75f6b8e20bb5de66f1bd8dfc8a1c382c.ppt

- Количество слайдов: 20

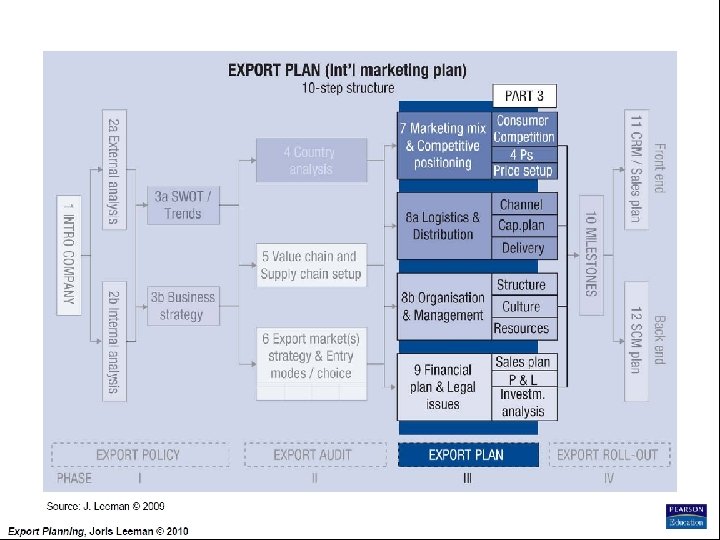

Export Planning A 10 -step approach Chapter 9: Financial plan and legal issues Internationalisation of the firm Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning A 10 -step approach Chapter 9: Financial plan and legal issues Internationalisation of the firm Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Learning objectives (learning tasks) Ch. 9 At the end of the chapter you are able to: 1. develop your sales plan; 2. put together the profit & loss – and cash flow statement; 3. execute an investment analysis; 4. identify relevant legal issues; 5. prepare the 3 rd review gate decision to finalise the ‘Export Plan – phase’ Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Learning objectives (learning tasks) Ch. 9 At the end of the chapter you are able to: 1. develop your sales plan; 2. put together the profit & loss – and cash flow statement; 3. execute an investment analysis; 4. identify relevant legal issues; 5. prepare the 3 rd review gate decision to finalise the ‘Export Plan – phase’ Export Planning Institute _II_BPM Joris Leeman© , 2010

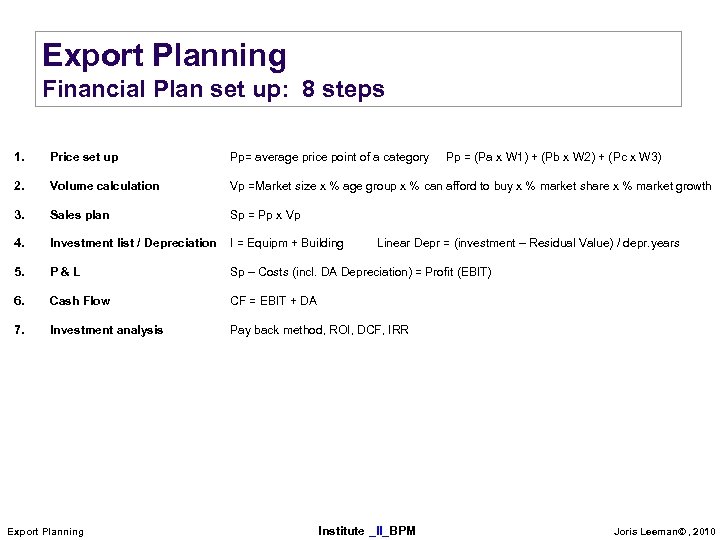

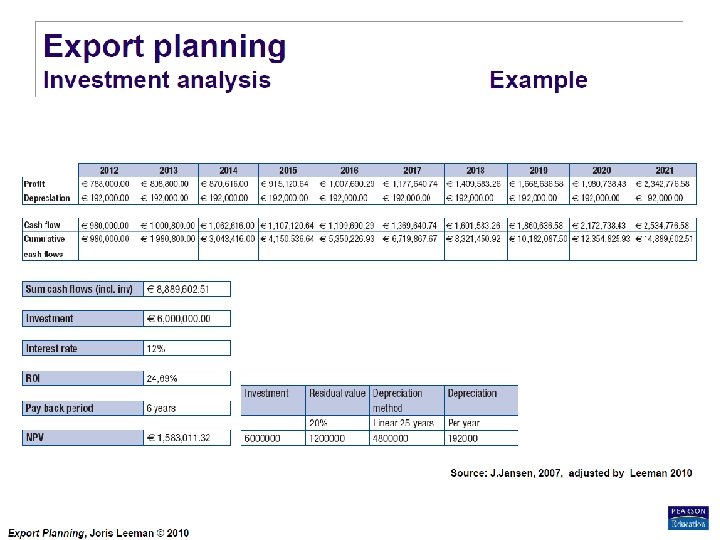

Export Planning Financial Plan set up: 8 steps 1. Price set up Pp= average price point of a category 2. Volume calculation Vp =Market size x % age group x % can afford to buy x % market share x % market growth 3. Sales plan Sp = Pp x Vp 4. Investment list / Depreciation I = Equipm + Building Linear Depr = (investment – Residual Value) / depr. years 5. P&L Sp – Costs (incl. DA Depreciation) = Profit (EBIT) 6. Cash Flow CF = EBIT + DA 7. Investment analysis Pay back method, ROI, DCF, IRR Export Planning Institute _II_BPM Pp = (Pa x W 1) + (Pb x W 2) + (Pc x W 3) Joris Leeman© , 2010

Export Planning Financial Plan set up: 8 steps 1. Price set up Pp= average price point of a category 2. Volume calculation Vp =Market size x % age group x % can afford to buy x % market share x % market growth 3. Sales plan Sp = Pp x Vp 4. Investment list / Depreciation I = Equipm + Building Linear Depr = (investment – Residual Value) / depr. years 5. P&L Sp – Costs (incl. DA Depreciation) = Profit (EBIT) 6. Cash Flow CF = EBIT + DA 7. Investment analysis Pay back method, ROI, DCF, IRR Export Planning Institute _II_BPM Pp = (Pa x W 1) + (Pb x W 2) + (Pc x W 3) Joris Leeman© , 2010

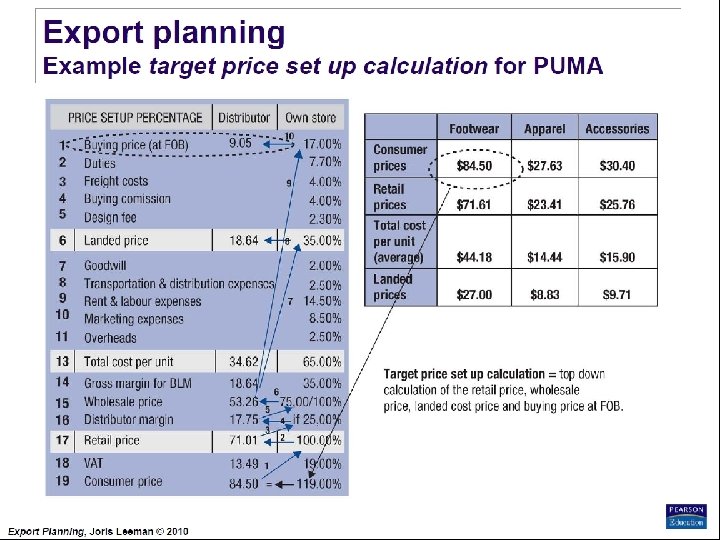

Export Planning Financial Plan set up: Landed costs + + Buying price goods (FOB) (incl. Gross margin of supplier) + Duties + Freight (MNF-DC) + Quota + Design fee + Buying commission agent = Landed Cost price I. Price set up W/S costs + Landed cost price + Marketing expenses + Distribution costs (DC + freight to Cust) + Adm. Overhead exp. + Gross margin W/S = Wholesale price of BLM Retailer costs Wholesale price + Marketing expenses + Distribution costs (DC + freight to stores) + Store costs + Adm. Overhead exp. + Gross margin Retailer = Retailer price = Consumer price Retailer price - Markdowns/Discount + VAT = Consumer retail price Landed costs LC = FOB + D + FR + Q + DF + BC Example: LC = € 8, - + (13% of 8, -) + (4% of 8, -) + (6% of 8, -) = € 10, 56 W/S price: W/S price = LC + MAR + DIS + ADM + GM Example: W/S price = 10, 56 + (20% of LC) + (5% of LC) + (8% of LC) + (30% of LC) = € 17, 21 Retail price: RET price = W/S + MAR + DIS + STORE + ADM + GM + VAT Example: RET price = W/S + (10% of W/S) + DIS (5% of W/S) + (15% of W/S) + (30% of W/S) + (19% of Retail price excl. VAT) = 17, 21 x 165% = 28, 40 x 119% = € 33, 80 W/S = wholesaler, BLM = Brand Label Manufacturer, VAT = Value Added Tax Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Financial Plan set up: Landed costs + + Buying price goods (FOB) (incl. Gross margin of supplier) + Duties + Freight (MNF-DC) + Quota + Design fee + Buying commission agent = Landed Cost price I. Price set up W/S costs + Landed cost price + Marketing expenses + Distribution costs (DC + freight to Cust) + Adm. Overhead exp. + Gross margin W/S = Wholesale price of BLM Retailer costs Wholesale price + Marketing expenses + Distribution costs (DC + freight to stores) + Store costs + Adm. Overhead exp. + Gross margin Retailer = Retailer price = Consumer price Retailer price - Markdowns/Discount + VAT = Consumer retail price Landed costs LC = FOB + D + FR + Q + DF + BC Example: LC = € 8, - + (13% of 8, -) + (4% of 8, -) + (6% of 8, -) = € 10, 56 W/S price: W/S price = LC + MAR + DIS + ADM + GM Example: W/S price = 10, 56 + (20% of LC) + (5% of LC) + (8% of LC) + (30% of LC) = € 17, 21 Retail price: RET price = W/S + MAR + DIS + STORE + ADM + GM + VAT Example: RET price = W/S + (10% of W/S) + DIS (5% of W/S) + (15% of W/S) + (30% of W/S) + (19% of Retail price excl. VAT) = 17, 21 x 165% = 28, 40 x 119% = € 33, 80 W/S = wholesaler, BLM = Brand Label Manufacturer, VAT = Value Added Tax Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Financial Plan set up: Price x Price set up: II Sales plan Volume = Sales plan: Volume plan: W/S price or Retail Price per product category and Average sales weight of each product category Sales plan (Turnover or Revenue) Market size % target group % potential buyers % target market share % yearly market growth - by Product Line - by Category Price set up Pp = (Pa x W 1) + (Pb x W 2) + (Pc x W 3) Pp= average Price Point of a category Pa= product item a, b, c, …z W 1=weight % 1, 2, 3, … 99 Example: Pp = (€ 79, 00 x 0. 33)+(€ 89, 00 x 0. 33)+(99, 00 x 0. 33) = 89, 00 average price point of the category Volume calculation Vp =Market size x % age group x % can afford to buy x % target market share x % market growth Vp= Volume plan of a category Example: Vp=17 mln population country x 25% age 10 -20 years x 40% can buy it x 5% market share target x 1. 05 (year 1) = 89. 250 units Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Financial Plan set up: Price x Price set up: II Sales plan Volume = Sales plan: Volume plan: W/S price or Retail Price per product category and Average sales weight of each product category Sales plan (Turnover or Revenue) Market size % target group % potential buyers % target market share % yearly market growth - by Product Line - by Category Price set up Pp = (Pa x W 1) + (Pb x W 2) + (Pc x W 3) Pp= average Price Point of a category Pa= product item a, b, c, …z W 1=weight % 1, 2, 3, … 99 Example: Pp = (€ 79, 00 x 0. 33)+(€ 89, 00 x 0. 33)+(99, 00 x 0. 33) = 89, 00 average price point of the category Volume calculation Vp =Market size x % age group x % can afford to buy x % target market share x % market growth Vp= Volume plan of a category Example: Vp=17 mln population country x 25% age 10 -20 years x 40% can buy it x 5% market share target x 1. 05 (year 1) = 89. 250 units Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

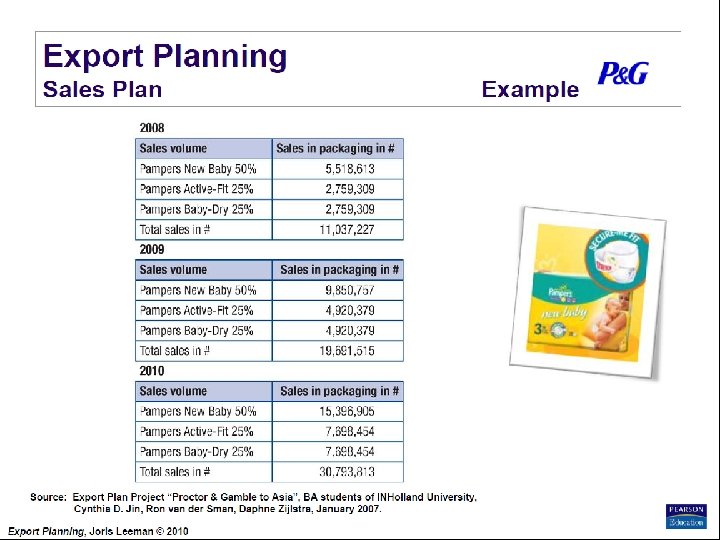

Export Planning Volume forecast calculation - example - Marketing objective • “Gain 20 percent market share in the disposable diaper market, by the use of exporting different disposable diapers towards the Indian market, by the year 2010. ” Market size Source: Export Plan – Project „Proctor & Gamble to Asia“, BA students of INHolland University, Cynthia D. Jin, Ron van der Sman, Daphne Zijlstra, January 2007. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Volume forecast calculation - example - Marketing objective • “Gain 20 percent market share in the disposable diaper market, by the use of exporting different disposable diapers towards the Indian market, by the year 2010. ” Market size Source: Export Plan – Project „Proctor & Gamble to Asia“, BA students of INHolland University, Cynthia D. Jin, Ron van der Sman, Daphne Zijlstra, January 2007. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

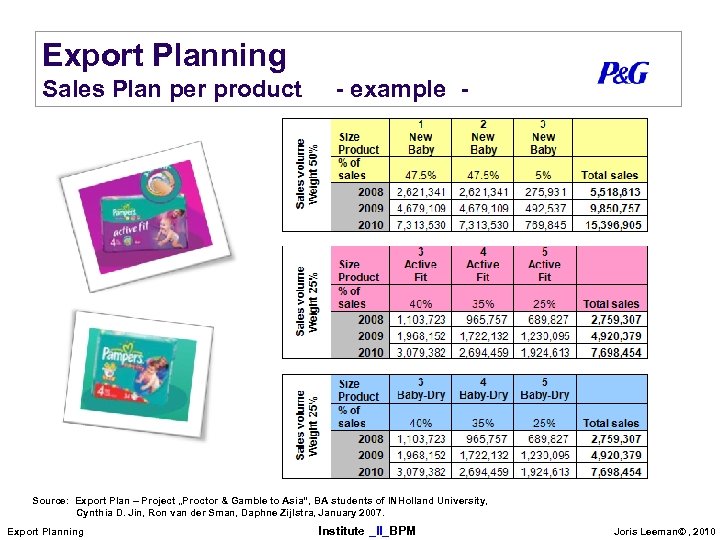

Export Planning Sales Plan per product - example - Source: Export Plan – Project „Proctor & Gamble to Asia“, BA students of INHolland University, Cynthia D. Jin, Ron van der Sman, Daphne Zijlstra, January 2007. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Sales Plan per product - example - Source: Export Plan – Project „Proctor & Gamble to Asia“, BA students of INHolland University, Cynthia D. Jin, Ron van der Sman, Daphne Zijlstra, January 2007. Export Planning Institute _II_BPM Joris Leeman© , 2010

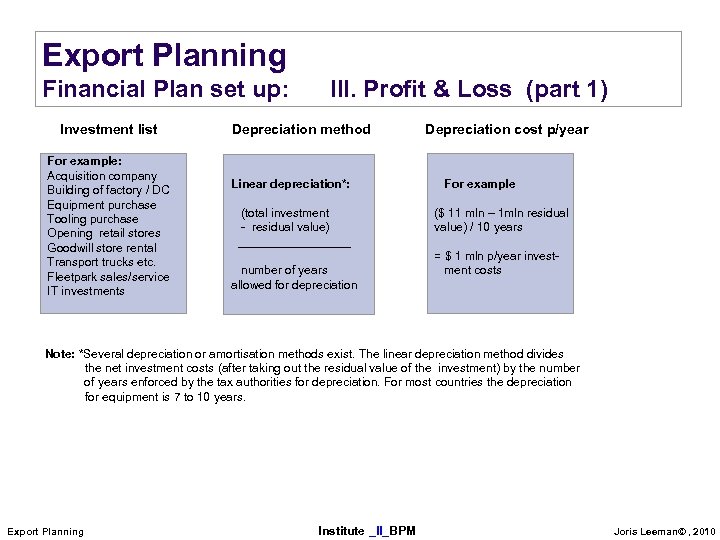

Export Planning Financial Plan set up: Investment list For example: Acquisition company Building of factory / DC Equipment purchase Tooling purchase Opening retail stores Goodwill store rental Transport trucks etc. Fleetpark sales/service IT investments III. Profit & Loss (part 1) Depreciation method Linear depreciation*: (total investment - residual value) _________ number of years allowed for depreciation Depreciation cost p/year For example ($ 11 mln – 1 mln residual value) / 10 years = $ 1 mln p/year invest ment costs Note: *Several depreciation or amortisation methods exist. The linear depreciation method divides the net investment costs (after taking out the residual value of the investment) by the number of years enforced by the tax authorities for depreciation. For most countries the depreciation for equipment is 7 to 10 years. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Financial Plan set up: Investment list For example: Acquisition company Building of factory / DC Equipment purchase Tooling purchase Opening retail stores Goodwill store rental Transport trucks etc. Fleetpark sales/service IT investments III. Profit & Loss (part 1) Depreciation method Linear depreciation*: (total investment - residual value) _________ number of years allowed for depreciation Depreciation cost p/year For example ($ 11 mln – 1 mln residual value) / 10 years = $ 1 mln p/year invest ment costs Note: *Several depreciation or amortisation methods exist. The linear depreciation method divides the net investment costs (after taking out the residual value of the investment) by the number of years enforced by the tax authorities for depreciation. For most countries the depreciation for equipment is 7 to 10 years. Export Planning Institute _II_BPM Joris Leeman© , 2010

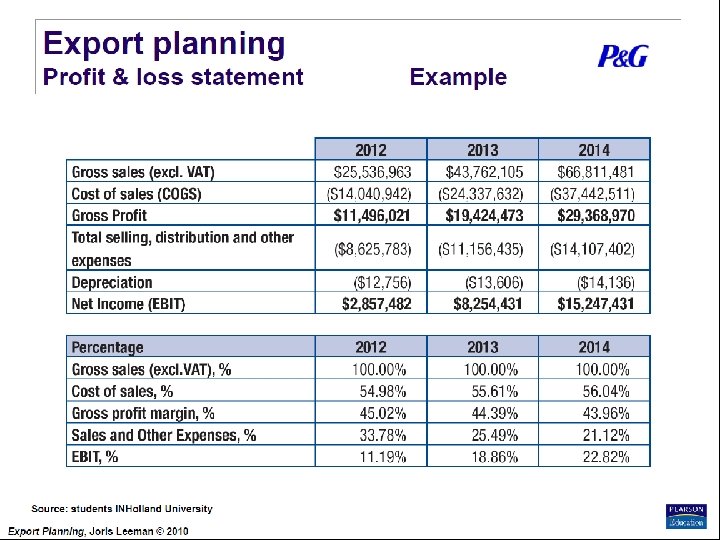

Export Planning Financial Plan set up: Sales Price x Volume - III. Profit & Loss (part 2) Costs = COGS p/unit x volume Expenditures: - Marketing & sales - Distribution costs - Overhead - rental cost stores - depreciation costs etc. Profit (EBT, EBIT or EBITDA) Profit (EBIT) or EBITDA or EBT or NIAT COGS = Cost of goods sold EBITDA EBT NIAT = = Earnings before interest and tax Earnings before interest, tax, depreciation and amortisation Earnings before tax Net income after tax Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Financial Plan set up: Sales Price x Volume - III. Profit & Loss (part 2) Costs = COGS p/unit x volume Expenditures: - Marketing & sales - Distribution costs - Overhead - rental cost stores - depreciation costs etc. Profit (EBT, EBIT or EBITDA) Profit (EBIT) or EBITDA or EBT or NIAT COGS = Cost of goods sold EBITDA EBT NIAT = = Earnings before interest and tax Earnings before interest, tax, depreciation and amortisation Earnings before tax Net income after tax Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Important elements Agent- and Distributor Contract 1. Information parties 2. Information on the product 3. Territory & Exclusivity clause 4. Warranty clause 5. Shipment/ insurance/ payment 6. Commission/ method of payment for agent/ distributor 7. Quality control 8. Dispute resolution, choice of law, choice of jurisdiction & choice of language 9. Termination clause 10. Expiration clause/ fixed Term 11. Termination provision 12. Distribution channels 13. Trademark 14. Force majeure or excuse or non-performance of contract 15. Non-competition Source: Reader distribution law, Dr. Jay. D. Olivier, 2006 Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Important elements Agent- and Distributor Contract 1. Information parties 2. Information on the product 3. Territory & Exclusivity clause 4. Warranty clause 5. Shipment/ insurance/ payment 6. Commission/ method of payment for agent/ distributor 7. Quality control 8. Dispute resolution, choice of law, choice of jurisdiction & choice of language 9. Termination clause 10. Expiration clause/ fixed Term 11. Termination provision 12. Distribution channels 13. Trademark 14. Force majeure or excuse or non-performance of contract 15. Non-competition Source: Reader distribution law, Dr. Jay. D. Olivier, 2006 Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Chapter review questions (10 min. ) 1. Explain the difference between the buying price (at a given INCOTERM) and the landed cost price? Explain your answer. 2. Explain the terms landed cost price, wholesale price, retailer price and retail consumer price. 3. Which price do you need to use if you are exporting via a distributor in Brazil? 4. And if you are importing goods from China in Germany? And if you are selling via 5. your own retail stores products in New York? 4. Explain the relationship between the use of the average base price point and 5. target price set up – calculation. 5. When do you use COGS and when COG? Give an example. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Chapter review questions (10 min. ) 1. Explain the difference between the buying price (at a given INCOTERM) and the landed cost price? Explain your answer. 2. Explain the terms landed cost price, wholesale price, retailer price and retail consumer price. 3. Which price do you need to use if you are exporting via a distributor in Brazil? 4. And if you are importing goods from China in Germany? And if you are selling via 5. your own retail stores products in New York? 4. Explain the relationship between the use of the average base price point and 5. target price set up – calculation. 5. When do you use COGS and when COG? Give an example. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Chapter review questions (10 min. ) 6. Explain the different profits: gross profit, net income, EBT, EBITDA, NIAT. 7. How is a profit & loss statement composed? Create an overview. 8. What does the term cash flow mean? What components do you need to add up? 9. What are the four investment analyses – methods? Provide a brief explanation for each method. 10. What does counterfeiting mean? Explain and give an example. Export Planning Institute _II_BPM Joris Leeman© , 2010

Export Planning Chapter review questions (10 min. ) 6. Explain the different profits: gross profit, net income, EBT, EBITDA, NIAT. 7. How is a profit & loss statement composed? Create an overview. 8. What does the term cash flow mean? What components do you need to add up? 9. What are the four investment analyses – methods? Provide a brief explanation for each method. 10. What does counterfeiting mean? Explain and give an example. Export Planning Institute _II_BPM Joris Leeman© , 2010