SFHA l One single-family residence: l l Two commercial buildings: l l l Valued at $200, 000 (exclusive of land) One valued at $1, 000 (exclusive of land) One value at $300, 000 (exclusive of land) Loan amount is $2, 000 (first lien) 14

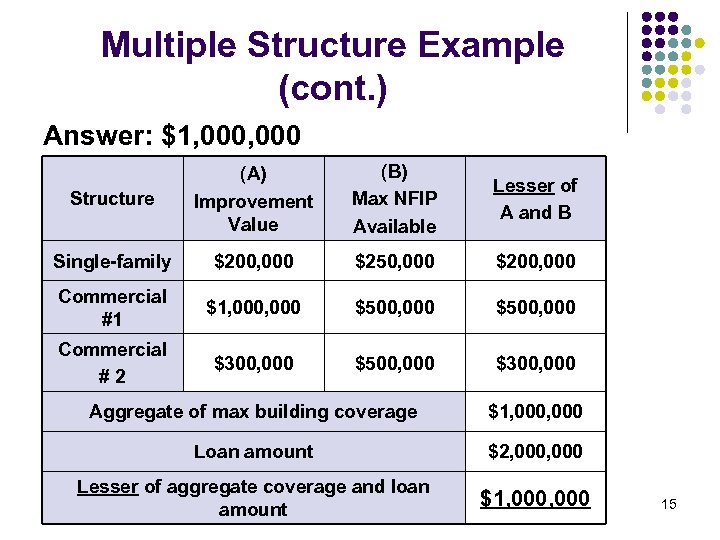

Multiple Structure Example (cont. ) Answer: $1, 000 Structure (A) Improvement Value (B) Max NFIP Available Lesser of A and B Single-family $200, 000 $250, 000 $200, 000 Commercial #1 $1, 000 $500, 000 Commercial #2 $300, 000 $500, 000 $300, 000 Aggregate of max building coverage $1, 000 Loan amount $2, 000 Lesser of aggregate coverage and loan amount $1, 000 15

Multiple Structure Example (cont. ) Answer: $1, 000 Structure (A) Improvement Value (B) Max NFIP Available Lesser of A and B Single-family $200, 000 $250, 000 $200, 000 Commercial #1 $1, 000 $500, 000 Commercial #2 $300, 000 $500, 000 $300, 000 Aggregate of max building coverage $1, 000 Loan amount $2, 000 Lesser of aggregate coverage and loan amount $1, 000 15

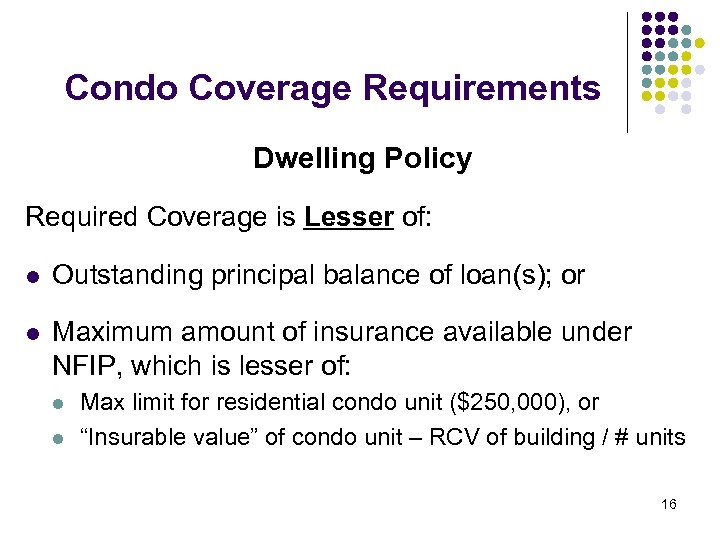

Condo Coverage Requirements Dwelling Policy Required Coverage is Lesser of: l Outstanding principal balance of loan(s); or l Maximum amount of insurance available under NFIP, which is lesser of: l l Max limit for residential condo unit ($250, 000), or “Insurable value” of condo unit – RCV of building / # units 16

Condo Coverage Requirements Dwelling Policy Required Coverage is Lesser of: l Outstanding principal balance of loan(s); or l Maximum amount of insurance available under NFIP, which is lesser of: l l Max limit for residential condo unit ($250, 000), or “Insurable value” of condo unit – RCV of building / # units 16

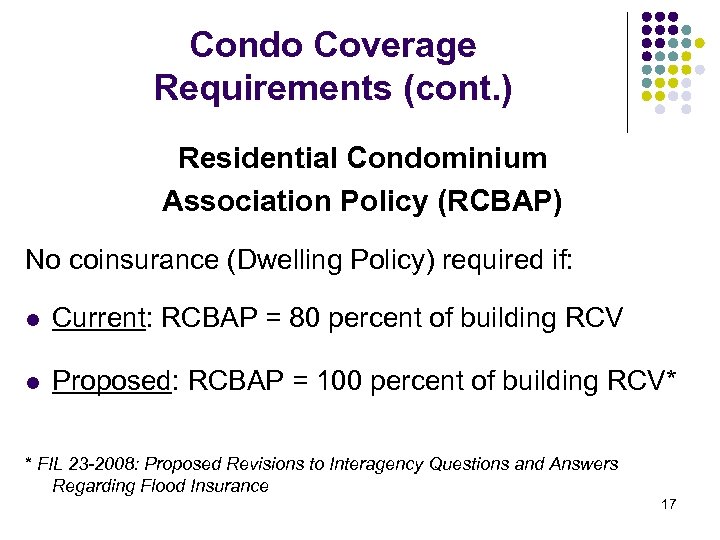

Condo Coverage Requirements (cont. ) Residential Condominium Association Policy (RCBAP) No coinsurance (Dwelling Policy) required if: l Current: RCBAP = 80 percent of building RCV l Proposed: RCBAP = 100 percent of building RCV* * FIL 23 -2008: Proposed Revisions to Interagency Questions and Answers Regarding Flood Insurance 17

Condo Coverage Requirements (cont. ) Residential Condominium Association Policy (RCBAP) No coinsurance (Dwelling Policy) required if: l Current: RCBAP = 80 percent of building RCV l Proposed: RCBAP = 100 percent of building RCV* * FIL 23 -2008: Proposed Revisions to Interagency Questions and Answers Regarding Flood Insurance 17

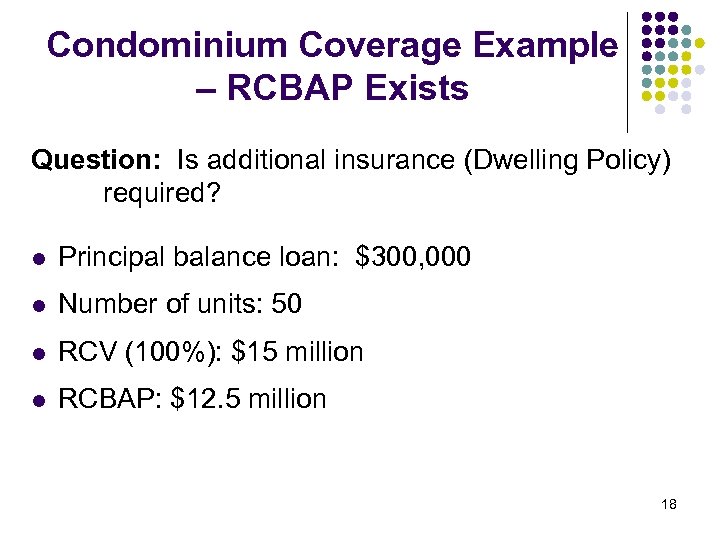

Condominium Coverage Example – RCBAP Exists Question: Is additional insurance (Dwelling Policy) required? l Principal balance loan: $300, 000 l Number of units: 50 l RCV (100%): $15 million l RCBAP: $12. 5 million 18

Condominium Coverage Example – RCBAP Exists Question: Is additional insurance (Dwelling Policy) required? l Principal balance loan: $300, 000 l Number of units: 50 l RCV (100%): $15 million l RCBAP: $12. 5 million 18

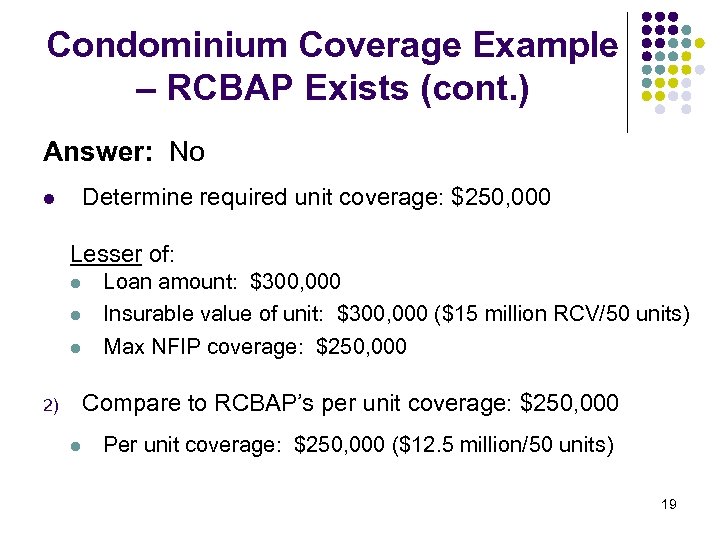

Condominium Coverage Example – RCBAP Exists (cont. ) Answer: No Determine required unit coverage: $250, 000 l Lesser of: l l l Loan amount: $300, 000 Insurable value of unit: $300, 000 ($15 million RCV/50 units) Max NFIP coverage: $250, 000 Compare to RCBAP’s per unit coverage: $250, 000 2) l Per unit coverage: $250, 000 ($12. 5 million/50 units) 19

Condominium Coverage Example – RCBAP Exists (cont. ) Answer: No Determine required unit coverage: $250, 000 l Lesser of: l l l Loan amount: $300, 000 Insurable value of unit: $300, 000 ($15 million RCV/50 units) Max NFIP coverage: $250, 000 Compare to RCBAP’s per unit coverage: $250, 000 2) l Per unit coverage: $250, 000 ($12. 5 million/50 units) 19

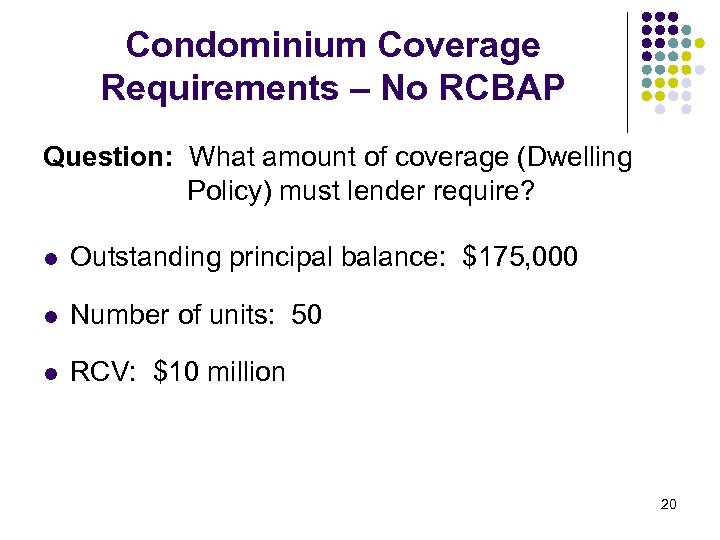

Condominium Coverage Requirements – No RCBAP Question: What amount of coverage (Dwelling Policy) must lender require? l Outstanding principal balance: $175, 000 l Number of units: 50 l RCV: $10 million 20

Condominium Coverage Requirements – No RCBAP Question: What amount of coverage (Dwelling Policy) must lender require? l Outstanding principal balance: $175, 000 l Number of units: 50 l RCV: $10 million 20

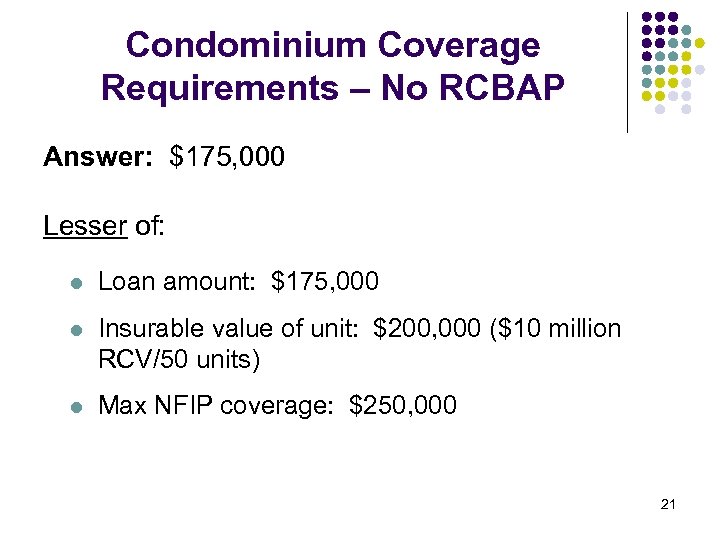

Condominium Coverage Requirements – No RCBAP Answer: $175, 000 Lesser of: l Loan amount: $175, 000 l Insurable value of unit: $200, 000 ($10 million RCV/50 units) l Max NFIP coverage: $250, 000 21

Condominium Coverage Requirements – No RCBAP Answer: $175, 000 Lesser of: l Loan amount: $175, 000 l Insurable value of unit: $200, 000 ($10 million RCV/50 units) l Max NFIP coverage: $250, 000 21

Flood Compliance – Problem Areas During 2007, 20% of exams in SF Region had one or more violations of Part 339 Problem Areas: l l l l Insufficient coverage Lack of coverage at origination Lapse in coverage Late borrower notification No borrower notification Force placement requirements Flood determinations 22

Flood Compliance – Problem Areas During 2007, 20% of exams in SF Region had one or more violations of Part 339 Problem Areas: l l l l Insufficient coverage Lack of coverage at origination Lapse in coverage Late borrower notification No borrower notification Force placement requirements Flood determinations 22

Flood Compliance – Problem Areas (cont. ) l Insufficient coverage § § § l Multiple Structures – no insurance on one or more buildings Junior Liens – did not consider first lien balance Cash-out refinances – did not increase coverage Insured for incorrect risk rating zone Excessive deductibles No insurance on building and/or contents at origination § § Premiums collected at closing Use of binder to demonstrate proof on insurance Abundance of caution loans No contents coverage – commercial loans 23

Flood Compliance – Problem Areas (cont. ) l Insufficient coverage § § § l Multiple Structures – no insurance on one or more buildings Junior Liens – did not consider first lien balance Cash-out refinances – did not increase coverage Insured for incorrect risk rating zone Excessive deductibles No insurance on building and/or contents at origination § § Premiums collected at closing Use of binder to demonstrate proof on insurance Abundance of caution loans No contents coverage – commercial loans 23

Flood Compliance – Problem Areas (cont. ) l Lapse in coverage § § l Late borrower notification § § l Lack of monitoring for coverage Misconception that life of loan flood determination coverage monitors flood insurance coverage Providing notice at closing Obtaining SFHDF after underwriting complete – delays delivery of notice No borrower notification § § Refinances, extensions, renewals, increases Properties in non-participating communities 24

Flood Compliance – Problem Areas (cont. ) l Lapse in coverage § § l Late borrower notification § § l Lack of monitoring for coverage Misconception that life of loan flood determination coverage monitors flood insurance coverage Providing notice at closing Obtaining SFHDF after underwriting complete – delays delivery of notice No borrower notification § § Refinances, extensions, renewals, increases Properties in non-participating communities 24

Flood Compliance – Problem Areas (cont. ) l Force placement requirements § § l Failure to notify borrower of inadequate coverage Failure to force place after 45 days of notification Use of standard flood determination form § § Not obtaining flood determination Not retaining SFHDF 25

Flood Compliance – Problem Areas (cont. ) l Force placement requirements § § l Failure to notify borrower of inadequate coverage Failure to force place after 45 days of notification Use of standard flood determination form § § Not obtaining flood determination Not retaining SFHDF 25

Civil Money Penalties (CMPs) l Mandatory CMPs for pattern or practice of violations of following requirements: l l l Purchase of flood insurance Escrow of flood insurance premiums Forced placement of flood insurance Borrower Notification Servicer Notification Penalty of up to $385 per violation, maximum $125, 000 per year 26

Civil Money Penalties (CMPs) l Mandatory CMPs for pattern or practice of violations of following requirements: l l l Purchase of flood insurance Escrow of flood insurance premiums Forced placement of flood insurance Borrower Notification Servicer Notification Penalty of up to $385 per violation, maximum $125, 000 per year 26

San Francisco Region Flood CMPs l Since January 2007, 10 CMPs have been issued for flood insurance violations l l Penalties up to $55, 000 Seeing an upward trend in CMP cases, both in number and the amount of CMP 27

San Francisco Region Flood CMPs l Since January 2007, 10 CMPs have been issued for flood insurance violations l l Penalties up to $55, 000 Seeing an upward trend in CMP cases, both in number and the amount of CMP 27

Pattern or Practice l Not defined by Flood Disaster Protection Act l Facts and circumstances weighed for each case l Look to guidance and experience under other regulations l l l Regulation B (Equal Credit Opportunity Act) The Policy Statement on Discrimination in Lending Regulation Z (Truth in Lending) 28

Pattern or Practice l Not defined by Flood Disaster Protection Act l Facts and circumstances weighed for each case l Look to guidance and experience under other regulations l l l Regulation B (Equal Credit Opportunity Act) The Policy Statement on Discrimination in Lending Regulation Z (Truth in Lending) 28

Pattern or Practice (cont. ) l Factors considered (but not limited to): l Common cause l Existence of written policy or established practice l Duration of violations l Relationship among violations l Significance in relation to total number of applicable transactions l Prior violations l Effectiveness of flood insurance policies, procedures, training, monitoring, and audit function 29

Pattern or Practice (cont. ) l Factors considered (but not limited to): l Common cause l Existence of written policy or established practice l Duration of violations l Relationship among violations l Significance in relation to total number of applicable transactions l Prior violations l Effectiveness of flood insurance policies, procedures, training, monitoring, and audit function 29

FEMA Guide Changes Mandatory Purchase of Flood Insurance Guidelines Highlights of Revisions (effective September 2007): l Section A l l Flowchart illustrating mandatory purchase process at loan origination Section B l Flood zone discrepancies between SFHDF and policy l Letter of Determination Review (LODR) 30

FEMA Guide Changes Mandatory Purchase of Flood Insurance Guidelines Highlights of Revisions (effective September 2007): l Section A l l Flowchart illustrating mandatory purchase process at loan origination Section B l Flood zone discrepancies between SFHDF and policy l Letter of Determination Review (LODR) 30

FEMA Guide Changes (cont. ) l Section C l l Purchasing coverage for construction loans Section D l RCBAP coverage l l l Declarations page must show RCV and number of units Recommends 100% RCV Section E l Flowchart describing tripwires during life of loan 31

FEMA Guide Changes (cont. ) l Section C l l Purchasing coverage for construction loans Section D l RCBAP coverage l l l Declarations page must show RCV and number of units Recommends 100% RCV Section E l Flowchart describing tripwires during life of loan 31

Interagency Flood Q&As* l Proposed Revisions l l New topics: l l l Comment period ended May 20, 2008 Agencies received 60 unique comments Final adoption anticipated by year-end Second liens Syndications/participations Flood zone discrepancies Imposition of CMPs Substantive modifications: l l Construction loans Condominium loans * FIL 23 -2008: Proposed Revisions to Interagency Questions and Answers Regarding Flood Insurance 32

Interagency Flood Q&As* l Proposed Revisions l l New topics: l l l Comment period ended May 20, 2008 Agencies received 60 unique comments Final adoption anticipated by year-end Second liens Syndications/participations Flood zone discrepancies Imposition of CMPs Substantive modifications: l l Construction loans Condominium loans * FIL 23 -2008: Proposed Revisions to Interagency Questions and Answers Regarding Flood Insurance 32

Interagency Flood Q&As (cont. ) l Second liens l l Must ensure sufficient coverage for all loans (or max available) Syndications/participations l Participating lender expected to undertake due diligence to ensure lead lender or agent: l l Agreements should provide for lead or agent to provide info to participants Flood zone discrepancies l l Obtains insurance where necessary Has controls in place to monitor for compliance Must have process in place to identify and resolve discrepancies Imposition of CMPs l General standards for determining pattern or practice 33

Interagency Flood Q&As (cont. ) l Second liens l l Must ensure sufficient coverage for all loans (or max available) Syndications/participations l Participating lender expected to undertake due diligence to ensure lead lender or agent: l l Agreements should provide for lead or agent to provide info to participants Flood zone discrepancies l l Obtains insurance where necessary Has controls in place to monitor for compliance Must have process in place to identify and resolve discrepancies Imposition of CMPs l General standards for determining pattern or practice 33

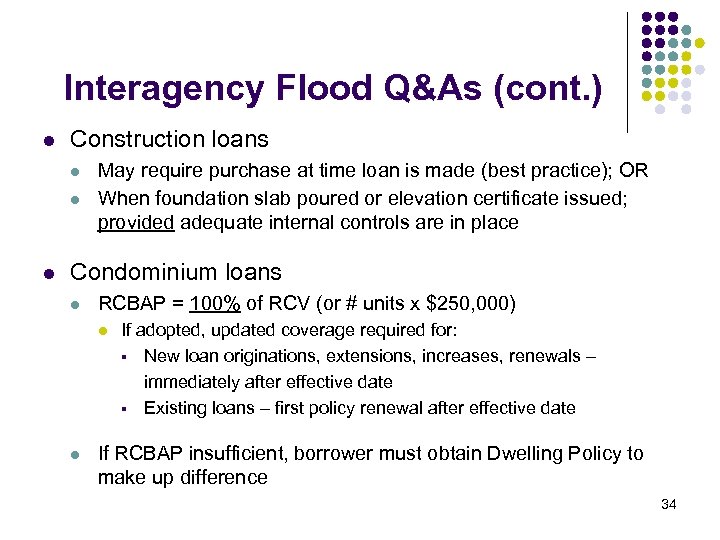

Interagency Flood Q&As (cont. ) l Construction loans l l l May require purchase at time loan is made (best practice); OR When foundation slab poured or elevation certificate issued; provided adequate internal controls are in place Condominium loans l RCBAP = 100% of RCV (or # units x $250, 000) l l If adopted, updated coverage required for: § New loan originations, extensions, increases, renewals – immediately after effective date § Existing loans – first policy renewal after effective date If RCBAP insufficient, borrower must obtain Dwelling Policy to make up difference 34

Interagency Flood Q&As (cont. ) l Construction loans l l l May require purchase at time loan is made (best practice); OR When foundation slab poured or elevation certificate issued; provided adequate internal controls are in place Condominium loans l RCBAP = 100% of RCV (or # units x $250, 000) l l If adopted, updated coverage required for: § New loan originations, extensions, increases, renewals – immediately after effective date § Existing loans – first policy renewal after effective date If RCBAP insufficient, borrower must obtain Dwelling Policy to make up difference 34

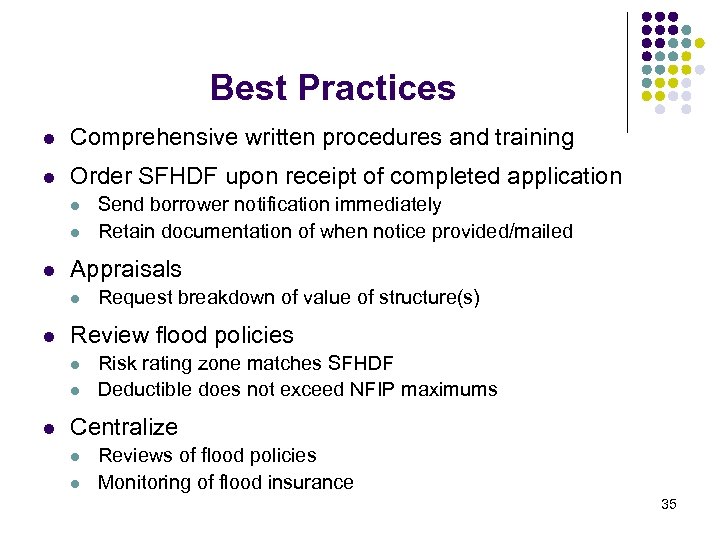

Best Practices l Comprehensive written procedures and training l Order SFHDF upon receipt of completed application l l l Appraisals l l Request breakdown of value of structure(s) Review flood policies l l l Send borrower notification immediately Retain documentation of when notice provided/mailed Risk rating zone matches SFHDF Deductible does not exceed NFIP maximums Centralize l l Reviews of flood policies Monitoring of flood insurance 35

Best Practices l Comprehensive written procedures and training l Order SFHDF upon receipt of completed application l l l Appraisals l l Request breakdown of value of structure(s) Review flood policies l l l Send borrower notification immediately Retain documentation of when notice provided/mailed Risk rating zone matches SFHDF Deductible does not exceed NFIP maximums Centralize l l Reviews of flood policies Monitoring of flood insurance 35

Best Practices (cont. ) l Secondary reviews of designated loans l l l Prior to closing Notification and purchase requirements Frequent flood determination vender queries l Determinations in SFHA l Periodic reviews of tickler system l Targeted audits of designated loans l Map changes l l Life of loan determinations No LOL – review portfolio 36

Best Practices (cont. ) l Secondary reviews of designated loans l l l Prior to closing Notification and purchase requirements Frequent flood determination vender queries l Determinations in SFHA l Periodic reviews of tickler system l Targeted audits of designated loans l Map changes l l Life of loan determinations No LOL – review portfolio 36

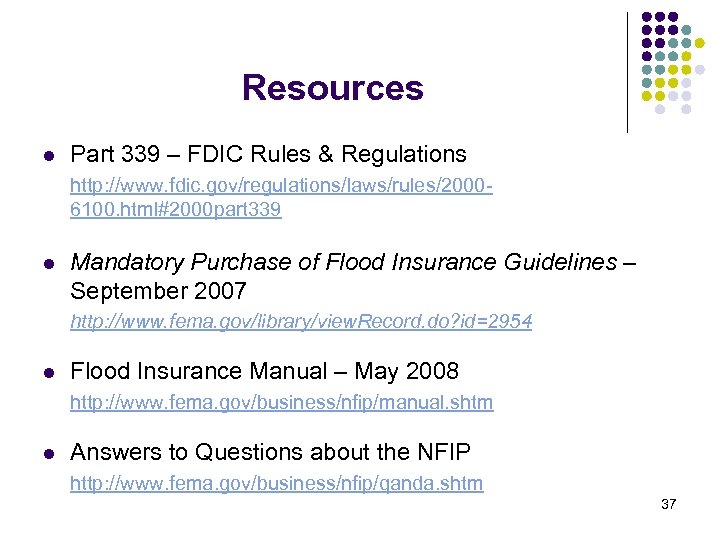

Resources l Part 339 – FDIC Rules & Regulations http: //www. fdic. gov/regulations/laws/rules/20006100. html#2000 part 339 l Mandatory Purchase of Flood Insurance Guidelines – September 2007 http: //www. fema. gov/library/view. Record. do? id=2954 l Flood Insurance Manual – May 2008 http: //www. fema. gov/business/nfip/manual. shtm l Answers to Questions about the NFIP http: //www. fema. gov/business/nfip/qanda. shtm 37

Resources l Part 339 – FDIC Rules & Regulations http: //www. fdic. gov/regulations/laws/rules/20006100. html#2000 part 339 l Mandatory Purchase of Flood Insurance Guidelines – September 2007 http: //www. fema. gov/library/view. Record. do? id=2954 l Flood Insurance Manual – May 2008 http: //www. fema. gov/business/nfip/manual. shtm l Answers to Questions about the NFIP http: //www. fema. gov/business/nfip/qanda. shtm 37

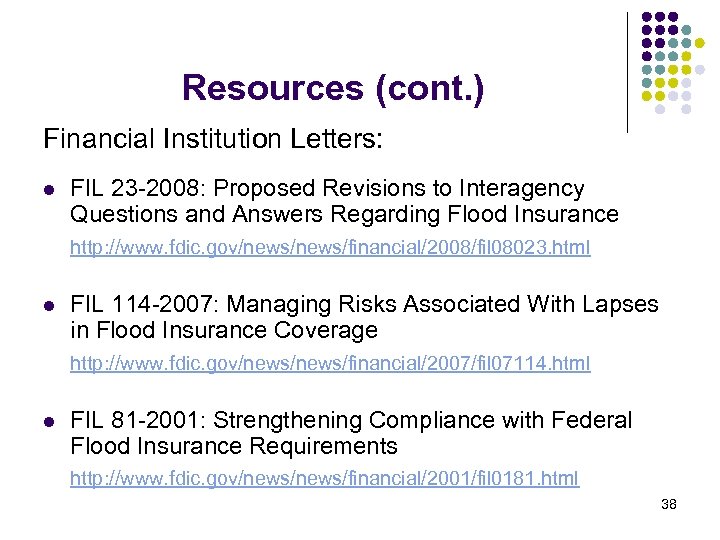

Resources (cont. ) Financial Institution Letters: l FIL 23 -2008: Proposed Revisions to Interagency Questions and Answers Regarding Flood Insurance http: //www. fdic. gov/news/financial/2008/fil 08023. html l FIL 114 -2007: Managing Risks Associated With Lapses in Flood Insurance Coverage http: //www. fdic. gov/news/financial/2007/fil 07114. html l FIL 81 -2001: Strengthening Compliance with Federal Flood Insurance Requirements http: //www. fdic. gov/news/financial/2001/fil 0181. html 38

Resources (cont. ) Financial Institution Letters: l FIL 23 -2008: Proposed Revisions to Interagency Questions and Answers Regarding Flood Insurance http: //www. fdic. gov/news/financial/2008/fil 08023. html l FIL 114 -2007: Managing Risks Associated With Lapses in Flood Insurance Coverage http: //www. fdic. gov/news/financial/2007/fil 07114. html l FIL 81 -2001: Strengthening Compliance with Federal Flood Insurance Requirements http: //www. fdic. gov/news/financial/2001/fil 0181. html 38

Question and Answer Session 39

Question and Answer Session 39

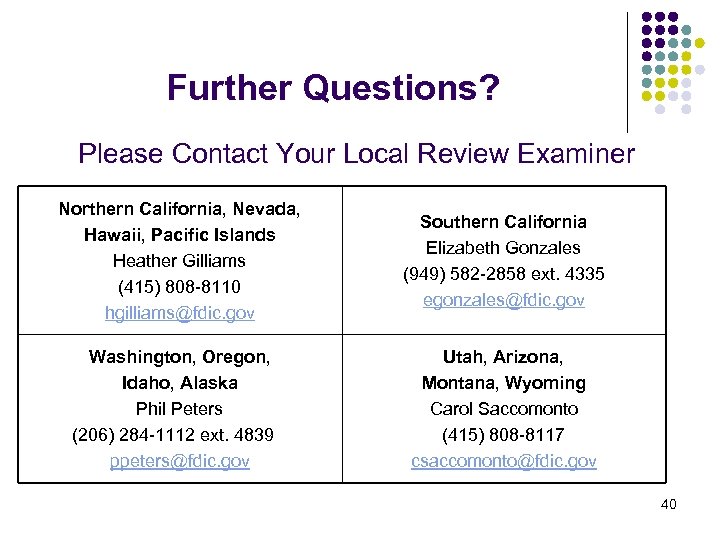

Further Questions? Please Contact Your Local Review Examiner Northern California, Nevada, Hawaii, Pacific Islands Heather Gilliams (415) 808 -8110 hgilliams@fdic. gov Washington, Oregon, Idaho, Alaska Phil Peters (206) 284 -1112 ext. 4839 ppeters@fdic. gov Southern California Elizabeth Gonzales (949) 582 -2858 ext. 4335 egonzales@fdic. gov Utah, Arizona, Montana, Wyoming Carol Saccomonto (415) 808 -8117 csaccomonto@fdic. gov 40

Further Questions? Please Contact Your Local Review Examiner Northern California, Nevada, Hawaii, Pacific Islands Heather Gilliams (415) 808 -8110 hgilliams@fdic. gov Washington, Oregon, Idaho, Alaska Phil Peters (206) 284 -1112 ext. 4839 ppeters@fdic. gov Southern California Elizabeth Gonzales (949) 582 -2858 ext. 4335 egonzales@fdic. gov Utah, Arizona, Montana, Wyoming Carol Saccomonto (415) 808 -8117 csaccomonto@fdic. gov 40