533a8183cc79924e0df65c5e3d4062b5.ppt

- Количество слайдов: 45

Experience Using Innovative Finance for Major Projects Northern Border Finance Conference Chicago, Illinois May 14 th, 2007 Richard Fyfe, COO Gateway Program, BC

Experience Using Innovative Finance for Major Projects Northern Border Finance Conference Chicago, Illinois May 14 th, 2007 Richard Fyfe, COO Gateway Program, BC

Public Private Partnerships: Top-Down Support “Having modern, reliable infrastructure in place allows businesses to invest with greater certainty, thus furthering the adjustment process. This may mean the use of private funds to develop public infrastructure projects. . . and now is the time to encourage this type of investment, given our climate of low nominal interest rates, and the presence of large pension funds that are searching for these kinds of investment opportunities. ” David Dodge, Governor of the Bank of Canada June 21, 2006

Public Private Partnerships: Top-Down Support “Having modern, reliable infrastructure in place allows businesses to invest with greater certainty, thus furthering the adjustment process. This may mean the use of private funds to develop public infrastructure projects. . . and now is the time to encourage this type of investment, given our climate of low nominal interest rates, and the presence of large pension funds that are searching for these kinds of investment opportunities. ” David Dodge, Governor of the Bank of Canada June 21, 2006

Public Private Partnerships: Commitment “Since we launched the public/private initiative in 2002, we have actually either started or completed $4. 7 billion in new P 3 projects. . . that is the future of Development in the Province of British Columbia: Better value, on time, on budget. So, in the future, we’re going to work with you, but we will insist that Partnerships BC look at major Projects and the base case in British Columbia will be P 3’s unless Partnerships BC says there’s a compelling reason to do otherwise. P 3 will be the Standard in British Columbia for three reasons: They work for you, they work for us, and most importantly, they work for the taxpayers that we work for. ” British Columbia Premier Gordon Campbell - Speech to UBCM, October 27, 2006

Public Private Partnerships: Commitment “Since we launched the public/private initiative in 2002, we have actually either started or completed $4. 7 billion in new P 3 projects. . . that is the future of Development in the Province of British Columbia: Better value, on time, on budget. So, in the future, we’re going to work with you, but we will insist that Partnerships BC look at major Projects and the base case in British Columbia will be P 3’s unless Partnerships BC says there’s a compelling reason to do otherwise. P 3 will be the Standard in British Columbia for three reasons: They work for you, they work for us, and most importantly, they work for the taxpayers that we work for. ” British Columbia Premier Gordon Campbell - Speech to UBCM, October 27, 2006

B. C. Experience: Foundation for Success n Legislative Framework q q n Policy Framework q q n Transportation Investment Act Significant Projects Streamlining Act Capital Asset Management Framework Tolling Guidelines Supporting Organization q q Partnerships BC Suitable Projects

B. C. Experience: Foundation for Success n Legislative Framework q q n Policy Framework q q n Transportation Investment Act Significant Projects Streamlining Act Capital Asset Management Framework Tolling Guidelines Supporting Organization q q Partnerships BC Suitable Projects

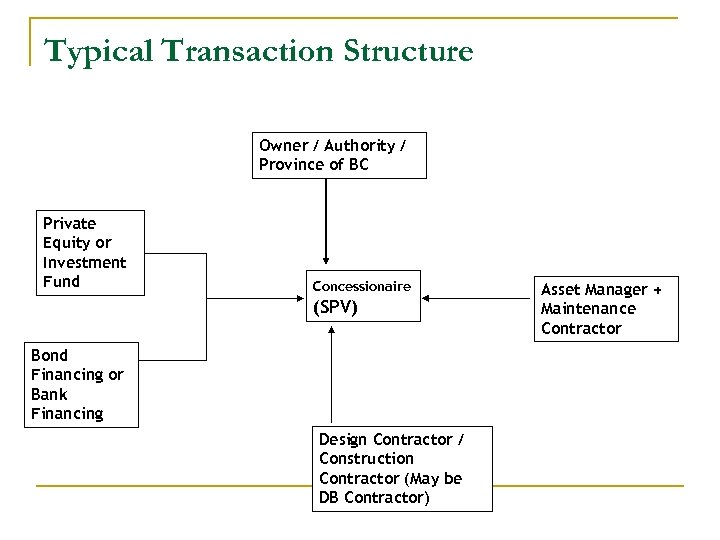

Typical Transaction Structure Owner / Authority / Province of BC Private Equity or Investment Fund DBFO Agreement Concessionaire O & M Contract (SPV) Bond Financing or Bank Financing DB Contract Design Contractor / Construction Contractor (May be DB Contractor) Asset Manager + Maintenance Contractor

Typical Transaction Structure Owner / Authority / Province of BC Private Equity or Investment Fund DBFO Agreement Concessionaire O & M Contract (SPV) Bond Financing or Bank Financing DB Contract Design Contractor / Construction Contractor (May be DB Contractor) Asset Manager + Maintenance Contractor

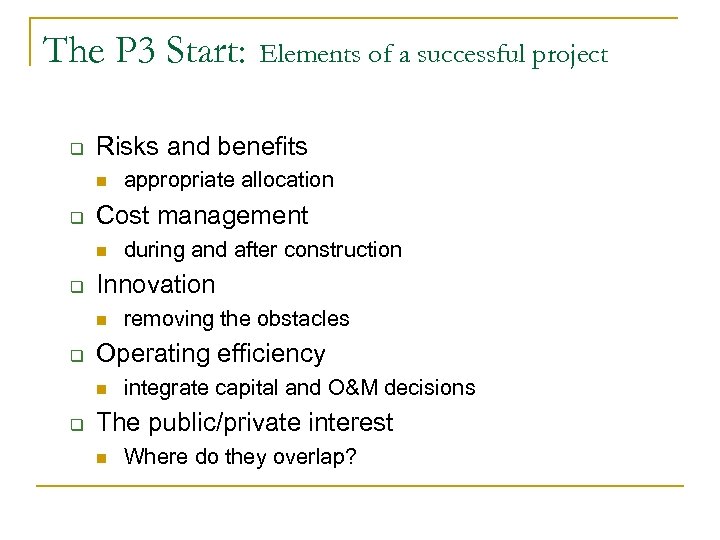

The P 3 Start: q Risks and benefits n q removing the obstacles Operating efficiency n q during and after construction Innovation n q appropriate allocation Cost management n q Elements of a successful project integrate capital and O&M decisions The public/private interest n Where do they overlap?

The P 3 Start: q Risks and benefits n q removing the obstacles Operating efficiency n q during and after construction Innovation n q appropriate allocation Cost management n q Elements of a successful project integrate capital and O&M decisions The public/private interest n Where do they overlap?

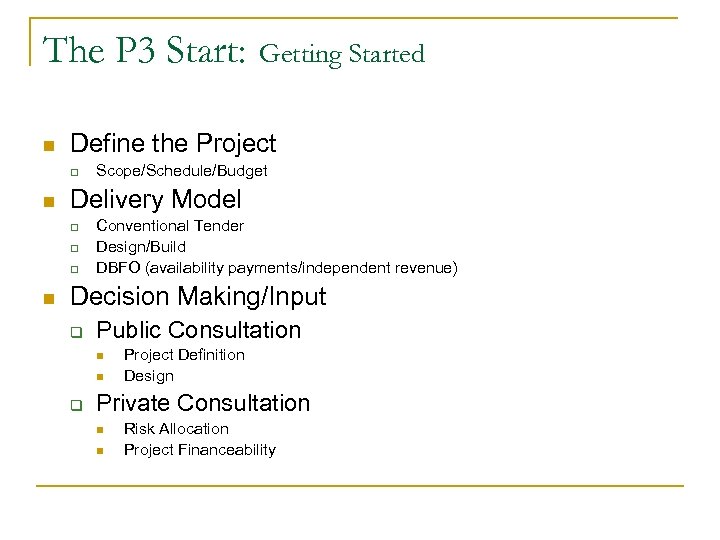

The P 3 Start: n Define the Project q n Scope/Schedule/Budget Delivery Model q q q n Getting Started Conventional Tender Design/Build DBFO (availability payments/independent revenue) Decision Making/Input q Public Consultation n n q Project Definition Design Private Consultation n n Risk Allocation Project Financeability

The P 3 Start: n Define the Project q n Scope/Schedule/Budget Delivery Model q q q n Getting Started Conventional Tender Design/Build DBFO (availability payments/independent revenue) Decision Making/Input q Public Consultation n n q Project Definition Design Private Consultation n n Risk Allocation Project Financeability

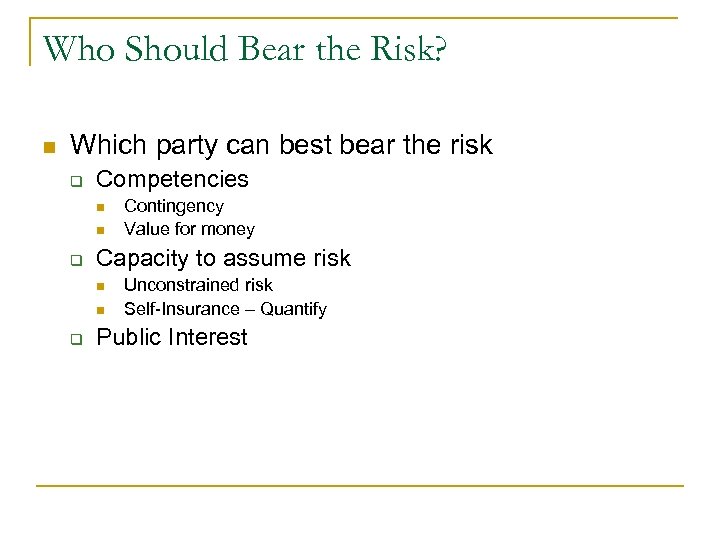

Who Should Bear the Risk? n Which party can best bear the risk q Competencies n n q Capacity to assume risk n n q Contingency Value for money Unconstrained risk Self-Insurance – Quantify Public Interest

Who Should Bear the Risk? n Which party can best bear the risk q Competencies n n q Capacity to assume risk n n q Contingency Value for money Unconstrained risk Self-Insurance – Quantify Public Interest

Risk Decisions n n Commercial v. Technical Insurable v. Uninsurable Quantified v. Unconstrained Allocating v. Creating

Risk Decisions n n Commercial v. Technical Insurable v. Uninsurable Quantified v. Unconstrained Allocating v. Creating

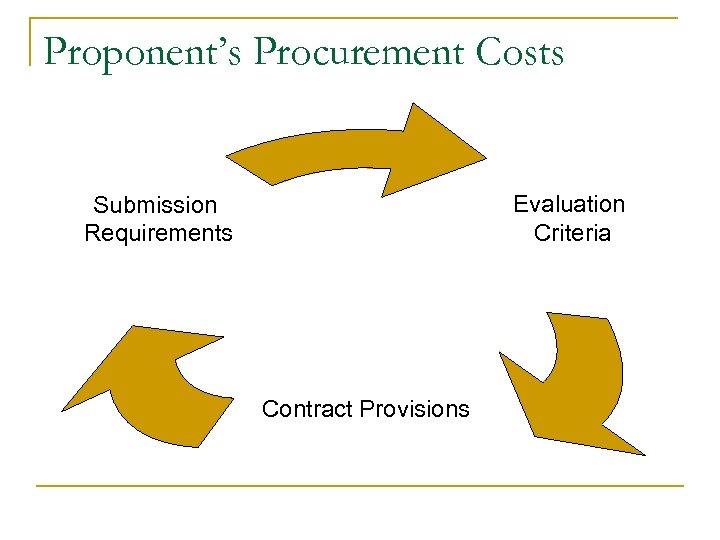

Proponent’s Procurement Costs Evaluation Criteria Submission Requirements Contract Provisions

Proponent’s Procurement Costs Evaluation Criteria Submission Requirements Contract Provisions

Structuring a Procurement Process n n Registration of Interest (ROI) Request for Qualifications (RFQ) Request for Proposals (RFP) Best and Final Offer (BAFO)

Structuring a Procurement Process n n Registration of Interest (ROI) Request for Qualifications (RFQ) Request for Proposals (RFP) Best and Final Offer (BAFO)

Procurement Risk Allocation n Province’s rights q q q amend or cancel the procurement process negotiate if no conforming proposal reject any and all proposals not responsible for procurement costs or damages request proposal clarification and additional information

Procurement Risk Allocation n Province’s rights q q q amend or cancel the procurement process negotiate if no conforming proposal reject any and all proposals not responsible for procurement costs or damages request proposal clarification and additional information

Concession Contract: Overview Province q q Pay After Construction Complete (Availability payments or tolls) Property, EAC, Approvals Concessionaire Risks / Responsibility q q q Traffic management Construction risk Comply: n n q Obtain: n q q q Environmental Assessment Certificate laws, regulations and permits subsidiary permits, licenses and approvals Indemnify BC and BCTFA for losses and claims Site safety and security Protestors and trespassers

Concession Contract: Overview Province q q Pay After Construction Complete (Availability payments or tolls) Property, EAC, Approvals Concessionaire Risks / Responsibility q q q Traffic management Construction risk Comply: n n q Obtain: n q q q Environmental Assessment Certificate laws, regulations and permits subsidiary permits, licenses and approvals Indemnify BC and BCTFA for losses and claims Site safety and security Protestors and trespassers

Concession Contract: Overview n Concessionaire Risks / Responsibility q q q q Design, construction, completion, commissioning and testing of the Works Delay events, compensation events, Province changes and force majeure traffic management plan Archeological surveys, inspections and impact assessments Insurance with Province and BCTFA named insureds Quality management system and quality documentation compliance Reporting Project records

Concession Contract: Overview n Concessionaire Risks / Responsibility q q q q Design, construction, completion, commissioning and testing of the Works Delay events, compensation events, Province changes and force majeure traffic management plan Archeological surveys, inspections and impact assessments Insurance with Province and BCTFA named insureds Quality management system and quality documentation compliance Reporting Project records

Design/Build Agreement n Pass-Through Obligations of Concessionaire : q n design/ construction/ completion/ commission and testing of Works Cap on maximum DB contractor liability for liquidated damages q 10% of the aggregate DB Contract Price

Design/Build Agreement n Pass-Through Obligations of Concessionaire : q n design/ construction/ completion/ commission and testing of Works Cap on maximum DB contractor liability for liquidated damages q 10% of the aggregate DB Contract Price

Lessons Learned n n n Importance of linkage between project objectives, evaluation and payment Importance of interaction between Owner and Proponents Focus on User Benefits Open Communication Contract Documents to be finished early

Lessons Learned n n n Importance of linkage between project objectives, evaluation and payment Importance of interaction between Owner and Proponents Focus on User Benefits Open Communication Contract Documents to be finished early

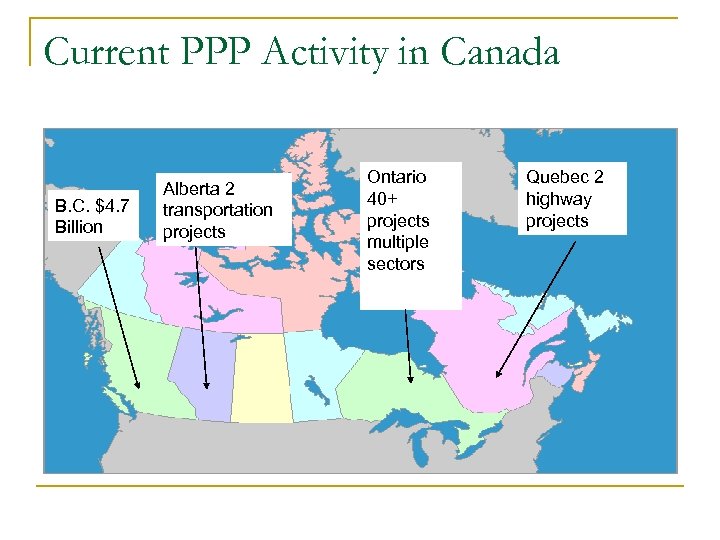

Current PPP Activity in Canada B. C. $4. 7 Billion Alberta 2 transportation projects Ontario 40+ projects multiple sectors Quebec 2 highway projects

Current PPP Activity in Canada B. C. $4. 7 Billion Alberta 2 transportation projects Ontario 40+ projects multiple sectors Quebec 2 highway projects

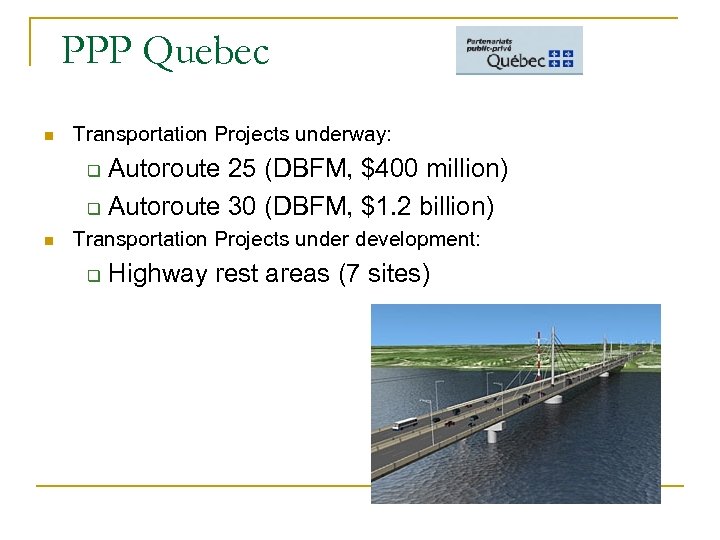

PPP Quebec n Transportation Projects underway: Autoroute 25 (DBFM, $400 million) q Autoroute 30 (DBFM, $1. 2 billion) q n Transportation Projects under development: q Highway rest areas (7 sites)

PPP Quebec n Transportation Projects underway: Autoroute 25 (DBFM, $400 million) q Autoroute 30 (DBFM, $1. 2 billion) q n Transportation Projects under development: q Highway rest areas (7 sites)

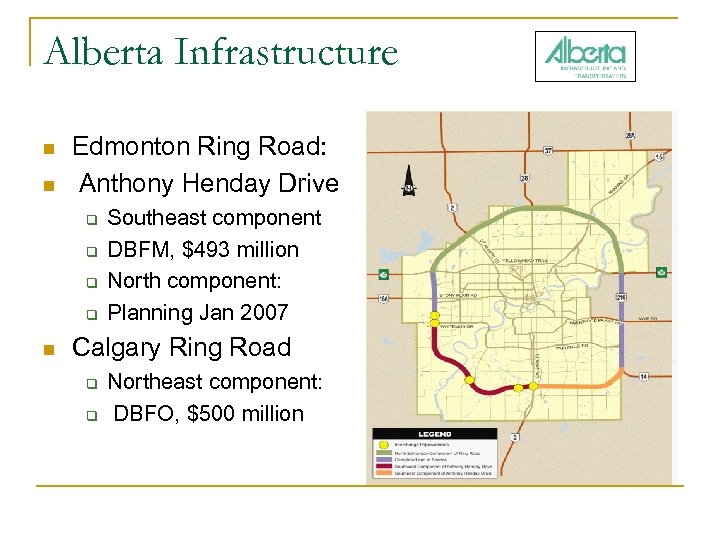

Alberta Infrastructure n n Edmonton Ring Road: Anthony Henday Drive q q n Southeast component DBFM, $493 million North component: Planning Jan 2007 Calgary Ring Road q q Northeast component: DBFO, $500 million

Alberta Infrastructure n n Edmonton Ring Road: Anthony Henday Drive q q n Southeast component DBFM, $493 million North component: Planning Jan 2007 Calgary Ring Road q q Northeast component: DBFO, $500 million

Partnerships BC: Role and Structure n n n Window on British Columbia Develop partnership market Knowledge bank of Best Practices q Consistency in business case planning q Reduce government’s planning / procurement costs q Consolidated experience Commercial viability Transparency and disclosure

Partnerships BC: Role and Structure n n n Window on British Columbia Develop partnership market Knowledge bank of Best Practices q Consistency in business case planning q Reduce government’s planning / procurement costs q Consolidated experience Commercial viability Transparency and disclosure

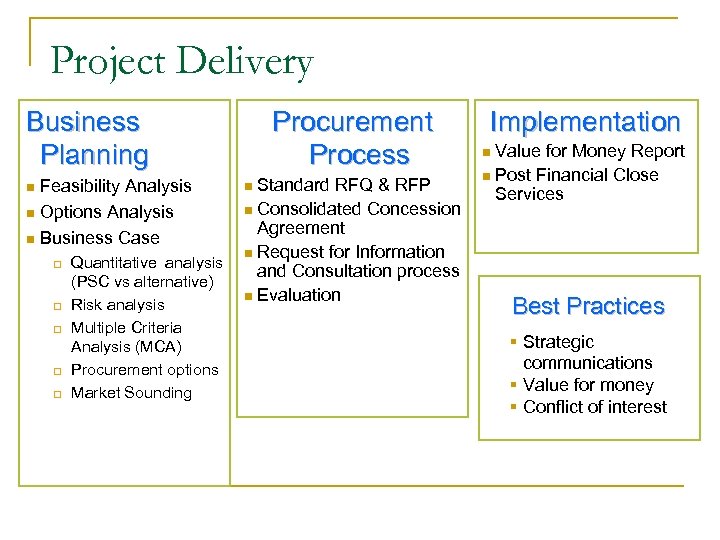

Project Delivery Business Planning Feasibility Analysis n Options Analysis n Business Case n q q q Quantitative analysis (PSC vs alternative) Risk analysis Multiple Criteria Analysis (MCA) Procurement options Market Sounding Procurement Process Standard RFQ & RFP n Consolidated Concession Agreement n Request for Information and Consultation process n Evaluation n Implementation Value for Money Report n Post Financial Close Services n Best Practices § Strategic communications § Value for money § Conflict of interest

Project Delivery Business Planning Feasibility Analysis n Options Analysis n Business Case n q q q Quantitative analysis (PSC vs alternative) Risk analysis Multiple Criteria Analysis (MCA) Procurement options Market Sounding Procurement Process Standard RFQ & RFP n Consolidated Concession Agreement n Request for Information and Consultation process n Evaluation n Implementation Value for Money Report n Post Financial Close Services n Best Practices § Strategic communications § Value for money § Conflict of interest

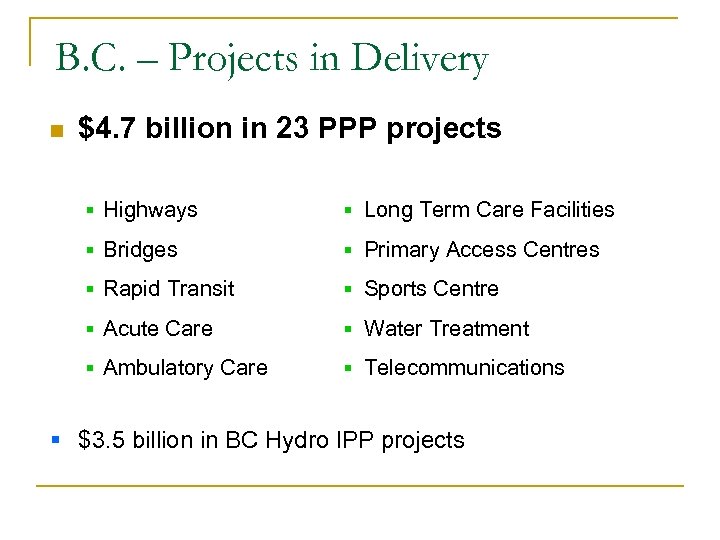

B. C. – Projects in Delivery n $4. 7 billion in 23 PPP projects § Highways § Long Term Care Facilities § Bridges § Primary Access Centres § Rapid Transit § Sports Centre § Acute Care § Water Treatment § Ambulatory Care § Telecommunications § $3. 5 billion in BC Hydro IPP projects

B. C. – Projects in Delivery n $4. 7 billion in 23 PPP projects § Highways § Long Term Care Facilities § Bridges § Primary Access Centres § Rapid Transit § Sports Centre § Acute Care § Water Treatment § Ambulatory Care § Telecommunications § $3. 5 billion in BC Hydro IPP projects

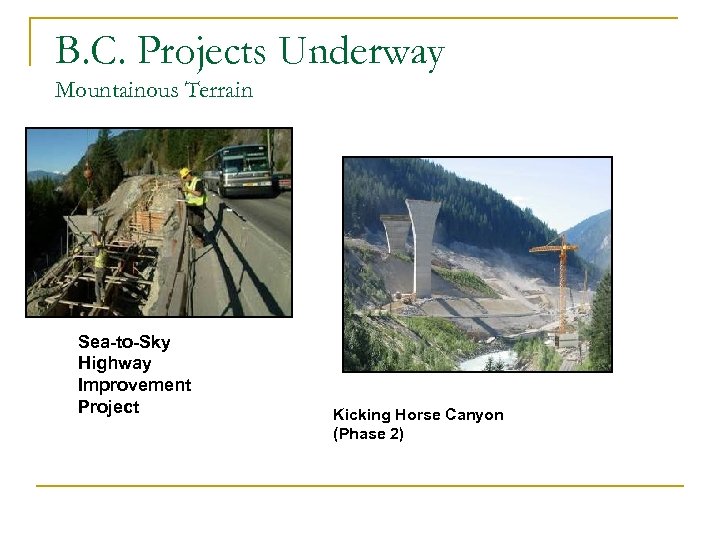

B. C. Projects Underway Mountainous Terrain Sea-to-Sky Highway Improvement Project Kicking Horse Canyon (Phase 2)

B. C. Projects Underway Mountainous Terrain Sea-to-Sky Highway Improvement Project Kicking Horse Canyon (Phase 2)

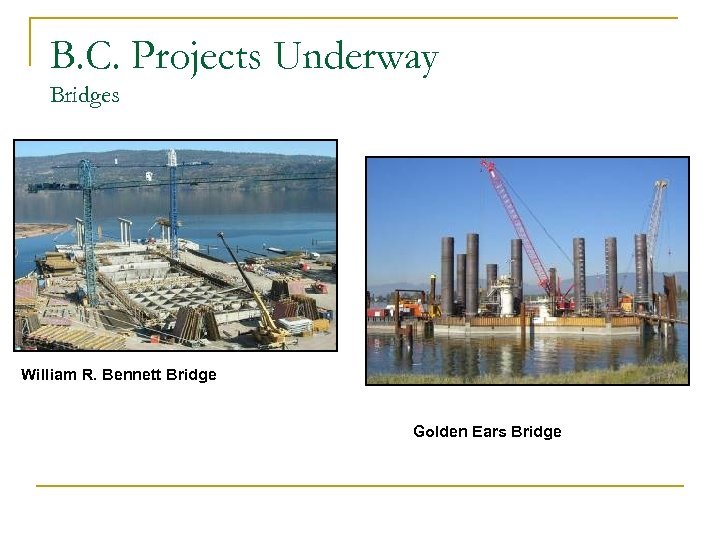

B. C. Projects Underway Bridges William R. Bennett Bridge Golden Ears Bridge

B. C. Projects Underway Bridges William R. Bennett Bridge Golden Ears Bridge

B. C. Projects Underway Other Transportation Projects Sierra Yoyo Desan Resource Road Canada Line

B. C. Projects Underway Other Transportation Projects Sierra Yoyo Desan Resource Road Canada Line

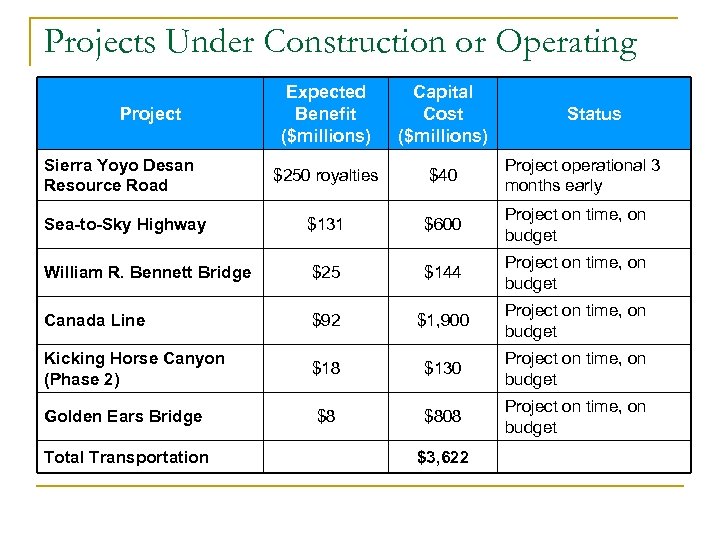

Projects Under Construction or Operating Expected Benefit ($millions) Capital Cost ($millions) $250 royalties $40 Project operational 3 months early Sea-to-Sky Highway $131 $600 Project on time, on budget William R. Bennett Bridge $25 $144 Project on time, on budget Canada Line $92 $1, 900 Project on time, on budget Kicking Horse Canyon (Phase 2) $18 $130 Project on time, on budget Golden Ears Bridge $8 $808 Project on time, on budget Project Sierra Yoyo Desan Resource Road Total Transportation $3, 622 Status

Projects Under Construction or Operating Expected Benefit ($millions) Capital Cost ($millions) $250 royalties $40 Project operational 3 months early Sea-to-Sky Highway $131 $600 Project on time, on budget William R. Bennett Bridge $25 $144 Project on time, on budget Canada Line $92 $1, 900 Project on time, on budget Kicking Horse Canyon (Phase 2) $18 $130 Project on time, on budget Golden Ears Bridge $8 $808 Project on time, on budget Project Sierra Yoyo Desan Resource Road Total Transportation $3, 622 Status

Current Partners in B. C. n Developers / Constructors Bilfinger-Berger BOT Inc. ** n Bilfinger-Berger Constructors ** n CH 2 M Hill ** n EPCOR ** n Flatiron Constructors ** n Giffels Design Build n Ledcor ** n Macquarie North America ** n Parsons Overseas Company n PCL ** n Peter Kiewit & Sons Co. ** n SNC-Lavalin ** n EGIS Projects ** ** Located in British Columbia n n n n Sources of Capital ABN AMRO/Capital Markets ** Bank of Ireland BC Investment Management Corp ** CIT DEPFA Deutsche Bank Dexia Manulife ** Nordebank Ontario Teachers Pension Plan Royal Bank of Scotland Societe Generale SNC-Lavalin Capital ** Sun Life **

Current Partners in B. C. n Developers / Constructors Bilfinger-Berger BOT Inc. ** n Bilfinger-Berger Constructors ** n CH 2 M Hill ** n EPCOR ** n Flatiron Constructors ** n Giffels Design Build n Ledcor ** n Macquarie North America ** n Parsons Overseas Company n PCL ** n Peter Kiewit & Sons Co. ** n SNC-Lavalin ** n EGIS Projects ** ** Located in British Columbia n n n n Sources of Capital ABN AMRO/Capital Markets ** Bank of Ireland BC Investment Management Corp ** CIT DEPFA Deutsche Bank Dexia Manulife ** Nordebank Ontario Teachers Pension Plan Royal Bank of Scotland Societe Generale SNC-Lavalin Capital ** Sun Life **

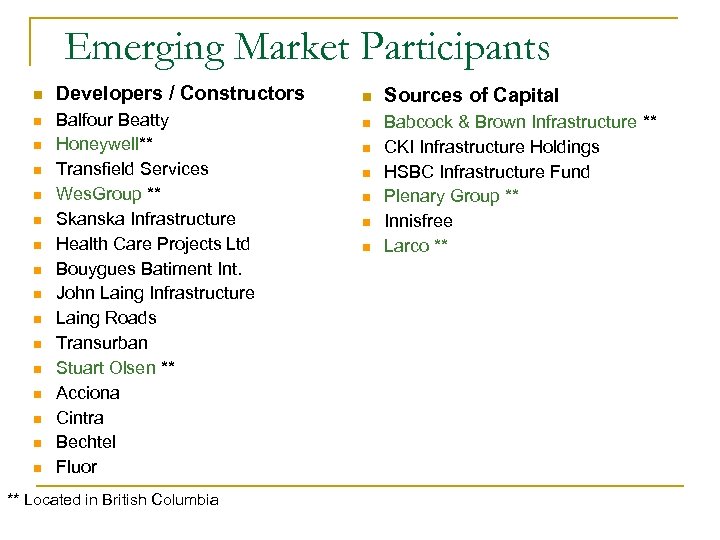

Emerging Market Participants n Developers / Constructors n Balfour Beatty Honeywell** Transfield Services Wes. Group ** Skanska Infrastructure Health Care Projects Ltd Bouygues Batiment Int. John Laing Infrastructure Laing Roads Transurban Stuart Olsen ** Acciona Cintra Bechtel Fluor n n n n ** Located in British Columbia n Sources of Capital n Babcock & Brown Infrastructure ** CKI Infrastructure Holdings HSBC Infrastructure Fund Plenary Group ** Innisfree Larco ** n n n

Emerging Market Participants n Developers / Constructors n Balfour Beatty Honeywell** Transfield Services Wes. Group ** Skanska Infrastructure Health Care Projects Ltd Bouygues Batiment Int. John Laing Infrastructure Laing Roads Transurban Stuart Olsen ** Acciona Cintra Bechtel Fluor n n n n ** Located in British Columbia n Sources of Capital n Babcock & Brown Infrastructure ** CKI Infrastructure Holdings HSBC Infrastructure Fund Plenary Group ** Innisfree Larco ** n n n

BC Transportation Projects Under Development

BC Transportation Projects Under Development

Pacific Gateway Opportunities

Pacific Gateway Opportunities

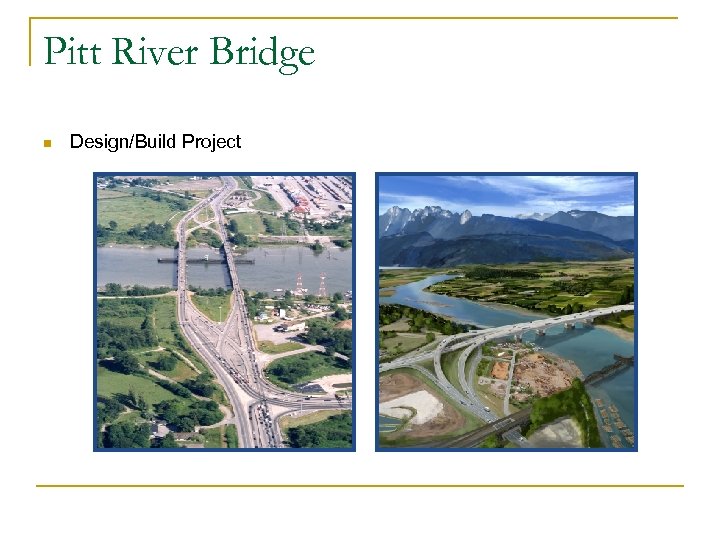

Pitt River Bridge n Pitt River Bridge Design/Build Project

Pitt River Bridge n Pitt River Bridge Design/Build Project

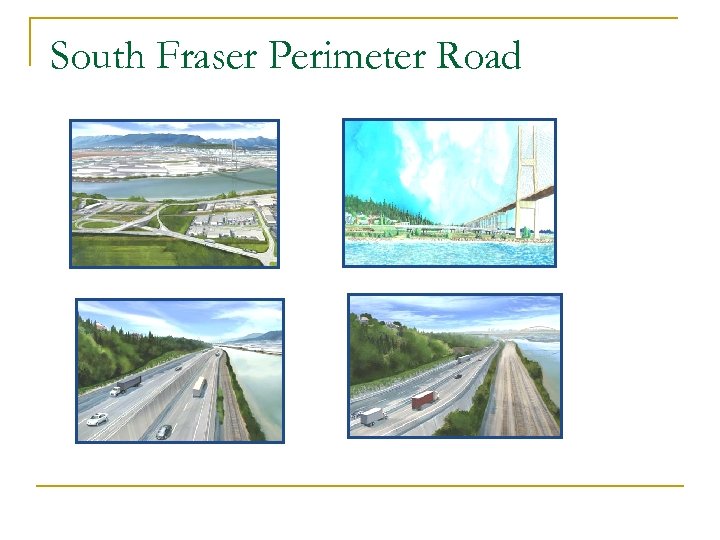

South Fraser Perimeter Road

South Fraser Perimeter Road

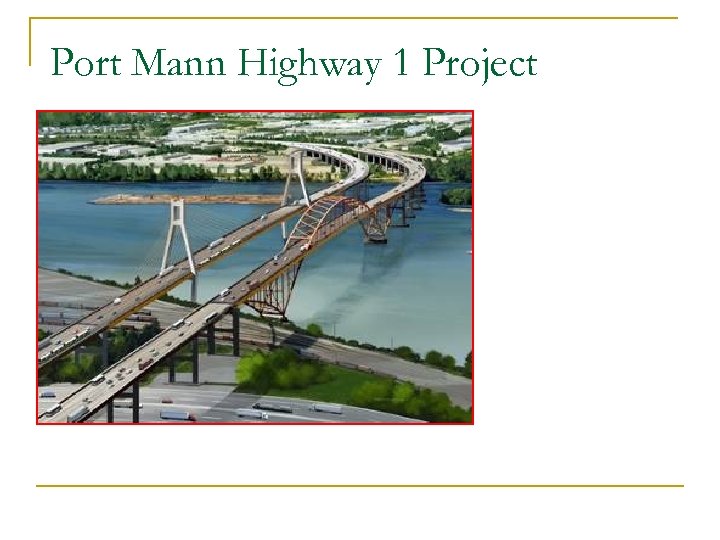

Port Mann Highway 1 Project

Port Mann Highway 1 Project

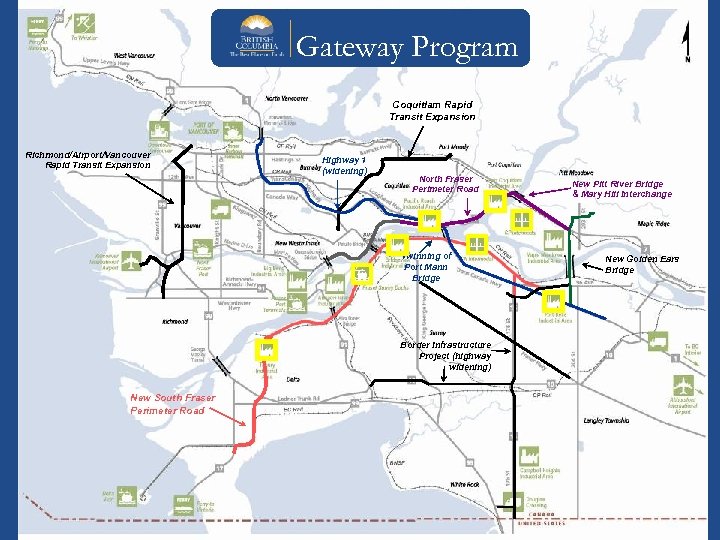

Gateway Program Coquitlam Rapid Transit Expansion Richmond/Airport/Vancouver Rapid Transit Expansion Highway 1 (widening) North Fraser Perimeter Road Twinning of Port Mann Bridge Border Infrastructure Project (highway widening) New South Fraser Perimeter Road New Pitt River Bridge & Mary Hill Interchange New Golden Ears Bridge

Gateway Program Coquitlam Rapid Transit Expansion Richmond/Airport/Vancouver Rapid Transit Expansion Highway 1 (widening) North Fraser Perimeter Road Twinning of Port Mann Bridge Border Infrastructure Project (highway widening) New South Fraser Perimeter Road New Pitt River Bridge & Mary Hill Interchange New Golden Ears Bridge

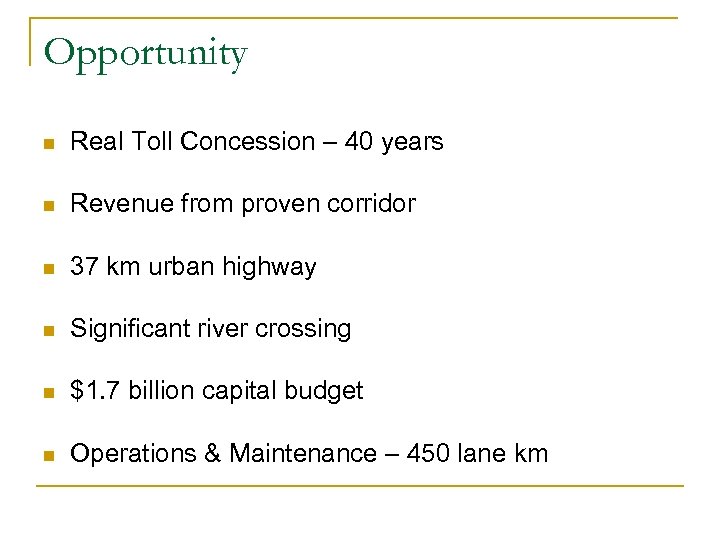

Opportunity n Real Toll Concession – 40 years n Revenue from proven corridor n 37 km urban highway n Significant river crossing n $1. 7 billion capital budget n Operations & Maintenance – 450 lane km

Opportunity n Real Toll Concession – 40 years n Revenue from proven corridor n 37 km urban highway n Significant river crossing n $1. 7 billion capital budget n Operations & Maintenance – 450 lane km

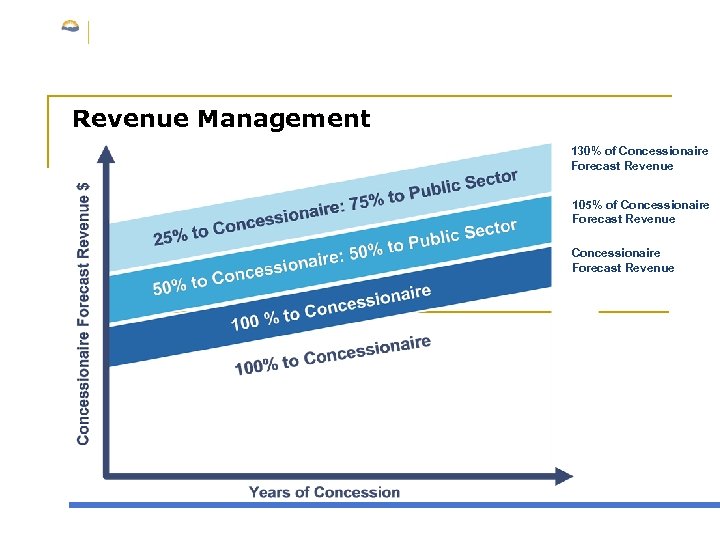

Revenue Management 130% of Concessionaire Forecast Revenue 105% of Concessionaire Forecast Revenue

Revenue Management 130% of Concessionaire Forecast Revenue 105% of Concessionaire Forecast Revenue

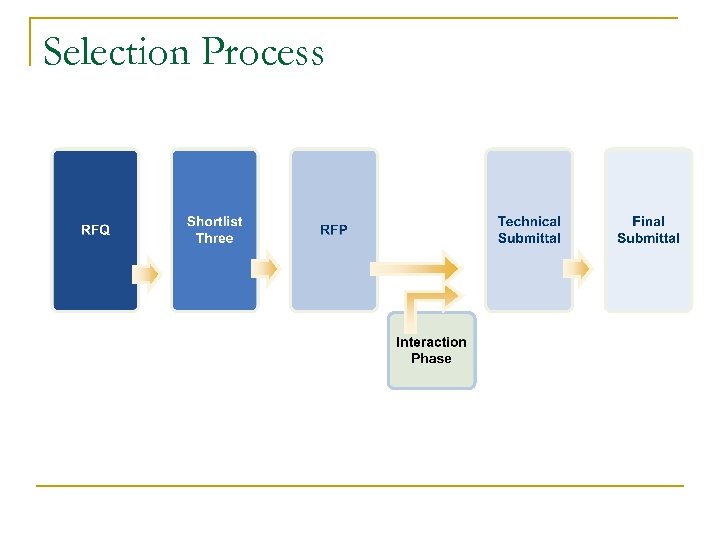

Selection Process

Selection Process

RFQ Objective n Select 3 potential long-term partners with: n Complex infrastructure development experience n Toll concession operations experience n Customer service focus n Asset management experience

RFQ Objective n Select 3 potential long-term partners with: n Complex infrastructure development experience n Toll concession operations experience n Customer service focus n Asset management experience

RFP Process n Technical and Financial Submittal n Draft concession agreement issued with RFP n 6 – 7 months for technical submittal n Honoraria n Bidders agreement

RFP Process n Technical and Financial Submittal n Draft concession agreement issued with RFP n 6 – 7 months for technical submittal n Honoraria n Bidders agreement

Interactive Process n Exchange information, clarify issue q q n All party meetings q n Fair Process Balance Confidentiality and Information Sharing Information provided by Province One-on-one meetings q q Mandatory workshops Topic meetings as required

Interactive Process n Exchange information, clarify issue q q n All party meetings q n Fair Process Balance Confidentiality and Information Sharing Information provided by Province One-on-one meetings q q Mandatory workshops Topic meetings as required

Two-Part Submittal n Technical Submittal q q n Traffic forecast sign-off by lenders Complete technical submission End of interactive process Acceptance by Province triggers final stage Financial Submittal q q q Committed equity and debt funding Commitment to enter C. A. by concessionaire and lenders Annual Payment Commitment

Two-Part Submittal n Technical Submittal q q n Traffic forecast sign-off by lenders Complete technical submission End of interactive process Acceptance by Province triggers final stage Financial Submittal q q q Committed equity and debt funding Commitment to enter C. A. by concessionaire and lenders Annual Payment Commitment

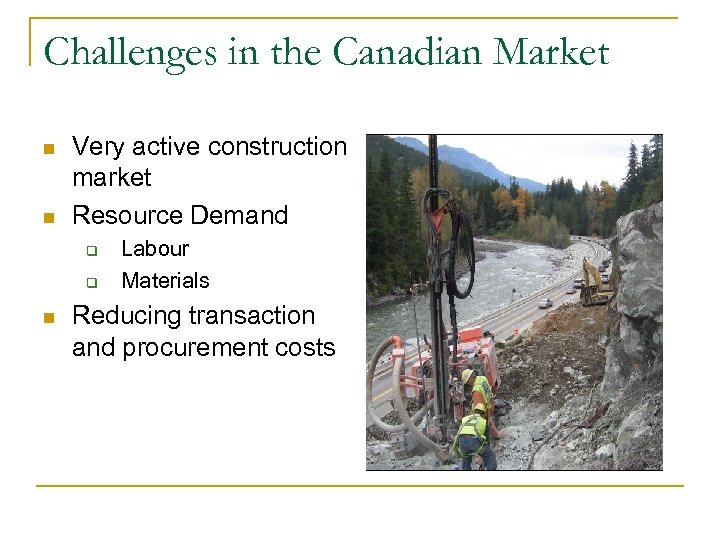

Challenges in the Canadian Market n n Very active construction market Resource Demand q q n Labour Materials Reducing transaction and procurement costs

Challenges in the Canadian Market n n Very active construction market Resource Demand q q n Labour Materials Reducing transaction and procurement costs

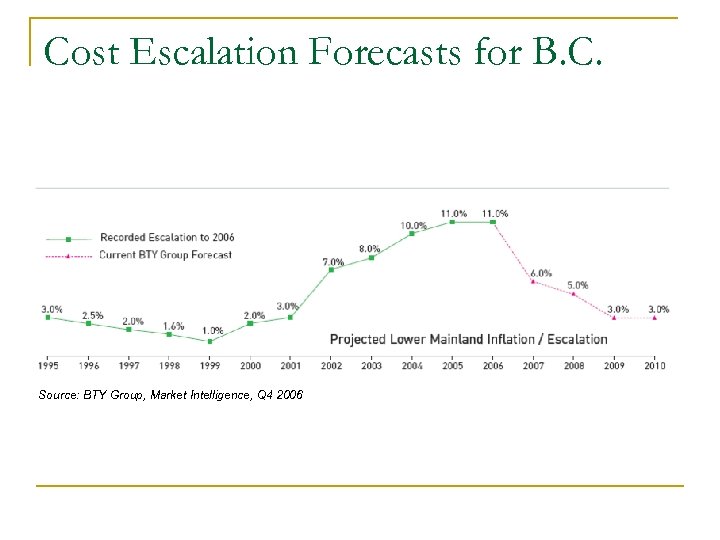

Cost Escalation Forecasts for B. C. Source: BTY Group, Market Intelligence, Q 4 2006

Cost Escalation Forecasts for B. C. Source: BTY Group, Market Intelligence, Q 4 2006

Lessons Learned n Central PPP Advocate q q n Consistency q q q n Effective for government and market Approximately 30 PPP agencies worldwide Policy Processes (lower costs) Information (to and from market) Need to build Pan-Canadian, consistent market

Lessons Learned n Central PPP Advocate q q n Consistency q q q n Effective for government and market Approximately 30 PPP agencies worldwide Policy Processes (lower costs) Information (to and from market) Need to build Pan-Canadian, consistent market

“British Columbia, in particular, has been receiving international accolades for its early accomplishments in the area of P 3 development. ” TD Bank Financial Group June 2006 “Partnerships BC is at the vanguard of public-private partnership agencies worldwide. ” Chair, U. K. Public Private Partnerships Export Advisory Group As quoted by Don Cayo Vancouver Sun, October 2006

“British Columbia, in particular, has been receiving international accolades for its early accomplishments in the area of P 3 development. ” TD Bank Financial Group June 2006 “Partnerships BC is at the vanguard of public-private partnership agencies worldwide. ” Chair, U. K. Public Private Partnerships Export Advisory Group As quoted by Don Cayo Vancouver Sun, October 2006