cfff26203f1ce84cbf9df88ecc99f986.ppt

- Количество слайдов: 57

Externalities and Property Rights MB MC Chapter 11: Externalities and Property Rights

MB MC External Costs and Benefits n External Cost (negative externality) l A cost of an activity that falls on people other than those who pursue the activity Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 2

MB MC External Costs and Benefits n External Benefit (positive externality) l A benefit of an activity received by people other than those who pursue the activity Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 3

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation Externalities reduce economic efficiency. l Solutions of externalities may be efficient. l When efficient solutions to externalities are not possible, government intervention or other collective action may be used. l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 4

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l Does the honeybee keeper face the right incentives? (Part I) u Bees pollinate the apple orchards. u The honeybee keeper may not consider the external benefit to the apple growers when considering the optimal number of hives. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 5

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l Does the honeybee keeper face the right incentives? (Part I) u If the external benefit is not considered, the bee keeper’s optimal number of hives will be less than the socially optimal number of hives. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 6

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l Does the honeybee keeper face the right incentives? (Part II) u If the hives are located near a school and nursing home, additional hives will cause more people to get stung by the bees. u For the students and nursing home residents, the bee hives create an external cost. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 7

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l Does the honeybee keeper face the right incentives? (Part II) u If the external costs are not considered, the optimal number of hives for the beekeeper will be greater than the socially optimal number of hives. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 8

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l When an activity does not create an externality, the optimal level of the activity for the individual will equal the socially optimal level of the activity. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 9

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l When an activity generates a negative externality, the level of the activity will be greater than the socially optimal level. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 10

MB MC External Costs and Benefits n How Externalities Affect Resource Allocation l When an activity generates a positive externality, the level of the activity will be less than the socially optimal level. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 11

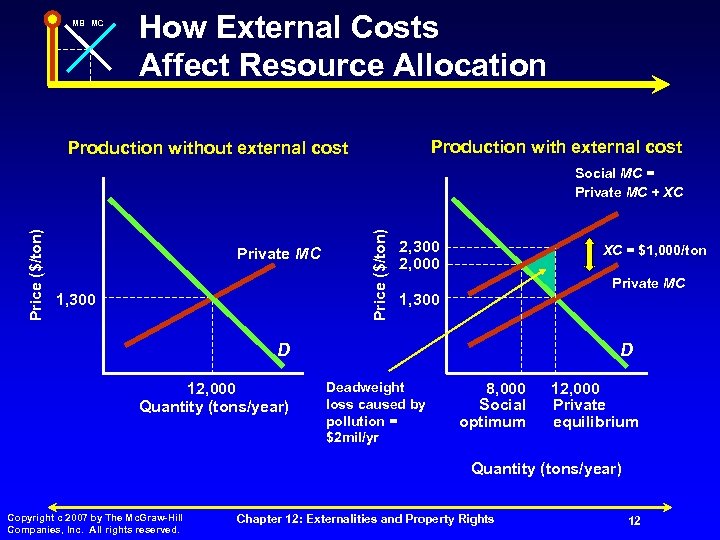

MB MC How External Costs Affect Resource Allocation Production with external cost Production without external cost Private MC 1, 300 Price ($/ton) Social MC = Private MC + XC 2, 300 2, 000 XC = $1, 000/ton Private MC 1, 300 D 12, 000 Quantity (tons/year) D Deadweight loss caused by pollution = $2 mil/yr 8, 000 Social optimum 12, 000 Private equilibrium Quantity (tons/year) Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 12

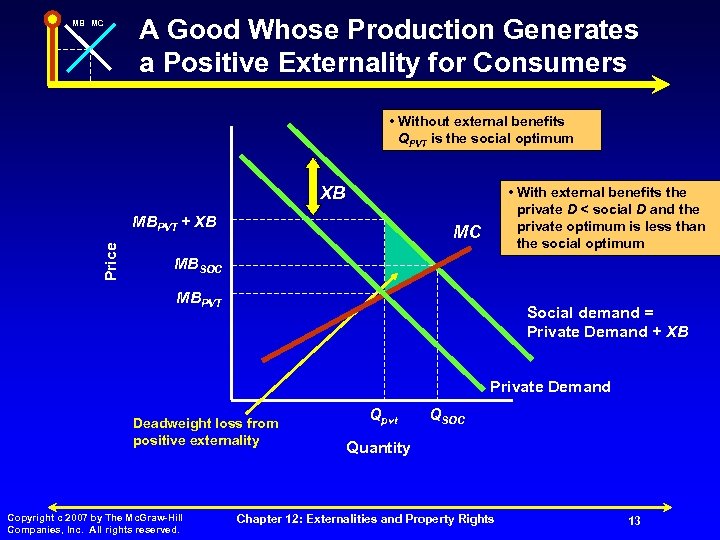

MB MC A Good Whose Production Generates a Positive Externality for Consumers • Without external benefits QPVT is the social optimum XB Price MBPVT + XB • With external benefits the private D < social D and the private optimum is less than the social optimum MC MBSOC MBPVT Social demand = Private Demand + XB Private Demand Deadweight loss from positive externality Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qpvt QSOC Quantity Chapter 12: Externalities and Property Rights 13

MB MC External Costs and Benefits n The Coase Theorem l When a market leaves cash on table there is usually a response to capture the unrealized value. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 14

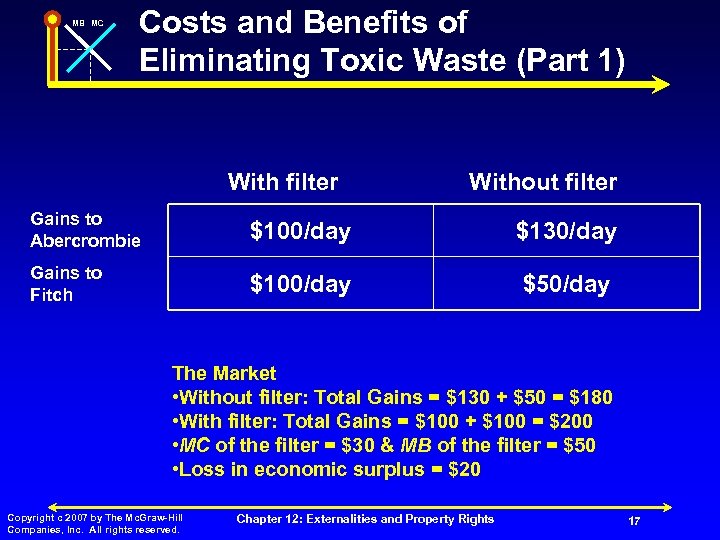

MB MC External Costs and Benefits n Example l Will Abercrombie dump toxins in the river (Part I) Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 15

MB MC External Costs and Benefits n Example l The Market u Abercrombie’s company produces a toxic waste. u If the waste is dumped into the river, Fitch cannot fish the river. u Should Abercrombie install a filter? o Assume there is no communication between Abercrombie and Fitch Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 16

MB MC Costs and Benefits of Eliminating Toxic Waste (Part 1) With filter Without filter Gains to Abercrombie $100/day $130/day Gains to Fitch $100/day $50/day The Market • Without filter: Total Gains = $130 + $50 = $180 • With filter: Total Gains = $100 + $100 = $200 • MC of the filter = $30 & MB of the filter = $50 • Loss in economic surplus = $20 Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 17

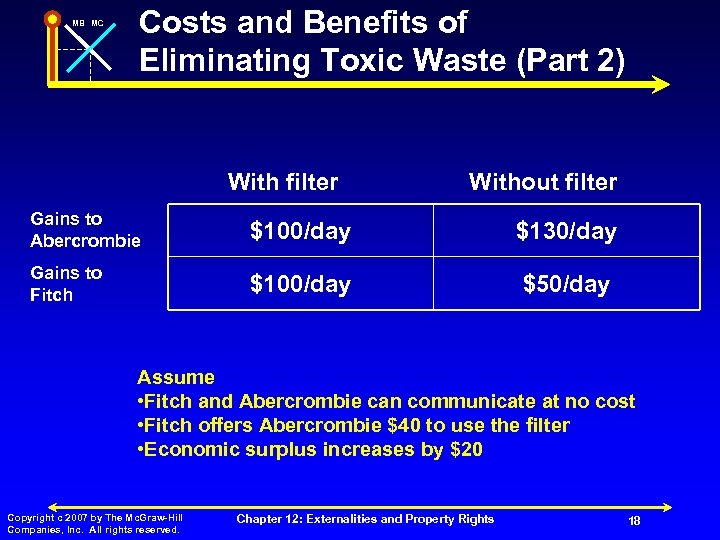

MB MC Costs and Benefits of Eliminating Toxic Waste (Part 2) With filter Without filter Gains to Abercrombie $100/day $130/day Gains to Fitch $100/day $50/day Assume • Fitch and Abercrombie can communicate at no cost • Fitch offers Abercrombie $40 to use the filter • Economic surplus increases by $20 Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 18

MB MC External Costs and Benefits n The Coase Theorem l If at no cost people can negotiate the purchase and sale of the right to perform activities that cause externalities, they can always arrive at efficient solutions to problems caused by externalities. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 19

MB MC External Costs and Benefits n Question l Why should Fitch pay Abercrombie to filter out toxins that would not be there in the first place if not for Abercrombie’s factory? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 20

MB MC External Costs and Benefits n Example By law Abercrombie cannot dump without Fitch’s approval. l Fitch and Abercrombie can negotiate without cost. l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 21

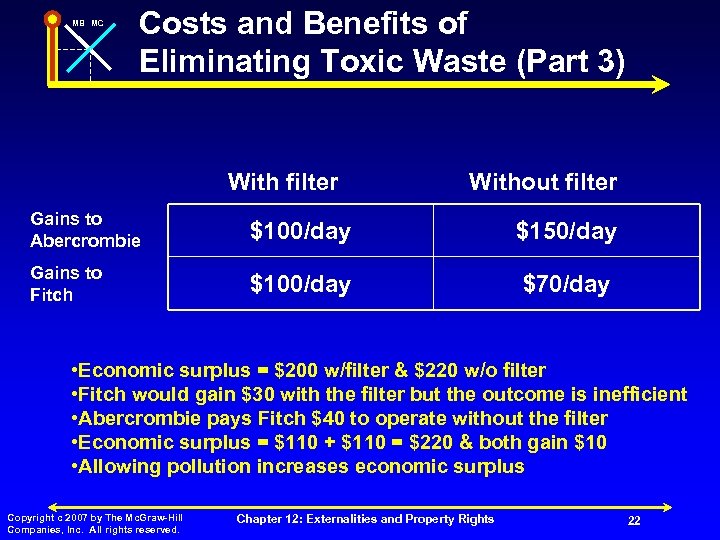

MB MC Costs and Benefits of Eliminating Toxic Waste (Part 3) With filter Without filter Gains to Abercrombie $100/day $150/day Gains to Fitch $100/day $70/day • Economic surplus = $200 w/filter & $220 w/o filter • Fitch would gain $30 with the filter but the outcome is inefficient • Abercrombie pays Fitch $40 to operate without the filter • Economic surplus = $110 + $110 = $220 & both gain $10 • Allowing pollution increases economic surplus Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 22

MB MC External Costs and Benefits n When polluters are liable: Polluter’s income is lowered. l Those injured by pollution will have higher income. l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 23

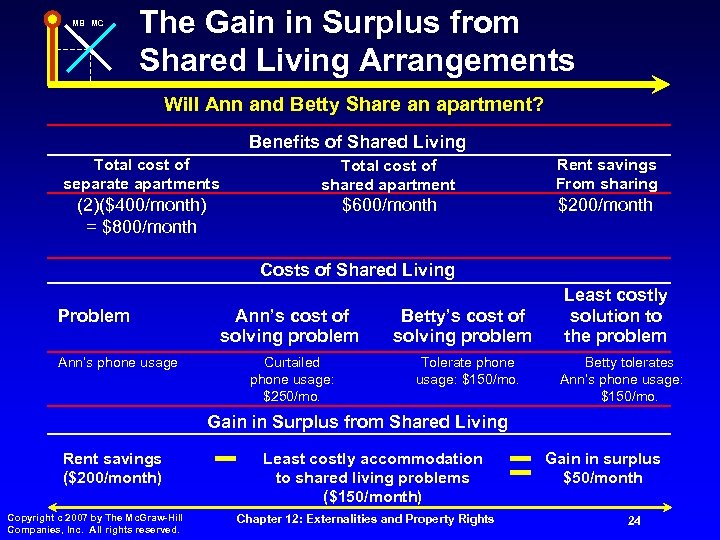

MB MC The Gain in Surplus from Shared Living Arrangements Will Ann and Betty Share an apartment? Benefits of Shared Living Total cost of separate apartments Total cost of shared apartment Rent savings From sharing (2)($400/month) = $800/month $600/month $200/month Costs of Shared Living Problem Ann’s phone usage Ann’s cost of solving problem Curtailed phone usage: $250/mo. Betty’s cost of solving problem Tolerate phone usage: $150/mo. Least costly solution to the problem Betty tolerates Ann’s phone usage: $150/mo. Gain in Surplus from Shared Living Rent savings ($200/month) Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Least costly accommodation to shared living problems ($150/month) Chapter 12: Externalities and Property Rights Gain in surplus $50/month 24

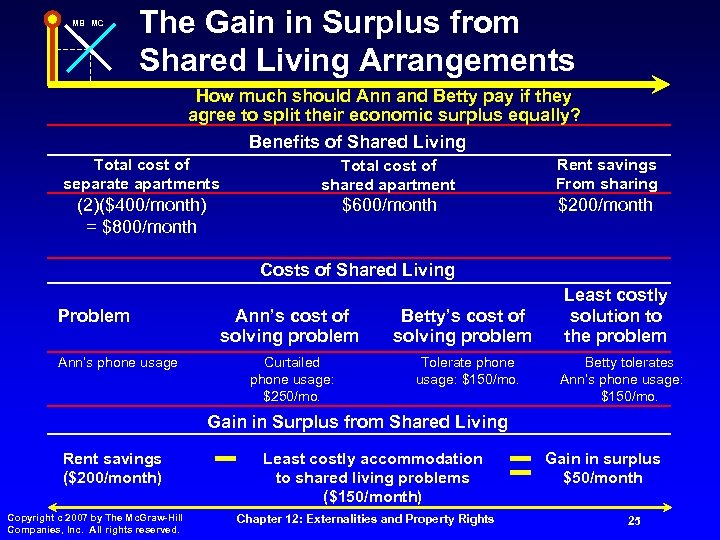

MB MC The Gain in Surplus from Shared Living Arrangements How much should Ann and Betty pay if they agree to split their economic surplus equally? Benefits of Shared Living Total cost of separate apartments Total cost of shared apartment Rent savings From sharing (2)($400/month) = $800/month $600/month $200/month Costs of Shared Living Problem Ann’s phone usage Ann’s cost of solving problem Curtailed phone usage: $250/mo. Betty’s cost of solving problem Tolerate phone usage: $150/mo. Least costly solution to the problem Betty tolerates Ann’s phone usage: $150/mo. Gain in Surplus from Shared Living Rent savings ($200/month) Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Least costly accommodation to shared living problems ($150/month) Chapter 12: Externalities and Property Rights Gain in surplus $50/month 25

MB MC External Costs and Benefits n Legal Remedies for Externalities l When negotiation is costless: u Efficient solutions to externalities can be found. u The adjustment to the externality is usually done by the party with the lowest cost. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 26

MB MC External Costs and Benefits n Legal Remedies for Externalities l When negotiation is not costless: u Laws may be used to correct for externalities. u The burden of the law can be placed on those who have the lowest cost. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 27

MB MC Legal Remedies for Externalities n Economic Naturalist l What is the purpose of speed limits and traffic laws? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 28

MB MC Legal Remedies for Externalities n Economic Naturalist l Why do most communities have zoning laws? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 29

MB MC Legal Remedies for Externalities n Economic Naturalist l Why do many governments enact laws that limit the discharge of environmental pollutants? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 30

MB MC Legal Remedies for Externalities n Economic Naturalist l What is the purpose of free speech laws? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 31

MB MC Legal Remedies for Externalities n Economic Naturalist l Why does government subsidize the planting of trees on hillsides? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 32

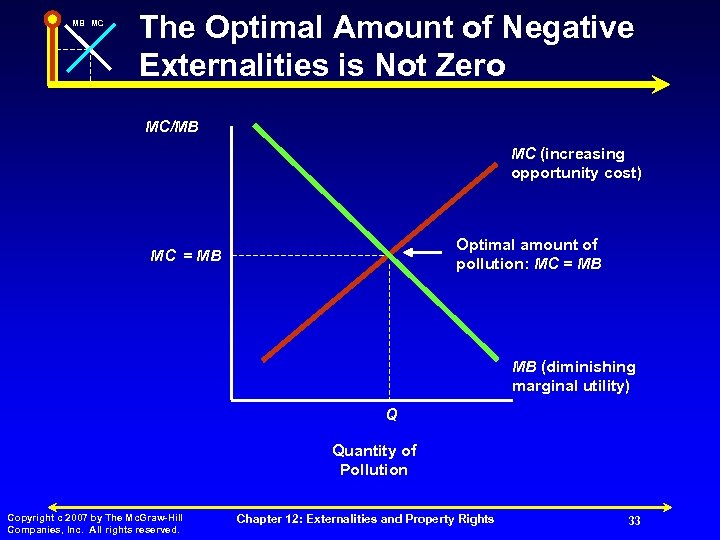

MB MC The Optimal Amount of Negative Externalities is Not Zero MC/MB MC (increasing opportunity cost) Optimal amount of pollution: MC = MB MB (diminishing marginal utility) Q Quantity of Pollution Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 33

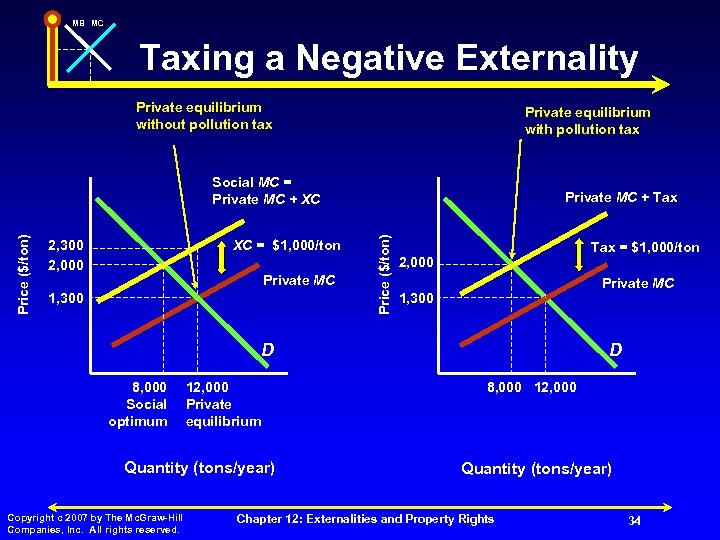

MB MC Taxing a Negative Externality Private equilibrium without pollution tax Private equilibrium with pollution tax 2, 300 2, 000 XC = $1, 000/ton Private MC 1, 300 Private MC + Tax Price ($/ton) Social MC = Private MC + XC Tax = $1, 000/ton 2, 000 Private MC 1, 300 D 8, 000 Social optimum 12, 000 Private equilibrium Quantity (tons/year) Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. D 8, 000 12, 000 Quantity (tons/year) Chapter 12: Externalities and Property Rights 34

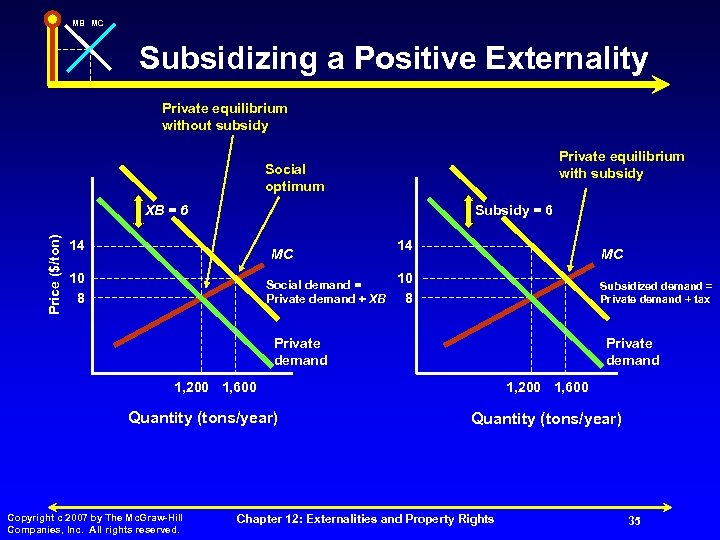

MB MC Subsidizing a Positive Externality Private equilibrium without subsidy Private equilibrium with subsidy Social optimum Price ($/ton) XB = 6 Subsidy = 6 14 MC 10 8 14 MC 10 Social demand = 8 Private demand + XB Subsidized demand = Private demand + tax Private demand 1, 200 1, 600 Quantity (tons/year) Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Quantity (tons/year) Chapter 12: Externalities and Property Rights 35

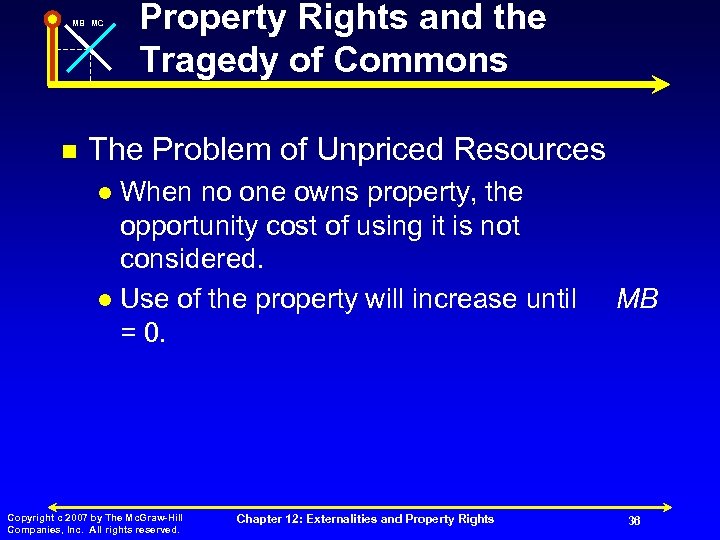

MB MC n Property Rights and the Tragedy of Commons The Problem of Unpriced Resources When no one owns property, the opportunity cost of using it is not considered. l Use of the property will increase until = 0. l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights MB 36

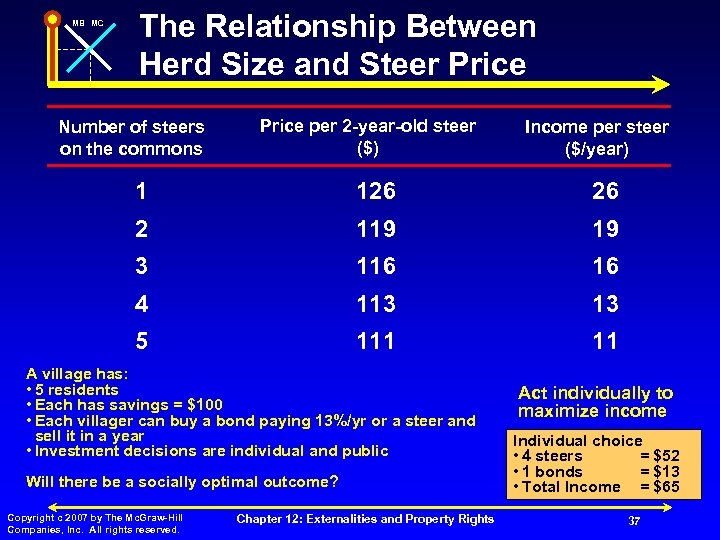

MB MC The Relationship Between Herd Size and Steer Price Number of steers on the commons Price per 2 -year-old steer ($) Income per steer ($/year) 1 126 26 2 119 19 3 116 16 4 113 13 5 111 11 A village has: • 5 residents • Each has savings = $100 • Each villager can buy a bond paying 13%/yr or a steer and sell it in a year • Investment decisions are individual and public Will there be a socially optimal outcome? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights Act individually to maximize income Individual choice • 4 steers = $52 • 1 bonds = $13 • Total Income = $65 37

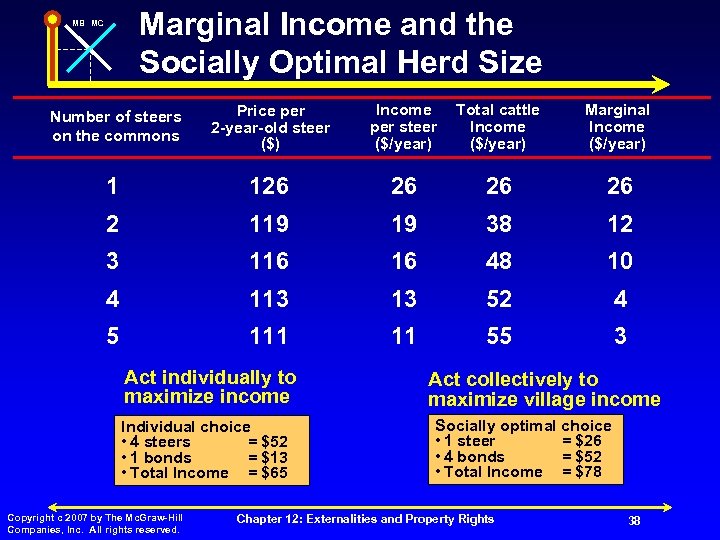

Marginal Income and the Socially Optimal Herd Size MB MC Number of steers on the commons Price per 2 -year-old steer ($) Income per steer ($/year) Total cattle Income ($/year) Marginal Income ($/year) 1 126 26 2 119 19 38 12 3 116 16 48 10 4 113 13 52 4 5 111 11 55 3 Act individually to maximize income Individual choice • 4 steers = $52 • 1 bonds = $13 • Total Income = $65 Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Act collectively to maximize village income Socially optimal choice • 1 steer = $26 • 4 bonds = $52 • Total Income = $78 Chapter 12: Externalities and Property Rights 38

MB MC n Property Rights and the Tragedy of Commons The Problem of Unpriced Resources When no one owns the commons, the opportunity cost of using it is not considered. l Use of the commons will increase until MB = 0. l One person’s use of the commons imposes an external cost on the others by making the property less valuable. l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 39

MB MC n Property Rights and the Tragedy of Commons The Effect of Private Ownership l Example u How much will the right to control the village commons sell for? Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 40

MB MC n Property Rights and the Tragedy of Commons The Effect of Private Ownership l Assume u Villagers can borrow and lend at 13%. u The villagers decide to auction off the rights to the commons. u One steer is the optimal number Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 41

MB MC n Property Rights and the Tragedy of Commons The Effect of Private Ownership l Assume u Income from one steer = $26. u Pay $100 for the commons o The $26 profit covers the cost of the loan to buy the steer at the opportunity cost of $100 or $13 u Economic surplus of the village will be: o (4 x $13) + $26 = $78 or o (4 x $13) + $13 rent + $13 highest bidder = $78 Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 42

MB MC n Property Rights and the Tragedy of Commons The Effect of Private Ownership l Observations u When the land is auctioned, the highest bidder will have an incentive to consider the opportunity cost of grazing additional steers. u Common property is not used efficiently. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 43

MB MC n Property Rights and the Tragedy of Commons The Effect of Private Ownership l Observations u Zoning laws and other regulations restrict the use of private property. u The laws can be used to maximize economic surplus. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 44

MB MC n Property Rights and the Tragedy of Commons The Effect of Private Ownership l Observations u The laws can also be used to achieve an individual goal (reelection) by reducing the economic surplus. u Private ownership may be impractical. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 45

MB MC n Property Rights and the Tragedy of Commons Economic Naturalist Why do blackberries in public parks get picked too soon? l Why are shared milkshakes consumed too quickly? l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 46

MB MC n Property Rights and the Tragedy of Commons When Private Ownership is Impractical Harvesting timber on remote public land l Harvesting whales in international waters l Controlling multinational environmental pollution l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 47

MB MC Positional Externalities n Payoffs That Depend on Relative Performance l In a competitive situation: u There is an incentive to take an action to increase the odds of winning. u The overall gain to the players as a group will be zero. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 48

MB MC Positional Externalities n Payoffs That Depend on Relative Performance l In a competitive situation: u When the payoff depends on relative performance, incentive to invest in performance activities will be excessive from a collective point of view. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 49

MB MC Positional Externalities n Economic Naturalist l Why do football players take anabolic steroids? u Smith and Jones are competing for a single position and a $1 million contract. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 50

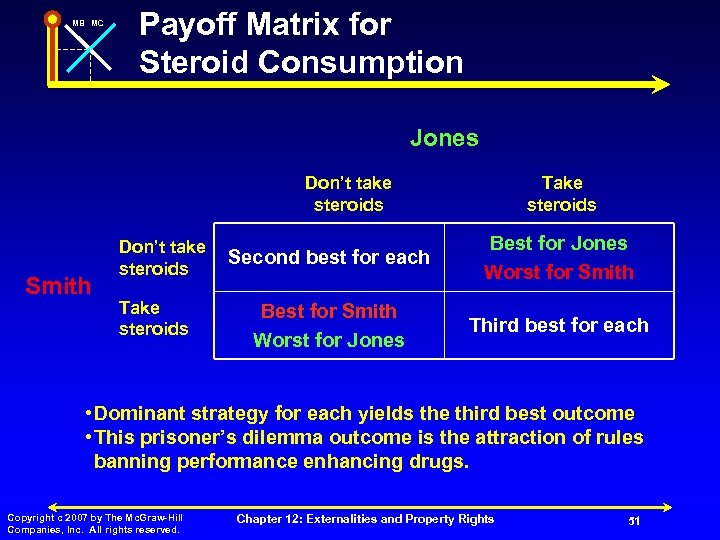

MB MC Payoff Matrix for Steroid Consumption Jones Don’t take steroids Smith Don’t take steroids Take steroids Second best for each Best for Jones Worst for Smith Best for Smith Worst for Jones Third best for each • Dominant strategy for each yields the third best outcome • This prisoner’s dilemma outcome is the attraction of rules banning performance enhancing drugs. Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 51

MB MC n Positional Arms Races and Positional Arms Control Agreements Positional Externality l When an increase in one person’s performance reduces the expected reward of another in situations in which reward depends on relative performance Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 52

MB MC n Positional Arms Races and Positional Arms Control Agreements Positional Arms Race l A series of mutually offsetting investments in performance enhancement that is stimulated by a positional externality Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 53

MB MC n Positional Arms Races and Positional Arms Control Agreements l An agreement in which contestants attempt to limit mutually offsetting investments in performance enhancements Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 54

MB MC n Positional Arms Races and Positional Arms Control Agreements Campaign spending limits l Roster limits l Arbitration agreements l Mandatory starting dates for kindergarten l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 55

MB MC n Positional Arms Races and Positional Arms Control Agreements Social Norms as Positional Arms Control Agreements Nerd norms l Fashion norms l Norms of taste l Norms against vanity l Copyright c 2007 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Chapter 12: Externalities and Property Rights 56

End of Chapter MB MC Chapter 11: Externalities and Property Rights

cfff26203f1ce84cbf9df88ecc99f986.ppt