8ae462f65447a295fc3b0ecb6d324524.ppt

- Количество слайдов: 52

Export-led SME Development & Entrepreneurship in the GMS ASEAN SME Regional Gateway Forum Mekong Institute Khon Kaen, 6 September 2010 Masato Abe Trade & Investment Division 1

Export-led SME Development & Entrepreneurship in the GMS ASEAN SME Regional Gateway Forum Mekong Institute Khon Kaen, 6 September 2010 Masato Abe Trade & Investment Division 1

About ESCAP • United Nations Economic and Social Commission for Asia and the Pacific • Asia & Pacific – 58 regional members & associated members • Policy advocacy, analytical work & technical assistance for regional development • Headquarters in Bangkok – Nine branches 2

About ESCAP • United Nations Economic and Social Commission for Asia and the Pacific • Asia & Pacific – 58 regional members & associated members • Policy advocacy, analytical work & technical assistance for regional development • Headquarters in Bangkok – Nine branches 2

Development Strategies in the GMS • Export & FDI driven development • Agro industry development • Gradual industrialization toward products with high value added • Infrastructure development • Technology transfer & adaptation • Subregional cooperation (ASEAN, GMS; BIMST-EC) • SME development • Eco-industry 3

Development Strategies in the GMS • Export & FDI driven development • Agro industry development • Gradual industrialization toward products with high value added • Infrastructure development • Technology transfer & adaptation • Subregional cooperation (ASEAN, GMS; BIMST-EC) • SME development • Eco-industry 3

SMEs’ Role • Consisting of more than 95% of total enterprises – 99% for China; 98% for Thailand (2003); 99% for Viet Nam (2002) • Creating about 60% of private sector jobs – 75% for China; 65% for Thailand (2003); 77% for Viet Nam (2002) • Contributing about 20 -30% of GDP – 65% of industrial output (China); 47% of GDP & 55% of exports (Thailand); 20% of exports (Viet Nam) (2003) 4

SMEs’ Role • Consisting of more than 95% of total enterprises – 99% for China; 98% for Thailand (2003); 99% for Viet Nam (2002) • Creating about 60% of private sector jobs – 75% for China; 65% for Thailand (2003); 77% for Viet Nam (2002) • Contributing about 20 -30% of GDP – 65% of industrial output (China); 47% of GDP & 55% of exports (Thailand); 20% of exports (Viet Nam) (2003) 4

SMEs’ Role (cont. ) • Innovation & dynamism • Graduating to large enterprises (& multinationals) • Many in the informal sector • Critical part of the social safety net 5

SMEs’ Role (cont. ) • Innovation & dynamism • Graduating to large enterprises (& multinationals) • Many in the informal sector • Critical part of the social safety net 5

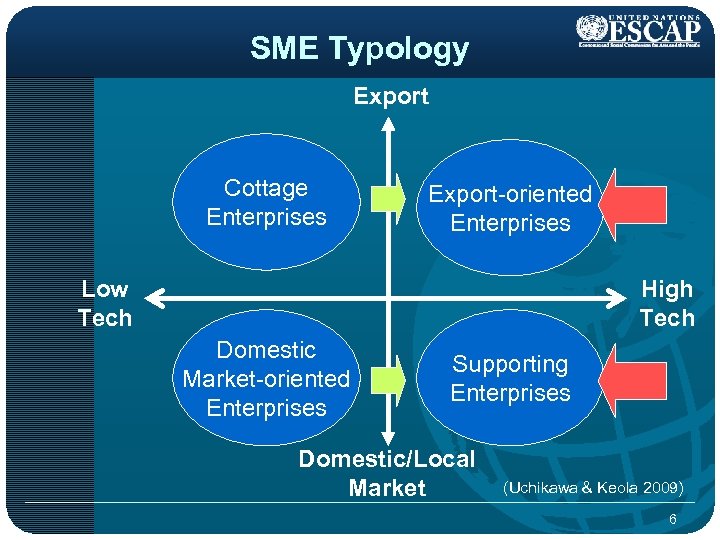

SME Typology Export Cottage Enterprises Export-oriented Enterprises Low Tech High Tech Domestic Market-oriented Enterprises Supporting Enterprises Domestic/Local Market (Uchikawa & Keola 2009) 6

SME Typology Export Cottage Enterprises Export-oriented Enterprises Low Tech High Tech Domestic Market-oriented Enterprises Supporting Enterprises Domestic/Local Market (Uchikawa & Keola 2009) 6

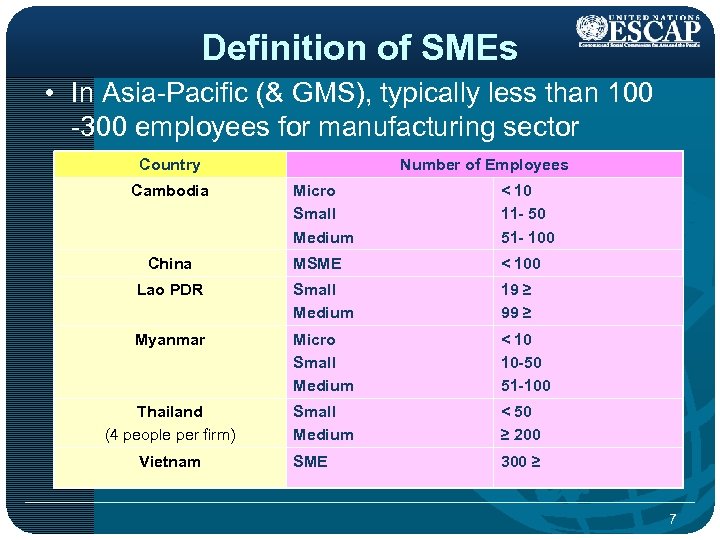

Definition of SMEs • In Asia-Pacific (& GMS), typically less than 100 -300 employees for manufacturing sector Country Cambodia Number of Employees Micro Small Medium < 10 11 - 50 51 - 100 MSME < 100 Lao PDR Small Medium 19 ≥ 99 ≥ Myanmar Micro Small Medium < 10 10 -50 51 -100 Thailand (4 people per firm) Small Medium < 50 ≥ 200 SME 300 ≥ China Vietnam 7

Definition of SMEs • In Asia-Pacific (& GMS), typically less than 100 -300 employees for manufacturing sector Country Cambodia Number of Employees Micro Small Medium < 10 11 - 50 51 - 100 MSME < 100 Lao PDR Small Medium 19 ≥ 99 ≥ Myanmar Micro Small Medium < 10 10 -50 51 -100 Thailand (4 people per firm) Small Medium < 50 ≥ 200 SME 300 ≥ China Vietnam 7

SMEs per 1, 000 people Source: ESCAP (2009), developed based on data from World Bank (2000 -2006) 8

SMEs per 1, 000 people Source: ESCAP (2009), developed based on data from World Bank (2000 -2006) 8

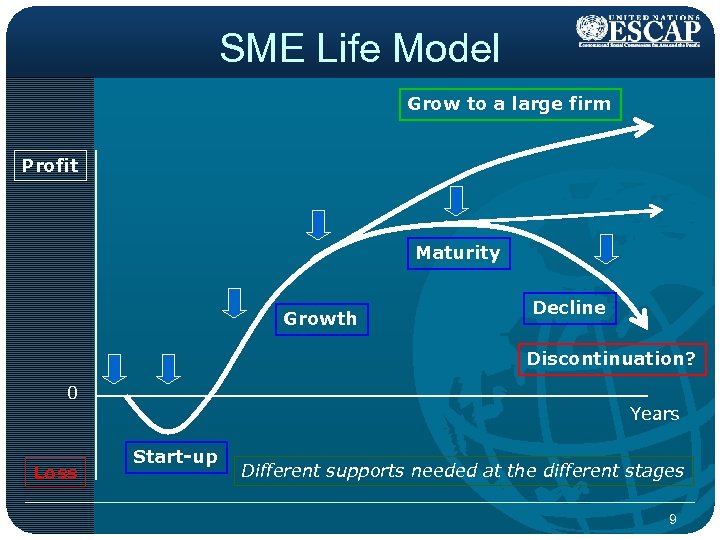

SME Life Model Grow to a large firm Profit Maturity Growth Decline Discontinuation? 0 Loss Years Start-up Different supports needed at the different stages 9

SME Life Model Grow to a large firm Profit Maturity Growth Decline Discontinuation? 0 Loss Years Start-up Different supports needed at the different stages 9

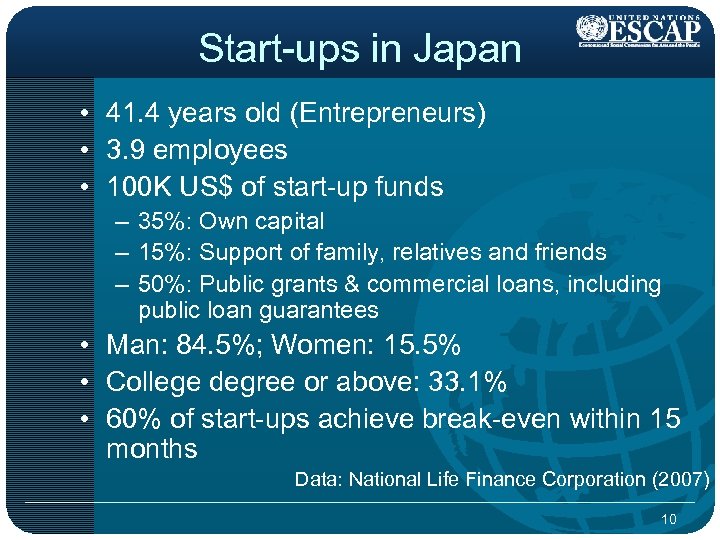

Start-ups in Japan • 41. 4 years old (Entrepreneurs) • 3. 9 employees • 100 K US$ of start-up funds – 35%: Own capital – 15%: Support of family, relatives and friends – 50%: Public grants & commercial loans, including public loan guarantees • Man: 84. 5%; Women: 15. 5% • College degree or above: 33. 1% • 60% of start-ups achieve break-even within 15 months Data: National Life Finance Corporation (2007) 10

Start-ups in Japan • 41. 4 years old (Entrepreneurs) • 3. 9 employees • 100 K US$ of start-up funds – 35%: Own capital – 15%: Support of family, relatives and friends – 50%: Public grants & commercial loans, including public loan guarantees • Man: 84. 5%; Women: 15. 5% • College degree or above: 33. 1% • 60% of start-ups achieve break-even within 15 months Data: National Life Finance Corporation (2007) 10

Start-up: Difficult Time • 2/3 discontinued within 5 years (USA) • 40% discontinued within 2 years (UK) • Approx. 40% in red after 1 year (Japan) 11

Start-up: Difficult Time • 2/3 discontinued within 5 years (USA) • 40% discontinued within 2 years (UK) • Approx. 40% in red after 1 year (Japan) 11

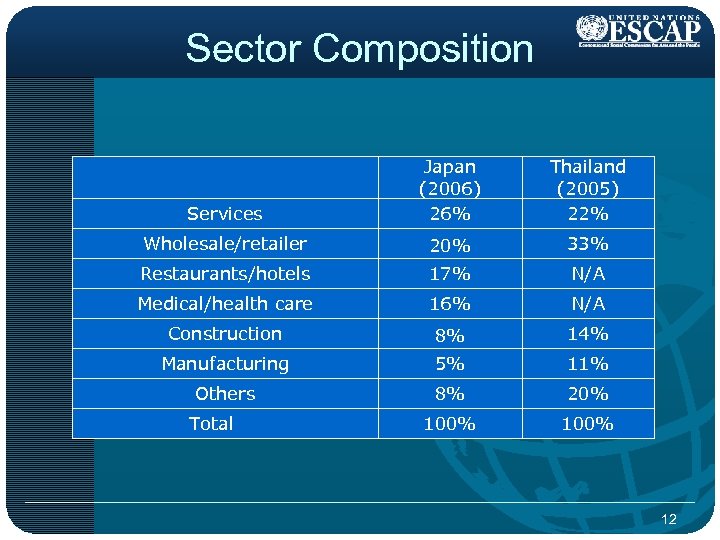

Sector Composition Services Japan (2006) 26% Thailand (2005) 22% Wholesale/retailer 20% 33% Restaurants/hotels 17% N/A Medical/health care 16% N/A Construction 8% 14% Manufacturing 5% 11% Others 8% 20% 100% Total 12

Sector Composition Services Japan (2006) 26% Thailand (2005) 22% Wholesale/retailer 20% 33% Restaurants/hotels 17% N/A Medical/health care 16% N/A Construction 8% 14% Manufacturing 5% 11% Others 8% 20% 100% Total 12

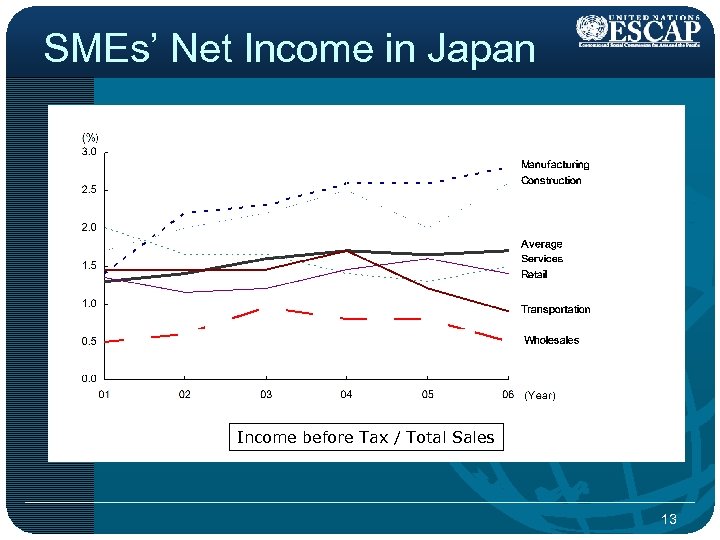

SMEs’ Net Income in Japan Income before Tax / Total Sales 13

SMEs’ Net Income in Japan Income before Tax / Total Sales 13

Policy Objectives • • Increase the number of start-ups Facilitate their growth Increase their survival rate Foster SME graduates (to be large enterprises) • Facilitate the smooth exist of losers, providing second (& more) chance • Encourage to be incorporated • Foster SME exporters & supporters 14

Policy Objectives • • Increase the number of start-ups Facilitate their growth Increase their survival rate Foster SME graduates (to be large enterprises) • Facilitate the smooth exist of losers, providing second (& more) chance • Encourage to be incorporated • Foster SME exporters & supporters 14

Challenges • Scattered targets (high transaction costs) • Lack of the economies of scale • Limited public resources • Limited understanding about the targets, i. e. SMEs • Limited communication channels • Limited knowledge & skills • Limited information on global & regional markets 15

Challenges • Scattered targets (high transaction costs) • Lack of the economies of scale • Limited public resources • Limited understanding about the targets, i. e. SMEs • Limited communication channels • Limited knowledge & skills • Limited information on global & regional markets 15

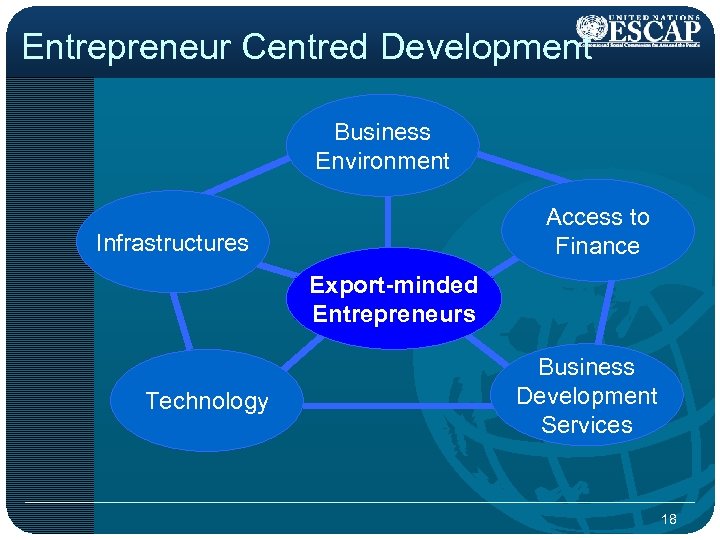

Six Areas for Interventions • • • Pro-business legal & regulatory framework Supporting infrastructure (e. g. ind. zones) Enhanced access to finance Entrepreneurship development Technology transfer & adaptation (plus R&D and product standards) • Business development services Entrepreneur centred development strategy 16

Six Areas for Interventions • • • Pro-business legal & regulatory framework Supporting infrastructure (e. g. ind. zones) Enhanced access to finance Entrepreneurship development Technology transfer & adaptation (plus R&D and product standards) • Business development services Entrepreneur centred development strategy 16

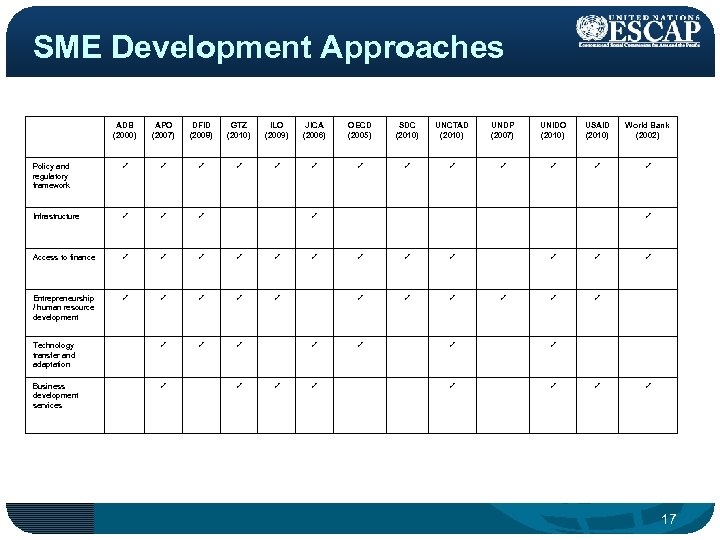

SME Development Approaches ADB (2000) APO (2007) DFID (2008) GTZ (2010) ILO (2009) JICA (2006) OECD (2005) SDC (2010) UNCTAD (2010) UNDP (2007) UNIDO (2010) USAID (2010) World Bank (2002) Policy and regulatory framework Infrastructure Access to finance Entrepreneurship / human resource development Technology transfer and adaptation Business development services 17

SME Development Approaches ADB (2000) APO (2007) DFID (2008) GTZ (2010) ILO (2009) JICA (2006) OECD (2005) SDC (2010) UNCTAD (2010) UNDP (2007) UNIDO (2010) USAID (2010) World Bank (2002) Policy and regulatory framework Infrastructure Access to finance Entrepreneurship / human resource development Technology transfer and adaptation Business development services 17

Entrepreneur Centred Development Business Environment Access to Finance Infrastructures Export-minded Entrepreneurs Technology Business Development Services 18

Entrepreneur Centred Development Business Environment Access to Finance Infrastructures Export-minded Entrepreneurs Technology Business Development Services 18

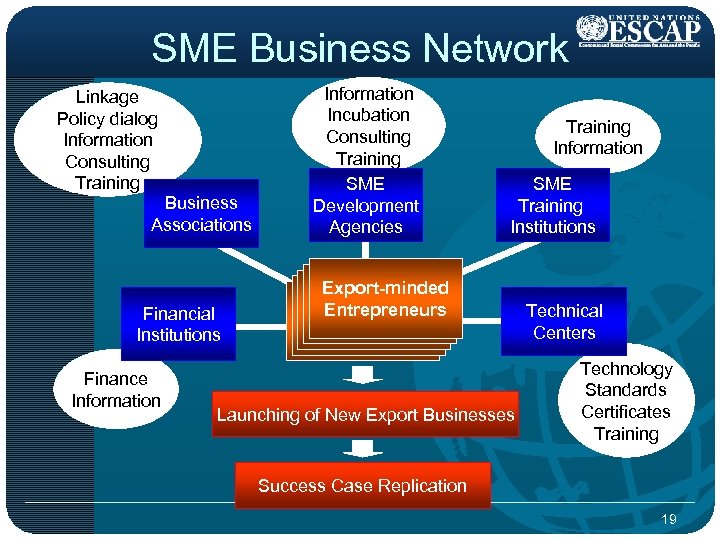

SME Business Network Linkage Policy dialog Information Consulting Training Business Associations Financial Institutions Finance Information Incubation Consulting Training SME Development Agencies Training Information SME Training Institutions Export-minded Entrepreneurs Export-minded Entrepreneurs Launching of New Export Businesses Technical Centers Technology Standards Certificates Training Success Case Replication 19

SME Business Network Linkage Policy dialog Information Consulting Training Business Associations Financial Institutions Finance Information Incubation Consulting Training SME Development Agencies Training Information SME Training Institutions Export-minded Entrepreneurs Export-minded Entrepreneurs Launching of New Export Businesses Technical Centers Technology Standards Certificates Training Success Case Replication 19

Global Value Chains 20

Global Value Chains 20

In the era of globalization… Can SMEs compete in the international market? Can SMEs learn to be competitive? Will SMEs benefit from the globalization? Can SMEs survive in the global competition? What can we do to bring the benefit of the globalization to the poor? 21

In the era of globalization… Can SMEs compete in the international market? Can SMEs learn to be competitive? Will SMEs benefit from the globalization? Can SMEs survive in the global competition? What can we do to bring the benefit of the globalization to the poor? 21

The ideal is… p Selling products directly to the international consumers with “Brand Presence” & “Pricing Power” - Have information related to market/process/product - Have capabilities over the full Value Chain: design, production, marketing, distribution, etc. - Respond effectively to the changing market conditions Very difficult for SMEs in developing countries p Alternate option: Reaching global market through global value chains 22

The ideal is… p Selling products directly to the international consumers with “Brand Presence” & “Pricing Power” - Have information related to market/process/product - Have capabilities over the full Value Chain: design, production, marketing, distribution, etc. - Respond effectively to the changing market conditions Very difficult for SMEs in developing countries p Alternate option: Reaching global market through global value chains 22

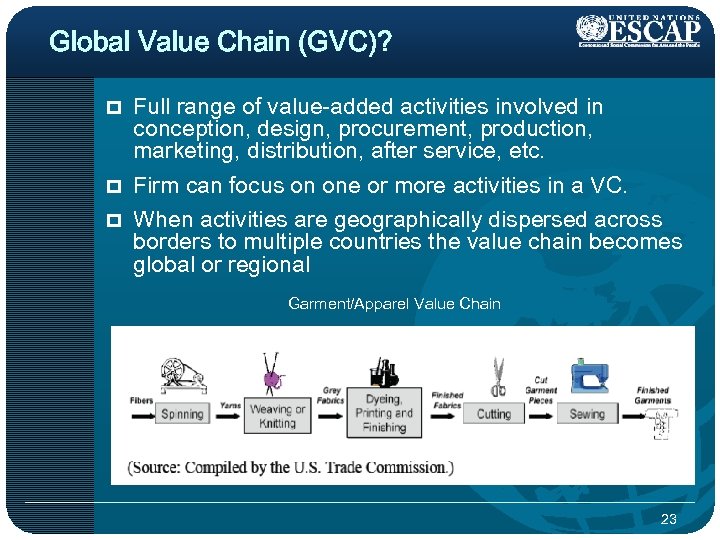

Global Value Chain (GVC)? p p p Full range of value-added activities involved in conception, design, procurement, production, marketing, distribution, after service, etc. Firm can focus on one or more activities in a VC. When activities are geographically dispersed across borders to multiple countries the value chain becomes global or regional Garment/Apparel Value Chain 23

Global Value Chain (GVC)? p p p Full range of value-added activities involved in conception, design, procurement, production, marketing, distribution, after service, etc. Firm can focus on one or more activities in a VC. When activities are geographically dispersed across borders to multiple countries the value chain becomes global or regional Garment/Apparel Value Chain 23

Characteristics of GVCs p A lead firm (a larger enterprise/a multinational) regulates a GVC with specific competences, making a higher profit p Brands, resources, technology, expertise and/or goodwill Customer vs. Production vs. Natural Endowment driven value chains p p Inviting outside experts on specific functions to manage complicated tasks to maximize the efficiency and effectives of the entire GVC 24

Characteristics of GVCs p A lead firm (a larger enterprise/a multinational) regulates a GVC with specific competences, making a higher profit p Brands, resources, technology, expertise and/or goodwill Customer vs. Production vs. Natural Endowment driven value chains p p Inviting outside experts on specific functions to manage complicated tasks to maximize the efficiency and effectives of the entire GVC 24

Characteristics of GVCs (cont. ) • Contracting with a selected number of capable SMEs typically as subordinate partners for specific tasks or functional support • Integration of business process, coordinated behaviours and information sharing among independent firms • Mutual investment into business process and long-term relationship 25

Characteristics of GVCs (cont. ) • Contracting with a selected number of capable SMEs typically as subordinate partners for specific tasks or functional support • Integration of business process, coordinated behaviours and information sharing among independent firms • Mutual investment into business process and long-term relationship 25

Emergence of GVCs: Drivers p Multilateral and regional free trade agreements p Policy Liberalization Ø Trade, investment, capital & finance, HR p Compliance with local content requirements p Technological innovation Ø Transportation and ICT p Increasing competition (pressures for lower cost, higher efficiency/ quality etc. ) p New management strategies Ø JIT, e-commerce, ERP, supply chain management 26

Emergence of GVCs: Drivers p Multilateral and regional free trade agreements p Policy Liberalization Ø Trade, investment, capital & finance, HR p Compliance with local content requirements p Technological innovation Ø Transportation and ICT p Increasing competition (pressures for lower cost, higher efficiency/ quality etc. ) p New management strategies Ø JIT, e-commerce, ERP, supply chain management 26

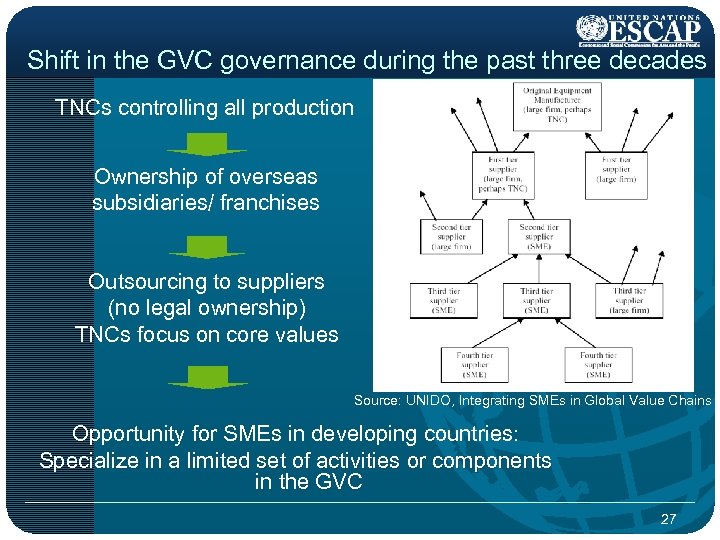

Shift in the GVC governance during the past three decades TNCs controlling all production Ownership of overseas subsidiaries/ franchises Outsourcing to suppliers (no legal ownership) TNCs focus on core values Source: UNIDO, Integrating SMEs in Global Value Chains Opportunity for SMEs in developing countries: Specialize in a limited set of activities or components in the GVC 27

Shift in the GVC governance during the past three decades TNCs controlling all production Ownership of overseas subsidiaries/ franchises Outsourcing to suppliers (no legal ownership) TNCs focus on core values Source: UNIDO, Integrating SMEs in Global Value Chains Opportunity for SMEs in developing countries: Specialize in a limited set of activities or components in the GVC 27

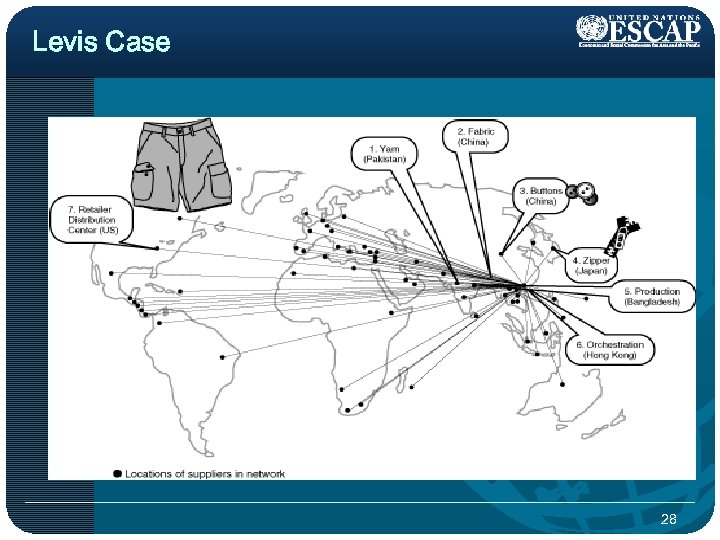

Levis Case 28

Levis Case 28

Emergence of GVCs: Consequences p Smaller number of dominant lead firms p Emergence of large/strong suppliers p Intensified competition toward high-value added activities p Competition on continuous skill development and knowledge enhancement Economic disparities at the region, country, community and firm levels Ø 29

Emergence of GVCs: Consequences p Smaller number of dominant lead firms p Emergence of large/strong suppliers p Intensified competition toward high-value added activities p Competition on continuous skill development and knowledge enhancement Economic disparities at the region, country, community and firm levels Ø 29

Lead Firm’s Objectives with SME Suppliers p Cost down / quality up; QDC (Quality, Delivery and Cost) improvement p Strategic focus and outsourcing non-core functions p Speed, effectiveness and flexibility p Access to expertise / technology p Long-term security p Control over supply chain networks p Local content requirements and local supplier development 30

Lead Firm’s Objectives with SME Suppliers p Cost down / quality up; QDC (Quality, Delivery and Cost) improvement p Strategic focus and outsourcing non-core functions p Speed, effectiveness and flexibility p Access to expertise / technology p Long-term security p Control over supply chain networks p Local content requirements and local supplier development 30

Opportunities for SMEs in developing countries p Access to international markets p Support from TNC (training/investment in business process/information sharing etc. ) p Technology and knowledge transfer p Long term buyer-supplier relationship; secured orders p Reputation and brand development p Opportunity to up-grade and move up to the next tier 31

Opportunities for SMEs in developing countries p Access to international markets p Support from TNC (training/investment in business process/information sharing etc. ) p Technology and knowledge transfer p Long term buyer-supplier relationship; secured orders p Reputation and brand development p Opportunity to up-grade and move up to the next tier 31

Challenges for SMEs in developing countries p Lack of awareness, capacity and resources Ø Infrastructure Ø Capital Ø Skilled labour Ø Managerial expertise Ø Knowledge and technology Ø Contacts / networks 32

Challenges for SMEs in developing countries p Lack of awareness, capacity and resources Ø Infrastructure Ø Capital Ø Skilled labour Ø Managerial expertise Ø Knowledge and technology Ø Contacts / networks 32

Challenges for SMEs in developing countries (cont. ) p High entry barriers -- International Standards Ø Have to deliver specified product, required quantity and right quality at competitive price and agreed leadtime p Competition is not solely based on cost but also based on product and process related standards, such as quality, safety, environmental preservation and respect for labour 33

Challenges for SMEs in developing countries (cont. ) p High entry barriers -- International Standards Ø Have to deliver specified product, required quantity and right quality at competitive price and agreed leadtime p Competition is not solely based on cost but also based on product and process related standards, such as quality, safety, environmental preservation and respect for labour 33

Challenges for SMEs in developing countries (cont. ) p Unfavorable national business environment Ø Rules and regulations Ø Red tape/corruption Ø Political instability Insufficient business development services Ø 34

Challenges for SMEs in developing countries (cont. ) p Unfavorable national business environment Ø Rules and regulations Ø Red tape/corruption Ø Political instability Insufficient business development services Ø 34

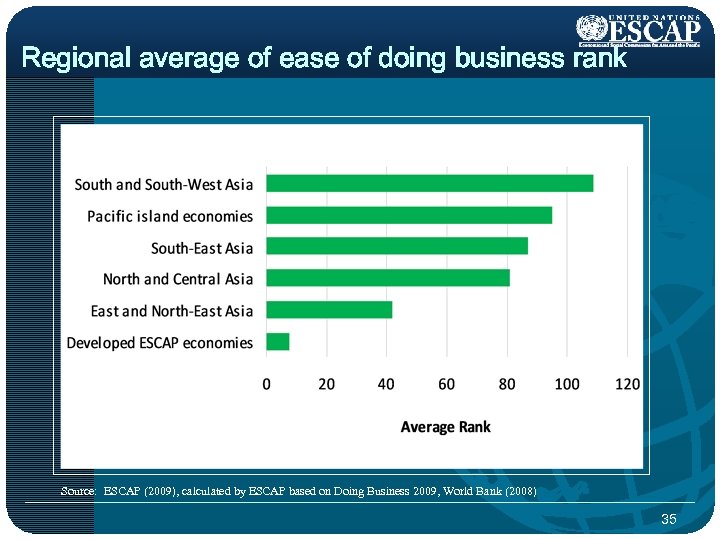

Regional average of ease of doing business rank Source: ESCAP (2009), calculated by ESCAP based on Doing Business 2009, World Bank (2008) 35

Regional average of ease of doing business rank Source: ESCAP (2009), calculated by ESCAP based on Doing Business 2009, World Bank (2008) 35

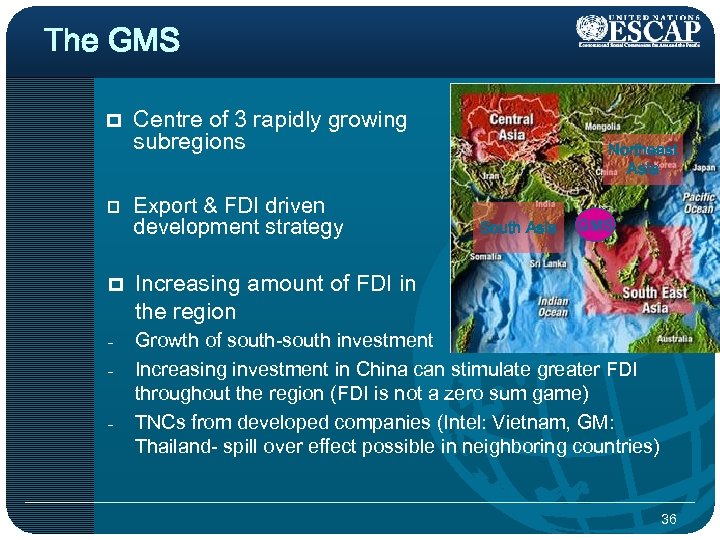

The GMS p p p - Centre of 3 rapidly growing subregions Export & FDI driven development strategy Northeast Asia South Asia GMS Increasing amount of FDI in the region Growth of south-south investment Increasing investment in China can stimulate greater FDI throughout the region (FDI is not a zero sum game) TNCs from developed companies (Intel: Vietnam, GM: Thailand- spill over effect possible in neighboring countries) 36

The GMS p p p - Centre of 3 rapidly growing subregions Export & FDI driven development strategy Northeast Asia South Asia GMS Increasing amount of FDI in the region Growth of south-south investment Increasing investment in China can stimulate greater FDI throughout the region (FDI is not a zero sum game) TNCs from developed companies (Intel: Vietnam, GM: Thailand- spill over effect possible in neighboring countries) 36

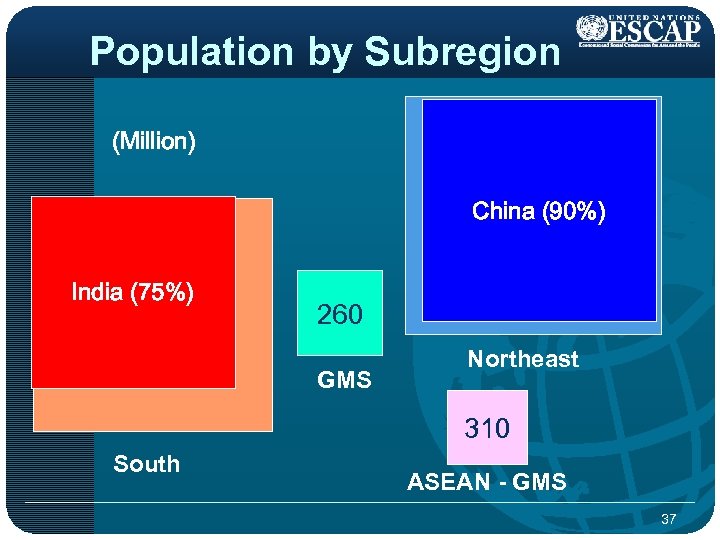

Population by Subregion (Million) China (90%) 1, 500 India (75%) 1, 350 260 GMS Northeast 310 South ASEAN - GMS 37

Population by Subregion (Million) China (90%) 1, 500 India (75%) 1, 350 260 GMS Northeast 310 South ASEAN - GMS 37

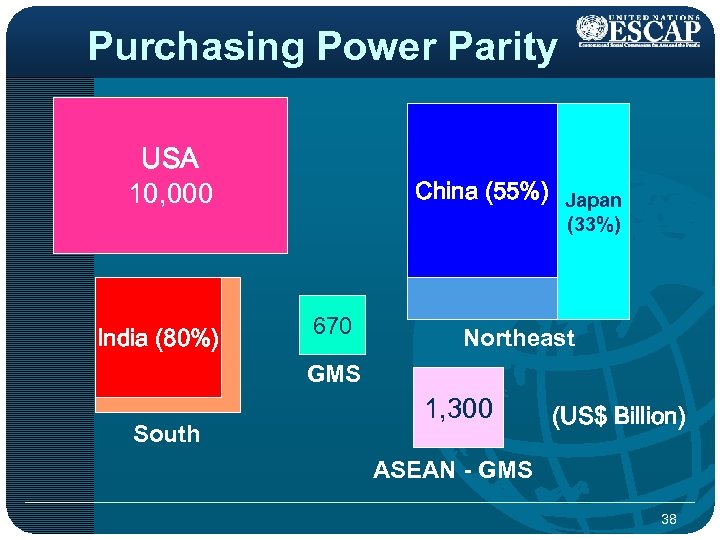

Purchasing Power Parity USA 10, 000 India (80%) 3, 300 South China (55%) Japan 11, 000(33%) 670 Northeast GMS 1, 300 (US$ Billion) ASEAN - GMS 38

Purchasing Power Parity USA 10, 000 India (80%) 3, 300 South China (55%) Japan 11, 000(33%) 670 Northeast GMS 1, 300 (US$ Billion) ASEAN - GMS 38

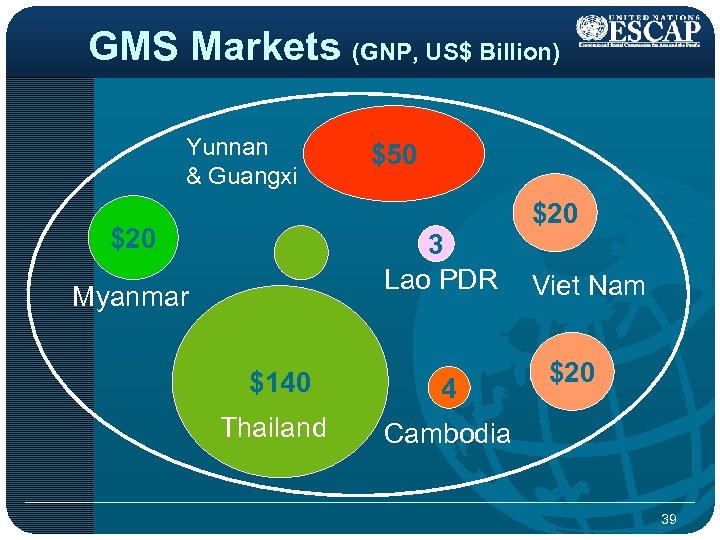

GMS Markets (GNP, US$ Billion) Yunnan & Guangxi $20 $50 3 Lao PDR Myanmar $140 4 Thailand $20 Viet Nam $20 Cambodia 39

GMS Markets (GNP, US$ Billion) Yunnan & Guangxi $20 $50 3 Lao PDR Myanmar $140 4 Thailand $20 Viet Nam $20 Cambodia 39

GVCs in GMS p Thailand: various GVCs in auto, electronics, high-tech, agri -business, consumer-goods sectors. p Yunnan: VCs mainly serves other provincial markets p Viet Nam: GVCs under development in garment, consumer goods, auto and electronics sectors p Cambodia, Lao PDR and Myanmar: Agro-business and garments; need promotion to attract GVCs although some FDI have been observed advanced manufacturing sectors recently (underdeveloped domestic markets) 40

GVCs in GMS p Thailand: various GVCs in auto, electronics, high-tech, agri -business, consumer-goods sectors. p Yunnan: VCs mainly serves other provincial markets p Viet Nam: GVCs under development in garment, consumer goods, auto and electronics sectors p Cambodia, Lao PDR and Myanmar: Agro-business and garments; need promotion to attract GVCs although some FDI have been observed advanced manufacturing sectors recently (underdeveloped domestic markets) 40

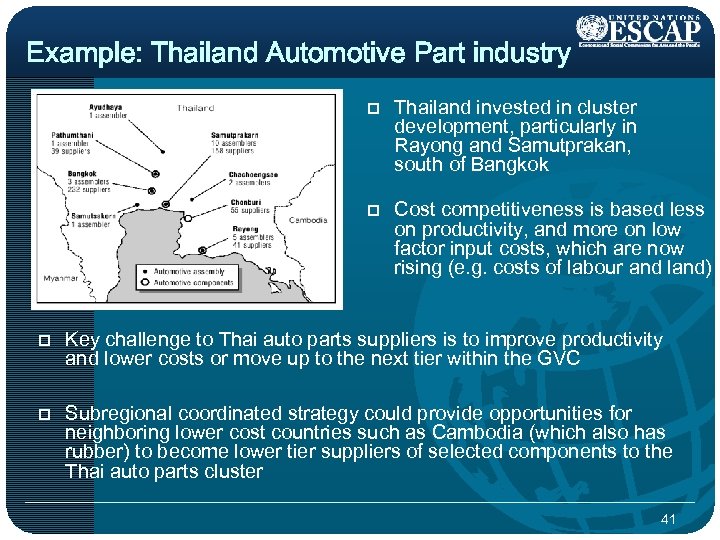

Example: Thailand Automotive Part industry p Thailand invested in cluster development, particularly in Rayong and Samutprakan, south of Bangkok p Cost competitiveness is based less on productivity, and more on low factor input costs, which are now rising (e. g. costs of labour and land) p Key challenge to Thai auto parts suppliers is to improve productivity and lower costs or move up to the next tier within the GVC p Subregional coordinated strategy could provide opportunities for neighboring lower cost countries such as Cambodia (which also has rubber) to become lower tier suppliers of selected components to the Thai auto parts cluster 41

Example: Thailand Automotive Part industry p Thailand invested in cluster development, particularly in Rayong and Samutprakan, south of Bangkok p Cost competitiveness is based less on productivity, and more on low factor input costs, which are now rising (e. g. costs of labour and land) p Key challenge to Thai auto parts suppliers is to improve productivity and lower costs or move up to the next tier within the GVC p Subregional coordinated strategy could provide opportunities for neighboring lower cost countries such as Cambodia (which also has rubber) to become lower tier suppliers of selected components to the Thai auto parts cluster 41

Opportunities for SMEs • Geographical advantage – Centre of 3 rapidly growing subregions • Export & FDI driven development strategy • More donor assistance expected – The combined resources of donors, governments, the private sector currently provides 20% of needs • Underdeveloped intra-regional trade & investment – Potential home markets – Yunnan & Guangxi’s integration • Flexibility & specialization 42

Opportunities for SMEs • Geographical advantage – Centre of 3 rapidly growing subregions • Export & FDI driven development strategy • More donor assistance expected – The combined resources of donors, governments, the private sector currently provides 20% of needs • Underdeveloped intra-regional trade & investment – Potential home markets – Yunnan & Guangxi’s integration • Flexibility & specialization 42

SMEs’ Corporate Strategies p Improve quality and develop brand p Reach the global market through existing GVCs that are most likely dominated by lead firms p Enter into lower tiers with a low-value role in GVCs p Move up GVCs to high-value added activities over time p Find adequate financing for the investments and accessing quality workforce p Collaborate with other SME players vertically and horizontally in a GVC p Establish joint ventures with foreign investors 43

SMEs’ Corporate Strategies p Improve quality and develop brand p Reach the global market through existing GVCs that are most likely dominated by lead firms p Enter into lower tiers with a low-value role in GVCs p Move up GVCs to high-value added activities over time p Find adequate financing for the investments and accessing quality workforce p Collaborate with other SME players vertically and horizontally in a GVC p Establish joint ventures with foreign investors 43

SME actions needed p Improvement of quality Ø Performance Ø Ø Durability Ø Serviceability Ø p Reliability Perceived quality Aggressive marketing (networking and branding) Ø Catalogues Ø Trade journals & directories Ø Sales representatives Ø Trade missions / fairs / exhibitions Ø Internet 44

SME actions needed p Improvement of quality Ø Performance Ø Ø Durability Ø Serviceability Ø p Reliability Perceived quality Aggressive marketing (networking and branding) Ø Catalogues Ø Trade journals & directories Ø Sales representatives Ø Trade missions / fairs / exhibitions Ø Internet 44

SME actions needed (cont. ) p R&D and technology adaptation in cooperation with public/private research/technological institutions p Seek finance and credit opportunity with governments and banks p Seek services from business associations p Develop and involve in producers’ associations p Seek aggressively investment opportunity in cooperation with both domestic and foreign investors 45

SME actions needed (cont. ) p R&D and technology adaptation in cooperation with public/private research/technological institutions p Seek finance and credit opportunity with governments and banks p Seek services from business associations p Develop and involve in producers’ associations p Seek aggressively investment opportunity in cooperation with both domestic and foreign investors 45

Government actions needed p Change of FDI strategy: Attract GVCs fit for the country. p Develop GVCs by participating in neighbouring countries’ GVCs. p Classic SME export promotion p p Create enabling business environment p p Marketing research, export promotion, product development, export financing, trade fairs and missions Laws and regulations and their enforcement, ICT and logistic infrastructure and software Enhanced access to SME finance 46

Government actions needed p Change of FDI strategy: Attract GVCs fit for the country. p Develop GVCs by participating in neighbouring countries’ GVCs. p Classic SME export promotion p p Create enabling business environment p p Marketing research, export promotion, product development, export financing, trade fairs and missions Laws and regulations and their enforcement, ICT and logistic infrastructure and software Enhanced access to SME finance 46

Government actions needed (cont. ) p Capacity and HR development for SMEs and related government agencies p Fostering capacity and quality of business associations p Training on working relationship in a multicultural environment p Focus on agri-business value chains p Foster stronger backward linkages with SMEs through intra-regional South-South investment 47

Government actions needed (cont. ) p Capacity and HR development for SMEs and related government agencies p Fostering capacity and quality of business associations p Training on working relationship in a multicultural environment p Focus on agri-business value chains p Foster stronger backward linkages with SMEs through intra-regional South-South investment 47

Government actions needed (cont. ) p Facilitate SMEs’ adoption of world standards and credible certifications p Productivity improvement through infrastructure development and logistical improvement p Improving the cross-border flow of goods p Sector based value chain studies p Foster national lead firms – Graduates from the SME sector with quality and brand 48

Government actions needed (cont. ) p Facilitate SMEs’ adoption of world standards and credible certifications p Productivity improvement through infrastructure development and logistical improvement p Improving the cross-border flow of goods p Sector based value chain studies p Foster national lead firms – Graduates from the SME sector with quality and brand 48

Government Strategies (cont. ) Additional GVC strategies: p Supply side capacity building Training/ counseling and advice/ micro financing/ market intelligence etc. p p Develop opportunities through cooperation (i. e. SME clusters) Economies of scale/ joint action/ information sharing/ enhancing attractiveness to global buyers by reducing transaction costs etc. p p Promote the GVC mindset 49

Government Strategies (cont. ) Additional GVC strategies: p Supply side capacity building Training/ counseling and advice/ micro financing/ market intelligence etc. p p Develop opportunities through cooperation (i. e. SME clusters) Economies of scale/ joint action/ information sharing/ enhancing attractiveness to global buyers by reducing transaction costs etc. p p Promote the GVC mindset 49

GMS Subregional Cooperation p Develop ‘GVC mindset’ in cross-border cooperation among GMS countries p Strengthen cross-border (GMS/subregional) logistics systems p Focus trade facilitation cooperation (e. g. in GMS Programme) on particular GVCs p Facilitate GMS supplier development, including development of SME clusters across borders (and share information/ best practices etc. ) p Facilitate cross-border linkages of domestic business institutions (e. g. GMS-BF) 50

GMS Subregional Cooperation p Develop ‘GVC mindset’ in cross-border cooperation among GMS countries p Strengthen cross-border (GMS/subregional) logistics systems p Focus trade facilitation cooperation (e. g. in GMS Programme) on particular GVCs p Facilitate GMS supplier development, including development of SME clusters across borders (and share information/ best practices etc. ) p Facilitate cross-border linkages of domestic business institutions (e. g. GMS-BF) 50

Further reading p Two in-depth studies on SME development in Asia & the Pacific are available at ESCAP website (www. unescap. org) 51

Further reading p Two in-depth studies on SME development in Asia & the Pacific are available at ESCAP website (www. unescap. org) 51

For further inquiry, contact: Masato Abe, Ph. D. Economic Affairs Officer Private Sector and Development Section Trade and Investment Division United Nations ESCAP Bangkok, Thailand abem@un. org www. unescap. org 52

For further inquiry, contact: Masato Abe, Ph. D. Economic Affairs Officer Private Sector and Development Section Trade and Investment Division United Nations ESCAP Bangkok, Thailand abem@un. org www. unescap. org 52