a948cb594dd9ddf5cb0fcf1619cc447e.ppt

- Количество слайдов: 50

EXCISE DUTY IN TURKIYE GENERAL FRAMEWORK 1

EXCISE DUTY IN TURKIYE GENERAL FRAMEWORK 1

TAXATION: EXCISE DUTY CONTENTS I. General Explanations II. Legislation III. General Structure IV. Goods Within the Scope V. Common Provisions The Presidency of Revenue Administration

TAXATION: EXCISE DUTY CONTENTS I. General Explanations II. Legislation III. General Structure IV. Goods Within the Scope V. Common Provisions The Presidency of Revenue Administration

TAXATION: EXCISE DUTY I. GENERAL EXPLANATIONS q Law on Excise Duty No: 4760 q The Official Gazette No: 24783, dated 12 June 2002 q Put into force on 1 August 2002 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY I. GENERAL EXPLANATIONS q Law on Excise Duty No: 4760 q The Official Gazette No: 24783, dated 12 June 2002 q Put into force on 1 August 2002 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY I. GENERAL EXPLANATIONS (cont’d) Aim: ØSimplification of indirect tax system Ø Harmonization with EU legislation The Presidency of Revenue Administration

TAXATION: EXCISE DUTY I. GENERAL EXPLANATIONS (cont’d) Aim: ØSimplification of indirect tax system Ø Harmonization with EU legislation The Presidency of Revenue Administration

TAXATION: EXCISE DUTY II. LEGISLATION ü Law on Excise Duty No: 4760 ü Cabinet Decrees ü Communiqués ü Circulars The Presidency of Revenue Administration

TAXATION: EXCISE DUTY II. LEGISLATION ü Law on Excise Duty No: 4760 ü Cabinet Decrees ü Communiqués ü Circulars The Presidency of Revenue Administration

TAXATION: EXCISE DUTY III. GENERAL STRUCTURE q Excise Duty Ø collected at one stage of consumption process only for once. Ø taxes the goods laid down in the four Lists annexed to the Law. q Tax incidence to the final consumers is possible. q The goods laid down in Lists annexed to the Law, are subject to Excise duty only for once, from the stage of production and importation to the stage of selling and using. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY III. GENERAL STRUCTURE q Excise Duty Ø collected at one stage of consumption process only for once. Ø taxes the goods laid down in the four Lists annexed to the Law. q Tax incidence to the final consumers is possible. q The goods laid down in Lists annexed to the Law, are subject to Excise duty only for once, from the stage of production and importation to the stage of selling and using. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY IV. GOODS WITHIN THE SCOPE q Goods listed in the Excise Duty Law numbered 4760 are laid down in the 4 Lists annexed to the Law. q These goods are mentioned in the Law by codes in the Turkish Customs Tariff Nomenclature (TCTN). q Turkish Customs Tariff Nomenclature is in compliance with the Combined Nomenclature which is the international classification system for goods. Example: 2710. 11. 31. 00 Aviation spirit 2710. 19. 41. 00. 11 Diesel The Presidency of Revenue Administration

TAXATION: EXCISE DUTY IV. GOODS WITHIN THE SCOPE q Goods listed in the Excise Duty Law numbered 4760 are laid down in the 4 Lists annexed to the Law. q These goods are mentioned in the Law by codes in the Turkish Customs Tariff Nomenclature (TCTN). q Turkish Customs Tariff Nomenclature is in compliance with the Combined Nomenclature which is the international classification system for goods. Example: 2710. 11. 31. 00 Aviation spirit 2710. 19. 41. 00. 11 Diesel The Presidency of Revenue Administration

TAXATION: EXCISE DUTY IV. GOODS WITHIN THE SCOPE (cont’d) The List No: (I) Energy Products The List No: (II) Vehicles The List No: (III) Alcoholic Beverages And Tobacco Products The List No: (IV) Other Consumption Goods The Presidency of Revenue Administration

TAXATION: EXCISE DUTY IV. GOODS WITHIN THE SCOPE (cont’d) The List No: (I) Energy Products The List No: (II) Vehicles The List No: (III) Alcoholic Beverages And Tobacco Products The List No: (IV) Other Consumption Goods The Presidency of Revenue Administration

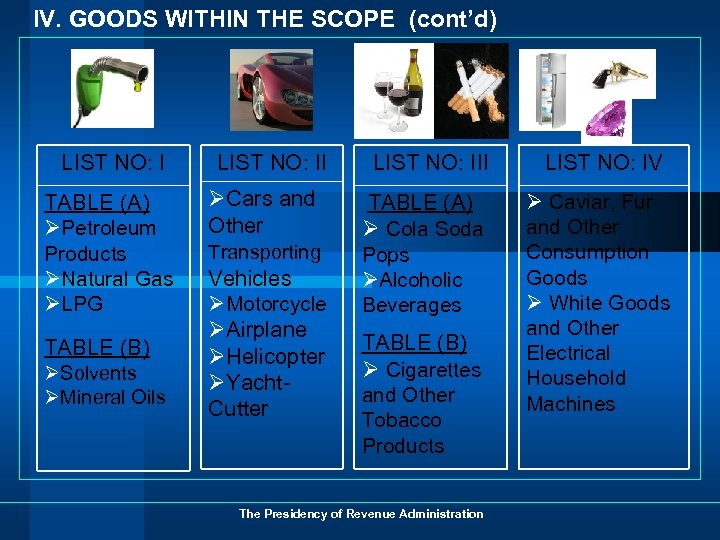

IV. GOODS WITHIN THE SCOPE (cont’d) LIST NO: III LIST NO: IV TABLE (A) ØPetroleum Products ØNatural Gas ØLPG ØCars and Other Transporting Vehicles ØMotorcycle ØAirplane ØHelicopter ØYacht. Cutter TABLE (A) Ø Cola Soda Pops ØAlcoholic Beverages Ø Caviar, Fur and Other Consumption Goods Ø White Goods and Other Electrical Household Machines TABLE (B) ØSolvents ØMineral Oils TABLE (B) Ø Cigarettes and Other Tobacco Products The Presidency of Revenue Administration

IV. GOODS WITHIN THE SCOPE (cont’d) LIST NO: III LIST NO: IV TABLE (A) ØPetroleum Products ØNatural Gas ØLPG ØCars and Other Transporting Vehicles ØMotorcycle ØAirplane ØHelicopter ØYacht. Cutter TABLE (A) Ø Cola Soda Pops ØAlcoholic Beverages Ø Caviar, Fur and Other Consumption Goods Ø White Goods and Other Electrical Household Machines TABLE (B) ØSolvents ØMineral Oils TABLE (B) Ø Cigarettes and Other Tobacco Products The Presidency of Revenue Administration

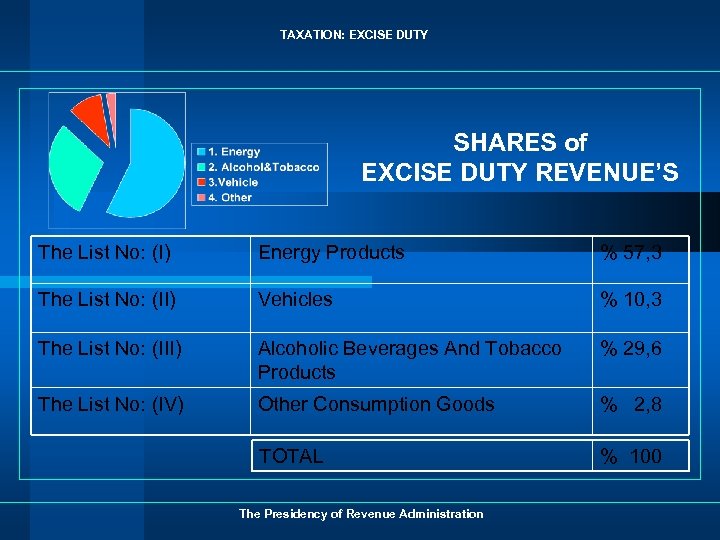

TAXATION: EXCISE DUTY SHARES of EXCISE DUTY REVENUE’S The List No: (I) Energy Products % 57, 3 The List No: (II) Vehicles % 10, 3 The List No: (III) Alcoholic Beverages And Tobacco Products % 29, 6 The List No: (IV) Other Consumption Goods % 2, 8 TOTAL % 100 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY SHARES of EXCISE DUTY REVENUE’S The List No: (I) Energy Products % 57, 3 The List No: (II) Vehicles % 10, 3 The List No: (III) Alcoholic Beverages And Tobacco Products % 29, 6 The List No: (IV) Other Consumption Goods % 2, 8 TOTAL % 100 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. COMMON PROVISIONS 1. 2. 3. 4. 5. 6. 7. 8. 9. Taxable event Delivery Importation Tax responsibility Exemptions Tax deduction Rate or amount Declaration, assessment and payment of duty Indication of duty on documents The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. COMMON PROVISIONS 1. 2. 3. 4. 5. 6. 7. 8. 9. Taxable event Delivery Importation Tax responsibility Exemptions Tax deduction Rate or amount Declaration, assessment and payment of duty Indication of duty on documents The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 1. Taxable event (Article 1) q Taxable event occurs at the time of: Ødelivery Øimport Øfirst acquisition q Taxable event differs for each of the Lists annexed to the Law. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 1. Taxable event (Article 1) q Taxable event occurs at the time of: Ødelivery Øimport Øfirst acquisition q Taxable event differs for each of the Lists annexed to the Law. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 2. Delivery (Article 2) “Delivery” means the transfer of the right of disposition of property to the recipient or to those acting on behalf of him, by the owner or by those acting on behalf of him. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 2. Delivery (Article 2) “Delivery” means the transfer of the right of disposition of property to the recipient or to those acting on behalf of him, by the owner or by those acting on behalf of him. The Presidency of Revenue Administration

2. Delivery (cont’d) In addition; q The consignment of goods to a place or to a person designated by the recipient or by those acting on behalf of him, is considered as delivery. q In the case of dispatching of goods to the recipient or to those acting on behalf of him, commencement of the transportation of goods or the consignment of the goods to the transporter or driver, shall also be regarded as delivery of the goods. q Barter is considered as two separate deliveries. q In the cases of returning of containers, wraps, wastes and leavings are routine; delivery is considered to be done for the products inside of these.

2. Delivery (cont’d) In addition; q The consignment of goods to a place or to a person designated by the recipient or by those acting on behalf of him, is considered as delivery. q In the case of dispatching of goods to the recipient or to those acting on behalf of him, commencement of the transportation of goods or the consignment of the goods to the transporter or driver, shall also be regarded as delivery of the goods. q Barter is considered as two separate deliveries. q In the cases of returning of containers, wraps, wastes and leavings are routine; delivery is considered to be done for the products inside of these.

Delivery (cont’d) q Where invoice or similar documents are issued before the goods are delivered, issuing of invoice or similar documents is considered as delivery provided that the amount is limited to that shown on such documents. q When delivery of goods in parts is routine or in the cases of an agreement to this effect, delivery of each part is considered as a separate delivery. q Where goods are sold through intermediaries or on consignment, dispatch of goods to the recipient is delivery.

Delivery (cont’d) q Where invoice or similar documents are issued before the goods are delivered, issuing of invoice or similar documents is considered as delivery provided that the amount is limited to that shown on such documents. q When delivery of goods in parts is routine or in the cases of an agreement to this effect, delivery of each part is considered as a separate delivery. q Where goods are sold through intermediaries or on consignment, dispatch of goods to the recipient is delivery.

2. Delivery (cont’d) States considered as delivery: q Any kind of Ø utilisation, Ø consumption, Ø removal from the enterprise, Ø dispensions to the employees as wages, premium, bonus, gift, donation, of the goods subject to taxation, However the above mentioned uses of goods in the production of the goods subject to taxation is not considered as delivery. q Transfer of possession in the bailment lease sales.

2. Delivery (cont’d) States considered as delivery: q Any kind of Ø utilisation, Ø consumption, Ø removal from the enterprise, Ø dispensions to the employees as wages, premium, bonus, gift, donation, of the goods subject to taxation, However the above mentioned uses of goods in the production of the goods subject to taxation is not considered as delivery. q Transfer of possession in the bailment lease sales.

TAXATION: EXCISE DUTY 3. Importation (Article 2) “Importation” means the entry of goods subject to excise duty into the Customs Territory of the Republic of Turkey. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 3. Importation (Article 2) “Importation” means the entry of goods subject to excise duty into the Customs Territory of the Republic of Turkey. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 4. Tax responsibility (Article 4) Persons involved in the transactions, are responsible for the payment of the duty in the following cases: Ø When taxpayers do not have, ü domicile, ü workplace, ü head office and business headquarter, in Turkey Ø When considered necessary by the Ministry of Finance. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 4. Tax responsibility (Article 4) Persons involved in the transactions, are responsible for the payment of the duty in the following cases: Ø When taxpayers do not have, ü domicile, ü workplace, ü head office and business headquarter, in Turkey Ø When considered necessary by the Ministry of Finance. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 5. Exemptions a. Exportation exemption b. Diplomatic exemption c. Importation exemptions d. Supply of goods destined for export The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 5. Exemptions a. Exportation exemption b. Diplomatic exemption c. Importation exemptions d. Supply of goods destined for export The Presidency of Revenue Administration

TAXATION: EXCISE DUTY a. Exportation Exemption (Article 5) Export deliveries of goods are exempted from duty, if the following conditions are met: a) The delivery must be made to a customer abroad. b) The goods subject to delivery must leave the Customs Territory of the Republic of Turkey.

TAXATION: EXCISE DUTY a. Exportation Exemption (Article 5) Export deliveries of goods are exempted from duty, if the following conditions are met: a) The delivery must be made to a customer abroad. b) The goods subject to delivery must leave the Customs Territory of the Republic of Turkey.

TAXATION: EXCISE DUTY a. Exportation exemption (Article 5) (cont’d) Ø The term “customer abroad” shall mean recipients whose domicile, place of business and legal headquarter are abroad, as well as branches in foreign countries acting on behalf of a firm established in Turkey. Ø Excise duty indicated on invoices or similar documents related to exported goods is refunded to exporter.

TAXATION: EXCISE DUTY a. Exportation exemption (Article 5) (cont’d) Ø The term “customer abroad” shall mean recipients whose domicile, place of business and legal headquarter are abroad, as well as branches in foreign countries acting on behalf of a firm established in Turkey. Ø Excise duty indicated on invoices or similar documents related to exported goods is refunded to exporter.

TAXATION: EXCISE DUTY b. Diplomatic exemption (Article 6) Ø The first acquisition and importation of goods laid down in Lists No: (I), (II) and (III) for the needs of the following persons and enterprises or deliveries to them are exempted from duty, on provision that this be done on a reciprocal basis Ø Persons and enterprises benefiting from diplomatic exemption: ü diplomatic representation and consulates of foreign countries in Turkey, ü international organizations to whom a duty exemption based on international agreements have been granted, ü their members who have diplomatic rights. Ø Goods in List No: (IV) are not subject to diplomatic exemption.

TAXATION: EXCISE DUTY b. Diplomatic exemption (Article 6) Ø The first acquisition and importation of goods laid down in Lists No: (I), (II) and (III) for the needs of the following persons and enterprises or deliveries to them are exempted from duty, on provision that this be done on a reciprocal basis Ø Persons and enterprises benefiting from diplomatic exemption: ü diplomatic representation and consulates of foreign countries in Turkey, ü international organizations to whom a duty exemption based on international agreements have been granted, ü their members who have diplomatic rights. Ø Goods in List No: (IV) are not subject to diplomatic exemption.

c. Importation exemptions (Article 7) Ø Importation of goods which are exempted and excluded from the customs duties under the following provisions of the Customs Law No: 4458 are also exempted from excise duty; ü ü Article 167, temporary import procedures, outward processing procedures, importation of goods returned.

c. Importation exemptions (Article 7) Ø Importation of goods which are exempted and excluded from the customs duties under the following provisions of the Customs Law No: 4458 are also exempted from excise duty; ü ü Article 167, temporary import procedures, outward processing procedures, importation of goods returned.

d. Supply of goods destined for export (Article 8) q The excise duty of the goods delivered to the exporters for the export purposes is assessed, accrued and then deferred by tax deferred office upon the request of taxpayers provided that the duty are not collected by these taxpayers from exporters. q Deferred duty is cancelled when these goods have been exported within 3 months as of the first day of the month following the date of delivery to the exporter.

d. Supply of goods destined for export (Article 8) q The excise duty of the goods delivered to the exporters for the export purposes is assessed, accrued and then deferred by tax deferred office upon the request of taxpayers provided that the duty are not collected by these taxpayers from exporters. q Deferred duty is cancelled when these goods have been exported within 3 months as of the first day of the month following the date of delivery to the exporter.

TAXATION: EXCISE DUTY 6. Tax deduction (Article 9) If the goods subject to excise duty are used in manufacturing of other goods in the same List, duty paid shall be deducted from due duty. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 6. Tax deduction (Article 9) If the goods subject to excise duty are used in manufacturing of other goods in the same List, duty paid shall be deducted from due duty. The Presidency of Revenue Administration

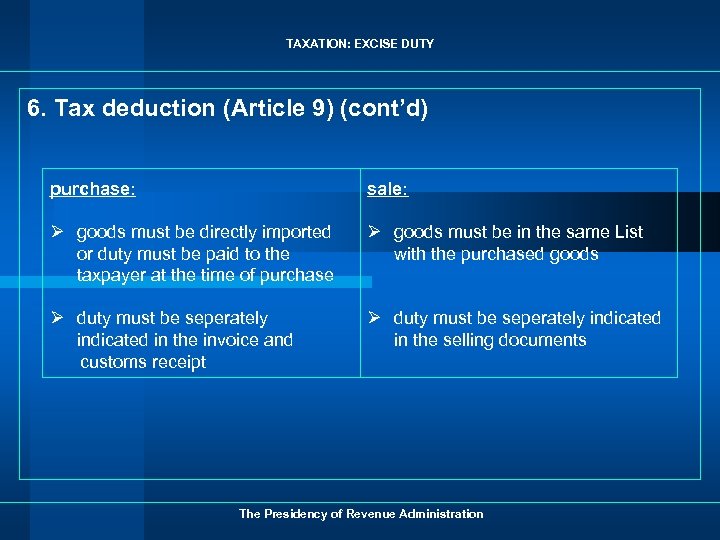

TAXATION: EXCISE DUTY 6. Tax deduction (Article 9) (cont’d) purchase: sale: Ø goods must be directly imported or duty must be paid to the taxpayer at the time of purchase Ø goods must be in the same List with the purchased goods Ø duty must be seperately indicated in the invoice and customs receipt Ø duty must be seperately indicated in the selling documents The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 6. Tax deduction (Article 9) (cont’d) purchase: sale: Ø goods must be directly imported or duty must be paid to the taxpayer at the time of purchase Ø goods must be in the same List with the purchased goods Ø duty must be seperately indicated in the invoice and customs receipt Ø duty must be seperately indicated in the selling documents The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 7. Rate or amount (Article 12) q Excise duty shall be collected on rates and/or amounts shown in Lists annexed to this Law. q The Council of Ministers is authorized to change the rates and/or amounts designated for each List annexed to the Law. q The limits of the above mentioned authorization are defined in the Law. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 7. Rate or amount (Article 12) q Excise duty shall be collected on rates and/or amounts shown in Lists annexed to this Law. q The Council of Ministers is authorized to change the rates and/or amounts designated for each List annexed to the Law. q The limits of the above mentioned authorization are defined in the Law. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 8. Declaration, assessment and payment of duty (Article 14) q Excise duty is assessed and collected upon declaration of taxpayers. q Excise duty is calculated by customs administration on importation. The duty is paid at the same time with import duties. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 8. Declaration, assessment and payment of duty (Article 14) q Excise duty is assessed and collected upon declaration of taxpayers. q Excise duty is calculated by customs administration on importation. The duty is paid at the same time with import duties. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 9. Indication of duty on documents (Article 15) q Taxpayers must separately indicate the excise duty on their sales documents. q Although there is no transaction subject to duty, the persons who indicates the duty on the documents by mistake (invoice or similar documents) are liable for declaration and payment of the duty. q This provision is also valid for taxpayers who indicates the amount higher than the duty that they have to calculate according to the Law. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 9. Indication of duty on documents (Article 15) q Taxpayers must separately indicate the excise duty on their sales documents. q Although there is no transaction subject to duty, the persons who indicates the duty on the documents by mistake (invoice or similar documents) are liable for declaration and payment of the duty. q This provision is also valid for taxpayers who indicates the amount higher than the duty that they have to calculate according to the Law. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 9. Indication of duty on documents (Article 15) (cont’d) Taxpayers who realised transactions subject to duty, can make adjustments on duties which they have debted or paid, can deduct from this duty, can claim for refund in the following conditions when, Ø the goods are returned Ø the transaction does not occur Ø the transaction is given up Ø excessive and unnecessary duty is calculated The Presidency of Revenue Administration

TAXATION: EXCISE DUTY 9. Indication of duty on documents (Article 15) (cont’d) Taxpayers who realised transactions subject to duty, can make adjustments on duties which they have debted or paid, can deduct from this duty, can claim for refund in the following conditions when, Ø the goods are returned Ø the transaction does not occur Ø the transaction is given up Ø excessive and unnecessary duty is calculated The Presidency of Revenue Administration

TAXATION: EXCISE DUTY ENERGY PRODUCTS The Presidency of Revenue Administration

TAXATION: EXCISE DUTY ENERGY PRODUCTS The Presidency of Revenue Administration

TAXATION: EXCISE DUTY CONTENT I. Legislation II. Energy products subject to duty III. Energy products not subject to duty IV. Subject of duty V. Taxable event VI. Taxpayer VII. Taxation The Presidency of Revenue Administration

TAXATION: EXCISE DUTY CONTENT I. Legislation II. Energy products subject to duty III. Energy products not subject to duty IV. Subject of duty V. Taxable event VI. Taxpayer VII. Taxation The Presidency of Revenue Administration

TAXATION: EXCISE DUTY CONTENTS (cont’d) VIII. Units of taxation IX. Tax amounts X. Joint responsibility XI. Declaration and payment of duty XII. Exemptions and reduced duty applications The Presidency of Revenue Administration

TAXATION: EXCISE DUTY CONTENTS (cont’d) VIII. Units of taxation IX. Tax amounts X. Joint responsibility XI. Declaration and payment of duty XII. Exemptions and reduced duty applications The Presidency of Revenue Administration

TAXATION: EXCISE DUTY I. LEGISLATION • Basic legislation • Related Legislation ü Law on Excise Duty No: 4760 ü Electricity Consumption Tax laid down in the Law on Municipality Revenues No: 2464 ü Cabinet Decrees ü Customs Law No: 4458. ü Communiqués on Excise Duty ü Electricity Market Law No: 4628 ü Natural Gas Market Law No: 4646 ü Petroleum Market Law No: 5015 ü LPG Market Law No: 5307 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY I. LEGISLATION • Basic legislation • Related Legislation ü Law on Excise Duty No: 4760 ü Electricity Consumption Tax laid down in the Law on Municipality Revenues No: 2464 ü Cabinet Decrees ü Customs Law No: 4458. ü Communiqués on Excise Duty ü Electricity Market Law No: 4628 ü Natural Gas Market Law No: 4646 ü Petroleum Market Law No: 5015 ü LPG Market Law No: 5307 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY II. ENERGY PRODUCTS SUBJECT TO DUTY Ø Energy products are classified in the List No: (I) annexed to Law on Excise Duty No: 4760 in Tables (A) and (B). Ø There are 130 kinds of CN Codes, 90 of which are placed in Table (A) and 40 of which are placed in Table (B). The Presidency of Revenue Administration

TAXATION: EXCISE DUTY II. ENERGY PRODUCTS SUBJECT TO DUTY Ø Energy products are classified in the List No: (I) annexed to Law on Excise Duty No: 4760 in Tables (A) and (B). Ø There are 130 kinds of CN Codes, 90 of which are placed in Table (A) and 40 of which are placed in Table (B). The Presidency of Revenue Administration

TAXATION: EXCISE DUTY II. ENERGY PRODUCTS SUBJECT TO DUTY (cont’d) THE LIST NO: I (A) TABLE - Petrol - Diesel - Fuel oil - Natural Gas - LPG (B) TABLE - Solvents - Thinner - Mineral Oils (lubricating oils) The Presidency of Revenue Administration

TAXATION: EXCISE DUTY II. ENERGY PRODUCTS SUBJECT TO DUTY (cont’d) THE LIST NO: I (A) TABLE - Petrol - Diesel - Fuel oil - Natural Gas - LPG (B) TABLE - Solvents - Thinner - Mineral Oils (lubricating oils) The Presidency of Revenue Administration

TAXATION: EXCISE DUTY III. ENERGY PRODUCTS NOT SUBJECT TO DUTY q Coal and coke, and electricity are not in the scope of Law on Excise Duty No: 4760, although, they are among the energy products listed in the Article 4 of the Directive No: 2003/96/EC. q Coal and coke are only subject to VAT and electricity is subject to both VAT and Electricity Consumption Tax regulated in the Law on Municipality Revenues No: 2464 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY III. ENERGY PRODUCTS NOT SUBJECT TO DUTY q Coal and coke, and electricity are not in the scope of Law on Excise Duty No: 4760, although, they are among the energy products listed in the Article 4 of the Directive No: 2003/96/EC. q Coal and coke are only subject to VAT and electricity is subject to both VAT and Electricity Consumption Tax regulated in the Law on Municipality Revenues No: 2464 The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. SUBJECT OF DUTY (ARTICLE 1) q Delivery of goods laid down in the List No: (I) by their importers or producers (including refineries), q Sale of the goods laid down in the List No: (I) by public auction which have not been subject to excise duty q is subject to excise duty only for once. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. SUBJECT OF DUTY (ARTICLE 1) q Delivery of goods laid down in the List No: (I) by their importers or producers (including refineries), q Sale of the goods laid down in the List No: (I) by public auction which have not been subject to excise duty q is subject to excise duty only for once. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. TAXABLE EVENT (ARTICLE 3) q For the goods laid down in the List No: (I) taxable event does not occur at the stage of importation but at domestic delivery of goods. q According to the Article 16 of the Law, for the goods in List (I), at the stage of importation, guarantee is required for the corresponding duty which becomes payable in Turkey. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. TAXABLE EVENT (ARTICLE 3) q For the goods laid down in the List No: (I) taxable event does not occur at the stage of importation but at domestic delivery of goods. q According to the Article 16 of the Law, for the goods in List (I), at the stage of importation, guarantee is required for the corresponding duty which becomes payable in Turkey. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. TAXABLE EVENT (ARTICLE 3) (cont’d) When the goods incompliant with the standards which are confiscated on the border gates are delivered to the refineries by the public authority, taxable event does not occur at this stage, but at the deliveries of them to the refineries. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY V. TAXABLE EVENT (ARTICLE 3) (cont’d) When the goods incompliant with the standards which are confiscated on the border gates are delivered to the refineries by the public authority, taxable event does not occur at this stage, but at the deliveries of them to the refineries. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY VI. TAXPAYER (ARTICLE 4) ü Producers and importers of the goods in List No: (I), ü Persons carrying out the sale of these products by auction. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY VI. TAXPAYER (ARTICLE 4) ü Producers and importers of the goods in List No: (I), ü Persons carrying out the sale of these products by auction. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY VII. TAXATION ü Proportional excise duty is not applied to goods laid down in the List No: (I). ü Instead, specific tax is collected from these goods on declared tax amounts. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY VII. TAXATION ü Proportional excise duty is not applied to goods laid down in the List No: (I). ü Instead, specific tax is collected from these goods on declared tax amounts. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY VIII. UNITS OF TAXATION (ARTICLE 11) q The specific excise duty amounts determined for goods in the List No: (I) can be defined with: Ø kilogram Ø liter Ø meter cube Ø standard meter cube Ø kilo calorie their sub and over units and if necessary can be defined as containers, wraps or units considering their greatness. q The Council of the Ministers is authorised to change the units of taxation according to the type of goods. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY VIII. UNITS OF TAXATION (ARTICLE 11) q The specific excise duty amounts determined for goods in the List No: (I) can be defined with: Ø kilogram Ø liter Ø meter cube Ø standard meter cube Ø kilo calorie their sub and over units and if necessary can be defined as containers, wraps or units considering their greatness. q The Council of the Ministers is authorised to change the units of taxation according to the type of goods. The Presidency of Revenue Administration

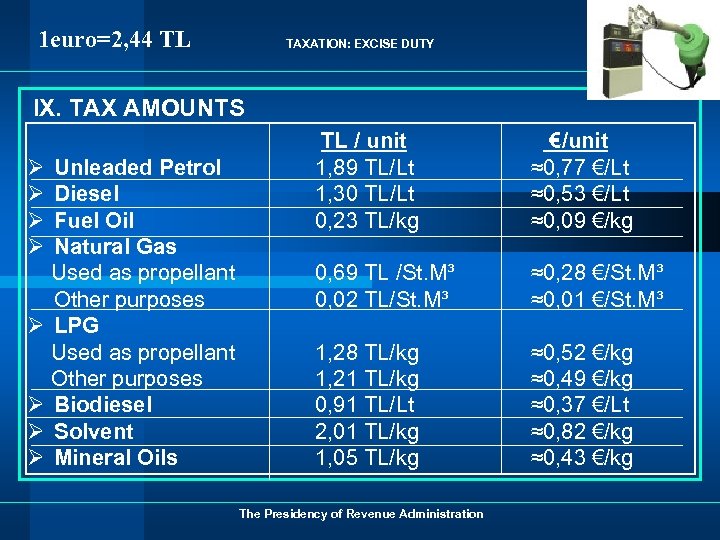

1 euro=2, 44 TL TAXATION: EXCISE DUTY IX. TAX AMOUNTS Ø Unleaded Petrol Ø Diesel Ø Fuel Oil Ø Natural Gas Used as propellant Other purposes Ø LPG Used as propellant Other purposes Ø Biodiesel Ø Solvent Ø Mineral Oils TL / unit 1, 89 TL/Lt 1, 30 TL/Lt 0, 23 TL/kg €/unit ≈0, 77 €/Lt ≈0, 53 €/Lt ≈0, 09 €/kg 0, 69 TL /St. M³ 0, 02 TL/St. M³ ≈0, 28 €/St. M³ ≈0, 01 €/St. M³ 1, 28 TL/kg 1, 21 TL/kg 0, 91 TL/Lt 2, 01 TL/kg 1, 05 TL/kg ≈0, 52 €/kg ≈0, 49 €/kg ≈0, 37 €/Lt ≈0, 82 €/kg ≈0, 43 €/kg The Presidency of Revenue Administration

1 euro=2, 44 TL TAXATION: EXCISE DUTY IX. TAX AMOUNTS Ø Unleaded Petrol Ø Diesel Ø Fuel Oil Ø Natural Gas Used as propellant Other purposes Ø LPG Used as propellant Other purposes Ø Biodiesel Ø Solvent Ø Mineral Oils TL / unit 1, 89 TL/Lt 1, 30 TL/Lt 0, 23 TL/kg €/unit ≈0, 77 €/Lt ≈0, 53 €/Lt ≈0, 09 €/kg 0, 69 TL /St. M³ 0, 02 TL/St. M³ ≈0, 28 €/St. M³ ≈0, 01 €/St. M³ 1, 28 TL/kg 1, 21 TL/kg 0, 91 TL/Lt 2, 01 TL/kg 1, 05 TL/kg ≈0, 52 €/kg ≈0, 49 €/kg ≈0, 37 €/Lt ≈0, 82 €/kg ≈0, 43 €/kg The Presidency of Revenue Administration

TAXATION: EXCISE DUTY X. JOINT RESPONSIBILITY (ARTICLE 13) q The refineries producing the goods in the List No: (I) as contract manufacturing, q The persons using goods in the List No: (I), as the goods subject to higher amounts of duty, or those selling them at these higher amounts to the third parties, have joint responsibility. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY X. JOINT RESPONSIBILITY (ARTICLE 13) q The refineries producing the goods in the List No: (I) as contract manufacturing, q The persons using goods in the List No: (I), as the goods subject to higher amounts of duty, or those selling them at these higher amounts to the third parties, have joint responsibility. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY X. JOINT RESPONSIBILITY (ARTICLE 13) (cont’d) Example; q Tax differentiation is applied for natural gas by taking account of its utilization places. Natural gas Tax amount/unit - used as propellant 0, 52 €/St. M³ - others 0, 49 €/St. M³ q If the persons buy the natural gas with the lower amount of duty but use it as a good subject to higher amount of duty because of its utilisation purpose, they must pay the duty difference. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY X. JOINT RESPONSIBILITY (ARTICLE 13) (cont’d) Example; q Tax differentiation is applied for natural gas by taking account of its utilization places. Natural gas Tax amount/unit - used as propellant 0, 52 €/St. M³ - others 0, 49 €/St. M³ q If the persons buy the natural gas with the lower amount of duty but use it as a good subject to higher amount of duty because of its utilisation purpose, they must pay the duty difference. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY XI. DECLARATION AND PAYMENT OF DUTY (Article 14) q There are two taxation periods in a month. The first taxation period is the first 15 days of each month and the second taxation period is the remaining part of the month. q Excise duty return is submitted to the tax office by the end of the 10 th day following the end of the taxation period and payment should be done in the same period. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY XI. DECLARATION AND PAYMENT OF DUTY (Article 14) q There are two taxation periods in a month. The first taxation period is the first 15 days of each month and the second taxation period is the remaining part of the month. q Excise duty return is submitted to the tax office by the end of the 10 th day following the end of the taxation period and payment should be done in the same period. The Presidency of Revenue Administration

TAXATION: EXCISE DUTY XII. EXEMPTIONS AND REDUCED DUTY APPLICATIONS 1. Common exemptions - exportation exemption - diplomatic exemptions - importation exemptions - supply of goods destined for export 2. Energy products delivered to the armed forces 3. Energy products used for petroleum exploration and production activities 4. Free of charge delivery of the goods which have been disposed according to the Customs Law to the public institutions in case of disasters, infectious diseases and similar circumstances 5. Exemption on diesel for the vehicles leaving Turkey for export The Presidency of Revenue Administration

TAXATION: EXCISE DUTY XII. EXEMPTIONS AND REDUCED DUTY APPLICATIONS 1. Common exemptions - exportation exemption - diplomatic exemptions - importation exemptions - supply of goods destined for export 2. Energy products delivered to the armed forces 3. Energy products used for petroleum exploration and production activities 4. Free of charge delivery of the goods which have been disposed according to the Customs Law to the public institutions in case of disasters, infectious diseases and similar circumstances 5. Exemption on diesel for the vehicles leaving Turkey for export The Presidency of Revenue Administration

TAXATION: EXCISE DUTY XII. EXEMPTIONS AND REDUCED DUTY APPLICATIONS (cont’d) 6. Deferment and cancellation 7. Tax reduction for the Table (B) of the List No: (1) 8. Tax reduction in the fuels of sea vehicles 9. Tax reduction in the delivery of base oil 10. Tax reduction application in delivery of petrol with bioethanol 11. Tax reduction application in biodiesel The Presidency of Revenue Administration

TAXATION: EXCISE DUTY XII. EXEMPTIONS AND REDUCED DUTY APPLICATIONS (cont’d) 6. Deferment and cancellation 7. Tax reduction for the Table (B) of the List No: (1) 8. Tax reduction in the fuels of sea vehicles 9. Tax reduction in the delivery of base oil 10. Tax reduction application in delivery of petrol with bioethanol 11. Tax reduction application in biodiesel The Presidency of Revenue Administration

Thank you for your attention 50

Thank you for your attention 50