80e8e6953cbef12f2451ebbf485bfb2d.ppt

- Количество слайдов: 27

Farm Financial Statements • Net Worth Statement √ • Statement of Cash Flows • Net Income Statement • Statement of Owner Equity

Farm Financial Statements • Net Worth Statement √ • Statement of Cash Flows • Net Income Statement • Statement of Owner Equity

Recording Transactions in the Cash Journal • • Date Description Value Amount (bu. , lb. , etc) To (from) whom Enterprise (optional) Production period (optional)

Recording Transactions in the Cash Journal • • Date Description Value Amount (bu. , lb. , etc) To (from) whom Enterprise (optional) Production period (optional)

Transactions can be: • Receipts (cash inflows) • Expenditures (cash outflows)

Transactions can be: • Receipts (cash inflows) • Expenditures (cash outflows)

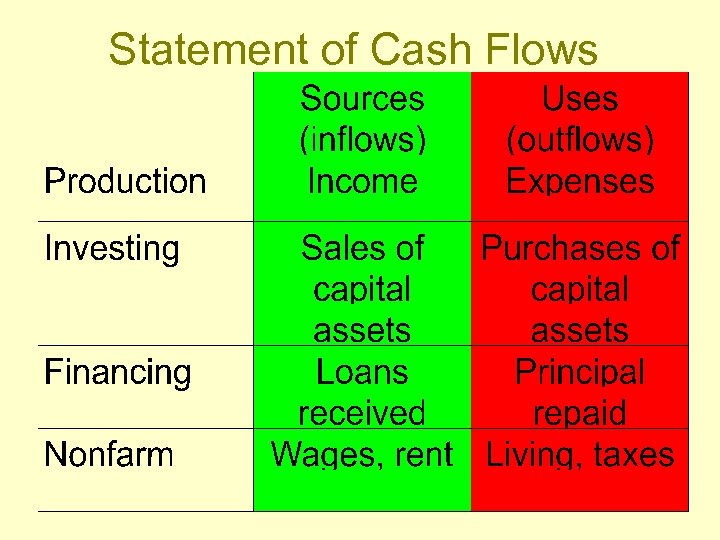

Transactions are Posted to 4 Types of Accounts • Production • Investment • Financing • Nonfarm

Transactions are Posted to 4 Types of Accounts • Production • Investment • Financing • Nonfarm

Statement of Cash Flows

Statement of Cash Flows

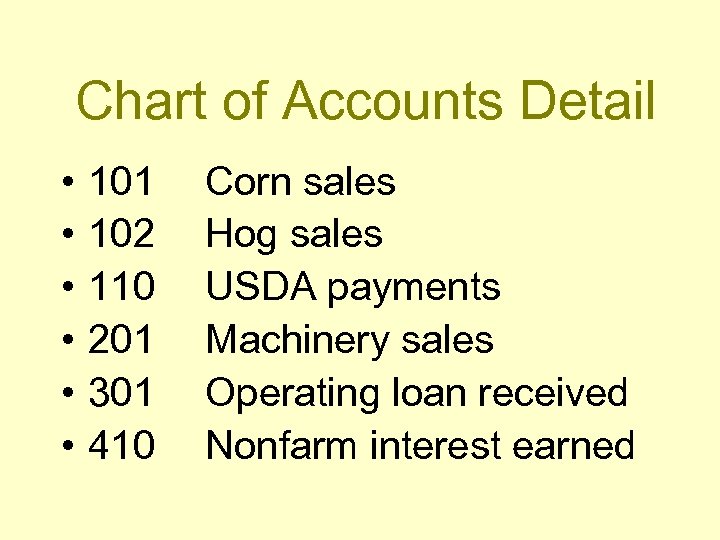

Chart of Accounts Detail • • • 101 102 110 201 301 410 Corn sales Hog sales USDA payments Machinery sales Operating loan received Nonfarm interest earned

Chart of Accounts Detail • • • 101 102 110 201 301 410 Corn sales Hog sales USDA payments Machinery sales Operating loan received Nonfarm interest earned

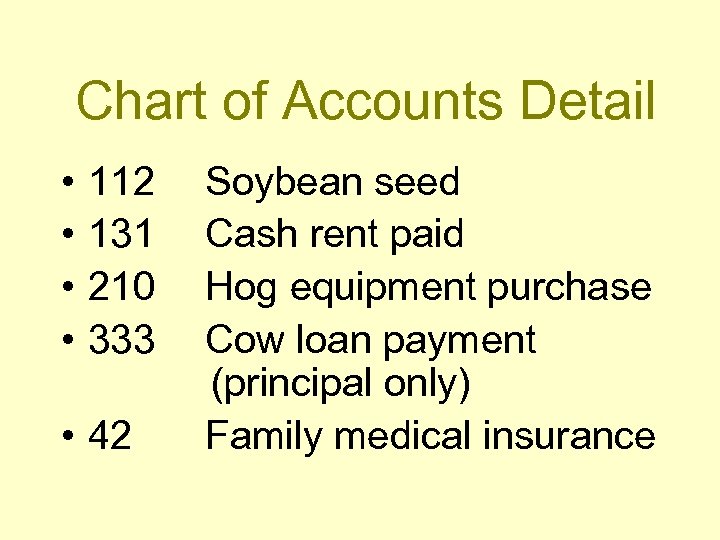

Chart of Accounts Detail • • 112 131 210 333 • 42 Soybean seed Cash rent paid Hog equipment purchase Cow loan payment (principal only) Family medical insurance

Chart of Accounts Detail • • 112 131 210 333 • 42 Soybean seed Cash rent paid Hog equipment purchase Cow loan payment (principal only) Family medical insurance

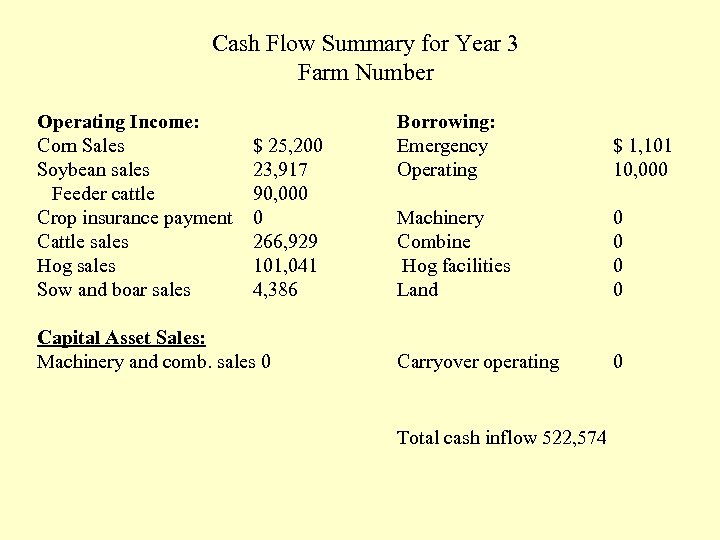

Cash Flow Summary for Year 3 Farm Number Operating Income: Corn Sales $ 25, 200 Soybean sales 23, 917 Feeder cattle 90, 000 Crop insurance payment 0 Cattle sales 266, 929 Hog sales 101, 041 Sow and boar sales 4, 386 Capital Asset Sales: Machinery and comb. sales 0 Borrowing: Emergency Operating $ 1, 101 10, 000 Machinery Combine Hog facilities Land 0 0 Carryover operating 0 Total cash inflow 522, 574

Cash Flow Summary for Year 3 Farm Number Operating Income: Corn Sales $ 25, 200 Soybean sales 23, 917 Feeder cattle 90, 000 Crop insurance payment 0 Cattle sales 266, 929 Hog sales 101, 041 Sow and boar sales 4, 386 Capital Asset Sales: Machinery and comb. sales 0 Borrowing: Emergency Operating $ 1, 101 10, 000 Machinery Combine Hog facilities Land 0 0 Carryover operating 0 Total cash inflow 522, 574

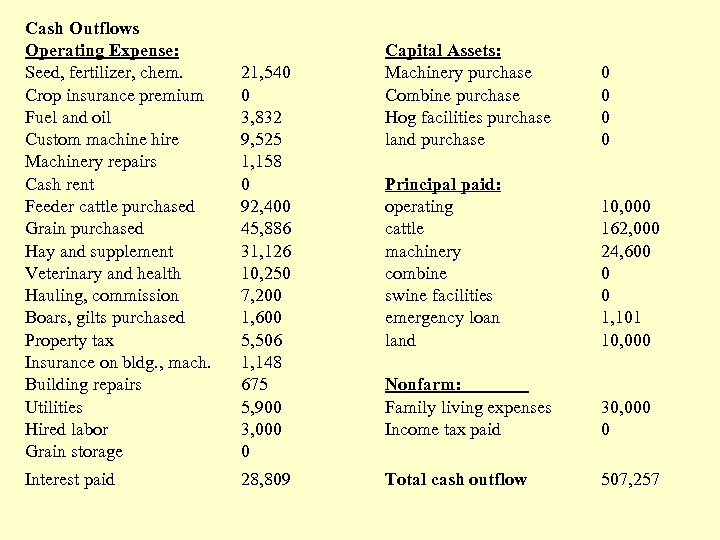

Cash Outflows Operating Expense: Seed, fertilizer, chem. Crop insurance premium Fuel and oil Custom machine hire Machinery repairs Cash rent Feeder cattle purchased Grain purchased Hay and supplement Veterinary and health Hauling, commission Boars, gilts purchased Property tax Insurance on bldg. , mach. Building repairs Utilities Hired labor Grain storage 21, 540 0 3, 832 9, 525 1, 158 0 92, 400 45, 886 31, 126 10, 250 7, 200 1, 600 5, 506 1, 148 675 5, 900 3, 000 0 Interest paid 28, 809 Capital Assets: Machinery purchase Combine purchase Hog facilities purchase land purchase 0 0 Principal paid: operating cattle machinery combine swine facilities emergency loan land 10, 000 162, 000 24, 600 0 0 1, 101 10, 000 Nonfarm: Family living expenses Income tax paid 30, 000 0 Total cash outflow 507, 257

Cash Outflows Operating Expense: Seed, fertilizer, chem. Crop insurance premium Fuel and oil Custom machine hire Machinery repairs Cash rent Feeder cattle purchased Grain purchased Hay and supplement Veterinary and health Hauling, commission Boars, gilts purchased Property tax Insurance on bldg. , mach. Building repairs Utilities Hired labor Grain storage 21, 540 0 3, 832 9, 525 1, 158 0 92, 400 45, 886 31, 126 10, 250 7, 200 1, 600 5, 506 1, 148 675 5, 900 3, 000 0 Interest paid 28, 809 Capital Assets: Machinery purchase Combine purchase Hog facilities purchase land purchase 0 0 Principal paid: operating cattle machinery combine swine facilities emergency loan land 10, 000 162, 000 24, 600 0 0 1, 101 10, 000 Nonfarm: Family living expenses Income tax paid 30, 000 0 Total cash outflow 507, 257

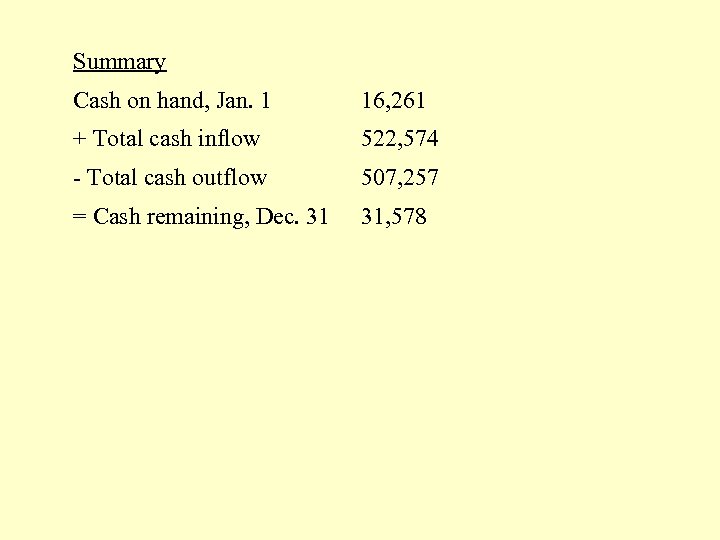

Summary Cash on hand, Jan. 1 16, 261 + Total cash inflow 522, 574 - Total cash outflow 507, 257 = Cash remaining, Dec. 31 31, 578

Summary Cash on hand, Jan. 1 16, 261 + Total cash inflow 522, 574 - Total cash outflow 507, 257 = Cash remaining, Dec. 31 31, 578

Net Farm Income Statement (Profit and Loss Statement) Total Income - Total Expenses = Net Farm Income

Net Farm Income Statement (Profit and Loss Statement) Total Income - Total Expenses = Net Farm Income

Step 1. Record Cash Income and Cash Expenses from the Statement of Cash Flows =Cash Net Farm Income (do not include loans, capital assets, or nonfarm transactions)

Step 1. Record Cash Income and Cash Expenses from the Statement of Cash Flows =Cash Net Farm Income (do not include loans, capital assets, or nonfarm transactions)

Step 2: Make Accrual Adjustments at end of the Year • Include income in the year it is produced (rather than in year sold) • Include expenses in the year the products or services are used (rather than in year paid).

Step 2: Make Accrual Adjustments at end of the Year • Include income in the year it is produced (rather than in year sold) • Include expenses in the year the products or services are used (rather than in year paid).

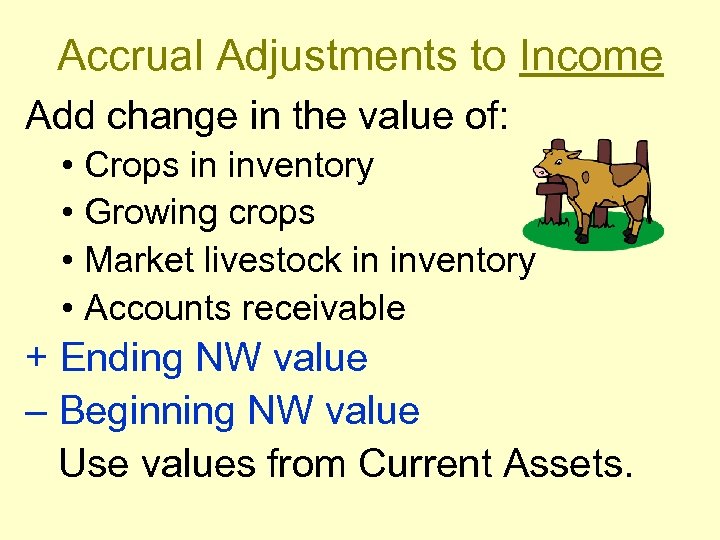

Accrual Adjustments to Income Add change in the value of: • Crops in inventory • Growing crops • Market livestock in inventory • Accounts receivable + Ending NW value – Beginning NW value Use values from Current Assets.

Accrual Adjustments to Income Add change in the value of: • Crops in inventory • Growing crops • Market livestock in inventory • Accounts receivable + Ending NW value – Beginning NW value Use values from Current Assets.

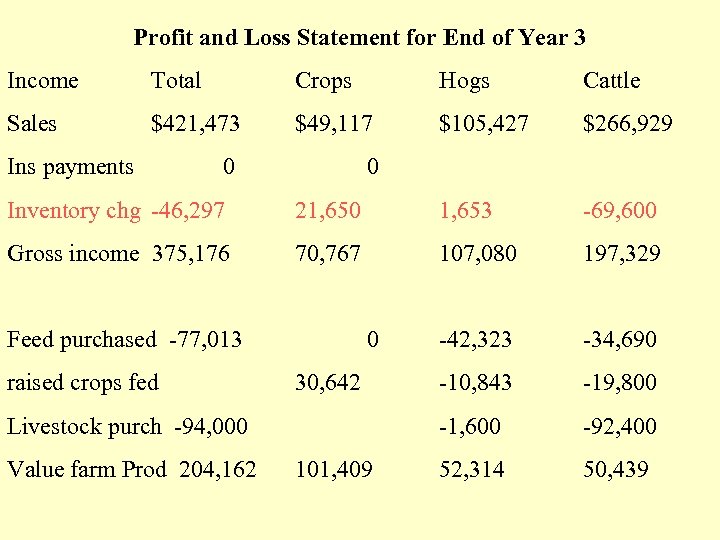

Profit and Loss Statement for End of Year 3 Income Total Crops Hogs Cattle Sales $421, 473 $49, 117 $105, 427 $266, 929 Ins payments 0 0 Inventory chg -46, 297 21, 650 1, 653 -69, 600 Gross income 375, 176 70, 767 107, 080 197, 329 -42, 323 -34, 690 -10, 843 -19, 800 -1, 600 -92, 400 52, 314 50, 439 Feed purchased -77, 013 raised crops fed 0 30, 642 Livestock purch -94, 000 Value farm Prod 204, 162 101, 409

Profit and Loss Statement for End of Year 3 Income Total Crops Hogs Cattle Sales $421, 473 $49, 117 $105, 427 $266, 929 Ins payments 0 0 Inventory chg -46, 297 21, 650 1, 653 -69, 600 Gross income 375, 176 70, 767 107, 080 197, 329 -42, 323 -34, 690 -10, 843 -19, 800 -1, 600 -92, 400 52, 314 50, 439 Feed purchased -77, 013 raised crops fed 0 30, 642 Livestock purch -94, 000 Value farm Prod 204, 162 101, 409

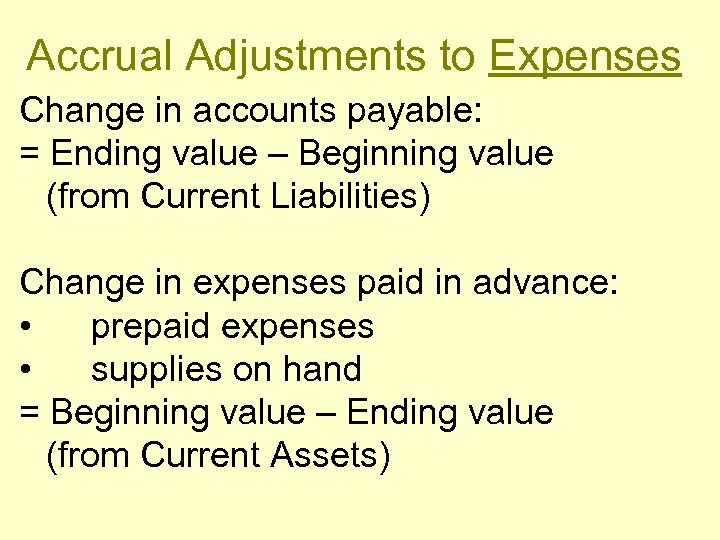

Accrual Adjustments to Expenses Change in accounts payable: = Ending value – Beginning value (from Current Liabilities) Change in expenses paid in advance: • prepaid expenses • supplies on hand = Beginning value – Ending value (from Current Assets)

Accrual Adjustments to Expenses Change in accounts payable: = Ending value – Beginning value (from Current Liabilities) Change in expenses paid in advance: • prepaid expenses • supplies on hand = Beginning value – Ending value (from Current Assets)

Capital Assets Accrual adjustment to intermediate and long-term assets is made through: Depreciation expense

Capital Assets Accrual adjustment to intermediate and long-term assets is made through: Depreciation expense

Capital Gain or Loss • Difference between the selling price of a capital asset and its cost (depreciated) value. • Can be positive (capital gain) or negative (capital loss)

Capital Gain or Loss • Difference between the selling price of a capital asset and its cost (depreciated) value. • Can be positive (capital gain) or negative (capital loss)

Cash Income +/- adjustments minus Cash Expenses +/- adjustments equals Net Farm Income from Operations +/-Capital gains (or losses) equals Net Farm Income

Cash Income +/- adjustments minus Cash Expenses +/- adjustments equals Net Farm Income from Operations +/-Capital gains (or losses) equals Net Farm Income

Net Worth and Net Farm Income Beginning Net Worth + Net Farm Income Ending Net Worth

Net Worth and Net Farm Income Beginning Net Worth + Net Farm Income Ending Net Worth

Net Worth is also affected by: • Contributions of nonfarm capital (+) • Withdrawals for nonfarm expenses(-) • Changes in the market values of capital assets (affect market value net worth, only)

Net Worth is also affected by: • Contributions of nonfarm capital (+) • Withdrawals for nonfarm expenses(-) • Changes in the market values of capital assets (affect market value net worth, only)

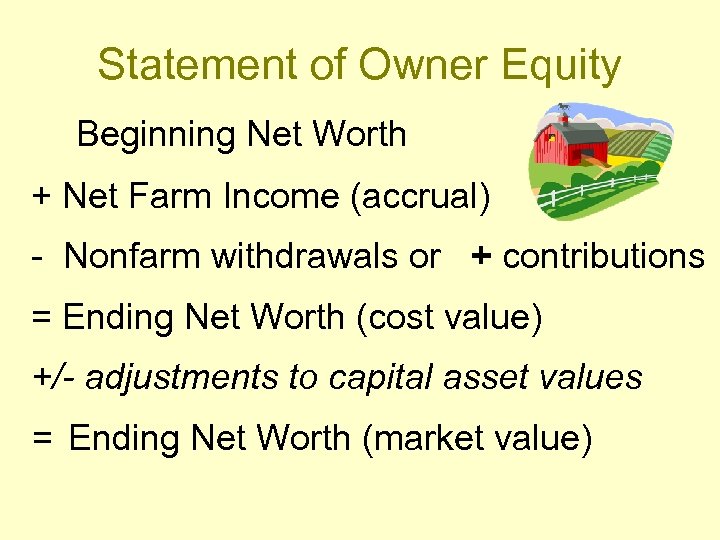

Statement of Owner Equity Beginning Net Worth + Net Farm Income (accrual) - Nonfarm withdrawals or + contributions = Ending Net Worth (cost value) +/- adjustments to capital asset values = Ending Net Worth (market value)

Statement of Owner Equity Beginning Net Worth + Net Farm Income (accrual) - Nonfarm withdrawals or + contributions = Ending Net Worth (cost value) +/- adjustments to capital asset values = Ending Net Worth (market value)

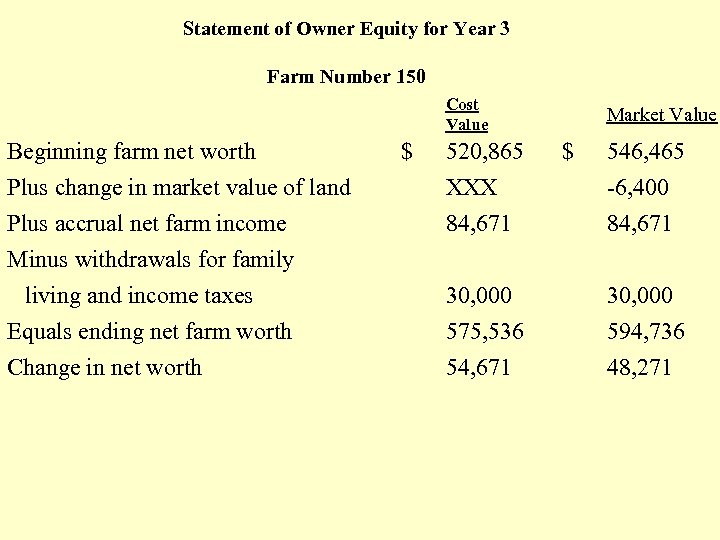

Statement of Owner Equity for Year 3 Farm Number 150 Cost Value Market Value Beginning farm net worth $ 520, 865 $ 546, 465 Plus change in market value of land XXX -6, 400 Plus accrual net farm income 84, 671 Minus withdrawals for family living and income taxes 30, 000 Equals ending net farm worth 575, 536 594, 736 Change in net worth 54, 671 48, 271

Statement of Owner Equity for Year 3 Farm Number 150 Cost Value Market Value Beginning farm net worth $ 520, 865 $ 546, 465 Plus change in market value of land XXX -6, 400 Plus accrual net farm income 84, 671 Minus withdrawals for family living and income taxes 30, 000 Equals ending net farm worth 575, 536 594, 736 Change in net worth 54, 671 48, 271

Single and Double-Entry Accounting • Single Entry: record only income and expenses • Double Entry: record changes to assets and liabilities as you go (credits and debits)

Single and Double-Entry Accounting • Single Entry: record only income and expenses • Double Entry: record changes to assets and liabilities as you go (credits and debits)

Advantages to Double Entry • Net Worth Statement is always up to date. • Can check accuracy by comparing account values to actual balances and inventories. • Accrual adjustments are made automatically

Advantages to Double Entry • Net Worth Statement is always up to date. • Can check accuracy by comparing account values to actual balances and inventories. • Accrual adjustments are made automatically

Double-Entry Example 1. Harvest grain and sell it +Increase Grain Sales account (income) +Increase Cash on Hand account (asset) 2. Buy skid loader for cash + Increase Machinery account (asset) – Decrease Cash on Hand account (asset)

Double-Entry Example 1. Harvest grain and sell it +Increase Grain Sales account (income) +Increase Cash on Hand account (asset) 2. Buy skid loader for cash + Increase Machinery account (asset) – Decrease Cash on Hand account (asset)

Double-entry Examples 3. Pay back cattle loan--principal – Reduce Cash on Hand account (asset) – Reduce Bank Loan account (liability) 4. Pay electric bill – Reduce Cash on Hand account (asset) + Increase Utilities Expense account (expense)

Double-entry Examples 3. Pay back cattle loan--principal – Reduce Cash on Hand account (asset) – Reduce Bank Loan account (liability) 4. Pay electric bill – Reduce Cash on Hand account (asset) + Increase Utilities Expense account (expense)