b7d199018501c8e4b3250794f59b3016.ppt

- Количество слайдов: 22

External Background • US economy still has considerable momentum • Japan continues to show most positive signs in over a decade • China still growing strongly • UK struggling, but outlook positive • Euro Zone continues to improve • Solid external background

The Risks • Oil Prices • US twin deficits • Currency instability • Too much aggression from paranoid ECB

Financial Conditions • ECB rate tightening to continue • 1% by end-2007 • Another 0. 5% from Fed, BOE could cut • Exchange rate markets very stable • Euro should make some gains against sterling & dollar

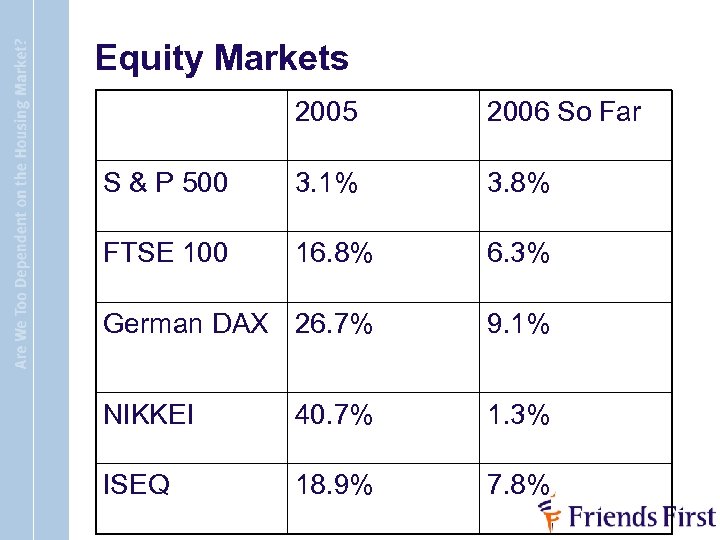

Equity Markets • Strong momentum has carried over to 2006 • Markets not concerned about risks • Focused on solid economic & earnings fundamentals • Euro Zone markets continue to be favoured • Japan has struggled, but has potential • US not promising too many dramatics • Irish market retains solid fundamental support • 2006 another good year for equity investors & pension funds

Equity Markets 2005 2006 So Far S & P 500 3. 1% 3. 8% FTSE 100 16. 8% 6. 3% German DAX 26. 7% 9. 1% NIKKEI 40. 7% 1. 3% ISEQ 18. 9% 7. 8%

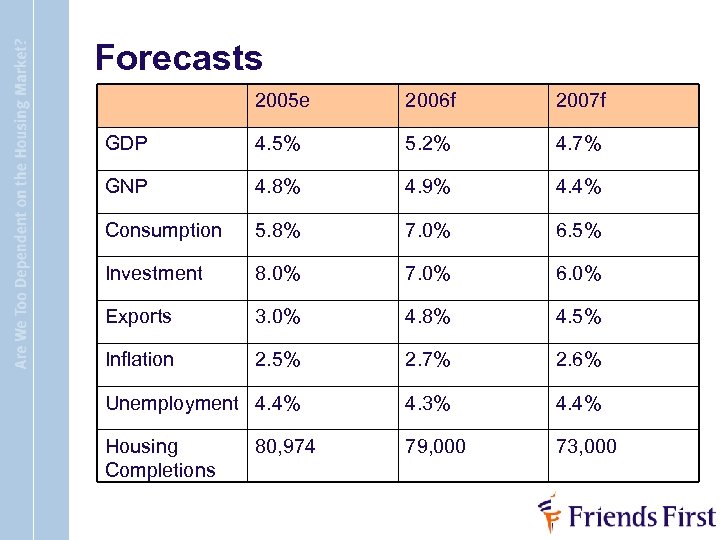

The Irish Economy • Strong momentum has carried over to 2006 • Consumer spending, Construction & Business Investment strong • Exports/Manufacturing finding life challenging • Strong public finances, another ‘budget bonanza’ in December • SSIAs will exert considerable influence over next year • Growth prospects 2006 & 2007 good

Forecasts 2005 e 2006 f 2007 f GDP 4. 5% 5. 2% 4. 7% GNP 4. 8% 4. 9% 4. 4% Consumption 5. 8% 7. 0% 6. 5% Investment 8. 0% 7. 0% 6. 0% Exports 3. 0% 4. 8% 4. 5% Inflation 2. 5% 2. 7% 2. 6% Unemployment 4. 4% 4. 3% 4. 4% Housing Completions 79, 000 73, 000 80, 974

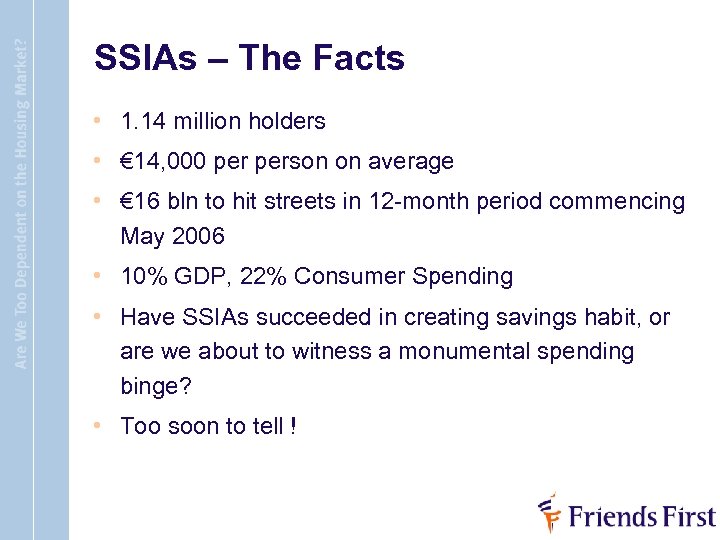

SSIAs – The Facts • 1. 14 million holders • € 14, 000 person on average • € 16 bln to hit streets in 12 -month period commencing May 2006 • 10% GDP, 22% Consumer Spending • Have SSIAs succeeded in creating savings habit, or are we about to witness a monumental spending binge? • Too soon to tell !

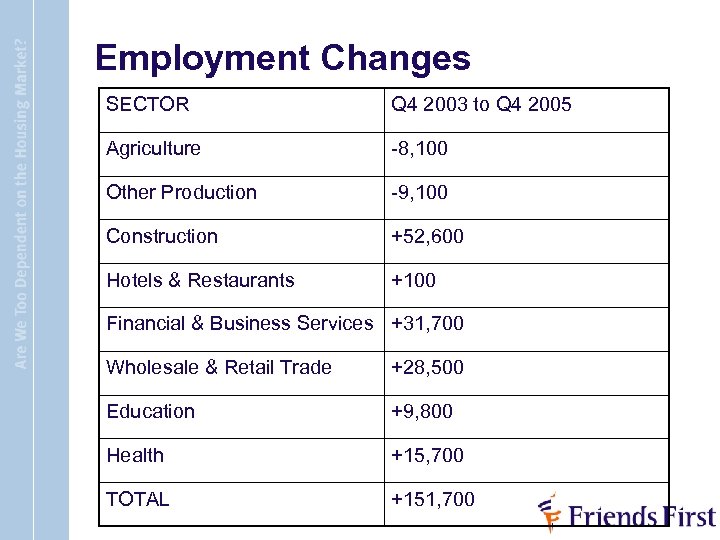

Employment Changes SECTOR Q 4 2003 to Q 4 2005 Agriculture -8, 100 Other Production -9, 100 Construction +52, 600 Hotels & Restaurants +100 Financial & Business Services +31, 700 Wholesale & Retail Trade +28, 500 Education +9, 800 Health +15, 700 TOTAL +151, 700

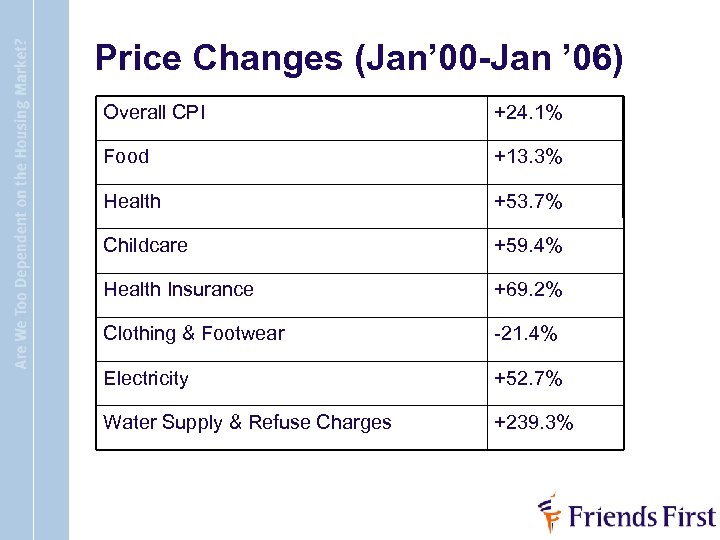

Price Changes (Jan’ 00 -Jan ’ 06) Overall CPI +24. 1% Food +13. 3% Health +53. 7% Childcare +59. 4% Health Insurance +69. 2% Clothing & Footwear -21. 4% Electricity +52. 7% Water Supply & Refuse Charges +239. 3%

The Big Economic Issues • Future labour supply • Infrastructure & Public Services • IT Capability • Quality of labour force • Globalisation • Unbalanced nature of economic development/Threats to rural economic sustainability • The Housing Market

Housing Market • Very strong performance in 2005 • Very strong start to 2006 • Demand forces still very strong • Supply response very strong • Market has to be approaching equilibrium • Prospects of hard landing remote • Economy has heavy dependence on housing market

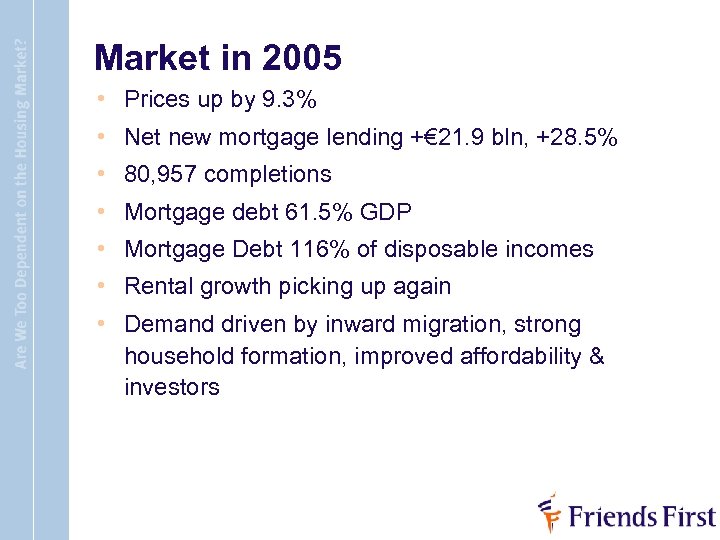

Market in 2005 • Prices up by 9. 3% • Net new mortgage lending +€ 21. 9 bln, +28. 5% • 80, 957 completions • Mortgage debt 61. 5% GDP • Mortgage Debt 116% of disposable incomes • Rental growth picking up again • Demand driven by inward migration, strong household formation, improved affordability & investors

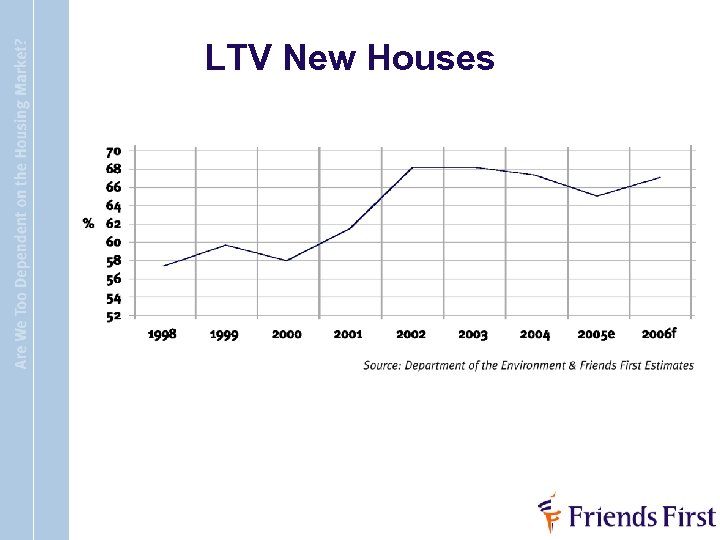

LTV New Houses

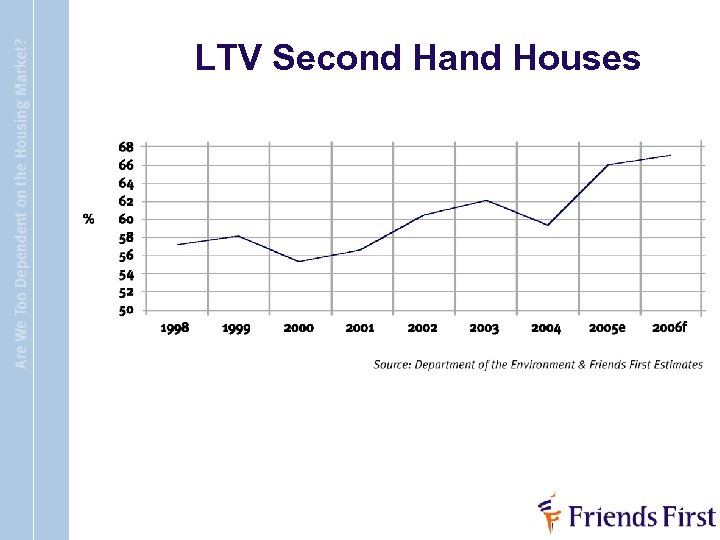

LTV Second Hand Houses

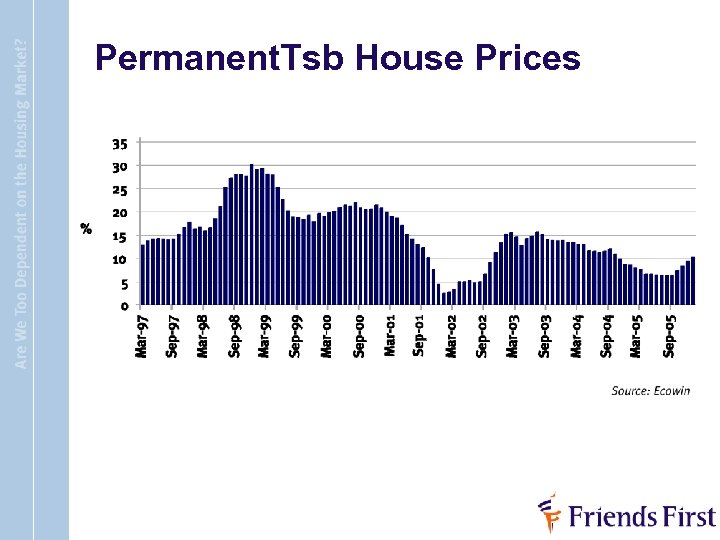

Permanent. Tsb House Prices

The Market in 2006 • Frenetic start to 2006 • Demand forces to remain strong • Interest rates will have no more than a modest sobering effect • SSIAs will have an important influence • Completions of around 79, 000 • Prices set to rise by 7% • Residential housing will be an important driver of activity once again

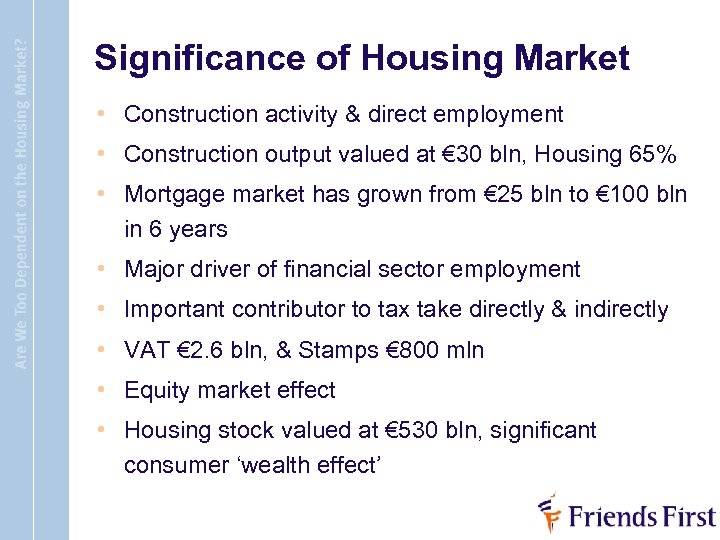

Significance of Housing Market • Construction activity & direct employment • Construction output valued at € 30 bln, Housing 65% • Mortgage market has grown from € 25 bln to € 100 bln in 6 years • Major driver of financial sector employment • Important contributor to tax take directly & indirectly • VAT € 2. 6 bln, & Stamps € 800 mln • Equity market effect • Housing stock valued at € 530 bln, significant consumer ‘wealth effect’

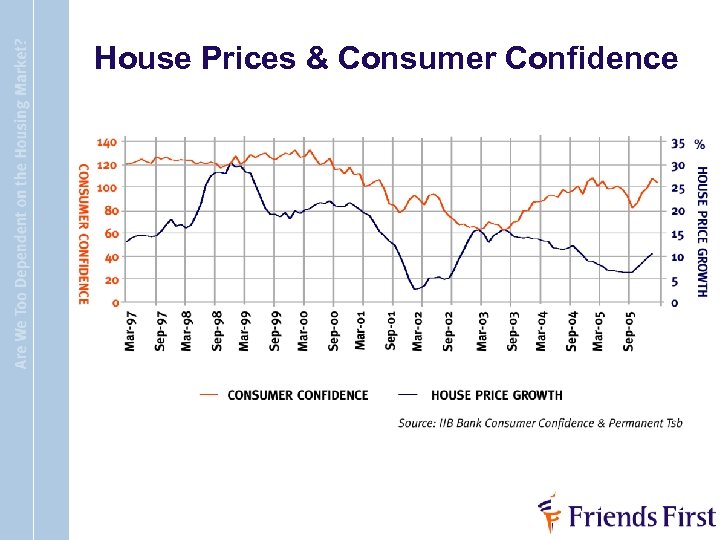

House Prices & Consumer Confidence

Is Economy too Dependent? • Yes & No • Residential housing having a major impact on economic activity • Significant setback to market would have very negative effect on overall economy • Activity is justified by the ‘fundamentals’ • Risk of significant setback low, but not immaterial • Policy imperative to create other sustainable activities!

ANY QUESTIONS

b7d199018501c8e4b3250794f59b3016.ppt