29c096057792e082d82c57a52dd12bc1.ppt

- Количество слайдов: 14

EXECUTIVE BENEFITS

BB&T Insurance Services, Inc. {Client Name} {Producer Name} {Date} 2

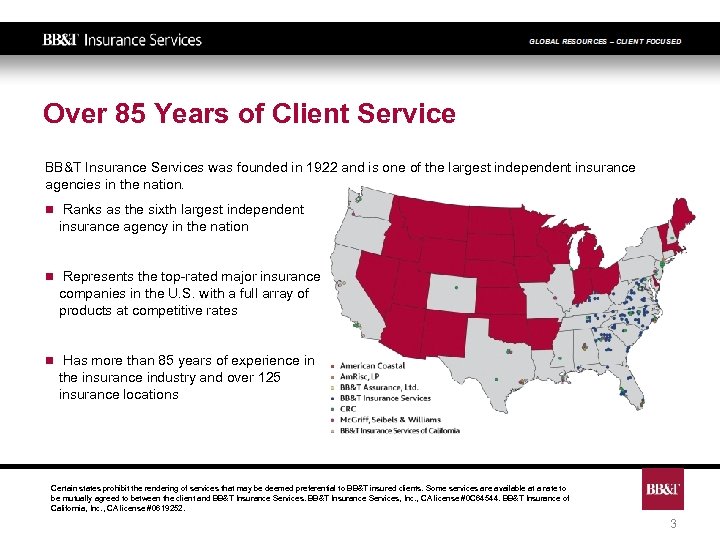

Over 85 Years of Client Service BB&T Insurance Services was founded in 1922 and is one of the largest independent insurance agencies in the nation. n Ranks as the sixth largest independent insurance agency in the nation n Represents the top-rated major insurance companies in the U. S. with a full array of products at competitive rates n Has more than 85 years of experience in the insurance industry and over 125 insurance locations Certain states prohibit the rendering of services that may be deemed preferential to BB&T insured clients. Some services are available at a rate to be mutually agreed to between the client and BB&T Insurance Services, Inc. , CA license #0 C 64544. BB&T Insurance of California, Inc. , CA license #0619252. 3

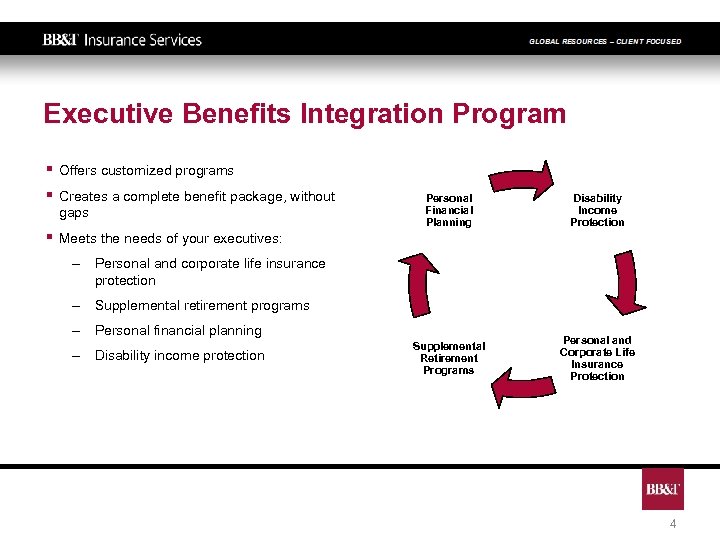

Executive Benefits Integration Program § § Offers customized programs § Meets the needs of your executives: Creates a complete benefit package, without gaps Personal Financial Planning Disability Income Protection Supplemental Retirement Programs Personal and Corporate Life Insurance Protection – Personal and corporate life insurance protection – Supplemental retirement programs – Personal financial planning – Disability income protection 4

Domestic Individual Disability Insurance § § § In addition to Group Long-Term Disability Offers additional level of coverage for executives Benefits include: – Level premiums to age 65 – Guaranteed Standard Issue programs – Potential of up to $15, 000 per month – Own occupation coverage to age 65 – Non-cancellable/guaranteed renewable contracts – Fully portable – Partial disability coverage – Discounts on retail insurance products – Return-to-work benefits – Cost of living adjustments 5

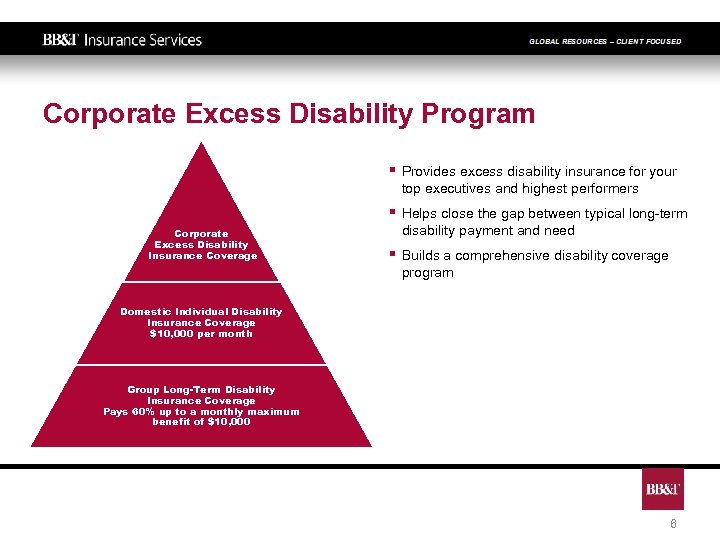

Corporate Excess Disability Program § § Corporate Excess Disability Insurance Coverage Provides excess disability insurance for your top executives and highest performers Helps close the gap between typical long-term disability payment and need § Builds a comprehensive disability coverage program Domestic Individual Disability Insurance Coverage $10, 000 per month Group Long-Term Disability Insurance Coverage Pays 60% up to a monthly maximum benefit of $10, 000 6

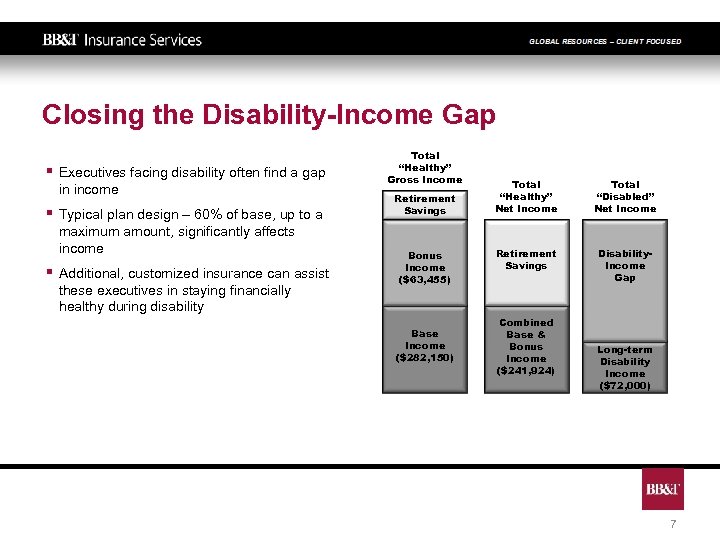

Closing the Disability-Income Gap § § § Executives facing disability often find a gap in income Typical plan design – 60% of base, up to a maximum amount, significantly affects income Additional, customized insurance can assist these executives in staying financially healthy during disability Total “Healthy” Gross Income Retirement Savings Bonus Income ($63, 455) Base Income ($282, 150) Total “Healthy” Net Income Total “Disabled” Net Income Retirement Savings Disability. Income Gap Combined Base & Bonus Income ($241, 924) Long-term Disability Income ($72, 000) 7

Executive Disability-Income Gap Program Highlights § § § Income replacement ratio up to 65% Extended five-year benefit period Lump sum benefit available Executive may define their own occupation Possible $25, 000 monthly Guaranteed Standard Issue coverage For three years, policies have: – Renewable contracts – Rate guarantee – Level premiums § Program is portable by executive during coverage and has renewal options 8

Corporate Term Life Insurance § § Designed as institutional purchase of individual term life insurance Easy underwriting: – One-page application, ages 25 -70 – 71 -75, some additional questions § Can provide up to $3, 000 of coverage on employees with only one question; no blood work, no exam, etc. § § Portable at any time Not experience-rated with long-term rate schedule guarantees — 15 years at most ages 9

Uses of Corporate Term Life § § § “Carve out” group life and replace with Corporate Term life insurance Provide as additional insurance with group life Can replace another “carve out” plan Continue life insurance benefit in unraveling Split-Dollar plans Corporate ownership situations: buy-out, key-man, etc. Corporate term life gives highly-valued employees a highly-valued benefit. 10

Personal Retirement Consultations § One-on-one meetings for key employees to discuss retirement goals § § § Customized for company, tailored for employees Assists employees in addressing retirement concerns Provides a forum to discuss recreating their income stream during retirement 11

Supplemental Retirement Program § § § Another benefit option for retaining executives and high performers Can be offered to employees as a retention or reward benefit Institutionally priced Provides both mutual funds and traditional fixed products Depending on participation, may include simplified and GSI underwriting Offers several funding designs for a variety of employment situations – Employee bonus – Employee retention – Deferred compensation 12

Personal Financial Planning § § § For executives and key employees, with cost shared § Plan is customized for the employee and their family, considering: Convenient access to in-depth personal financial planning Includes several – not just one – consultations with employees – Employee goals – Employee resources – Planning alternatives § Review of options with employee 13

Preferred Pricing on Banking Products § § Provided at no cost to the company Through BB&T@Work, provides: – Preferred pricing on traditional banking products – Periodic special offers on select CDs, savings accounts and home equity lines © 2010 BB&T. Insurance products are not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by the bank; may be subject to investment risk. 14

29c096057792e082d82c57a52dd12bc1.ppt