bdc46f593ac49dcb7882475404fa8fd0.ppt

- Количество слайдов: 25

Exchange Rates IB Chapter 23

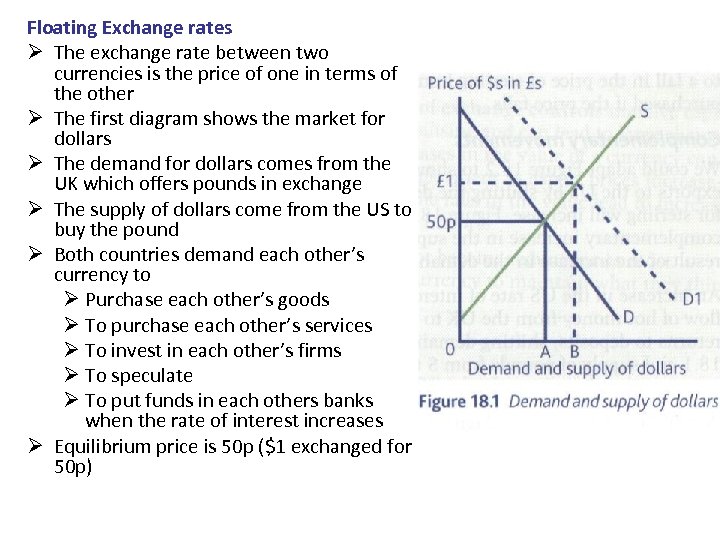

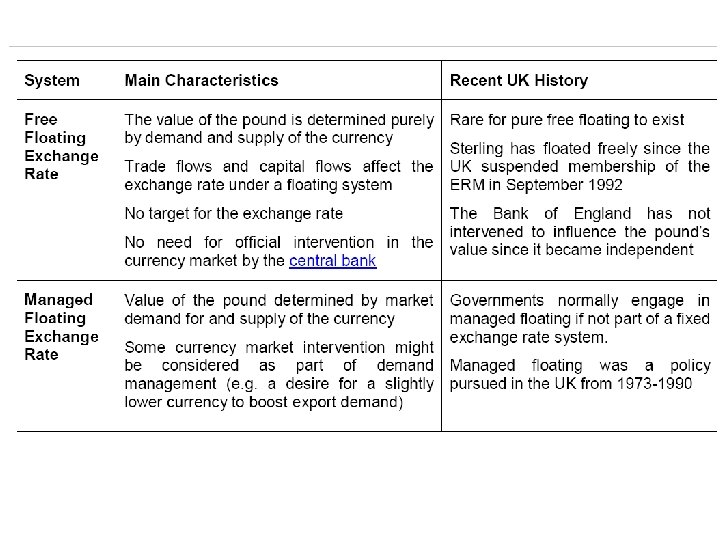

Floating Exchange rates Ø The exchange rate between two currencies is the price of one in terms of the other Ø The first diagram shows the market for dollars Ø The demand for dollars comes from the UK which offers pounds in exchange Ø The supply of dollars come from the US to buy the pound Ø Both countries demand each other’s currency to Ø Purchase each other’s goods Ø To purchase each other’s services Ø To invest in each other’s firms Ø To speculate Ø To put funds in each others banks when the rate of interest increases Ø Equilibrium price is 50 p ($1 exchanged for 50 p)

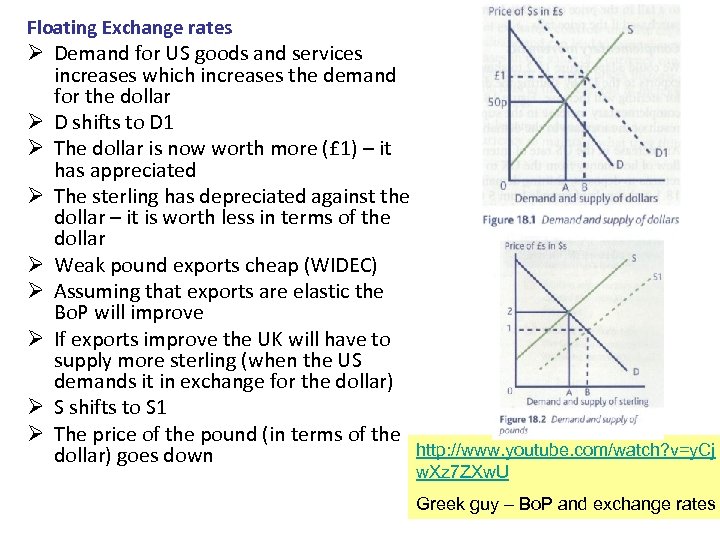

Floating Exchange rates Ø Demand for US goods and services increases which increases the demand for the dollar Ø D shifts to D 1 Ø The dollar is now worth more (£ 1) – it has appreciated Ø The sterling has depreciated against the dollar – it is worth less in terms of the dollar Ø Weak pound exports cheap (WIDEC) Ø Assuming that exports are elastic the Bo. P will improve Ø If exports improve the UK will have to supply more sterling (when the US demands it in exchange for the dollar) Ø S shifts to S 1 Ø The price of the pound (in terms of the http: //www. youtube. com/watch? v=y. Cj dollar) goes down w. Xz 7 ZXw. U Greek guy – Bo. P and exchange rates

Floating Exchange rates Ø Things that increase the demand for the £ from the US Ø Increase in interest rates relative to the US causes a flow of hot money (dollars coming to the UK) Ø A rise in demand for UK exports by the US Ø If speculators think the value of the sterling will fall and the dollar to increase they will buy sterling Ø A floating exchange rate is one that is dictated by the market

Advantages of a Floating Exchange rate Ø Automatic adjustment mean that a country with a large balance of payments will see their exchange rate depreciating which means the price of exports will fall and become more competitive leading to an improvement in the Bo. P Ø Reduced speculative pressure – if there are fixed exchange rates speculators will sell and then repurchase when the price has fallen Ø If there is a large amount of speculation this may force governments to reduce the value of the currency Ø Speculators will gain by selling it at one price and buying back at a lower price Ø Under floating exchange rates countries cannot be forced to devalue and speculators have no idea how far a central bank will allow its currency to fall Ø The currency is more stable Ø If government does not have to maintain the level of a fixed exchange rate it will not have to hold such large foreign exchange reserves

Advantages of a Floating Exchange rate Ø If government does not have to maintain the level of a fixed exchange rate it will not have to hold such large foreign exchange reserves Ø Freedom (autonomy) for domestic monetary policy: This is arguably the most important advantage of having a floating exchange rate Ø absence of an exchange rate target allows short term interest rates to be set to meet domestic economic objectives such as controlling inflation or stabilising the economic cycle

Disadvantages of a Floating Exchange rate Ø No guarantee to solve Bo. P problem – depends on the PEDs for exports and imports Ø Effect on domestic inflation – when the currency depreciates imports increase in price Ø Raw materials more expensive and firm’s costs go up Ø Pass on to consumer with higher prices Ø Demand for higher wages Ø Uncertainty – since the removal of exchange controls massive capital flows can occur leading to large changes in a currency’s price Ø Rapid increases lead to unemployment Ø Falls lead to increasing inflation Ø Foreign currency reserves have not really become redundant because most governments buy and sell their currency to maintain what they think should be an optimal value Exchange controls: restrictions on the ability to trade foreign currencies by a country’s central bank

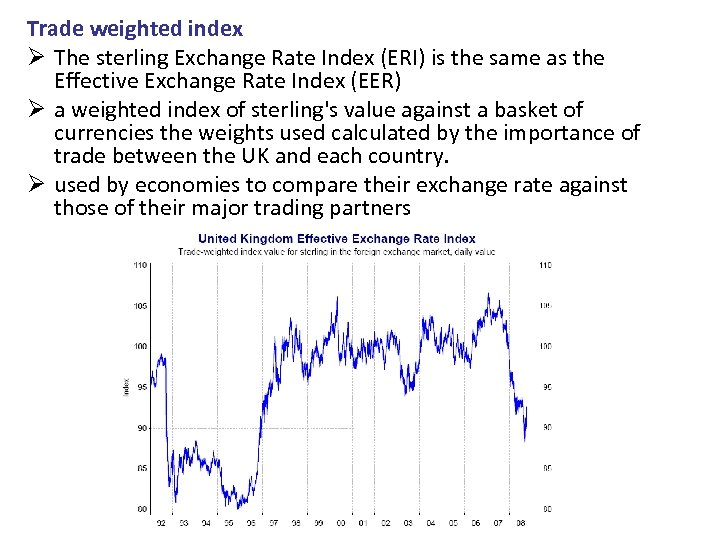

Trade weighted index Ø The sterling Exchange Rate Index (ERI) is the same as the Effective Exchange Rate Index (EER) Ø a weighted index of sterling's value against a basket of currencies the weights used calculated by the importance of trade between the UK and each country. Ø used by economies to compare their exchange rate against those of their major trading partners

Factors affecting exchange rates Ø Relative interest rates Ø An increase in the relative rate of interest in the UK should lead to an increase in the demand for sterling Ø Hot money – enormous pool of money owned by companies and rich individuals that moves around the world seeking the highest interest rate (return) with least risk Ø This will increase the demand for sterling making it appreciate in value Ø Imports cheaper Ø Exports more expensive Ø If imports/exports are elastic Bo. P will be affected Ø May lead to rise in unemployment

Factors affecting exchange rates Ø Inflation has led to the depreciation of sterling (when inflation is rising faster than the US) Ø Less revenue from exports Ø To maintain export earning the UK must increase exports Ø In the UK foreign demand (exports) tends to be price elastic so this should benefit the Bo. P Ø Imports appear to be inelastic so more is spent on imports Ø Overall depreciation benefits UK – Marshall. Lerner condition holds Ø All depends on the PEDs Ø Depreciation leads to increasing inflation possibly leading to inflationary spiral Ø If more exports are required there may be a need for more capacity – government may need to take steps to ensure that the goods are not consumed domestically (with imports being more expensive)

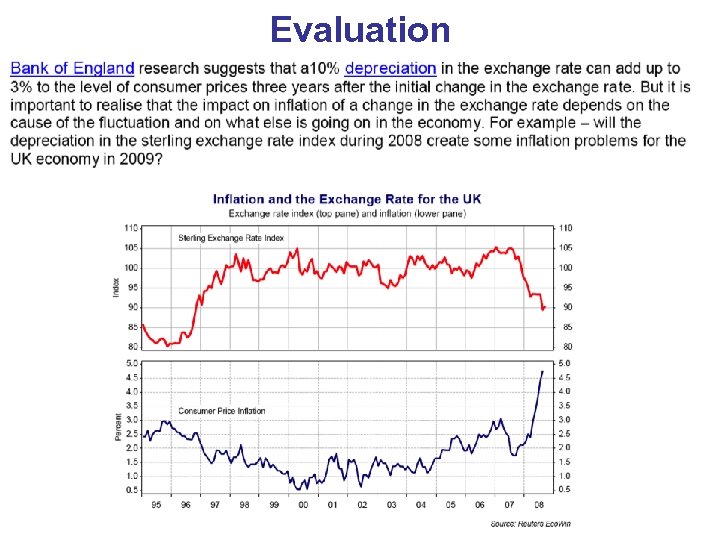

Evaluation

Factors affecting exchange rates Ø Foreign Direct Investment (FDI) Less revenue from exports Ø FDI = flows of capital (long term investment opposed to short term hot money) Ø Usually to set up a factory or purchase shares in a foreign business Ø Increase in FDI increases demand leading to appreciating currency Ø Increasing inflows of FDI into Asia leads to an appreciation of the Asian currencies Ø Trade and current account deficits Ø Importing more increases the supply of their currency which depreciates the value Ø If the deficits are persistent or a large percentage of GDP speculators may feel the value will fall and sell Ø Causes uncertainty

Fixed exchange rates Ø Fixed exchange rates have fallen out of fashion with the increased supply-side emphasis on markets Ø The UK’s exchange rate was fixed between 1944 and 1972 Ø Then again in 1990 to 91 when the UK joined the ERM (Exchange Rate Mechanism) Ø The major problem – when rates were fixed they were realistic but changes in the market meant they were very different from the market rate Ø This was due to Ø Difference in inflation rates between countries causing the £ to depreciate Ø Difference in growth rates – high growth rates (long term) reduces prices of goods causing the currency to appreciate Ø Fixed exchange rates vulnerable to speculation

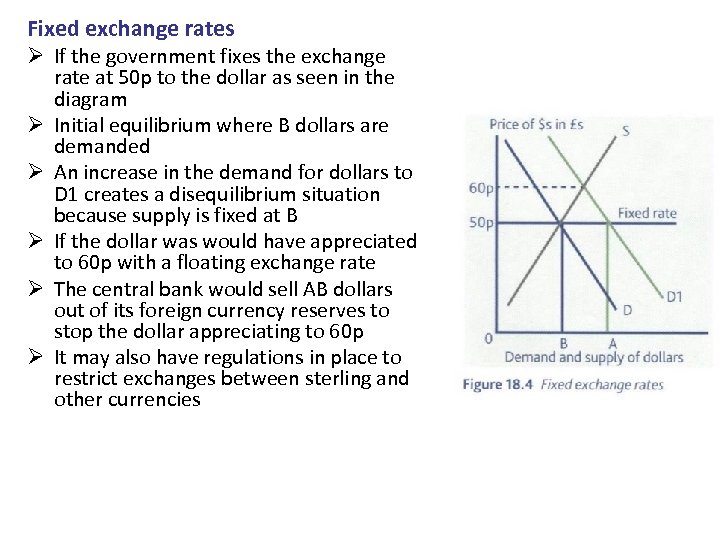

Fixed exchange rates Ø If the government fixes the exchange rate at 50 p to the dollar as seen in the diagram Ø Initial equilibrium where B dollars are demanded Ø An increase in the demand for dollars to D 1 creates a disequilibrium situation because supply is fixed at B Ø If the dollar was would have appreciated to 60 p with a floating exchange rate Ø The central bank would sell AB dollars out of its foreign currency reserves to stop the dollar appreciating to 60 p Ø It may also have regulations in place to restrict exchanges between sterling and other currencies Fig 18. 4 P 212

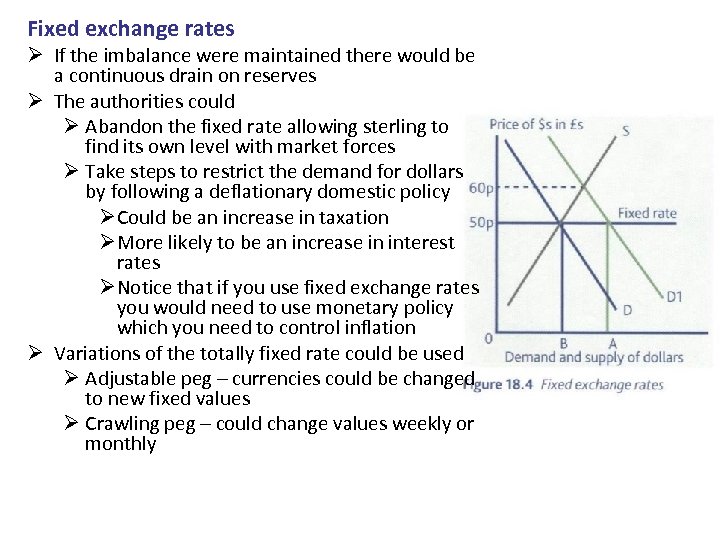

Fixed exchange rates Ø If the imbalance were maintained there would be a continuous drain on reserves Ø The authorities could Ø Abandon the fixed rate allowing sterling to find its own level with market forces Ø Take steps to restrict the demand for dollars by following a deflationary domestic policy Ø Could be an increase in taxation Ø More likely to be an increase in interest rates Ø Notice that if you use fixed exchange rates you would need to use monetary policy which you need to control inflation Ø Variations of the totally fixed rate could be used Ø Adjustable peg – currencies could be changed to new fixed values Ø Crawling peg – could change values weekly or monthly

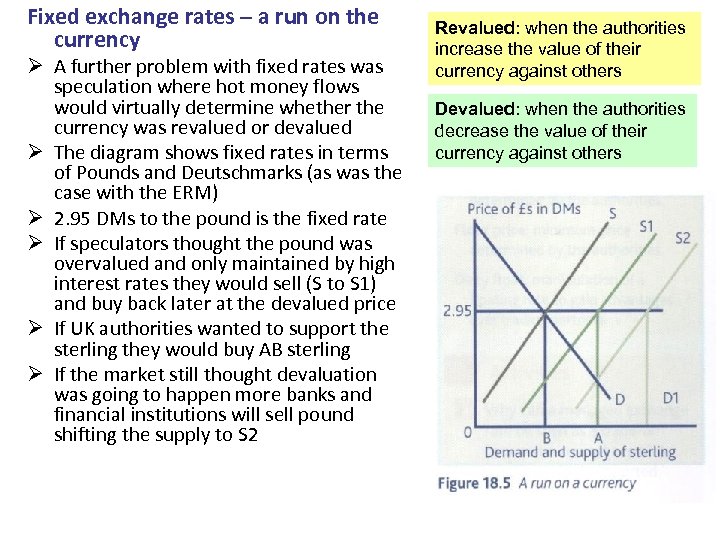

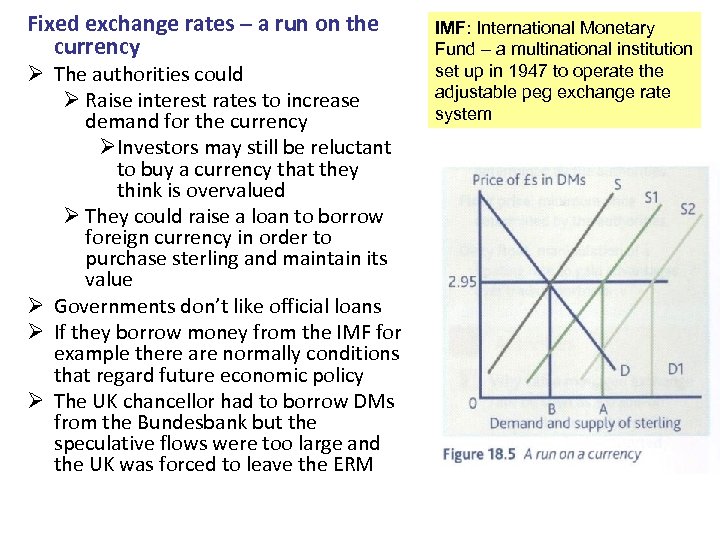

Fixed exchange rates – a run on the currency Ø A further problem with fixed rates was speculation where hot money flows would virtually determine whether the currency was revalued or devalued Ø The diagram shows fixed rates in terms of Pounds and Deutschmarks (as was the case with the ERM) Ø 2. 95 DMs to the pound is the fixed rate Ø If speculators thought the pound was overvalued and only maintained by high interest rates they would sell (S to S 1) and buy back later at the devalued price Ø If UK authorities wanted to support the sterling they would buy AB sterling Ø If the market still thought devaluation was going to happen more banks and financial institutions will sell pound shifting the supply to S 2 Revalued: when the authorities increase the value of their currency against others Devalued: when the authorities decrease the value of their currency against others

Fixed exchange rates – a run on the currency Ø The authorities could Ø Raise interest rates to increase demand for the currency ØInvestors may still be reluctant to buy a currency that they think is overvalued Ø They could raise a loan to borrow foreign currency in order to purchase sterling and maintain its value Ø Governments don’t like official loans Ø If they borrow money from the IMF for example there are normally conditions that regard future economic policy Ø The UK chancellor had to borrow DMs from the Bundesbank but the speculative flows were too large and the UK was forced to leave the ERM IMF: International Monetary Fund – a multinational institution set up in 1947 to operate the adjustable peg exchange rate system Fig 18. 5 P 213

Fig 18. 5 P 213

The case for a fixed exchange rate Ø Reinforcing comparative advantage Read ‘Fixed or Flexible? ’ on P 214

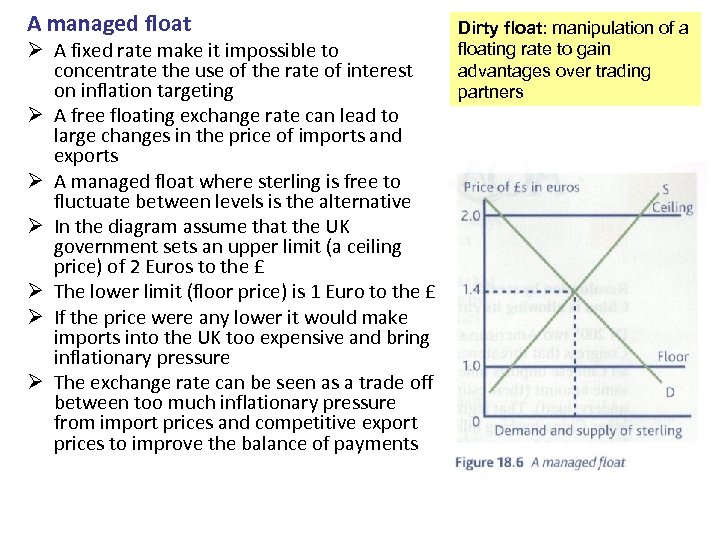

A managed float Ø A fixed rate make it impossible to concentrate the use of the rate of interest on inflation targeting Ø A free floating exchange rate can lead to large changes in the price of imports and exports Ø A managed float where sterling is free to fluctuate between levels is the alternative Ø In the diagram assume that the UK government sets an upper limit (a ceiling price) of 2 Euros to the £ Ø The lower limit (floor price) is 1 Euro to the £ Ø If the price were any lower it would make imports into the UK too expensive and bring inflationary pressure Ø The exchange rate can be seen as a trade off between too much inflationary pressure from import prices and competitive export prices to improve the balance of payments Dirty float: manipulation of a floating rate to gain advantages over trading partners Fig 18. 6 P 215

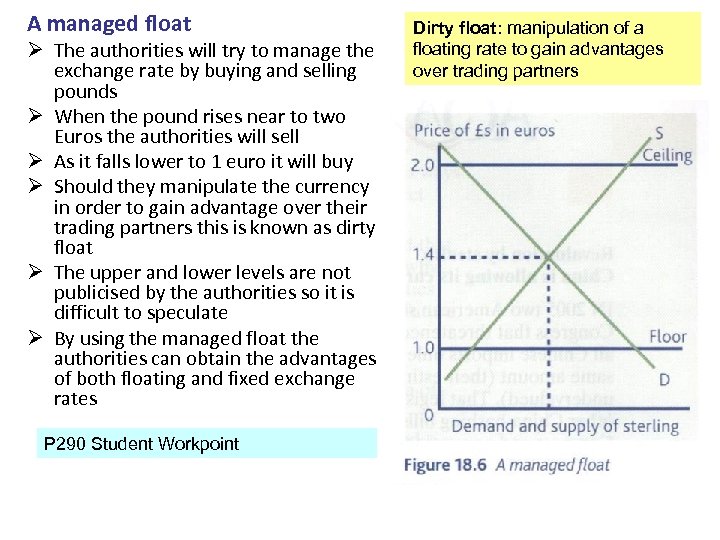

A managed float Ø The authorities will try to manage the exchange rate by buying and selling pounds Ø When the pound rises near to two Euros the authorities will sell Ø As it falls lower to 1 euro it will buy Ø Should they manipulate the currency in order to gain advantage over their trading partners this is known as dirty float Ø The upper and lower levels are not publicised by the authorities so it is difficult to speculate Ø By using the managed float the authorities can obtain the advantages of both floating and fixed exchange rates P 290 Student Workpoint Dirty float: manipulation of a floating rate to gain advantages over trading partners Fig 18. 6 P 215

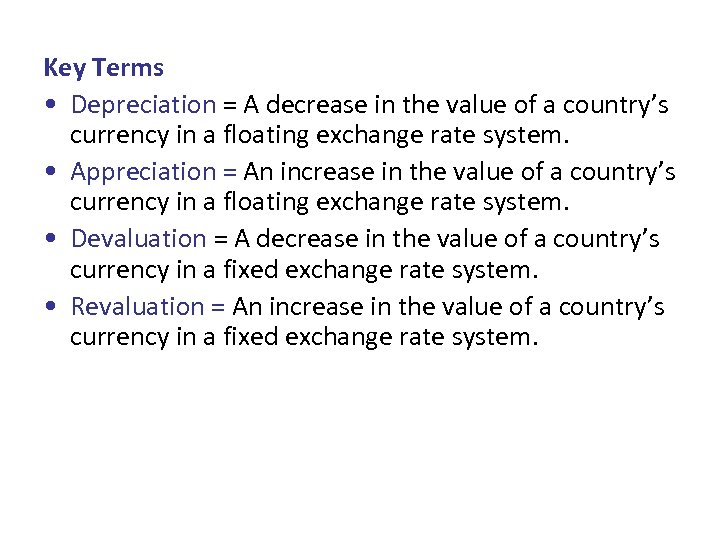

Key Terms • Depreciation = A decrease in the value of a country’s currency in a floating exchange rate system. • Appreciation = An increase in the value of a country’s currency in a floating exchange rate system. • Devaluation = A decrease in the value of a country’s currency in a fixed exchange rate system. • Revaluation = An increase in the value of a country’s currency in a fixed exchange rate system.

Videos Mjmfoodie ü Work through all of the student workpoints in the Exchange rate chapter (to hand in) ü HL work through the two HL assessment advices (to hand in) ü Next week: During each lesson there will be some kind of assessment on international economics ü Revise for homework (revise for homework)

bdc46f593ac49dcb7882475404fa8fd0.ppt