dc86a769b2285b40b1e87d4e46f0b89f.ppt

- Количество слайдов: 26

Farming for the Future… What Farmers Need to Know Risk Management Strategies Ø Why is it important? Ø What tools can I use? Ø Who can help? Ø Questions?

Farming for the Future… What Farmers Need to Know Risk Management Strategies Ø Why is it important? Ø What tools can I use? Ø Who can help? Ø Questions?

Financial Survival of Operation Ø Cash and equity preservation Ø Lender comfort level increases Ø Prevention of large equity variations Ø Cash flow consistency Ø Marital/business partner harmony

Financial Survival of Operation Ø Cash and equity preservation Ø Lender comfort level increases Ø Prevention of large equity variations Ø Cash flow consistency Ø Marital/business partner harmony

Protection Against Uncertainties Ø Value of US dollar Ø Affects trade – demand for product Ø Unforeseen disease issues Ø BSE (mad cow – beef industry) Ø PEDV (swine industry) Ø Avian Flu (poultry industry) Ø Unpredictable weather Ø Drought Ø Harsh winters

Protection Against Uncertainties Ø Value of US dollar Ø Affects trade – demand for product Ø Unforeseen disease issues Ø BSE (mad cow – beef industry) Ø PEDV (swine industry) Ø Avian Flu (poultry industry) Ø Unpredictable weather Ø Drought Ø Harsh winters

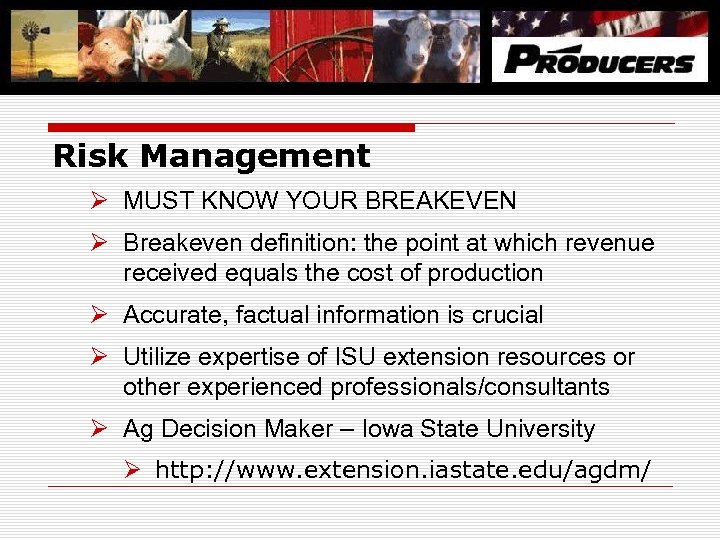

Risk Management Ø MUST KNOW YOUR BREAKEVEN Ø Breakeven definition: the point at which revenue received equals the cost of production Ø Accurate, factual information is crucial Ø Utilize expertise of ISU extension resources or other experienced professionals/consultants Ø Ag Decision Maker – Iowa State University Ø http: //www. extension. iastate. edu/agdm/

Risk Management Ø MUST KNOW YOUR BREAKEVEN Ø Breakeven definition: the point at which revenue received equals the cost of production Ø Accurate, factual information is crucial Ø Utilize expertise of ISU extension resources or other experienced professionals/consultants Ø Ag Decision Maker – Iowa State University Ø http: //www. extension. iastate. edu/agdm/

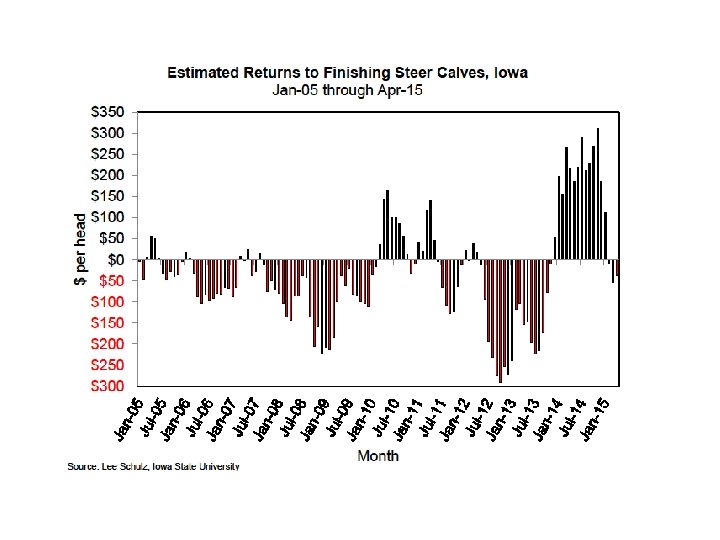

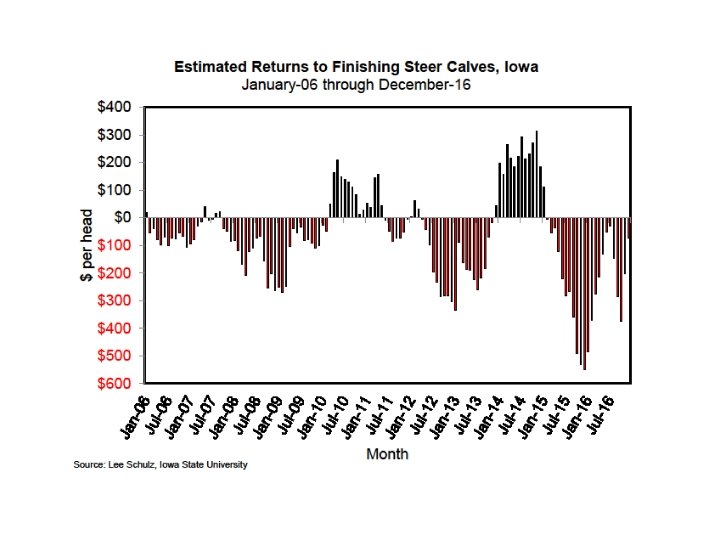

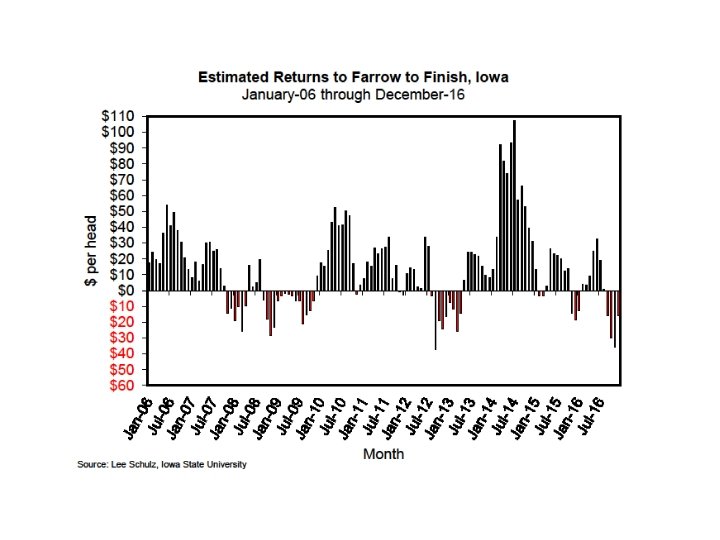

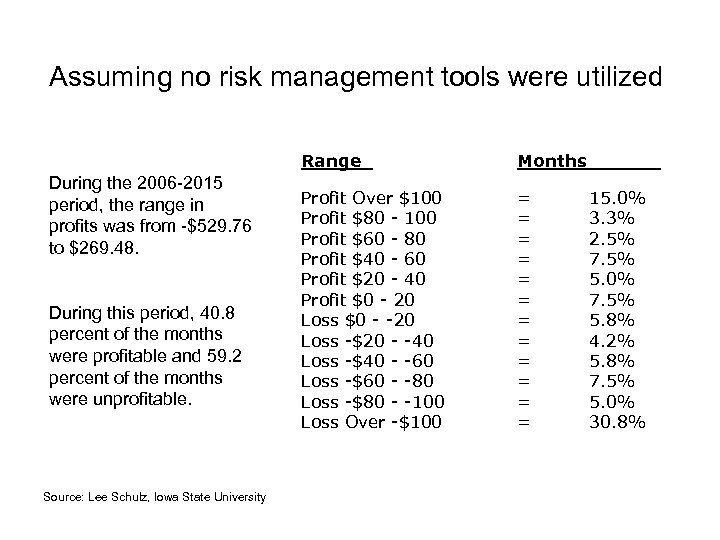

Assuming no risk management tools were utilized Range During the 2006 -2015 period, the range in profits was from -$529. 76 to $269. 48. During this period, 40. 8 percent of the months were profitable and 59. 2 percent of the months were unprofitable. Source: Lee Schulz, Iowa State University Months Profit Over $100 Profit $80 - 100 Profit $60 - 80 Profit $40 - 60 Profit $20 - 40 Profit $0 - 20 Loss $0 - -20 Loss -$20 - -40 Loss -$40 - -60 Loss -$60 - -80 Loss -$80 - -100 Loss Over -$100 = = = 15. 0% 3. 3% 2. 5% 7. 5% 5. 0% 7. 5% 5. 8% 4. 2% 5. 8% 7. 5% 5. 0% 30. 8%

Assuming no risk management tools were utilized Range During the 2006 -2015 period, the range in profits was from -$529. 76 to $269. 48. During this period, 40. 8 percent of the months were profitable and 59. 2 percent of the months were unprofitable. Source: Lee Schulz, Iowa State University Months Profit Over $100 Profit $80 - 100 Profit $60 - 80 Profit $40 - 60 Profit $20 - 40 Profit $0 - 20 Loss $0 - -20 Loss -$20 - -40 Loss -$40 - -60 Loss -$60 - -80 Loss -$80 - -100 Loss Over -$100 = = = 15. 0% 3. 3% 2. 5% 7. 5% 5. 0% 7. 5% 5. 8% 4. 2% 5. 8% 7. 5% 5. 0% 30. 8%

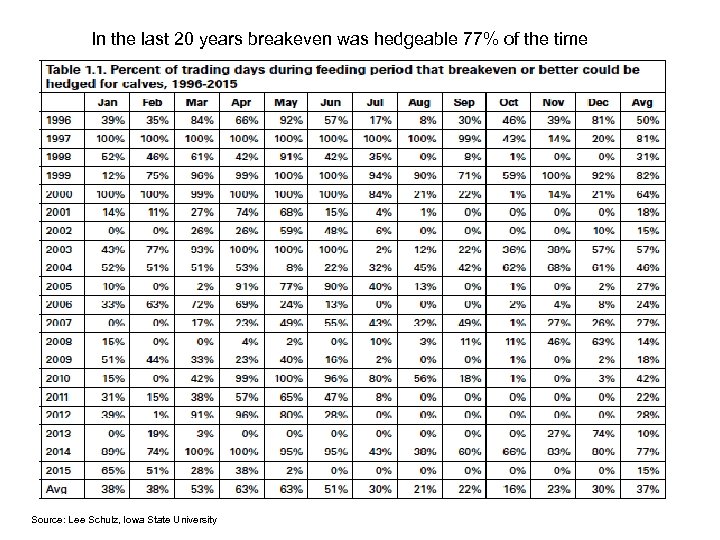

In the last 20 years breakeven was hedgeable 77% of the time Source: Lee Schulz, Iowa State University

In the last 20 years breakeven was hedgeable 77% of the time Source: Lee Schulz, Iowa State University

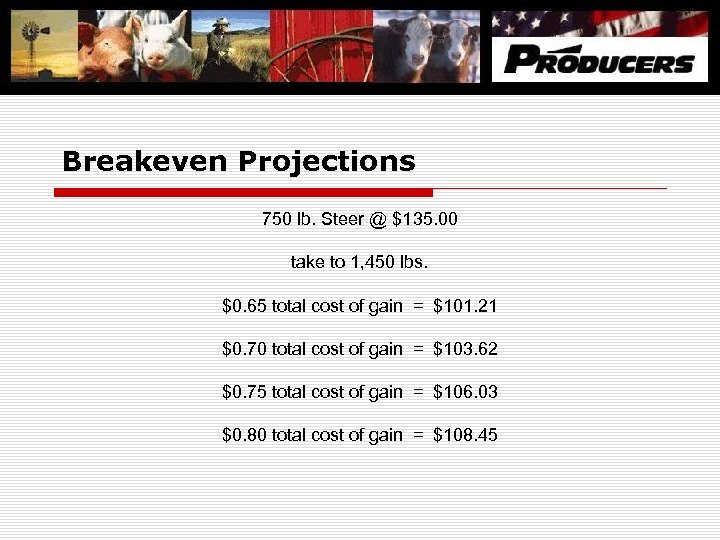

Breakeven Projections 750 lb. Steer @ $135. 00 take to 1, 450 lbs. $0. 65 total cost of gain = $101. 21 $0. 70 total cost of gain = $103. 62 $0. 75 total cost of gain = $106. 03 $0. 80 total cost of gain = $108. 45

Breakeven Projections 750 lb. Steer @ $135. 00 take to 1, 450 lbs. $0. 65 total cost of gain = $101. 21 $0. 70 total cost of gain = $103. 62 $0. 75 total cost of gain = $106. 03 $0. 80 total cost of gain = $108. 45

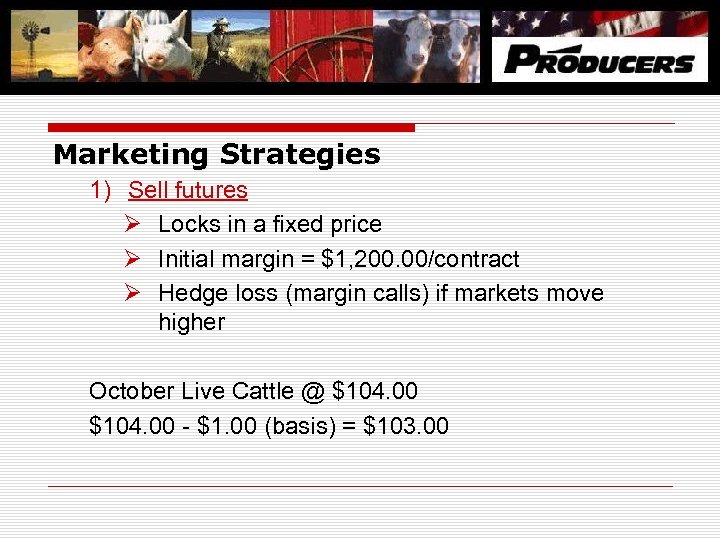

Marketing Strategies 1) Sell futures Ø Locks in a fixed price Ø Initial margin = $1, 200. 00/contract Ø Hedge loss (margin calls) if markets move higher October Live Cattle @ $104. 00 - $1. 00 (basis) = $103. 00

Marketing Strategies 1) Sell futures Ø Locks in a fixed price Ø Initial margin = $1, 200. 00/contract Ø Hedge loss (margin calls) if markets move higher October Live Cattle @ $104. 00 - $1. 00 (basis) = $103. 00

Missed opportunity profit You did not lose money by hedging (see below) $107. 00 - $ 98. 00 Basis + $ 2. 00 Gain $ 11. 00 1450 x $11. 00 = $159/head profit

Missed opportunity profit You did not lose money by hedging (see below) $107. 00 - $ 98. 00 Basis + $ 2. 00 Gain $ 11. 00 1450 x $11. 00 = $159/head profit

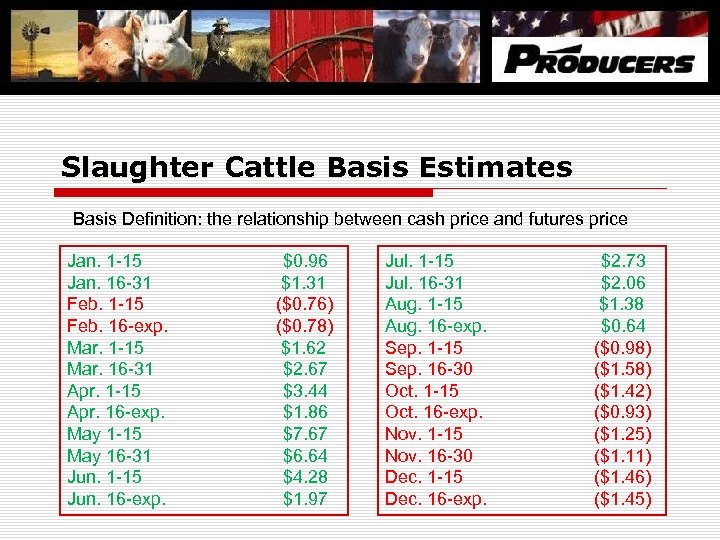

Slaughter Cattle Basis Estimates Basis Definition: the relationship between cash price and futures price Jan. 1 -15 Jan. 16 -31 Feb. 1 -15 Feb. 16 -exp. Mar. 1 -15 Mar. 16 -31 Apr. 1 -15 Apr. 16 -exp. May 1 -15 May 16 -31 Jun. 1 -15 Jun. 16 -exp. $0. 96 $1. 31 ($0. 76) ($0. 78) $1. 62 $2. 67 $3. 44 $1. 86 $7. 67 $6. 64 $4. 28 $1. 97 Jul. 1 -15 Jul. 16 -31 Aug. 1 -15 Aug. 16 -exp. Sep. 1 -15 Sep. 16 -30 Oct. 1 -15 Oct. 16 -exp. Nov. 1 -15 Nov. 16 -30 Dec. 1 -15 Dec. 16 -exp. $2. 73 $2. 06 $1. 38 $0. 64 ($0. 98) ($1. 58) ($1. 42) ($0. 93) ($1. 25) ($1. 11) ($1. 46) ($1. 45)

Slaughter Cattle Basis Estimates Basis Definition: the relationship between cash price and futures price Jan. 1 -15 Jan. 16 -31 Feb. 1 -15 Feb. 16 -exp. Mar. 1 -15 Mar. 16 -31 Apr. 1 -15 Apr. 16 -exp. May 1 -15 May 16 -31 Jun. 1 -15 Jun. 16 -exp. $0. 96 $1. 31 ($0. 76) ($0. 78) $1. 62 $2. 67 $3. 44 $1. 86 $7. 67 $6. 64 $4. 28 $1. 97 Jul. 1 -15 Jul. 16 -31 Aug. 1 -15 Aug. 16 -exp. Sep. 1 -15 Sep. 16 -30 Oct. 1 -15 Oct. 16 -exp. Nov. 1 -15 Nov. 16 -30 Dec. 1 -15 Dec. 16 -exp. $2. 73 $2. 06 $1. 38 $0. 64 ($0. 98) ($1. 58) ($1. 42) ($0. 93) ($1. 25) ($1. 11) ($1. 46) ($1. 45)

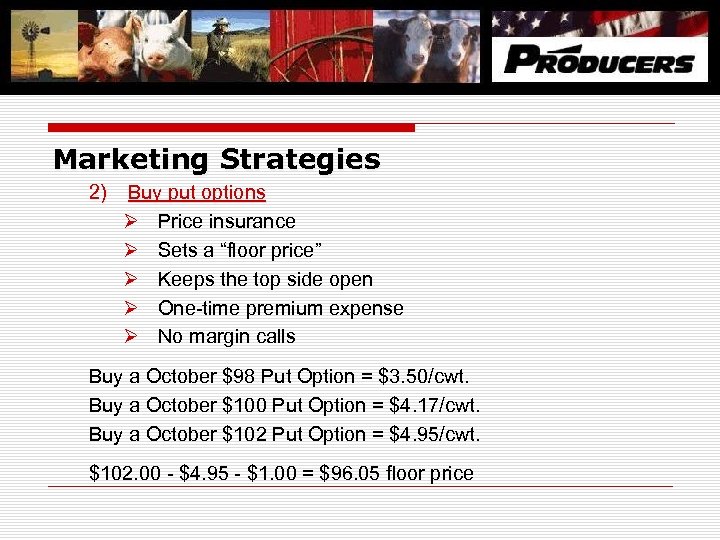

Marketing Strategies 2) Buy put options Ø Price insurance Ø Sets a “floor price” Ø Keeps the top side open Ø One-time premium expense Ø No margin calls Buy a October $98 Put Option = $3. 50/cwt. Buy a October $100 Put Option = $4. 17/cwt. Buy a October $102 Put Option = $4. 95/cwt. $102. 00 - $4. 95 - $1. 00 = $96. 05 floor price

Marketing Strategies 2) Buy put options Ø Price insurance Ø Sets a “floor price” Ø Keeps the top side open Ø One-time premium expense Ø No margin calls Buy a October $98 Put Option = $3. 50/cwt. Buy a October $100 Put Option = $4. 17/cwt. Buy a October $102 Put Option = $4. 95/cwt. $102. 00 - $4. 95 - $1. 00 = $96. 05 floor price

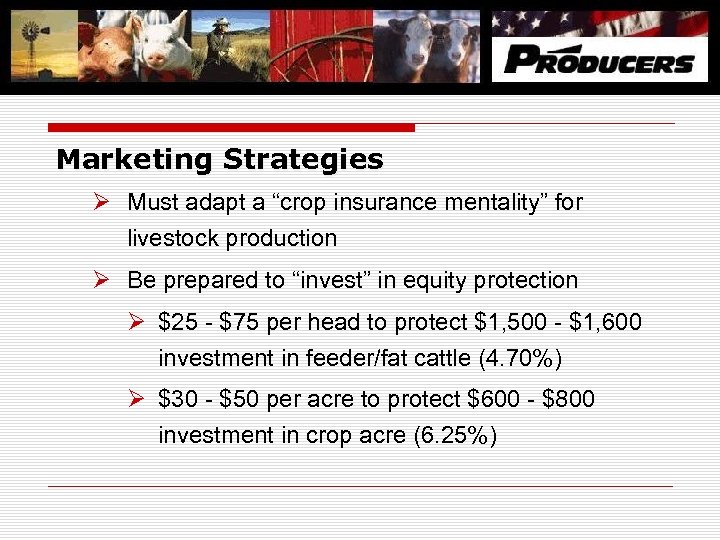

Marketing Strategies Ø Must adapt a “crop insurance mentality” for livestock production Ø Be prepared to “invest” in equity protection Ø $25 - $75 per head to protect $1, 500 - $1, 600 investment in feeder/fat cattle (4. 70%) Ø $30 - $50 per acre to protect $600 - $800 investment in crop acre (6. 25%)

Marketing Strategies Ø Must adapt a “crop insurance mentality” for livestock production Ø Be prepared to “invest” in equity protection Ø $25 - $75 per head to protect $1, 500 - $1, 600 investment in feeder/fat cattle (4. 70%) Ø $30 - $50 per acre to protect $600 - $800 investment in crop acre (6. 25%)

$117. 00 - $102. 45 Basis + $ 2. 00 Gain $ 16. 55 1450 x $16. 55 = $239/head profit Breakeven $102. 45 $98 Put @ $4. 45

$117. 00 - $102. 45 Basis + $ 2. 00 Gain $ 16. 55 1450 x $16. 55 = $239/head profit Breakeven $102. 45 $98 Put @ $4. 45

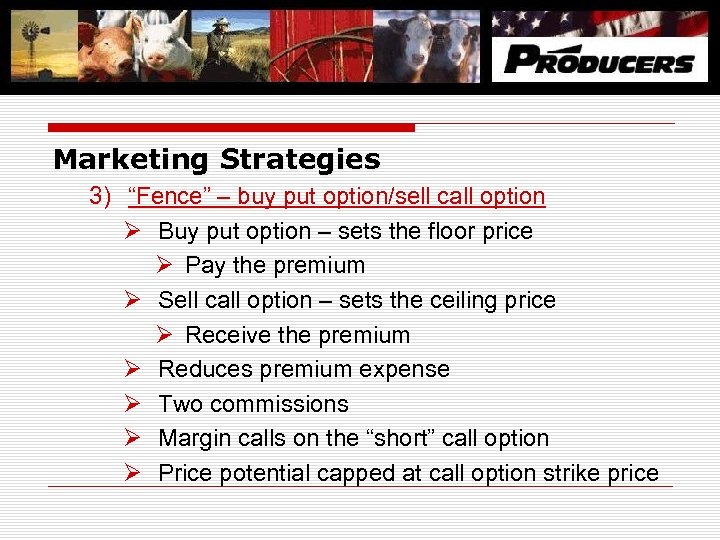

Marketing Strategies 3) “Fence” – buy put option/sell call option b Ø Buy put option – sets the floor price Ø Pay the premium Ø Sell call option – sets the ceiling price Ø Receive the premium Ø Reduces premium expense Ø Two commissions Ø Margin calls on the “short” call option Ø Price potential capped at call option strike price

Marketing Strategies 3) “Fence” – buy put option/sell call option b Ø Buy put option – sets the floor price Ø Pay the premium Ø Sell call option – sets the ceiling price Ø Receive the premium Ø Reduces premium expense Ø Two commissions Ø Margin calls on the “short” call option Ø Price potential capped at call option strike price

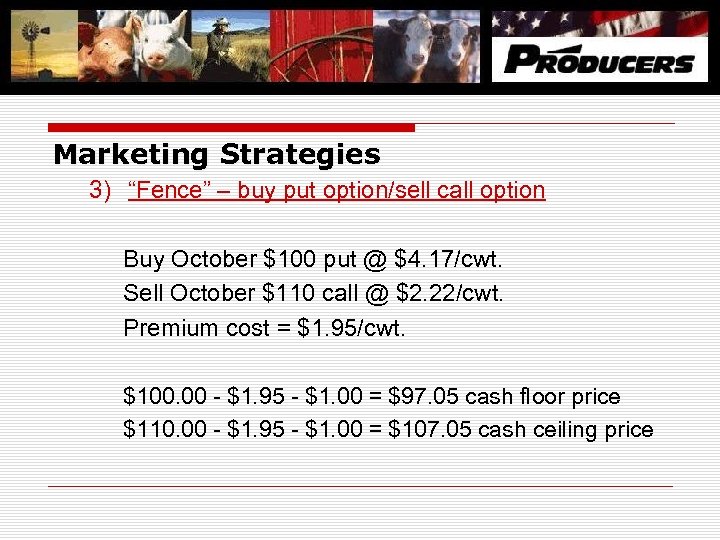

Marketing Strategies 3) “Fence” – buy put option/sell call option b Buy October $100 put @ $4. 17/cwt. Sell October $110 call @ $2. 22/cwt. Premium cost = $1. 95/cwt. $100. 00 - $1. 95 - $1. 00 = $97. 05 cash floor price $110. 00 - $1. 95 - $1. 00 = $107. 05 cash ceiling price

Marketing Strategies 3) “Fence” – buy put option/sell call option b Buy October $100 put @ $4. 17/cwt. Sell October $110 call @ $2. 22/cwt. Premium cost = $1. 95/cwt. $100. 00 - $1. 95 - $1. 00 = $97. 05 cash floor price $110. 00 - $1. 95 - $1. 00 = $107. 05 cash ceiling price

Marketing Strategies 4) Sell futures/buy call options Ø Lock in fixed price with futures Ø Open top side potential with call option Ø Increase in call option value will offset loss in futures Ø “Synthetic put option” Ø Sell futures today, buy call option at a later date Sell October futures @ $104. 00 Buy a $110. 00 call option @ $2. 22/cwt.

Marketing Strategies 4) Sell futures/buy call options Ø Lock in fixed price with futures Ø Open top side potential with call option Ø Increase in call option value will offset loss in futures Ø “Synthetic put option” Ø Sell futures today, buy call option at a later date Sell October futures @ $104. 00 Buy a $110. 00 call option @ $2. 22/cwt.

Marketing Strategies 5) Packer contract/basis contracts Ø October/December basis = minus $1. 00 -$2. 00 Ø Contract specs negotiated Ø 63. 5% yield Ø 60%-70% choice Ø Packer sets delivery date Ø Adds to “captive supply”

Marketing Strategies 5) Packer contract/basis contracts Ø October/December basis = minus $1. 00 -$2. 00 Ø Contract specs negotiated Ø 63. 5% yield Ø 60%-70% choice Ø Packer sets delivery date Ø Adds to “captive supply”

Marketing Strategies 6) Other more complex strategies Ø Ratio spread Ø Buy 1 put option/sell 2 call options Ø Buy 1 put option/sell 2 put options Ø Sell 1 futures/sell 2 put options Ø Straddle Ø Buy put option/buy call option Ø Customer must establish commodity trading account and meet all margin calls

Marketing Strategies 6) Other more complex strategies Ø Ratio spread Ø Buy 1 put option/sell 2 call options Ø Buy 1 put option/sell 2 put options Ø Sell 1 futures/sell 2 put options Ø Straddle Ø Buy put option/buy call option Ø Customer must establish commodity trading account and meet all margin calls

Revenue Insurance for Livestock Producers Ø Livestock Gross Margin Ø Available for cattle, milk, and swine producers Ø Producers elect guarantee levels of total gross margin Ø Producer pays premium according to guarantee level Ø Livestock Risk Protections Ø Available for finished hogs, lambs, feeder cattle and fed cattle Ø LRP protects against declining livestock prices only Ø Producer selects time period and level of protection desired Ø Both products must be purchased through authorized insurance agents

Revenue Insurance for Livestock Producers Ø Livestock Gross Margin Ø Available for cattle, milk, and swine producers Ø Producers elect guarantee levels of total gross margin Ø Producer pays premium according to guarantee level Ø Livestock Risk Protections Ø Available for finished hogs, lambs, feeder cattle and fed cattle Ø LRP protects against declining livestock prices only Ø Producer selects time period and level of protection desired Ø Both products must be purchased through authorized insurance agents

Commodity Marketing Division Ø Risk management/ag-hedging services Ø 55% cattle, 30% hogs, 15% grains Ø Commodity brokerage accounts Ø Hedge PLCC financed livestock Ø “Hedge Contract” Ø Four licensed (salaried) brokers & support staff Ø Clear through FC Stone

Commodity Marketing Division Ø Risk management/ag-hedging services Ø 55% cattle, 30% hogs, 15% grains Ø Commodity brokerage accounts Ø Hedge PLCC financed livestock Ø “Hedge Contract” Ø Four licensed (salaried) brokers & support staff Ø Clear through FC Stone

Other Resources Ø Livestock Revenue Insurance Agents Ø Lenders Ø Local commodity brokers Ø ISU Extension Agents

Other Resources Ø Livestock Revenue Insurance Agents Ø Lenders Ø Local commodity brokers Ø ISU Extension Agents

In the business world, the rear view mirror is always cleaner than the windshield. - Warren Buffett The key to risk management is never putting yourself in a position where you cannot live to fight another day. - Richard Feld We must have courage to bet on our ideas, to take the calculated risk, and to act. - Maxwell Maltz

In the business world, the rear view mirror is always cleaner than the windshield. - Warren Buffett The key to risk management is never putting yourself in a position where you cannot live to fight another day. - Richard Feld We must have courage to bet on our ideas, to take the calculated risk, and to act. - Maxwell Maltz

Website: www. producerslivestock. net Commodity Division 800 -831 -5936 Credit Division 800 -950 -7522 Pork Division 800 -257 -4046 Beef Division 800 -257 -4046 Tim Meyer Email: tmeyer@plmcoop. com Twitter: @Tim. Tmeyer

Website: www. producerslivestock. net Commodity Division 800 -831 -5936 Credit Division 800 -950 -7522 Pork Division 800 -257 -4046 Beef Division 800 -257 -4046 Tim Meyer Email: tmeyer@plmcoop. com Twitter: @Tim. Tmeyer