b0680c96d47a43c24f11d5a097512a15.ppt

- Количество слайдов: 21

Expanding Your Sales Through multi-life opportunities

Benefits of multi-life sales For your client: • Employee reward and retention • Flexibility and cost control • Savings on personal insurance coverage • Premium savings to apply to additional protection For you: • Higher close ratio • More referrals • Multiple cross-selling opportunities • Increased persistency • Reduced expenses 2

Employee needs Long Term Care Insurance Retirement Individual Disability Insurance STD/LTD Medical Dental 3

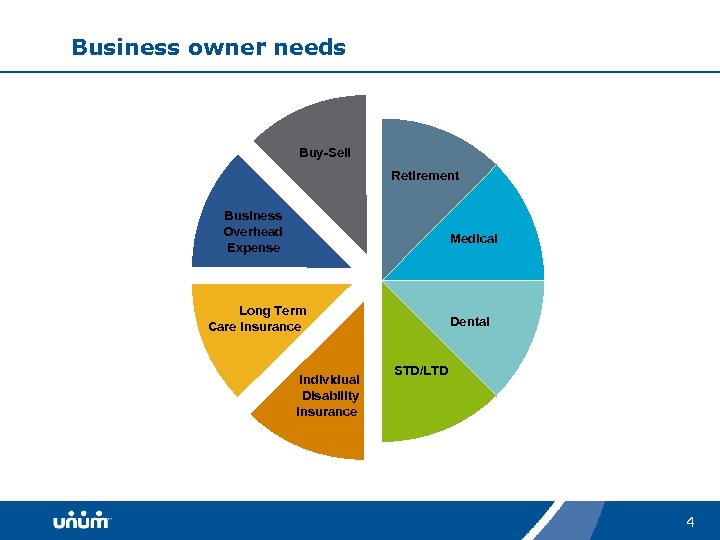

Business owner needs Buy-Sell Retirement Business Overhead Expense Medical Long Term Care Insurance Individual Disability Insurance Dental STD/LTD 4

Exploring multi-life possibilities “Do you have employees who could also benefit from this type of coverage? ” or… “Have you considered offering individual disability insurance to your employees? ” 5

Women-owned businesses – a prime market 41% of all privately-held firms in the country have at least 50% female ownership. * Women-Owned Businesses in 2006: Trends in the U. S. and 50 States, Center for Women's Business Research, 2006, retrieved 11/5/2007 from: http: //www. nfwbo. org/press/details. php? id=143 6

Women-owned businesses – a prime market For the past two decades, the majority of women-owned firms have continued to grow at around two times the rate of all firms (42% vs. 24%). * * Key Facts About Women-Owned Businesses. (n. d. ). The Center For Women’s Business Research. Retrieved November 5, 2007, from http: //www. nfwbo. org/facts/index. php 7

Scenario one Client profiles: • Two male business owners • Age 40 • Non-tobacco • Occupation class B 1 • Annual earnings $90, 000 each • No other coverage or significant unearned income 8

Scenario one Typical Plan Design: • Income II NC • 90 -Day elimination period • To age 65 benefit period • Monthly benefit: $3, 500 base $1, 000 SIS $3, 000 Catastrophic Disability Benefit • Monthly premium: $167. 33 each Combined non-Discounted monthly premium: $334. 66 9

Scenario one – add one employee Client profile: • Female • Age 40 • Non-tobacco • Occupation Class D 1 • Annual earnings $45, 000 • No other coverage or unearned income 10

Scenario One – Add One Employee Typical Plan Design: • Income I NC • 90 -Day elimination period • Five-year benefit period • Monthly benefit: $400 base $600 SIS $1, 169 Catastrophic Disability Benefit Non-discounted monthly premium: $40. 05 11

Scenario one – employer-paid multi-life $167. 33 $134. 25 $25. 64 Combined nondiscounted monthly premium: Combined discounted monthly premium: $334. 66 $294. 14 Total monthly savings: $40. 52 More than 12% 12

Scenario two Client profiles: • Two female business owners • Age 40 • Non-tobacco • Occupation class B 1 • Annual earnings $90, 000 each • No other coverage or significant unearned income 13

Scenario two Typical plan design: • Income II NC • 90 -Day elimination period • To age 65 benefit period • Monthly benefit: $3, 500 base $1, 000 SIS $3, 000 Catastrophic Disability Benefit • Monthly premium: $234. 04 each Combined non-discounted monthly premium: $468. 08 14

Scenario two – add one employee Typical plan design: • Income I NC • 90 -Day elimination period • Five-year benefit period • Monthly benefit: $400 base $600 SIS $1, 169 Catastrophic Disability Benefit Non-discounted monthly premium: $40. 05 15

Scenario two – employer-paid multi-life $234. 04 $134. 25 $25. 64 Combined nondiscounted monthly premium: Combined discounted monthly premium: $468. 08 $294. 14 Total monthly savings: $173. 94 More than 37% 16

Adding value – cross-selling to BOE Client profiles: Two female business owners occupation class S Typical plan design: • $4, 000 Business Overhead Expense • $2, 000 Business Value Protector • 60 -day elimination period • 18 -month benefit period • Residual Disability Benefit Business Overhead Expense Policy 1737 Non-discounted premium: $68. 80 x 2 owners = $137. 60 Discounted premium: $59. 49 x 2 owners = $118. 98 17

Compare the cost Business Overhead Expense $137. 60 Discounted: 2 female owners 1 employee Business Overhead Expense Total: Non-discounted: 2 female owners $605. 68 $468. 08 $268. 50 $25. 64 $118. 98 $413. 12 Total monthly savings $192. 56 32% and added an additional employee 18

Benefits to your client • Employee reward and retention • Flexibility and cost control • Premium savings to apply to additional protection • Savings on personal coverage 19

Benefits to you • Higher close ratio • More referrals • Multiple cross-selling opportunities • Increased persistency • Reduced expenses • Want to know more about growing your business with multi-life sales? Contact your local Unum representative or call Unum’s Sales Support Center at 877 -322 -7222. 20

Unum is not in any way affilated with the Internet site listed in this document, does not endorse the information it contains and is not responsible for the accuracy of the information. Insurance products are underwritten and services offered by the subsidiaries of Unum Group. Not all companies do business in all jurisdictions. In New York, insurance products are offered by First Unum Life Insurance Company, Provident Life and Casualty Insurance Company and The Paul Revere Life Insurance Company. Policies have exclusions and limitations that may affect any benefits payable. See the actual policy or your Unum representative for specific provisions and details of availability. © 2008 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries. PP-227 21

b0680c96d47a43c24f11d5a097512a15.ppt