9bce689d772f029f06854e4fc3cb1a55.ppt

- Количество слайдов: 30

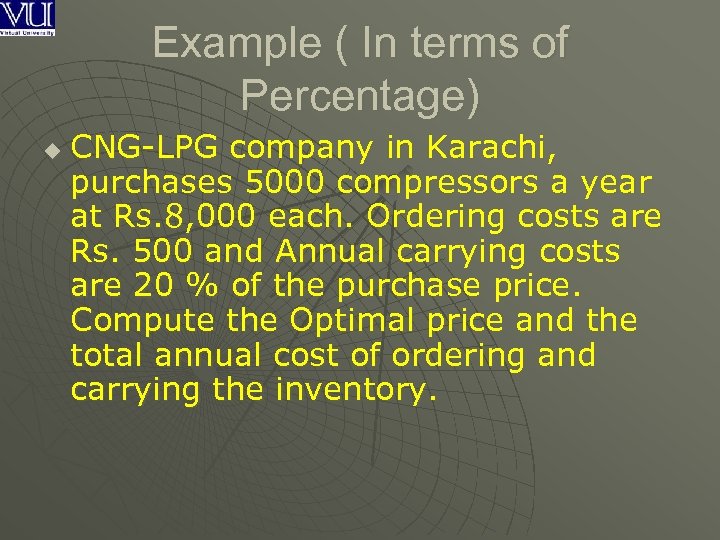

Example ( In terms of Percentage) u CNG-LPG company in Karachi, purchases 5000 compressors a year at Rs. 8, 000 each. Ordering costs are Rs. 500 and Annual carrying costs are 20 % of the purchase price. Compute the Optimal price and the total annual cost of ordering and carrying the inventory.

Example ( In terms of Percentage) u CNG-LPG company in Karachi, purchases 5000 compressors a year at Rs. 8, 000 each. Ordering costs are Rs. 500 and Annual carrying costs are 20 % of the purchase price. Compute the Optimal price and the total annual cost of ordering and carrying the inventory.

Example ( In terms of Percentage) Data u • D=Demand =5, 000 • S=Ordering= Rs. 500 • H=Holding/Carrying Cost=0. 2 X 8, 000=Rs. 1600

Example ( In terms of Percentage) Data u • D=Demand =5, 000 • S=Ordering= Rs. 500 • H=Holding/Carrying Cost=0. 2 X 8, 000=Rs. 1600

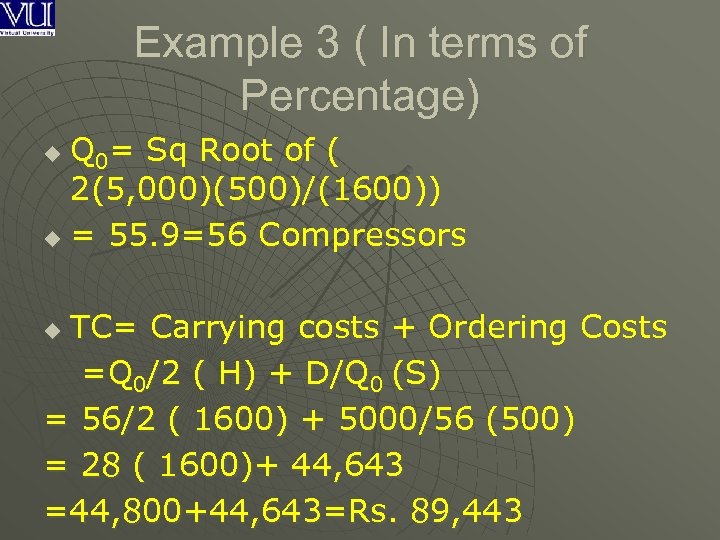

Example 3 ( In terms of Percentage) Q 0= Sq Root of ( 2(5, 000)(500)/(1600)) u = 55. 9=56 Compressors u TC= Carrying costs + Ordering Costs =Q 0/2 ( H) + D/Q 0 (S) = 56/2 ( 1600) + 5000/56 (500) = 28 ( 1600)+ 44, 643 =44, 800+44, 643=Rs. 89, 443 u

Example 3 ( In terms of Percentage) Q 0= Sq Root of ( 2(5, 000)(500)/(1600)) u = 55. 9=56 Compressors u TC= Carrying costs + Ordering Costs =Q 0/2 ( H) + D/Q 0 (S) = 56/2 ( 1600) + 5000/56 (500) = 28 ( 1600)+ 44, 643 =44, 800+44, 643=Rs. 89, 443 u

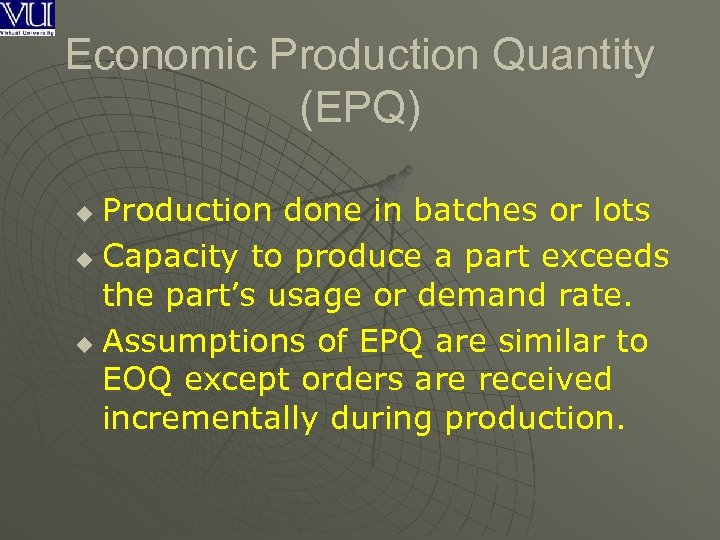

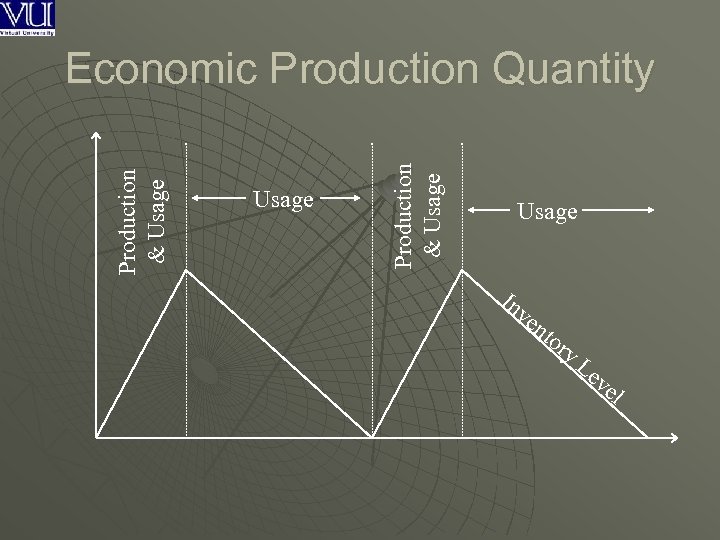

Economic Production Quantity (EPQ) Production done in batches or lots u Capacity to produce a part exceeds the part’s usage or demand rate. u Assumptions of EPQ are similar to EOQ except orders are received incrementally during production. u

Economic Production Quantity (EPQ) Production done in batches or lots u Capacity to produce a part exceeds the part’s usage or demand rate. u Assumptions of EPQ are similar to EOQ except orders are received incrementally during production. u

Usage Production & Usage Economic Production Quantity Usage In ve nt o ry Le ve l

Usage Production & Usage Economic Production Quantity Usage In ve nt o ry Le ve l

Economic Production Quantity Assumptions Only one item is involved u Annual demand is known u Usage rate is constant u Usage occurs continuously u Production rate is constant u Lead time does not vary u No quantity discounts u

Economic Production Quantity Assumptions Only one item is involved u Annual demand is known u Usage rate is constant u Usage occurs continuously u Production rate is constant u Lead time does not vary u No quantity discounts u

Economic Production Quantity Assumptions The basic EOQ model assumes that each order is delivered at a single point in time. u If the firm is the producer and user, practical examples indicate that inventories are replenished over time and not instantaneously. u If usage and production ( delivery) rates are equal, then there is no buildup of inventory. u

Economic Production Quantity Assumptions The basic EOQ model assumes that each order is delivered at a single point in time. u If the firm is the producer and user, practical examples indicate that inventories are replenished over time and not instantaneously. u If usage and production ( delivery) rates are equal, then there is no buildup of inventory. u

Economic Production Quantity Assumptions u Set up costs in a way our similar to ordering costs because they are independent of lot size.

Economic Production Quantity Assumptions u Set up costs in a way our similar to ordering costs because they are independent of lot size.

Economic Production Quantity Assumptions The larger the run size, the fewer the number of runs needed and hence lower the annual setup. u The number of runs is D/Q and the annual setup cost is equal to the number of runs per year times the cost per run ( D/Q)S. u

Economic Production Quantity Assumptions The larger the run size, the fewer the number of runs needed and hence lower the annual setup. u The number of runs is D/Q and the annual setup cost is equal to the number of runs per year times the cost per run ( D/Q)S. u

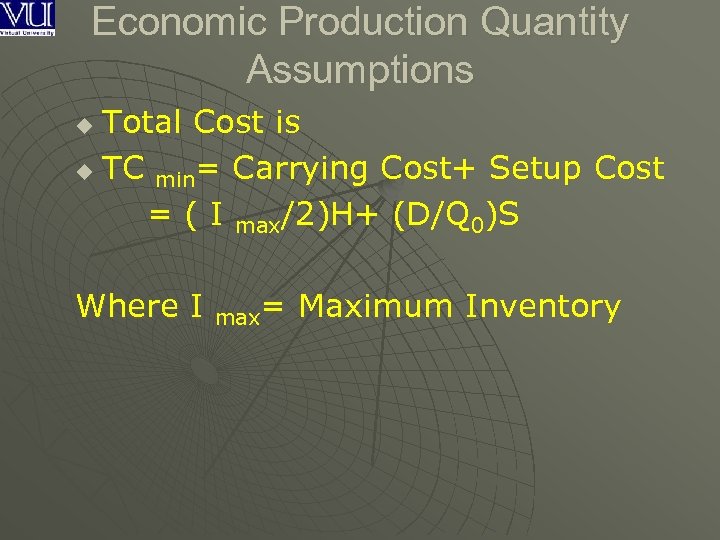

Economic Production Quantity Assumptions Total Cost is u TC min= Carrying Cost+ Setup Cost = ( I max/2)H+ (D/Q 0)S u Where I max= Maximum Inventory

Economic Production Quantity Assumptions Total Cost is u TC min= Carrying Cost+ Setup Cost = ( I max/2)H+ (D/Q 0)S u Where I max= Maximum Inventory

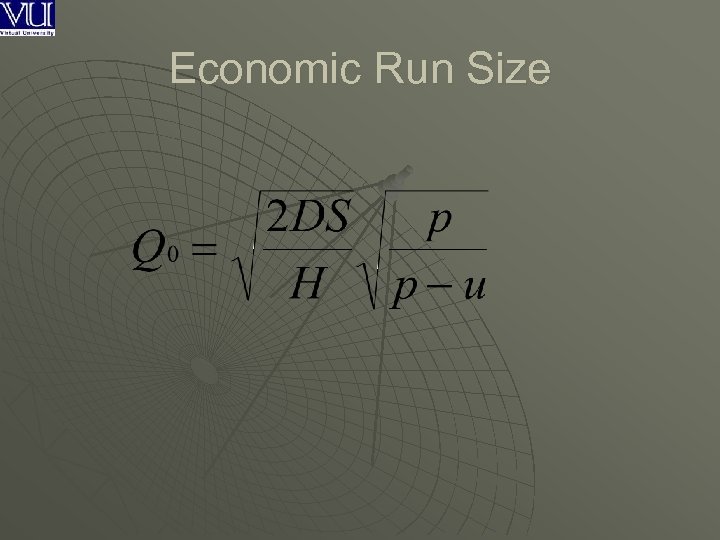

Economic Run Size

Economic Run Size

Economic Production Quantity Assumptions Where p= production rate u U = usage rate u

Economic Production Quantity Assumptions Where p= production rate u U = usage rate u

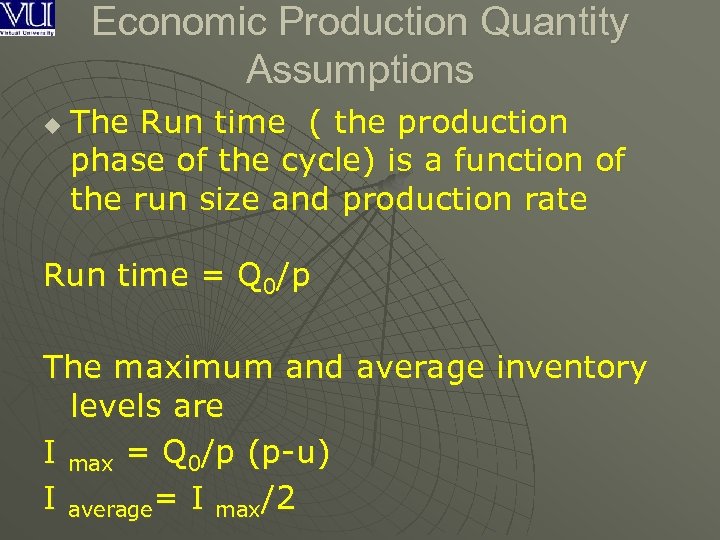

Economic Production Quantity Assumptions u The Run time ( the production phase of the cycle) is a function of the run size and production rate Run time = Q 0/p The maximum and average inventory levels are I max = Q 0/p (p-u) I average= I max/2

Economic Production Quantity Assumptions u The Run time ( the production phase of the cycle) is a function of the run size and production rate Run time = Q 0/p The maximum and average inventory levels are I max = Q 0/p (p-u) I average= I max/2

Example (Economic Run Size) u A firm in Sialkot produces 250, 000 each world class footballs for both domestic and international markets. It can make footballs at a rate of 2000 per day. The footballs are manufactured uniformly over the whole year. Carrying cost is Rs. 100 per football and Setup cost for a production run is Rs. 2500. The manufacturing unit operates for 250 days per year.

Example (Economic Run Size) u A firm in Sialkot produces 250, 000 each world class footballs for both domestic and international markets. It can make footballs at a rate of 2000 per day. The footballs are manufactured uniformly over the whole year. Carrying cost is Rs. 100 per football and Setup cost for a production run is Rs. 2500. The manufacturing unit operates for 250 days per year.

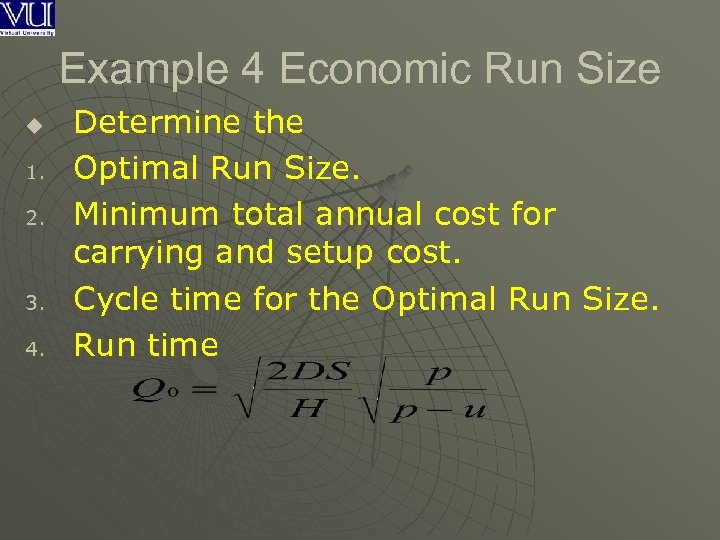

Example 4 Economic Run Size u 1. 2. 3. 4. Determine the Optimal Run Size. Minimum total annual cost for carrying and setup cost. Cycle time for the Optimal Run Size. Run time

Example 4 Economic Run Size u 1. 2. 3. 4. Determine the Optimal Run Size. Minimum total annual cost for carrying and setup cost. Cycle time for the Optimal Run Size. Run time

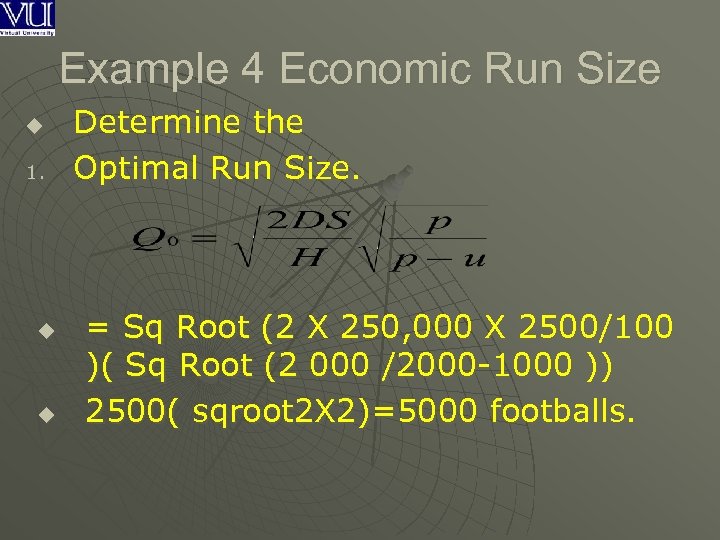

Example 4 Economic Run Size u 1. u u Determine the Optimal Run Size. = Sq Root (2 X 250, 000 X 2500/100 )( Sq Root (2 000 /2000 -1000 )) 2500( sqroot 2 X 2)=5000 footballs.

Example 4 Economic Run Size u 1. u u Determine the Optimal Run Size. = Sq Root (2 X 250, 000 X 2500/100 )( Sq Root (2 000 /2000 -1000 )) 2500( sqroot 2 X 2)=5000 footballs.

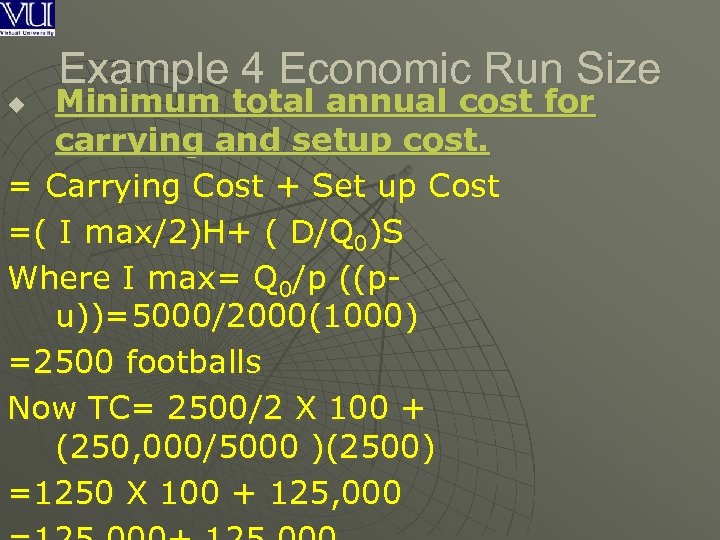

Example 4 Economic Run Size Minimum total annual cost for carrying and setup cost. = Carrying Cost + Set up Cost =( I max/2)H+ ( D/Q 0)S Where I max= Q 0/p ((pu))=5000/2000(1000) =2500 footballs Now TC= 2500/2 X 100 + (250, 000/5000 )(2500) =1250 X 100 + 125, 000 u

Example 4 Economic Run Size Minimum total annual cost for carrying and setup cost. = Carrying Cost + Set up Cost =( I max/2)H+ ( D/Q 0)S Where I max= Q 0/p ((pu))=5000/2000(1000) =2500 footballs Now TC= 2500/2 X 100 + (250, 000/5000 )(2500) =1250 X 100 + 125, 000 u

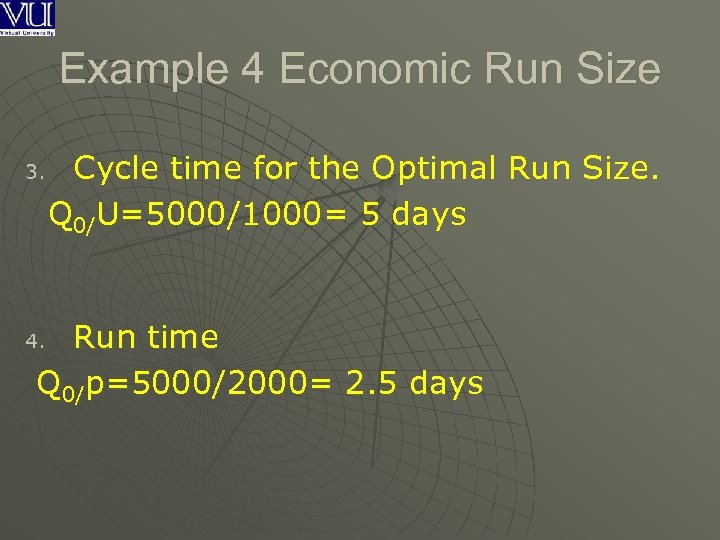

Example 4 Economic Run Size 3. Cycle time for the Optimal Run Size. Q 0/U=5000/1000= 5 days Run time Q 0/p=5000/2000= 2. 5 days 4.

Example 4 Economic Run Size 3. Cycle time for the Optimal Run Size. Q 0/U=5000/1000= 5 days Run time Q 0/p=5000/2000= 2. 5 days 4.

Quantity Discount u Price reductions for large orders are called Quantity Discounts.

Quantity Discount u Price reductions for large orders are called Quantity Discounts.

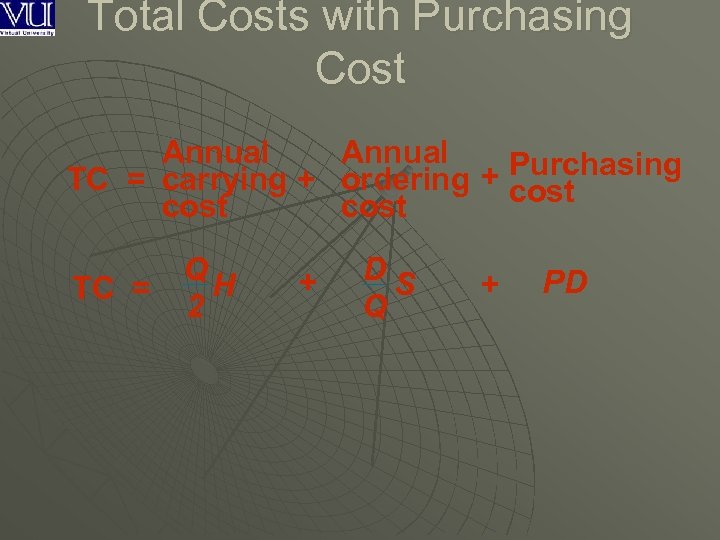

Total Costs with Purchasing Cost Annual + Purchasing TC = carrying + ordering cost Q H TC = 2 + DS Q + PD

Total Costs with Purchasing Cost Annual + Purchasing TC = carrying + ordering cost Q H TC = 2 + DS Q + PD

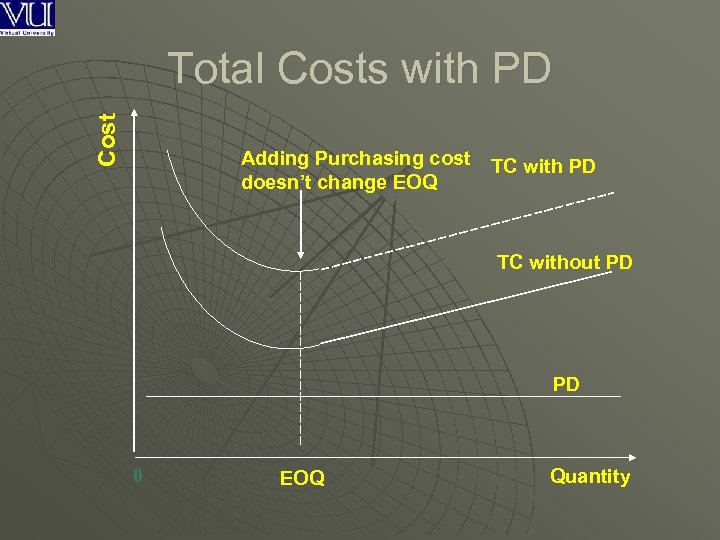

Cost Total Costs with PD Adding Purchasing cost doesn’t change EOQ TC with PD TC without PD PD 0 EOQ Quantity

Cost Total Costs with PD Adding Purchasing cost doesn’t change EOQ TC with PD TC without PD PD 0 EOQ Quantity

Example u The maintenance department of a large cardiology hospital in Islamabad uses about 1200 cases of corrosion removal liquid, used for maintenance of hospital. Ordering costs are Rs 100, carrying cost are Rs 20 per case, and the new price schedule indicates that

Example u The maintenance department of a large cardiology hospital in Islamabad uses about 1200 cases of corrosion removal liquid, used for maintenance of hospital. Ordering costs are Rs 100, carrying cost are Rs 20 per case, and the new price schedule indicates that

Example orders of less than 50 cases will cost Rs 1250 per case, 50 to 79 cases will cost Rs 1150 per case , 80 to 99 cases will cost Rs 1050 per case and larger costs will be Rs 1000 per case. u. Determine the Optimal Order Quantity and the Total Cost. u

Example orders of less than 50 cases will cost Rs 1250 per case, 50 to 79 cases will cost Rs 1150 per case , 80 to 99 cases will cost Rs 1050 per case and larger costs will be Rs 1000 per case. u. Determine the Optimal Order Quantity and the Total Cost. u

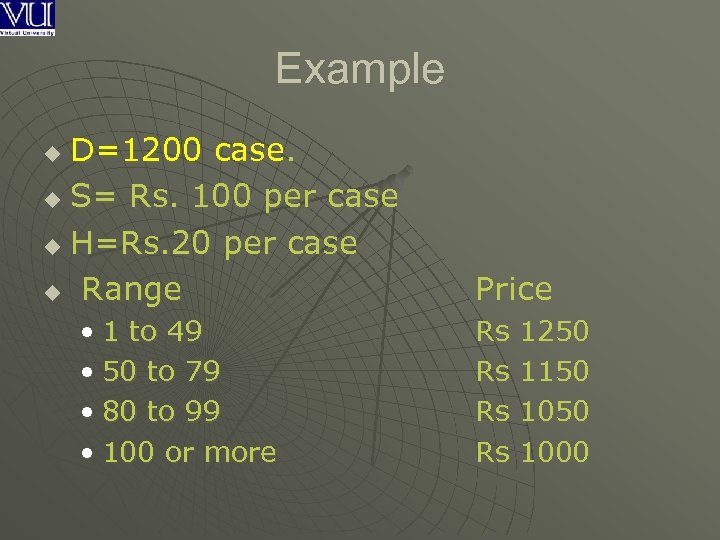

Example D=1200 case. u S= Rs. 100 per case u H=Rs. 20 per case u Range u • 1 to 49 • 50 to 79 • 80 to 99 • 100 or more Price Rs Rs 1250 1150 1000

Example D=1200 case. u S= Rs. 100 per case u H=Rs. 20 per case u Range u • 1 to 49 • 50 to 79 • 80 to 99 • 100 or more Price Rs Rs 1250 1150 1000

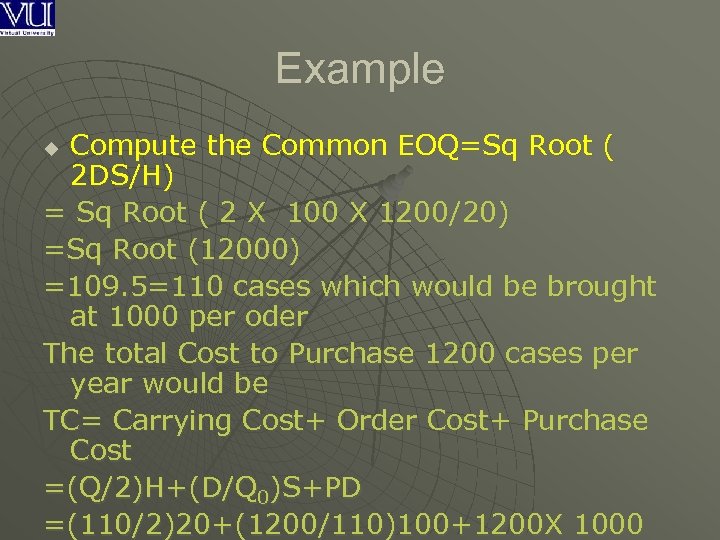

Example Compute the Common EOQ=Sq Root ( 2 DS/H) = Sq Root ( 2 X 100 X 1200/20) =Sq Root (12000) =109. 5=110 cases which would be brought at 1000 per oder The total Cost to Purchase 1200 cases per year would be TC= Carrying Cost+ Order Cost+ Purchase Cost =(Q/2)H+(D/Q 0)S+PD =(110/2)20+(1200/110)100+1200 X 1000 u

Example Compute the Common EOQ=Sq Root ( 2 DS/H) = Sq Root ( 2 X 100 X 1200/20) =Sq Root (12000) =109. 5=110 cases which would be brought at 1000 per oder The total Cost to Purchase 1200 cases per year would be TC= Carrying Cost+ Order Cost+ Purchase Cost =(Q/2)H+(D/Q 0)S+PD =(110/2)20+(1200/110)100+1200 X 1000 u

When to Reorder with EOQ Ordering u u u Reorder Point - When the quantity on hand of an item drops to this amount, the item is reordered. Safety Stock - Stock that is held in excess of expected demand due to variable demand rate and/or lead time. Service Level - Probability that demand will not exceed supply

When to Reorder with EOQ Ordering u u u Reorder Point - When the quantity on hand of an item drops to this amount, the item is reordered. Safety Stock - Stock that is held in excess of expected demand due to variable demand rate and/or lead time. Service Level - Probability that demand will not exceed supply

Example u An apartment complex in Quetta requires water for its home use. Usage= 2 barrels a day u Lead time= 5 days u ROP= Usage X Lead Time u = 2 barrels a day X 7 = 14 barrels u

Example u An apartment complex in Quetta requires water for its home use. Usage= 2 barrels a day u Lead time= 5 days u ROP= Usage X Lead Time u = 2 barrels a day X 7 = 14 barrels u

Determinants of the Reorder Point u The rate of demand u The lead time u Stock out risk (safety stock) u Demand and/or lead time variability

Determinants of the Reorder Point u The rate of demand u The lead time u Stock out risk (safety stock) u Demand and/or lead time variability

Example u An owner of a Montessori equipment firm in Karachi, determined from historical records that demand for wood required for Montessori equipment averages 25 tones per anum. His operations management expertise allowed him to determine the demand during lead that could be described by a normal distribution that has a mean of 25 tons and a

Example u An owner of a Montessori equipment firm in Karachi, determined from historical records that demand for wood required for Montessori equipment averages 25 tones per anum. His operations management expertise allowed him to determine the demand during lead that could be described by a normal distribution that has a mean of 25 tons and a

Fixed-Order-Interval Model Orders are placed at fixed time intervals. u Order quantity for next interval? u Suppliers might encourage fixed intervals. u May require only periodic checks of inventory levels. u Risk of stock out. u

Fixed-Order-Interval Model Orders are placed at fixed time intervals. u Order quantity for next interval? u Suppliers might encourage fixed intervals. u May require only periodic checks of inventory levels. u Risk of stock out. u