82bcaaa5d36d5a1fce2758572e42e3c6.ppt

- Количество слайдов: 32

EXPORTS &IMPORTS IN GST REGIME Dr Ajay Sahai Director General &CEO

EXPORTS &IMPORTS IN GST REGIME Dr Ajay Sahai Director General &CEO

Positives for Exports Zero Rating of Exports including supply to SEZ Final goods/ services exports by a supplier exempted from IGST Imports by SEZ exempted from IGST CST integrated into IGST eligible for ITC refund ITC Refund for non GST exports Unjust enrichment not applicable for exports Self declaration facility for exporters irrespective of refund amount Job Work on intimation and against Challan

Positives for Exports Zero Rating of Exports including supply to SEZ Final goods/ services exports by a supplier exempted from IGST Imports by SEZ exempted from IGST CST integrated into IGST eligible for ITC refund ITC Refund for non GST exports Unjust enrichment not applicable for exports Self declaration facility for exporters irrespective of refund amount Job Work on intimation and against Challan

Transitional Provision Credit of Central Taxes merged in CGST to be credited in the CGST A/C while State taxes in SGST A/C For Inputs from EOU/EHTP, credit as per 3(7) of CENVAT The electronic declaration to be filed within 90 days from the appointed date. Provided ü Credit is available both under earlier law and GST law and credit is reflected in the Return for the period ending appointed date.

Transitional Provision Credit of Central Taxes merged in CGST to be credited in the CGST A/C while State taxes in SGST A/C For Inputs from EOU/EHTP, credit as per 3(7) of CENVAT The electronic declaration to be filed within 90 days from the appointed date. Provided ü Credit is available both under earlier law and GST law and credit is reflected in the Return for the period ending appointed date.

Transitional Provision (Contd. . ) ü Credit is available to regular tax payer. Those under composition scheme not eligible ü Closing stock to be used for taxable supplies A registered person , not registered under earlier law , if no having duty paying document , input tax credit to be granted at 60% of the rate of the product , if the rate is 9% or more else 40% both for Central and State/U T

Transitional Provision (Contd. . ) ü Credit is available to regular tax payer. Those under composition scheme not eligible ü Closing stock to be used for taxable supplies A registered person , not registered under earlier law , if no having duty paying document , input tax credit to be granted at 60% of the rate of the product , if the rate is 9% or more else 40% both for Central and State/U T

DEFINITION OF EXPORTS Exports of goods means taking goods out of India to a place outside India Export of supply means supply of service when : i. Supplier of services is located in India ii. Recipient of services is located outside India iii. Place of supply of service is outside India iv. Payment for such service is received in convertible foreign exchange and v. Supplier and recipient of services are distinct persons

DEFINITION OF EXPORTS Exports of goods means taking goods out of India to a place outside India Export of supply means supply of service when : i. Supplier of services is located in India ii. Recipient of services is located outside India iii. Place of supply of service is outside India iv. Payment for such service is received in convertible foreign exchange and v. Supplier and recipient of services are distinct persons

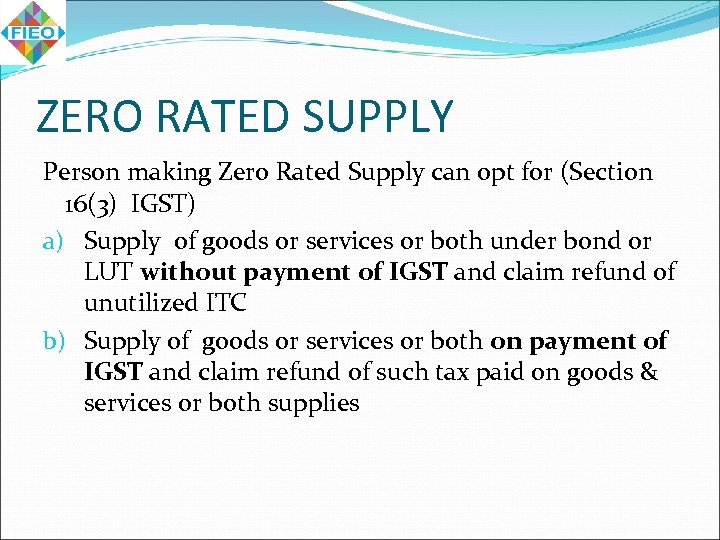

ZERO RATED SUPPLY Zero Rated Supply: Such supply an exempted supply but credit of Input tax would be available on such supply. Zero Rated Supply includes supply of goods or services or both by A. Exports of goods or services or both B. Supply of Goods or services or both to a SEZ developer or a unit

ZERO RATED SUPPLY Zero Rated Supply: Such supply an exempted supply but credit of Input tax would be available on such supply. Zero Rated Supply includes supply of goods or services or both by A. Exports of goods or services or both B. Supply of Goods or services or both to a SEZ developer or a unit

ZERO RATED SUPPLY Person making Zero Rated Supply can opt for (Section 16(3) IGST) a) Supply of goods or services or both under bond or LUT without payment of IGST and claim refund of unutilized ITC b) Supply of goods or services or both on payment of IGST and claim refund of such tax paid on goods & services or both supplies

ZERO RATED SUPPLY Person making Zero Rated Supply can opt for (Section 16(3) IGST) a) Supply of goods or services or both under bond or LUT without payment of IGST and claim refund of unutilized ITC b) Supply of goods or services or both on payment of IGST and claim refund of such tax paid on goods & services or both supplies

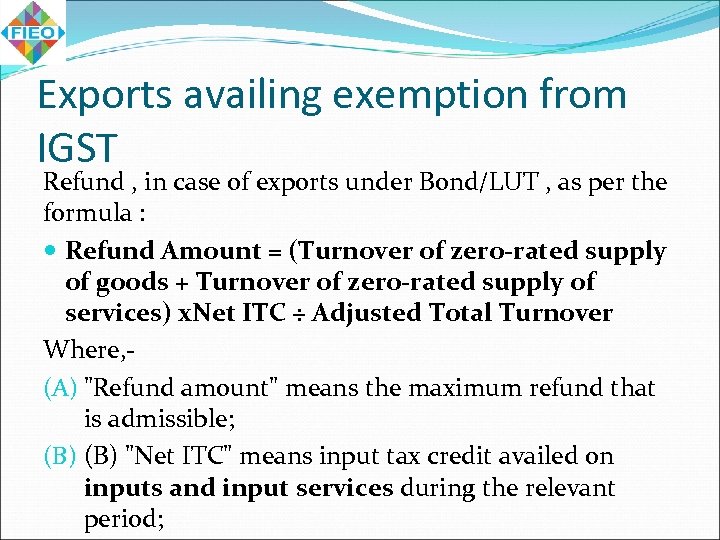

Exports availing exemption from IGST Refund , in case of exports under Bond/LUT , as per the formula : Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x. Net ITC ÷ Adjusted Total Turnover Where, (A) "Refund amount" means the maximum refund that is admissible; (B) "Net ITC" means input tax credit availed on inputs and input services during the relevant period;

Exports availing exemption from IGST Refund , in case of exports under Bond/LUT , as per the formula : Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x. Net ITC ÷ Adjusted Total Turnover Where, (A) "Refund amount" means the maximum refund that is admissible; (B) "Net ITC" means input tax credit availed on inputs and input services during the relevant period;

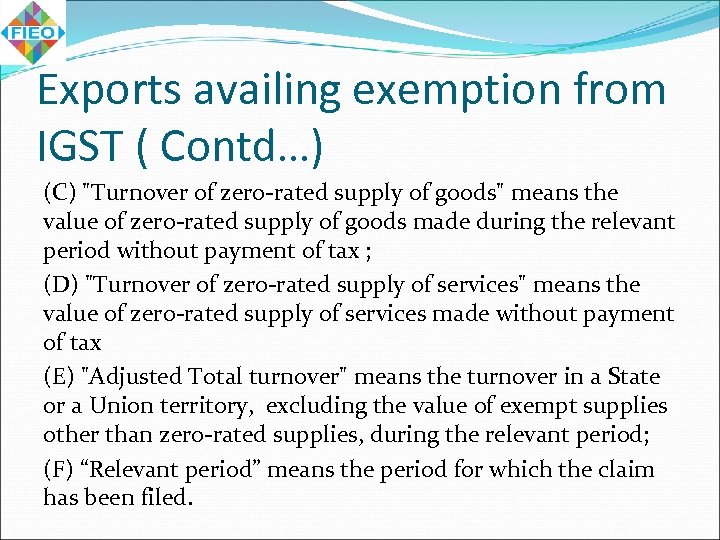

Exports availing exemption from IGST ( Contd…) (C) "Turnover of zero-rated supply of goods" means the value of zero-rated supply of goods made during the relevant period without payment of tax ; (D) "Turnover of zero-rated supply of services" means the value of zero-rated supply of services made without payment of tax (E) "Adjusted Total turnover" means the turnover in a State or a Union territory, excluding the value of exempt supplies other than zero-rated supplies, during the relevant period; (F) “Relevant period” means the period for which the claim has been filed.

Exports availing exemption from IGST ( Contd…) (C) "Turnover of zero-rated supply of goods" means the value of zero-rated supply of goods made during the relevant period without payment of tax ; (D) "Turnover of zero-rated supply of services" means the value of zero-rated supply of services made without payment of tax (E) "Adjusted Total turnover" means the turnover in a State or a Union territory, excluding the value of exempt supplies other than zero-rated supplies, during the relevant period; (F) “Relevant period” means the period for which the claim has been filed.

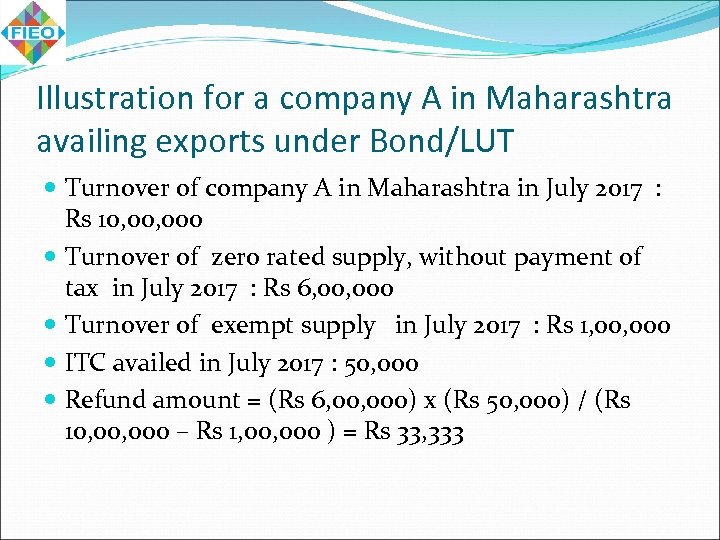

Illustration for a company A in Maharashtra availing exports under Bond/LUT Turnover of company A in Maharashtra in July 2017 : Rs 10, 000 Turnover of zero rated supply, without payment of tax in July 2017 : Rs 6, 000 Turnover of exempt supply in July 2017 : Rs 1, 000 ITC availed in July 2017 : 50, 000 Refund amount = (Rs 6, 000) x (Rs 50, 000) / (Rs 10, 000 – Rs 1, 000 ) = Rs 33, 333

Illustration for a company A in Maharashtra availing exports under Bond/LUT Turnover of company A in Maharashtra in July 2017 : Rs 10, 000 Turnover of zero rated supply, without payment of tax in July 2017 : Rs 6, 000 Turnover of exempt supply in July 2017 : Rs 1, 000 ITC availed in July 2017 : 50, 000 Refund amount = (Rs 6, 000) x (Rs 50, 000) / (Rs 10, 000 – Rs 1, 000 ) = Rs 33, 333

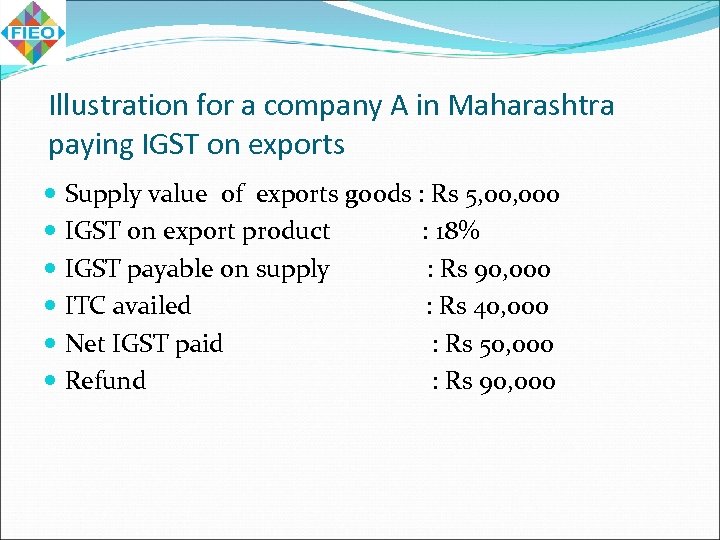

Illustration for a company A in Maharashtra paying IGST on exports Supply value of exports goods : Rs 5, 000 IGST on export product : 18% IGST payable on supply : Rs 90, 000 ITC availed : Rs 40, 000 Net IGST paid : Rs 50, 000 Refund : Rs 90, 000

Illustration for a company A in Maharashtra paying IGST on exports Supply value of exports goods : Rs 5, 000 IGST on export product : 18% IGST payable on supply : Rs 90, 000 ITC availed : Rs 40, 000 Net IGST paid : Rs 50, 000 Refund : Rs 90, 000

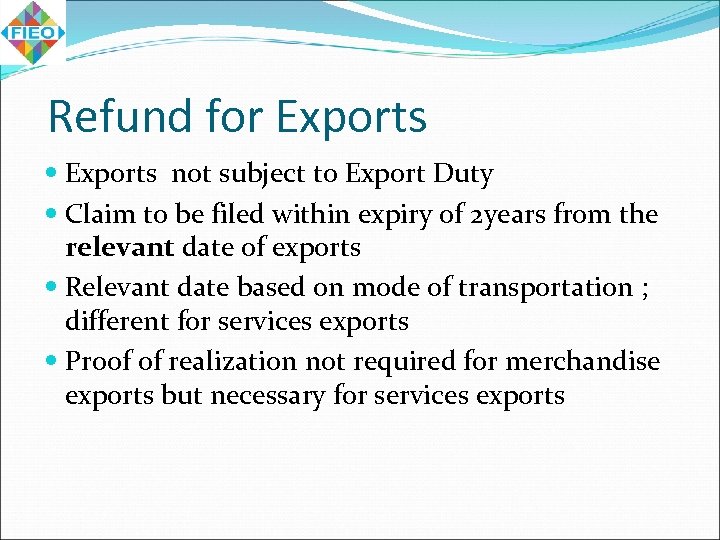

Refund for Exports not subject to Export Duty Claim to be filed within expiry of 2 years from the relevant date of exports Relevant date based on mode of transportation ; different for services exports Proof of realization not required for merchandise exports but necessary for services exports

Refund for Exports not subject to Export Duty Claim to be filed within expiry of 2 years from the relevant date of exports Relevant date based on mode of transportation ; different for services exports Proof of realization not required for merchandise exports but necessary for services exports

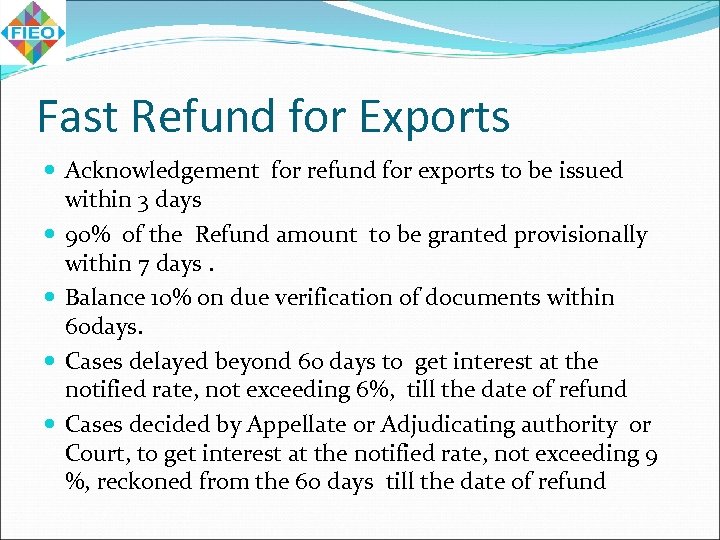

Fast Refund for Exports Acknowledgement for refund for exports to be issued within 3 days 90% of the Refund amount to be granted provisionally within 7 days. Balance 10% on due verification of documents within 60 days. Cases delayed beyond 60 days to get interest at the notified rate, not exceeding 6%, till the date of refund Cases decided by Appellate or Adjudicating authority or Court, to get interest at the notified rate, not exceeding 9 %, reckoned from the 6 o days till the date of refund

Fast Refund for Exports Acknowledgement for refund for exports to be issued within 3 days 90% of the Refund amount to be granted provisionally within 7 days. Balance 10% on due verification of documents within 60 days. Cases delayed beyond 60 days to get interest at the notified rate, not exceeding 6%, till the date of refund Cases decided by Appellate or Adjudicating authority or Court, to get interest at the notified rate, not exceeding 9 %, reckoned from the 6 o days till the date of refund

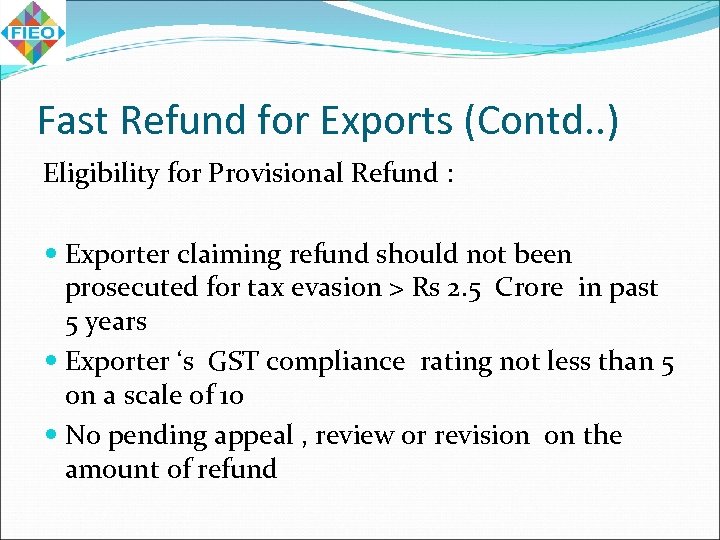

Fast Refund for Exports (Contd. . ) Eligibility for Provisional Refund : Exporter claiming refund should not been prosecuted for tax evasion > Rs 2. 5 Crore in past 5 years Exporter ‘s GST compliance rating not less than 5 on a scale of 10 No pending appeal , review or revision on the amount of refund

Fast Refund for Exports (Contd. . ) Eligibility for Provisional Refund : Exporter claiming refund should not been prosecuted for tax evasion > Rs 2. 5 Crore in past 5 years Exporter ‘s GST compliance rating not less than 5 on a scale of 10 No pending appeal , review or revision on the amount of refund

Refund Procedure Goods exports : A statement containing the number and date of shipping bills and the number and date of relevant export invoices. Services Exports : A statement containing the number and date of invoices and the relevant Bank Realization Certificates or Foreign Inward Remittance Certificates, as the case may be

Refund Procedure Goods exports : A statement containing the number and date of shipping bills and the number and date of relevant export invoices. Services Exports : A statement containing the number and date of invoices and the relevant Bank Realization Certificates or Foreign Inward Remittance Certificates, as the case may be

Refund Procedure ( Contd. . ) Where the application relates to refund of input tax credit, the electronic credit ledger shall be debited by the applicant in an amount equal to the refund so claimed. The application for refund to be forwarded to the proper officer who shall, within three days of filing of the said application issue an acknowledgement in FORM GST RFD-02

Refund Procedure ( Contd. . ) Where the application relates to refund of input tax credit, the electronic credit ledger shall be debited by the applicant in an amount equal to the refund so claimed. The application for refund to be forwarded to the proper officer who shall, within three days of filing of the said application issue an acknowledgement in FORM GST RFD-02

Refund Procedure ( Contd. . ) The officer to make an order in FORM GST RFD-04, sanctioning the amount of refund on a provisional basis within a period not exceeding seven days The officer to issue a payment advice in FORM GST RFD-05 to be electronically credited to any of the bank accounts of the applicant as given in registration particulars as specified in the application. Balance 10% to be given after scrutiny of documents in FORM GST RFD-06, sanctioning the balance amount

Refund Procedure ( Contd. . ) The officer to make an order in FORM GST RFD-04, sanctioning the amount of refund on a provisional basis within a period not exceeding seven days The officer to issue a payment advice in FORM GST RFD-05 to be electronically credited to any of the bank accounts of the applicant as given in registration particulars as specified in the application. Balance 10% to be given after scrutiny of documents in FORM GST RFD-06, sanctioning the balance amount

8 digit Harmonisation Turnover upto Rs 1. 5 Cr : No digit Turnover Between Rs 1. 5 Cr to Rs 5 Cr : 2 digit Turnover above Rs 5 Cr : 4 digit Exports/ Imports transaction: 8 digit Services as per Standard Accounting Code(SAC) Additional work for recipient if fall under higher category

8 digit Harmonisation Turnover upto Rs 1. 5 Cr : No digit Turnover Between Rs 1. 5 Cr to Rs 5 Cr : 2 digit Turnover above Rs 5 Cr : 4 digit Exports/ Imports transaction: 8 digit Services as per Standard Accounting Code(SAC) Additional work for recipient if fall under higher category

Job Work Principal (Exporter) may send inputs or capital goods, without payment of tax, for job work The intimation letter to contain description of inputs to be sent and nature of processing to be carried by job worker The intimation to be submitted to the jurisdictional officer by email or physical copy of letter The exporter may retain the credit availed by him on the inputs/capital goods sent to job worker

Job Work Principal (Exporter) may send inputs or capital goods, without payment of tax, for job work The intimation letter to contain description of inputs to be sent and nature of processing to be carried by job worker The intimation to be submitted to the jurisdictional officer by email or physical copy of letter The exporter may retain the credit availed by him on the inputs/capital goods sent to job worker

Job Work …. contd. The job worker after processing can send the goods to another job worker or send to any place of business of the exporter or exports outside India without payment of tax Value addition will be subject to GST to enable job worker to claim ITC Inputs to be brought back after completion of job work within one year (3 years for capital goods) Else credit to be reversed by the Exporter

Job Work …. contd. The job worker after processing can send the goods to another job worker or send to any place of business of the exporter or exports outside India without payment of tax Value addition will be subject to GST to enable job worker to claim ITC Inputs to be brought back after completion of job work within one year (3 years for capital goods) Else credit to be reversed by the Exporter

ADVANCE AUTHORISATION Advance authorization may provide exemption from basic customs duty, anti-dumping duty, safeguard duty and transition product specific safeguard duty and anti-subsidy duty No exemption from IGST on import of inputs under the instrument IGST may be claimed as input tax credit Drawback on inputs not covered under advance authorisation to get refund of basic customs duty

ADVANCE AUTHORISATION Advance authorization may provide exemption from basic customs duty, anti-dumping duty, safeguard duty and transition product specific safeguard duty and anti-subsidy duty No exemption from IGST on import of inputs under the instrument IGST may be claimed as input tax credit Drawback on inputs not covered under advance authorisation to get refund of basic customs duty

DFIA Since Scheme provides exemption from basic customs duty only, no changes will be warranted in the GST Regime Instead of ACD/SAD, the authorisation holder shall pay IGST and claim the same as input tax credit The provision of drawback on inputs not covered under DFIA will cover only refund of basic customs duty

DFIA Since Scheme provides exemption from basic customs duty only, no changes will be warranted in the GST Regime Instead of ACD/SAD, the authorisation holder shall pay IGST and claim the same as input tax credit The provision of drawback on inputs not covered under DFIA will cover only refund of basic customs duty

EPCG SCHEME EPCG Scheme to provide only exemption from basic customs duty Payment of IGST on such imports to be available as ITC Since IGST on capital goods would be immediately available as ITC, as against ACD utilization over 2 years, some relief would be available The export obligation link with duty saved amount needs to be relooked into as duty saved would be only basic customs duty CG definition needs to be aligned.

EPCG SCHEME EPCG Scheme to provide only exemption from basic customs duty Payment of IGST on such imports to be available as ITC Since IGST on capital goods would be immediately available as ITC, as against ACD utilization over 2 years, some relief would be available The export obligation link with duty saved amount needs to be relooked into as duty saved would be only basic customs duty CG definition needs to be aligned.

DEEMED EXPORTS Categories of deemed exports under Chapter 7 will be notified by the Government on the recommendation of GST Council as per Section 147 of CGST Act Deemed exports are not zero rated supply No exemption from GST on the supplies categorised as deemed exports. However, refund would be available on such supplies. Deemed exports benefit to be available only to the recipient and not to supplier No disclaimer facility to claim Deemed Exports

DEEMED EXPORTS Categories of deemed exports under Chapter 7 will be notified by the Government on the recommendation of GST Council as per Section 147 of CGST Act Deemed exports are not zero rated supply No exemption from GST on the supplies categorised as deemed exports. However, refund would be available on such supplies. Deemed exports benefit to be available only to the recipient and not to supplier No disclaimer facility to claim Deemed Exports

EOUs Exemption to EOUs to be restricted to basic customs duty Imports by EOUs would be subject to IGST Supplies to EOUs/EHTP/STP may be classified as deemed exports ? Such refund to be available to the recipient unit No concessional duty on DTA sale: Full IGST/CGST/ SGST to be paid on such sale No restriction on DTA sale for goods but restriction of 50% of FOB value remains on Services Accumulated credit of GST eligible for refund u/S 54 (3) of CGST Act

EOUs Exemption to EOUs to be restricted to basic customs duty Imports by EOUs would be subject to IGST Supplies to EOUs/EHTP/STP may be classified as deemed exports ? Such refund to be available to the recipient unit No concessional duty on DTA sale: Full IGST/CGST/ SGST to be paid on such sale No restriction on DTA sale for goods but restriction of 50% of FOB value remains on Services Accumulated credit of GST eligible for refund u/S 54 (3) of CGST Act

Treatment of Scrips/Transferable authorization Such scrips to be used only for payment of basic customs duty IGST on imports will have to be paid in cash Utilization of scrips may be restricted affecting its premium Supply of scrips may be subject to GST unless exempted as a “Security” Scrips may be provided an extended validity and utilize for payment of composition fee etc. by DGFT

Treatment of Scrips/Transferable authorization Such scrips to be used only for payment of basic customs duty IGST on imports will have to be paid in cash Utilization of scrips may be restricted affecting its premium Supply of scrips may be subject to GST unless exempted as a “Security” Scrips may be provided an extended validity and utilize for payment of composition fee etc. by DGFT

DUTY DRAWBACK Facility of All Industry Drawback and Brand Rate Drawback to continue Drawback to provide refund of only basic customs duty. New Rates to be announced before 1 st July , 2017 For specified petroleum products, both basic customs duty and central excise duty Embedded tax in supplies not being neutralized to affect competitiveness in exports Mechanism to provide relief to small exporters procuring goods from unregistered units or under composition limit to suffer burden of input tax credit

DUTY DRAWBACK Facility of All Industry Drawback and Brand Rate Drawback to continue Drawback to provide refund of only basic customs duty. New Rates to be announced before 1 st July , 2017 For specified petroleum products, both basic customs duty and central excise duty Embedded tax in supplies not being neutralized to affect competitiveness in exports Mechanism to provide relief to small exporters procuring goods from unregistered units or under composition limit to suffer burden of input tax credit

TRANSITIONAL ARRANGEMENTS Any import of goods & services made on or after the appointed date (1 st July, 2017) shall be liable to IGST on imports. If the arrival of cargo is prior to 1 st July , it will be treated under pre GST regime. If tax on such services imports paid in full under the existing law , no IGST to be levied. If part paid , IGST on pro-rata basis to be levied Refund claims filed after the appointed day of duty /tax paid under the existing laws for exports made before or after the appointed date to be disposed off in accordance with the provision s of existing law provided the amount has not been carried forward

TRANSITIONAL ARRANGEMENTS Any import of goods & services made on or after the appointed date (1 st July, 2017) shall be liable to IGST on imports. If the arrival of cargo is prior to 1 st July , it will be treated under pre GST regime. If tax on such services imports paid in full under the existing law , no IGST to be levied. If part paid , IGST on pro-rata basis to be levied Refund claims filed after the appointed day of duty /tax paid under the existing laws for exports made before or after the appointed date to be disposed off in accordance with the provision s of existing law provided the amount has not been carried forward

TRANSITIONAL ARRANGEMENTS ( Contd. . ) Existing Drawback facility to continue in the transtion period. Likely to be for 3 months. All existing authorisations/scrips issued undr FTP to follow new GST provision from the appointed date irrespective of the exemption provided under the existing taxes/duties

TRANSITIONAL ARRANGEMENTS ( Contd. . ) Existing Drawback facility to continue in the transtion period. Likely to be for 3 months. All existing authorisations/scrips issued undr FTP to follow new GST provision from the appointed date irrespective of the exemption provided under the existing taxes/duties

Misc. . Issues Ocean/Air freight on exports : Where location of supplier of service and recipient both are in India , as section 12(8) of IGST , the place of supply will be location of the recipient. Thus taxable. If the supplier of service is not registered in India as per section 13(9) of IGST the place of supply shall be the place of destination of goods , thus non taxable Advances : Advance by a foreign buyer exempt from IGST but advance from a Merchant to manufacturer in India subject to GST

Misc. . Issues Ocean/Air freight on exports : Where location of supplier of service and recipient both are in India , as section 12(8) of IGST , the place of supply will be location of the recipient. Thus taxable. If the supplier of service is not registered in India as per section 13(9) of IGST the place of supply shall be the place of destination of goods , thus non taxable Advances : Advance by a foreign buyer exempt from IGST but advance from a Merchant to manufacturer in India subject to GST

Misc. . Issues (Contd. . ) Commission to Foreign Agent : Covered under the definition of “intermediary services ”. As per POS rules , the location of supplier being outside India , non taxable under GST. Participation in Overseas Fairs/exhibition. Conference etc : Place of supply is the place where event is actually held. Being outside the taxable territory , non taxable under GST.

Misc. . Issues (Contd. . ) Commission to Foreign Agent : Covered under the definition of “intermediary services ”. As per POS rules , the location of supplier being outside India , non taxable under GST. Participation in Overseas Fairs/exhibition. Conference etc : Place of supply is the place where event is actually held. Being outside the taxable territory , non taxable under GST.

THANK YOU

THANK YOU