c7990aca81bc453e96a3d1c8670fa9ce.ppt

- Количество слайдов: 16

EXTERNAL AUDIT OF MUNICIPALITIES IN DIFFERENT EUROSAI COUNTRIES Edita Remizovienė, Adviser Audit Department 3 7 October 2015

EXTERNAL AUDIT OF MUNICIPALITIES IN DIFFERENT EUROSAI COUNTRIES Edita Remizovienė, Adviser Audit Department 3 7 October 2015

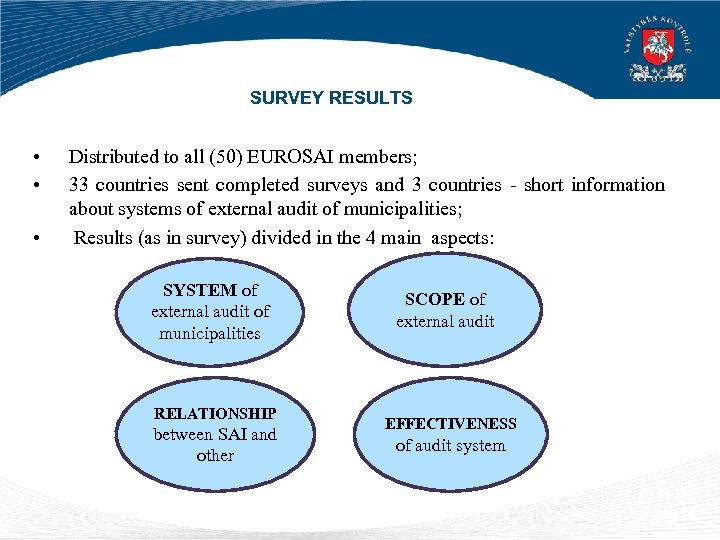

SURVEY RESULTS • • • Distributed to all (50) EUROSAI members; 33 countries sent completed surveys and 3 countries - short information about systems of external audit of municipalities; Results (as in survey) divided in the 4 main aspects: SYSTEM of external audit of municipalities RELATIONSHIP between SAI and other SCOPE of external audit EFFECTIVENESS of audit system

SURVEY RESULTS • • • Distributed to all (50) EUROSAI members; 33 countries sent completed surveys and 3 countries - short information about systems of external audit of municipalities; Results (as in survey) divided in the 4 main aspects: SYSTEM of external audit of municipalities RELATIONSHIP between SAI and other SCOPE of external audit EFFECTIVENESS of audit system

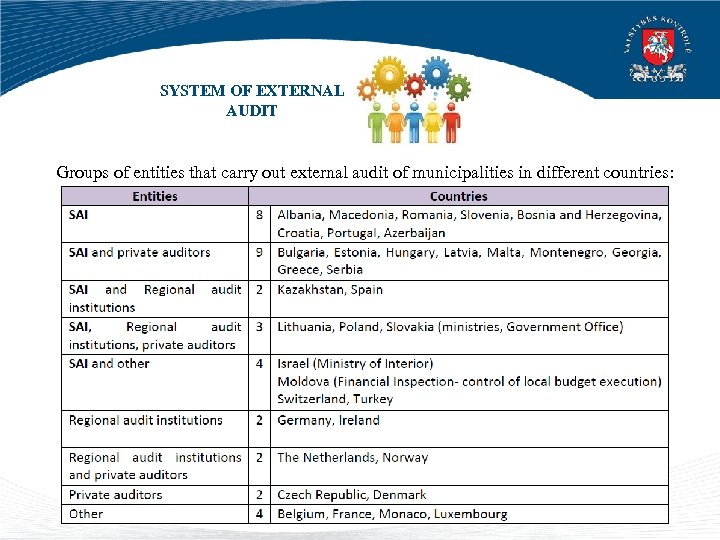

SYSTEM OF EXTERNAL AUDIT Groups of entities that carry out external audit of municipalities in different countries:

SYSTEM OF EXTERNAL AUDIT Groups of entities that carry out external audit of municipalities in different countries:

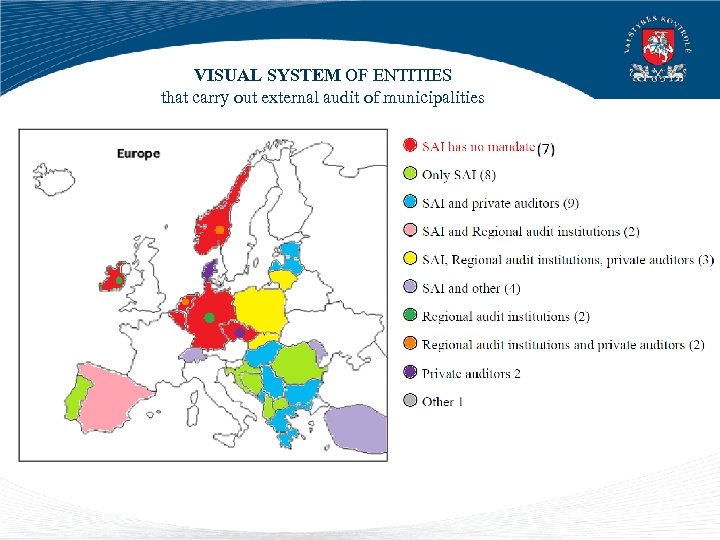

VISUAL SYSTEM OF ENTITIES that carry out external audit of municipalities

VISUAL SYSTEM OF ENTITIES that carry out external audit of municipalities

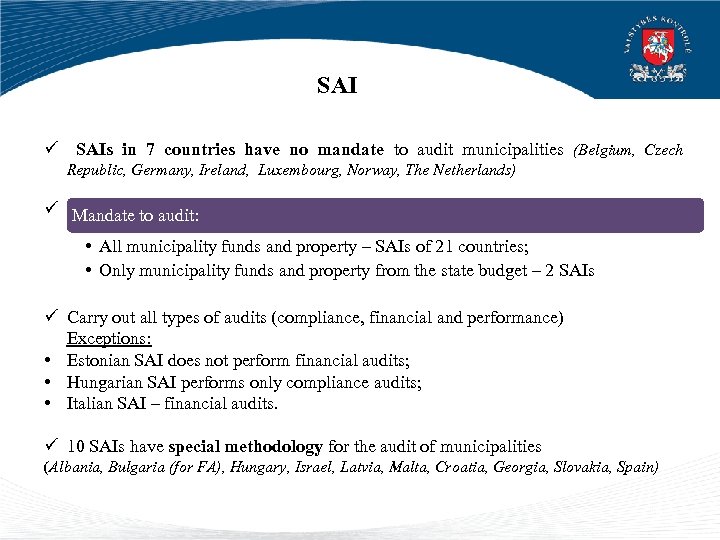

SAI ü SAIs in 7 countries have no mandate to audit municipalities (Belgium, Czech Republic, Germany, Ireland, Luxembourg, Norway, The Netherlands) ü Mandate to audit: • All municipality funds and property – SAIs of 21 countries; • Only municipality funds and property from the state budget – 2 SAIs ü Carry out all types of audits (compliance, financial and performance) Exceptions: • Estonian SAI does not perform financial audits; • Hungarian SAI performs only compliance audits; • Italian SAI – financial audits. ü 10 SAIs have special methodology for the audit of municipalities (Albania, Bulgaria (for FA), Hungary, Israel, Latvia, Malta, Croatia, Georgia, Slovakia, Spain)

SAI ü SAIs in 7 countries have no mandate to audit municipalities (Belgium, Czech Republic, Germany, Ireland, Luxembourg, Norway, The Netherlands) ü Mandate to audit: • All municipality funds and property – SAIs of 21 countries; • Only municipality funds and property from the state budget – 2 SAIs ü Carry out all types of audits (compliance, financial and performance) Exceptions: • Estonian SAI does not perform financial audits; • Hungarian SAI performs only compliance audits; • Italian SAI – financial audits. ü 10 SAIs have special methodology for the audit of municipalities (Albania, Bulgaria (for FA), Hungary, Israel, Latvia, Malta, Croatia, Georgia, Slovakia, Spain)

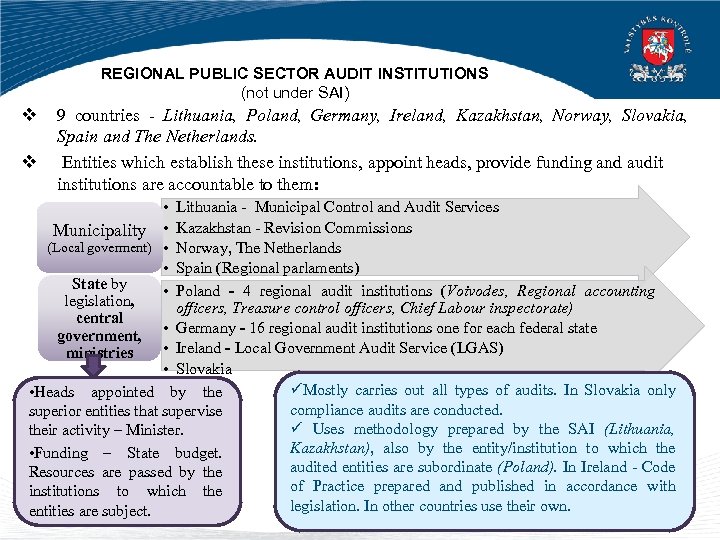

REGIONAL PUBLIC SECTOR AUDIT INSTITUTIONS (not under SAI) v v 9 countries - Lithuania, Poland, Germany, Ireland, Kazakhstan, Norway, Slovakia, Spain and The Netherlands. Entities which establish these institutions, appoint heads, provide funding and audit institutions are accountable to them: • Lithuania - Municipal Control and Audit Services Municipality • Kazakhstan - Revision Commissions (Local goverment) • Norway, The Netherlands • Spain (Regional parlaments) State by • Poland - 4 regional audit institutions (Voivodes, Regional accounting legislation, officers, Treasure control officers, Chief Labour inspectorate) central government, • Germany - 16 regional audit institutions one for each federal state • Ireland - Local Government Audit Service (LGAS) ministries • Slovakia üMostly carries out all types of audits. In Slovakia only • Heads appointed by the compliance audits are conducted. superior entities that supervise ü Uses methodology prepared by the SAI (Lithuania, their activity – Minister. Kazakhstan), also by the entity/institution to which the • Funding – State budget. audited entities are subordinate (Poland). In Ireland - Code Resources are passed by the of Practice prepared and published in accordance with institutions to which the legislation. In other countries use their own. entities are subject.

REGIONAL PUBLIC SECTOR AUDIT INSTITUTIONS (not under SAI) v v 9 countries - Lithuania, Poland, Germany, Ireland, Kazakhstan, Norway, Slovakia, Spain and The Netherlands. Entities which establish these institutions, appoint heads, provide funding and audit institutions are accountable to them: • Lithuania - Municipal Control and Audit Services Municipality • Kazakhstan - Revision Commissions (Local goverment) • Norway, The Netherlands • Spain (Regional parlaments) State by • Poland - 4 regional audit institutions (Voivodes, Regional accounting legislation, officers, Treasure control officers, Chief Labour inspectorate) central government, • Germany - 16 regional audit institutions one for each federal state • Ireland - Local Government Audit Service (LGAS) ministries • Slovakia üMostly carries out all types of audits. In Slovakia only • Heads appointed by the compliance audits are conducted. superior entities that supervise ü Uses methodology prepared by the SAI (Lithuania, their activity – Minister. Kazakhstan), also by the entity/institution to which the • Funding – State budget. audited entities are subordinate (Poland). In Ireland - Code Resources are passed by the of Practice prepared and published in accordance with institutions to which the legislation. In other countries use their own. entities are subject.

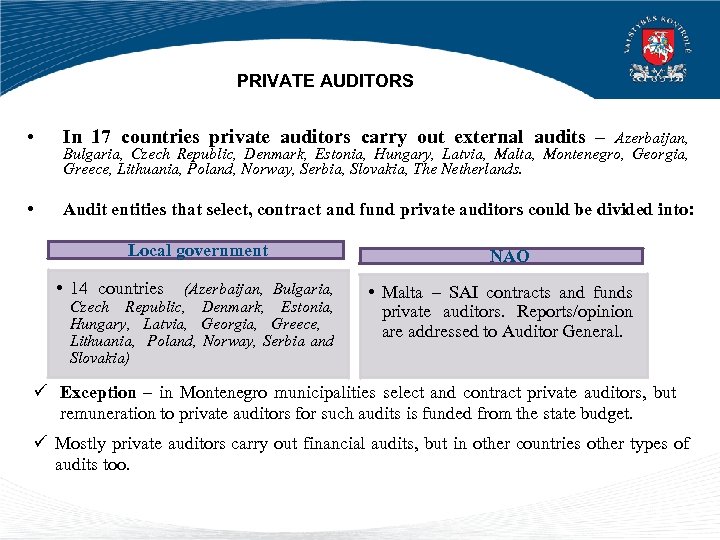

PRIVATE AUDITORS • In 17 countries private auditors carry out external audits – • Audit entities that select, contract and fund private auditors could be divided into: Azerbaijan, Bulgaria, Czech Republic, Denmark, Estonia, Hungary, Latvia, Malta, Montenegro, Georgia, Greece, Lithuania, Poland, Norway, Serbia, Slovakia, The Netherlands. Local government • 14 countries (Azerbaijan, Bulgaria, Czech Republic, Denmark, Estonia, Hungary, Latvia, Georgia, Greece, Lithuania, Poland, Norway, Serbia and Slovakia) NAO • Malta – SAI contracts and funds private auditors. Reports/opinion are addressed to Auditor General. ü Exception – in Montenegro municipalities select and contract private auditors, but remuneration to private auditors for such audits is funded from the state budget. ü Mostly private auditors carry out financial audits, but in other countries other types of audits too.

PRIVATE AUDITORS • In 17 countries private auditors carry out external audits – • Audit entities that select, contract and fund private auditors could be divided into: Azerbaijan, Bulgaria, Czech Republic, Denmark, Estonia, Hungary, Latvia, Malta, Montenegro, Georgia, Greece, Lithuania, Poland, Norway, Serbia, Slovakia, The Netherlands. Local government • 14 countries (Azerbaijan, Bulgaria, Czech Republic, Denmark, Estonia, Hungary, Latvia, Georgia, Greece, Lithuania, Poland, Norway, Serbia and Slovakia) NAO • Malta – SAI contracts and funds private auditors. Reports/opinion are addressed to Auditor General. ü Exception – in Montenegro municipalities select and contract private auditors, but remuneration to private auditors for such audits is funded from the state budget. ü Mostly private auditors carry out financial audits, but in other countries other types of audits too.

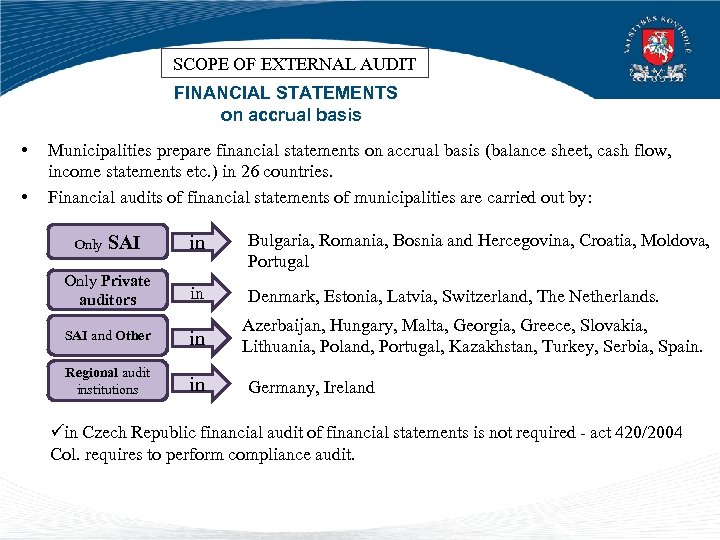

SCOPE OF EXTERNAL AUDIT FINANCIAL STATEMENTS on accrual basis • • Municipalities prepare financial statements on accrual basis (balance sheet, cash flow, income statements etc. ) in 26 countries. Financial audits of financial statements of municipalities are carried out by: Only SAI Only Private auditors in Bulgaria, Romania, Bosnia and Hercegovina, Croatia, Moldova, Portugal in Denmark, Estonia, Latvia, Switzerland, The Netherlands. SAI and Other in Regional audit institutions in Azerbaijan, Hungary, Malta, Georgia, Greece, Slovakia, Lithuania, Poland, Portugal, Kazakhstan, Turkey, Serbia, Spain. Germany, Ireland üin Czech Republic financial audit of financial statements is not required - act 420/2004 Col. requires to perform compliance audit.

SCOPE OF EXTERNAL AUDIT FINANCIAL STATEMENTS on accrual basis • • Municipalities prepare financial statements on accrual basis (balance sheet, cash flow, income statements etc. ) in 26 countries. Financial audits of financial statements of municipalities are carried out by: Only SAI Only Private auditors in Bulgaria, Romania, Bosnia and Hercegovina, Croatia, Moldova, Portugal in Denmark, Estonia, Latvia, Switzerland, The Netherlands. SAI and Other in Regional audit institutions in Azerbaijan, Hungary, Malta, Georgia, Greece, Slovakia, Lithuania, Poland, Portugal, Kazakhstan, Turkey, Serbia, Spain. Germany, Ireland üin Czech Republic financial audit of financial statements is not required - act 420/2004 Col. requires to perform compliance audit.

FINANCIAL STATEMENTS on accrual basis v Financial statements prepared on accrual basis are consolidated at the national level with financial statements of the State and other funds in 12 countries (Bulgaria, Estonia, Latvia, Lithuania, Romania, Croatia, Germany, Luxembourg, Moldova, Slovakia, Serbia and Turkey) v SAI is responsible for the financial audit of consolidated set.

FINANCIAL STATEMENTS on accrual basis v Financial statements prepared on accrual basis are consolidated at the national level with financial statements of the State and other funds in 12 countries (Bulgaria, Estonia, Latvia, Lithuania, Romania, Croatia, Germany, Luxembourg, Moldova, Slovakia, Serbia and Turkey) v SAI is responsible for the financial audit of consolidated set.

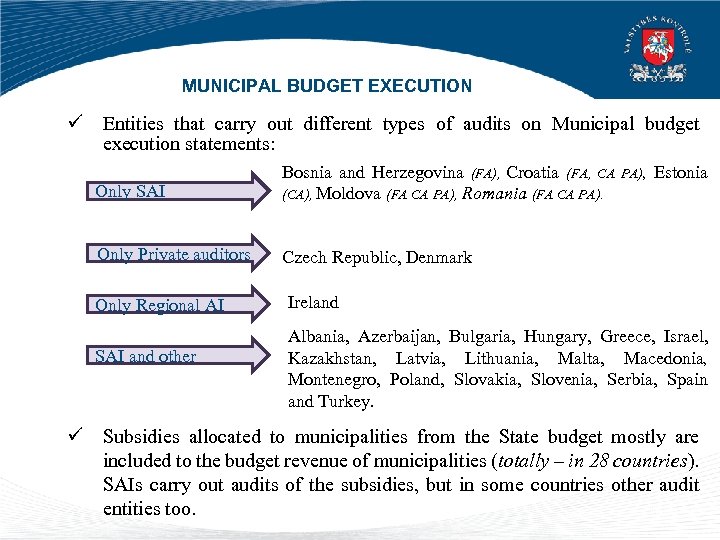

MUNICIPAL BUDGET EXECUTION ü Entities that carry out different types of audits on Municipal budget execution statements: Only SAI Bosnia and Herzegovina (FA), Croatia (FA, CA (CA), Moldova (FA CA PA), Romania (FA CA PA). Only Private auditors Czech Republic, Denmark Only Regional AI SAI and other PA), Estonia Ireland Albania, Azerbaijan, Bulgaria, Hungary, Greece, Israel, Kazakhstan, Latvia, Lithuania, Malta, Macedonia, Montenegro, Poland, Slovakia, Slovenia, Serbia, Spain and Turkey. ü Subsidies allocated to municipalities from the State budget mostly are included to the budget revenue of municipalities (totally – in 28 countries). SAIs carry out audits of the subsidies, but in some countries other audit entities too.

MUNICIPAL BUDGET EXECUTION ü Entities that carry out different types of audits on Municipal budget execution statements: Only SAI Bosnia and Herzegovina (FA), Croatia (FA, CA (CA), Moldova (FA CA PA), Romania (FA CA PA). Only Private auditors Czech Republic, Denmark Only Regional AI SAI and other PA), Estonia Ireland Albania, Azerbaijan, Bulgaria, Hungary, Greece, Israel, Kazakhstan, Latvia, Lithuania, Malta, Macedonia, Montenegro, Poland, Slovakia, Slovenia, Serbia, Spain and Turkey. ü Subsidies allocated to municipalities from the State budget mostly are included to the budget revenue of municipalities (totally – in 28 countries). SAIs carry out audits of the subsidies, but in some countries other audit entities too.

SCOPE OF EXTERNAL AUDIT Financial statements prepared by municipality owned enterprises: ü Financial audits mostly are carried out by private auditors; ü Regional public sector audit institutions - in countries where these institutions are established; ü Only in Albania, Bosnia and Herzegovina, Macedonia and Romania SAIs conduct financial audits; ü In Israel it is conducted by the Ministry of Interior.

SCOPE OF EXTERNAL AUDIT Financial statements prepared by municipality owned enterprises: ü Financial audits mostly are carried out by private auditors; ü Regional public sector audit institutions - in countries where these institutions are established; ü Only in Albania, Bosnia and Herzegovina, Macedonia and Romania SAIs conduct financial audits; ü In Israel it is conducted by the Ministry of Interior.

RELATIONSHIP BETWEEN SAI AND OTHER EXTERNAL AUDITORS REGARDING THE EXTERNAL AUDITS OF MUNICIPALITIES

RELATIONSHIP BETWEEN SAI AND OTHER EXTERNAL AUDITORS REGARDING THE EXTERNAL AUDITS OF MUNICIPALITIES

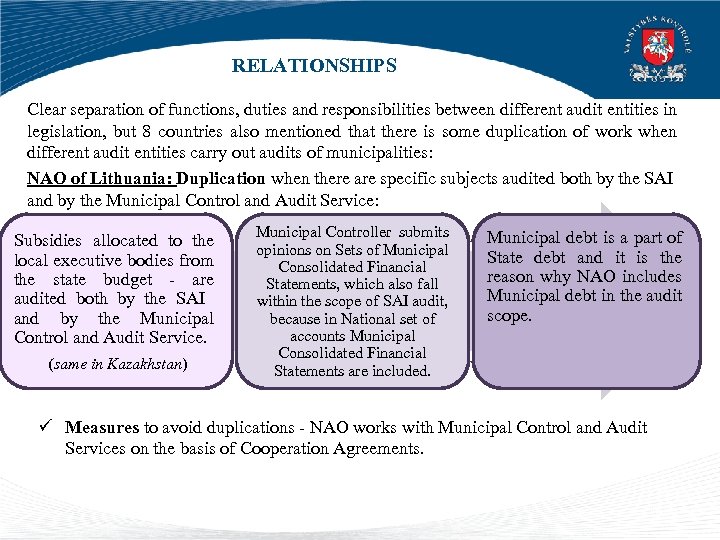

RELATIONSHIPS Clear separation of functions, duties and responsibilities between different audit entities in legislation, but 8 countries also mentioned that there is some duplication of work when different audit entities carry out audits of municipalities: NAO of Lithuania: Duplication when there are specific subjects audited both by the SAI and by the Municipal Control and Audit Service: Subsidies allocated to the local executive bodies from the state budget - are audited both by the SAI and by the Municipal Control and Audit Service. (same in Kazakhstan) Municipal Controller submits opinions on Sets of Municipal Consolidated Financial Statements, which also fall within the scope of SAI audit, because in National set of accounts Municipal Consolidated Financial Statements are included. Municipal debt is a part of State debt and it is the reason why NAO includes Municipal debt in the audit scope. ü Measures to avoid duplications - NAO works with Municipal Control and Audit Services on the basis of Cooperation Agreements.

RELATIONSHIPS Clear separation of functions, duties and responsibilities between different audit entities in legislation, but 8 countries also mentioned that there is some duplication of work when different audit entities carry out audits of municipalities: NAO of Lithuania: Duplication when there are specific subjects audited both by the SAI and by the Municipal Control and Audit Service: Subsidies allocated to the local executive bodies from the state budget - are audited both by the SAI and by the Municipal Control and Audit Service. (same in Kazakhstan) Municipal Controller submits opinions on Sets of Municipal Consolidated Financial Statements, which also fall within the scope of SAI audit, because in National set of accounts Municipal Consolidated Financial Statements are included. Municipal debt is a part of State debt and it is the reason why NAO includes Municipal debt in the audit scope. ü Measures to avoid duplications - NAO works with Municipal Control and Audit Services on the basis of Cooperation Agreements.

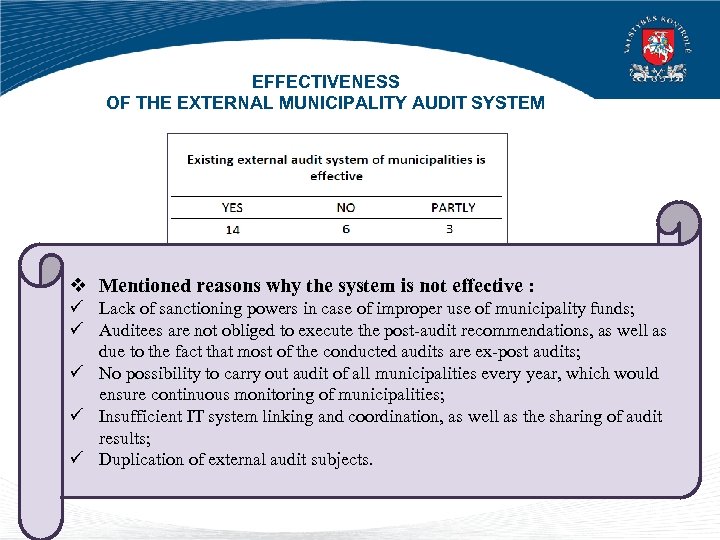

EFFECTIVENESS OF THE EXTERNAL MUNICIPALITY AUDIT SYSTEM v Mentioned reasons why the system is not effective : ü Lack of sanctioning powers in case of improper use of municipality funds; ü Auditees are not obliged to execute the post-audit recommendations, as well as due to the fact that most of the conducted audits are ex-post audits; ü No possibility to carry out audit of all municipalities every year, which would ensure continuous monitoring of municipalities; ü Insufficient IT system linking and coordination, as well as the sharing of audit results; ü Duplication of external audit subjects.

EFFECTIVENESS OF THE EXTERNAL MUNICIPALITY AUDIT SYSTEM v Mentioned reasons why the system is not effective : ü Lack of sanctioning powers in case of improper use of municipality funds; ü Auditees are not obliged to execute the post-audit recommendations, as well as due to the fact that most of the conducted audits are ex-post audits; ü No possibility to carry out audit of all municipalities every year, which would ensure continuous monitoring of municipalities; ü Insufficient IT system linking and coordination, as well as the sharing of audit results; ü Duplication of external audit subjects.

EFFECTIVENESS OF THE EXTERNAL MUNICIPALITY AUDIT SYSTEM Changes, improvements in the system that would be beneficial and would make the system more effective: ü Intensifying/increasing cooperation between audit entities; ü Linking the SAI with the computer systems of audited entities and other audit institutions; ü Coordination and access to the audit results of other audit institutions; ü Increase the scope/number of municipality audits annually; ü Combine audits in several municipalities in areas such as environment, public services, use of assets, water resources; ü Enhance human resources ☺

EFFECTIVENESS OF THE EXTERNAL MUNICIPALITY AUDIT SYSTEM Changes, improvements in the system that would be beneficial and would make the system more effective: ü Intensifying/increasing cooperation between audit entities; ü Linking the SAI with the computer systems of audited entities and other audit institutions; ü Coordination and access to the audit results of other audit institutions; ü Increase the scope/number of municipality audits annually; ü Combine audits in several municipalities in areas such as environment, public services, use of assets, water resources; ü Enhance human resources ☺

Thank you for your attention !

Thank you for your attention !