тема Investment market the lastest version 9 November.ppt

- Количество слайдов: 80

Fall Semester, 2016 Financial and Economical Faculty Department of Finance, Banking & Insurance Lecturer Remnova Lyudmyla, Ph. D in Economics, Professor

Fall Semester, 2016 Financial and Economical Faculty Department of Finance, Banking & Insurance Lecturer Remnova Lyudmyla, Ph. D in Economics, Professor

Topic # 5 Investment Market

Topic # 5 Investment Market

We have guests ))) • You are WELLCOME !!!

We have guests ))) • You are WELLCOME !!!

Main questions 1. Investment Market and its Functions 2. Investment Market Structure 3. Investment Market Evaluation 4. Investment Attractiveness : Country, Branch, Region

Main questions 1. Investment Market and its Functions 2. Investment Market Structure 3. Investment Market Evaluation 4. Investment Attractiveness : Country, Branch, Region

What are the primary studying goals? • Acquaintance with the basic concepts, characteristics and functions of investment market. • Studying of basics of investment market cycles, technical analysis, the main factors of influence. • Practical mastering in analyzing Ukrainian investment attractiveness

What are the primary studying goals? • Acquaintance with the basic concepts, characteristics and functions of investment market. • Studying of basics of investment market cycles, technical analysis, the main factors of influence. • Practical mastering in analyzing Ukrainian investment attractiveness

FORBES # 2 , 2012

FORBES # 2 , 2012

Зв’язок з іншими темами How this topic is connected та дисциплінами with other topics and subjects?

Зв’язок з іншими темами How this topic is connected та дисциплінами with other topics and subjects?

Recommendations for students’ home-work

Recommendations for students’ home-work

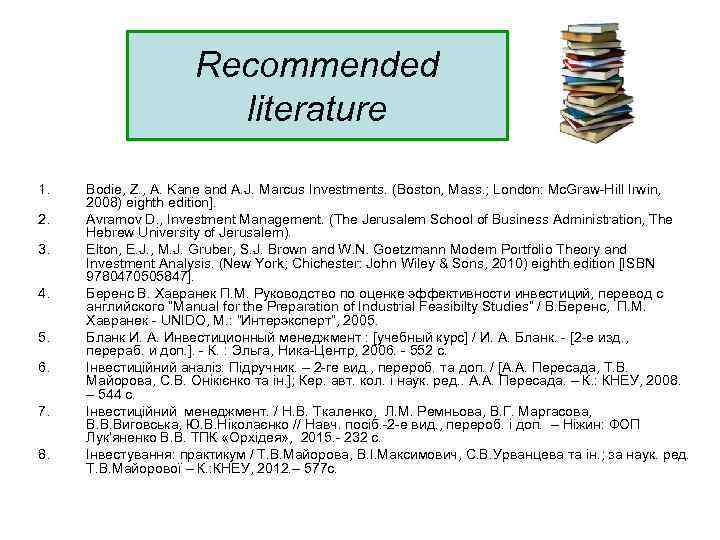

Recommended literature 1. 2. 3. 4. 5. 6. 7. 8. Bodie, Z. , A. Kane and A. J. Marcus Investments. (Boston, Mass. ; London: Mc. Graw-Hill Irwin, 2008) eighth edition]. Avramov D. , Investment Management. (The Jerusalem School of Business Administration, The Hebrew University of Jerusalem). Elton, E. J. , M. J. Gruber, S. J. Brown and W. N. Goetzmann Modern Portfolio Theory and Investment Analysis. (New York; Chichester: John Wiley & Sons, 2010) eighth edition [ISBN 9780470505847]. Беренс В. Хавранек П. М. Руководство по оценке эффективности инвестиций, перевод с английского “Manual for the Preparation of Industrial Feasibilty Studies” / В. Беренс, П. М. Хавранек - UNIDO, М. : “Интерэксперт”, 2005. Бланк И. А. Инвестиционный менеджмент : [учебный курс] / И. А. Бланк. - [2 -е изд. , перераб. и доп. ]. - К. : Эльга, Ника-Центр, 2006. - 552 с. Інвестиційний аналіз: Підручник. – 2 -ге вид. , перероб. та доп. / [А. А. Пересада, Т. В. Майорова, С. В. Онікієнко та ін. ]; Кер. авт. кол. і наук. ред. . А. А. Пересада. – К. : КНЕУ, 2008. – 544 с. Інвестиційний менеджмент. / Н. В. Ткаленко, Л. М. Ремньова, В. Г. Маргасова, В. В. Виговська, Ю. В. Ніколаєнко // Навч. посіб. -2 -е вид. , перероб. і доп. – Ніжин: ФОП Лук’яненко В. В. ТПК «Орхідея» , 2015. - 232 с. Інвестування: практикум / Т. В. Майорова, В. І. Максимович, С. В. Урванцева та ін. ; за наук. ред. Т. В. Майорової – К. : КНЕУ, 2012. – 577 с.

Recommended literature 1. 2. 3. 4. 5. 6. 7. 8. Bodie, Z. , A. Kane and A. J. Marcus Investments. (Boston, Mass. ; London: Mc. Graw-Hill Irwin, 2008) eighth edition]. Avramov D. , Investment Management. (The Jerusalem School of Business Administration, The Hebrew University of Jerusalem). Elton, E. J. , M. J. Gruber, S. J. Brown and W. N. Goetzmann Modern Portfolio Theory and Investment Analysis. (New York; Chichester: John Wiley & Sons, 2010) eighth edition [ISBN 9780470505847]. Беренс В. Хавранек П. М. Руководство по оценке эффективности инвестиций, перевод с английского “Manual for the Preparation of Industrial Feasibilty Studies” / В. Беренс, П. М. Хавранек - UNIDO, М. : “Интерэксперт”, 2005. Бланк И. А. Инвестиционный менеджмент : [учебный курс] / И. А. Бланк. - [2 -е изд. , перераб. и доп. ]. - К. : Эльга, Ника-Центр, 2006. - 552 с. Інвестиційний аналіз: Підручник. – 2 -ге вид. , перероб. та доп. / [А. А. Пересада, Т. В. Майорова, С. В. Онікієнко та ін. ]; Кер. авт. кол. і наук. ред. . А. А. Пересада. – К. : КНЕУ, 2008. – 544 с. Інвестиційний менеджмент. / Н. В. Ткаленко, Л. М. Ремньова, В. Г. Маргасова, В. В. Виговська, Ю. В. Ніколаєнко // Навч. посіб. -2 -е вид. , перероб. і доп. – Ніжин: ФОП Лук’яненко В. В. ТПК «Орхідея» , 2015. - 232 с. Інвестування: практикум / Т. В. Майорова, В. І. Максимович, С. В. Урванцева та ін. ; за наук. ред. Т. В. Майорової – К. : КНЕУ, 2012. – 577 с.

Internet resources 1. 2. 3. 4. 5. The 13 th Yalta European Strategy Annual Meeting entitled “The World, Europe and Ukraine: storms of changes” http: //yes-ukraine. org/en/photoand-video/13 -a-shchorichna-zustrich-yes/globalne-bachennyazagrozi-innovatsiyi-ekonomika UAIB Analytical Review of the Collective Investments Market in Ukraine Q 4 2015 & Full 2015 http: //www. uaib. com. ua/eng/analituaib/publ_ici_quart/238580. html TOP 10 reasons why Ukraine dropped scores in Global Competitiveness Index https: //www. stockworld. com. ua/en/column/top-10 -reasons-whyukraine-dropped-scores-in-global-competitiveness-index #Stock. World Volodymyr Groysman about the newly established Investment Support Office http: //www. kmu. gov. ua/control/publish/article? art_id=249415084 BREXIT: Medium Term Perspectives and Global Insights https: //www. ampcapital. com. au/article-detail? . . . /brexit-insigh.

Internet resources 1. 2. 3. 4. 5. The 13 th Yalta European Strategy Annual Meeting entitled “The World, Europe and Ukraine: storms of changes” http: //yes-ukraine. org/en/photoand-video/13 -a-shchorichna-zustrich-yes/globalne-bachennyazagrozi-innovatsiyi-ekonomika UAIB Analytical Review of the Collective Investments Market in Ukraine Q 4 2015 & Full 2015 http: //www. uaib. com. ua/eng/analituaib/publ_ici_quart/238580. html TOP 10 reasons why Ukraine dropped scores in Global Competitiveness Index https: //www. stockworld. com. ua/en/column/top-10 -reasons-whyukraine-dropped-scores-in-global-competitiveness-index #Stock. World Volodymyr Groysman about the newly established Investment Support Office http: //www. kmu. gov. ua/control/publish/article? art_id=249415084 BREXIT: Medium Term Perspectives and Global Insights https: //www. ampcapital. com. au/article-detail? . . . /brexit-insigh.

Write an essay 1: What is the influence of political factors on the investment market situation? • Brexit ? • The US election 2016 ?

Write an essay 1: What is the influence of political factors on the investment market situation? • Brexit ? • The US election 2016 ?

Write an essay 2: Why should you invest in Ukraine and in what branches and regions exactly?

Write an essay 2: Why should you invest in Ukraine and in what branches and regions exactly?

1. Investment Market and its Functions

1. Investment Market and its Functions

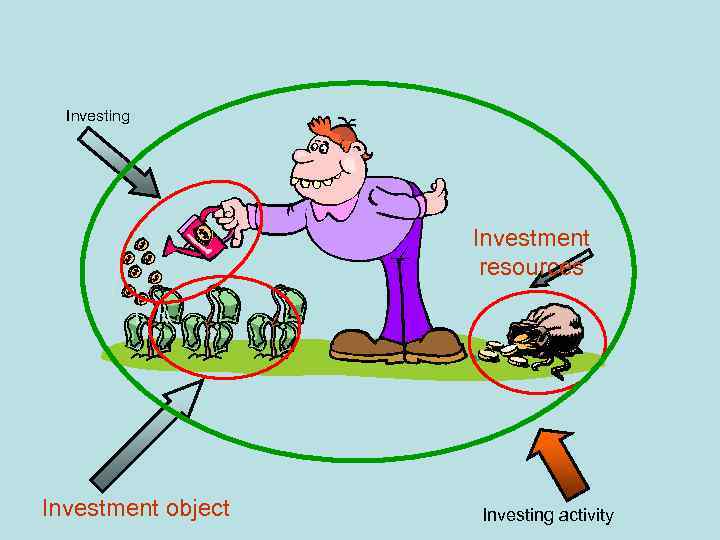

Investing Investment resources Investment object Investing activity

Investing Investment resources Investment object Investing activity

What are the main market levers?

What are the main market levers?

How can we definite ‘INVESTMENT MARKET’?

How can we definite ‘INVESTMENT MARKET’?

INVESTMENT MARKET – the system of economic relations concerning buying or selling investment products and services on market ‘ prices that are formed by demand /supply ratio on the competitive base

INVESTMENT MARKET – the system of economic relations concerning buying or selling investment products and services on market ‘ prices that are formed by demand /supply ratio on the competitive base

What are the main investment market functions?

What are the main investment market functions?

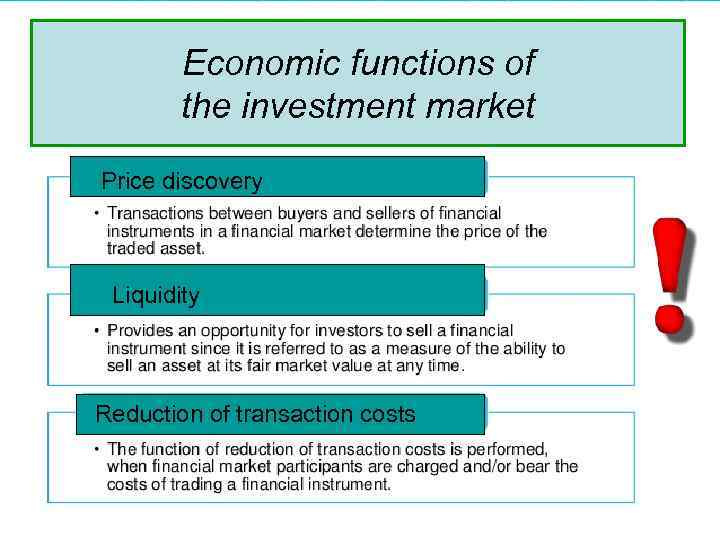

Economic functions of the investment market Price discovery Liquidity Reduction of transaction costs

Economic functions of the investment market Price discovery Liquidity Reduction of transaction costs

Tree pillars • Price discovery • Liquidity • Reduction of transaction costs WHAT ELSE

Tree pillars • Price discovery • Liquidity • Reduction of transaction costs WHAT ELSE

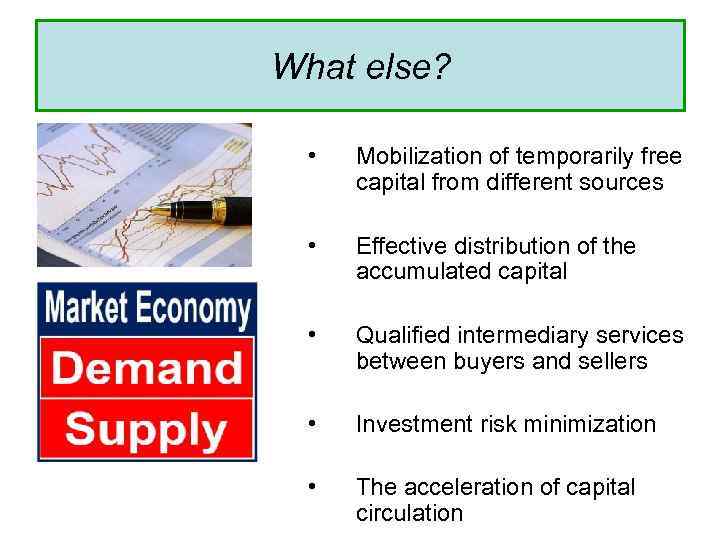

What else? • • Mobilization of temporarily free capital from different sources Effective distribution of the accumulated capital • Qualified intermediary services between buyers and sellers • Investment risk minimization • The acceleration of capital circulation

What else? • • Mobilization of temporarily free capital from different sources Effective distribution of the accumulated capital • Qualified intermediary services between buyers and sellers • Investment risk minimization • The acceleration of capital circulation

How The Stock Exchange Works - You. Tube https: //www. youtube. com/watch? v=F 3 Qpg. XBt. Deo What are the main functions of the stock exchange ? Is it effective market place ?

How The Stock Exchange Works - You. Tube https: //www. youtube. com/watch? v=F 3 Qpg. XBt. Deo What are the main functions of the stock exchange ? Is it effective market place ?

What Does a Bull and Bear Mean in the Stock Market - You. Tube https: //www. youtube. com/watch? v=1 x. AQLl v. EIo. Q What market is called bullish market? What market is called bearish market? What market is more desirable for investors?

What Does a Bull and Bear Mean in the Stock Market - You. Tube https: //www. youtube. com/watch? v=1 x. AQLl v. EIo. Q What market is called bullish market? What market is called bearish market? What market is more desirable for investors?

2. Investment Market Structure

2. Investment Market Structure

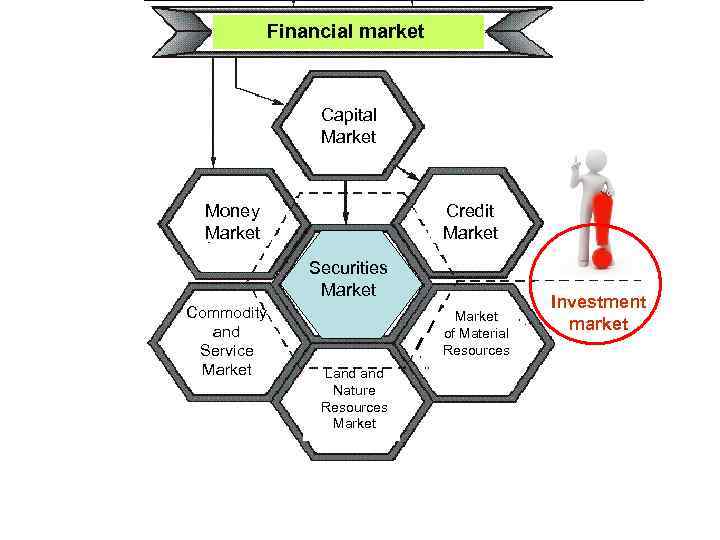

Financial market Capital market Money Market Credit Market Securities Market Commodity and Service Market of Material Resources Land Nature Resources Market Investment market

Financial market Capital market Money Market Credit Market Securities Market Commodity and Service Market of Material Resources Land Nature Resources Market Investment market

Investment market structure

Investment market structure

Classification features • By investment type: real investment market, financial investment market • By region: local, regional, national, international, global • By the conditions of capital circulation: primary, secondary • By the level of organization: organized, non-organized • 4 types of market structure

Classification features • By investment type: real investment market, financial investment market • By region: local, regional, national, international, global • By the conditions of capital circulation: primary, secondary • By the level of organization: organized, non-organized • 4 types of market structure

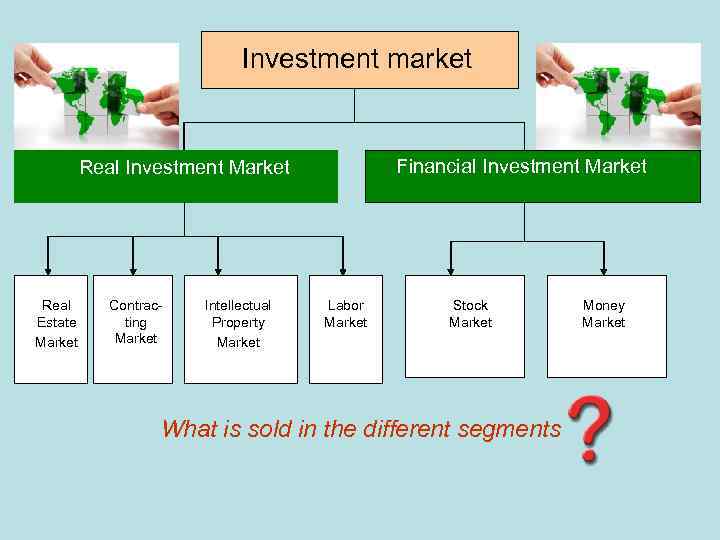

Investment market Financial Investment Market Real Estate Market Contracting Market Intellectual Property Market Labor Market Stock Market What is sold in the different segments Money Market

Investment market Financial Investment Market Real Estate Market Contracting Market Intellectual Property Market Labor Market Stock Market What is sold in the different segments Money Market

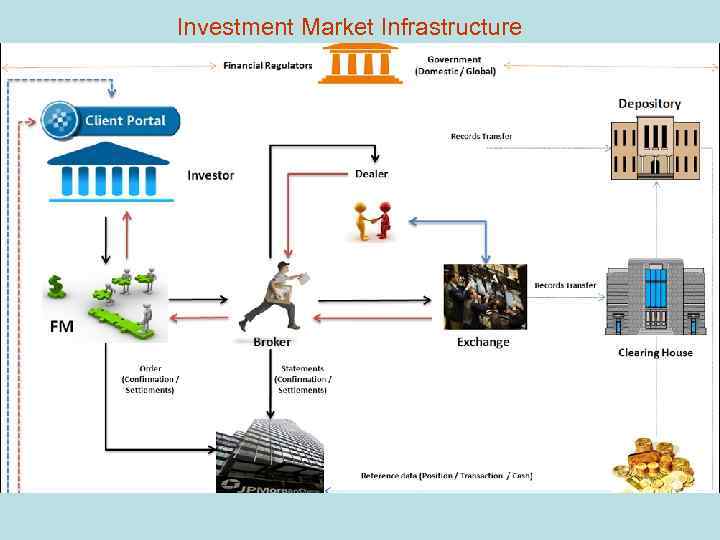

Investment Market Infrastructure

Investment Market Infrastructure

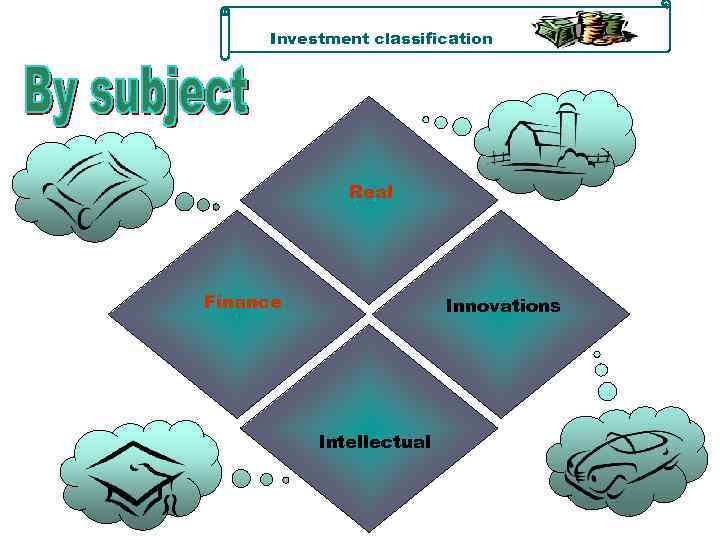

Investment classification Real Finance Innovations Intellectual

Investment classification Real Finance Innovations Intellectual

What other institutions refer to the investment market infrastructure?

What other institutions refer to the investment market infrastructure?

Investment market infrastructure • • • • Banks Insurance companies Construction companies Leasing companies Securities traders Stock and commodity exchanges Asset management companies (AMC) Non-state pension funds (NPF) Depository institutions Collective Investment Institutions (CII) Self-regulatory organizations (SRО) Rating agencies Marketing agencies etc.

Investment market infrastructure • • • • Banks Insurance companies Construction companies Leasing companies Securities traders Stock and commodity exchanges Asset management companies (AMC) Non-state pension funds (NPF) Depository institutions Collective Investment Institutions (CII) Self-regulatory organizations (SRО) Rating agencies Marketing agencies etc.

3. Investment Market Evaluation

3. Investment Market Evaluation

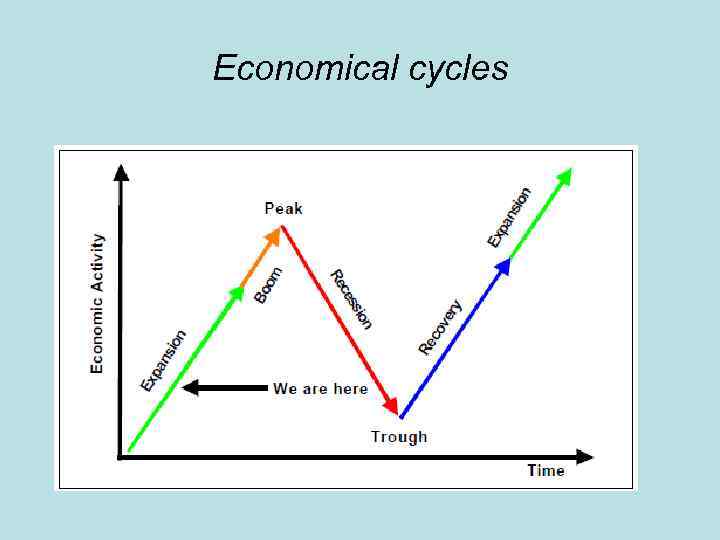

Economical cycles

Economical cycles

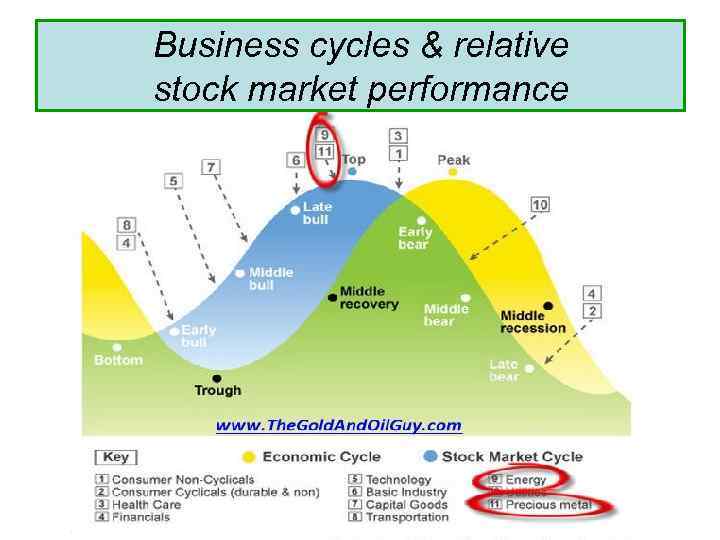

Business cycles & relative stock market performance

Business cycles & relative stock market performance

Cycles + behavior

Cycles + behavior

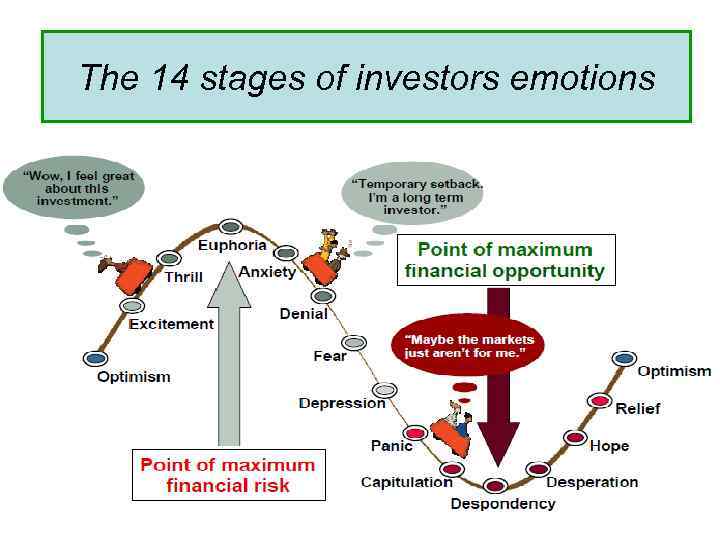

The 14 stages of investors emotions

The 14 stages of investors emotions

The 14 stages of investors emotions Optimism – A positive outlook encourages us about the future, leading us to buy stocks. Excitement – Having seen some of our initial ideas work, we begin considering what our market success could allow us to accomplish. Thrill – At this point we investors cannot believe our success and begin to comment on how smart we are. Euphoria – This marks the point of maximum financial risk. Having seen every decision result in quick, easy profits, we begin to ignore risk and expect every trade to become profitable. Anxiety – For the first time the market moves against us. Having never stared at unrealized losses, we tell ourselves we are long-term investors and that all our ideas will eventually work. Denial – When markets have not rebounded, yet we do not know how to respond, we begin denying either that we made poor choices or that things will not improve shortly. Fear – The market realities become confusing. We believe the stocks we own will never move in our favour. Desperation – Not knowing how to act, we grasp at any idea that will allow us to get back to break even. Panic – Having exhausted all ideas, we are at a loss for what to do next. Capitulation – Deciding our portfolio will never increase again, we sell all our stocks to avoid any future losses. Despondency – After exiting the markets we do not want to buy stocks ever again. This often marks the moment of greatest financial opportunity. Depression – Not knowing how we could be so foolish, we are left trying to understand our actions. Hope – Eventually we return to the realization that markets move in cycles, and we begin looking for our next opportunity. Relief – Having bought a stock that turned profitable, we renew our faith that there is a future in investing.

The 14 stages of investors emotions Optimism – A positive outlook encourages us about the future, leading us to buy stocks. Excitement – Having seen some of our initial ideas work, we begin considering what our market success could allow us to accomplish. Thrill – At this point we investors cannot believe our success and begin to comment on how smart we are. Euphoria – This marks the point of maximum financial risk. Having seen every decision result in quick, easy profits, we begin to ignore risk and expect every trade to become profitable. Anxiety – For the first time the market moves against us. Having never stared at unrealized losses, we tell ourselves we are long-term investors and that all our ideas will eventually work. Denial – When markets have not rebounded, yet we do not know how to respond, we begin denying either that we made poor choices or that things will not improve shortly. Fear – The market realities become confusing. We believe the stocks we own will never move in our favour. Desperation – Not knowing how to act, we grasp at any idea that will allow us to get back to break even. Panic – Having exhausted all ideas, we are at a loss for what to do next. Capitulation – Deciding our portfolio will never increase again, we sell all our stocks to avoid any future losses. Despondency – After exiting the markets we do not want to buy stocks ever again. This often marks the moment of greatest financial opportunity. Depression – Not knowing how we could be so foolish, we are left trying to understand our actions. Hope – Eventually we return to the realization that markets move in cycles, and we begin looking for our next opportunity. Relief – Having bought a stock that turned profitable, we renew our faith that there is a future in investing.

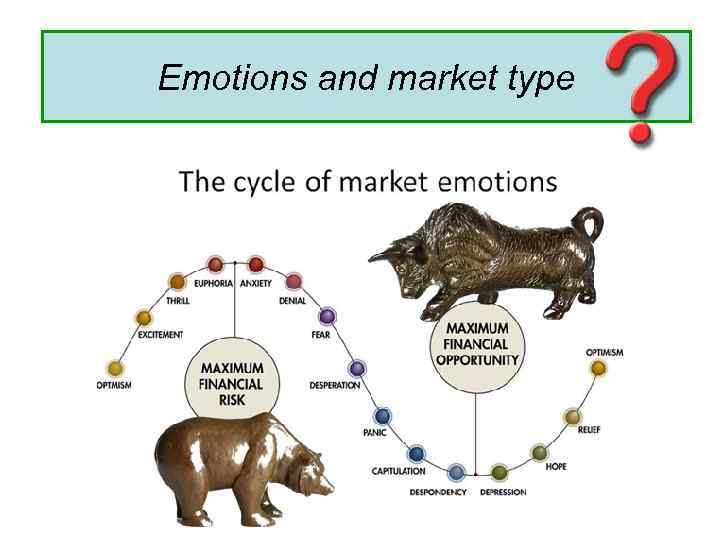

Emotions and market type

Emotions and market type

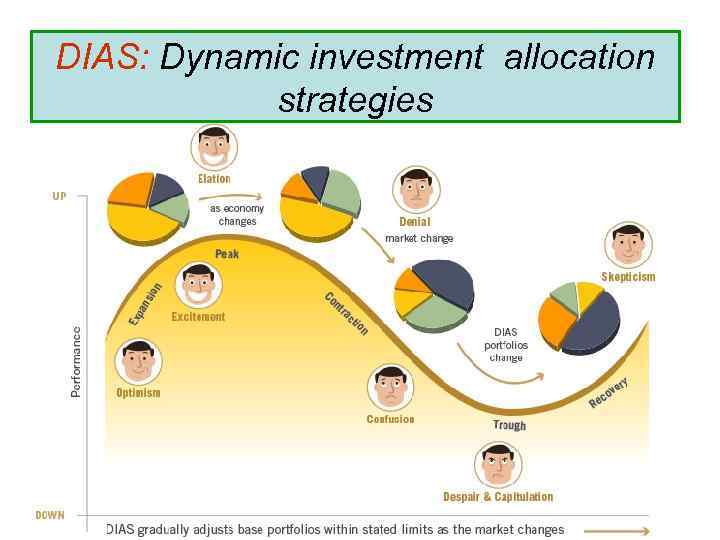

DIAS: Dynamic investment allocation strategies

DIAS: Dynamic investment allocation strategies

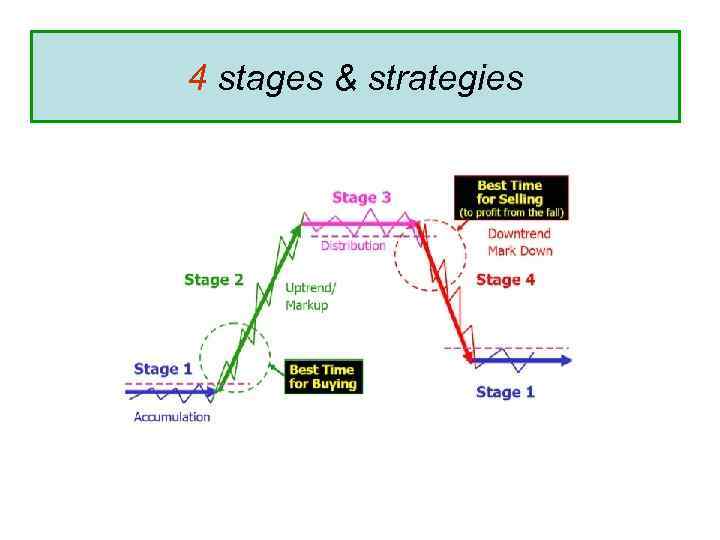

4 stages & strategies

4 stages & strategies

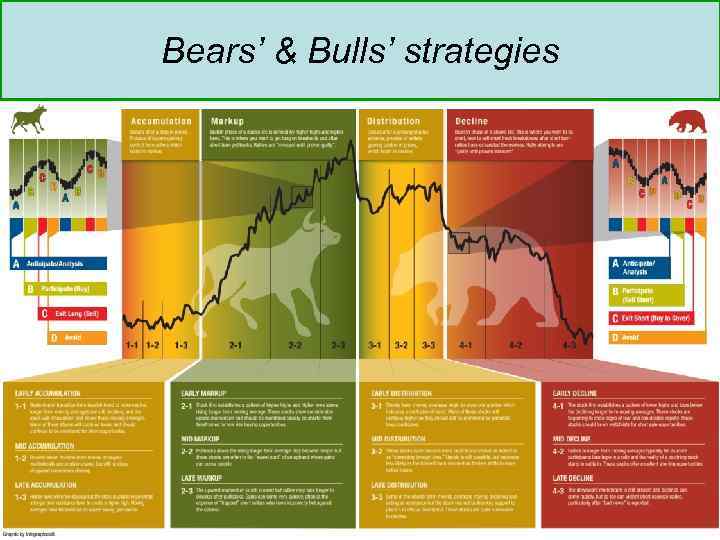

Bears’ & Bulls’ strategies

Bears’ & Bulls’ strategies

Market index • An index is an indicator or measure of something, and in finance, it typically refers to a statistical measure of change in a securities market. • Estimates the likely level of sales using important market factors in combination.

Market index • An index is an indicator or measure of something, and in finance, it typically refers to a statistical measure of change in a securities market. • Estimates the likely level of sales using important market factors in combination.

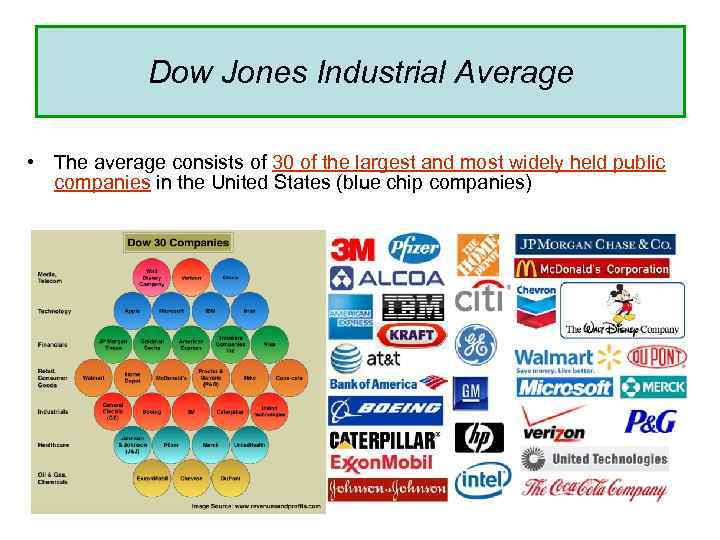

Dow Jones Industrial Average • The average consists of 30 of the largest and most widely held public companies in the United States (blue chip companies)

Dow Jones Industrial Average • The average consists of 30 of the largest and most widely held public companies in the United States (blue chip companies)

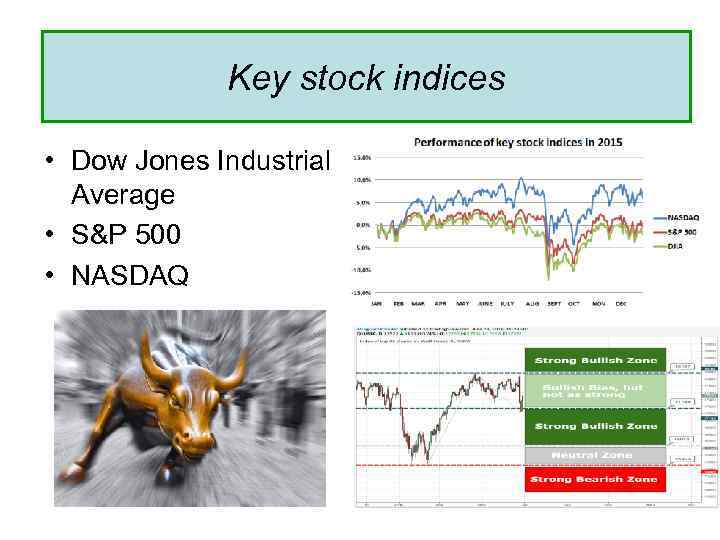

Key stock indices • Dow Jones Industrial Average • S&P 500 • NASDAQ

Key stock indices • Dow Jones Industrial Average • S&P 500 • NASDAQ

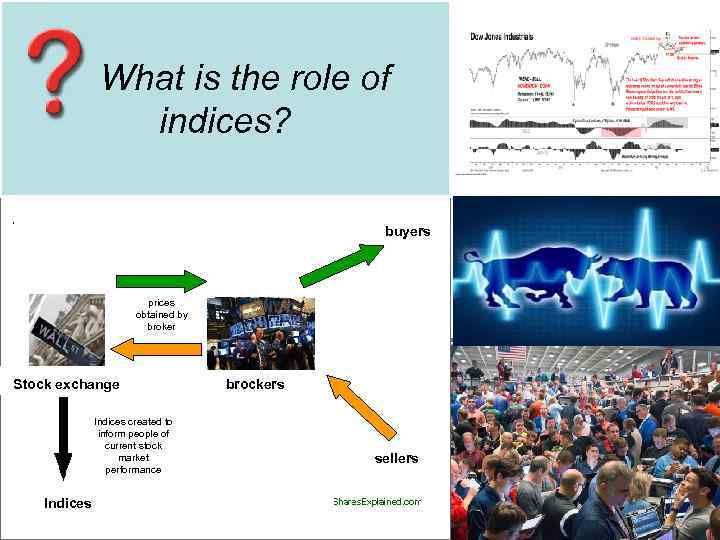

What is the role of indices? buyers prices obtained by broker Stock exchange Indices created to inform people of current stock market performance Indices brockers sellers

What is the role of indices? buyers prices obtained by broker Stock exchange Indices created to inform people of current stock market performance Indices brockers sellers

What is the Stock Index – You Tube https: //www. youtube. com/watc h? v=EQ-67 ud. ZEeg What stock indices do you know? What stock indices are used in Ukraine?

What is the Stock Index – You Tube https: //www. youtube. com/watc h? v=EQ-67 ud. ZEeg What stock indices do you know? What stock indices are used in Ukraine?

What do the stock indices show?

What do the stock indices show?

Investment market evaluation • Technical analysis - the forecasting of future financial price movements based on an examination of past price movements. What is the price? Where has it been? Where is it going? When to sell? When to buy? When to hold?

Investment market evaluation • Technical analysis - the forecasting of future financial price movements based on an examination of past price movements. What is the price? Where has it been? Where is it going? When to sell? When to buy? When to hold?

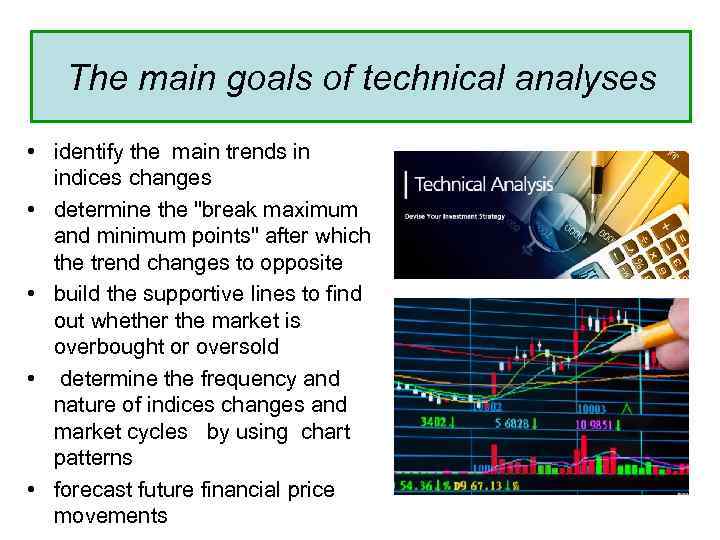

The main goals of technical analyses • identify the main trends in indices changes • determine the "break maximum and minimum points" after which the trend changes to opposite • build the supportive lines to find out whether the market is overbought or oversold • determine the frequency and nature of indices changes and market cycles by using chart patterns • forecast future financial price movements

The main goals of technical analyses • identify the main trends in indices changes • determine the "break maximum and minimum points" after which the trend changes to opposite • build the supportive lines to find out whether the market is overbought or oversold • determine the frequency and nature of indices changes and market cycles by using chart patterns • forecast future financial price movements

Investing Basics: Technical Analysis – You Tube https: //www. youtube. com/wa tch? v=nm 38 oig. Lv-U What instruments are used for technical analyses of the investment market? Can we completely believe such forecasts?

Investing Basics: Technical Analysis – You Tube https: //www. youtube. com/wa tch? v=nm 38 oig. Lv-U What instruments are used for technical analyses of the investment market? Can we completely believe such forecasts?

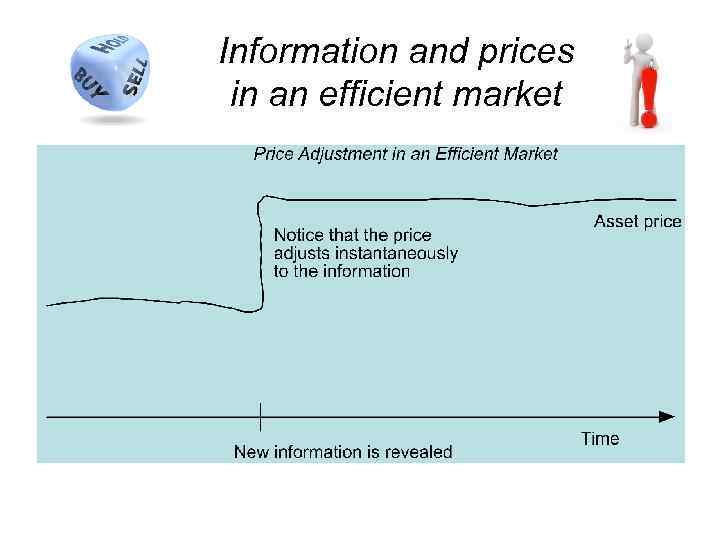

Information and prices in an efficient market

Information and prices in an efficient market

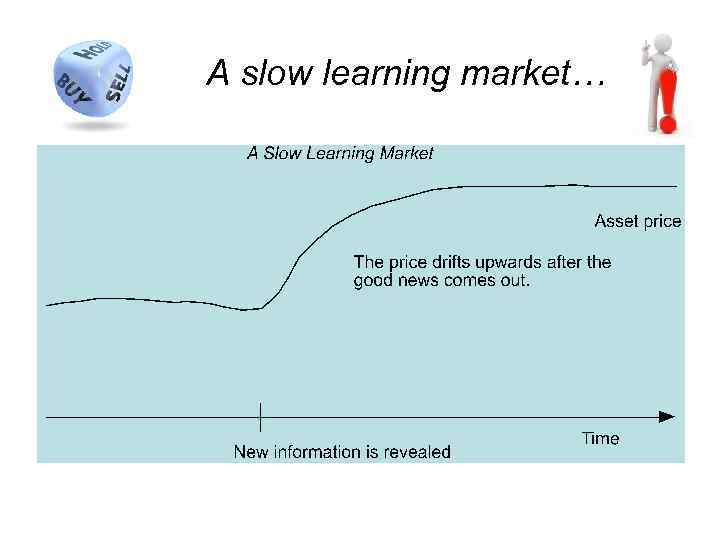

A slow learning market…

A slow learning market…

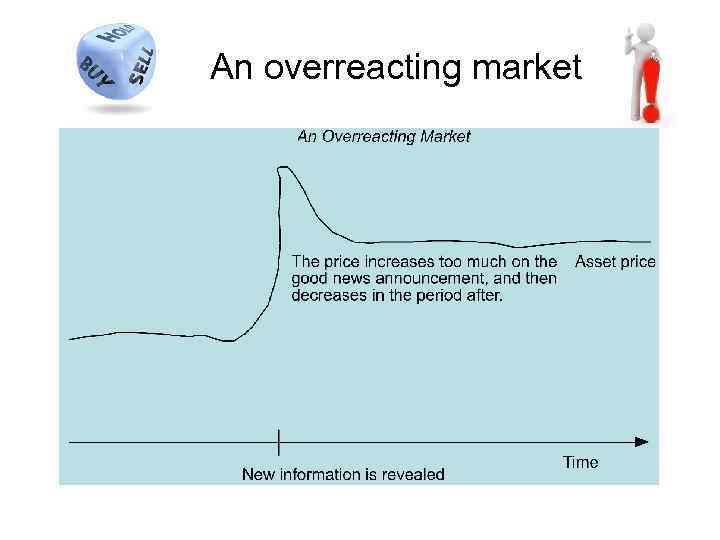

An overreacting market

An overreacting market

Write an essay: What is the influence of political factors on the investment market situation? • Brexit ? • The US election 2016 ?

Write an essay: What is the influence of political factors on the investment market situation? • Brexit ? • The US election 2016 ?

4. Investment Attractiveness : country, branch, region

4. Investment Attractiveness : country, branch, region

WHY SHOULD YOU INVEST IN

WHY SHOULD YOU INVEST IN

Reasons to invest in Ukraine

Reasons to invest in Ukraine

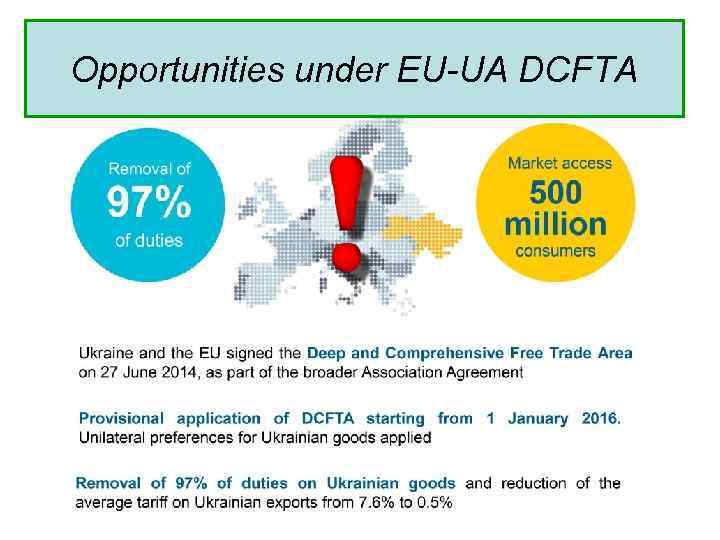

Opportunities under EU-UA DCFTA

Opportunities under EU-UA DCFTA

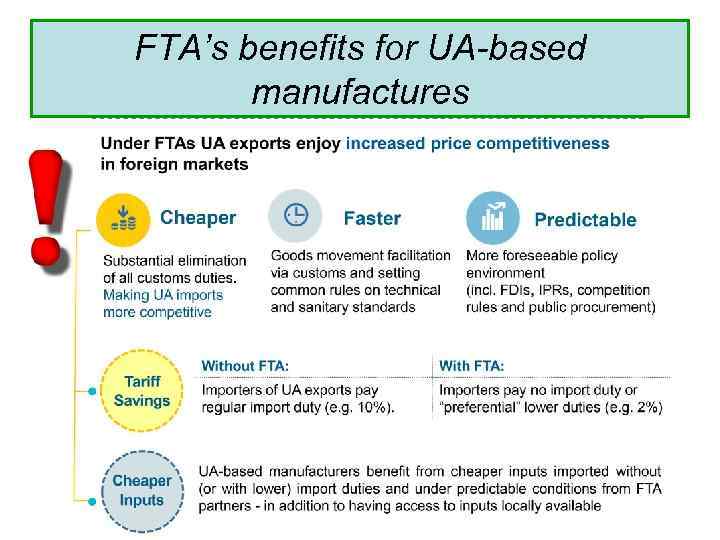

FTA’s benefits for UA-based manufactures

FTA’s benefits for UA-based manufactures

Highly skilled human capital

Highly skilled human capital

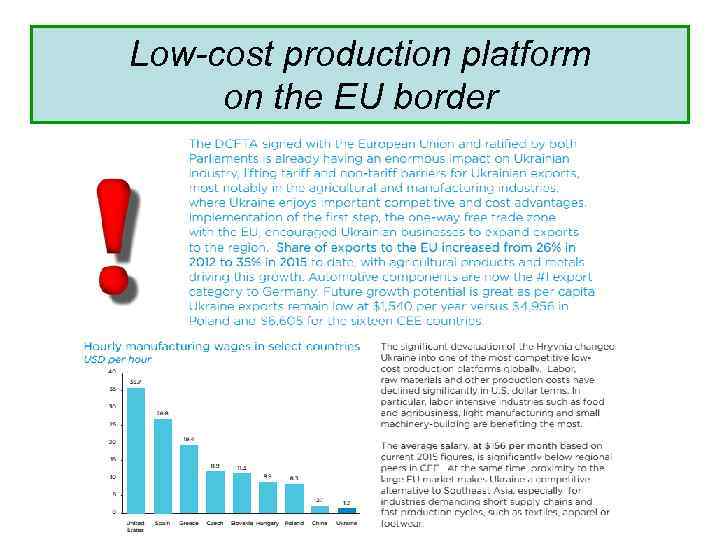

Low-cost production platform on the EU border

Low-cost production platform on the EU border

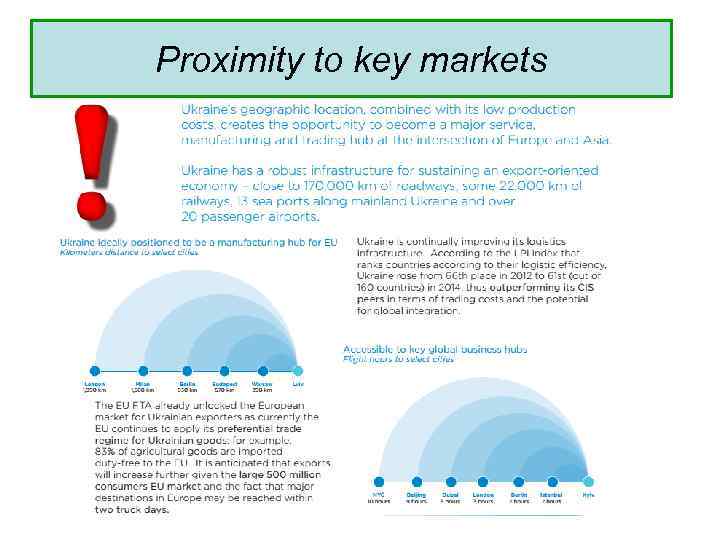

Proximity to key markets

Proximity to key markets

Availability of competitive industries • • • Agribusiness Complex engineering Energetics ІТ-industry Tourism

Availability of competitive industries • • • Agribusiness Complex engineering Energetics ІТ-industry Tourism

Ukranian sectors with attractive returns for investors

Ukranian sectors with attractive returns for investors

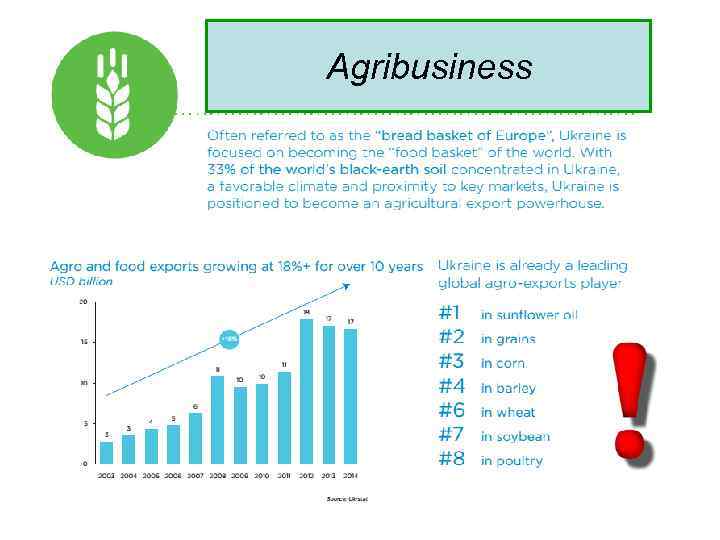

Agribusiness

Agribusiness

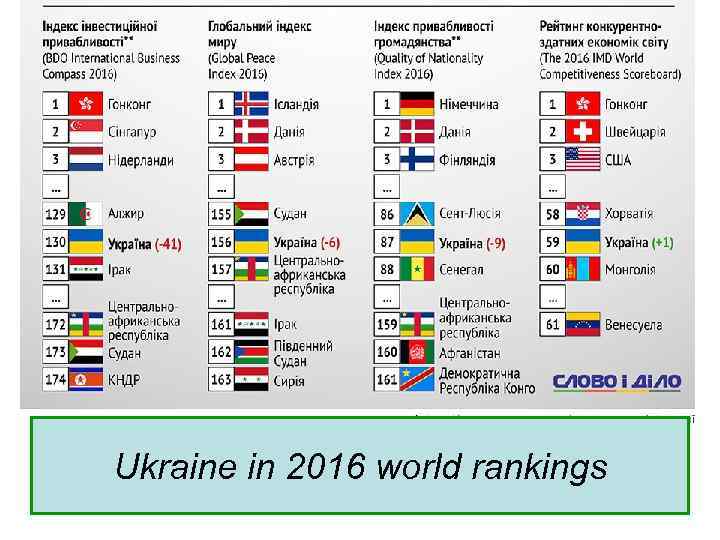

Ukraine in 2016 world rankings

Ukraine in 2016 world rankings

Ukraine in 2016 world rankings

Ukraine in 2016 world rankings

83 46 17 2015 2016 2017 NEW! • Investment Support Office of Ukraine (19/10/2016)

83 46 17 2015 2016 2017 NEW! • Investment Support Office of Ukraine (19/10/2016)

WHY SHOULD YOU INVEST IN

WHY SHOULD YOU INVEST IN

Why should you invest in Ukraine? • Excellent geographical location and FTA’s benefits • Large iternal market and proximity to key EU markets • Qualified and available labor force • Low-cost production platform on the EU border • Availability of competitive industries WHAT ELSE?

Why should you invest in Ukraine? • Excellent geographical location and FTA’s benefits • Large iternal market and proximity to key EU markets • Qualified and available labor force • Low-cost production platform on the EU border • Availability of competitive industries WHAT ELSE?

Why should you invest in Ukraine? • War conflict in the eastern Ukraine • Vulnerable banking system, 83 banks on liquidation • Unstable law system • None tax exemptions and noneffective economic zones • Corruption • WHAT ELSE?

Why should you invest in Ukraine? • War conflict in the eastern Ukraine • Vulnerable banking system, 83 banks on liquidation • Unstable law system • None tax exemptions and noneffective economic zones • Corruption • WHAT ELSE?

Ukraine, open for U– You Tube https: //www. youtube. com/wa tch? v=jd. SQuan. I 8 Z 8 Are the positive reasons stronger than the negative ones? How to increase the flow of FDI to Ukraine?

Ukraine, open for U– You Tube https: //www. youtube. com/wa tch? v=jd. SQuan. I 8 Z 8 Are the positive reasons stronger than the negative ones? How to increase the flow of FDI to Ukraine?