f481a01e9b35f111c15cdd18de08e5cd.ppt

- Количество слайдов: 24

Exchange Rates • More and more firms are becoming multinational enterprises. • Exports and imports are influenced by changes in international exchange rates. • Differences in long run inflation rates (according to theory of purchasing power parity), national economic growth rates, and interest rates help explain long-term exchange rate movements. Slide 1

Exchange Rates • More and more firms are becoming multinational enterprises. • Exports and imports are influenced by changes in international exchange rates. • Differences in long run inflation rates (according to theory of purchasing power parity), national economic growth rates, and interest rates help explain long-term exchange rate movements. Slide 1

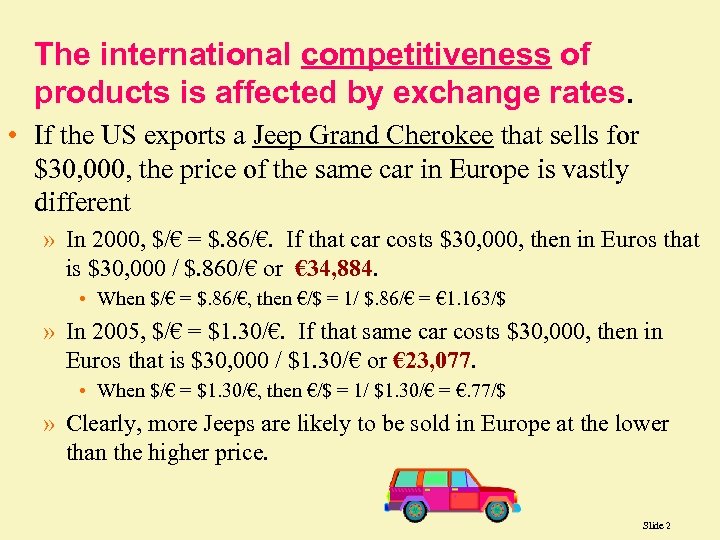

The international competitiveness of products is affected by exchange rates. • If the US exports a Jeep Grand Cherokee that sells for $30, 000, the price of the same car in Europe is vastly different » In 2000, $/€ = $. 86/€. If that car costs $30, 000, then in Euros that is $30, 000 / $. 860/€ or € 34, 884. • When $/€ = $. 86/€, then €/$ = 1/ $. 86/€ = € 1. 163/$ » In 2005, $/€ = $1. 30/€. If that same car costs $30, 000, then in Euros that is $30, 000 / $1. 30/€ or € 23, 077. • When $/€ = $1. 30/€, then €/$ = 1/ $1. 30/€ = €. 77/$ » Clearly, more Jeeps are likely to be sold in Europe at the lower than the higher price. Slide 2

The international competitiveness of products is affected by exchange rates. • If the US exports a Jeep Grand Cherokee that sells for $30, 000, the price of the same car in Europe is vastly different » In 2000, $/€ = $. 86/€. If that car costs $30, 000, then in Euros that is $30, 000 / $. 860/€ or € 34, 884. • When $/€ = $. 86/€, then €/$ = 1/ $. 86/€ = € 1. 163/$ » In 2005, $/€ = $1. 30/€. If that same car costs $30, 000, then in Euros that is $30, 000 / $1. 30/€ or € 23, 077. • When $/€ = $1. 30/€, then €/$ = 1/ $1. 30/€ = €. 77/$ » Clearly, more Jeeps are likely to be sold in Europe at the lower than the higher price. Slide 2

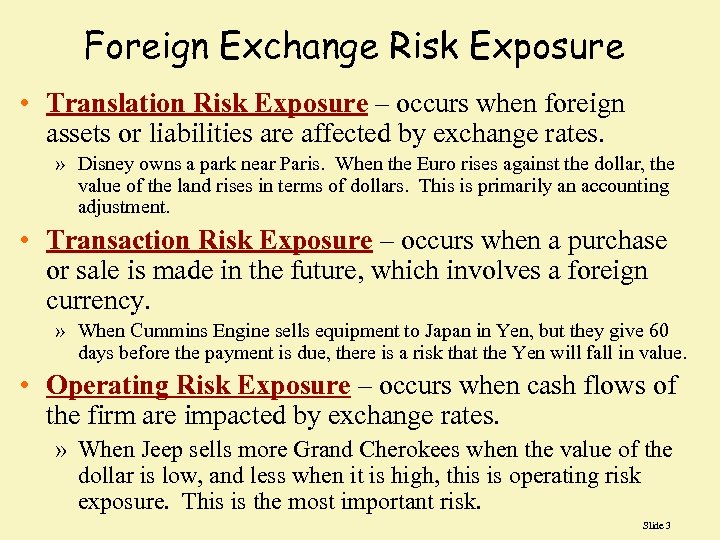

Foreign Exchange Risk Exposure • Translation Risk Exposure – occurs when foreign assets or liabilities are affected by exchange rates. » Disney owns a park near Paris. When the Euro rises against the dollar, the value of the land rises in terms of dollars. This is primarily an accounting adjustment. • Transaction Risk Exposure – occurs when a purchase or sale is made in the future, which involves a foreign currency. » When Cummins Engine sells equipment to Japan in Yen, but they give 60 days before the payment is due, there is a risk that the Yen will fall in value. • Operating Risk Exposure – occurs when cash flows of the firm are impacted by exchange rates. » When Jeep sells more Grand Cherokees when the value of the dollar is low, and less when it is high, this is operating risk exposure. This is the most important risk. Slide 3

Foreign Exchange Risk Exposure • Translation Risk Exposure – occurs when foreign assets or liabilities are affected by exchange rates. » Disney owns a park near Paris. When the Euro rises against the dollar, the value of the land rises in terms of dollars. This is primarily an accounting adjustment. • Transaction Risk Exposure – occurs when a purchase or sale is made in the future, which involves a foreign currency. » When Cummins Engine sells equipment to Japan in Yen, but they give 60 days before the payment is due, there is a risk that the Yen will fall in value. • Operating Risk Exposure – occurs when cash flows of the firm are impacted by exchange rates. » When Jeep sells more Grand Cherokees when the value of the dollar is low, and less when it is high, this is operating risk exposure. This is the most important risk. Slide 3

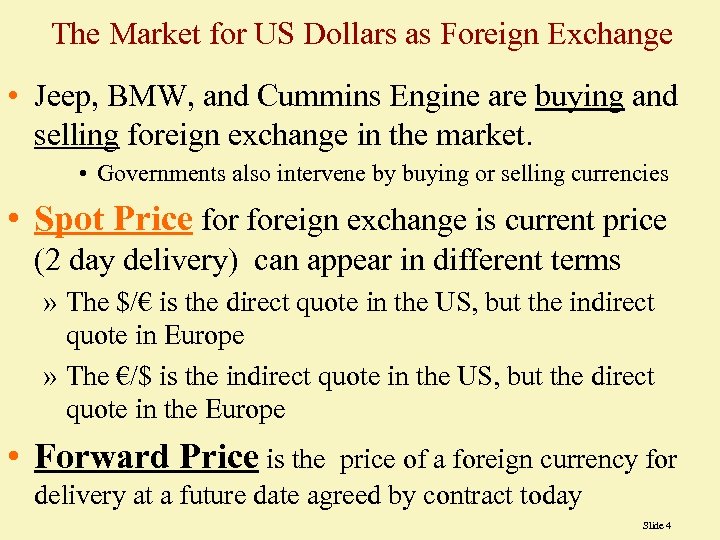

The Market for US Dollars as Foreign Exchange • Jeep, BMW, and Cummins Engine are buying and selling foreign exchange in the market. • Governments also intervene by buying or selling currencies • Spot Price foreign exchange is current price (2 day delivery) can appear in different terms » The $/€ is the direct quote in the US, but the indirect quote in Europe » The €/$ is the indirect quote in the US, but the direct quote in the Europe • Forward Price is the price of a foreign currency for delivery at a future date agreed by contract today Slide 4

The Market for US Dollars as Foreign Exchange • Jeep, BMW, and Cummins Engine are buying and selling foreign exchange in the market. • Governments also intervene by buying or selling currencies • Spot Price foreign exchange is current price (2 day delivery) can appear in different terms » The $/€ is the direct quote in the US, but the indirect quote in Europe » The €/$ is the indirect quote in the US, but the direct quote in the Europe • Forward Price is the price of a foreign currency for delivery at a future date agreed by contract today Slide 4

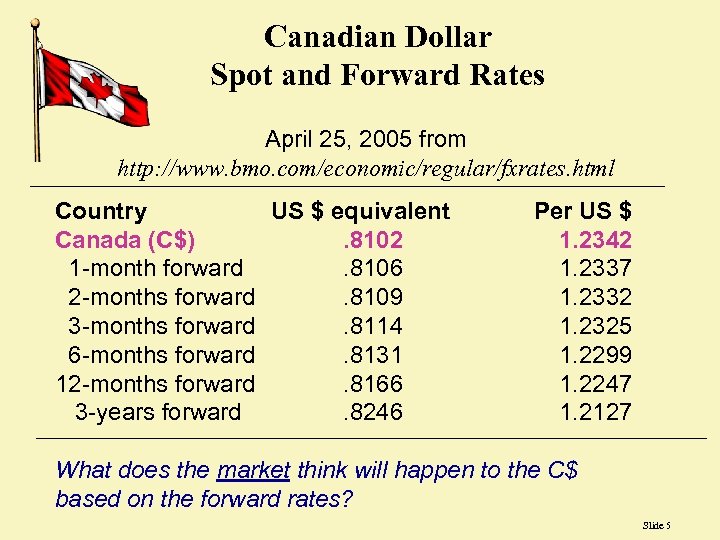

Canadian Dollar Spot and Forward Rates April 25, 2005 from http: //www. bmo. com/economic/regular/fxrates. html Country US $ equivalent Canada (C$) . 8102 1 -month forward. 8106 2 -months forward. 8109 3 -months forward. 8114 6 -months forward. 8131 12 -months forward. 8166 3 -years forward. 8246 Per US $ 1. 2342 1. 2337 1. 2332 1. 2325 1. 2299 1. 2247 1. 2127 What does the market think will happen to the C$ based on the forward rates? Slide 5

Canadian Dollar Spot and Forward Rates April 25, 2005 from http: //www. bmo. com/economic/regular/fxrates. html Country US $ equivalent Canada (C$) . 8102 1 -month forward. 8106 2 -months forward. 8109 3 -months forward. 8114 6 -months forward. 8131 12 -months forward. 8166 3 -years forward. 8246 Per US $ 1. 2342 1. 2337 1. 2332 1. 2325 1. 2299 1. 2247 1. 2127 What does the market think will happen to the C$ based on the forward rates? Slide 5

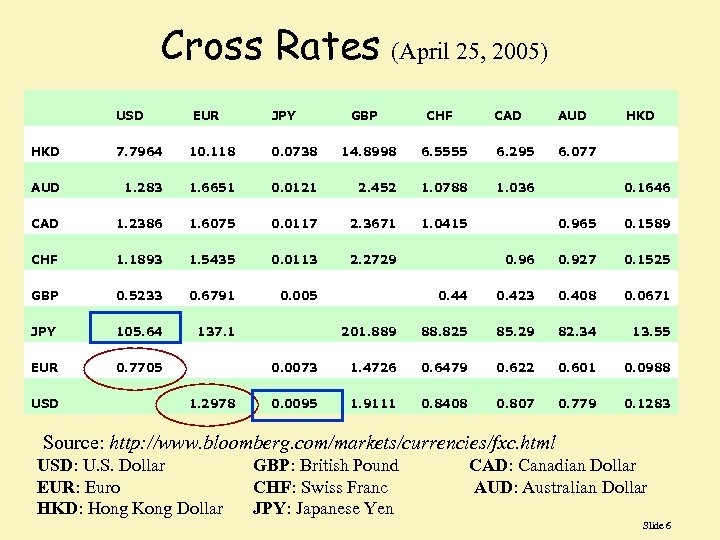

Cross Rates (April 25, 2005) USD EUR JPY GBP CHF CAD AUD HKD 7. 7964 10. 118 0. 0738 14. 8998 6. 5555 6. 295 6. 077 AUD 1. 283 1. 6651 0. 0121 2. 452 1. 0788 1. 036 0. 1646 CAD 1. 2386 1. 6075 0. 0117 2. 3671 1. 0415 0. 965 0. 1589 CHF 1. 1893 1. 5435 0. 0113 2. 2729 0. 96 0. 927 0. 1525 GBP 0. 5233 0. 6791 0. 005 0. 44 0. 423 0. 408 0. 0671 JPY 105. 64 137. 1 201. 889 88. 825 85. 29 82. 34 13. 55 EUR 0. 7705 0. 0073 1. 4726 0. 6479 0. 622 0. 601 0. 0988 USD 1. 2978 0. 0095 1. 9111 0. 8408 0. 807 0. 779 0. 1283 Source: http: //www. bloomberg. com/markets/currencies/fxc. html USD: U. S. Dollar EUR: Euro HKD: Hong Kong Dollar GBP: British Pound CHF: Swiss Franc JPY: Japanese Yen CAD: Canadian Dollar AUD: Australian Dollar Slide 6

Cross Rates (April 25, 2005) USD EUR JPY GBP CHF CAD AUD HKD 7. 7964 10. 118 0. 0738 14. 8998 6. 5555 6. 295 6. 077 AUD 1. 283 1. 6651 0. 0121 2. 452 1. 0788 1. 036 0. 1646 CAD 1. 2386 1. 6075 0. 0117 2. 3671 1. 0415 0. 965 0. 1589 CHF 1. 1893 1. 5435 0. 0113 2. 2729 0. 96 0. 927 0. 1525 GBP 0. 5233 0. 6791 0. 005 0. 44 0. 423 0. 408 0. 0671 JPY 105. 64 137. 1 201. 889 88. 825 85. 29 82. 34 13. 55 EUR 0. 7705 0. 0073 1. 4726 0. 6479 0. 622 0. 601 0. 0988 USD 1. 2978 0. 0095 1. 9111 0. 8408 0. 807 0. 779 0. 1283 Source: http: //www. bloomberg. com/markets/currencies/fxc. html USD: U. S. Dollar EUR: Euro HKD: Hong Kong Dollar GBP: British Pound CHF: Swiss Franc JPY: Japanese Yen CAD: Canadian Dollar AUD: Australian Dollar Slide 6

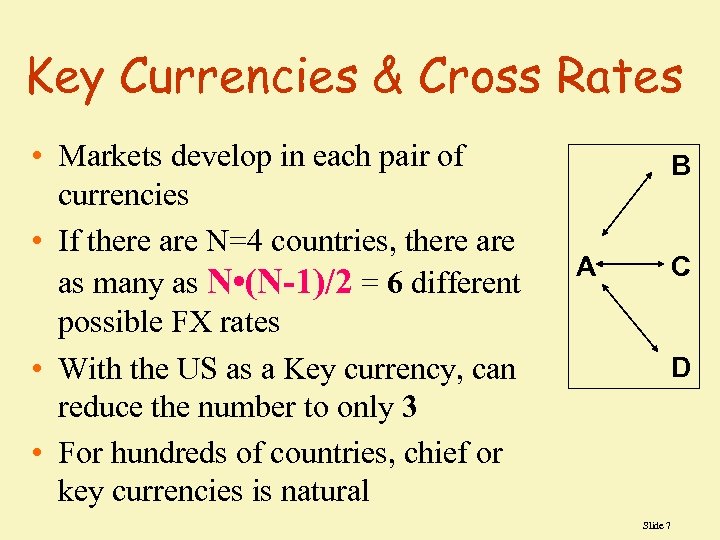

Key Currencies & Cross Rates • Markets develop in each pair of currencies • If there are N=4 countries, there as many as N • (N-1)/2 = 6 different possible FX rates • With the US as a Key currency, can reduce the number to only 3 • For hundreds of countries, chief or key currencies is natural B A C D Slide 7

Key Currencies & Cross Rates • Markets develop in each pair of currencies • If there are N=4 countries, there as many as N • (N-1)/2 = 6 different possible FX rates • With the US as a Key currency, can reduce the number to only 3 • For hundreds of countries, chief or key currencies is natural B A C D Slide 7

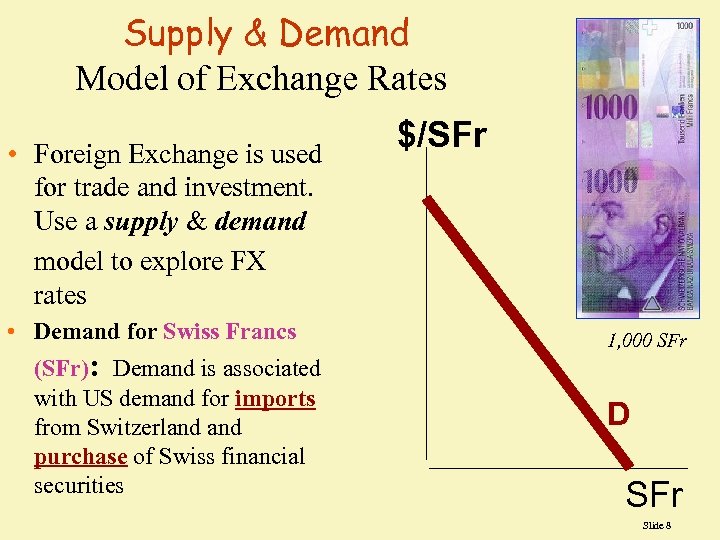

Supply & Demand Model of Exchange Rates • Foreign Exchange is used for trade and investment. Use a supply & demand model to explore FX rates • Demand for Swiss Francs (SFr): Demand is associated with US demand for imports from Switzerland purchase of Swiss financial securities $/SFr 1, 000 SFr D SFr Slide 8

Supply & Demand Model of Exchange Rates • Foreign Exchange is used for trade and investment. Use a supply & demand model to explore FX rates • Demand for Swiss Francs (SFr): Demand is associated with US demand for imports from Switzerland purchase of Swiss financial securities $/SFr 1, 000 SFr D SFr Slide 8

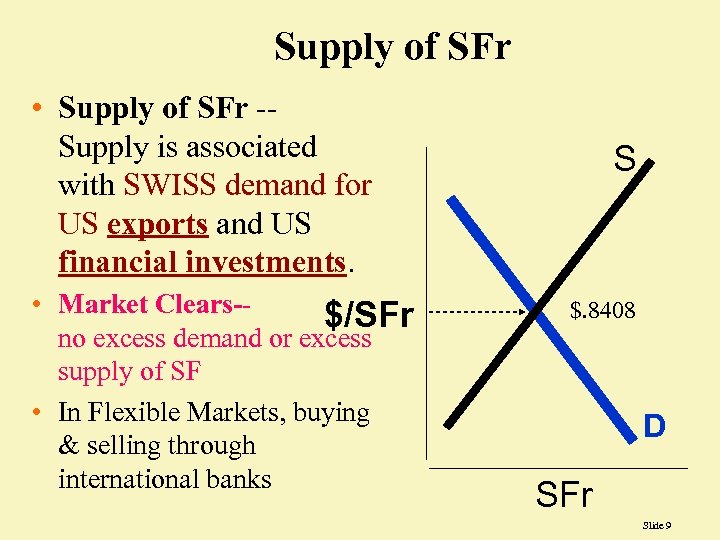

Supply of SFr • Supply of SFr -Supply is associated with SWISS demand for US exports and US financial investments. • Market Clears-$/SFr no excess demand or excess supply of SF • In Flexible Markets, buying & selling through international banks S $. 8408 D SFr Slide 9

Supply of SFr • Supply of SFr -Supply is associated with SWISS demand for US exports and US financial investments. • Market Clears-$/SFr no excess demand or excess supply of SF • In Flexible Markets, buying & selling through international banks S $. 8408 D SFr Slide 9

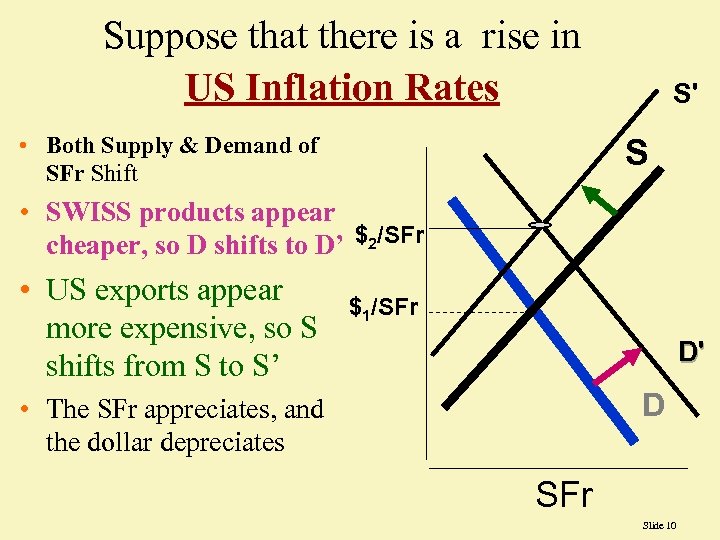

Suppose that there is a rise in US Inflation Rates • Both Supply & Demand of SFr Shift S' S • SWISS products appear cheaper, so D shifts to D’ $2/SFr • US exports appear more expensive, so S shifts from S to S’ $1/SFr D' D • The SFr appreciates, and the dollar depreciates SFr Slide 10

Suppose that there is a rise in US Inflation Rates • Both Supply & Demand of SFr Shift S' S • SWISS products appear cheaper, so D shifts to D’ $2/SFr • US exports appear more expensive, so S shifts from S to S’ $1/SFr D' D • The SFr appreciates, and the dollar depreciates SFr Slide 10

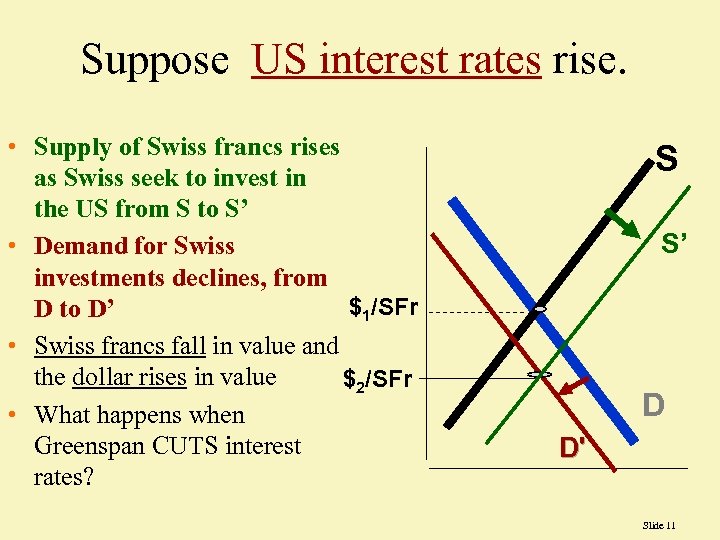

Suppose US interest rates rise. • Supply of Swiss francs rises as Swiss seek to invest in the US from S to S’ • Demand for Swiss investments declines, from $1/SFr D to D’ • Swiss francs fall in value and the dollar rises in value $2/SFr • What happens when Greenspan CUTS interest rates? S S’ D D' Slide 11

Suppose US interest rates rise. • Supply of Swiss francs rises as Swiss seek to invest in the US from S to S’ • Demand for Swiss investments declines, from $1/SFr D to D’ • Swiss francs fall in value and the dollar rises in value $2/SFr • What happens when Greenspan CUTS interest rates? S S’ D D' Slide 11

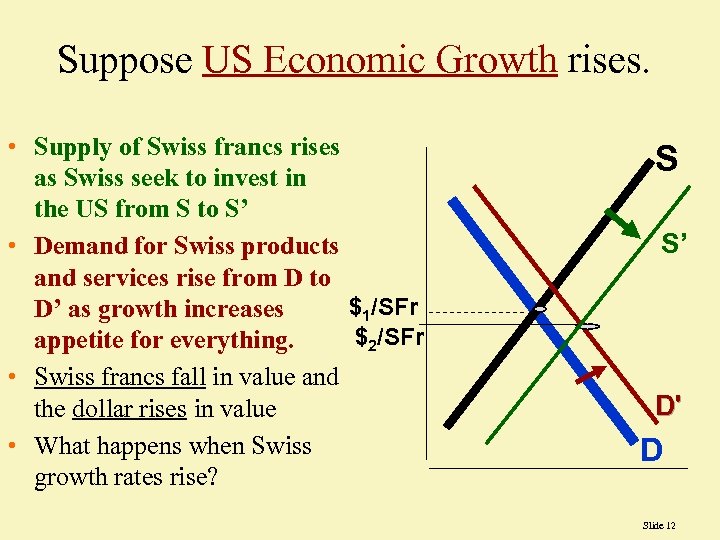

Suppose US Economic Growth rises. • Supply of Swiss francs rises as Swiss seek to invest in the US from S to S’ • Demand for Swiss products and services rise from D to $1/SFr D’ as growth increases $2/SFr appetite for everything. • Swiss francs fall in value and the dollar rises in value • What happens when Swiss growth rates rise? S S’ D' D Slide 12

Suppose US Economic Growth rises. • Supply of Swiss francs rises as Swiss seek to invest in the US from S to S’ • Demand for Swiss products and services rise from D to $1/SFr D’ as growth increases $2/SFr appetite for everything. • Swiss francs fall in value and the dollar rises in value • What happens when Swiss growth rates rise? S S’ D' D Slide 12

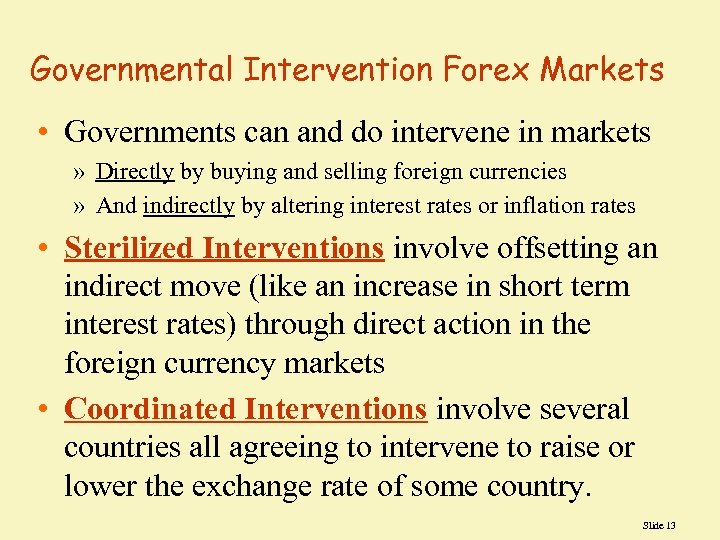

Governmental Intervention Forex Markets • Governments can and do intervene in markets » Directly by buying and selling foreign currencies » And indirectly by altering interest rates or inflation rates • Sterilized Interventions involve offsetting an indirect move (like an increase in short term interest rates) through direct action in the foreign currency markets • Coordinated Interventions involve several countries all agreeing to intervene to raise or lower the exchange rate of some country. Slide 13

Governmental Intervention Forex Markets • Governments can and do intervene in markets » Directly by buying and selling foreign currencies » And indirectly by altering interest rates or inflation rates • Sterilized Interventions involve offsetting an indirect move (like an increase in short term interest rates) through direct action in the foreign currency markets • Coordinated Interventions involve several countries all agreeing to intervene to raise or lower the exchange rate of some country. Slide 13

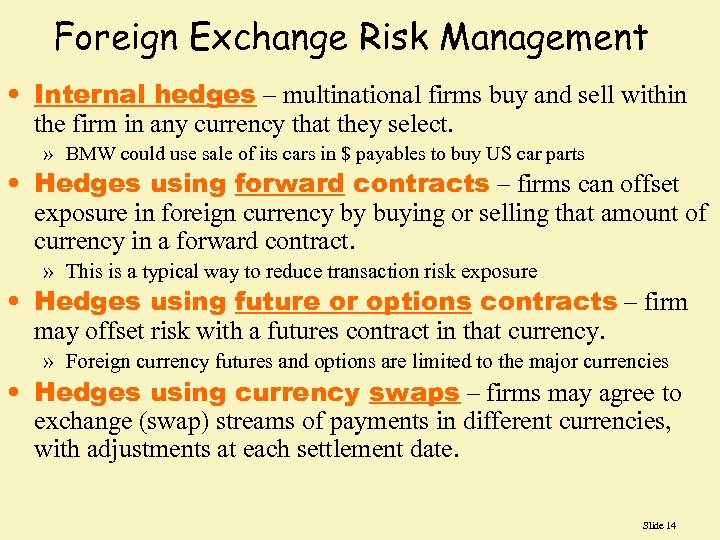

Foreign Exchange Risk Management • Internal hedges – multinational firms buy and sell within the firm in any currency that they select. » BMW could use sale of its cars in $ payables to buy US car parts • Hedges using forward contracts – firms can offset exposure in foreign currency by buying or selling that amount of currency in a forward contract. » This is a typical way to reduce transaction risk exposure • Hedges using future or options contracts – firm may offset risk with a futures contract in that currency. » Foreign currency futures and options are limited to the major currencies • Hedges using currency swaps – firms may agree to exchange (swap) streams of payments in different currencies, with adjustments at each settlement date. Slide 14

Foreign Exchange Risk Management • Internal hedges – multinational firms buy and sell within the firm in any currency that they select. » BMW could use sale of its cars in $ payables to buy US car parts • Hedges using forward contracts – firms can offset exposure in foreign currency by buying or selling that amount of currency in a forward contract. » This is a typical way to reduce transaction risk exposure • Hedges using future or options contracts – firm may offset risk with a futures contract in that currency. » Foreign currency futures and options are limited to the major currencies • Hedges using currency swaps – firms may agree to exchange (swap) streams of payments in different currencies, with adjustments at each settlement date. Slide 14

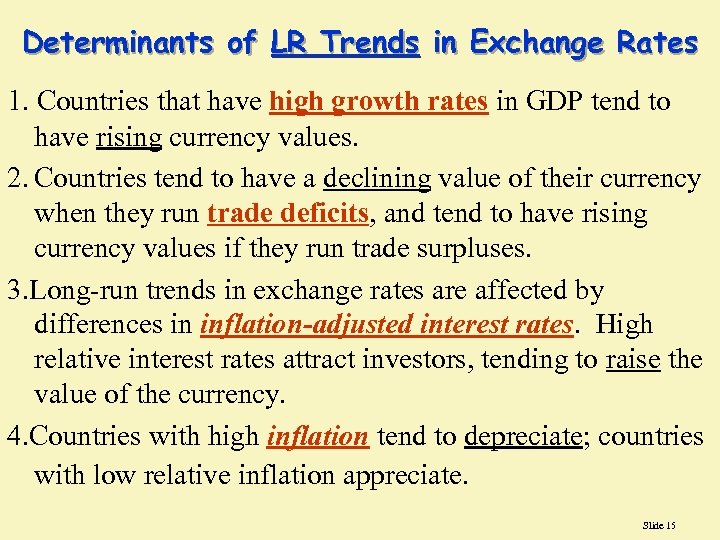

Determinants of LR Trends in Exchange Rates 1. Countries that have high growth rates in GDP tend to have rising currency values. 2. Countries tend to have a declining value of their currency when they run trade deficits, and tend to have rising currency values if they run trade surpluses. 3. Long-run trends in exchange rates are affected by differences in inflation-adjusted interest rates. High relative interest rates attract investors, tending to raise the value of the currency. 4. Countries with high inflation tend to depreciate; countries with low relative inflation appreciate. Slide 15

Determinants of LR Trends in Exchange Rates 1. Countries that have high growth rates in GDP tend to have rising currency values. 2. Countries tend to have a declining value of their currency when they run trade deficits, and tend to have rising currency values if they run trade surpluses. 3. Long-run trends in exchange rates are affected by differences in inflation-adjusted interest rates. High relative interest rates attract investors, tending to raise the value of the currency. 4. Countries with high inflation tend to depreciate; countries with low relative inflation appreciate. Slide 15

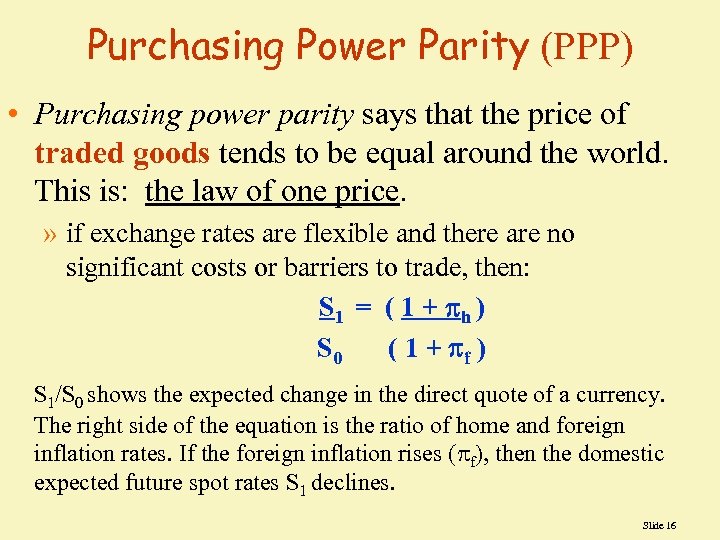

Purchasing Power Parity (PPP) • Purchasing power parity says that the price of traded goods tends to be equal around the world. This is: the law of one price. » if exchange rates are flexible and there are no significant costs or barriers to trade, then: S 1 = ( 1 + h ) S 0 ( 1 + f ) S 1/S 0 shows the expected change in the direct quote of a currency. The right side of the equation is the ratio of home and foreign inflation rates. If the foreign inflation rises ( f), then the domestic expected future spot rates S 1 declines. Slide 16

Purchasing Power Parity (PPP) • Purchasing power parity says that the price of traded goods tends to be equal around the world. This is: the law of one price. » if exchange rates are flexible and there are no significant costs or barriers to trade, then: S 1 = ( 1 + h ) S 0 ( 1 + f ) S 1/S 0 shows the expected change in the direct quote of a currency. The right side of the equation is the ratio of home and foreign inflation rates. If the foreign inflation rises ( f), then the domestic expected future spot rates S 1 declines. Slide 16

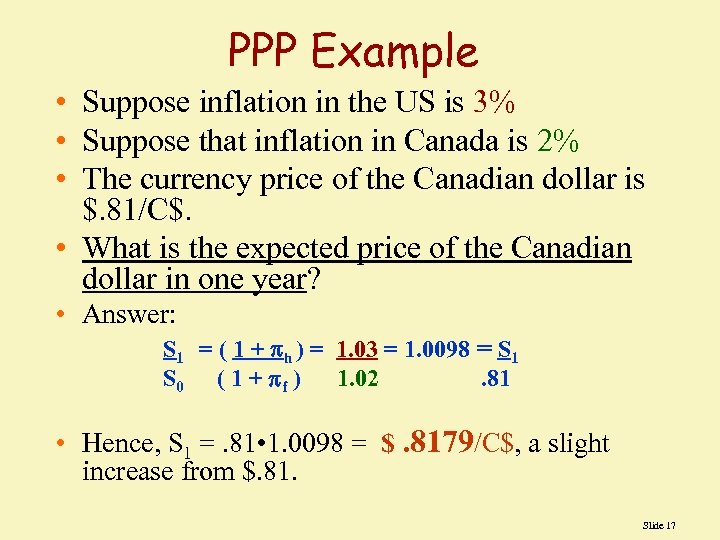

PPP Example • Suppose inflation in the US is 3% • Suppose that inflation in Canada is 2% • The currency price of the Canadian dollar is $. 81/C$. • What is the expected price of the Canadian dollar in one year? • Answer: S 1 = ( 1 + h ) = 1. 03 = 1. 0098 = S 1 S 0 ( 1 + f ) 1. 02. 81 • Hence, S 1 =. 81 • 1. 0098 = $. 8179/C$, a slight increase from $. 81. Slide 17

PPP Example • Suppose inflation in the US is 3% • Suppose that inflation in Canada is 2% • The currency price of the Canadian dollar is $. 81/C$. • What is the expected price of the Canadian dollar in one year? • Answer: S 1 = ( 1 + h ) = 1. 03 = 1. 0098 = S 1 S 0 ( 1 + f ) 1. 02. 81 • Hence, S 1 =. 81 • 1. 0098 = $. 8179/C$, a slight increase from $. 81. Slide 17

Qualifications of PPP • PPP is sensitive to the starting point, S 0. The base time period may not in equilibrium • Differences in the traded goods, or cross-cultural differences, may prevent the law of one price to equilibrate price differences. • The inflation rate used may include some nontraded goods. • PPP tends to work better in the long run than in short run changes in inflationary expectations. Slide 18

Qualifications of PPP • PPP is sensitive to the starting point, S 0. The base time period may not in equilibrium • Differences in the traded goods, or cross-cultural differences, may prevent the law of one price to equilibrate price differences. • The inflation rate used may include some nontraded goods. • PPP tends to work better in the long run than in short run changes in inflationary expectations. Slide 18

International Trade and Trading Blocs • With no barriers to trade in a free trade block, such as we have in North America because of NAFTA, trade expands • In 1980, 33% of US trade was in North American. In 1999, that number is 47%. • In 1980, 57% of European trade was in Europe. In 1999, that percentage rose to 61% • In 1980, 13% of trade in South America in the bloc know as MERCOSUR was within that region. In 1999, that percentage rose to 22% » In each case, freer trade within the region led to more intraregional trade. Slide 19

International Trade and Trading Blocs • With no barriers to trade in a free trade block, such as we have in North America because of NAFTA, trade expands • In 1980, 33% of US trade was in North American. In 1999, that number is 47%. • In 1980, 57% of European trade was in Europe. In 1999, that percentage rose to 61% • In 1980, 13% of trade in South America in the bloc know as MERCOSUR was within that region. In 1999, that percentage rose to 22% » In each case, freer trade within the region led to more intraregional trade. Slide 19

Optimal Currency Areas • The Optimal Currency Area involves the question of how many different currencies are best. • If all of Europe has only one currency, trade is quite easy. • But if Italy needs assistance, for example, reducing the value of the Euro for the whole group of countries doesn't target the single ailing region. • Hence, it is an open question as to how many currencies Europe should have. • It is expected that the Euro will help the participating countries, but it makes helping the poorest countries harder. Slide 20

Optimal Currency Areas • The Optimal Currency Area involves the question of how many different currencies are best. • If all of Europe has only one currency, trade is quite easy. • But if Italy needs assistance, for example, reducing the value of the Euro for the whole group of countries doesn't target the single ailing region. • Hence, it is an open question as to how many currencies Europe should have. • It is expected that the Euro will help the participating countries, but it makes helping the poorest countries harder. Slide 20

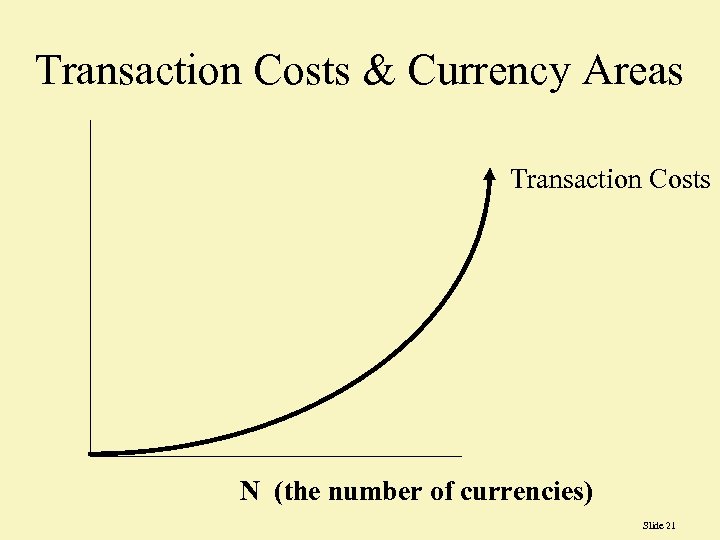

Transaction Costs & Currency Areas Transaction Costs N (the number of currencies) Slide 21

Transaction Costs & Currency Areas Transaction Costs N (the number of currencies) Slide 21

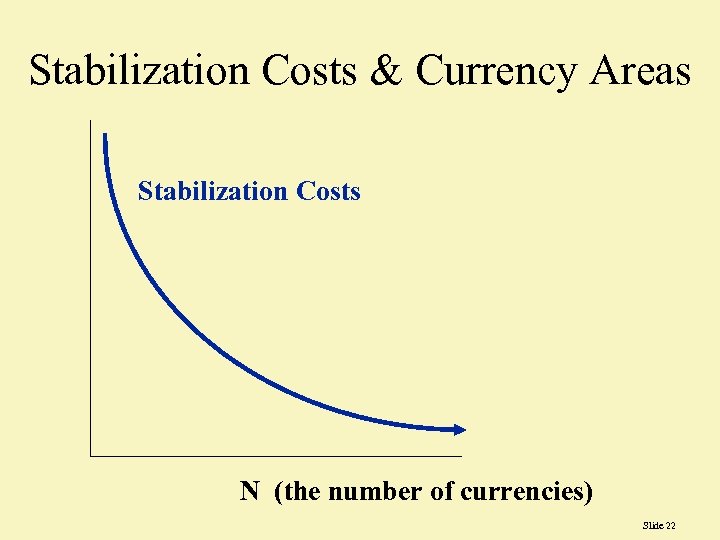

Stabilization Costs & Currency Areas Stabilization Costs N (the number of currencies) Slide 22

Stabilization Costs & Currency Areas Stabilization Costs N (the number of currencies) Slide 22

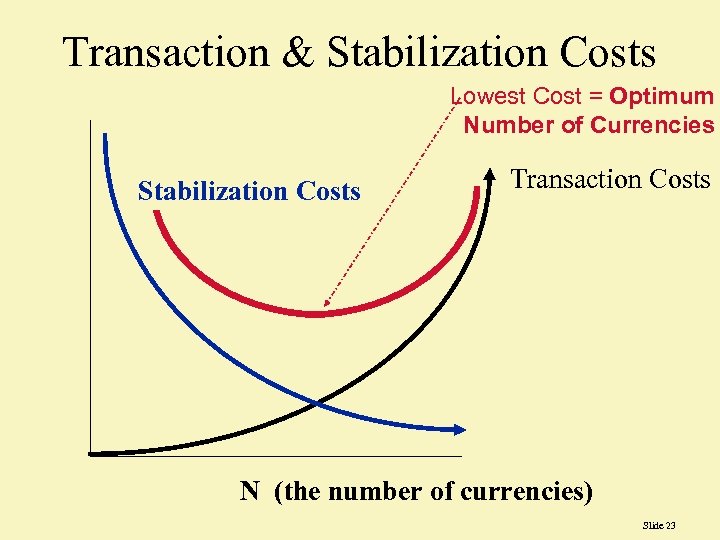

Transaction & Stabilization Costs Lowest Cost = Optimum Number of Currencies Stabilization Costs Transaction Costs N (the number of currencies) Slide 23

Transaction & Stabilization Costs Lowest Cost = Optimum Number of Currencies Stabilization Costs Transaction Costs N (the number of currencies) Slide 23

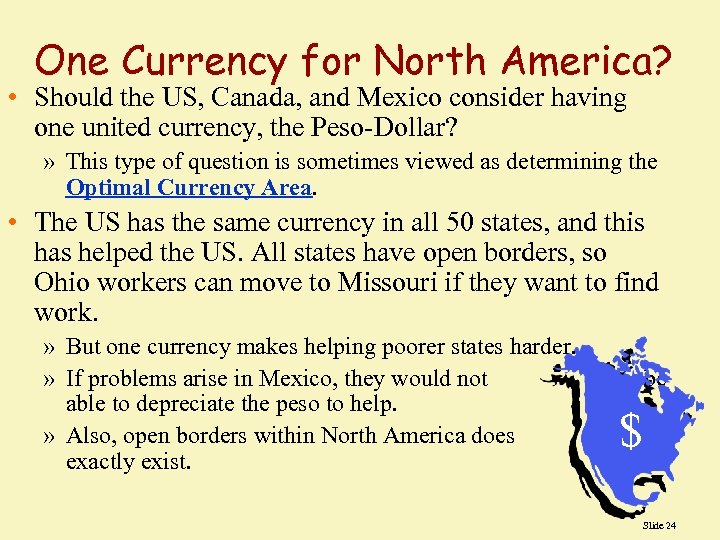

One Currency for North America? • Should the US, Canada, and Mexico consider having one united currency, the Peso-Dollar? » This type of question is sometimes viewed as determining the Optimal Currency Area. • The US has the same currency in all 50 states, and this has helped the US. All states have open borders, so Ohio workers can move to Missouri if they want to find work. » But one currency makes helping poorer states harder. » If problems arise in Mexico, they would not able to depreciate the peso to help. » Also, open borders within North America does exactly exist. be $not Slide 24

One Currency for North America? • Should the US, Canada, and Mexico consider having one united currency, the Peso-Dollar? » This type of question is sometimes viewed as determining the Optimal Currency Area. • The US has the same currency in all 50 states, and this has helped the US. All states have open borders, so Ohio workers can move to Missouri if they want to find work. » But one currency makes helping poorer states harder. » If problems arise in Mexico, they would not able to depreciate the peso to help. » Also, open borders within North America does exactly exist. be $not Slide 24