3583382b4ddf438d13178bea153efe19.ppt

- Количество слайдов: 51

Exchange Rates and Instruments of International Business

BOP • Trade Deficit Exports – Imports • Foreign Receipts • Foreign Remittances • Foreign Payments

The Balance of Payments Account • Meaning of the balance of payments • The current account – trade in goods – trade in services – balance of trade in goods and services – income flows – current transfers of money – balance on current account

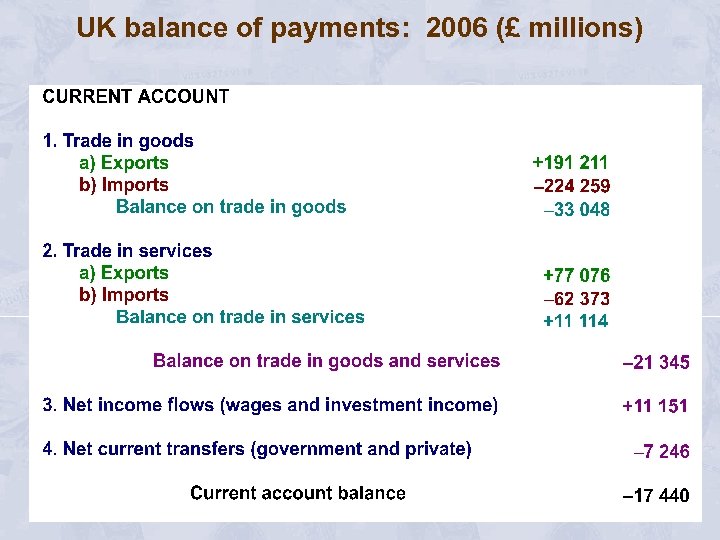

UK balance of payments: 2006 (£ millions)

UK balance of payments: 2006 (£ millions)

The Balance of Payments Account • The capital account • The financial account – investment • direct • portfolio – other financial flows (mainly short term) – flows to and from reserves – financial account balance • Overall balance of payments • Assessing balance of payments figures

FOREIGN EXCHANGE

Evolution • • • Bimetallism Gold & Silver: Before 1875 Classical Gold Standard: 1875 -1914 Interwar Period: 1915 -1944 BW System: 1945 -1972 Flexible Exchange Rate system: 1973 to Date ( Jamaica Agreement)

Exchange rate systems in practice The Bretton Woods system the Triffin dilemma a non-adjustable system stable exchange rates and the postwar boom The non-system as an inflation ‘shock absorber’ The European exchange rate mechanism (ERM) A zone of monetary stability in Europe a fixed but adjustable system 1979– 87 a non-adjustable system after 1987

Current systems • Fixed Exchange rate system • Floating Exchange rate System • Managed System There is no absolute system of these. Mostly combination of these.

The balance of payments, exchange rates and business Fixed exchange rates expenditure reduction policy and expenditure-switching policy Flexible exchange rates no depression of demand in the domestic market Fixed versus flexible exchange rates in a business context firms prefer stable economic conditions to less stable ones some advantage in a degree of currency management

Exchange Rates • The rate of exchange – individual rates of exchange – exchange rate index • Determination of exchange rates – the equilibrium exchange rate – appreciation and depreciation – shifts in currency demand supply

The weights of the currencies of various countries in the sterling exchange rate index

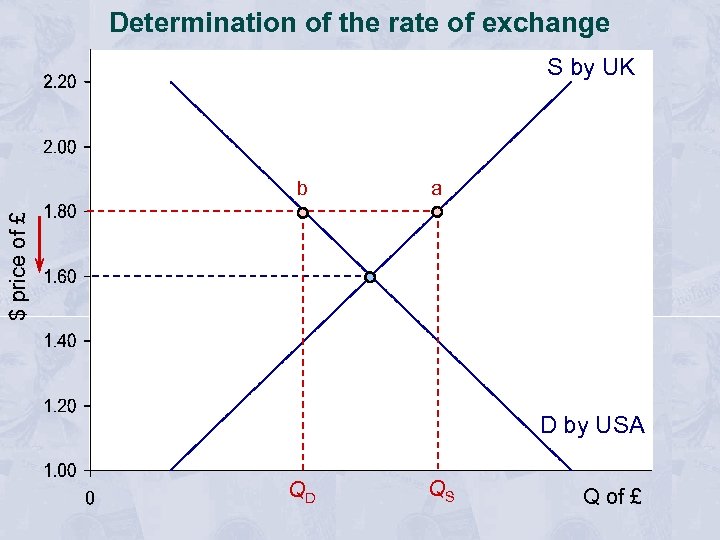

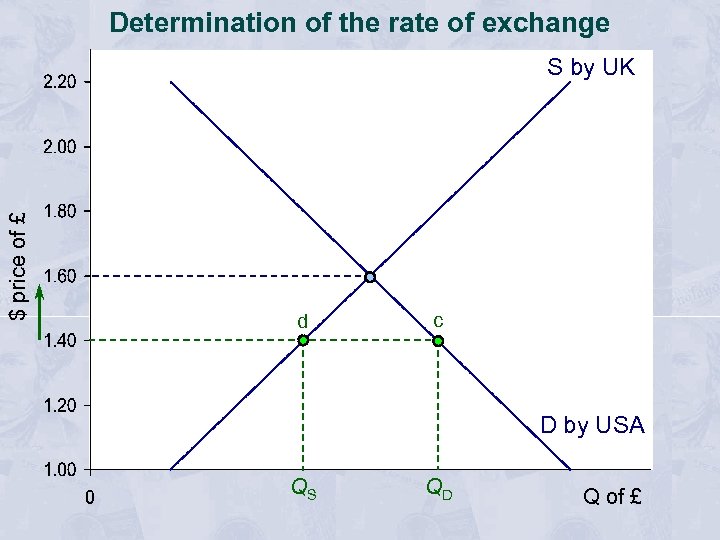

Determination of the rate of exchange S by UK a $ price of £ b D by USA QD QS Q of £

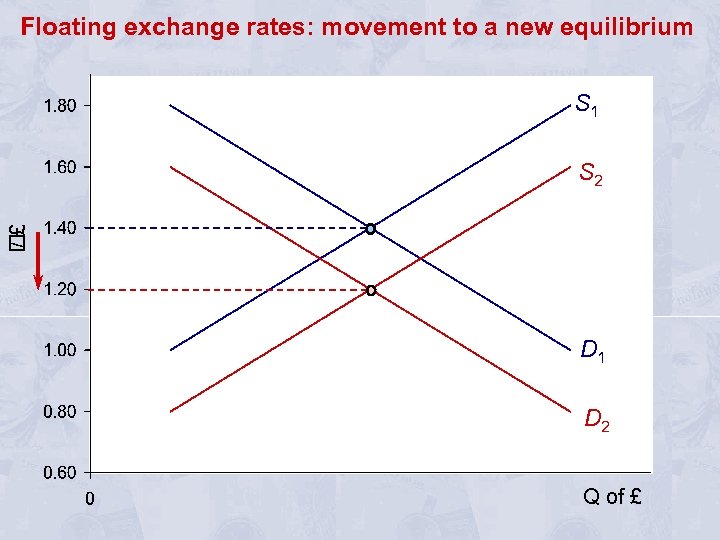

Determination of the rate of exchange $ price of £ S by UK d c D by USA QS QD Q of £

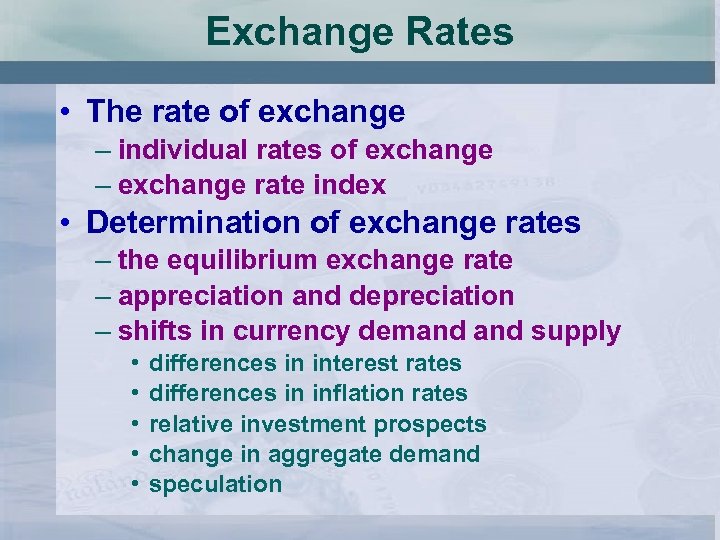

Floating exchange rates: movement to a new equilibrium S 1 £ / S 2 D 1 D 2 Q of £

Factors Affecting Exchange rate Determination • • • Market Forces ( Demand Supply) GDP Interest Rate BOP Inflation

Exchange Rates • The rate of exchange – individual rates of exchange – exchange rate index • Determination of exchange rates – the equilibrium exchange rate – appreciation and depreciation – shifts in currency demand supply • • • differences in interest rates differences in inflation rates relative investment prospects change in aggregate demand speculation

Exchange Rates and Balance of Payments • Exchange rates and the balance of payments: no government intervention – a floating exchange rate • how rates are determined by dealers – automatic balancing of overall balance of payments – current, capital and financial accounts may not separately balance

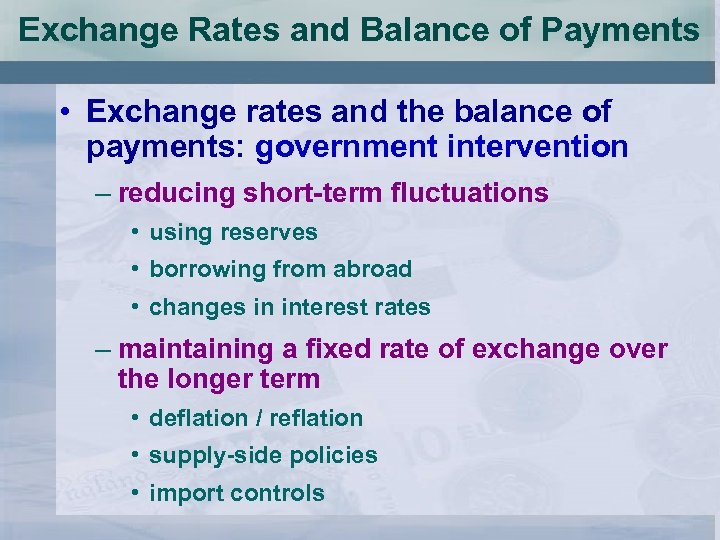

Exchange Rates and Balance of Payments • Exchange rates and the balance of payments: government intervention – reducing short-term fluctuations • using reserves • borrowing from abroad • changes in interest rates – maintaining a fixed rate of exchange over the longer term • deflation / reflation • supply-side policies • import controls

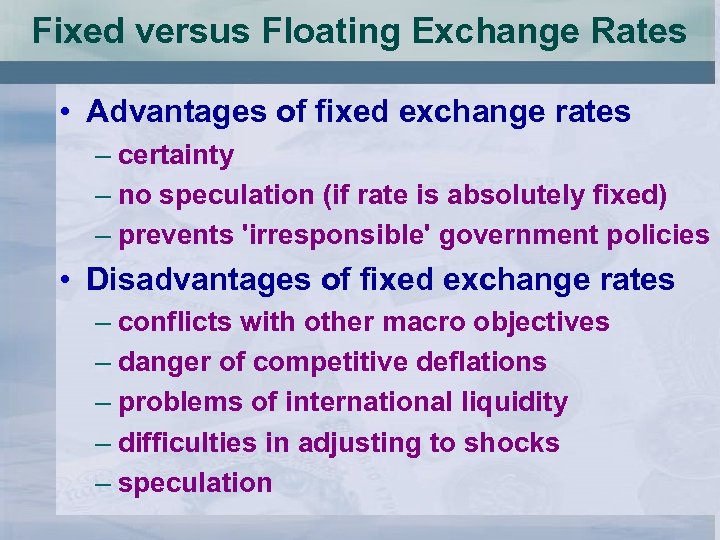

Fixed versus Floating Exchange Rates • Advantages of fixed exchange rates – certainty – no speculation (if rate is absolutely fixed) – prevents 'irresponsible' government policies • Disadvantages of fixed exchange rates – conflicts with other macro objectives – danger of competitive deflations – problems of international liquidity – difficulties in adjusting to shocks – speculation

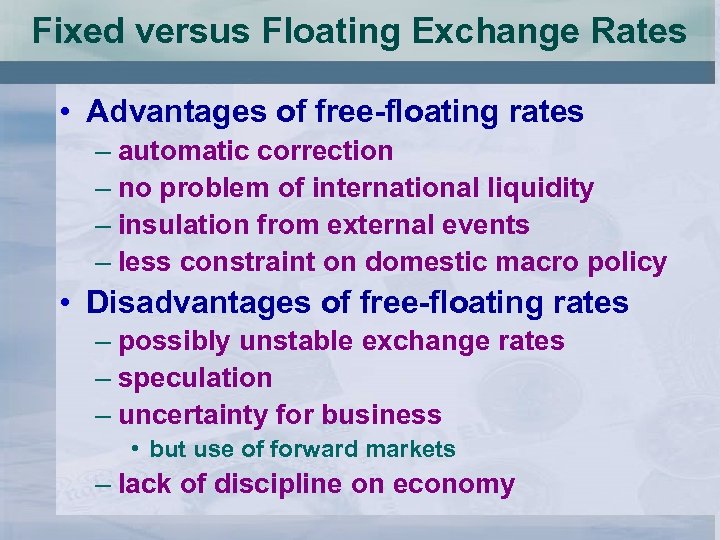

Fixed versus Floating Exchange Rates • Advantages of free-floating rates – automatic correction – no problem of international liquidity – insulation from external events – less constraint on domestic macro policy • Disadvantages of free-floating rates – possibly unstable exchange rates – speculation – uncertainty for business • but use of forward markets – lack of discipline on economy

FOREX Facts • Daily turn over : 1 Trillion $ daily • Three regions • Australasia Sydney, Hong Kong, Singapore, Tokyo, Bahrain • Europe London, Amsterdam, Paris, Frankfurt, Geneva • America New york, Ottawa, San Francisco etc

Representing Forex • US method or Direct Method • European Method or Indirect Method Currency Markets • Spot Market • Forward Market

Forex Exposure • Transaction Exposure • Translation Exposure • Economic Exposure

Arbitrage Opportunity • • Triangle Arbitrage Hedging Derivatives Currency Swaps

Questions • Why is China following a sort of Fixed exchange rate system? And why is that a concern for US? • Why is it so that some developed countries like Japan has lower exchange rate?

EURO

History • Treaty of Rome was ratified in 1958 European Economic Community (EEC) • Single European Act (1986) • Treaty on European Union (1992) • European Central Bank (ECB) 1 June 1998.

The Origins of the Euro • Post-war regulation of exchange rates – the Bretton Woods system – its collapse in the early 1970 s – dirty floating • The ERM – features of the ERM – the 1980 s – crisis in the ERM • events of 1992 • events of 1993 – a return of calm

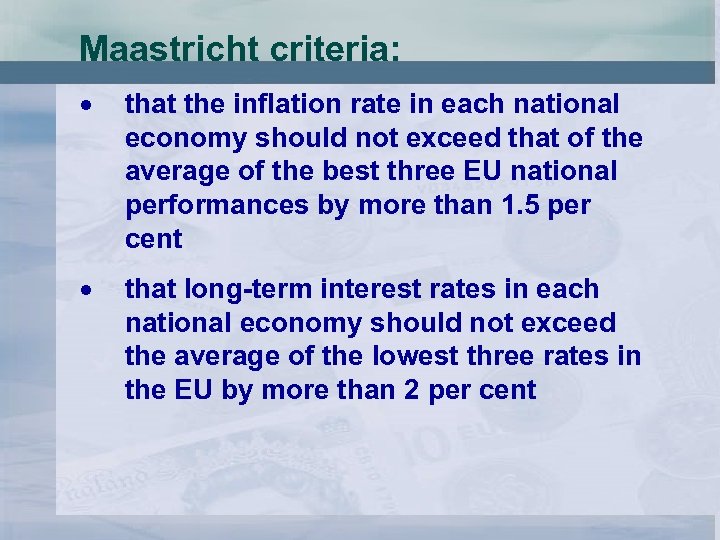

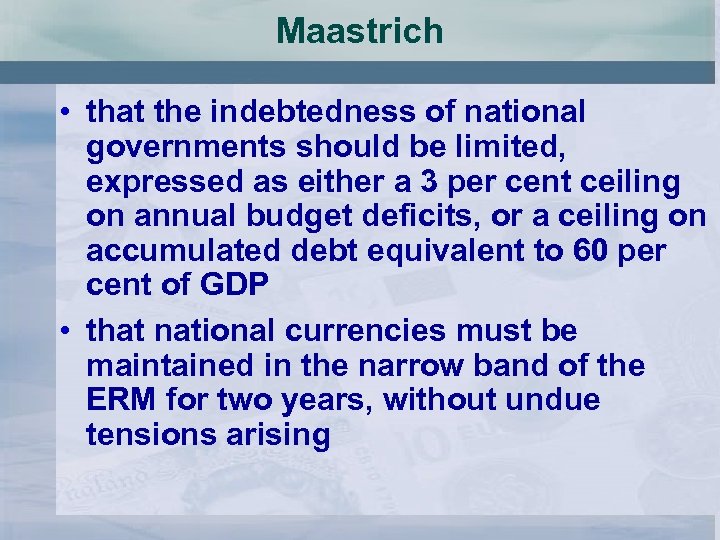

The Origins of the Euro • The Maastricht Treaty – the timetable for EMU – the convergence criteria • • • inflation interest rates budget deficits general government debt exchange rates • Birth of the euro – meeting the convergence criteria – role of the European Central Bank (ECB)

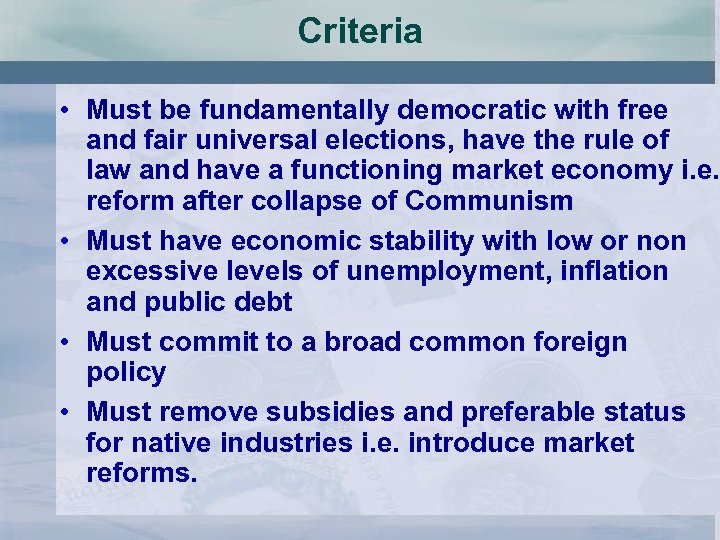

What are the criteria for joining the EU The Copenhagen criteria 1993 • Must have a good human rights record and protect minorities – Turkey still some way to go on the Kurds, Hungary improve record with Roma people • Must agree to adopt the ‘aquis communautaire’ – all previous EU treaties and legislation – in its entirety with no opt outs. Therefore will have to join the Euro when they meet the entry criteria of the Euro, can’t opt out unlike UK, Denmark and Sweden. Thus must adopt freedom of trade, health and safety regulations, minimum environmental standards etc

Criteria • Must be fundamentally democratic with free and fair universal elections, have the rule of law and have a functioning market economy i. e. reform after collapse of Communism • Must have economic stability with low or non excessive levels of unemployment, inflation and public debt • Must commit to a broad common foreign policy • Must remove subsidies and preferable status for native industries i. e. introduce market reforms.

Participating Countries 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Belgium Germany Greece Spain France Ireland Italy Luxembourg The Netherlands Austria Portugal Finland 13. Cyprus and Malta -01 -01 -08 Exceptions Denmark, Sweden and UK

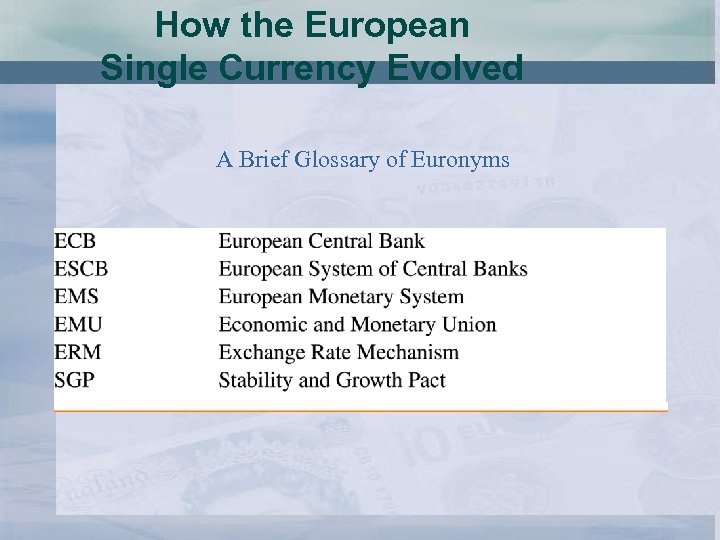

How the European Single Currency Evolved A Brief Glossary of Euronyms

Euro Currency • 1 st January 2002 • 5, 10, 20, 50 100, 200 and 500 denominations

Currency speculation and exchange rate systems Speculators as economic social workers Currency turbulence is inimical to trade, and as speculation fosters turbulence, speculation is an economic ‘bad’

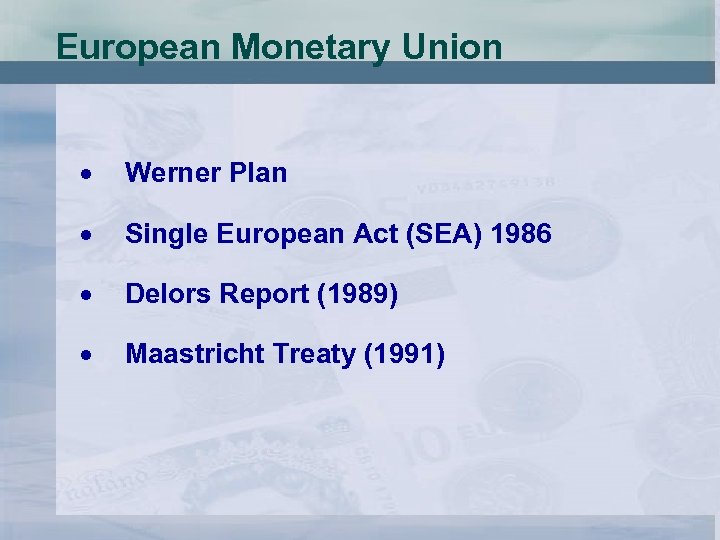

European Monetary Union Werner Plan Single European Act (SEA) 1986 Delors Report (1989) Maastricht Treaty (1991)

Maastricht criteria: that the inflation rate in each national economy should not exceed that of the average of the best three EU national performances by more than 1. 5 per cent that long-term interest rates in each national economy should not exceed the average of the lowest three rates in the EU by more than 2 per cent

Maastrich • that the indebtedness of national governments should be limited, expressed as either a 3 per cent ceiling on annual budget deficits, or a ceiling on accumulated debt equivalent to 60 per cent of GDP • that national currencies must be maintained in the narrow band of the ERM for two years, without undue tensions arising

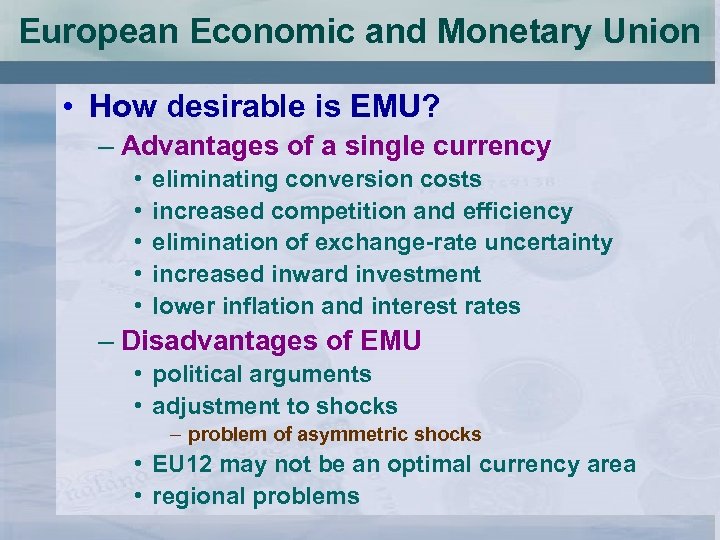

EURO ADVANTAGE & DISADVANTAGES Euro advantages deeper integration micro advantages macro advantages Euro weaknesses optimum currency areas a chronically weak currency?

European Economic and Monetary Union • How desirable is EMU? – Advantages of a single currency • • • eliminating conversion costs increased competition and efficiency elimination of exchange-rate uncertainty increased inward investment lower inflation and interest rates – Disadvantages of EMU • political arguments • adjustment to shocks – problem of asymmetric shocks • EU 12 may not be an optimal currency area • regional problems

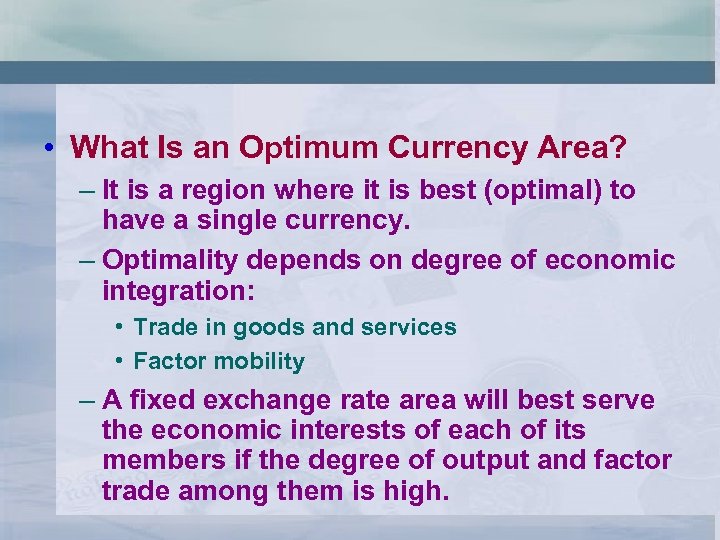

• What Is an Optimum Currency Area? – It is a region where it is best (optimal) to have a single currency. – Optimality depends on degree of economic integration: • Trade in goods and services • Factor mobility – A fixed exchange rate area will best serve the economic interests of each of its members if the degree of output and factor trade among them is high.

The Theory of Optimum Currency Areas • Theory of optimum currency areas – It predicts that fixed exchange rates are most appropriate for areas closely integrated through international trade and factor movements.

The Theory of Optimum Currency Areas • Economic Integration and the Benefits of a Fixed Exchange Rate Area: Schedule – Monetary efficiency gain • The joiner’s saving from avoiding the uncertainty, confusion, and calculation and transaction costs that arise when exchange rates float. • It is higher, the higher the degree of economic integration between the joining country and the fixed exchange rate area. – GG schedule • It shows how the potential gain of a country from joining the euro zone depends on its trading link with that region. • It slopes upward.

The Future of EMU • If EMU succeeds it will promote European political as well as economic integration. • If EMU fails the goal of European political unification will be set back. • Problems that the EMU will face in the coming years: – Europe is not an optimum currency area. – Economic union is so far in front of political union. – EU labor markets are very rigid.

Summary • Fixed exchange rates in Europe were a by-product of the Bretton Woods system. • The EMS of fixed intra-EU exchange rates was inaugurated in March 1979. • In practice all EMS currencies were pegged to the DM. • On January 1, 1999, 11 EU countries initiated an EMU by adopting a common currency, the euro. – Greece became the 12 th member two years later.

Summary • The Maastricht Treaty specified a set of macroeconomic convergence criteria that EU countries would need to satisfy to qualify for admission to EMU. • The theory of optimum currency areas implies that countries will wish to join fixed exchange rate areas closely linked to their own economies through trade and factor mobility. • The EU does not appear to satisfy all of the criteria for an optimum currency area.

Globalisation and the Problem of Instability • Interdependence through trade – international effects of changes in aggregate demand – vulnerability of open economies • Financial interdependence – size of international financial flows – international effects of changes in interest rates

Globalisation and the Problem of Instability • The need for policy co-ordination – the search for policy co-ordination • G 7/G 8 meetings: attempts at harmonisation • but lack of convergence • Difficulties in achieving harmonisation – differences in budget deficits and debt – interest rate divergence – different internal structures of economies – politicians more concerned with domestic issues

3583382b4ddf438d13178bea153efe19.ppt