7802b52666d60c41bd936da2b6420775.ppt

- Количество слайдов: 39

Exploring Financial Aid Opportunities Office of Student Financial Aid Montgomery College

Exploring Financial Aid Opportunities Office of Student Financial Aid Montgomery College

Topics We Will Discuss… What is Financial Aid Cost of Attendance Expected Family Contribution Determining Financial Need Sources and Types of Financial Aid Free Application for Federal Student Aid Follow-up Steps/Resources Questions & Answers

Topics We Will Discuss… What is Financial Aid Cost of Attendance Expected Family Contribution Determining Financial Need Sources and Types of Financial Aid Free Application for Federal Student Aid Follow-up Steps/Resources Questions & Answers

What is Financial Aid? Financial aid is funds provided to students and families to help pay for postsecondary educational expenses.

What is Financial Aid? Financial aid is funds provided to students and families to help pay for postsecondary educational expenses.

What is Cost of Attendance (COA)? • Tuition and fees Room and board Books and supplies Transportation Miscellaneous personal expenses • Costs will widely vary from college to college • •

What is Cost of Attendance (COA)? • Tuition and fees Room and board Books and supplies Transportation Miscellaneous personal expenses • Costs will widely vary from college to college • •

What is Expected Family Contribution (EFC)? Amount family can reasonably be expected to contribute Two components ◦ Parent contribution ◦ Student contribution Calculated using data from a federal application form and a federal methodology Stays the same regardless of college

What is Expected Family Contribution (EFC)? Amount family can reasonably be expected to contribute Two components ◦ Parent contribution ◦ Student contribution Calculated using data from a federal application form and a federal methodology Stays the same regardless of college

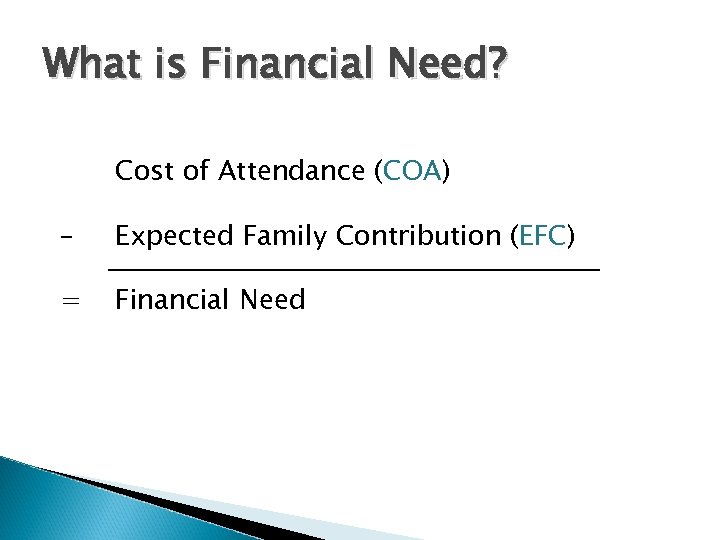

What is Financial Need? Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need

What is Financial Need? Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need

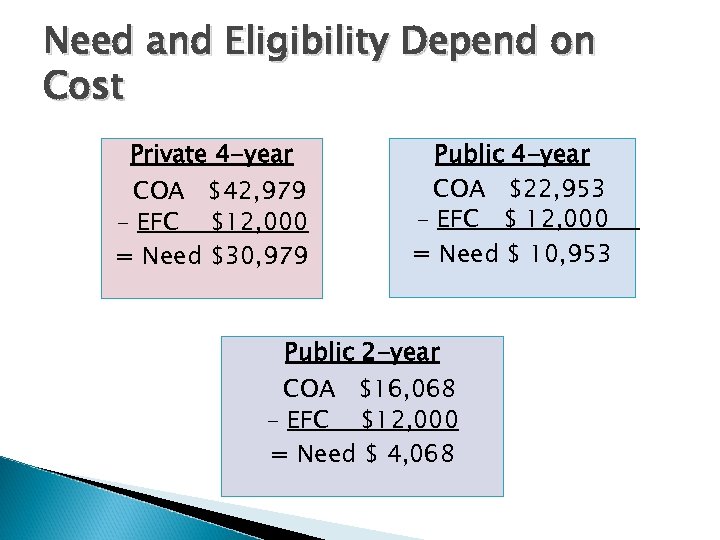

Need and Eligibility Depend on Cost Private 4 -year COA $42, 979 - EFC $12, 000 = Need $30, 979 Public 4 -year COA $22, 953 - EFC $ 12, 000 = Need $ 10, 953 Public 2 -year COA $16, 068 - EFC $12, 000 = Need $ 4, 068

Need and Eligibility Depend on Cost Private 4 -year COA $42, 979 - EFC $12, 000 = Need $30, 979 Public 4 -year COA $22, 953 - EFC $ 12, 000 = Need $ 10, 953 Public 2 -year COA $16, 068 - EFC $12, 000 = Need $ 4, 068

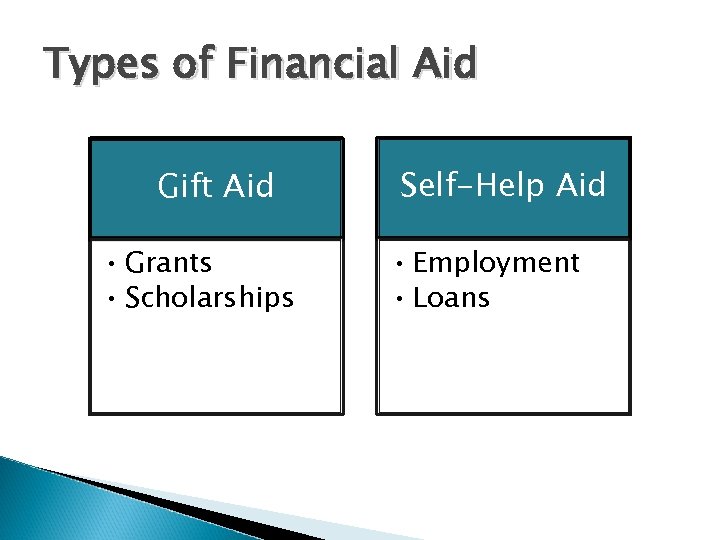

Types of Financial Aid Gift Aid • Grants • Scholarships Self-Help Aid • Employment • Loans

Types of Financial Aid Gift Aid • Grants • Scholarships Self-Help Aid • Employment • Loans

Grants Money that does not have to be paid back Usually awarded on the basis of financial need

Grants Money that does not have to be paid back Usually awarded on the basis of financial need

Scholarships Money that does not have to be paid back Awarded on the basis of merit, skill or unique characteristic

Scholarships Money that does not have to be paid back Awarded on the basis of merit, skill or unique characteristic

Employment Program provides student with employment Earned while attending school Money does not have to be repaid

Employment Program provides student with employment Earned while attending school Money does not have to be repaid

Loans Money students and parents borrow to help pay college expenses Repayment usually begins after education is finished or when enrollment falls below required enrollment status Only borrow what is really needed

Loans Money students and parents borrow to help pay college expenses Repayment usually begins after education is finished or when enrollment falls below required enrollment status Only borrow what is really needed

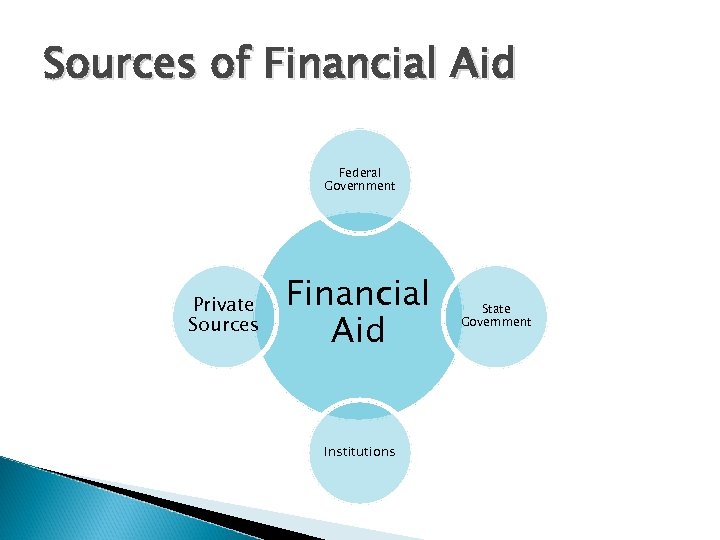

Sources of Financial Aid Federal Government Private Sources Financial Aid Institutions State Government

Sources of Financial Aid Federal Government Private Sources Financial Aid Institutions State Government

Federal Government Largest source of financial aid Aid awarded primarily on the basis of financial need Must apply every year, beginning in the student’s senior year of high school, using the Free Application for Federal Student Aid (FAFSA)

Federal Government Largest source of financial aid Aid awarded primarily on the basis of financial need Must apply every year, beginning in the student’s senior year of high school, using the Free Application for Federal Student Aid (FAFSA)

Federal Government Check basic eligibility requirements: Be a U. S. citizen or eligible non-citizen Have a valid Social Security number Comply with Selective Service registration, if required Have a high school diploma, a General Educational Development (GED) Certificate or pass an approved ability-to-benefit (ATB) test Be working toward a degree or certificate in an eligible program at a school that participates in the federal student aid programs Maintain satisfactory academic progress once in school

Federal Government Check basic eligibility requirements: Be a U. S. citizen or eligible non-citizen Have a valid Social Security number Comply with Selective Service registration, if required Have a high school diploma, a General Educational Development (GED) Certificate or pass an approved ability-to-benefit (ATB) test Be working toward a degree or certificate in an eligible program at a school that participates in the federal student aid programs Maintain satisfactory academic progress once in school

Federal Government Programs Federal Pell Grant Federal Supplemental Educational Opportunity Grant Academic Competitiveness Grant National Science & Mathematics Access to Retain Talent Grant Teacher Education Assistance for College & Higher Education Grant Federal Work Study Federal Perkins Loan Direct Stafford Loans PLUS Loan

Federal Government Programs Federal Pell Grant Federal Supplemental Educational Opportunity Grant Academic Competitiveness Grant National Science & Mathematics Access to Retain Talent Grant Teacher Education Assistance for College & Higher Education Grant Federal Work Study Federal Perkins Loan Direct Stafford Loans PLUS Loan

Federal Work-Study Money earned while attending school Does not have to be repaid For undergraduate and graduate students Jobs can be on campus or off campus Students are paid at least federal minimum wage

Federal Work-Study Money earned while attending school Does not have to be repaid For undergraduate and graduate students Jobs can be on campus or off campus Students are paid at least federal minimum wage

Federal Perkins Loan • • • Fixed interest rate of 5% 9 -month grace period Up to $5, 500 for undergraduate students Deferment and cancellation provisions for teaching, nursing, law enforcement, etc. Priority given to those with exceptional need – Eligibility for Federal Pell Grant is determined first

Federal Perkins Loan • • • Fixed interest rate of 5% 9 -month grace period Up to $5, 500 for undergraduate students Deferment and cancellation provisions for teaching, nursing, law enforcement, etc. Priority given to those with exceptional need – Eligibility for Federal Pell Grant is determined first

Federal Stafford Loans • Subsidized (Need-based) • Unsubsidized (Not need-based) • Annual and aggregate loan limits • 6 -month grace period, 10 year repayment • Not credit-based

Federal Stafford Loans • Subsidized (Need-based) • Unsubsidized (Not need-based) • Annual and aggregate loan limits • 6 -month grace period, 10 year repayment • Not credit-based

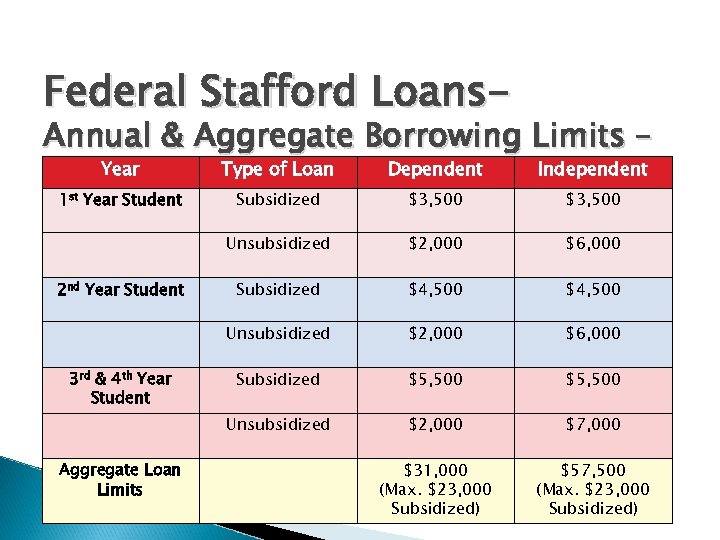

Federal Stafford Loans- Annual & Aggregate Borrowing Limits – Year Type of Loan Dependent Independent 1 st Year Student Subsidized $3, 500 Unsubsidized $2, 000 $6, 000 Subsidized $4, 500 Unsubsidized $2, 000 $6, 000 Subsidized $5, 500 Unsubsidized $2, 000 $7, 000 $31, 000 (Max. $23, 000 Subsidized) $57, 500 (Max. $23, 000 Subsidized) 2 nd Year Student 3 rd & 4 th Year Student Aggregate Loan Limits

Federal Stafford Loans- Annual & Aggregate Borrowing Limits – Year Type of Loan Dependent Independent 1 st Year Student Subsidized $3, 500 Unsubsidized $2, 000 $6, 000 Subsidized $4, 500 Unsubsidized $2, 000 $6, 000 Subsidized $5, 500 Unsubsidized $2, 000 $7, 000 $31, 000 (Max. $23, 000 Subsidized) $57, 500 (Max. $23, 000 Subsidized) 2 nd Year Student 3 rd & 4 th Year Student Aggregate Loan Limits

Federal PLUS Loan • Parents of dependent undergraduate students • Approval subject to credit status check • Loan Limits – Annual: COA less all other aid – Aggregate: None • Not need-based

Federal PLUS Loan • Parents of dependent undergraduate students • Approval subject to credit status check • Loan Limits – Annual: COA less all other aid – Aggregate: None • Not need-based

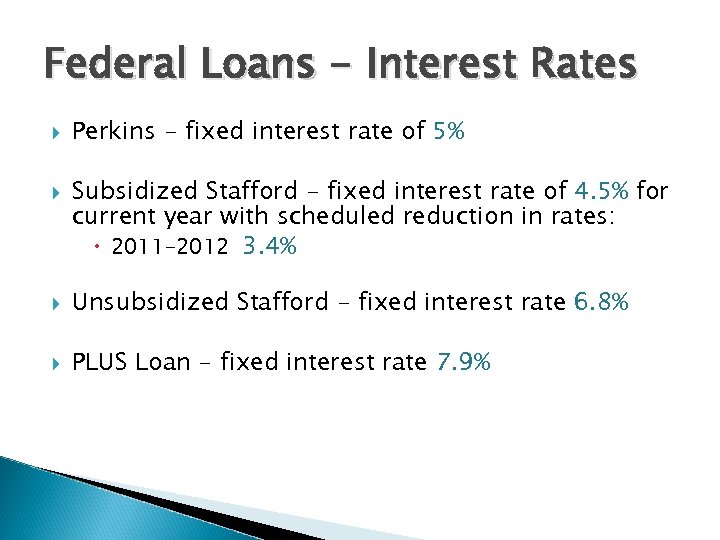

Federal Loans - Interest Rates Perkins - fixed interest rate of 5% Subsidized Stafford - fixed interest rate of 4. 5% for current year with scheduled reduction in rates: 2011 -2012 3. 4% Unsubsidized Stafford - fixed interest rate 6. 8% PLUS Loan - fixed interest rate 7. 9%

Federal Loans - Interest Rates Perkins - fixed interest rate of 5% Subsidized Stafford - fixed interest rate of 4. 5% for current year with scheduled reduction in rates: 2011 -2012 3. 4% Unsubsidized Stafford - fixed interest rate 6. 8% PLUS Loan - fixed interest rate 7. 9%

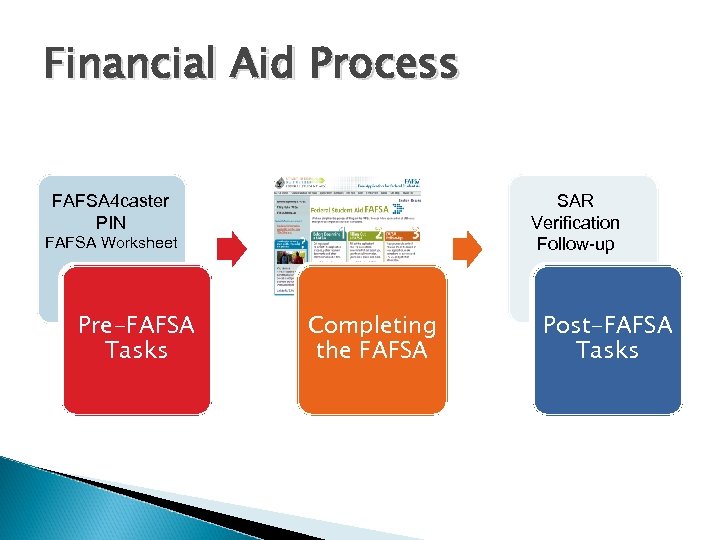

Financial Aid Process FAFSA 4 caster PIN SAR Verification Follow-up FAFSA Worksheet Pre-FAFSA Tasks Completing the FAFSA Post-FAFSA Tasks

Financial Aid Process FAFSA 4 caster PIN SAR Verification Follow-up FAFSA Worksheet Pre-FAFSA Tasks Completing the FAFSA Post-FAFSA Tasks

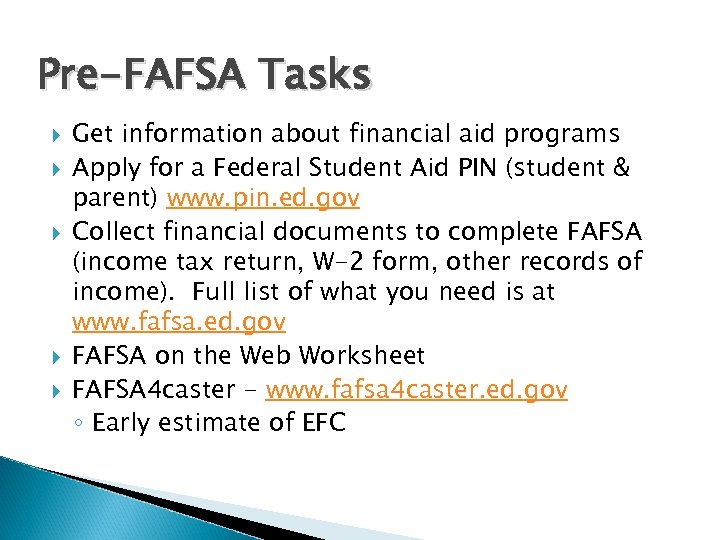

Pre-FAFSA Tasks Get information about financial aid programs Apply for a Federal Student Aid PIN (student & parent) www. pin. ed. gov Collect financial documents to complete FAFSA (income tax return, W-2 form, other records of income). Full list of what you need is at www. fafsa. ed. gov FAFSA on the Web Worksheet FAFSA 4 caster - www. fafsa 4 caster. ed. gov ◦ Early estimate of EFC

Pre-FAFSA Tasks Get information about financial aid programs Apply for a Federal Student Aid PIN (student & parent) www. pin. ed. gov Collect financial documents to complete FAFSA (income tax return, W-2 form, other records of income). Full list of what you need is at www. fafsa. ed. gov FAFSA on the Web Worksheet FAFSA 4 caster - www. fafsa 4 caster. ed. gov ◦ Early estimate of EFC

PIN Website – www. pin. ed. gov

PIN Website – www. pin. ed. gov

FAFSA Website – www. fafsa. gov

FAFSA Website – www. fafsa. gov

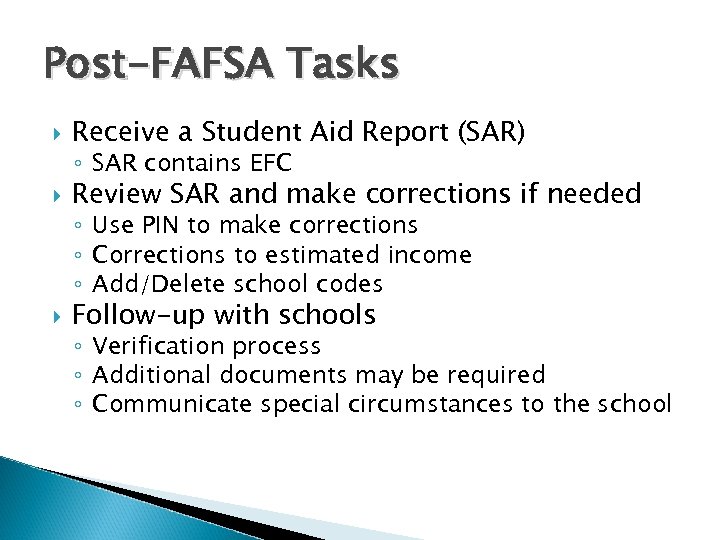

Post-FAFSA Tasks Receive a Student Aid Report (SAR) Review SAR and make corrections if needed Follow-up with schools ◦ SAR contains EFC ◦ Use PIN to make corrections ◦ Corrections to estimated income ◦ Add/Delete school codes ◦ Verification process ◦ Additional documents may be required ◦ Communicate special circumstances to the school

Post-FAFSA Tasks Receive a Student Aid Report (SAR) Review SAR and make corrections if needed Follow-up with schools ◦ SAR contains EFC ◦ Use PIN to make corrections ◦ Corrections to estimated income ◦ Add/Delete school codes ◦ Verification process ◦ Additional documents may be required ◦ Communicate special circumstances to the school

State Government Residency requirements Awards based on merit and need Deadlines vary by state; check paper FAFSA on the web Use the information on the FAFSA

State Government Residency requirements Awards based on merit and need Deadlines vary by state; check paper FAFSA on the web Use the information on the FAFSA

Maryland Higher Education Commission State deadline: March 1 st Maryland has financial aid programs based on financial need, merit or career track State aid may be used at public and private colleges/universities (primarily in MD)

Maryland Higher Education Commission State deadline: March 1 st Maryland has financial aid programs based on financial need, merit or career track State aid may be used at public and private colleges/universities (primarily in MD)

Maryland Additional resources and information College 411: Student Guide An Academic Year: Preparing for College

Maryland Additional resources and information College 411: Student Guide An Academic Year: Preparing for College

Institutional Aid Programs Colleges offer their own grants and scholarships Need-based and merit-based programs Academic, athletic, and other talent-based scholarships and grants Institutional aid may be for only the fist year or renewable for subsequent years Contact the school’s admissions and financial aid office for applications and deadlines UNIVERSITY

Institutional Aid Programs Colleges offer their own grants and scholarships Need-based and merit-based programs Academic, athletic, and other talent-based scholarships and grants Institutional aid may be for only the fist year or renewable for subsequent years Contact the school’s admissions and financial aid office for applications and deadlines UNIVERSITY

Private Sources of Student Aid Private businesses Political and advocacy organizations Religious and social organizations Parent and student’s place of employment Foundations Unions Deadlines and application procedures vary widely Begin researching private aid sources early

Private Sources of Student Aid Private businesses Political and advocacy organizations Religious and social organizations Parent and student’s place of employment Foundations Unions Deadlines and application procedures vary widely Begin researching private aid sources early

Private Sources of Student Aid Internet Scholarship Searches Scholarship Websites ◦ Provide a student profile ◦ Receive scholarship information ◦ Contact scholarship providers directly ◦ ◦ ◦ ◦ www. collegeboard. com/paying www. fastweb. com www. collegequest. com www. finaid. org www. freescholarships. com www. salliemae. com/scholarships www. college-scholarships. com

Private Sources of Student Aid Internet Scholarship Searches Scholarship Websites ◦ Provide a student profile ◦ Receive scholarship information ◦ Contact scholarship providers directly ◦ ◦ ◦ ◦ www. collegeboard. com/paying www. fastweb. com www. collegequest. com www. finaid. org www. freescholarships. com www. salliemae. com/scholarships www. college-scholarships. com

CSS/Financial Aid Profile Financial aid application service of The College Board Used to award private grant & scholarship funds Check for a listing of participating institutions/ scholarship programs ◦ www. collegeboard. com

CSS/Financial Aid Profile Financial aid application service of The College Board Used to award private grant & scholarship funds Check for a listing of participating institutions/ scholarship programs ◦ www. collegeboard. com

Deadlines are Important!!! Financial aid forms and applications are just like homework; you have to turn them in correctly and on time Schools have different deadlines for admissions and financial aid; research each school to find out the deadlines

Deadlines are Important!!! Financial aid forms and applications are just like homework; you have to turn them in correctly and on time Schools have different deadlines for admissions and financial aid; research each school to find out the deadlines

Be Careful!!!!! Filling out FAFSA is free!!! Avoid scholarship scams ◦ ◦ ◦ Exclusive scholarship information Scholarship guaranteed! You’ve been selected! Application fees Free seminar or candidate interview

Be Careful!!!!! Filling out FAFSA is free!!! Avoid scholarship scams ◦ ◦ ◦ Exclusive scholarship information Scholarship guaranteed! You’ve been selected! Application fees Free seminar or candidate interview

College Goal Sunday What: Receive free help to complete FAFSA When: Sunday, February 13, 2011 2 -4 pm Where: Montgomery College Takoma Park/Silver Spring Campus Charlene R. Nunley Student Service Center Register at: www. collegegoalsundayusa. org

College Goal Sunday What: Receive free help to complete FAFSA When: Sunday, February 13, 2011 2 -4 pm Where: Montgomery College Takoma Park/Silver Spring Campus Charlene R. Nunley Student Service Center Register at: www. collegegoalsundayusa. org

Follow-up & Resources Financial aid is a process Follow-up is key No news is good news ---not the case in financial aid Be your own advocate!

Follow-up & Resources Financial aid is a process Follow-up is key No news is good news ---not the case in financial aid Be your own advocate!

Questions & Answers

Questions & Answers