a1180c7d699b11deef78cd9d991b277c.ppt

- Количество слайдов: 20

Expert Mission on studying the most advanced experiences and application mechanisms in the field of allocation of state concessional loan to entrepreneurs organised by TAIEX, DG Enlargement in co-operation with National Fund for Entrepreneurship Support of Azerbaijan Republic Baku, 9. 1. 2012

Expert Mission on studying the most advanced experiences and application mechanisms in the field of allocation of state concessional loan to entrepreneurs organised by TAIEX, DG Enlargement in co-operation with National Fund for Entrepreneurship Support of Azerbaijan Republic Baku, 9. 1. 2012

Study the ways of indices (particularly NPV, IRR, PV) characterising the profitability of investment projects submitted on the development of different fields of economy Themistoklis Kossidas Scientific Collaborator / Auditor Ministry of Interior, Decentralisation and E-government

Study the ways of indices (particularly NPV, IRR, PV) characterising the profitability of investment projects submitted on the development of different fields of economy Themistoklis Kossidas Scientific Collaborator / Auditor Ministry of Interior, Decentralisation and E-government

1. Introduction 2. Main points 3. Conclusion 4. Sources 5. Questions and Answers

1. Introduction 2. Main points 3. Conclusion 4. Sources 5. Questions and Answers

1. Introduction Discounted Cash Flow (DCF) is an investment appraisal technique which takes into account both the timings of cash flows and also total profitability over a project’s life. - DCF looks at the cash flows of a project, not the accounting profits, it is concerned with liquidity, not profitability. Cash flows are considered because they show the costs and benefits of a project when they actually occur. - The timing of cash flows is taken into account by discounting them. The effect of discounting is to give a bigger value per $1 for cash flows that occur earlier. $1 earned after one year will be worth more than $1 earned after two years, which in turn will be worth more than $1 earned after five years.

1. Introduction Discounted Cash Flow (DCF) is an investment appraisal technique which takes into account both the timings of cash flows and also total profitability over a project’s life. - DCF looks at the cash flows of a project, not the accounting profits, it is concerned with liquidity, not profitability. Cash flows are considered because they show the costs and benefits of a project when they actually occur. - The timing of cash flows is taken into account by discounting them. The effect of discounting is to give a bigger value per $1 for cash flows that occur earlier. $1 earned after one year will be worth more than $1 earned after two years, which in turn will be worth more than $1 earned after five years.

Discounting starts with the future value and converts a future value to a present value. For example, if A expects to earn a compound rate of return of 10% on its investments, how much would it need to invest now to have the following investments? - $11. 000 after 1 year, - $12. 100 after 2 years, - $13. 310 after 3 years. The discounting formula to calculate the present value of a future sum of money at the end of a time periods is: PV=FV[1/(1+rª)]. Discounting can be applied to both money receivable and also to money payable at a future date. By discounting all payments and receipts from a capital investment to a present value, they can be compared on a common basis at a value which takes account of when the various cash flows will take place.

Discounting starts with the future value and converts a future value to a present value. For example, if A expects to earn a compound rate of return of 10% on its investments, how much would it need to invest now to have the following investments? - $11. 000 after 1 year, - $12. 100 after 2 years, - $13. 310 after 3 years. The discounting formula to calculate the present value of a future sum of money at the end of a time periods is: PV=FV[1/(1+rª)]. Discounting can be applied to both money receivable and also to money payable at a future date. By discounting all payments and receipts from a capital investment to a present value, they can be compared on a common basis at a value which takes account of when the various cash flows will take place.

Investment is any expenditure in the expectation of future benefits. We can divide such expenditure into two groups: - Capital expenditure is expenditure which results in the acquisition of fixed assets or an improvement in their earning capacity. It appears as a fixed asset in the balance sheet. - Revenue expenditure is expenditure which is incurred for either of the following reasons. For the purpose of the trade of the business. To maintain the existing earning capacity of fixed assets. a) b) Capital expenditure differ from day to day revenue expenditure because i) they often involve a bigger outlay of money and ii) the benefit will accrue over a long period of time

Investment is any expenditure in the expectation of future benefits. We can divide such expenditure into two groups: - Capital expenditure is expenditure which results in the acquisition of fixed assets or an improvement in their earning capacity. It appears as a fixed asset in the balance sheet. - Revenue expenditure is expenditure which is incurred for either of the following reasons. For the purpose of the trade of the business. To maintain the existing earning capacity of fixed assets. a) b) Capital expenditure differ from day to day revenue expenditure because i) they often involve a bigger outlay of money and ii) the benefit will accrue over a long period of time

2. Main points There are two methods of using DCF to evaluate capital investments. a) the net present value (NPV) method, b) the internal rate of return (IRR) method. a) The Net Present Value is the value obtained by discounting all cash outflows and inflows of a capital investment project by a chosen target rate of return. The NPV method compares the present value of all the cash inflows from an investment with the present value of all the cash outflows from an investment. The NPV is thus calculated as the PV of cash inflows minus the PV of cash outflows.

2. Main points There are two methods of using DCF to evaluate capital investments. a) the net present value (NPV) method, b) the internal rate of return (IRR) method. a) The Net Present Value is the value obtained by discounting all cash outflows and inflows of a capital investment project by a chosen target rate of return. The NPV method compares the present value of all the cash inflows from an investment with the present value of all the cash outflows from an investment. The NPV is thus calculated as the PV of cash inflows minus the PV of cash outflows.

i) iii) If the NPV is positive, it means that the cash inflows from a capital investment will yield a return in excess of the cost of capital and so the project should be undertaken if the cost of capital is the organisation’s target rate of return. If the NPV is negative, it means that the cash inflows from a capital investment will yield a return below the cost of capital and so the project should not be undertaken if the cost of capital is the organisation’s target rate of return. If the NPV is exactly zero, the cash inflows from a capital investment will yield a return which is exactly the same as the cost of capital and so if the cost of capital is the organisation’s target rate of return, the project will be only just worth undertaking.

i) iii) If the NPV is positive, it means that the cash inflows from a capital investment will yield a return in excess of the cost of capital and so the project should be undertaken if the cost of capital is the organisation’s target rate of return. If the NPV is negative, it means that the cash inflows from a capital investment will yield a return below the cost of capital and so the project should not be undertaken if the cost of capital is the organisation’s target rate of return. If the NPV is exactly zero, the cash inflows from a capital investment will yield a return which is exactly the same as the cost of capital and so if the cost of capital is the organisation’s target rate of return, the project will be only just worth undertaking.

Example: S ltd is considering a capital investment, where the estimated cash flows are as follows. 1) year 0 cash flow ($100. 000), 2) year 1 cash flow $60. 000, 3) year 2 cash flow $80. 000, 4) year 3 cash flow $40. 000, 5) year 4 cash flow $30. 000. S cost of capital is 15%. Calculate the NPV of the project and assess whether it should be undertaken? Solution: The PV of cash inflows exceeds the PV of cash outflows by $56. 160 which means that the project will earn a DCF yield in excess of 15%. It should therefore be undertaken.

Example: S ltd is considering a capital investment, where the estimated cash flows are as follows. 1) year 0 cash flow ($100. 000), 2) year 1 cash flow $60. 000, 3) year 2 cash flow $80. 000, 4) year 3 cash flow $40. 000, 5) year 4 cash flow $30. 000. S cost of capital is 15%. Calculate the NPV of the project and assess whether it should be undertaken? Solution: The PV of cash inflows exceeds the PV of cash outflows by $56. 160 which means that the project will earn a DCF yield in excess of 15%. It should therefore be undertaken.

Example: E ltd is considering the manufacture of a new product which would involve the use of both a new machine (costing $150. 000) and an existing machine, which cost $80. 000 two years ago and has a current net book value of $60. 000. There is sufficient capacity on this machine, which has so far been under-utilised. Annual sales of the product would be 5. 000 units, selling at $32 per unit. Unit costs would be as follows. Direct labour (4 hours at $2 per hour) 8 Direct materials 7 Fixed costs including depreciation 9 24 The project would have a 5 year life, after which the new machine would have a net residual value of $10. 000. Because direct labour is continually in short supply, labour resources would have to be diverted from other work which currently earns a contribution of $1. 50 per direct labour hour. The fixed overhead absorption rate would be $2. 25 per hour ($9 per unit) but the actual expenditure on fixed overhead would not alter. Working capital requirements would be $10. 000 in the 1 st year, rising to $15. 000 in the 2 nd year and remaining at this level until the end of the project, when it will all be recoved. E cost of capital is 20%, ignore taxation. Assess the project.

Example: E ltd is considering the manufacture of a new product which would involve the use of both a new machine (costing $150. 000) and an existing machine, which cost $80. 000 two years ago and has a current net book value of $60. 000. There is sufficient capacity on this machine, which has so far been under-utilised. Annual sales of the product would be 5. 000 units, selling at $32 per unit. Unit costs would be as follows. Direct labour (4 hours at $2 per hour) 8 Direct materials 7 Fixed costs including depreciation 9 24 The project would have a 5 year life, after which the new machine would have a net residual value of $10. 000. Because direct labour is continually in short supply, labour resources would have to be diverted from other work which currently earns a contribution of $1. 50 per direct labour hour. The fixed overhead absorption rate would be $2. 25 per hour ($9 per unit) but the actual expenditure on fixed overhead would not alter. Working capital requirements would be $10. 000 in the 1 st year, rising to $15. 000 in the 2 nd year and remaining at this level until the end of the project, when it will all be recoved. E cost of capital is 20%, ignore taxation. Assess the project.

b) The Internal Rate of Return Using the NPV method of discounted cash flow, present values are calculated by discounting at a target rate of return and the difference between the PV of costs and the PV of benefits is the NPV. In contrast, the IRR is to calculate the exact DCF rate of return which the project is expected to achieve, in other words the rate at which the NPV is zero. If the expected rate of return exceeds a target rate of return, the project would be worth undertaking (ignoring risk and uncertainty factors). l Without a calculator program, the calculation of the IRR is made using a hit-and-miss technique known as the interpolation method. l The first step is to calculate 2 NPV, both as close as possible to zero, using rates for the cost of capital which are whole numbers. Ideally, one NPV should be positive and the other negative.

b) The Internal Rate of Return Using the NPV method of discounted cash flow, present values are calculated by discounting at a target rate of return and the difference between the PV of costs and the PV of benefits is the NPV. In contrast, the IRR is to calculate the exact DCF rate of return which the project is expected to achieve, in other words the rate at which the NPV is zero. If the expected rate of return exceeds a target rate of return, the project would be worth undertaking (ignoring risk and uncertainty factors). l Without a calculator program, the calculation of the IRR is made using a hit-and-miss technique known as the interpolation method. l The first step is to calculate 2 NPV, both as close as possible to zero, using rates for the cost of capital which are whole numbers. Ideally, one NPV should be positive and the other negative.

l Choosing rates for the cost of capital which will give an NPV close to zero (that is, rates which are close to the actual rate of return) is a hit-and-miss exercise and several attempts may be needed to find satisfactory rates. As a rough guide, try starting at a return figure which is about two thirds or three quarters of the accounting rate of return (ARR). Example: A is trying to decide whether to buy a machine for $80. 000 which will save costs of $20. 000 per annum for 5 years and which will have a resale value of $10. 000 at the end of year 5. If it is the company’s policy to undertake projects only if they are expected to yield a DCF return of 10% or more, ascertain whether this project be undertaken.

l Choosing rates for the cost of capital which will give an NPV close to zero (that is, rates which are close to the actual rate of return) is a hit-and-miss exercise and several attempts may be needed to find satisfactory rates. As a rough guide, try starting at a return figure which is about two thirds or three quarters of the accounting rate of return (ARR). Example: A is trying to decide whether to buy a machine for $80. 000 which will save costs of $20. 000 per annum for 5 years and which will have a resale value of $10. 000 at the end of year 5. If it is the company’s policy to undertake projects only if they are expected to yield a DCF return of 10% or more, ascertain whether this project be undertaken.

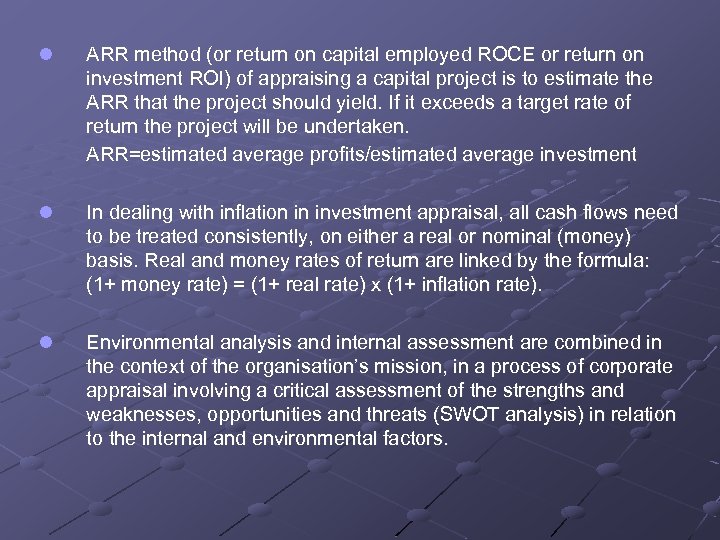

l ARR method (or return on capital employed ROCE or return on investment ROI) of appraising a capital project is to estimate the ARR that the project should yield. If it exceeds a target rate of return the project will be undertaken. ARR=estimated average profits/estimated average investment l In dealing with inflation in investment appraisal, all cash flows need to be treated consistently, on either a real or nominal (money) basis. Real and money rates of return are linked by the formula: (1+ money rate) = (1+ real rate) x (1+ inflation rate). l Environmental analysis and internal assessment are combined in the context of the organisation’s mission, in a process of corporate appraisal involving a critical assessment of the strengths and weaknesses, opportunities and threats (SWOT analysis) in relation to the internal and environmental factors.

l ARR method (or return on capital employed ROCE or return on investment ROI) of appraising a capital project is to estimate the ARR that the project should yield. If it exceeds a target rate of return the project will be undertaken. ARR=estimated average profits/estimated average investment l In dealing with inflation in investment appraisal, all cash flows need to be treated consistently, on either a real or nominal (money) basis. Real and money rates of return are linked by the formula: (1+ money rate) = (1+ real rate) x (1+ inflation rate). l Environmental analysis and internal assessment are combined in the context of the organisation’s mission, in a process of corporate appraisal involving a critical assessment of the strengths and weaknesses, opportunities and threats (SWOT analysis) in relation to the internal and environmental factors.

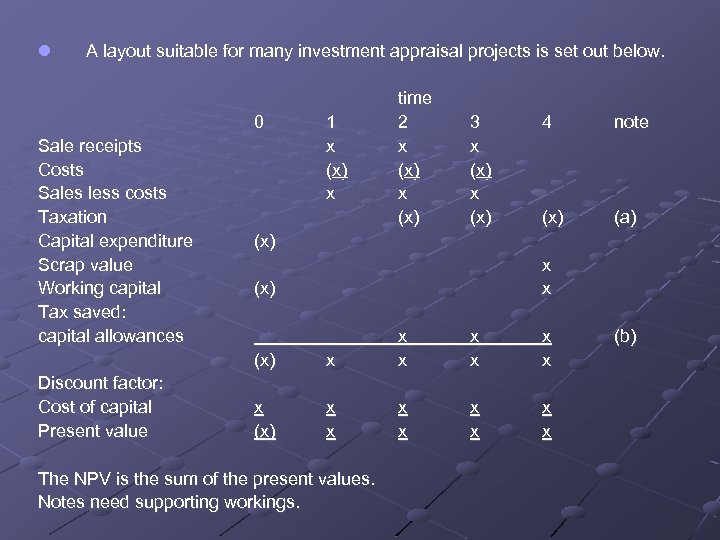

l A layout suitable for many investment appraisal projects is set out below. 0 Sale receipts Costs Sales less costs Taxation Capital expenditure Scrap value Working capital Tax saved: capital allowances 1 x (x) x time 2 x (x) 4 note (x) (a) (x) x x (x) Discount factor: Cost of capital Present value 3 x (x) x x The NPV is the sum of the present values. Notes need supporting workings. x x x x (b)

l A layout suitable for many investment appraisal projects is set out below. 0 Sale receipts Costs Sales less costs Taxation Capital expenditure Scrap value Working capital Tax saved: capital allowances 1 x (x) x time 2 x (x) 4 note (x) (a) (x) x x (x) Discount factor: Cost of capital Present value 3 x (x) x x The NPV is the sum of the present values. Notes need supporting workings. x x x x (b)

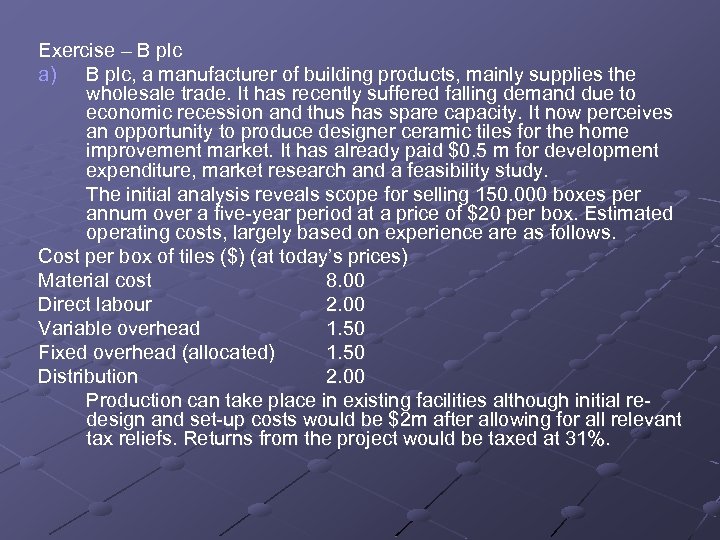

Exercise – B plc a) B plc, a manufacturer of building products, mainly supplies the wholesale trade. It has recently suffered falling demand due to economic recession and thus has spare capacity. It now perceives an opportunity to produce designer ceramic tiles for the home improvement market. It has already paid $0. 5 m for development expenditure, market research and a feasibility study. The initial analysis reveals scope for selling 150. 000 boxes per annum over a five-year period at a price of $20 per box. Estimated operating costs, largely based on experience are as follows. Cost per box of tiles ($) (at today’s prices) Material cost 8. 00 Direct labour 2. 00 Variable overhead 1. 50 Fixed overhead (allocated) 1. 50 Distribution 2. 00 Production can take place in existing facilities although initial redesign and set-up costs would be $2 m after allowing for all relevant tax reliefs. Returns from the project would be taxed at 31%.

Exercise – B plc a) B plc, a manufacturer of building products, mainly supplies the wholesale trade. It has recently suffered falling demand due to economic recession and thus has spare capacity. It now perceives an opportunity to produce designer ceramic tiles for the home improvement market. It has already paid $0. 5 m for development expenditure, market research and a feasibility study. The initial analysis reveals scope for selling 150. 000 boxes per annum over a five-year period at a price of $20 per box. Estimated operating costs, largely based on experience are as follows. Cost per box of tiles ($) (at today’s prices) Material cost 8. 00 Direct labour 2. 00 Variable overhead 1. 50 Fixed overhead (allocated) 1. 50 Distribution 2. 00 Production can take place in existing facilities although initial redesign and set-up costs would be $2 m after allowing for all relevant tax reliefs. Returns from the project would be taxed at 31%.

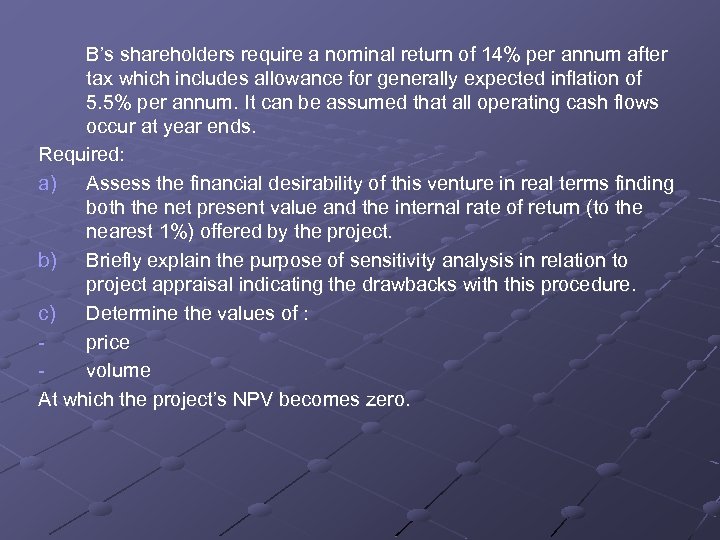

B’s shareholders require a nominal return of 14% per annum after tax which includes allowance for generally expected inflation of 5. 5% per annum. It can be assumed that all operating cash flows occur at year ends. Required: a) Assess the financial desirability of this venture in real terms finding both the net present value and the internal rate of return (to the nearest 1%) offered by the project. b) Briefly explain the purpose of sensitivity analysis in relation to project appraisal indicating the drawbacks with this procedure. c) Determine the values of : price volume At which the project’s NPV becomes zero.

B’s shareholders require a nominal return of 14% per annum after tax which includes allowance for generally expected inflation of 5. 5% per annum. It can be assumed that all operating cash flows occur at year ends. Required: a) Assess the financial desirability of this venture in real terms finding both the net present value and the internal rate of return (to the nearest 1%) offered by the project. b) Briefly explain the purpose of sensitivity analysis in relation to project appraisal indicating the drawbacks with this procedure. c) Determine the values of : price volume At which the project’s NPV becomes zero.

3. Conclusion NPV and IRR compared: the relative merits of each method have to be considered. l - - Advantages of IRR method: The main advantage of the IRR method is that the information it provides is more easily understood by managers, especially nonfinancial managers. For example, it is fairly easy to understand the meaning of the following statement. The project will be expected to have an initial capital outlay of $10. 000 and to earn a yield of 25%. This is in excess of the target yield of 15% for investments. It usually results in the same decision as the NPV method. l - Disadvantages of IRR method: IRR and accounting ROCE can be confused. IRR method ignores the relative size of investment. Mutually exclusive projects may be ranked incorrectly.

3. Conclusion NPV and IRR compared: the relative merits of each method have to be considered. l - - Advantages of IRR method: The main advantage of the IRR method is that the information it provides is more easily understood by managers, especially nonfinancial managers. For example, it is fairly easy to understand the meaning of the following statement. The project will be expected to have an initial capital outlay of $10. 000 and to earn a yield of 25%. This is in excess of the target yield of 15% for investments. It usually results in the same decision as the NPV method. l - Disadvantages of IRR method: IRR and accounting ROCE can be confused. IRR method ignores the relative size of investment. Mutually exclusive projects may be ranked incorrectly.

l - Advantages of NPV method: The method accounts correctly for the time value of money. It uses all expected cash flows relating to the project. It takes account of the size of the investment. It is consistent with the objective of shareholder wealth maximisation. l - Disadvantages of NPV method: The NPV concept is not easily understood. There is a need to estimate the cost of capital.

l - Advantages of NPV method: The method accounts correctly for the time value of money. It uses all expected cash flows relating to the project. It takes account of the size of the investment. It is consistent with the objective of shareholder wealth maximisation. l - Disadvantages of NPV method: The NPV concept is not easily understood. There is a need to estimate the cost of capital.

Sources ACCA practice & revision kit, 1999, Certificate Paper 8 Managerial Finance, BPP Publishing. ACCA study text, 1998, Certificate Paper 8 Managerial Finance, BPP Publishing. European Commission, 1997, Guide to cost-benefit analysis of investment projects, (Structural Fund-ERDF, Cohesion Fund and ISPA), Evaluation Unit DG Regional Policy. European Commission, 1997, Financial and economic analysis of development projects, Office for Official Publications of the European Communities, Luxembourg. European Commission, 2001, Project cycle management, Europe. Aid Co-operation Office, Evaluation Unit, Brusssells.

Sources ACCA practice & revision kit, 1999, Certificate Paper 8 Managerial Finance, BPP Publishing. ACCA study text, 1998, Certificate Paper 8 Managerial Finance, BPP Publishing. European Commission, 1997, Guide to cost-benefit analysis of investment projects, (Structural Fund-ERDF, Cohesion Fund and ISPA), Evaluation Unit DG Regional Policy. European Commission, 1997, Financial and economic analysis of development projects, Office for Official Publications of the European Communities, Luxembourg. European Commission, 2001, Project cycle management, Europe. Aid Co-operation Office, Evaluation Unit, Brusssells.

Thank you for your attention Questions and Answers

Thank you for your attention Questions and Answers