8a3c3b01a4bc1b9f3a8eb92b061f7704.ppt

- Количество слайдов: 59

Extra! Browse All About It! The Evolution of Circulars from Print to Digital Todd Hale SVP, Consumer & Shopper Insights December 1, 2011 1

Today’s presenter Todd Hale SVP, Consumer & Shopper Insights, Nielsen Todd Hale serves as Senior Vice President, Consumer & Shopper Insights for The Nielsen Company. Appointed to this role in 1999, Todd is responsible for creating thought leadership content and delivering client and industry presentations. A frequently soughtafter industry and client speaker, Todd shares his insights on consumer shopping, buying and media consumption behaviors and attitudes to provide manufacturers and retailers with strategic visions to facilitate brand, category and retail sales growth. Hale is often quoted in the press and in numerous trade publications on consumer trends. Todd has more than 33 years of experience in the consumer research industry, including 27 years with The Nielsen Company, where he held various marketing and sales management positions within advertising/product testing, advanced analytics and consumer panel practice areas. Prior to joining Nielsen in 1984, Todd was an executive with MRCA, a U. S. -based consumer panel company. Todd earned an MBA and a BA in Business from Wright State University. 2 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

“There is a delicate balance in the shift from print to digital. All customers will not migrate to the digital world at the same rate. It will be important to test and learn to understand overall acceptance in order to protect sales and profitability. ” - Erik Keptner AHOLD “What makes the online circular exciting to our business is less about rendering the existing circular on our website, but rather having the circular in a digital feed that can be published in different formats across multiple sites and devices. ” - Kat Kozitza SUPERVALU 3 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Circulars help shoppers plan, but manufacturers & retailers recognize additional digital benefits 1 2 Mfr & Paper • Critical as pre-planner • Slow, costly, & rigid • ¾ decisions made prior to store • Will play a role for some time • 50% use to make lists • Requires digital complements • Savings & eating link to brands 3 Mfr & Digital • Item/price shopping easy Retail & Paper • Less relevant as young grow up Manufacturer & Retailer POV 4 Retail & Digital • Far less costly • Complements paper • Multiple screens • Requires overarching message • Rethink promo cycle • Inspires menu planning • Dissects item / price • Planning > list > shopping • Data > Creative Source: Joe De. Petrillo, Nestle; Donald Smith, Family Dollar; unidentified retailer 4 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

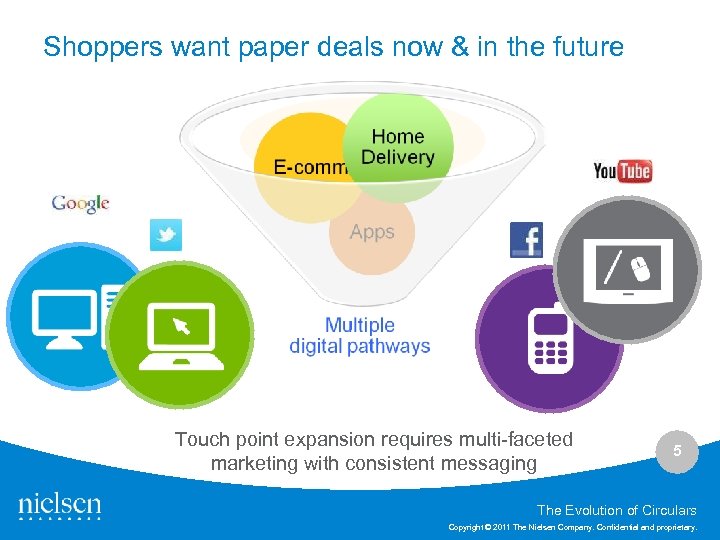

Shoppers want paper deals now & in the future Touch point expansion requires multi-faceted marketing with consistent messaging 5 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

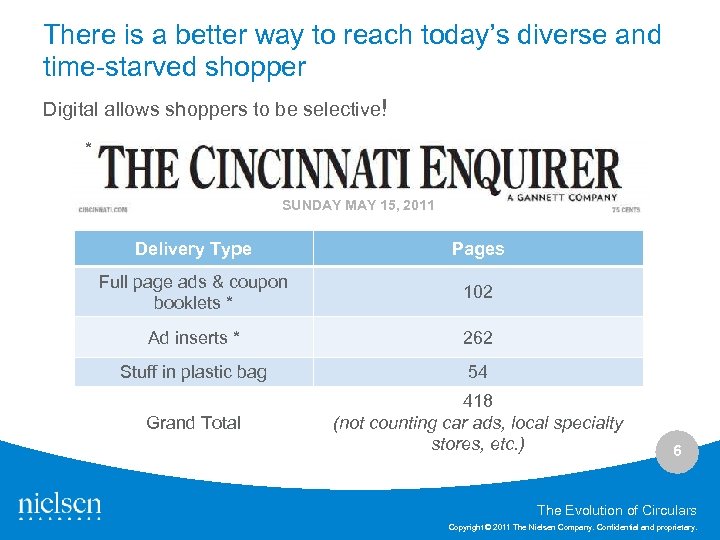

There is a better way to reach today’s diverse and time-starved shopper Digital allows shoppers to be selective! * SUNDAY MAY 15, 2011 Delivery Type Pages Full page ads & coupon booklets * 102 Ad inserts * 262 Stuff in plastic bag 54 Grand Total 418 (not counting car ads, local specialty stores, etc. ) 6 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

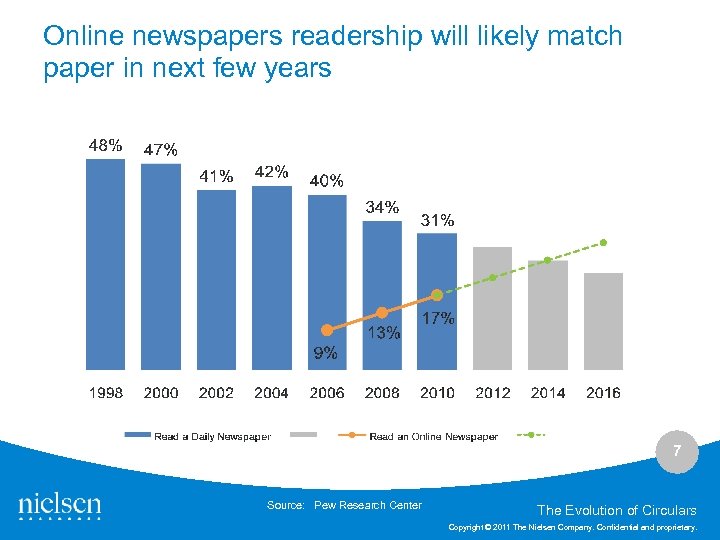

Online newspapers readership will likely match paper in next few years 7 Source: Pew Research Center The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

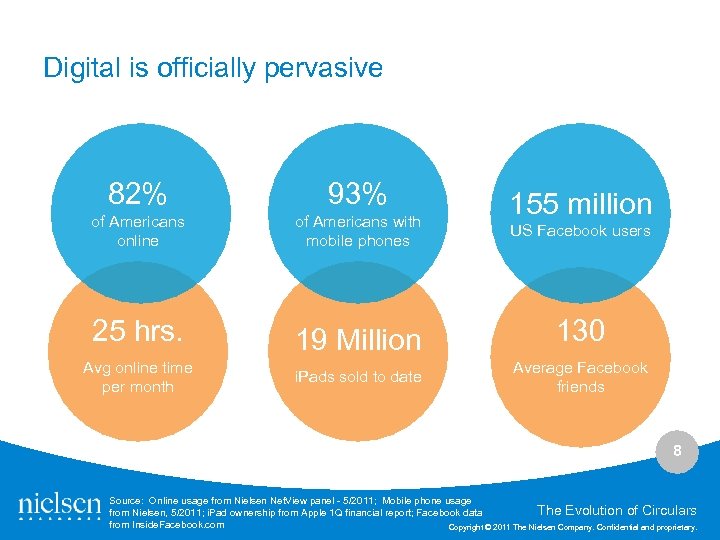

Digital is officially pervasive 82% 93% of Americans online of Americans with mobile phones 25 hrs. Avg online time per month 19 Million i. Pads sold to date 155 million US Facebook users 130 Average Facebook friends 8 Source: Online usage from Nielsen Net. View panel - 5/2011; Mobile phone usage The Evolution of Circulars from Nielsen, 5/2011; i. Pad ownership from Apple 1 Q financial report; Facebook data from Inside. Facebook. com Copyright © 2011 The Nielsen Company. Confidential and proprietary.

What Shoppers are Telling Us How, why, when, & where about print and digital 9

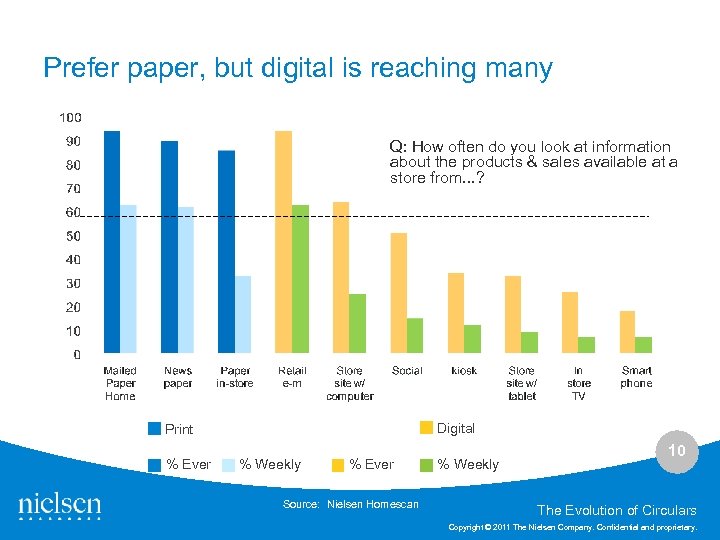

Prefer paper, but digital is reaching many Q: How often do you look at information about the products & sales available at a store from. . . ? Digital Print % Ever % Weekly % Ever Source: Nielsen Homescan % Weekly 10 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

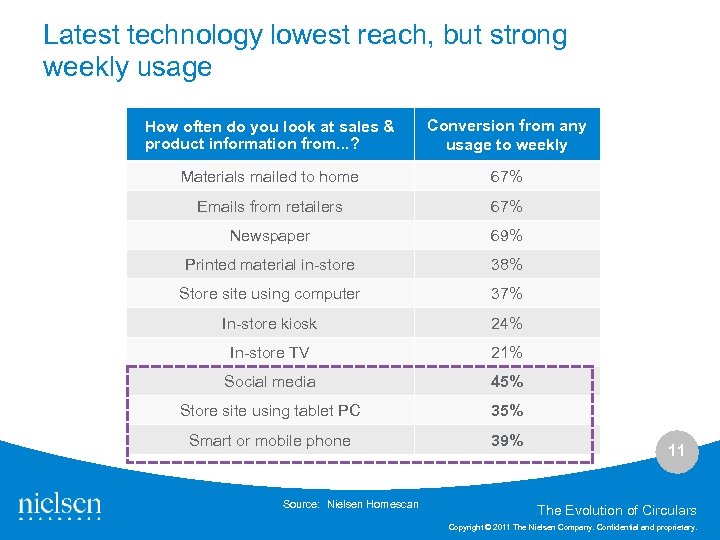

Latest technology lowest reach, but strong weekly usage How often do you look at sales & product information from. . . ? Conversion from any usage to weekly Materials mailed to home 67% Emails from retailers 67% Newspaper 69% Printed material in-store 38% Store site using computer 37% In-store kiosk 24% In-store TV 21% Social media 45% Store site using tablet PC 35% Smart or mobile phone 39% Source: Nielsen Homescan 11 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

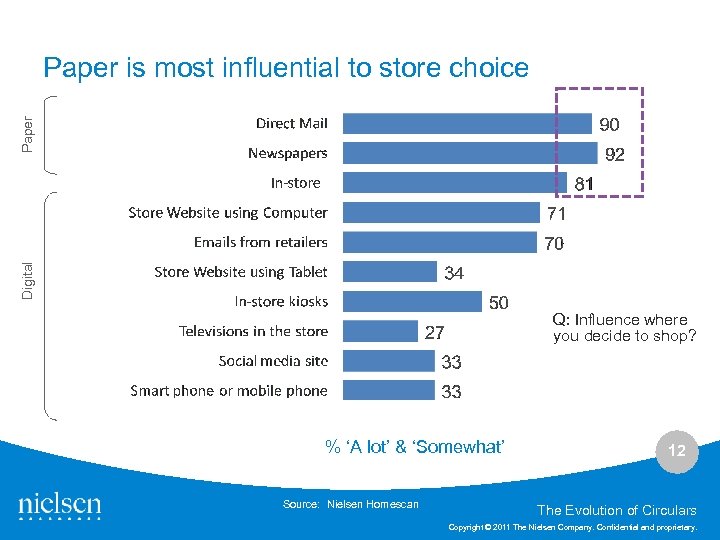

Digital Paper is most influential to store choice Q: Influence where you decide to shop? % ‘A lot’ & ‘Somewhat’ Source: Nielsen Homescan 12 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

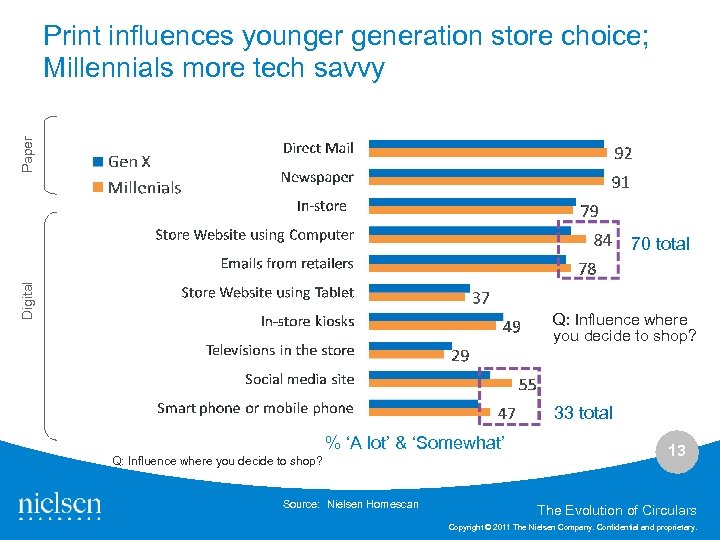

Paper Print influences younger generation store choice; Millennials more tech savvy Digital 70 total Q: Influence where you decide to shop? 33 total % ‘A lot’ & ‘Somewhat’ Q: Influence where you decide to shop? Source: Nielsen Homescan 13 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

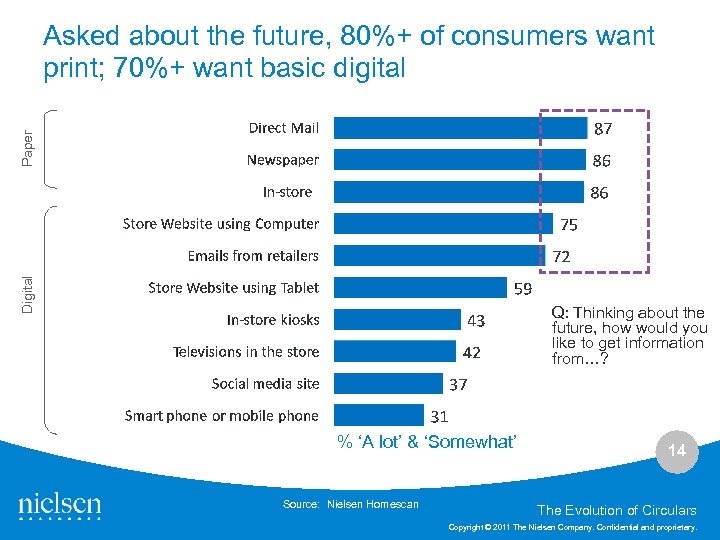

Digital Paper Asked about the future, 80%+ of consumers want print; 70%+ want basic digital Q: Thinking about the future, how would you like to get information from…? % ‘A lot’ & ‘Somewhat’ Source: Nielsen Homescan 14 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

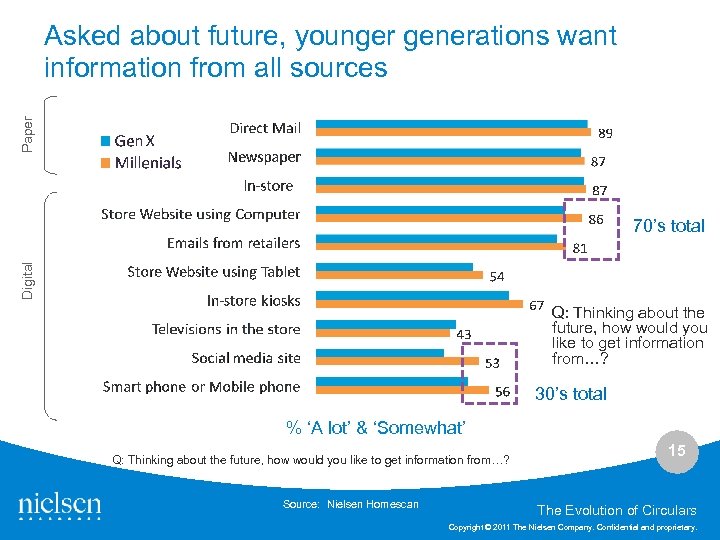

Paper Asked about future, younger generations want information from all sources Digital 70’s total Q: Thinking about the future, how would you like to get information from…? 30’s total % ‘A lot’ & ‘Somewhat’ Q: Thinking about the future, how would you like to get information from…? Source: Nielsen Homescan 15 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

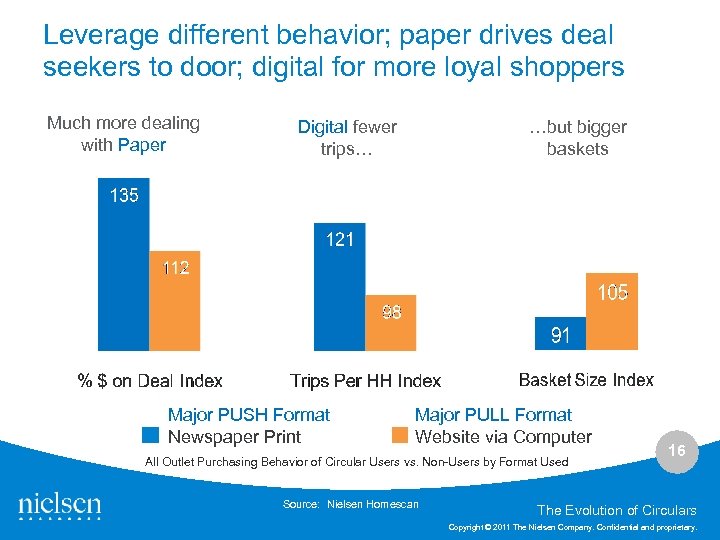

Leverage different behavior; paper drives deal seekers to door; digital for more loyal shoppers Much more dealing with Paper Digital fewer trips… Major PUSH Format Newspaper Print …but bigger baskets Major PULL Format Website via Computer All Outlet Purchasing Behavior of Circular Users vs. Non-Users by Format Used Source: Nielsen Homescan 16 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

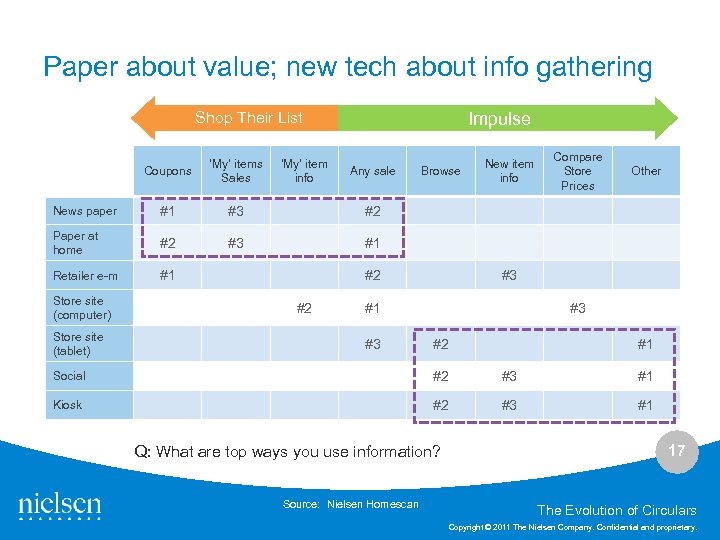

Paper about value; new tech about info gathering Shop Their List Coupons ‘My’ items Sales News paper #1 #3 Paper at home #2 #3 #1 Retailer e-m #1 Store site (tablet) Any sale Browse #2 #2 New item info Compare Store Prices #2 Store site (computer) ‘My’ item info Impulse #3 #1 #3 Other #3 #2 #1 Social #2 #3 #1 Kiosk #2 #3 #1 Q: What are top ways you use information? Source: Nielsen Homescan 17 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

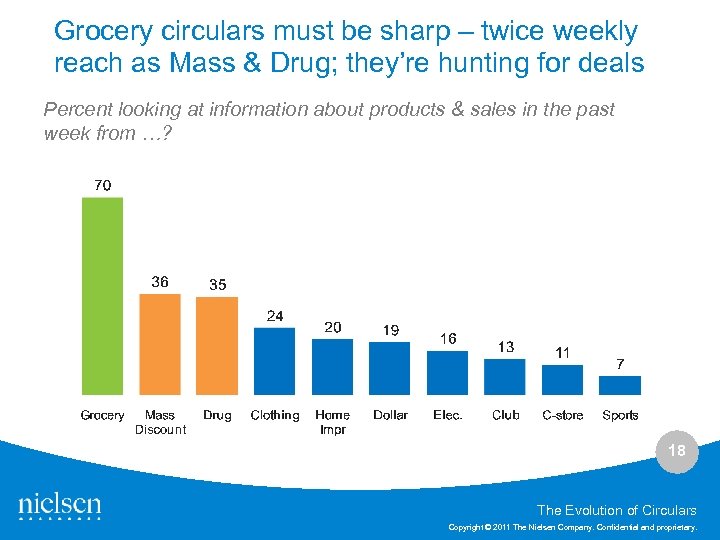

Grocery circulars must be sharp – twice weekly reach as Mass & Drug; they’re hunting for deals Percent looking at information about products & sales in the past week from …? 18 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Across generations shoppers looking for price and Market convenience; touch points and engagement vary Structure Traditional print Info. seekers ‘tweeners Status quo Local prices Open to digital Frugal Personalization Convenience Online due to mobility challenges Reduce hassle Personalization Reduce waste Q: Paint a picture about how you might get information in the future …what kind of Corp savings information & impact it would have Source: Nielsen Homescan & Quester Analytics 19 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

What shoppers are telling us Paper Digital Very influential across generations Low reach but high weekly use Requested for near future Loyal shopper tendencies Leveraged by deal seekers Find sales on ‘their’ items Requested strongly by Millennials Used for information gathering Greater marketing & sales potential Your efforts must include both Calls to Action Item / price remains the centerpiece Leverage complementary strengths 20 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Optimizing Print Getting the most out of print; it has a role with consumers and shoppers 21

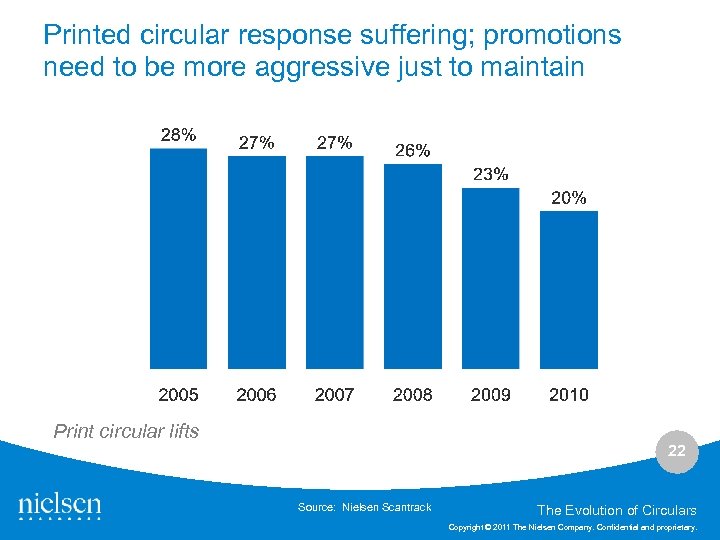

Printed circular response suffering; promotions need to be more aggressive just to maintain Print circular lifts 22 Source: Nielsen Scantrack The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

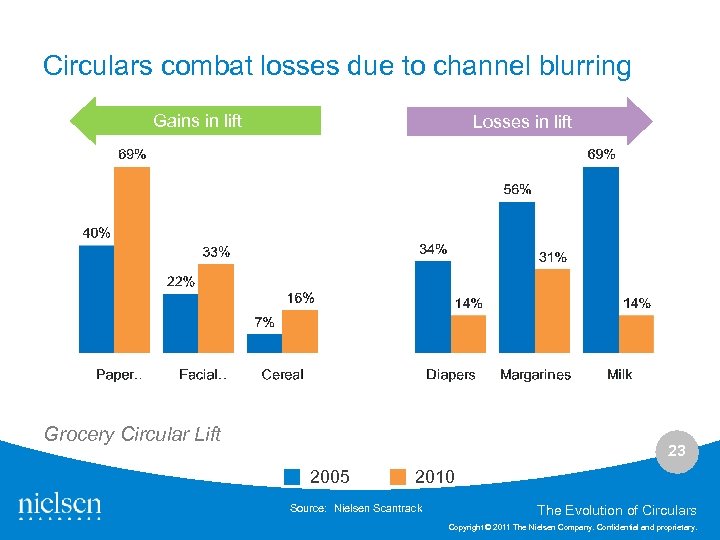

Circulars combat losses due to channel blurring Gains in lift Losses in lift Grocery Circular Lift 23 2005 2010 Source: Nielsen Scantrack The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

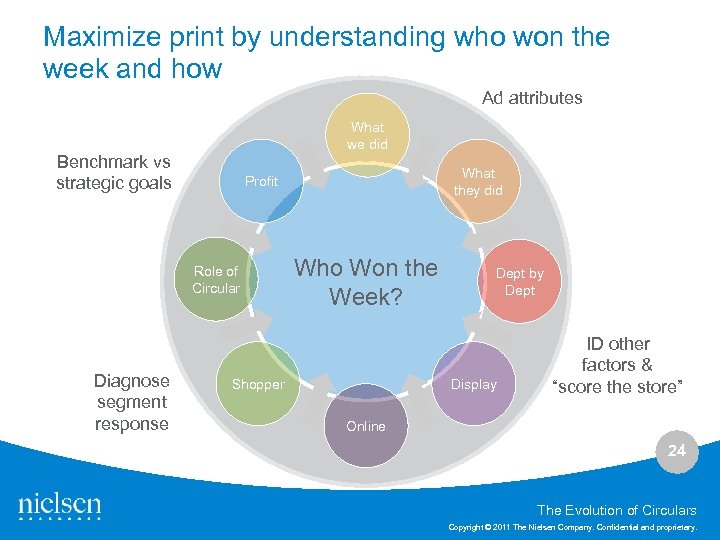

Maximize print by understanding who won the week and how Ad attributes What we did Benchmark vs strategic goals Role of Circular Diagnose segment response What they did Profit Who Won the Week? Dept by Dept Display Shopper ID other factors & “score the store” Online 24 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

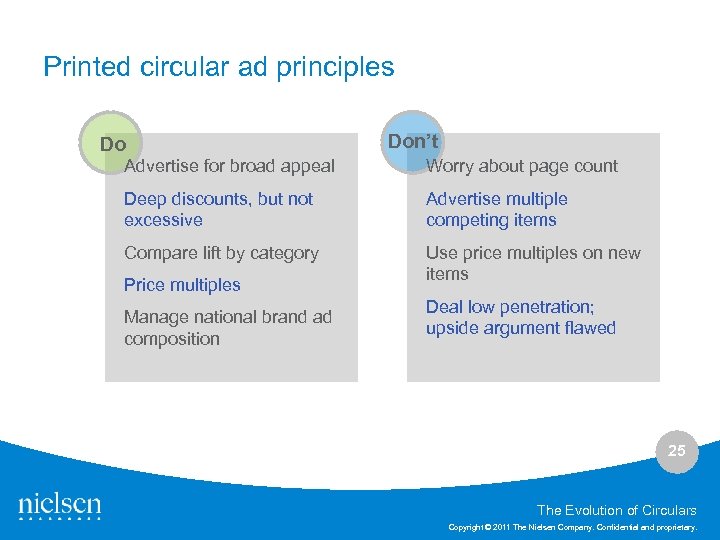

Printed circular ad principles Do Don’t Advertise for broad appeal Worry about page count Deep discounts, but not excessive Advertise multiple competing items Compare lift by category Use price multiples on new items Price multiples Manage national brand ad composition Deal low penetration; upside argument flawed 25 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

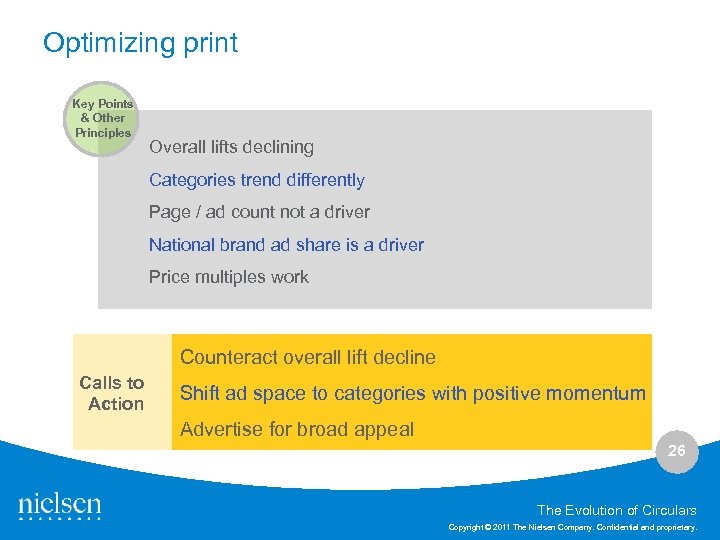

Optimizing print Key Points & Other Principles Overall lifts declining Categories trend differently Page / ad count not a driver National brand ad share is a driver Price multiples work Counteract overall lift decline Calls to Action Shift ad space to categories with positive momentum Advertise for broad appeal 26 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Digital Principles There is no choice 27

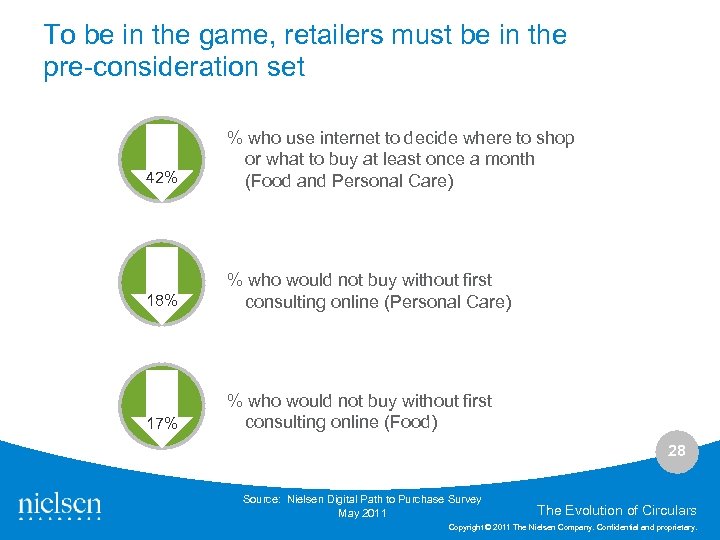

To be in the game, retailers must be in the pre-consideration set 42% % who use internet to decide where to shop or what to buy at least once a month (Food and Personal Care) 18% % who would not buy without first consulting online (Personal Care) 17% % who would not buy without first consulting online (Food) 28 Source: Nielsen Digital Path to Purchase Survey May 2011 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

The virtues of digital advertising Customized screens Consumer sharing easy High engagement Lower cost potential Target via site & search Environmentally friendly 29 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Retailers interested in a consistent set of issues Gaining online sales Driving offline sales through retailers’ owned assets How to more effectively engage shoppers online Gaining incremental offline sales through online marketing 30 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Retailers must invest in efforts to get shoppers visiting their sites Few brick & mortar retailers get more than 20% of store shoppers to their site… …but that those that visit sites spend about 30% more in the store! Source: Nielsen Homescan 31 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

If you’ve got dollars to invest in your website, you should spend it on your online circular Online circular visitors generally spend more than average, but current iteration of circular has room for improvement 32 Source: Nielsen Online panel, April 2011 Nielsen custom analysis The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Digital execution has to solve shopper need, not just replicate paper version 33 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

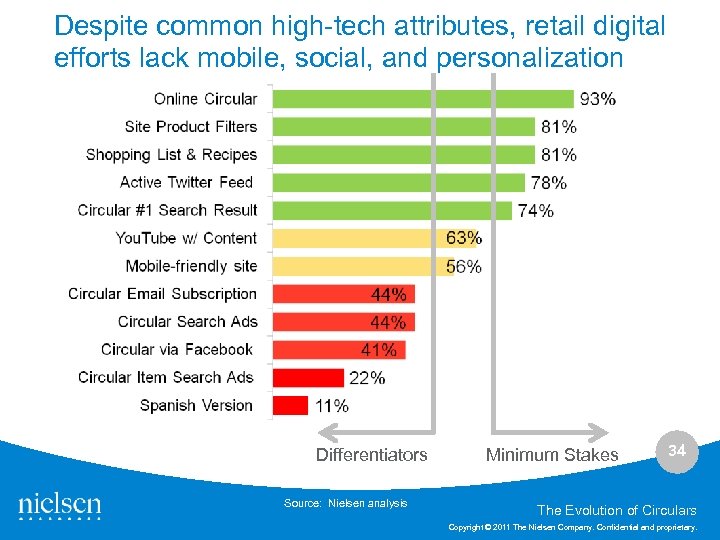

Despite common high-tech attributes, retail digital efforts lack mobile, social, and personalization Differentiators Source: Nielsen analysis Minimum Stakes 34 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Walmart funneling people online with expanded assortment and home delivery 35 Source: Walmart The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

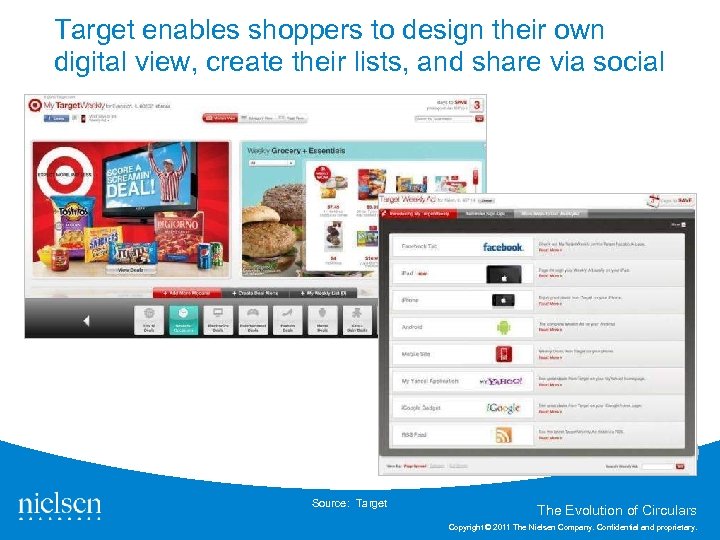

Target enables shoppers to design their own digital view, create their lists, and share via social 36 Source: Target The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

It’s not just the national retailers that are innovating! Drive thru solutions Funneling shoppers online 37 Source: Company websites The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

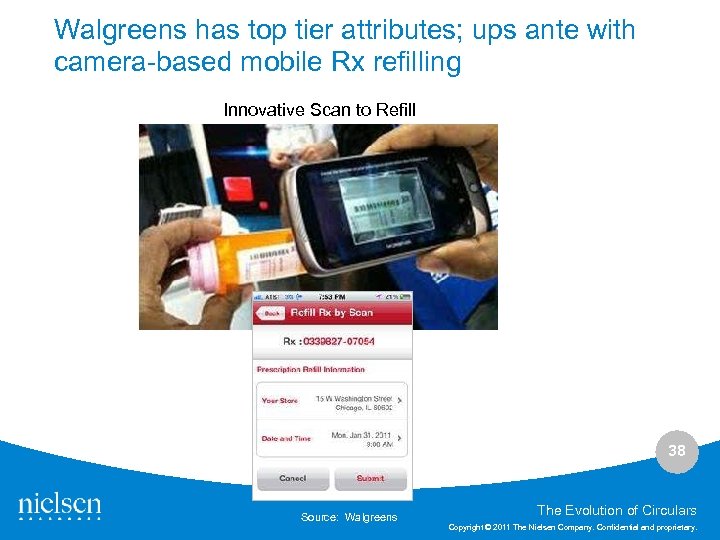

Walgreens has top tier attributes; ups ante with camera-based mobile Rx refilling Innovative Scan to Refill 38 Source: Walgreens The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Greater shopper engagement with circular as retailers strive to be most ‘Liked’ 39 Source: Whole Foods The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

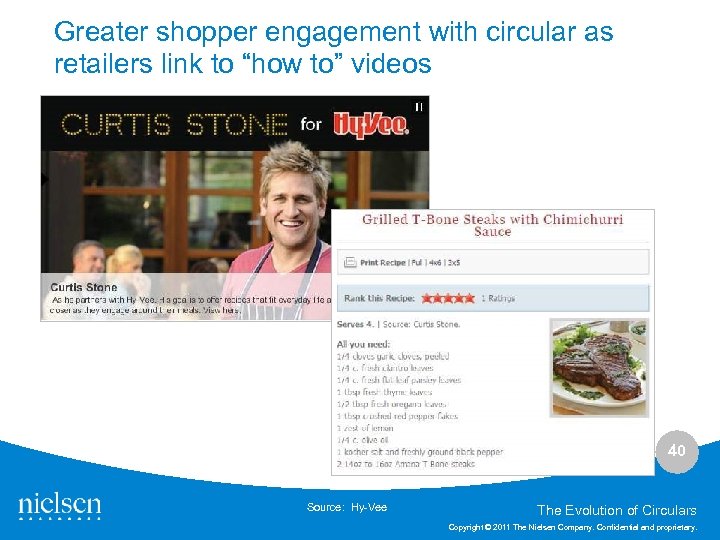

Greater shopper engagement with circular as retailers link to “how to” videos 40 Source: Hy-Vee The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Aldi turns the page; improves technology 41 Source: Aldi The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

E-mail, social networking & in-store kiosks engage shoppers with special offers 42 Source: Sam’s Club; Wall Street Journal The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

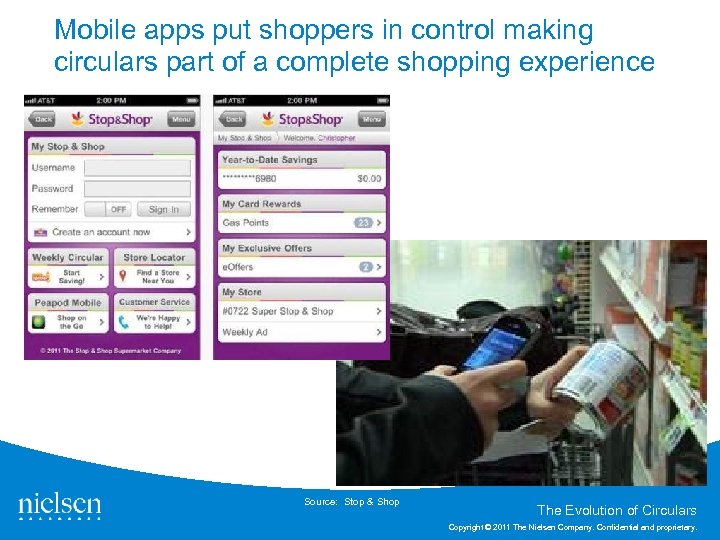

Mobile apps put shoppers in control making circulars part of a complete shopping experience 43 Source: Stop & Shop The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Walmart launches first i. Pad app & improves smart phone app New i. Pad App • Touch-optimized shopping • Browse My Store • Extended inventory Updated smartphone App — Smart Shopping Lists & QR Code Scanner Voice • Budgeting tools • Manufacturer’s coupons • Product information • Sharing • Store Item Finder beta Source: Walmart & i. Tunes 44 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Don’t assume that if you build it, they will come 45 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

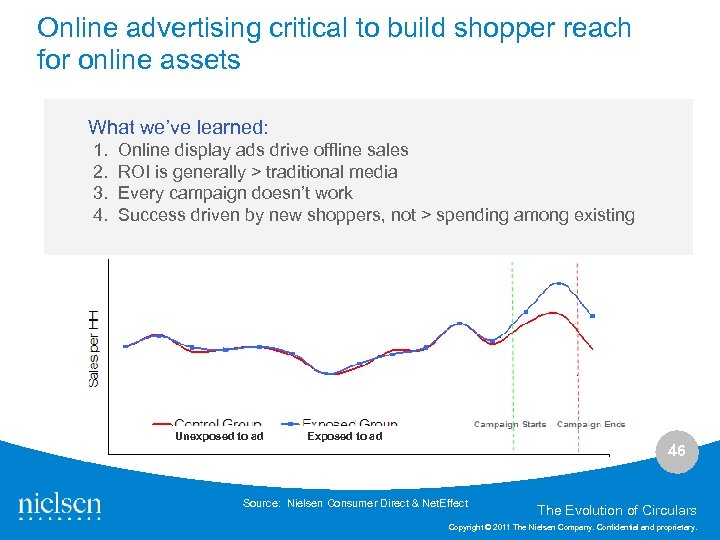

Online advertising critical to build shopper reach for online assets What we’ve learned: 1. Online display ads drive offline sales 2. ROI is generally > traditional media 3. Every campaign doesn’t work 4. Success driven by new shoppers, not > spending among existing Unexposed to ad Exposed to ad 46 Source: Nielsen Consumer Direct & Net. Effect The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

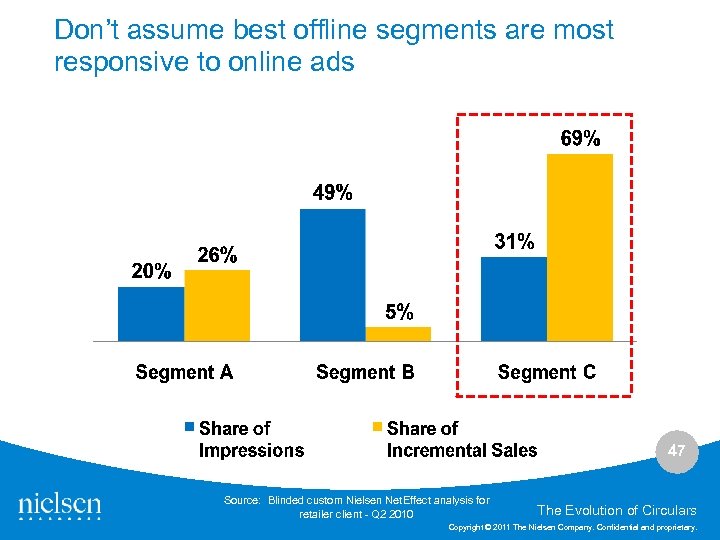

Don’t assume best offline segments are most responsive to online ads 47 Source: Blinded custom Nielsen Net. Effect analysis for retailer client - Q 2 2010 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

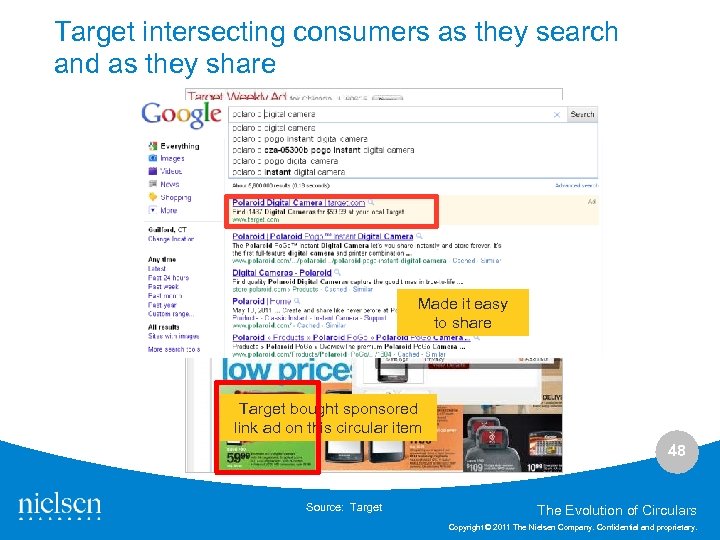

Target intersecting consumers as they search and as they share Made it easy to share Target bought sponsored link ad on this circular item 48 Source: Target The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Ongoing optimization secret to digital success Post campaign ROI analysis Post campaign demo & segment ROI analysis Innovate digital circular distribution Ensure desired audience is in sight Ongoing Optimization Refine promoted items Creative pre -testing 49 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

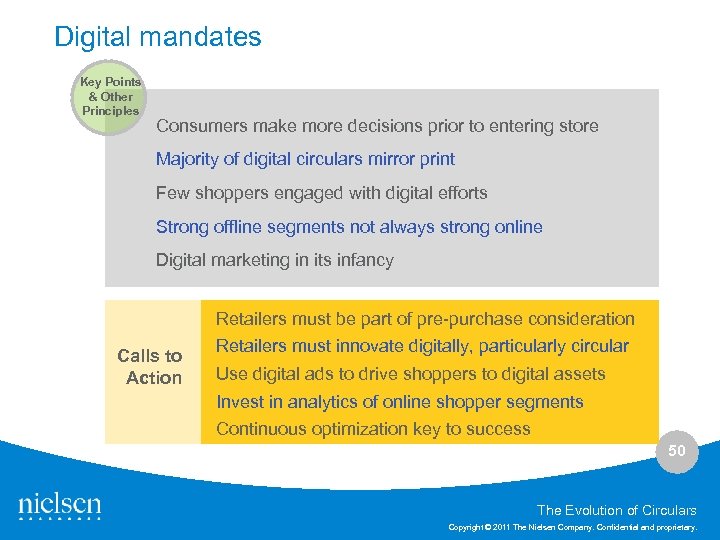

Digital mandates Key Points & Other Principles Consumers make more decisions prior to entering store Majority of digital circulars mirror print Few shoppers engaged with digital efforts Strong offline segments not always strong online Digital marketing in its infancy Retailers must be part of pre-purchase consideration Calls to Action Retailers must innovate digitally, particularly circular Use digital ads to drive shoppers to digital assets Invest in analytics of online shopper segments Continuous optimization key to success 50 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Looking around the corner 51 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

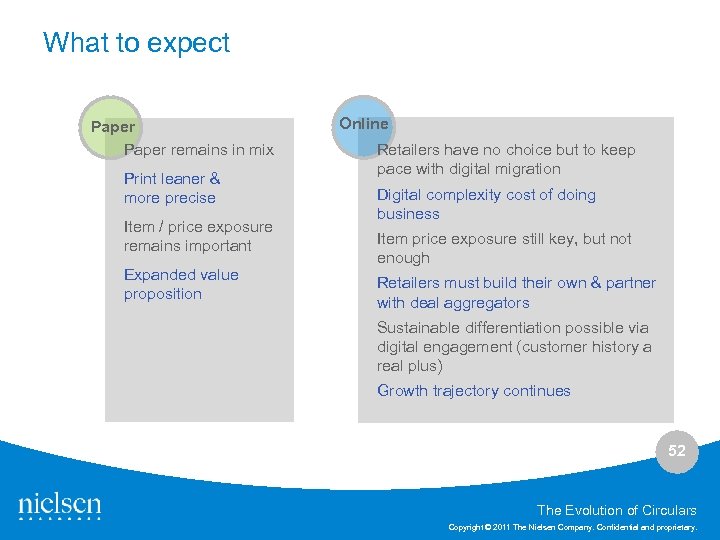

What to expect Paper remains in mix Print leaner & more precise Item / price exposure remains important Expanded value proposition Online Retailers have no choice but to keep pace with digital migration Digital complexity cost of doing business Item price exposure still key, but not enough Retailers must build their own & partner with deal aggregators Sustainable differentiation possible via digital engagement (customer history a real plus) Growth trajectory continues 52 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Digital personalizes coupon and circular, integrating value added content – centered on the shopper It’s all about me 53 Source: Safeway The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Commuter shopping takes new platform, literally! June 2011—A visual experiment in mobile supermarket shopping has done very well for Tesco in South Korea. The number of new registered members rose by 76%, and online sales increased 130% October 2011—P&G has set up virtual stores in four of the busiest subway stations in Prague (available until end of 2011); P&G products have 90% shelf share in first month 54 Source: P&G Corporate Newsroom The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

“marching beyond the walls of tech into retailing, advertising, publishing, movies, TV, communications, and even finance” “Bezos, Jobs, Zuckerberg, and Page look at the business world and justifiably imagine all of it funneling through their servers. ” Source: Fast Company 55 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

How will these companies enhance or disrupt the future of your retail space? 56 Source: Fast Company The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Battle ensues – Walmart makes advances; will a new line be drawn in online space? “Walmart's store managers and employees will get credit for online sales from their territory, just like sales in the store. That will give them more reason to promote Walmart. com, the new i. Pad app, My Local Walmart Facebook app, and … refurbished i. Phone app to the 140 million weekly in-store shoppers. ” 57 Source: Jack Neff, Ad Age & James Steinberg (photo) The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Once you’re back at your office… Customer Readiness Organizational Readiness • Know your customer • Digital goals • What do they want from…? • Resource support • Printed circulars • Executive support • Online • Continuous improvement support 58 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

Q&A Thank you for attending • If you have follow-up questions or want more information, please contact your Nielsen Professional Services Representative. • If you are not a current Nielsen client, please contact us by phone or email: Phone: 800 -553 -3727 email: CPGSolutions@nielsen. com OR if you have any questions regarding the content of this webinar, you can also contact: Todd Hale, email: todd. hale@nielsen. com 59 The Evolution of Circulars Copyright © 2011 The Nielsen Company. Confidential and proprietary.

8a3c3b01a4bc1b9f3a8eb92b061f7704.ppt