2c66b621350116255488045e78855a25.ppt

- Количество слайдов: 41

EXPENSE ALLOCATION OVERCHARGES HUNTING FOR THE BIG DOLLARS Presented by: Rick Burke, Lease Administration Solutions, LLC Michael Delman, Lease Administration Solutions, LLC Copyright © All Rights Reserved 2016

Agenda 1. Tenant’s Share Pro-Rata Share • Leasable v. Leased • Contributions and Self Maintained • 2. 3. 4. 5. One Expense to Multi-Properties Multi-Expenses To One Property Mixed Use Real Estate Taxes

Tenant’s Share Allocations

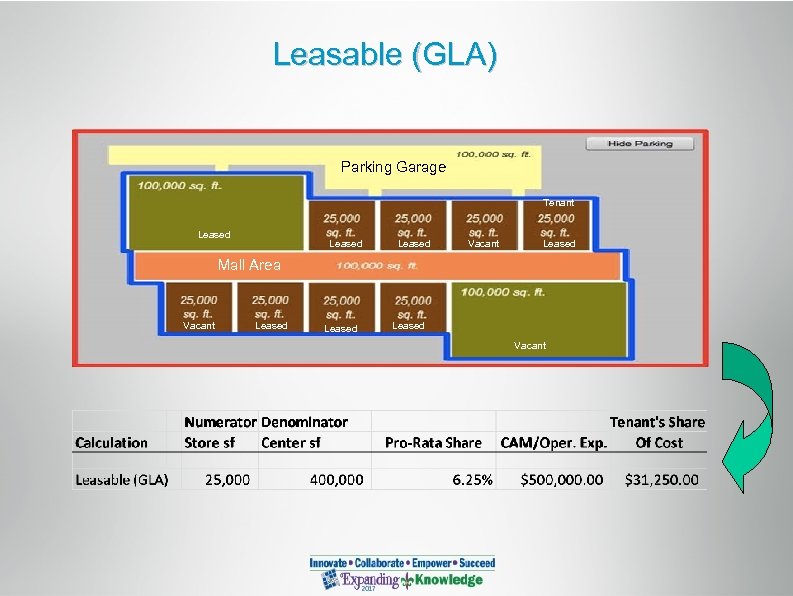

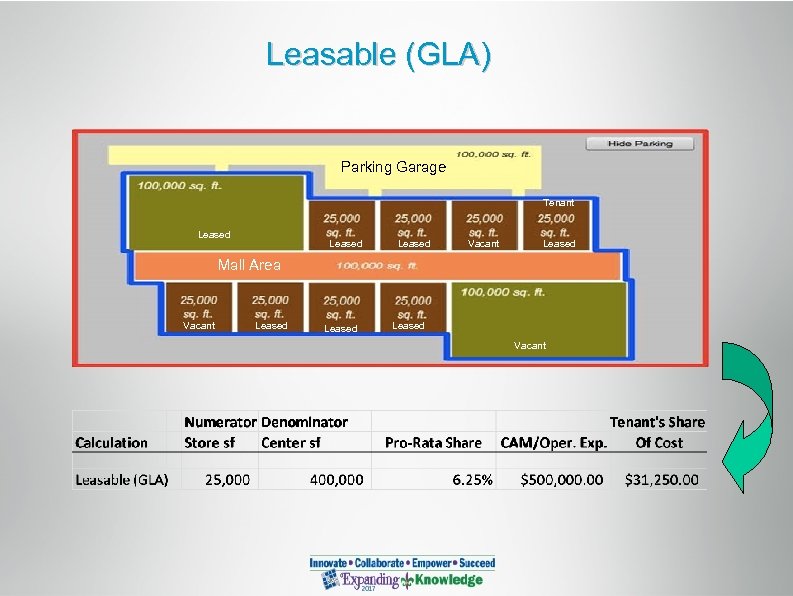

Leasable (GLA) Parking Garage Tenant Leased Vacant Leased Mall Area Vacant Leased Numerator Leased Denominator Vacant

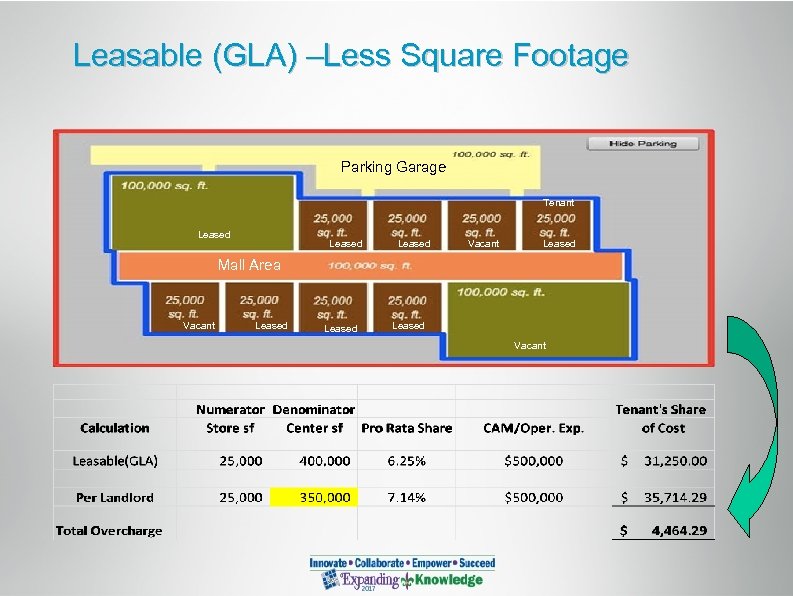

Leasable (GLA) –Less Square Footage Parking Garage Tenant Leased Vacant Leased Mall Area Vacant Leased Numerator Leased Denominator Vacant

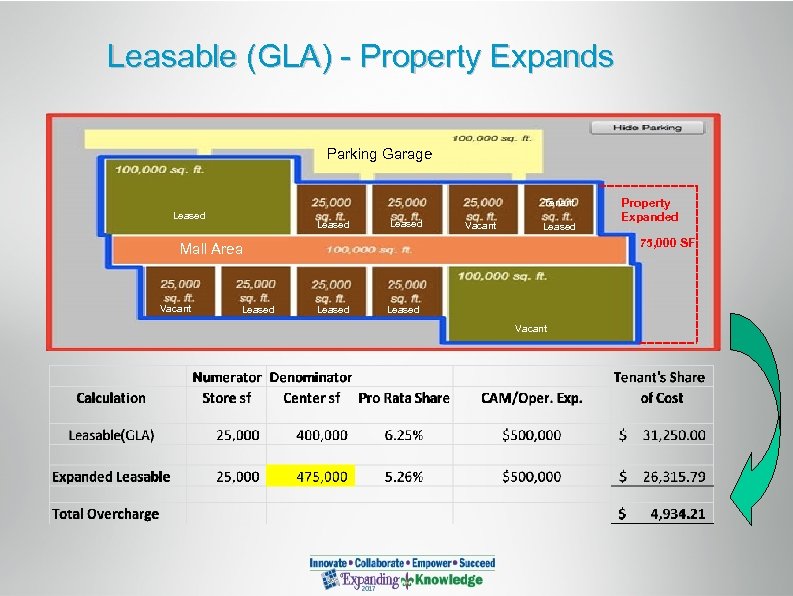

Leasable (GLA) - Property Expands Parking Garage Tenant Leased Vacant Leased 75, 000 SF Mall Area Vacant Leased Property Expanded Leased Vacant

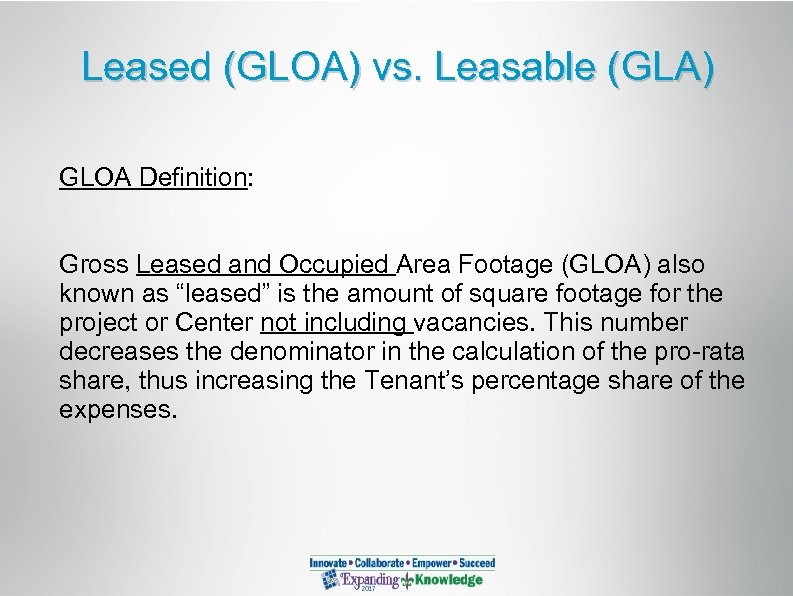

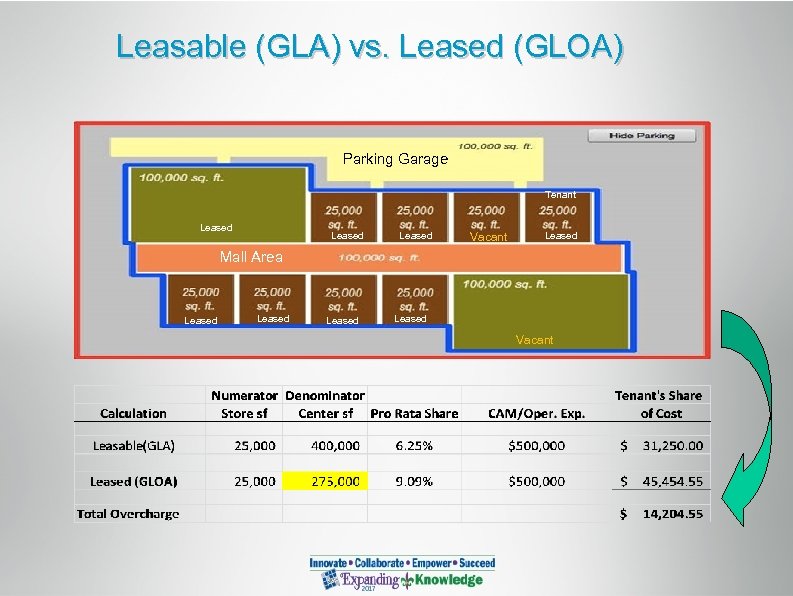

Leased (GLOA) vs. Leasable (GLA) GLOA Definition: Gross Leased and Occupied Area Footage (GLOA) also known as “leased” is the amount of square footage for the project or Center not including vacancies. This number decreases the denominator in the calculation of the pro-rata share, thus increasing the Tenant’s percentage share of the expenses.

Leasable (GLA) Parking Garage Tenant Leased Vacant Leased Mall Area Vacant Leased Numerator Leased Denominator Vacant

Leasable (GLA) vs. Leased (GLOA) Parking Garage Tenant Leased Vacant Leased Mall Area Leased Numerator Leased Denominator Vacant

What is Contributions? Contributions Definition: Larger Tenants or Tenants who attract shoppers to the Shopping Center often negotiate lower additional rent cost with the landlord. Landlord’s call this “Contributions” by Majors or Anchors. Basic idea is that landlord will deduct the Major(s) or Anchor(s) square footage from the calculation of Tenant’s Pro. Rata Share as well as deduct their Contributions from the total expenses before applying tenant’s pro-rata share. Contribution cpsf are far less than cpsf of the Tenant

Contributions Example • Anchor Defined: A tenant that occupies 75, 000 or more of contiguous square feet • Major Defined: A Tenant that occupies 30, 000 to 74, 999 or more of contiguous square feet • Contributions Language: In determining tenant’s Pro-rata Share, landlord may deduct anchor’s and major’s square footage and their related Contributions, IF ANY.

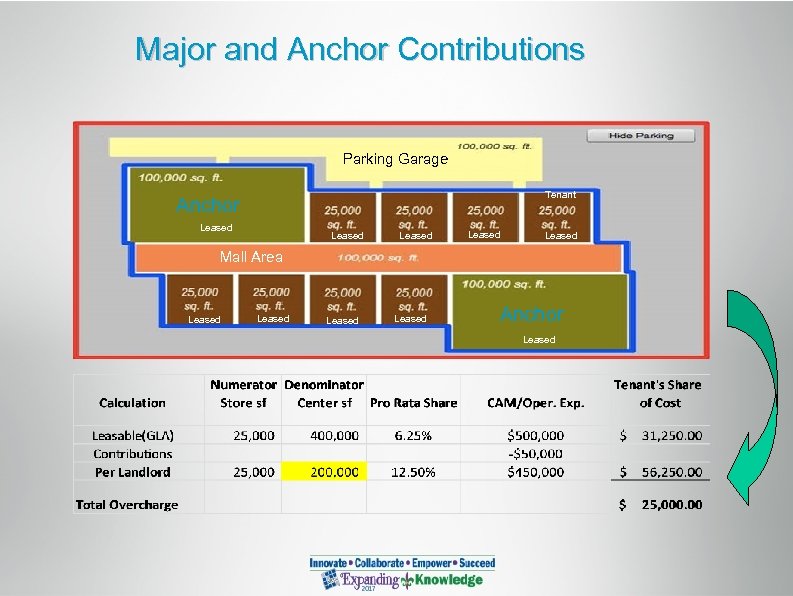

Major and Anchor Contributions Parking Garage Tenant Anchor Leased Leased Mall Area Leased Numerator Leased Anchor Denominator Leased

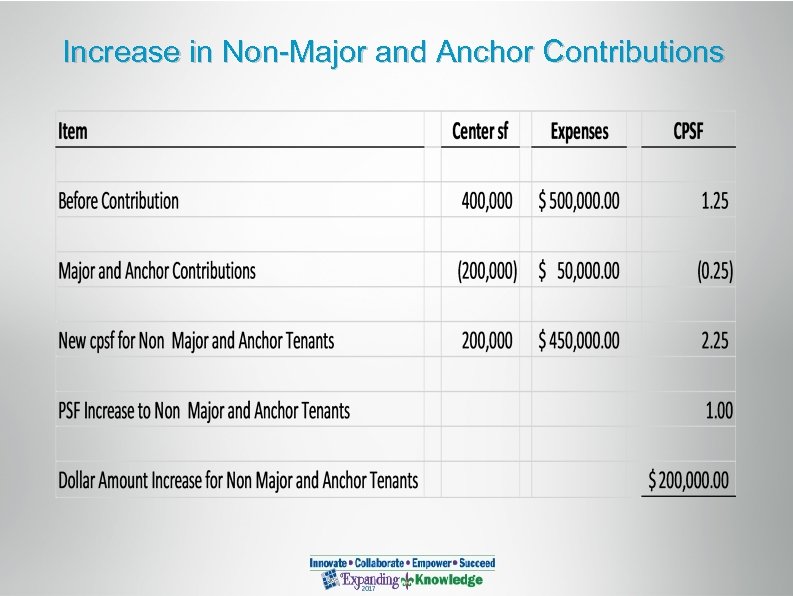

Increase in Non-Major and Anchor Contributions

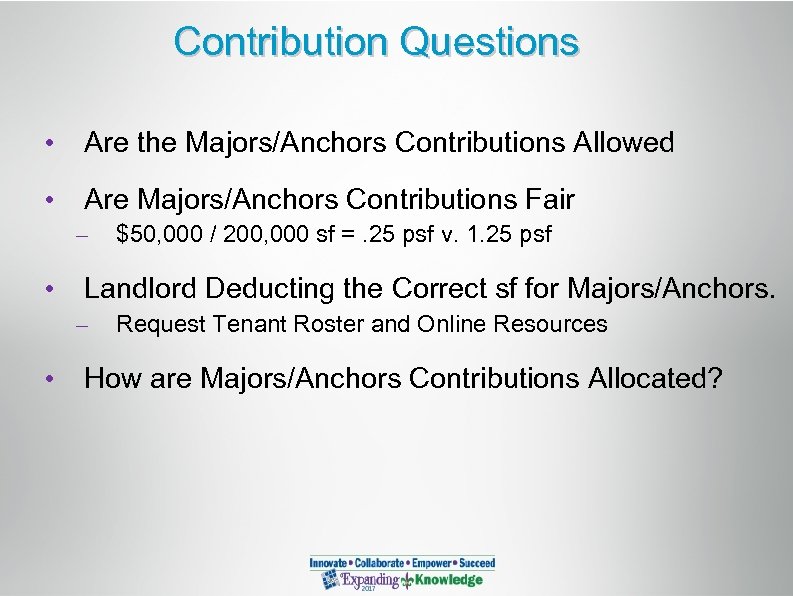

Contribution Questions • Are the Majors/Anchors Contributions Allowed • Are Majors/Anchors Contributions Fair – $50, 000 / 200, 000 sf =. 25 psf v. 1. 25 psf • Landlord Deducting the Correct sf for Majors/Anchors. – Request Tenant Roster and Online Resources • How are Majors/Anchors Contributions Allocated?

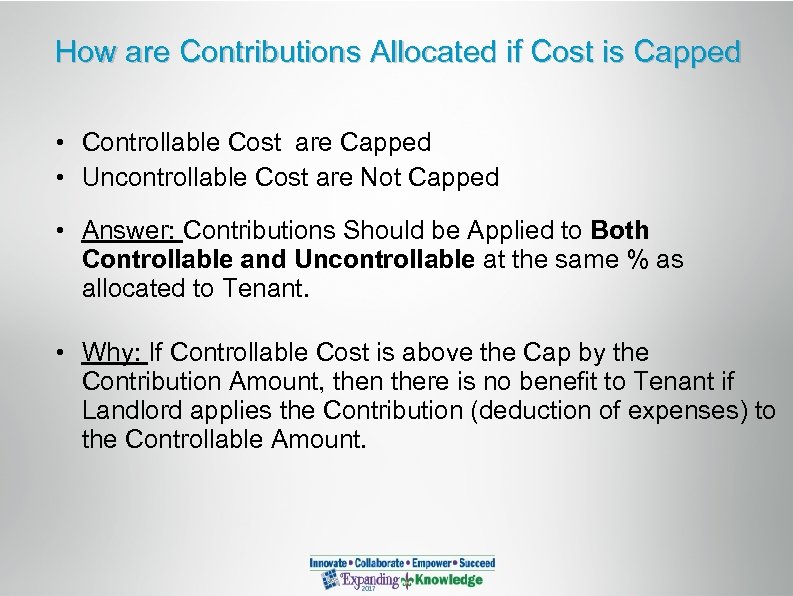

How are Contributions Allocated if Cost is Capped • Controllable Cost are Capped • Uncontrollable Cost are Not Capped • Answer: Contributions Should be Applied to Both Controllable and Uncontrollable at the same % as allocated to Tenant. • Why: If Controllable Cost is above the Cap by the Contribution Amount, then there is no benefit to Tenant if Landlord applies the Contribution (deduction of expenses) to the Controllable Amount.

Unfair Expense Allocation Within Property • • Restaurants Gyms Swim Clubs 24 Hour Stores Hospitals (Medical Complexes) Bars and Clubs Telecom Antennas

Lease Language – (Wish List) • Floor on Contribution: Contribution as stated in the lease shall not be less than 75% of the tenant’s cost for the same year on a cost per square foot basis. • Allocation Method: Contributions must be applied in the same allocation method as the stated in the tenants lease (i. e. Controllable vs. Uncontrollable) • Documentation Requirement: The lease also must require the landlord to support any major or anchor contributions with source documentation when requested by the tenant.

Review Approach • Read Lease – How is Tenant’s PRS Calculated • GLA v. GLOA, Contributions etc. • Request Tenant Roster with sf For Center/Property • Verifying Leased sf – Move-in and Move-out dates required • Review Landlord’s Website and Internet for sf • Understand Other Tenants (Unfair Expense Allocations) • View Google Earth for Historic View (Expansion) to Property • Goggle Earth Measurer – Terra. Server Measurer • Understand Landlord (Big REIT, Mom & Pop, )

One Expense Allocated to Multiple Properties

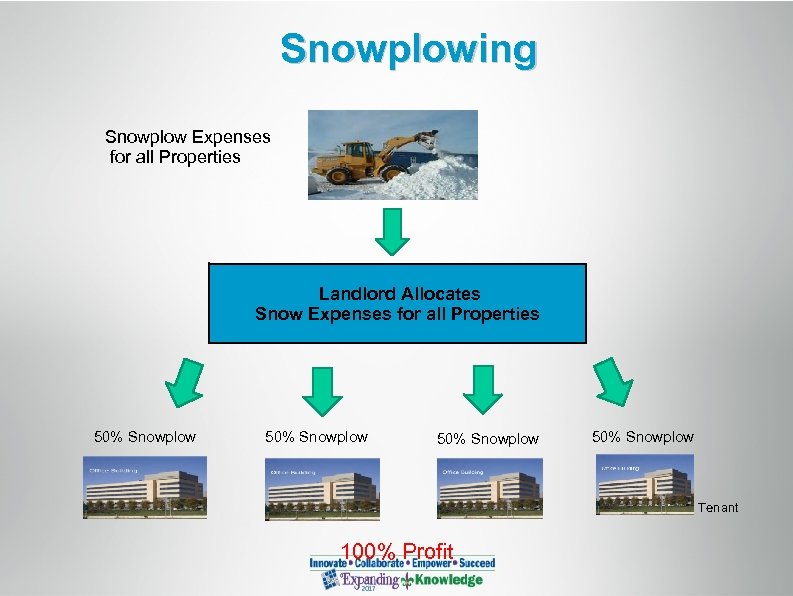

Snowplowing Snowplow Expenses for all Properties Landlord Allocates Snow Expenses for all Properties 50% Snowplow Tenant 100% Profit

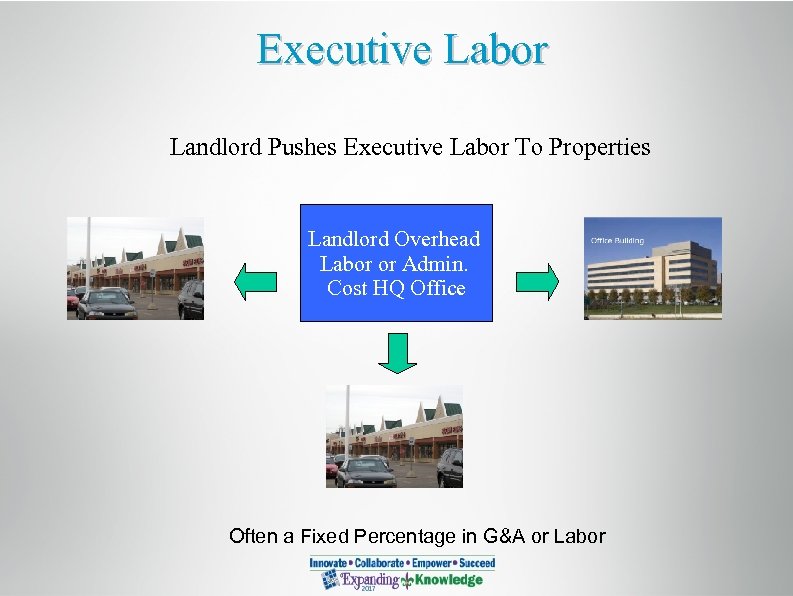

Executive Labor Landlord Pushes Executive Labor To Properties Landlord Overhead Labor or Admin. Cost HQ Office Often a Fixed Percentage in G&A or Labor

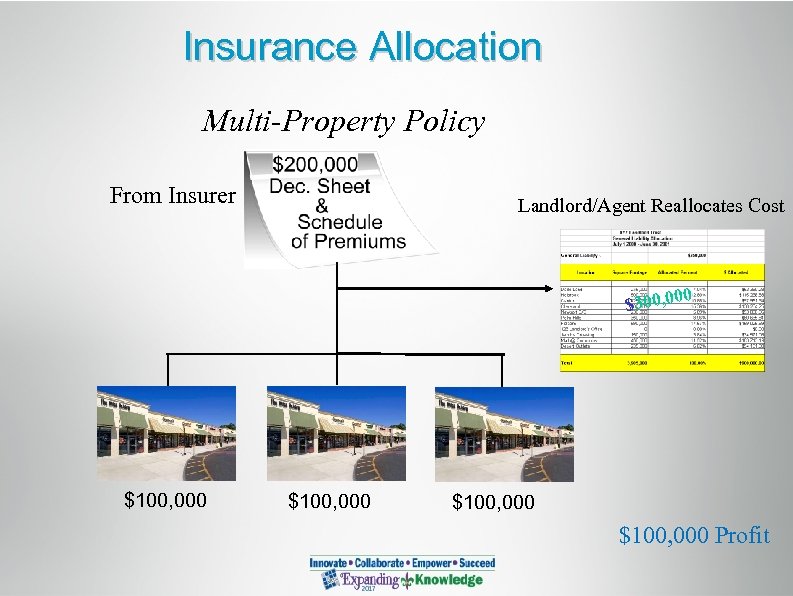

Insurance Allocation Multi-Property Policy From Insurer Landlord/Agent Reallocates Cost 0 $300, 00 $100, 000 Profit

Lease Language – (Wish List) Key Lease Definitions: • • Cost Only for Property Manager and Below Labor Must Work On-Site Labor Cost for Common Area (Not Entire Center) No Comingling or Pooling Cost from Other Properties If Related Party – Must be FMV of Cost Right for Documentation to Verify Cost Right to Verify Method of Allocation

Review Approach • Read Lease • Request All Invoices (Source Documentation) • Identify Possible Allocation Accounts (Labor, Insurance, G & A, Utilities, etc. ) • Contracts (Cleaning, Landscaping, Security) • Tie Actual Invoices to G/L and L/L’s Bill • Determine if Cost is FMV

Multiple Property Expenses Allocated to Tenant

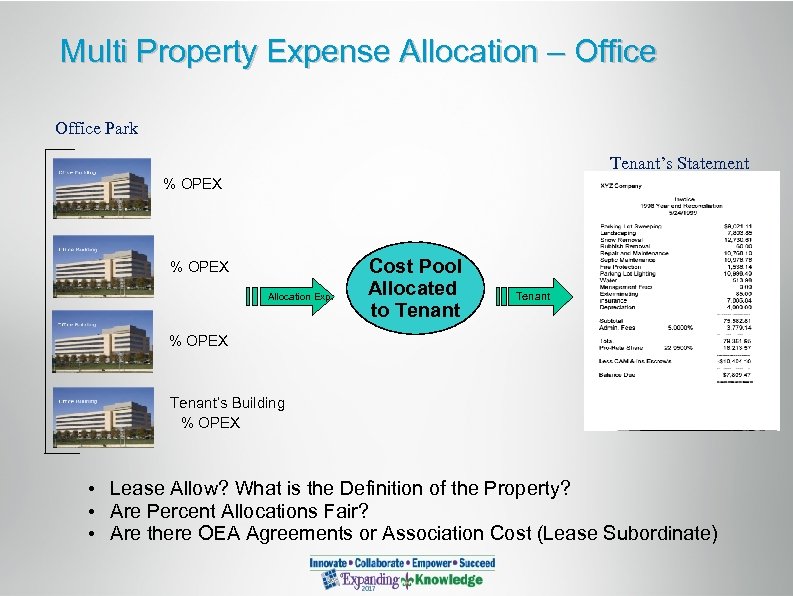

Multi Property Expense Allocation – Office Park Tenant’s Statement % OPEX Allocation Exp. Cost Pool Allocated to Tenant % OPEX Tenant’s Building % OPEX • Lease Allow? What is the Definition of the Property? • Are Percent Allocations Fair? • Are there OEA Agreements or Association Cost (Lease Subordinate)

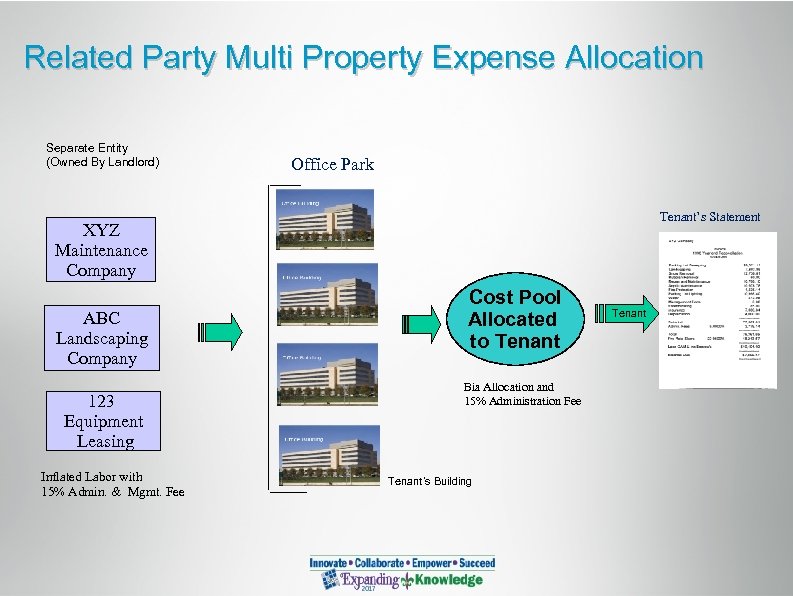

Related Party Multi Property Expense Allocation Separate Entity (Owned By Landlord) Office Park Tenant’s Statement XYZ Maintenance Company ABC Landscaping Company 123 Equipment Leasing Inflated Labor with 15% Admin. & Mgmt. Fee Cost Pool Allocated to Tenant Bia Allocation and 15% Administration Fee Tenant’s Building Tenant

Mixed Use Buildings Residential Hotel Office Retail

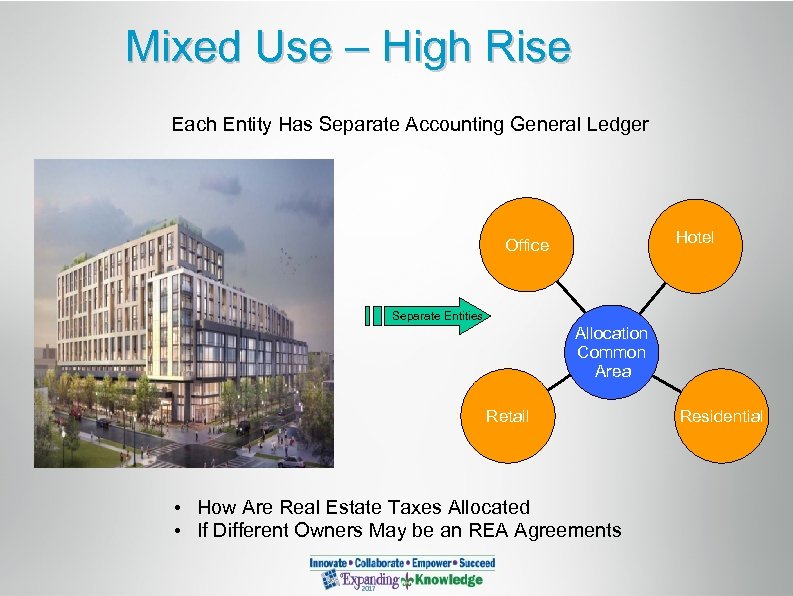

Mixed Use – High Rise Each Entity Has Separate Accounting General Ledger Hotel Office Separate Entities Allocation Common Area Retail • How Are Real Estate Taxes Allocated • If Different Owners May be an REA Agreements Residential

Mixed Use –Shopping Center Residential Office Strip Center Office Mall

Ring or Access Road Residential Office Strip Center Office Mall

Access Through Center - REA Residential

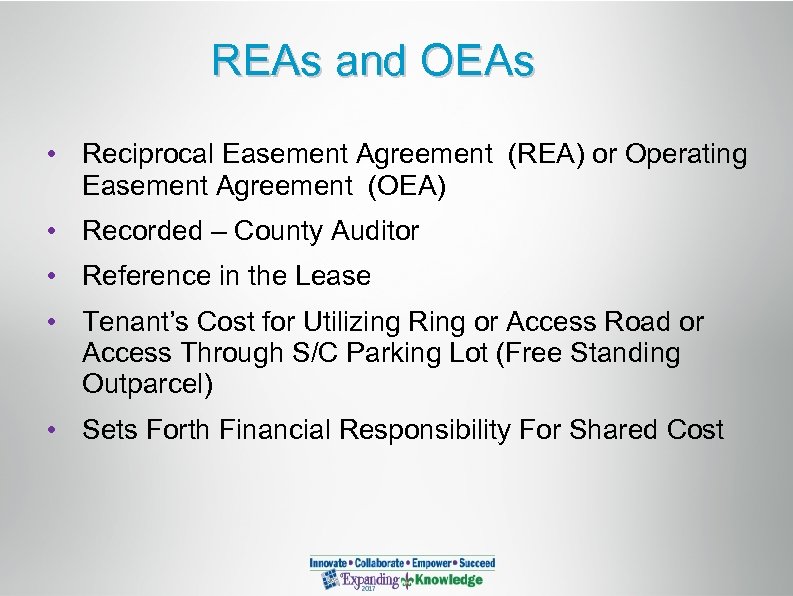

REAs and OEAs • Reciprocal Easement Agreement (REA) or Operating Easement Agreement (OEA) • Recorded – County Auditor • Reference in the Lease • Tenant’s Cost for Utilizing Ring or Access Road or Access Through S/C Parking Lot (Free Standing Outparcel) • Sets Forth Financial Responsibility For Shared Cost

Review Approach • Understand Property and Lease! • Percentage Allocation Fair • Request Invoices (Source Documentation) • Contracts (Cleaning, Landscaping, Security) • Request Tenant Roster w/SF and Tie to PRS • Identify Possible Allocation Accounts (Labor, Insurance, G & A, Utilities, etc. ) • REA or OEA (If applicable)

Real Estate Tax Allocation!

Real Estate Taxes Allocation • Pro-Rata Share • Contributions • Ring Road and Access Road • Separately Assessed Parcels v. Complete Shopping Center • Building Foot Print • Undeveloped Land • Acreage of Parcel upon Initial Construction

Separately Assessed

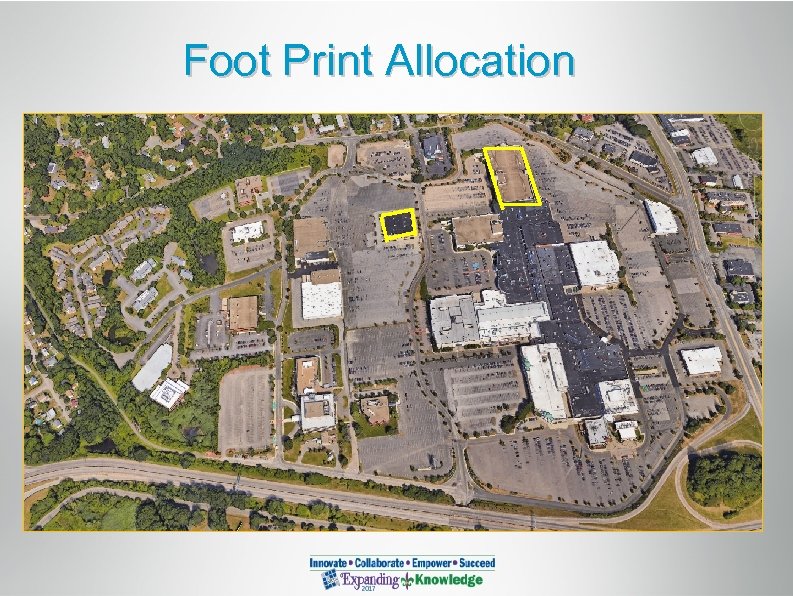

Foot Print Allocation

Undeveloped Land

Review Approach • Read The Lease • Understand Definition of Property • Verify Parcel Map (Tax Map or Plot Plan) with Tax Assessor • Match Parcel with Actual Property • Confirm Acreage • Obtain Property Record Card

Thank You EXPENSE ALLOCATION OVERCHARGES HUNTING FOR THE BIG DOLLARS Questions Rick Burke RBurke@Lease. Admin. Solutions. com Michael Delman Mdelman@Lease. Admin. Solutions. com Lease Administration Solutions, LLC Copyright © All Rights Reserved 2016

2c66b621350116255488045e78855a25.ppt