1fea0c3c7586df6d86828baa29e57a16.ppt

- Количество слайдов: 34

Exchanges, Clearing, Settlement and TARGET 2 Securities De Nederlandsche Bank Michael van Doeveren Richard Derksen Financial Sector of Macedonia Conference on Payments and Securities Settlement Systems Ohrid 24 June 2008 De Nederlandsche Bank Eurosysteem

Exchanges, Clearing, Settlement and TARGET 2 Securities De Nederlandsche Bank Michael van Doeveren Richard Derksen Financial Sector of Macedonia Conference on Payments and Securities Settlement Systems Ohrid 24 June 2008 De Nederlandsche Bank Eurosysteem

Agenda l The world of securities and exchanges l Risks in clearing and settlement of securities l TARGET 2 Securities and CCBM 2 De Nederlandsche Bank Eurosysteem

Agenda l The world of securities and exchanges l Risks in clearing and settlement of securities l TARGET 2 Securities and CCBM 2 De Nederlandsche Bank Eurosysteem

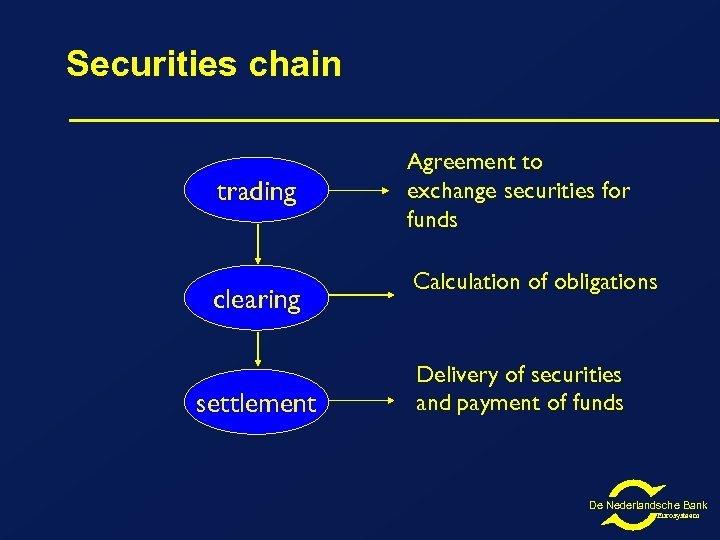

Securities chain trading clearing settlement Agreement to exchange securities for funds Calculation of obligations Delivery of securities and payment of funds De Nederlandsche Bank Eurosysteem

Securities chain trading clearing settlement Agreement to exchange securities for funds Calculation of obligations Delivery of securities and payment of funds De Nederlandsche Bank Eurosysteem

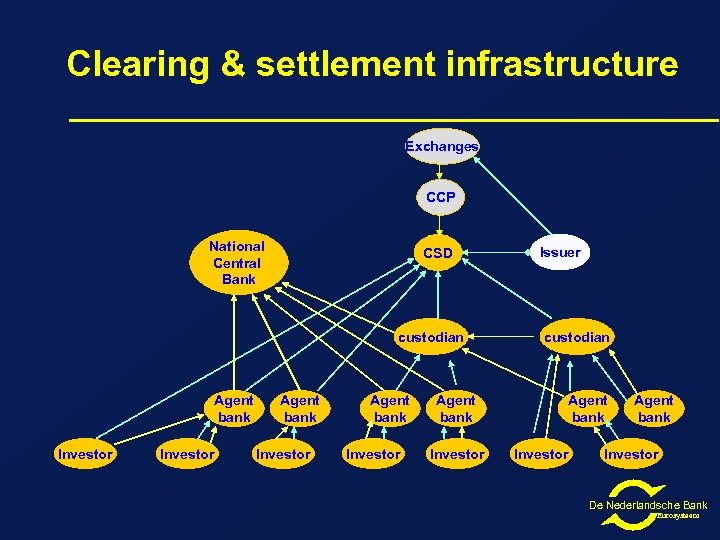

Clearing & settlement infrastructure Exchanges CCP National Central Bank CSD custodian Agent bank Investor Agent bank Investor Issuer custodian Agent bank Investor De Nederlandsche Bank Eurosysteem

Clearing & settlement infrastructure Exchanges CCP National Central Bank CSD custodian Agent bank Investor Agent bank Investor Issuer custodian Agent bank Investor De Nederlandsche Bank Eurosysteem

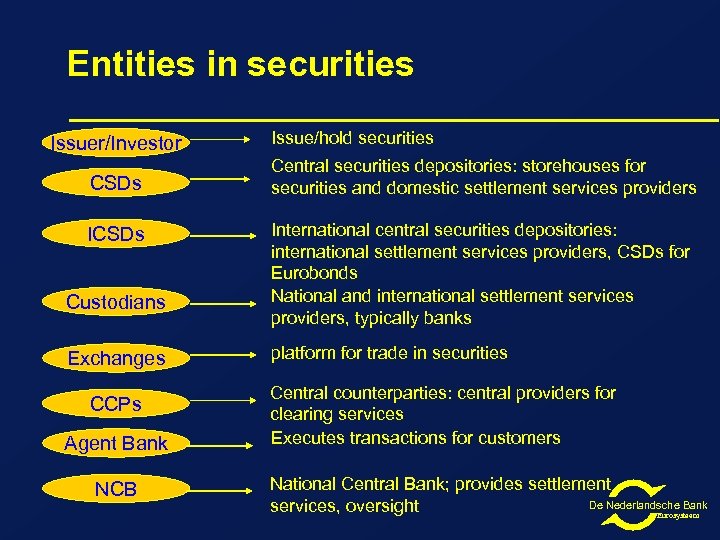

Entities in securities Issuer/Investor CSDs ICSDs Custodians Exchanges CCPs Agent Bank NCB Issue/hold securities Central securities depositories: storehouses for securities and domestic settlement services providers International central securities depositories: international settlement services providers, CSDs for Eurobonds National and international settlement services providers, typically banks platform for trade in securities Central counterparties: central providers for clearing services Executes transactions for customers National Central Bank; provides settlement De Nederlandsche Bank services, oversight Eurosysteem

Entities in securities Issuer/Investor CSDs ICSDs Custodians Exchanges CCPs Agent Bank NCB Issue/hold securities Central securities depositories: storehouses for securities and domestic settlement services providers International central securities depositories: international settlement services providers, CSDs for Eurobonds National and international settlement services providers, typically banks platform for trade in securities Central counterparties: central providers for clearing services Executes transactions for customers National Central Bank; provides settlement De Nederlandsche Bank services, oversight Eurosysteem

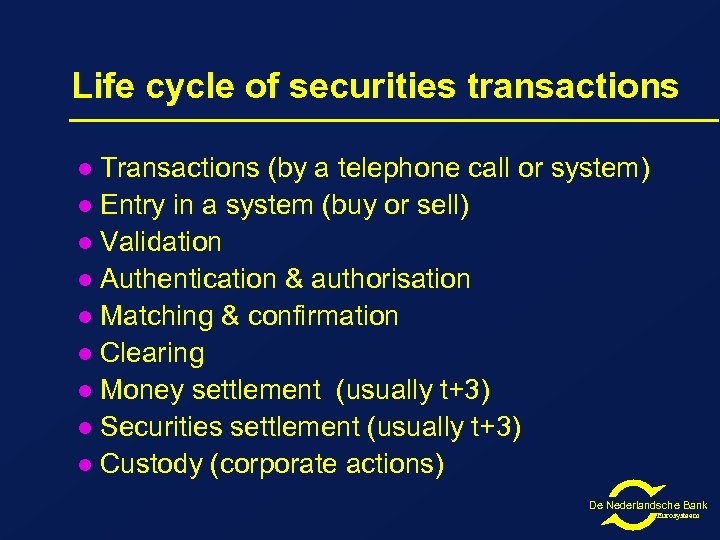

Life cycle of securities transactions Transactions (by a telephone call or system) l Entry in a system (buy or sell) l Validation l Authentication & authorisation l Matching & confirmation l Clearing l Money settlement (usually t+3) l Securities settlement (usually t+3) l Custody (corporate actions) l De Nederlandsche Bank Eurosysteem

Life cycle of securities transactions Transactions (by a telephone call or system) l Entry in a system (buy or sell) l Validation l Authentication & authorisation l Matching & confirmation l Clearing l Money settlement (usually t+3) l Securities settlement (usually t+3) l Custody (corporate actions) l De Nederlandsche Bank Eurosysteem

Risks in clearing and settlement of securities credit risk: • replacement cost risk • principal risk legal risk liquidity risk custody risk Risks operational risk of settlement bank failure systemic risk De Nederlandsche Bank Eurosysteem

Risks in clearing and settlement of securities credit risk: • replacement cost risk • principal risk legal risk liquidity risk custody risk Risks operational risk of settlement bank failure systemic risk De Nederlandsche Bank Eurosysteem

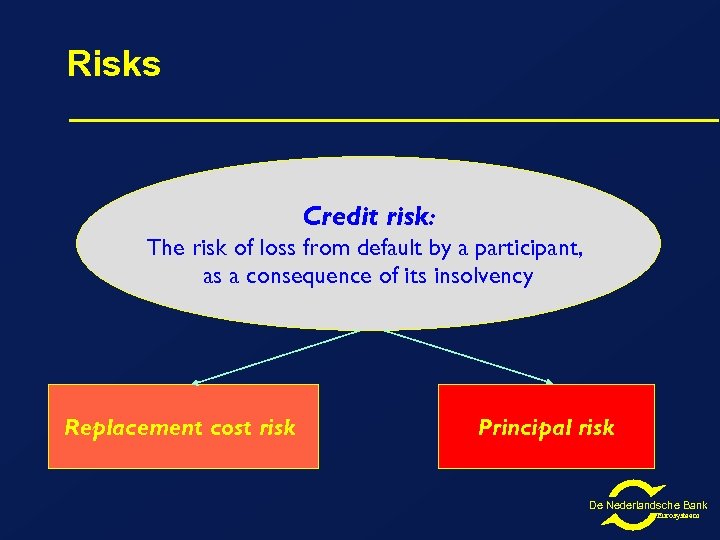

Risks Credit risk: The risk of loss from default by a participant, as a consequence of its insolvency Replacement cost risk Principal risk De Nederlandsche Bank Eurosysteem

Risks Credit risk: The risk of loss from default by a participant, as a consequence of its insolvency Replacement cost risk Principal risk De Nederlandsche Bank Eurosysteem

Risks Principal risk l l Risk that full value of securities or funds will be lost when either the seller or buyer fails to settle Can be eliminated by Delivery versus Payment De Nederlandsche Bank Eurosysteem

Risks Principal risk l l Risk that full value of securities or funds will be lost when either the seller or buyer fails to settle Can be eliminated by Delivery versus Payment De Nederlandsche Bank Eurosysteem

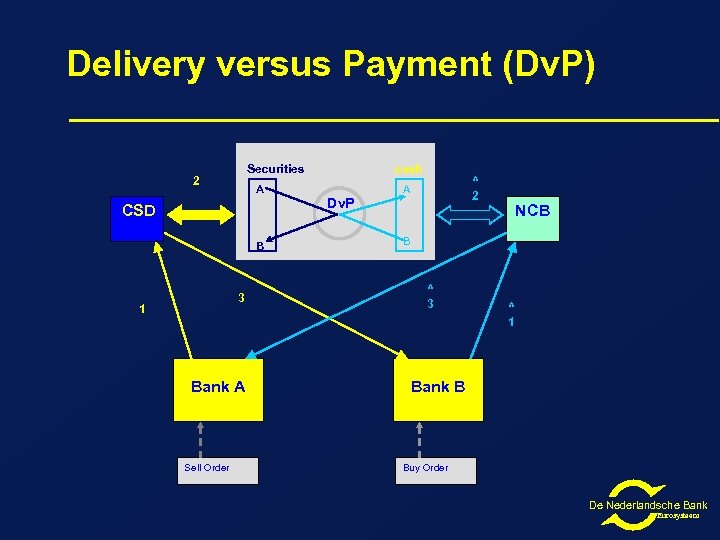

Delivery versus Payment (Dv. P) Securities 2 A CSD B 3 1 Bank A Sell Order cash Dv. P ^ 2 A NCB B ^ 3 ^ 1 Bank B Buy Order De Nederlandsche Bank Eurosysteem

Delivery versus Payment (Dv. P) Securities 2 A CSD B 3 1 Bank A Sell Order cash Dv. P ^ 2 A NCB B ^ 3 ^ 1 Bank B Buy Order De Nederlandsche Bank Eurosysteem

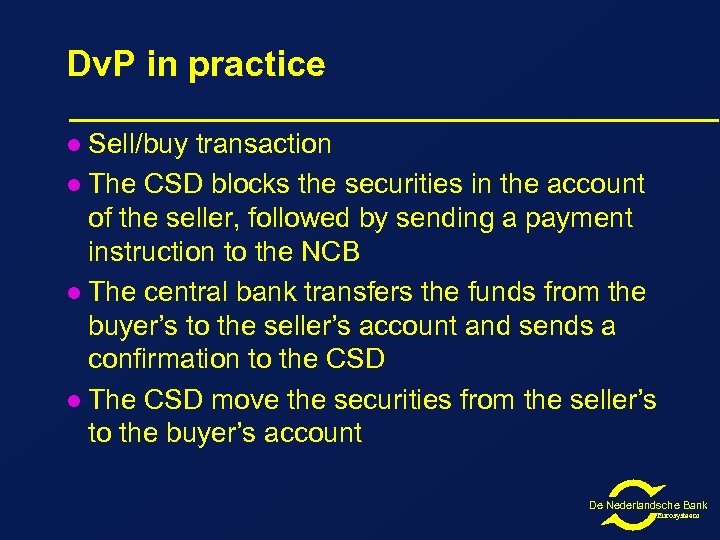

Dv. P in practice Sell/buy transaction l The CSD blocks the securities in the account of the seller, followed by sending a payment instruction to the NCB l The central bank transfers the funds from the buyer’s to the seller’s account and sends a confirmation to the CSD l The CSD move the securities from the seller’s to the buyer’s account l De Nederlandsche Bank Eurosysteem

Dv. P in practice Sell/buy transaction l The CSD blocks the securities in the account of the seller, followed by sending a payment instruction to the NCB l The central bank transfers the funds from the buyer’s to the seller’s account and sends a confirmation to the CSD l The CSD move the securities from the seller’s to the buyer’s account l De Nederlandsche Bank Eurosysteem

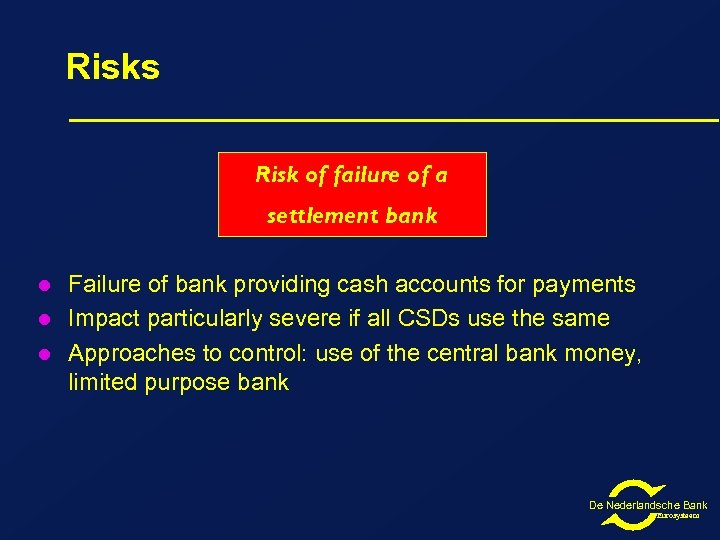

Risks Risk of failure of a settlement bank l l l Failure of bank providing cash accounts for payments Impact particularly severe if all CSDs use the same Approaches to control: use of the central bank money, limited purpose bank De Nederlandsche Bank Eurosysteem

Risks Risk of failure of a settlement bank l l l Failure of bank providing cash accounts for payments Impact particularly severe if all CSDs use the same Approaches to control: use of the central bank money, limited purpose bank De Nederlandsche Bank Eurosysteem

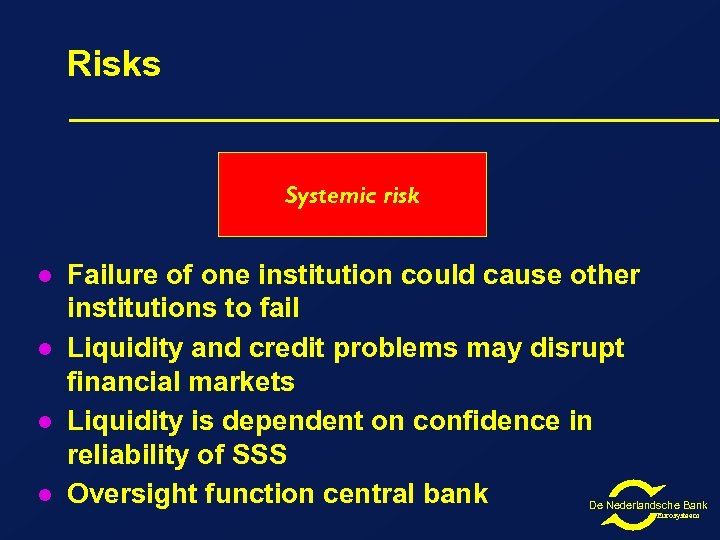

Risks Systemic risk l l Failure of one institution could cause other institutions to fail Liquidity and credit problems may disrupt financial markets Liquidity is dependent on confidence in reliability of SSS Oversight function central bank De Nederlandsche Bank Eurosysteem

Risks Systemic risk l l Failure of one institution could cause other institutions to fail Liquidity and credit problems may disrupt financial markets Liquidity is dependent on confidence in reliability of SSS Oversight function central bank De Nederlandsche Bank Eurosysteem

European developments Lisbon agenda 2000: European economy has to become stronger to compete with the USA and Japan/China l Shortage: there is no integrated European financial market l European Union has identified 15 barriers for integration (Giovannini 2001) § Technical, market practices (10) § Legal and fiscal barriers (5) l De Nederlandsche Bank Eurosysteem

European developments Lisbon agenda 2000: European economy has to become stronger to compete with the USA and Japan/China l Shortage: there is no integrated European financial market l European Union has identified 15 barriers for integration (Giovannini 2001) § Technical, market practices (10) § Legal and fiscal barriers (5) l De Nederlandsche Bank Eurosysteem

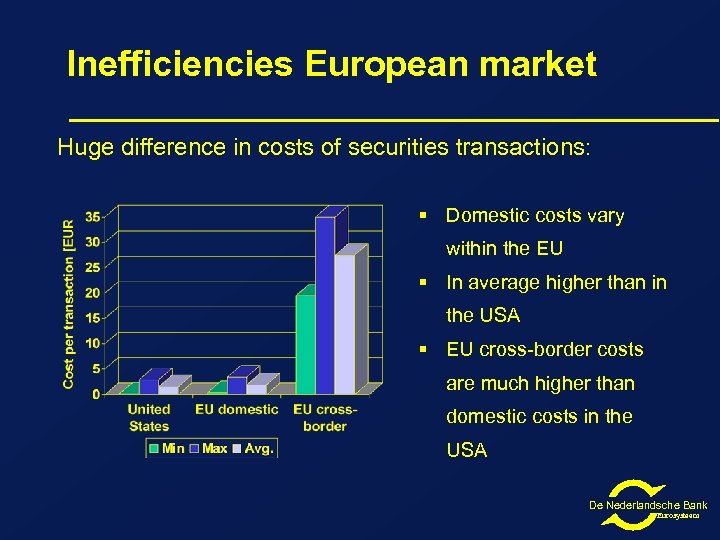

Inefficiencies European market Huge difference in costs of securities transactions: § Domestic costs vary within the EU § In average higher than in the USA § EU cross-border costs are much higher than domestic costs in the USA De Nederlandsche Bank Eurosysteem

Inefficiencies European market Huge difference in costs of securities transactions: § Domestic costs vary within the EU § In average higher than in the USA § EU cross-border costs are much higher than domestic costs in the USA De Nederlandsche Bank Eurosysteem

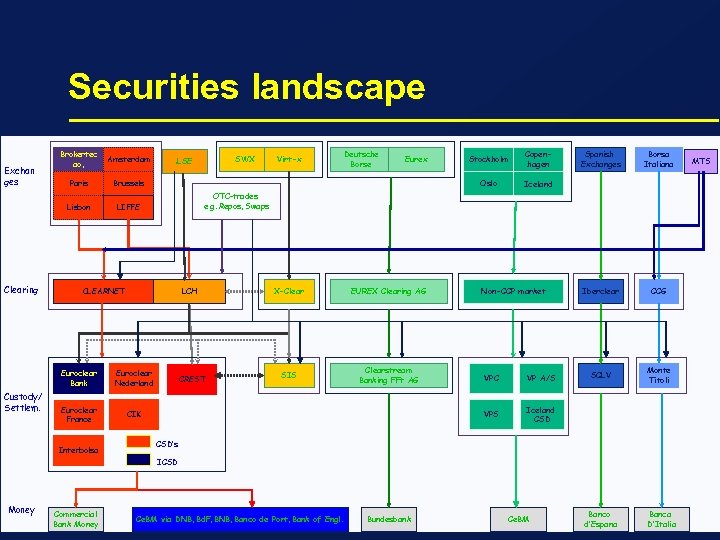

Securities landscape Exchan ges Brokertec ao, Amsterdam Paris Brussels Lisbon Clearing Custody/ Settlem. CLEARNET LCH Euroclear Nederland Euroclear France Deutsche Borse Eurex X-Clear EUREX Clearing AG SIS Clearstream Banking FFt AG CIK Interbolsa Copenhagen Spanish Exchanges Borsa Italiana Iberclear CCG SCLV Monte Titoli Iceland MTS OTC-trades e. g. Repos, Swaps LIFFE Euroclear Bank Virt-x Stockholm Oslo SWX LSE Non-CCP market VPC VP A/S VPS CREST Iceland CSD’s ICSD Money Commercial Bank Money De Nederlandsche Bank Ce. BM via DNB, Bd. F, BNB, Banco de Port, Bank of Engl. Bundesbank Ce. BM Banco d’Espana Banca Eurosysteem D’Italia

Securities landscape Exchan ges Brokertec ao, Amsterdam Paris Brussels Lisbon Clearing Custody/ Settlem. CLEARNET LCH Euroclear Nederland Euroclear France Deutsche Borse Eurex X-Clear EUREX Clearing AG SIS Clearstream Banking FFt AG CIK Interbolsa Copenhagen Spanish Exchanges Borsa Italiana Iberclear CCG SCLV Monte Titoli Iceland MTS OTC-trades e. g. Repos, Swaps LIFFE Euroclear Bank Virt-x Stockholm Oslo SWX LSE Non-CCP market VPC VP A/S VPS CREST Iceland CSD’s ICSD Money Commercial Bank Money De Nederlandsche Bank Ce. BM via DNB, Bd. F, BNB, Banco de Port, Bank of Engl. Bundesbank Ce. BM Banco d’Espana Banca Eurosysteem D’Italia

Integration & consolidation Financial integration for all market participants: • Equal access • Uniformal set of rules • Treatment in an equal way Consolidation means a less number of service providers De Nederlandsche Bank Eurosysteem

Integration & consolidation Financial integration for all market participants: • Equal access • Uniformal set of rules • Treatment in an equal way Consolidation means a less number of service providers De Nederlandsche Bank Eurosysteem

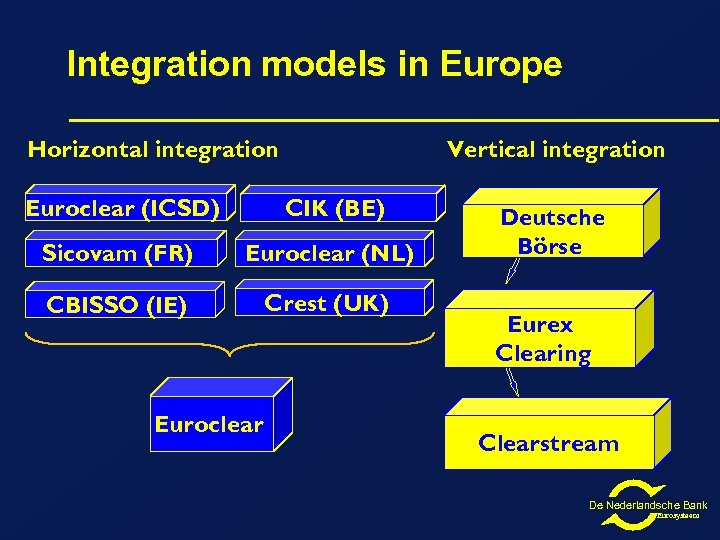

Integration models in Europe Horizontal integration Vertical integration Euroclear (ICSD) CIK (BE) Sicovam (FR) Euroclear (NL) CBISSO (IE) Crest (UK) Euroclear Deutsche Börse Eurex Clearing Clearstream De Nederlandsche Bank Eurosysteem

Integration models in Europe Horizontal integration Vertical integration Euroclear (ICSD) CIK (BE) Sicovam (FR) Euroclear (NL) CBISSO (IE) Crest (UK) Euroclear Deutsche Börse Eurex Clearing Clearstream De Nederlandsche Bank Eurosysteem

Dynamics in the securities market Market integration, level playing field and harmonisation l Consolidation of exchanges and SSSs in the market goes full speed on l Markets in Financial Instruments Directive l Code of Conduct for Clearing and Settlement l CESAME Group to lift technical, market practices Giovannini barriers l Internalisation: huge banks settle transactions internally l De Nederlandsche Bank Eurosysteem

Dynamics in the securities market Market integration, level playing field and harmonisation l Consolidation of exchanges and SSSs in the market goes full speed on l Markets in Financial Instruments Directive l Code of Conduct for Clearing and Settlement l CESAME Group to lift technical, market practices Giovannini barriers l Internalisation: huge banks settle transactions internally l De Nederlandsche Bank Eurosysteem

Risks Replacement cost risk l l l Risk of loss of unrealised gains Due to price changes between trade and settlement Exposure depends on price validility and time gap between trade settlement (e. i. t+3) De Nederlandsche Bank Eurosysteem

Risks Replacement cost risk l l l Risk of loss of unrealised gains Due to price changes between trade and settlement Exposure depends on price validility and time gap between trade settlement (e. i. t+3) De Nederlandsche Bank Eurosysteem

Risks Liquidity risk l l l Risk that counterparty will not settle an obligation when due Costs depend on degree of liquidity Potential to create systemic problems De Nederlandsche Bank Eurosysteem

Risks Liquidity risk l l l Risk that counterparty will not settle an obligation when due Costs depend on degree of liquidity Potential to create systemic problems De Nederlandsche Bank Eurosysteem

Risks Custody risk l l l Risks that securities are not adequately protected by the custodians Either full loss or temporary inability to transfer securities Segregation of accounts De Nederlandsche Bank Eurosysteem

Risks Custody risk l l l Risks that securities are not adequately protected by the custodians Either full loss or temporary inability to transfer securities Segregation of accounts De Nederlandsche Bank Eurosysteem

Risks Operational risk l Due to deficiencies in systems and controls, human error or management failure Legal risk l Due to uncertain legal rules (unenforceability of contracts, bankruptcy laws, delay in recovering funds or securities) De Nederlandsche Bank Eurosysteem

Risks Operational risk l Due to deficiencies in systems and controls, human error or management failure Legal risk l Due to uncertain legal rules (unenforceability of contracts, bankruptcy laws, delay in recovering funds or securities) De Nederlandsche Bank Eurosysteem

TARGET 2 Securities l An integrated platform of the Eurosystem for the DVP settlement of securities transactions in central bank money within the euro area De Nederlandsche Bank Eurosysteem

TARGET 2 Securities l An integrated platform of the Eurosystem for the DVP settlement of securities transactions in central bank money within the euro area De Nederlandsche Bank Eurosysteem

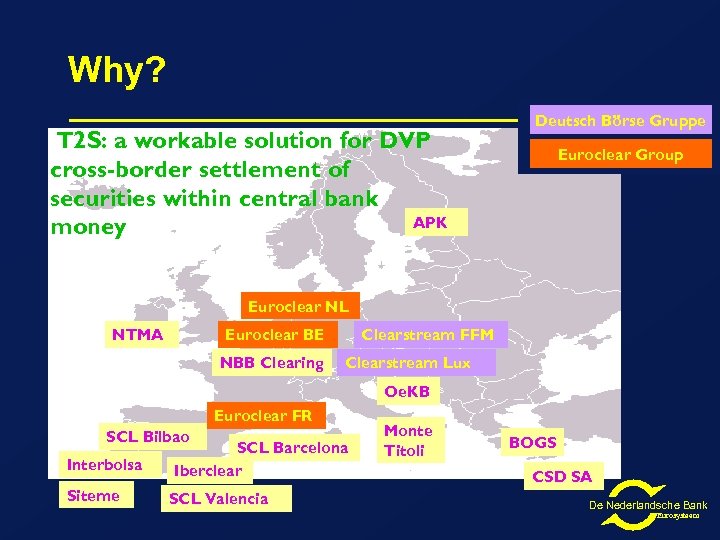

Why? The current initiatives: T 2 S: a workable solution for DVP cross-border settlement of securities within central bank APK money Deutsch Börse Gruppe Euroclear Group Euroclear NL NTMA Euroclear BE NBB Clearing Clearstream FFM Clearstream Lux Oe. KB Euroclear FR SCL Bilbao Interbolsa Siteme SCL Barcelona Iberclear SCL Valencia Monte Titoli BOGS CSD SA De Nederlandsche Bank Eurosysteem

Why? The current initiatives: T 2 S: a workable solution for DVP cross-border settlement of securities within central bank APK money Deutsch Börse Gruppe Euroclear Group Euroclear NL NTMA Euroclear BE NBB Clearing Clearstream FFM Clearstream Lux Oe. KB Euroclear FR SCL Bilbao Interbolsa Siteme SCL Barcelona Iberclear SCL Valencia Monte Titoli BOGS CSD SA De Nederlandsche Bank Eurosysteem

Why? l. The model can offer advantages in terms of efficiency and cost-cutting, provided that a critical mass of CSDs actually joins and the system can be developed at reasonable cost. l. It would benefit financial stability De Nederlandsche Bank Eurosysteem

Why? l. The model can offer advantages in terms of efficiency and cost-cutting, provided that a critical mass of CSDs actually joins and the system can be developed at reasonable cost. l. It would benefit financial stability De Nederlandsche Bank Eurosysteem

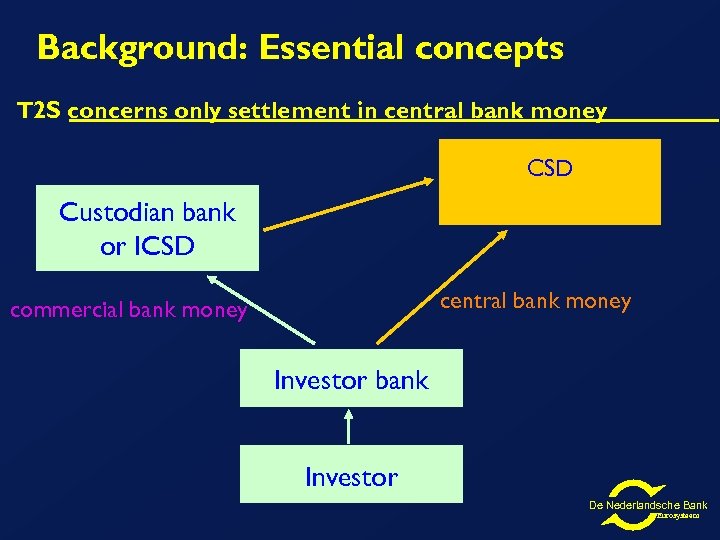

Background: Essential concepts T 2 S concerns only settlement in central bank money CSD Custodian bank or ICSD central bank money commercial bank money Investor bank Investor De Nederlandsche Bank Eurosysteem

Background: Essential concepts T 2 S concerns only settlement in central bank money CSD Custodian bank or ICSD central bank money commercial bank money Investor bank Investor De Nederlandsche Bank Eurosysteem

Traditional roles in securities market EXCHANGE LISTING TRADING CLEARING CCP HOUSE CLEARING CENTRAL BANK CSD SETTLEMENT ISSUER CSD INVESTOR CSD CASH CLEARING BANK & BROKER INVESTOR De Nederlandsche Bank Eurosysteem

Traditional roles in securities market EXCHANGE LISTING TRADING CLEARING CCP HOUSE CLEARING CENTRAL BANK CSD SETTLEMENT ISSUER CSD INVESTOR CSD CASH CLEARING BANK & BROKER INVESTOR De Nederlandsche Bank Eurosysteem

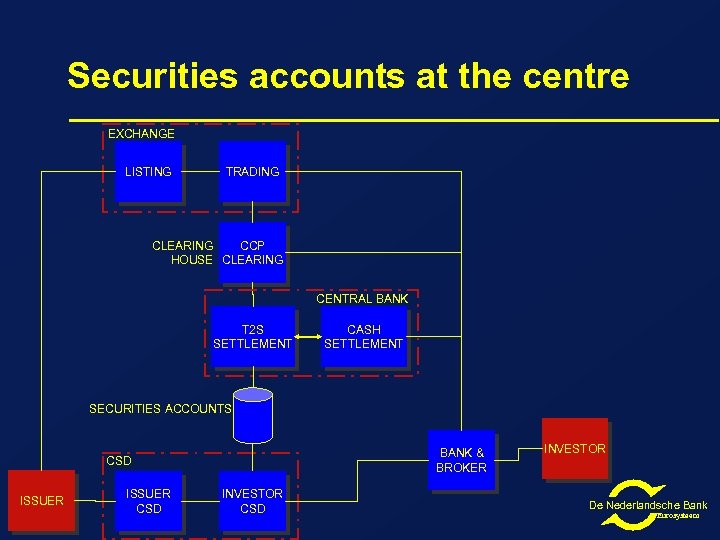

Securities accounts at the centre EXCHANGE LISTING TRADING CLEARING CCP HOUSE CLEARING CENTRAL BANK T 2 S SETTLEMENT CASH SETTLEMENT SECURITIES ACCOUNTS BANK & BROKER CSD ISSUER CSD INVESTOR De Nederlandsche Bank Eurosysteem

Securities accounts at the centre EXCHANGE LISTING TRADING CLEARING CCP HOUSE CLEARING CENTRAL BANK T 2 S SETTLEMENT CASH SETTLEMENT SECURITIES ACCOUNTS BANK & BROKER CSD ISSUER CSD INVESTOR De Nederlandsche Bank Eurosysteem

How? l l The CSDs outsource the administration of securities accounts to the Eurosystem, which then manages the securities and associated cash accounts on the platform. At the end of the day the money goes back into the TARGET 2 payment system, and the securities return to the CSDs Only securities settlement, CSDs keep the custody and notary functions Based on DVP De Nederlandsche Bank Eurosysteem

How? l l The CSDs outsource the administration of securities accounts to the Eurosystem, which then manages the securities and associated cash accounts on the platform. At the end of the day the money goes back into the TARGET 2 payment system, and the securities return to the CSDs Only securities settlement, CSDs keep the custody and notary functions Based on DVP De Nederlandsche Bank Eurosysteem

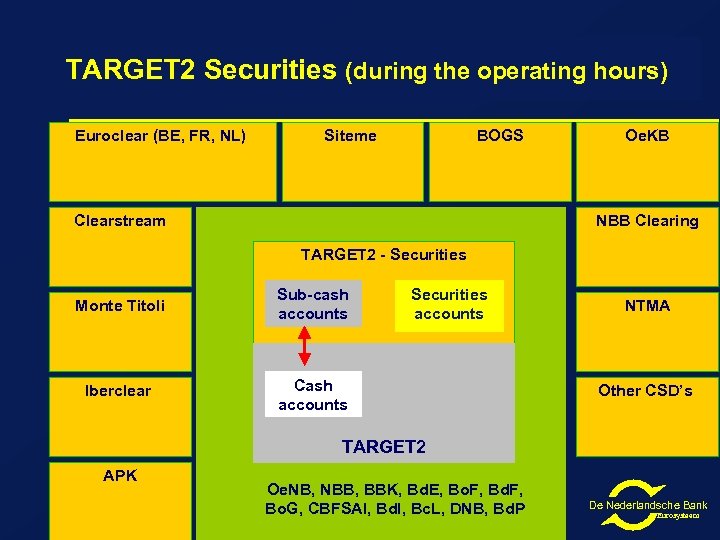

TARGET 2 Securities (during the operating hours) Euroclear (BE, FR, NL) Siteme BOGS Clearstream Oe. KB NBB Clearing TARGET 2 - Securities Monte Titoli Sub-cash accounts Iberclear Securities accounts Cash accounts NTMA Other CSD’s TARGET 2 APK Oe. NB, NBB, BBK, Bd. E, Bo. F, Bd. F, Bo. G, CBFSAI, Bd. I, Bc. L, DNB, Bd. P De Nederlandsche Bank Eurosysteem

TARGET 2 Securities (during the operating hours) Euroclear (BE, FR, NL) Siteme BOGS Clearstream Oe. KB NBB Clearing TARGET 2 - Securities Monte Titoli Sub-cash accounts Iberclear Securities accounts Cash accounts NTMA Other CSD’s TARGET 2 APK Oe. NB, NBB, BBK, Bd. E, Bo. F, Bd. F, Bo. G, CBFSAI, Bd. I, Bc. L, DNB, Bd. P De Nederlandsche Bank Eurosysteem

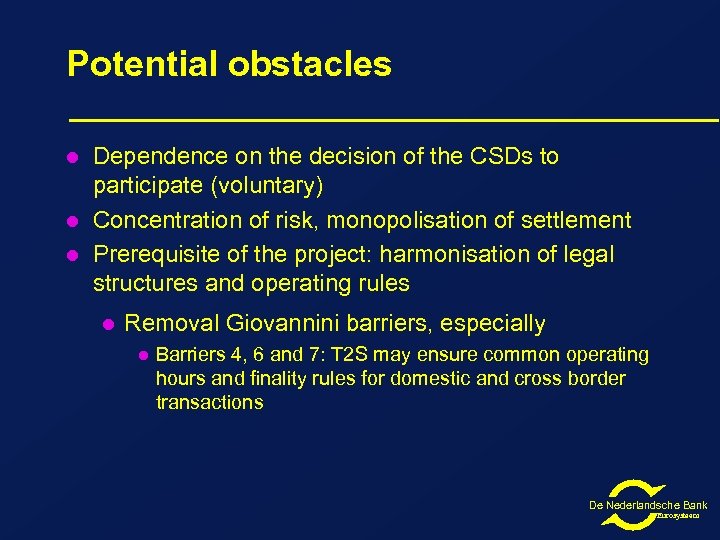

Potential obstacles l l l Dependence on the decision of the CSDs to participate (voluntary) Concentration of risk, monopolisation of settlement Prerequisite of the project: harmonisation of legal structures and operating rules l Removal Giovannini barriers, especially l Barriers 4, 6 and 7: T 2 S may ensure common operating hours and finality rules for domestic and cross border transactions De Nederlandsche Bank Eurosysteem

Potential obstacles l l l Dependence on the decision of the CSDs to participate (voluntary) Concentration of risk, monopolisation of settlement Prerequisite of the project: harmonisation of legal structures and operating rules l Removal Giovannini barriers, especially l Barriers 4, 6 and 7: T 2 S may ensure common operating hours and finality rules for domestic and cross border transactions De Nederlandsche Bank Eurosysteem

TARGET 2 Securities is a workable solution for the long term l Market consultation and user requirements is going on l Governing Council of the ECB will take a decision on the implementation of T 2 S in March 2008 l De Nederlandsche Bank Eurosysteem

TARGET 2 Securities is a workable solution for the long term l Market consultation and user requirements is going on l Governing Council of the ECB will take a decision on the implementation of T 2 S in March 2008 l De Nederlandsche Bank Eurosysteem

CCBM 2 Currently, banks hold collateral at several locations, it is exchanged through the Correspondent Central Bank Model l CCBM 2 is a common platform for central banks that integrates both domestic and cross -border collateral management l De Nederlandsche Bank Eurosysteem

CCBM 2 Currently, banks hold collateral at several locations, it is exchanged through the Correspondent Central Bank Model l CCBM 2 is a common platform for central banks that integrates both domestic and cross -border collateral management l De Nederlandsche Bank Eurosysteem