Chapter 16.ppt

- Количество слайдов: 34

Externalities in Our Lives • An externality is a cost or benefit that arises from production and falls on someone other than the producer, or a cost or benefit that arises from consumption and falls on someone other than the consumer. • A negative externality imposes a cost and a positive externality creates a benefit. • The four types of externality are – Negative production externalities – Positive production externalities – Negative consumption externalities – Positive consumption externalities 1

Externalities in Our Lives • An externality is a cost or benefit that arises from production and falls on someone other than the producer, or a cost or benefit that arises from consumption and falls on someone other than the consumer. • A negative externality imposes a cost and a positive externality creates a benefit. • The four types of externality are – Negative production externalities – Positive production externalities – Negative consumption externalities – Positive consumption externalities 1

Production Externalities • Negative production externalities are common. • Some examples are noise from aircraft and trucks, polluted rivers and lakes, the destruction of animal habitat, and air pollution in major cities from auto exhaust. • Positive production externalities are less common that negative externalities. • Two examples arise in honey and fruit production. By locating honeybees next to a fruit orchard, fruit production gets an external benefit from the bees, which pollinate the fruit orchards and boost fruit output; and honey production gets an external benefit from the orchards. 2

Production Externalities • Negative production externalities are common. • Some examples are noise from aircraft and trucks, polluted rivers and lakes, the destruction of animal habitat, and air pollution in major cities from auto exhaust. • Positive production externalities are less common that negative externalities. • Two examples arise in honey and fruit production. By locating honeybees next to a fruit orchard, fruit production gets an external benefit from the bees, which pollinate the fruit orchards and boost fruit output; and honey production gets an external benefit from the orchards. 2

Consumption Externalities • Negative consumption externalities are a common part of everyday life. • Smoking in a confined space poses a health risk to others; noisy parties or loud car stereos disturb others. • Positive consumption externalities are also common. • When you get a flue vaccination, everyone you come into contact with benefits. • When the owner of an historic building restores it, everyone who sees the building gets pleasure. 3

Consumption Externalities • Negative consumption externalities are a common part of everyday life. • Smoking in a confined space poses a health risk to others; noisy parties or loud car stereos disturb others. • Positive consumption externalities are also common. • When you get a flue vaccination, everyone you come into contact with benefits. • When the owner of an historic building restores it, everyone who sees the building gets pleasure. 3

Private Costs and Social Costs • A private cost of production is a cost that is borne by the producer, and marginal private cost (MC) is the private cost of producing one more unit of a good or service. • An external cost of production is a cost that is not borne by the producer but is borne by others. • Marginal external cost is the cost of producing one more unit of a good or service that falls on people other than the producer. 4

Private Costs and Social Costs • A private cost of production is a cost that is borne by the producer, and marginal private cost (MC) is the private cost of producing one more unit of a good or service. • An external cost of production is a cost that is not borne by the producer but is borne by others. • Marginal external cost is the cost of producing one more unit of a good or service that falls on people other than the producer. 4

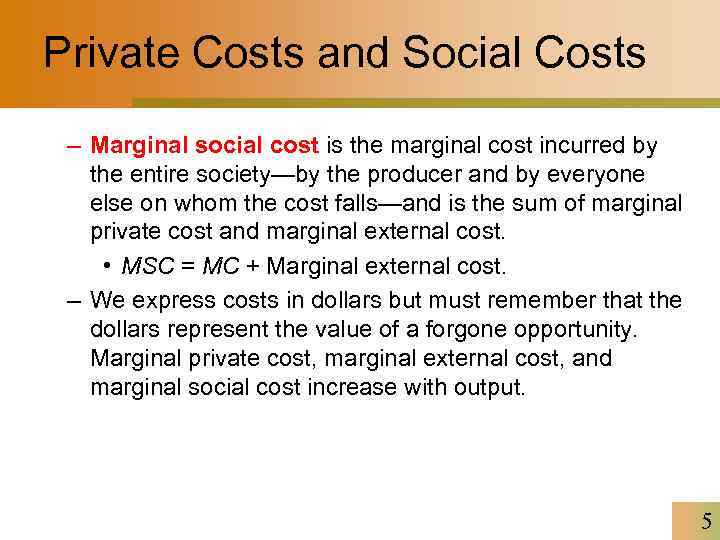

Private Costs and Social Costs – Marginal social cost is the marginal cost incurred by the entire society—by the producer and by everyone else on whom the cost falls—and is the sum of marginal private cost and marginal external cost. • MSC = MC + Marginal external cost. – We express costs in dollars but must remember that the dollars represent the value of a forgone opportunity. Marginal private cost, marginal external cost, and marginal social cost increase with output. 5

Private Costs and Social Costs – Marginal social cost is the marginal cost incurred by the entire society—by the producer and by everyone else on whom the cost falls—and is the sum of marginal private cost and marginal external cost. • MSC = MC + Marginal external cost. – We express costs in dollars but must remember that the dollars represent the value of a forgone opportunity. Marginal private cost, marginal external cost, and marginal social cost increase with output. 5

Private Costs and Social Costs 6

Private Costs and Social Costs 6

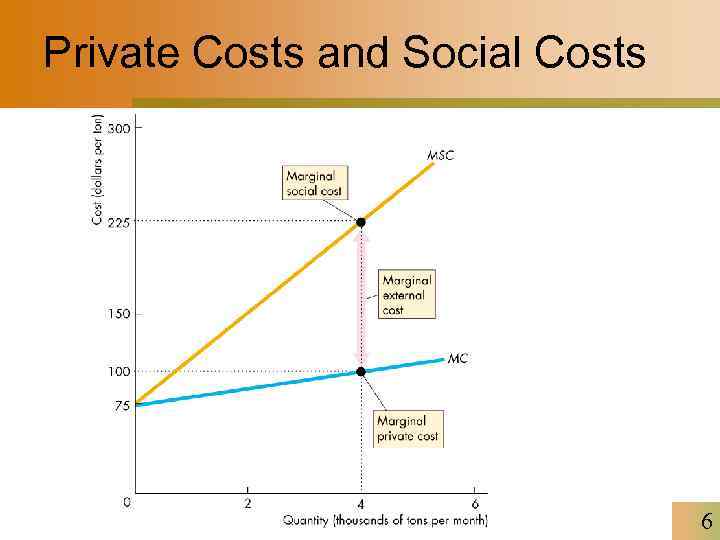

Negative Externalities • In the market for a good with an externality that is unregulated, the amount of pollution created depends on the equilibrium quantity of the good produced. 7

Negative Externalities • In the market for a good with an externality that is unregulated, the amount of pollution created depends on the equilibrium quantity of the good produced. 7

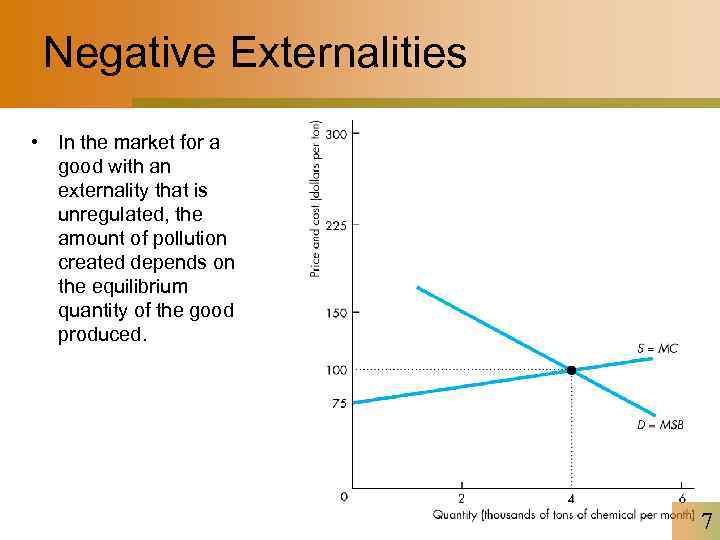

Negative Externalities • MSB is less than MSC in the market equilibrium, so the market equilibrium is inefficient. • The efficient quantity is where marginal social cost equals marginal benefit. • The competitive market overproduces and creates a deadweight loss. 8

Negative Externalities • MSB is less than MSC in the market equilibrium, so the market equilibrium is inefficient. • The efficient quantity is where marginal social cost equals marginal benefit. • The competitive market overproduces and creates a deadweight loss. 8

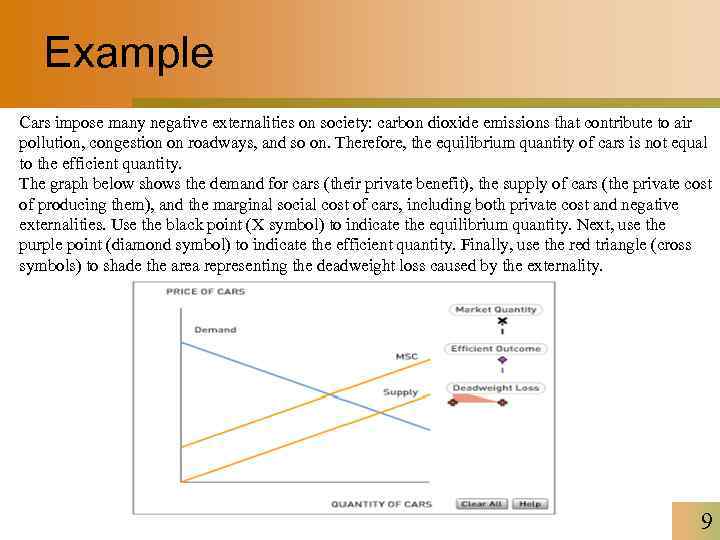

Example Cars impose many negative externalities on society: carbon dioxide emissions that contribute to air pollution, congestion on roadways, and so on. Therefore, the equilibrium quantity of cars is not equal to the efficient quantity. The graph below shows the demand for cars (their private benefit), the supply of cars (the private cost of producing them), and the marginal social cost of cars, including both private cost and negative externalities. Use the black point (X symbol) to indicate the equilibrium quantity. Next, use the purple point (diamond symbol) to indicate the efficient quantity. Finally, use the red triangle (cross symbols) to shade the area representing the deadweight loss caused by the externality. 9

Example Cars impose many negative externalities on society: carbon dioxide emissions that contribute to air pollution, congestion on roadways, and so on. Therefore, the equilibrium quantity of cars is not equal to the efficient quantity. The graph below shows the demand for cars (their private benefit), the supply of cars (the private cost of producing them), and the marginal social cost of cars, including both private cost and negative externalities. Use the black point (X symbol) to indicate the equilibrium quantity. Next, use the purple point (diamond symbol) to indicate the efficient quantity. Finally, use the red triangle (cross symbols) to shade the area representing the deadweight loss caused by the externality. 9

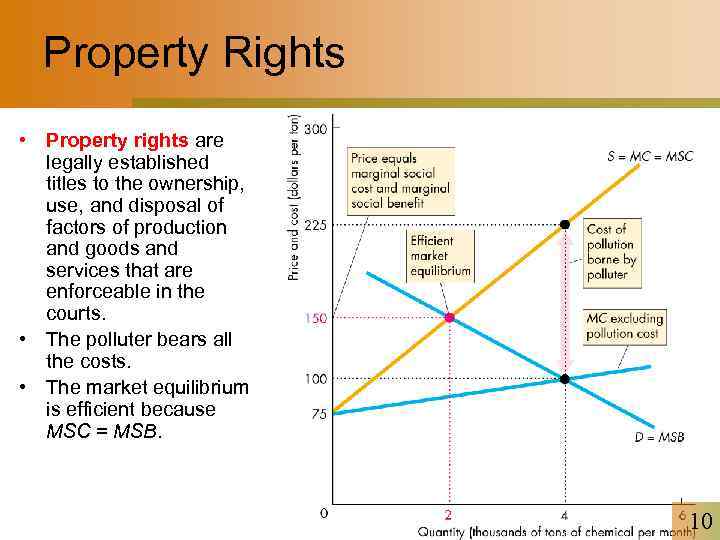

Property Rights • Property rights are legally established titles to the ownership, use, and disposal of factors of production and goods and services that are enforceable in the courts. • The polluter bears all the costs. • The market equilibrium is efficient because MSC = MSB. 10

Property Rights • Property rights are legally established titles to the ownership, use, and disposal of factors of production and goods and services that are enforceable in the courts. • The polluter bears all the costs. • The market equilibrium is efficient because MSC = MSB. 10

The Coase Theorem • The Coase theorem is a proposition that if property rights exist, if only a small number of parties are involved, and if transactions costs are low, then private transactions are efficient. • There are no externalities because all parties take into account the externalities involved. The outcome is independent of who has the property rights. 11

The Coase Theorem • The Coase theorem is a proposition that if property rights exist, if only a small number of parties are involved, and if transactions costs are low, then private transactions are efficient. • There are no externalities because all parties take into account the externalities involved. The outcome is independent of who has the property rights. 11

The Coase Theorem • The Coase solution works only if transaction costs are low. • Transactions costs are the cost of conducting a transaction. • An example is the transactions costs of buying a home include fees for a realtor, a mortgage loan advisor, and legal assistance. • When a large number of people are involved in an externality and transactions costs are high, the Coase solution of establishing property rights doesn’t work and governments try to deal with the externality. 12

The Coase Theorem • The Coase solution works only if transaction costs are low. • Transactions costs are the cost of conducting a transaction. • An example is the transactions costs of buying a home include fees for a realtor, a mortgage loan advisor, and legal assistance. • When a large number of people are involved in an externality and transactions costs are high, the Coase solution of establishing property rights doesn’t work and governments try to deal with the externality. 12

Government Actions in the Face of External Costs • There are three main methods that the government uses to cope with external costs: – Taxes – Emission charges – Marketable permits 13

Government Actions in the Face of External Costs • There are three main methods that the government uses to cope with external costs: – Taxes – Emission charges – Marketable permits 13

Taxes • The government can set a tax equal marginal external cost. • The effect of such a tax is to make marginal private cost plus the tax equal to marginal social cost, MC + tax = MSC. • This tax is called Pigovian tax. 14

Taxes • The government can set a tax equal marginal external cost. • The effect of such a tax is to make marginal private cost plus the tax equal to marginal social cost, MC + tax = MSC. • This tax is called Pigovian tax. 14

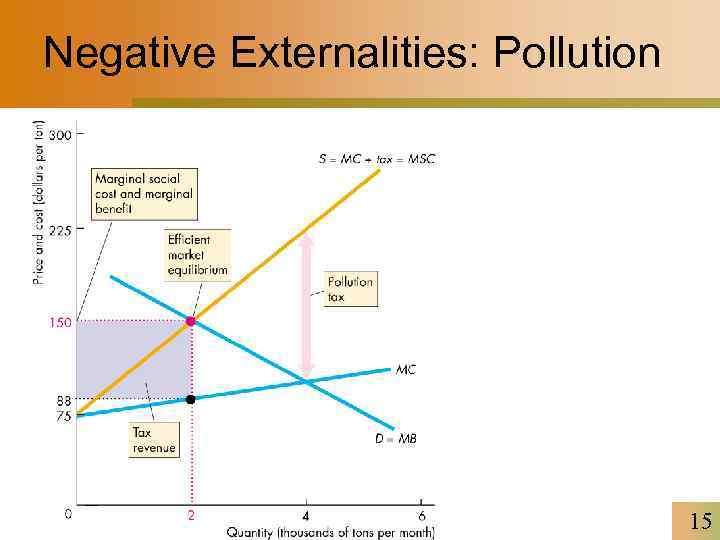

Negative Externalities: Pollution 15

Negative Externalities: Pollution 15

Example If the production of a good generates negative externalities, then: – The government can tax production of the good to increase efficiency – At the equilibrium quantity, output of the good is higher than the efficient quantity – Market forces may lead to an overallocation of resources to producing the good – All of these answers are correct 16

Example If the production of a good generates negative externalities, then: – The government can tax production of the good to increase efficiency – At the equilibrium quantity, output of the good is higher than the efficient quantity – Market forces may lead to an overallocation of resources to producing the good – All of these answers are correct 16

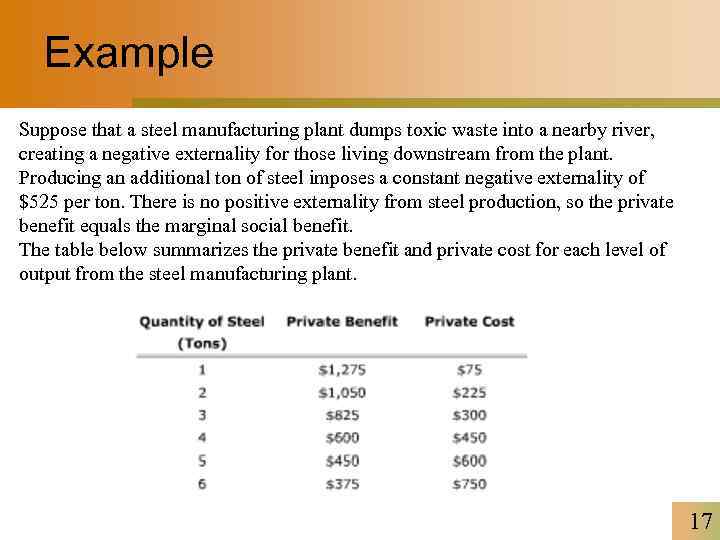

Example Suppose that a steel manufacturing plant dumps toxic waste into a nearby river, creating a negative externality for those living downstream from the plant. Producing an additional ton of steel imposes a constant negative externality of $525 per ton. There is no positive externality from steel production, so the private benefit equals the marginal social benefit. The table below summarizes the private benefit and private cost for each level of output from the steel manufacturing plant. 17

Example Suppose that a steel manufacturing plant dumps toxic waste into a nearby river, creating a negative externality for those living downstream from the plant. Producing an additional ton of steel imposes a constant negative externality of $525 per ton. There is no positive externality from steel production, so the private benefit equals the marginal social benefit. The table below summarizes the private benefit and private cost for each level of output from the steel manufacturing plant. 17

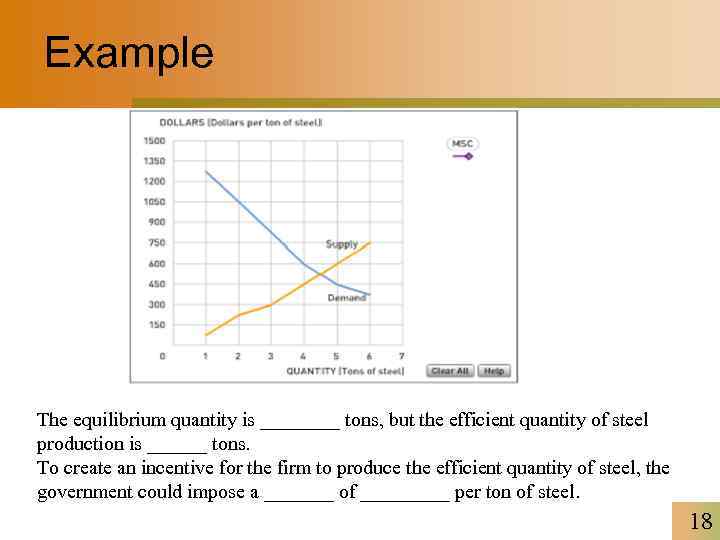

Example The equilibrium quantity is ____ tons, but the efficient quantity of steel production is ______ tons. To create an incentive for the firm to produce the efficient quantity of steel, the government could impose a _______ of _____ per ton of steel. 18

Example The equilibrium quantity is ____ tons, but the efficient quantity of steel production is ______ tons. To create an incentive for the firm to produce the efficient quantity of steel, the government could impose a _______ of _____ per ton of steel. 18

Emissions Charges • The government sets a price per unit of pollution, so that the more a firm pollutes, the higher are its emissions charges. • For the emissions charge to induce the firm to generate the efficient level of pollution, the government would need a lot of information that is usually unavailable. 19

Emissions Charges • The government sets a price per unit of pollution, so that the more a firm pollutes, the higher are its emissions charges. • For the emissions charge to induce the firm to generate the efficient level of pollution, the government would need a lot of information that is usually unavailable. 19

Marketable Permits • Each firm is assigned a permitted amount of pollution period and firms trade permits. • The market price of a permit confronts polluters with the social marginal cost of their actions and leads to an efficient outcome. 20

Marketable Permits • Each firm is assigned a permitted amount of pollution period and firms trade permits. • The market price of a permit confronts polluters with the social marginal cost of their actions and leads to an efficient outcome. 20

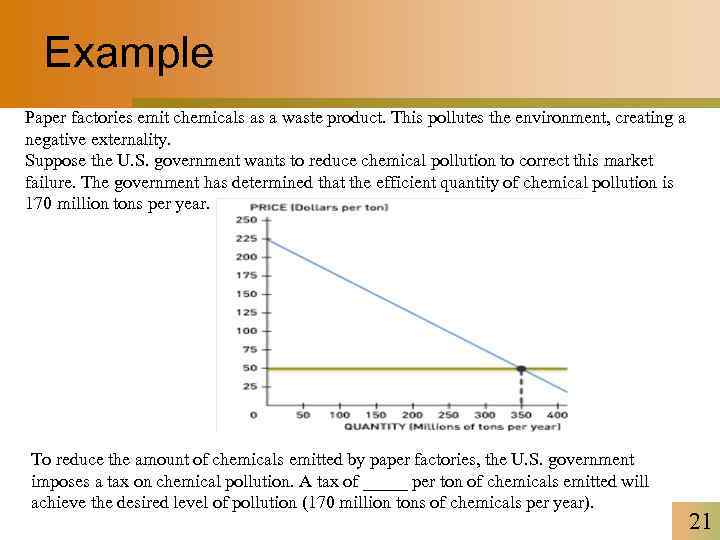

Example Paper factories emit chemicals as a waste product. This pollutes the environment, creating a negative externality. Suppose the U. S. government wants to reduce chemical pollution to correct this market failure. The government has determined that the efficient quantity of chemical pollution is 170 million tons per year. To reduce the amount of chemicals emitted by paper factories, the U. S. government imposes a tax on chemical pollution. A tax of _____ per ton of chemicals emitted will achieve the desired level of pollution (170 million tons of chemicals per year). 21

Example Paper factories emit chemicals as a waste product. This pollutes the environment, creating a negative externality. Suppose the U. S. government wants to reduce chemical pollution to correct this market failure. The government has determined that the efficient quantity of chemical pollution is 170 million tons per year. To reduce the amount of chemicals emitted by paper factories, the U. S. government imposes a tax on chemical pollution. A tax of _____ per ton of chemicals emitted will achieve the desired level of pollution (170 million tons of chemicals per year). 21

Example Suppose that instead of imposing a tax, the U. S. government decides to auction off tradable pollution permits to U. S. paper factories. Each permit entitles its owner to emit 1 ton of chemicals per year. In order to achieve a pollution level of 170 million tons per year (the efficient quantity of pollution), the government auctions off 170 million pollution permits. Given this quantity of permits, the price for each permit in the market for pollution rights will be _____. 22

Example Suppose that instead of imposing a tax, the U. S. government decides to auction off tradable pollution permits to U. S. paper factories. Each permit entitles its owner to emit 1 ton of chemicals per year. In order to achieve a pollution level of 170 million tons per year (the efficient quantity of pollution), the government auctions off 170 million pollution permits. Given this quantity of permits, the price for each permit in the market for pollution rights will be _____. 22

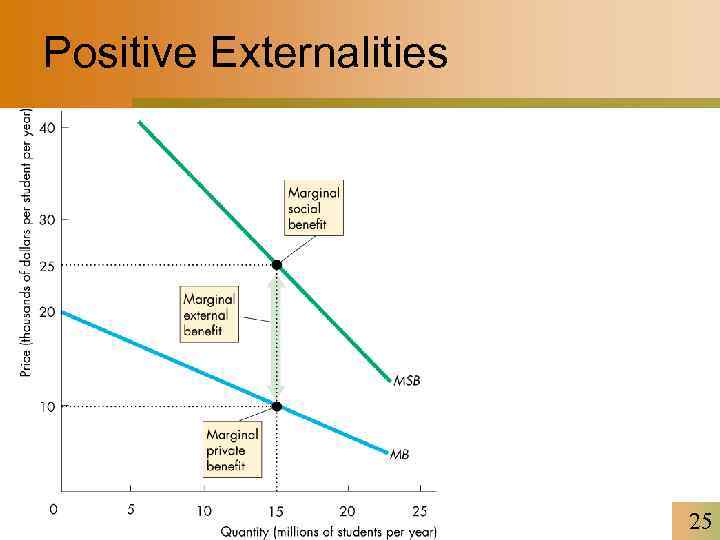

Positive Externalities • Private Benefits and Social Benefits – A private benefit is a benefit that the consumer of a good or service receives, and marginal private benefit (MB) is the private benefit from consuming one more unit of a good or service. – An external benefit is a benefit that someone other than the consumer receives. Marginal external benefit is the benefit from consuming one more unit of a good or service that people other than the consumer enjoy. 23

Positive Externalities • Private Benefits and Social Benefits – A private benefit is a benefit that the consumer of a good or service receives, and marginal private benefit (MB) is the private benefit from consuming one more unit of a good or service. – An external benefit is a benefit that someone other than the consumer receives. Marginal external benefit is the benefit from consuming one more unit of a good or service that people other than the consumer enjoy. 23

Positive Externalities • Marginal social benefit is the marginal benefit enjoyed by the entire society—by the consumer and by everyone else on whom the benefit falls. • Marginal social benefit is the sum of marginal private benefit and marginal external benefit. That is: • MSB = MB + Marginal external benefit. 24

Positive Externalities • Marginal social benefit is the marginal benefit enjoyed by the entire society—by the consumer and by everyone else on whom the benefit falls. • Marginal social benefit is the sum of marginal private benefit and marginal external benefit. That is: • MSB = MB + Marginal external benefit. 24

Positive Externalities 25

Positive Externalities 25

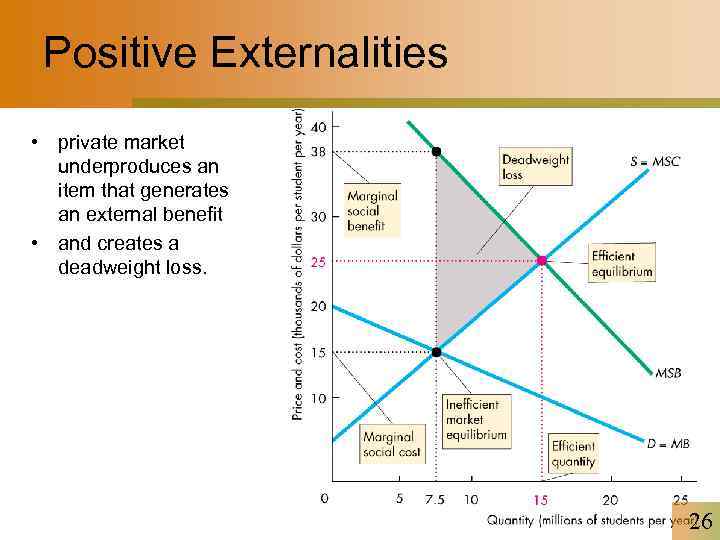

Positive Externalities • private market underproduces an item that generates an external benefit • and creates a deadweight loss. 26

Positive Externalities • private market underproduces an item that generates an external benefit • and creates a deadweight loss. 26

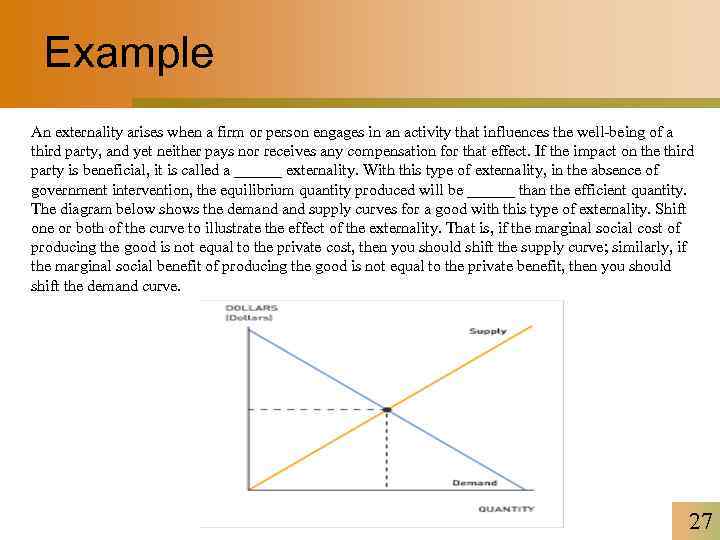

Example An externality arises when a firm or person engages in an activity that influences the well-being of a third party, and yet neither pays nor receives any compensation for that effect. If the impact on the third party is beneficial, it is called a ______ externality. With this type of externality, in the absence of government intervention, the equilibrium quantity produced will be ______ than the efficient quantity. The diagram below shows the demand supply curves for a good with this type of externality. Shift one or both of the curve to illustrate the effect of the externality. That is, if the marginal social cost of producing the good is not equal to the private cost, then you should shift the supply curve; similarly, if the marginal social benefit of producing the good is not equal to the private benefit, then you should shift the demand curve. 27

Example An externality arises when a firm or person engages in an activity that influences the well-being of a third party, and yet neither pays nor receives any compensation for that effect. If the impact on the third party is beneficial, it is called a ______ externality. With this type of externality, in the absence of government intervention, the equilibrium quantity produced will be ______ than the efficient quantity. The diagram below shows the demand supply curves for a good with this type of externality. Shift one or both of the curve to illustrate the effect of the externality. That is, if the marginal social cost of producing the good is not equal to the private cost, then you should shift the supply curve; similarly, if the marginal social benefit of producing the good is not equal to the private benefit, then you should shift the demand curve. 27

Example Which of the following are examples of the type of externality described above? Check all that apply. – David has planted several trees in his backyard that increase the beauty of the neighborhood, especially during the autumn foliage season. – Joe has bought a dartboard for the game room in his basement. – The city where you live has turned the publicly owned land next to your house into a park, causing trash dropped by park visitors to pile up in your backyard. – Sony has discovered a new technology that dramatically improves the picture quality of plasma televisions. Firms of all brands have free access to this technology. – Your roommate Amy has bought a puppy that barks all day while you are trying to study economics. 28

Example Which of the following are examples of the type of externality described above? Check all that apply. – David has planted several trees in his backyard that increase the beauty of the neighborhood, especially during the autumn foliage season. – Joe has bought a dartboard for the game room in his basement. – The city where you live has turned the publicly owned land next to your house into a park, causing trash dropped by park visitors to pile up in your backyard. – Sony has discovered a new technology that dramatically improves the picture quality of plasma televisions. Firms of all brands have free access to this technology. – Your roommate Amy has bought a puppy that barks all day while you are trying to study economics. 28

Government Action in the Face of External Benefits • Four devices that the government can use to achieve a more efficient allocation of resources in the presence of external benefits are – Public provision – Private subsidies – Vouchers – Patents and copyrights 29

Government Action in the Face of External Benefits • Four devices that the government can use to achieve a more efficient allocation of resources in the presence of external benefits are – Public provision – Private subsidies – Vouchers – Patents and copyrights 29

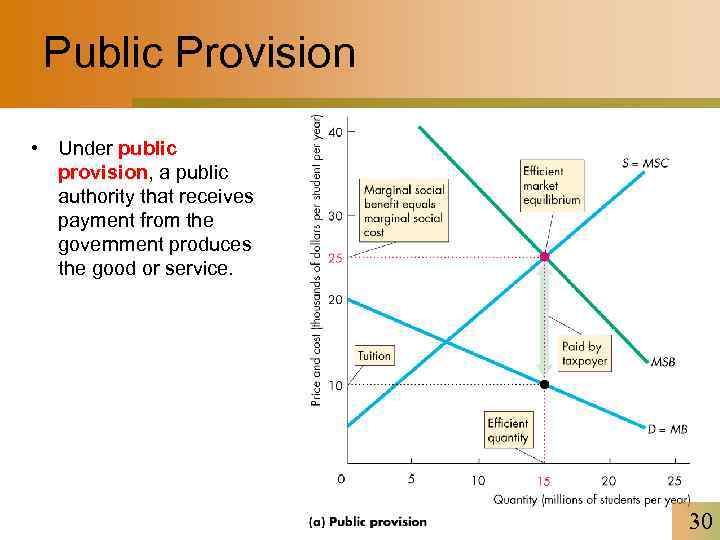

Public Provision • Under public provision, a public authority that receives payment from the government produces the good or service. 30

Public Provision • Under public provision, a public authority that receives payment from the government produces the good or service. 30

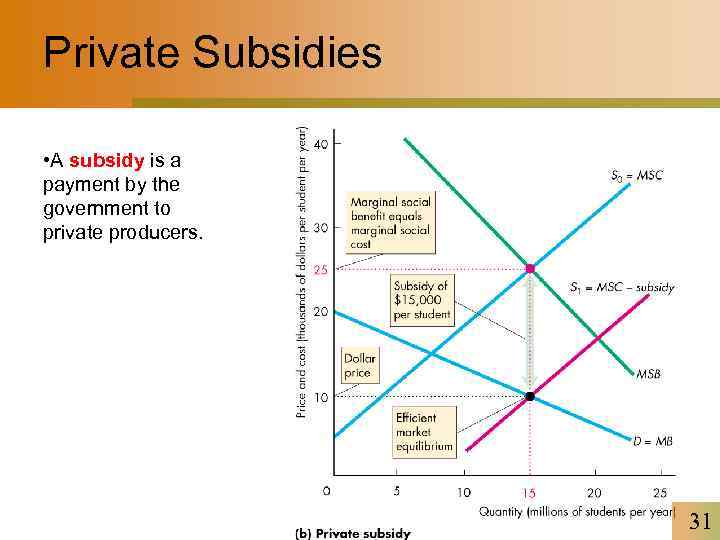

Private Subsidies • A subsidy is a payment by the government to private producers. 31

Private Subsidies • A subsidy is a payment by the government to private producers. 31

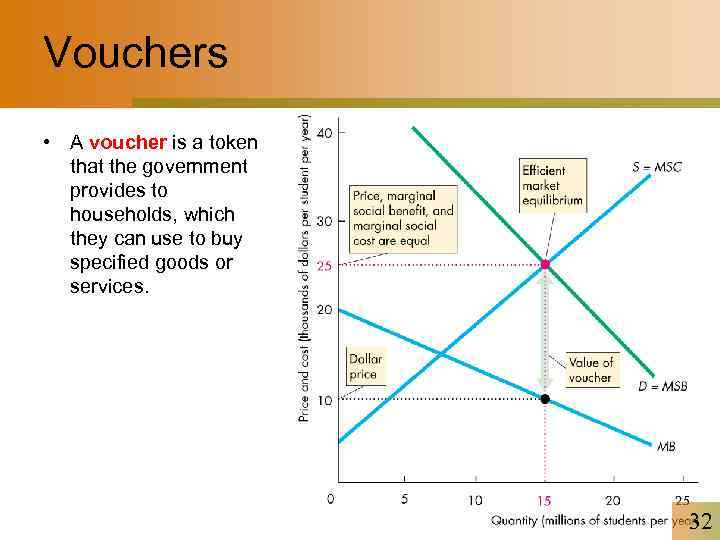

Vouchers • A voucher is a token that the government provides to households, which they can use to buy specified goods or services. 32

Vouchers • A voucher is a token that the government provides to households, which they can use to buy specified goods or services. 32

Patents and Copyrights • Intellectual property rights give the creator of knowledge the property right to the use of that knowledge. • The legal device for establishing an intellectual property right is the patent or a copyright. • A patent or copyright is a government-sanctioned exclusive right given to an inventor of a good, service or productive process to use to produce, use and sell the invention for a given number of years. 33

Patents and Copyrights • Intellectual property rights give the creator of knowledge the property right to the use of that knowledge. • The legal device for establishing an intellectual property right is the patent or a copyright. • A patent or copyright is a government-sanctioned exclusive right given to an inventor of a good, service or productive process to use to produce, use and sell the invention for a given number of years. 33

Example If the consumption of a good generates positive externalities, then: • The government can subsidize consumption of the good to increase efficiency • At the equilibrium quantity, output of the good is lower than the efficient quantity • Market forces may lead to an underallocation of resources to producing the good • All of these answers are correct 34

Example If the consumption of a good generates positive externalities, then: • The government can subsidize consumption of the good to increase efficiency • At the equilibrium quantity, output of the good is lower than the efficient quantity • Market forces may lead to an underallocation of resources to producing the good • All of these answers are correct 34