e9feb07622beaa0a6831259a305d2275.ppt

- Количество слайдов: 31

Explaining Multi-Family Property Foreclosures AREUEA 2010 Mid-Year Meetings Susanne E. Cannon and Rebel A. Cole Department of Real Estate De. Paul University

Explaining Multi-Family Property Foreclosures AREUEA 2010 Mid-Year Meetings Susanne E. Cannon and Rebel A. Cole Department of Real Estate De. Paul University

Summary n In this study, we use data from a new and comprehensive database on properties in Cook County, IL to provide new evidence on the factors that explain foreclosures on multifamily properties. Cannon and Cole © 2010

Summary n In this study, we use data from a new and comprehensive database on properties in Cook County, IL to provide new evidence on the factors that explain foreclosures on multifamily properties. Cannon and Cole © 2010

Summary n n n We find that foreclosures are more likely where buildings: • have higher ratios of loan to value • are older And where buildings are located in Census Tracts that are characterized by: • lower median household incomes • higher unemployment rates are higher. We also find that loan vintage is a key determinant of foreclosure. Cannon and Cole © 2010

Summary n n n We find that foreclosures are more likely where buildings: • have higher ratios of loan to value • are older And where buildings are located in Census Tracts that are characterized by: • lower median household incomes • higher unemployment rates are higher. We also find that loan vintage is a key determinant of foreclosure. Cannon and Cole © 2010

Introduction n There is a voluminous, and growing, literature on the determinants of defaults and foreclosures on single-family residential mortgages. Largely ignored, with a few notable exceptions, is the multifamily mortgage market. The primary reason for this is the lack of data on multifamily mortgages and their underlying properties. Cannon and Cole © 2010

Introduction n There is a voluminous, and growing, literature on the determinants of defaults and foreclosures on single-family residential mortgages. Largely ignored, with a few notable exceptions, is the multifamily mortgage market. The primary reason for this is the lack of data on multifamily mortgages and their underlying properties. Cannon and Cole © 2010

Introduction n n In this study, we take advantage of a new and comprehensive database covering every multifamily property located in Cook County, IL. We focus on properties with seven or more units, and use them to develop an empirical model that explains the probability of foreclosure. Cannon and Cole © 2010

Introduction n n In this study, we take advantage of a new and comprehensive database covering every multifamily property located in Cook County, IL. We focus on properties with seven or more units, and use them to develop an empirical model that explains the probability of foreclosure. Cannon and Cole © 2010

Introduction n n The ultimate purpose of this model is to develop a neighborhood index of risk that can be used to assess to risk of losing multifamily housing, And to guide policies designed to mitigate future foreclosures and the subsequent loss of affordable housing. Cannon and Cole © 2010

Introduction n n The ultimate purpose of this model is to develop a neighborhood index of risk that can be used to assess to risk of losing multifamily housing, And to guide policies designed to mitigate future foreclosures and the subsequent loss of affordable housing. Cannon and Cole © 2010

Literature n n The study closest is spirit to ours is Foote, Gerardi, Willen and Neg (JHE 2008), who examine determinants of residential foreclosure in Massachusetts. The focus of their paper, however, is their estimate of the homeowner’s equity, and the impact of equity on the probability of default. Cannon and Cole © 2010

Literature n n The study closest is spirit to ours is Foote, Gerardi, Willen and Neg (JHE 2008), who examine determinants of residential foreclosure in Massachusetts. The focus of their paper, however, is their estimate of the homeowner’s equity, and the impact of equity on the probability of default. Cannon and Cole © 2010

Literature n n n Another closely related study is Archer, Elmer, Harrison and Ling (REE 2002), who analyze the determinants of default for a sample of (primarily large) multifamily properties. These authors question the applicability of optionbased models of mortgage default to multifamily and commercial mortgages. They also question the importance of the competing risk of prepayment when analyzing the risk of default because commercial mortgages typically include prepayment penalties that make prepayment unlikely. Cannon and Cole © 2010

Literature n n n Another closely related study is Archer, Elmer, Harrison and Ling (REE 2002), who analyze the determinants of default for a sample of (primarily large) multifamily properties. These authors question the applicability of optionbased models of mortgage default to multifamily and commercial mortgages. They also question the importance of the competing risk of prepayment when analyzing the risk of default because commercial mortgages typically include prepayment penalties that make prepayment unlikely. Cannon and Cole © 2010

Literature n This leads them to estimate a simple model of default probability where: • the dependent variable is a binary variable indicating whether a loan has ever been 90 days or more late and • The explanatory variables are loan, lender and property characteristics observable at origination. Cannon and Cole © 2010

Literature n This leads them to estimate a simple model of default probability where: • the dependent variable is a binary variable indicating whether a loan has ever been 90 days or more late and • The explanatory variables are loan, lender and property characteristics observable at origination. Cannon and Cole © 2010

Literature n n n They find that the Debt Coverage Ratio is statistically significant in explaining default while the Loan-to-Value Ratio is not. They also find that Value per Square Foot and Number of Units are not correlated with default but Year Built is negative correlated, indicating that newer properties are less likely to default. None of their other control variables are significant. Cannon and Cole © 2010

Literature n n n They find that the Debt Coverage Ratio is statistically significant in explaining default while the Loan-to-Value Ratio is not. They also find that Value per Square Foot and Number of Units are not correlated with default but Year Built is negative correlated, indicating that newer properties are less likely to default. None of their other control variables are significant. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n IL is a judicial, as opposed to statutory, foreclosure state, so lenders must go to court to enforce their rights. The process begins when the lender files a Lis Pendens on the collateral property with the Recorder of Deeds to notify potential buyers that a foreclosure lawsuit is pending against the owner. The lender also files a Complaint to Foreclose Mortgage in the county Chancery Court, seeking relief in the form of a judgment of foreclosure and sale. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n IL is a judicial, as opposed to statutory, foreclosure state, so lenders must go to court to enforce their rights. The process begins when the lender files a Lis Pendens on the collateral property with the Recorder of Deeds to notify potential buyers that a foreclosure lawsuit is pending against the owner. The lender also files a Complaint to Foreclose Mortgage in the county Chancery Court, seeking relief in the form of a judgment of foreclosure and sale. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n The complaint is served on the borrower using a Mortgage Foreclosure Summons, which summons the borrower to court to answer the complaint. The borrower must file a a Verified Answer to Complain to Foreclose Mortgage within 30 days of receiving the Mortgage Foreclosure Summons, or face a default judgment in favor of the lender, if such a judgment is requested by the lender. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n The complaint is served on the borrower using a Mortgage Foreclosure Summons, which summons the borrower to court to answer the complaint. The borrower must file a a Verified Answer to Complain to Foreclose Mortgage within 30 days of receiving the Mortgage Foreclosure Summons, or face a default judgment in favor of the lender, if such a judgment is requested by the lender. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n Following receipt of the summons, the borrower may exercise a number of rights, including: • the Right of Possession to live in the home until a judge enters an order for possession; • the Right of Reinstatement for 90 days to bring the mortgage back to current status by making up late payments; and • the Right of Redemption for at least seven months to sell, refinance or pay off the mortgage. n The court can shorten the redemption period to 30 days if the property is abandoned, and can lengthen the redemption period if it so chooses. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n Following receipt of the summons, the borrower may exercise a number of rights, including: • the Right of Possession to live in the home until a judge enters an order for possession; • the Right of Reinstatement for 90 days to bring the mortgage back to current status by making up late payments; and • the Right of Redemption for at least seven months to sell, refinance or pay off the mortgage. n The court can shorten the redemption period to 30 days if the property is abandoned, and can lengthen the redemption period if it so chooses. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n If the borrower answers the summons as required within 30 days, then a trial is scheduled to be held in county court, during which the judge hears from both the plaintiff and defendant and makes a ruling as to whether or not the mortgage debt is valid. If the court rules in favor of the lender-plaintiff that the mortgage debt is valid, then the presiding judge will schedule the date, time and location for a Sheriff’s Sale—a public auction at which the property will be sold. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n If the borrower answers the summons as required within 30 days, then a trial is scheduled to be held in county court, during which the judge hears from both the plaintiff and defendant and makes a ruling as to whether or not the mortgage debt is valid. If the court rules in favor of the lender-plaintiff that the mortgage debt is valid, then the presiding judge will schedule the date, time and location for a Sheriff’s Sale—a public auction at which the property will be sold. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n After the redemption period expires, the lender must file a Notice of Sheriff’s Sale, which must be published in a local newspaper one a week for three weeks. The Sheriff’s Sale cannot take place for at least seven days following publication of the final notice of sale or more than 45 days after publication of the initial notice. At the Sheriff’s Sale, a public auction is held with the lender making the opening bid at the amount owed by the borrower plus and fee Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n After the redemption period expires, the lender must file a Notice of Sheriff’s Sale, which must be published in a local newspaper one a week for three weeks. The Sheriff’s Sale cannot take place for at least seven days following publication of the final notice of sale or more than 45 days after publication of the initial notice. At the Sheriff’s Sale, a public auction is held with the lender making the opening bid at the amount owed by the borrower plus and fee Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n The highest bidder is awarded a receipt of sale, describing the real estate purchased and showing the amount bid, the amount paid the total amount still to be paid, with the proceeds going to the lender. The bidder must put down 10% of the winning bid in cash at the time of sale with the balance paid within 24 hours. Upon payment in full, the Sheriff issues a Certificate of Sale to the purchaser. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n The highest bidder is awarded a receipt of sale, describing the real estate purchased and showing the amount bid, the amount paid the total amount still to be paid, with the proceeds going to the lender. The bidder must put down 10% of the winning bid in cash at the time of sale with the balance paid within 24 hours. Upon payment in full, the Sheriff issues a Certificate of Sale to the purchaser. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n Following the auction, the Sheriff must make a Report of Sale to the Chancery Court that includes copies of all receipts and the certificate of sale. The buyer must file a Motion to Confirm Sale with the Chancery Court. If confirmed, then the court directs that a Sheriff’s Deed be issued to the buyer. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n n Following the auction, the Sheriff must make a Report of Sale to the Chancery Court that includes copies of all receipts and the certificate of sale. The buyer must file a Motion to Confirm Sale with the Chancery Court. If confirmed, then the court directs that a Sheriff’s Deed be issued to the buyer. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n Finally, the court issues an order of possession, which authorizes the Sheriff to evict the borrower from the property. Even after foreclosure, the lender may pursue a Deficiency Judgment against the borrower if proceeds from the Sheriff’s Sale are insufficient to satisfy the lender’s outstanding claim against the borrower. Cannon and Cole © 2010

The Judicial Foreclosure Process in IL n n Finally, the court issues an order of possession, which authorizes the Sheriff to evict the borrower from the property. Even after foreclosure, the lender may pursue a Deficiency Judgment against the borrower if proceeds from the Sheriff’s Sale are insufficient to satisfy the lender’s outstanding claim against the borrower. Cannon and Cole © 2010

Data n n n The study utilizes information from a new database developed by the Institute of Housing Studies (“IHS”) at De. Paul University, which covers every parcel of property in Cook County, IL. As a base, the IHS database uses information from the Cook County Assessor’s Office, which assesses property taxes on every property in Cook County. There are more than 2 million records in the database, which is more than 1 TB in size. Cannon and Cole © 2010

Data n n n The study utilizes information from a new database developed by the Institute of Housing Studies (“IHS”) at De. Paul University, which covers every parcel of property in Cook County, IL. As a base, the IHS database uses information from the Cook County Assessor’s Office, which assesses property taxes on every property in Cook County. There are more than 2 million records in the database, which is more than 1 TB in size. Cannon and Cole © 2010

Data n n n Upon this base, IHS has layered data from numerous additional sources. For our purposes, the most important additional source is Chicago Title Company, which provides title information on every property in Cook county, enabling us to identify and track properties through the foreclosure process. Chicago Title also provides us with information on each mortgage. Cannon and Cole © 2010

Data n n n Upon this base, IHS has layered data from numerous additional sources. For our purposes, the most important additional source is Chicago Title Company, which provides title information on every property in Cook county, enabling us to identify and track properties through the foreclosure process. Chicago Title also provides us with information on each mortgage. Cannon and Cole © 2010

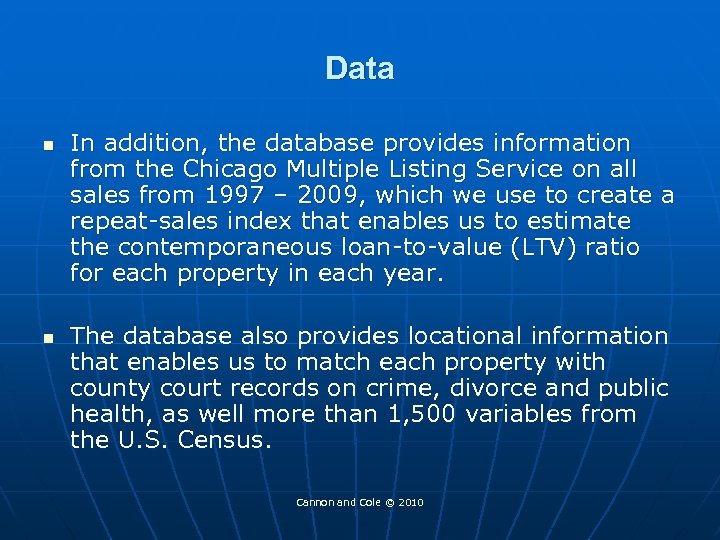

Data n n In addition, the database provides information from the Chicago Multiple Listing Service on all sales from 1997 – 2009, which we use to create a repeat-sales index that enables us to estimate the contemporaneous loan-to-value (LTV) ratio for each property in each year. The database also provides locational information that enables us to match each property with county court records on crime, divorce and public health, as well more than 1, 500 variables from the U. S. Census. Cannon and Cole © 2010

Data n n In addition, the database provides information from the Chicago Multiple Listing Service on all sales from 1997 – 2009, which we use to create a repeat-sales index that enables us to estimate the contemporaneous loan-to-value (LTV) ratio for each property in each year. The database also provides locational information that enables us to match each property with county court records on crime, divorce and public health, as well more than 1, 500 variables from the U. S. Census. Cannon and Cole © 2010

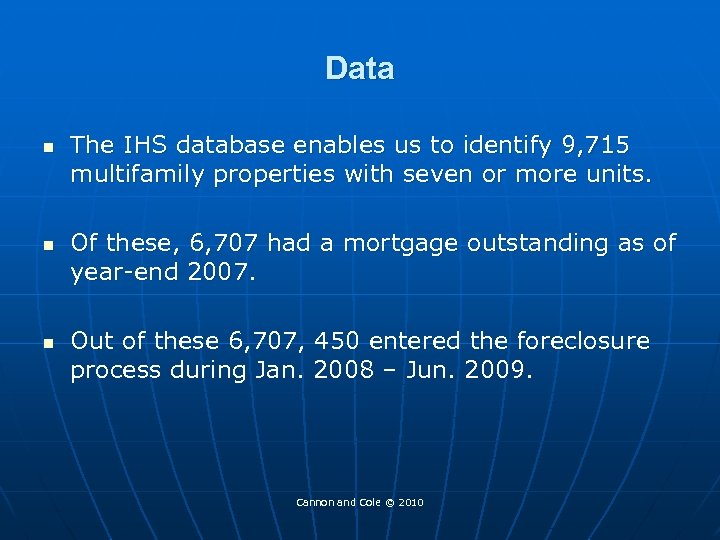

Data n n n The IHS database enables us to identify 9, 715 multifamily properties with seven or more units. Of these, 6, 707 had a mortgage outstanding as of year-end 2007. Out of these 6, 707, 450 entered the foreclosure process during Jan. 2008 – Jun. 2009. Cannon and Cole © 2010

Data n n n The IHS database enables us to identify 9, 715 multifamily properties with seven or more units. Of these, 6, 707 had a mortgage outstanding as of year-end 2007. Out of these 6, 707, 450 entered the foreclosure process during Jan. 2008 – Jun. 2009. Cannon and Cole © 2010

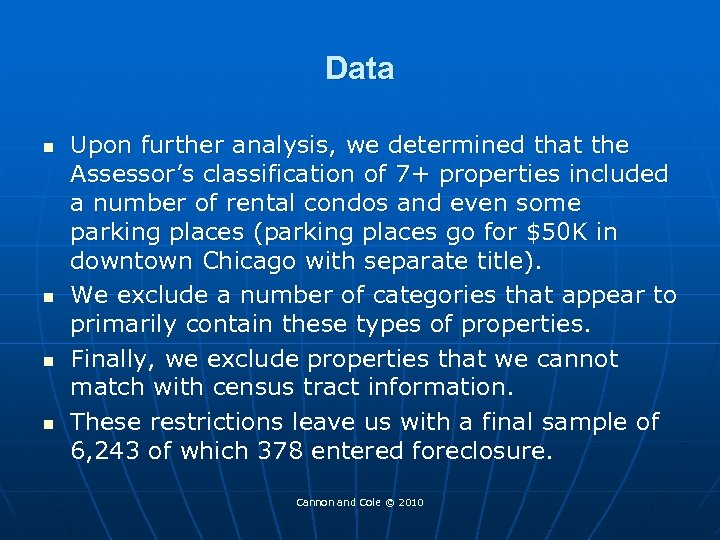

Data n n Upon further analysis, we determined that the Assessor’s classification of 7+ properties included a number of rental condos and even some parking places (parking places go for $50 K in downtown Chicago with separate title). We exclude a number of categories that appear to primarily contain these types of properties. Finally, we exclude properties that we cannot match with census tract information. These restrictions leave us with a final sample of 6, 243 of which 378 entered foreclosure. Cannon and Cole © 2010

Data n n Upon further analysis, we determined that the Assessor’s classification of 7+ properties included a number of rental condos and even some parking places (parking places go for $50 K in downtown Chicago with separate title). We exclude a number of categories that appear to primarily contain these types of properties. Finally, we exclude properties that we cannot match with census tract information. These restrictions leave us with a final sample of 6, 243 of which 378 entered foreclosure. Cannon and Cole © 2010

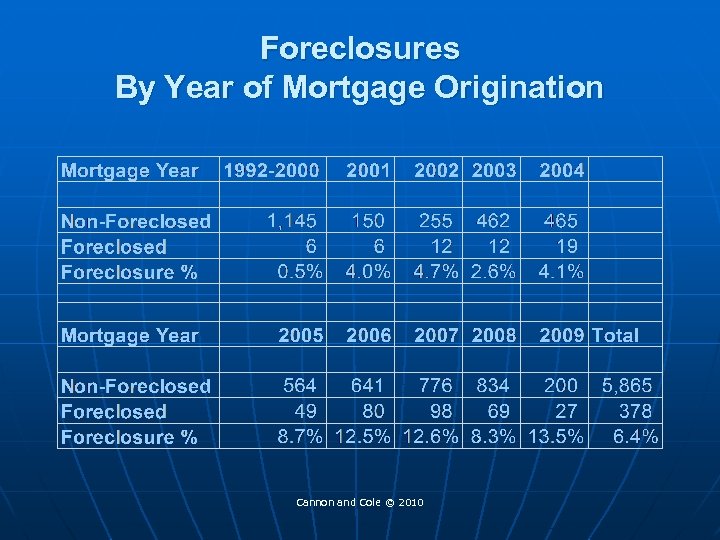

Foreclosures By Year of Mortgage Origination Cannon and Cole © 2010

Foreclosures By Year of Mortgage Origination Cannon and Cole © 2010

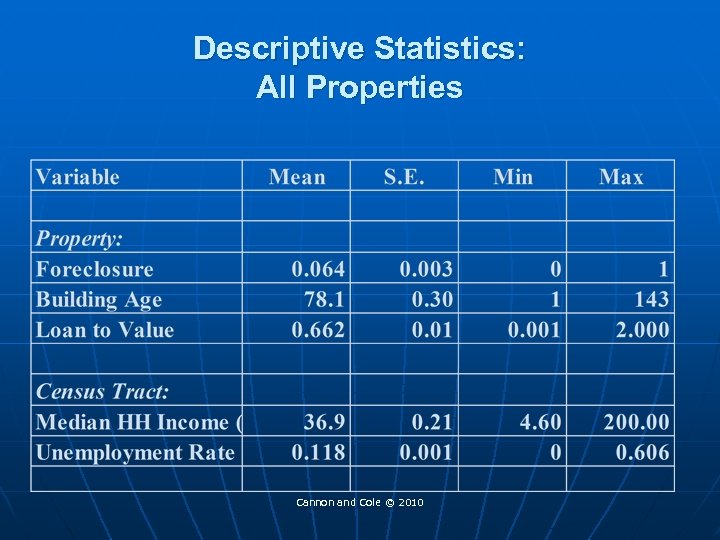

Descriptive Statistics: All Properties Cannon and Cole © 2010

Descriptive Statistics: All Properties Cannon and Cole © 2010

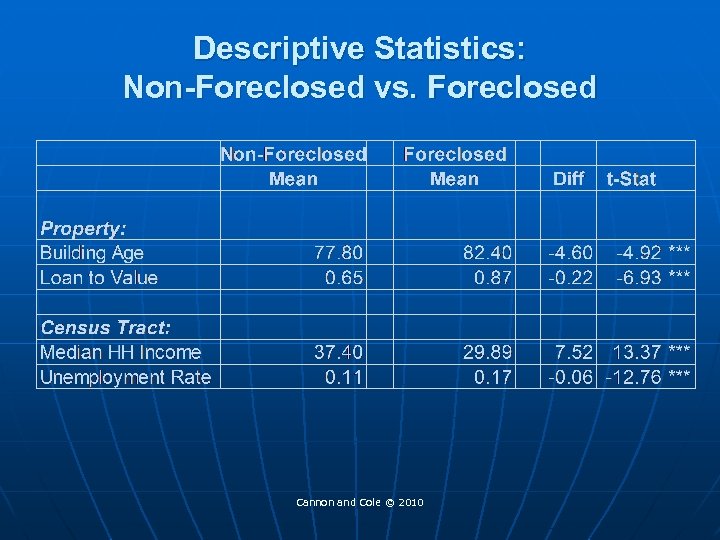

Descriptive Statistics: Non-Foreclosed vs. Foreclosed Cannon and Cole © 2010

Descriptive Statistics: Non-Foreclosed vs. Foreclosed Cannon and Cole © 2010

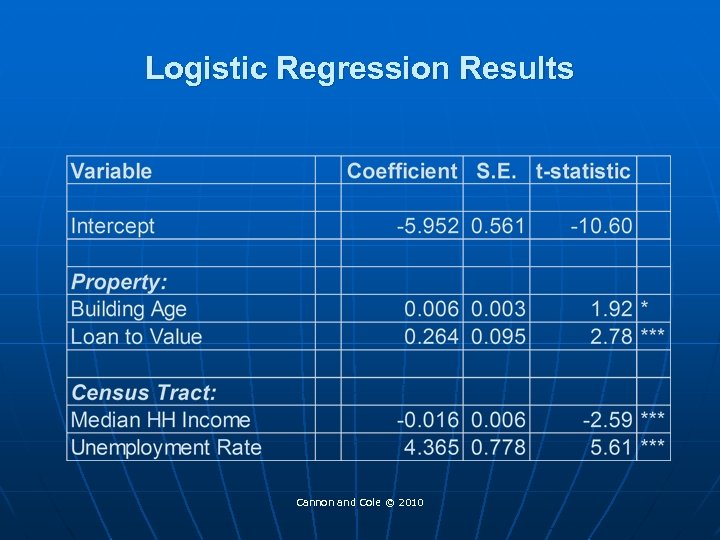

Logistic Regression Results Cannon and Cole © 2010

Logistic Regression Results Cannon and Cole © 2010

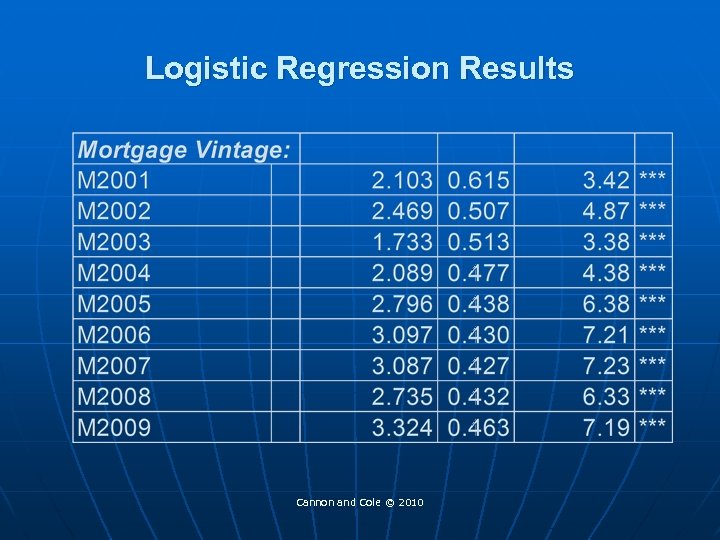

Logistic Regression Results Cannon and Cole © 2010

Logistic Regression Results Cannon and Cole © 2010

Conclusions n n Very preliminary findings, but very interesting. Confirms some of the results from previous research, contradicts others. Clearly, loan vintage is very important for MF foreclosures, just as previous research has shown for SF foreclosures. Neighborhood characteristics are very important. Cannon and Cole © 2010

Conclusions n n Very preliminary findings, but very interesting. Confirms some of the results from previous research, contradicts others. Clearly, loan vintage is very important for MF foreclosures, just as previous research has shown for SF foreclosures. Neighborhood characteristics are very important. Cannon and Cole © 2010

Conclusions n n n We find that MF foreclosures are more likely where buildings: • have higher ratios of loan to value • are older And where buildings are located in Census Tracts that are characterized by: • lower median household incomes • higher unemployment rates are higher. We also find that loan vintage is a key determinant of foreclosure. Cannon and Cole © 2010

Conclusions n n n We find that MF foreclosures are more likely where buildings: • have higher ratios of loan to value • are older And where buildings are located in Census Tracts that are characterized by: • lower median household incomes • higher unemployment rates are higher. We also find that loan vintage is a key determinant of foreclosure. Cannon and Cole © 2010

Future Research n Extend through last half of 2009 (and 2010). n Refine analysis variables. n Analyze additional variables. n Develop an index of “At-Risk” neighborhoods. Cannon and Cole © 2010

Future Research n Extend through last half of 2009 (and 2010). n Refine analysis variables. n Analyze additional variables. n Develop an index of “At-Risk” neighborhoods. Cannon and Cole © 2010